Académique Documents

Professionnel Documents

Culture Documents

Jan2016 Mackie Research - Spectral Medical

Transféré par

Anonymous sXJ5jvoCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Jan2016 Mackie Research - Spectral Medical

Transféré par

Anonymous sXJ5jvoDroits d'auteur :

Formats disponibles

Andre Uddin 416.860.

8675

auddin@mackieresearch.com

Mike Stevens 416.860.7614

mstevens@mackieresearch.com

Ja n ua ry 1 2 , 2 0 1 6

SPECTRAL MEDICAL INC. SPECULATIVE BUY

EDT - TSX

$0.78

TARGET (CAD$):

$2.50

PROJ. RETURN:

221%

VALUATION:

Ready For The Runup? Its All Or None

ACTION Initiating Coverage With a SPECULATIVE BUY Rating

We are initiating coverage of Spectral Medical Inc. (ETD-T) with a SPECULATIVE BUY

recommendation and a 12-month target price of $2.50/share. The key catalyst is the

outcome of their ongoing pivotal trial for Toraymyxin (PMX), with the hope of garnering

approval of the only FDA-approved treatment for sepsis and septic shock.

2018 Discounted

Earnings

Share Data

Basic Shares O/S (mm)

190.8

Fully Diluted (mm)

196.5

Market Cap (basic) ($mm)

148.8

Enterprise Value ($mm)

140.4

Debt ($mm)

DETAILS Large Market Opportunity High Risk, High Reward Potential

Unmet Medical Need: North America currently has no FDA-approved treatment for

sepsis and septic shock, yet it claims victim to nearly 1 million people every year in the

U.S. with over 30% of those cases leading to death.

0.0

Next Reporting Date

March

Not Its First Rodeo: Toraymyxin (PMX) is already approved in Europe and Japan, and

has safely treated over 150,000 sepsis patients in those markets with success. There is

also 22 years worth of clinical data for PMX treatment, including over 140 individual

studies on over 4,400 patients.

Thomson Chart 1 Year

Reputable Management/High Inside Ownership: The management team boasts a

wealth of experience in the area of sepsis treatment, including CEO Dr. Paul Walker,

who is widely regarded as a pioneer in the field and has made large contributions

(including developing Spectrals EAA diagnostic). Also, 45% of ownership comes from

the management and board, representing high confidence and commitment to

corporate goals.

Higher Risk High Reward Potential: The potential lofty reward doesnt come without

risk. Spectrals success depends on PMXs FDA-approval (given their lack of product

diversity), but the complexity of sepsis makes it a high risk potential.

Corporate Profile

Spectral Medical Inc. is a therapeutic

development company. Spectral is focused on

the development and commercialization of a

treatment for severe sepsis and septic shock.

Spectral also manufactures and sells certain

reagents, and their only clinical development

program is for PMX.

IMPACT A Runup Is Expected

The key catalyst for the stock is the pivotal clinical trial results which are expected

calendar Q3/Q4 2016 we expect the stock to trade up into that catalyst. If the

pivotal results are successful for PMX, we expect this stock to go through our current

target price. We are applying a conservative 50% discount rate to our estimated 2018

EPS (first full year of estimated PMX sales) in our valuation, and using a 25x P/E

multiple to derive our 12-month target price of $2.50.

Key Events

- Next reporting date: March, Expected pump

approval Q2, Pivotal Trial enrolment

completion June 16, Pivotal data Q3 16,

PMA filing of last (4th)module Q4 16

FYE Nov 30

Revenue

2014A

$ million

3.0

Q1/15A

0.9

Q2/15A

0.8

Q3/15A

0.7

Q4/15E

0.7

2015E

3.1

Q1/16E

0.9

Q2/16E

0.8

Q3/16E

0.7

Q4/16E

0.7

2016E

2017E

2018E

3.1

31.1

119.6

$0.23

Basic EPS

$/sh

($0.06)

($0.01)

($0.01)

($0.01)

($0.01)

($0.05)

($0.01)

($0.01)

($0.02)

($0.02)

($0.06)

$0.00

F.D. EPS

$/sh

($0.06)

($0.01)

($0.01)

($0.01)

($0.01)

($0.05)

($0.01)

($0.01)

($0.02)

($0.02)

($0.06)

$0.00

$0.23

CFPS

$/sh

$0.02

($0.02)

$0.02

($0.01)

($0.01)

($0.02)

$0.03

($0.01)

($0.02)

($0.02)

($0.01)

($0.00)

$0.23

P/Sales

multiple

50.2x

N/A

N/A

N/A

N/A

48.4x

N/A

N/A

N/A

N/A

48.0x

4.8x

1.2x

P/EPS

multiple

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

3.4x

P/CFPS

multiple

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

3.4x

This report has been created by analysts who are employed by Mackie Research Capital Corporation, a Canadian Investment Dealer. For further disclosures, please see last page of this report.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 2

HEALTHCARE MEDICAL DEVICE

SPECTRAL MEDICAL INC.

TA B LE O F C O NT E N TS

INVESTMENT HIGHLIGHTS ............................................................................................................................................................................. 1

EXECUTIVE SUMMARY ....................................................................................................................................................................................... 3

COMPANY BACKGROUND ................................................................................................................................................................................ 4

What is Sepsis? ..................................................................................................................................................................................................... 4

PRODUCTS .............................................................................................................................................................................................................. 5

EAA ........................................................................................................................................................................................................................ 5

Toraymyxin (PMX) .............................................................................................................................................................................................. 8

EUPHRATES Trial ....................................................................................................................................................................................... 11

MODS and MODS Score ............................................................................................................................................................................ 13

Spectrals Standalone Pump ...................................................................................................................................................................... 14

Reagents .............................................................................................................................................................................................................. 16

FINANCIAL FORECAST .................................................................................................................................................................................... 16

Estimates and Financial Statements .............................................................................................................................................................. 17

MANUFACTURING ............................................................................................................................................................................................ 19

MARKET OVERVIEW ......................................................................................................................................................................................... 19

Conventional Sepsis Treatments ..................................................................................................................................................................... 22

Cost Effectiveness of PMX/EAA ..................................................................................................................................................................... 22

COMPETITION/NEW ENTRANTS .................................................................................................................................................................. 23

Aethlon Medical ................................................................................................................................................................................................ 23

Cytosorbents ....................................................................................................................................................................................................... 23

Alteco Medical .................................................................................................................................................................................................... 24

VALUATION ......................................................................................................................................................................................................... 25

MANAGEMENT TEAM ...................................................................................................................................................................................... 27

Board of Directors .............................................................................................................................................................................................. 28

INTELLECTUAL PROPERTY .............................................................................................................................................................................. 30

RISKS ...................................................................................................................................................................................................................... 30

IMPORTANT DISCLOSURES ........................................................................................................................................................................... 32

ANALYST CERTIFICATION ............................................................................................................................................................................. 32

Note: All financial figures in this report are in Canadian dollars, unless stated otherwise. Report pricing date: 12-1-16

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 3

SPECIALTY PHARMA

SPECTRAL MEDICAL INC.

EX EC U TI V E SU M M A R Y

CO M P ANY B AC K G RO UN D

Founded in 1991 Headquartered in Toronto, Canada, Spectral Medical Inc. (EDT) is a clinical-stage medical device company focused

on the diagnoses and treatment of septic shock.

PM X T AR G ET ING A L ARG E M AR K ET T H AT H AS AN U NM ET M EDI C AL N E E D

Sepsis has been a graveyard for product development. Why has there been such a high failure rate in treating sepsis? The failure of

past treatments can be attributed in part to a rudimentary understanding of complex sepsis pathophysiology, unsophisticated and

poor clinical trial design, and an over-reliance on preclinical models for proof-of-concept. There is currently no FDA-approved

treatment for sepsis.

L ARG E CL I NI C AL U S E O F PM X AN D AM E NDM ENT O F P I VO T AL T RI AL PO SIT IO N S S P ECT R AL

W EL L

Toraymyxin (PMX) is already approved in Europe and Japan, and has safely treated over 150,000 sepsis patients in those markets with

success. There is also 22 years worth of clinical data for PMX treatment, including over 140 individual studies on over 4,400 patients.

In late September 2014, pursuant to the protocol change in April 2014 to effect the exclusion criterion that further refined patient

selection to sicker patients, the FDA recommended that only data for those patients randomized after the change be considered in the

determination of whether a statistically significant outcome related to the primary end point of 28-day mortality had been achieved.

This also represents positive news for Spectral.

That is, Spectral can use the post-amendment patients as the first analysis for the

primary endpoint but then add the patients prior to that with MODS score > 9, which could add power to the final results of the trial.

To be clear, only patients with MODS score > 9 are to be used for the primary endpoint that the FDA would be reviewing. All patients

enrolled in the EUPHRATES trial would be reviewed for safety and secondary endpoints. We believe these amendments should give

Spectral a decent shot of hitting its primary endpoint. Based on historical safety of the PMX device we do not believe safety would

pose a risk in this trial.

HIG H IN S ID E O W N E R SH I P M AN AG EM EN T T E AM VE RY S E P S I S- E X P ER I EN C ED

The management team at Spectral boasts a wealth of experience in the industry as well as considerable familiarity with the treatment

of sepsis. In particular, CEO Paul Walker is a pioneer in the field and has made large contributions (eg. developer of EAA diagnostic

for measuring endotoxin levels). Forty-five percent of ownership is occupied by the board and management, which demonstrates

both their commitment to accomplish Spectrals mission of bringing PMX to the North American market and their confidence in doing

so.

RE AD Y F O R T H E R U NU P? A H IG H RI SK , P O T ENT I AL HIG H R E W AR D

Any late-stage trial has risk, particularly if it is in a high risk disease like sepsis. However, based on all the safety data of PMX

and clinical results, we expect the device has a decent shot at obtaining FDA approval. Spectral is not a diversified entity, their

primary success is dependent upon their ongoing PMX clinical trials.

RE CO M M END AT IO N AN D T ARG ET

We are initiating coverage of Spectral Medical Inc. with a Speculative Buy recommendation and a 12-month target price of

C$2.50/share. We expect the share price to run-up in anticipation of the pivotal EUPHRATES clinical trial results. Assuming

clinical success and FDA approval, Spectral could turn into a large capitalized company if it is not acquired in that process.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 4

COMPANY BACKGROUND

The company was formerly known as Spectral Diagnostics Inc. and changed its name to Spectral Medical

Inc. (Spectral) in December 2014. Spectral was founded in 1991 and is headquartered in Toronto,

Canada. Spectral is a therapeutic development company focused on the development and

commercialization of a treatment for severe sepsis and septic shock utilizing its Endotoxin Activity Assay

(EAA) and the Toraymyxin (PMX) therapeutic. Spectral is also involved in the development, production,

and marketing of recombinant cardiac proteins, antibodies, and calibrators for use in research and

development; some of which are used in products manufactured by other diagnostic companies.

In May 2006, Spectral announced a partnership with Toray Medical Products to launch a combined

diagnostic and therapeutic strategic alliance for the management of severe sepsis. Toray Medical is the

developer of Toraymyxin (PMX), which has already been used for many years in Europe and Japan to treat

patients with sepsis. Not long after the 2006 announced partnership, Spectral announced the signing of a

distribution agreement with Estor S.p.A. for the commercial sale of its EAA and its reagents in Italy. Estor

is the exclusive Italian distributor of Torays PMX device. In March 2009, Spectral obtained the exclusive

development and commercial rights in the U.S. for PMX, and in November 2010, signed an exclusive

distribution agreement for this product in Canada. Spectral started the pivotal clinical development

program for PMX in 2010 and is still underway. This pivotal trial (called EUPHRATES) is expected to be

completed enrolment in June 2016 (further details on clinical trials are found in the Products section).

Given that sepsis and septic shock are the conditions that Spectrals products treat, its prudent to examine

sepsis in more detail before going further.

What is Sepsis?

Sepsis is an inflammatory reaction to systemic infection that can quickly lead to acute organ dysfunction

and death. It is difficult to predict, diagnose, and treat. Patients who develop sepsis have an increased risk

of complications and death, as well as face higher healthcare costs, and longer treatment.

Severe sepsis is more likely to occur in patients with chronic diseases, those who use immuno-suppressive

agents, the elderly, and patients with certain genetic predispositions to infection. It is a multi-process

disease involving both pro-inflammatory signals and anti-inflammatory signals. Primary treatment of

severe sepsis requires antibiotics targeting the source of the infection. This is augmented with drugs such

as low-dose corticosteroids to manage the inflammation, and procedures such as haemodialysis to assist

failing organs.

Diagnosis of Sepsis

Sepsis, the leading cause of death in non-cardiac ICUs (Intensive Care Units), is an under-recognized

condition. The failure to recognize the connections between infection, secondary organ failure, and sepsis

can lead to delayed recognition and treatment, which can end up being fatal.

Unfortunately, sepsis doesnt produce obvious symptoms. Although it claims almost as many lives as

acute myocardial infarction (MI), the initial symptoms of sepsis are much more subtle. Common

symptoms of sepsis are fever, chills, rapid breathing and heart rate, rash, confusion and disorientation.

Many of these symptoms, such as fever and difficulty breathing, mimic other conditions, making sepsis

hard to diagnose in its early stages. Sepsis arises unpredictably and can progress rapidly.

When patients with sepsis die, they do so in the ICU, but sepsis typically begins in the home or on the

medical-surgical unit; some causes are infection, trauma, surgery, renal failure, burns, or any immune

suppression. Thus, all clinicians must know how to recognize the signs and symptoms of sepsis.

Physicians diagnose sepsis by examining patients for fever, increased heart rate and increased respiratory

rate. They often perform a blood test to see if a patient has an abnormal number of white blood cells, a

common sign of sepsis, or an elevated lactate level, which correlates with severity of the condition.

Physicians also test blood and other bodily fluids such as urine and sputum for the presence of infectious

agents. In addition, a chest X-ray or a CT scan can help identify the site of infection. Some hospitals now

have rapid-response teams that help bedside nurses rapidly assess and treat patients with life-threatening

conditions such as sepsis. These teams are usually made up of an ICU nurse and other clinicians, such as a

physician, and a respiratory therapist.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 5

Figure 1: Sepsis: Progressive Clinical Syndrome

Source: Spectral Medical Inc.

Current Treatment of Sepsis

Rapid initiation of aggressive care should begin as soon as sepsis is suspected, with subsequent

management in an ICU setting as soon as possible. In order to achieve the most optimal outcome,

adequate resuscitation of blood pressure as well as efforts to restore tissue perfusion should be

accomplished within the first 6 hours of presentation. The most important consideration in the treatment

of sepsis is aggressive and timely efforts to identify and control the source of infection with antibiotics.

Therapy should be implemented without delay. Effective, appropriate parenteral antimicrobials should be

given within the first hour of recognition of severe sepsis or septic shock. Therapy typically includes more

than one drug against potential pathogens. Two Gram negative agents (i.e. extended spectrum beta-lactam

and either an aminoglycoside or fluoroquinolone) may be used empirically in order to increase the

likelihood of treating multidrug-resistant bacteria (i.e. Pseudomonas, Acinetobacter). A combination of

beta-lactam and macrolide may be used in patients with septic shock from bacteremic Streptococcus

pneumonia infections. Antimicrobial therapy should be reassessed daily for potential de-escalation in

order to reduce healthcare cost, potential adverse effects, and development of antimicrobial resistance.

PRODUCTS

Endotoxin Activity Assay (EAA)

Historically, the detection of bacterial endotoxin has been performed by the LAL-test, which was

introduced in the 1970s. Limulus Amebocyte Lysate (LAL) is derived from the blood cells, or amebocytes,

of the horseshoe crab, which clots in the presence of endotoxin. The LAL-test has some serious limitations;

one of the most important was a poor specificity for LPS (also known as Lipopolysaccharides; synonymous

with endotoxins).

In 2003, Spectrals Endotoxin Activity Assay was approved by the FDA, Health Canada, and European CE,

as the first rapid in vitro (technique of performing a given procedure in a controlled environment outside

of a living organism) diagnostic test for the risk of developing sepsis in the ICU. The EAA test utilizes a

specific monoclonal antibody to measure the endotoxin activity from a blood sample.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 6

Detailed Scientific Explanation of Spectrals EAA

Endotoxin (LPS), is found on Gram negative bacteria and is one of the key triggers that causes septic shock

and multiple organ dysfunction. Endotoxin exposure can induce systemic inflammation, progressing to

sepsis that results in shock and multi-organ failure. By measuring levels of LPS in the blood with Spectrals

EAA, physicians have one more tool to aid in the risk assessment of patients on their first day of admission

to the ICU for progression to severe sepsis.

Figure 2: Endotoxin, also known as Lipopolysaccharide (LPS), is a key component believed to trigger

septic shock

Source: Spectral Medical

Spectrals EAA reacts specifically with LPS of Gram negative bacteria and does not cross-react with Gram

positive bacteria and other micro-organisms. The EAA is based on the reaction of endotoxin with a

specific anti-endotoxin antibody. Complement proteins opsonize (the process by which the bacteria is

marked for ingestion and eliminated by a phagocyte) the endotoxin-antibody complex. Note that

complement proteins are a part of the immune system that helps antibodies and phagocytic cells to clear

pathogens (bacteria). Phagocytes are cells that protect the body by ingesting (phagocytosing) harmful

foreign particles, bacteria, and dead (or dying) cells. The opsonized immune complex primes neutrophils

in the blood to enhance their respiratory burst in response to zymosan (which is used to induce

experimental inflammation). The respiratory burst of the neutrophils yields oxidants that react with

luminol (a chemical that exhibits chemiluminescence with a blue glow) in the reaction mixture to emit

chemiluminescence. Note that respiratory burst (sometimes called oxidative burst) is the rapid release of

reactive oxygen species (superoxide radical and hydrogen peroxide) from cells. The chemiluminescence

can then be detected in a photon counting luminometer. A basal activity measurement (Tube 1) in the

absence of the specific anti-endotoxin antibody measures the non-specific oxidative burst of the patients

neutrophils this is the control sample. An additional control measurement involves including the specific

anti-endotoxin antibody and an excess of exogenous endotoxin (Tube 3) to measure the maximum

oxidative burst of the patients neutrophils. The test measurement (Tube 2) includes the specific antibody

to measure the neat level of endotoxin activity. The EAA level is calculated by normalizing the

chemiluminescence in the test sample (Tube 2) against the maximum chemiluminescence (Tube 3),

correcting both measurements for the basal activity chemiluminescence (Tube 1).

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 7

EAA - Clinical Studies

The Multi-Center Endotoxin Detection in Critical illness (MEDIC) trial was a multi-center, prospective

observational study, performed in 10 ICUs of academic hospital settings in North America and Europe.

While increased levels of endotoxin may not be the only risk factor for severe sepsis, its presence in graded

levels, low (0.00-0.39 EAA units), intermediate (0.40-0.59 EAA units) and high ( 0.60 EAA units) has a

strong association with the presence of the disease. The presence of endotoxemia was evaluated on the first

day of the patients ICU stay to determine the odds of developing severe sepsis within 24 hours of ICU

admission. The target population for the Risk Assessment Study included all eligible patients enrolled in

the MEDIC trial on first day of ICU admission who had evaluable samples, N=857. The MEDIC clinical

trial demonstrated that higher EAA levels were correlated with a higher risk of mortality, as well as an

increasing risk for developing sepsis (Figure 3).

Figure 3: Odds Ratio for Severe Sepsis and Level of Endotoxemia

Source: Spectral Medical

In a healthy population, it was shown that an EAA level of 0.40 represents a value that is +2 standard

deviations above the mean; 93% of subjects had an EAA level below this value. It is reasonable to

assume that a level of 0.40 represents a conservative cut-off below which most individuals should be

healthy. An EAA level of 0.60 represents a value of +4 standard deviations above the mean (in

healthy subjects); individual baseline variations may occur. There was an unexpected finding of slight

elevations of endotoxin reported in ambulatory conditions such as during periodontitis, or cigarette

smoking. No volunteers had a measured EAA level of 0.60 this represents a significant level above

where an EAA level may be indicative of an underlying adverse process.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 8

Figure 4: Histogram of EAA values in Healthy Subjects

Source: Spectral Medical

EAA distribution reach extended

In October 2015, Spectral expanded its business alliance with the Toray Medical Co., Ltd. through an

exclusive agreement to distribute Spectrals EAA diagnostic across fifteen countries in the Middle and Far

East: India, South Korea, Taiwan, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam,

Cambodia, Myanmar, Brunei, Laos, the Kingdom of Saudi Arabia, and the Republic of Turkey. Revenues

from this agreement are expected to be generated in Q1 2016.

On November 10, 2015, Spectral announced a non-exclusive European distribution agreement for its EAA

diagnostic with Fresenius Medical Care in eight countries Germany, Denmark , Sweden, Finland,

Norway, Poland, Hungary, and the Czech Republic.

Synergies between EAA and Toraymyxin (PMX)

We believe the use of EAA adds another layer which could improve the clinical outcome of the

EUPHRATES trial (discussed in next product section on Toraymyxin). A looming incentive for drug and

medical device manufacturers is to develop a proprietary diagnostic test to increase the success rate of

clinical trials and maximize therapy efficacy. Before the initiation of clinical trials, the diagnostic test can be

used to determine and optimize trial eligibility and enrollment by confirming the presence and quantity of

a molecular target in an individual patient that is, only patients with certain levels of disease biomarkers

measured by the diagnostic test will be recruited in a clinical trial. Then during the clinical trial, the

diagnostic test can be used to monitor treatment responses and patient outcomes by identifying and

predicting patient subpopulations that are most likely to respond to a given treatment. In Spectrals ongoing EUPHRATES trial, only patients with endotoxin activity 0.60 measured by EAA are enrolled. EAA

0.60 ensures all patients have severe sepsis or septic shock with high risk of death. Clinical data has

implied this patient population benefits the most from unconventional sepsis therapy. We believe if PMX

is approved by the FDA, the measurement of endotoxin activity (through the EAA) before treatment is

likely also going to be recommended as a product compliment.

Toraymyxin (PMX)

Spectral is seeking U.S. FDA approval for its lead product, Toraymyxin (PMX), a treatment for severe

sepsis and septic shock (Spectral is currently conducting a pivotal clinical trial details appear later in

section). PMX is a therapeutic hemoperfusion device that removes endotoxin (> 90% of endotoxin) from

the bloodstream. PMX has been used globally in more than 150,000 patients to date and has demonstrated

in clinical trials that it safely and effectively removes endotoxin and reduces mortality in patients with

severe sepsis and septic shock. The safety and use of the device has been established in Japan and Europe.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 9

Toray Medical developed the product, and Estor has distributed it in these markets. Spectral hopes to

continue this success in North American markets.

Figure 5: PMX Is A Non-Invasive Treatment Making Device Safety a Non-Issue

Source: Spectral Medical

How Does PMX Work?

Spectral Medicals PMX device targets septic shock that is due to toxicity caused by endotoxin in the

bloodstream. Endotoxin (Lipopolysaccharide, or LPS), a component of the cell wall of Gram negative

bacteria, is one of the main triggers of the pathogenesis of septic shock and multiple organ failure.

Polymyxin B (used in PMX) is a cationic cyclic polypeptide antibiotic that binds strongly to the lipid A

portion of Gram negative bacterial LPS (endotoxin). The hydrophobic amino acids (Phe, Leu) of

polymyxin B interact with hydrophobic bonds of the fatty acid part of the lipid A. Polymyxin B binds to

LPS via hydrophobic and ionic bonds, as noted in the molecular model below (Figure 6). In the PMX

column that is used to filter a patients blood, polymyxin B is covalently bound to the inert beads, thereby

binding the endoxin.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 10

Figure 6: Mechanism of Action of Polymyxcin B binding Endotoxin

Source: Spectral Medical

Clinical Background: EUPHAS Trial - a small clinical trial that showed promising efficacy of PMX

Results of the EUPHAS trial were published in the Journal of the American Medical Association (JAMA,

2009; Vol. 301 No. 23, 2445-2452). A prospective, multicenter, randomized, controlled trial (EUPHAS Trial)

was completed at 10 Italian tertiary care intensive care units between December 2004 and December 2007.

A total of 64 patients with severe sepsis, or septic shock, who underwent emergency surgery for intraabdominal infection, were randomized: 34 subjects received PMX plus conventional therapy and 30

subjects received conventional therapy. The primary endpoints were changes from baseline to 72 hours in

mean arterial pressure (MAP) and vasopressor requirements. The secondary endpoints included

PaO2/FIO2 (fraction of inspired oxygen) ratio, change in organ dysfunction (measured by delta SOFA

scores), and 28-day mortality. The Sepsis-related Organ Failure Assessment score, or just SOFA score, is

used to track a patient's status during the stay in an ICU. It is one of several ICU scoring systems. The

SOFA score helps to determine the extent of a person's organ function, or rate of failure, and is based on

six different scores: respiratory, cardiovascular, hepatic, coagulation, renal, and neurological systems.

Other measures were also reported, including the need for renal replacement therapy (RRT), the length of

stay in ICU, the length of hospital stay, and all-cause hospital mortality.

The results showed that PMX significantly improved mean arterial pressure (MAP) and the vasopressor

dependency index, while conventional therapy did not. The PMX group also achieved significant

improvement on secondary endpoints, including the PaO2/FIO2 (fraction of inspired oxygen) ratio and

delta SOFA scores. The 28-day all-cause mortality was 32% (11/34 patients) in the PMX group and 53%

(16/30 patients) in the conventional therapy group. The PMX group also had a significantly better

survival curve. With univariable analysis, only the treatment group and the SOFA score were

independently associated with mortality. After adjusting for SOFA score, the PMX group had a significant

reduction in 28-day mortality (adjusted HR, 0.36; P = 0.01). In a further analysis of hospital mortality, 20 of

30 patients (67%) died in the conventional therapy group compared with 14 of 34 patients (41%) in the

PMX group, which represents a significant reduction in hospital mortality rate. In terms of RRT (renal

replacement therapy), length of ICU stay, and hospital stay, both groups had similar results. The results

demonstrated that when PMX is added to conventional therapy, there is significantly improved

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 11

hemodynamics and organ function, and reduced 28-day mortality in patients with severe sepsis and septic

shock, in comparison to those patients in the conventional therapy group.

EUPHRATES trial pivotal trial for PMA (Premarket Approval) filing

In October 2010, Spectral announced the initiation of its pivotal clinical trial called EUPHRATES

(Evaluating the Use of Polymyxin B Hemoperfusion in a Randomized controlled trial of Adults Treated for

Endotoxemia and Septic shock) in the U.S. comparing standard of care versus PMX (Toraymyxin) plus

standard of care. The trial is still ongoing. The target population is critically ill patients with septic shock

and endotoxemia (as measured by the EAA). The trial is to enroll approximately 446 patients at 50 sites

throughout the U.S. and Canada, and will have a primary end point of 28-day mortality the trial is to

compare the safety and efficacy of the PMX cartridge based on mortality at 28-days in subjects with septic

shock ,who have high levels of endotoxin and are treated with standard medical care plus use of the PMX

cartridge, versus subjects who receive standard medical care alone. A secondary end point is to compare

mortality between the two groups at 90 days, 6 months, and 12 months post-start of treatment. This trial is

expected to be completed enrolment in June 2016, but final data collection from the primary endpoint

should conclude in July 2016. The EUPHRATES trial is over 90% enrolled implying the trial should be

completed on time. The submission of the final module (fourth) in the PMA (premarket approval) should

be made in Q4 2016.

The EUPHRATES trial is the worlds first theranostics trial conducted in the area of sepsis. Theranostics is

a term coined to represent more specific, or individualized, therapies to treat patients, combining a

diagnostic and therapeutic approach into a single agent. In Spectrals EUPHRATES trial, the EAA will be

used to determine the level of endotoxin in the bloodstream of a patient with septic shock, and if EAA is

elevated ( 0.6 EAA units) the patient is eligible to be randomized to Toraymyxin plus standard of care, or

standard of care alone. This two-step process, guided by the EAA detection process, allows physicians to

target patients most likely to benefit.

Figure 7: Spectral Medical Taking a Theranostic Approach

Source: Spectral Medical

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 12

Figure 8: Sepsis Patient Screening in the EUPHRATES Pivotal Trial

Source: Spectral Medical

In January 2013, an interim analysis was conducted on the first 76 randomized patients who were followed

for 28 days. The Data Safety and Monitoring Board (DSMB), consisting of experts in the fields of critical

care medicine, infectious disease, nephrology, biostatistics and regulatory affairs, reviewed the data set for

evidence of safety concerns, such as adverse events and/or adverse device effects, related to the use of the

PMX cartridge. The results from the first interim safety analysis by the DSMB stated that there were no

safety issues.

On January 27, 2014, the DSMB reviewed the results of the second interim analysis after 184 patients had

been randomized and followed for 28 days in accordance with the Statistical Analysis Plan agreed on with

the FDA. On that date, the DSMB reported that stopping rules for safety, efficacy and futility were not met

and that the trial should continue. The DSMB did not, however, provide the planned sample size

recalculation at that time. The DSMB requested that additional analysis be performed by the Contract

Research Organization on the original 184 patients prior to the recalculation.

Spectral received the recommendations of the DSMB pursuant to its analysis on April 10, 2014, which

included a recommendation of an additional exclusion criterion. The DSMB recommended that patients

with a Multiple Organ Dysfunction Score (MODS) score of 9 no longer be eligible for randomization in

the trial. The MODS score is a recognized scoring system used to evaluate the degree of organ dysfunction

which exists in patients with sepsis (refer to subsequent section on MODS for more insight). This

recommendation was consistent with data from previous PMX trials, which demonstrated that the PMX

column is most effective in reducing mortality rates of sicker patients. We believe this should have a

positive impact on the final efficacy analysis.

In late September 2014, pursuant to the protocol change in April 2014 to effect the exclusion criterion that

further refined patient selection to sicker patients, the FDA recommended that only data for those patients

randomized after the change be considered in the determination of whether a statistically significant

outcome related to the primary end point of 28-day mortality had been achieved. This also represents

positive news for Spectral. That is, Spectral can use the post-amendment patients as the first analysis for

the primary endpoint but then add the patients prior to that with MODS scores > 9, which could add

power to the final results of the trial. To be clear, only patients with MODS scores >9 are to be used for the

primary endpoint that the FDA would be reviewing. All patients enrolled in the EUPHRATES trial would

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 13

be reviewed for safety and secondary endpoints. We believe these amendments should give Spectral a

decent shot of hitting its primary endpoint. Based on historical safety of the PMX device we do not believe

safety would pose a risk in this trial.

In March 2015, Spectral announced that the DSMB recommended the EUPHRATES trial continue and

recommended subsequent interim results analysis based on the new criteria set in April 2014. Spectral was

also set to submit an amended statistical analysis plan (SAP) to the FDA incorporating an interim analysis,

including new stopping rules for safety and efficacy, with results anticipated in late fourth quarter of 2015.

In April, 2015, the FDA accepted the companys plan for a Premarket Approval (PMA) submission, which

consists of four separate modules and has the potential to significantly reduce the time to

commercialization. To date, Spectral has filed three of the four modules to the FDA, with the fourth and

final module expected to be submitted no later than fourth quarter 2016. The EUPHRATES trial is now

over 90% enrolled and is expected to be completed enrolment in June 2016, but final data collection from

the primary endpoint should finish in July 2016. Top-line results of the EUPHRATES trial are expected in

late Q3/early Q4 2016 (calendar year). We expect the clinical results to be first presented at the Society of

Critical Care Medicine conference to be held between January 21-25, 2017 in Hawaii.

MODS (Multiple Organ Dysfunction Syndrome) and the MODS Score

Multiple organ dysfunction syndrome (MODS) is a hypometabolic, immunodepressed state with clinical

and biochemical evidence of decreased functioning of the bodys organ systems that develops subsequent

to an acute injury or illness. Almost any disease that results in tissue injury may result in MODS; this

includes sepsis, major trauma, burns, pancreatitis, aspiration syndromes, extracorporeal circulation (eg.

cardiac bypass), multiple blood transfusion, ischaemia-reperfusion injury, autoimmune disease, headinduced illness, eclampsia, and poisoning/toxicity. MODS contributes to about 50% of all ICU deaths.

That being said, patients without a pre-existing organ disease have a decent chance of organ recovery.

Variations of the term used to include the word failure instead of dysfunction (eg. multiple organ failure

MOF), but dysfunction is preferred over failure, as the latter implies a sort of all or none functioning,

while also implying irreversibility. In contrast, dysfunction implies a spectrum, more in tune with

reality.

The concept surrounding a MODS score involves the findings that death, when it occurs, is not the

consequence of isolated lung, heart, or renal failure, but rather reflects the necessary interdependence of

multiple organ systems involved in the maintenance of homeostasis. Given that organ dysfunction is a

potentially preventable complication of critical illness, and in particular of the sequelae of infection,

ischemia, and injury, there became a need for reliable and validated measures of organ dysfunction to be

developed and tested.

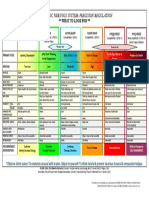

The MODS score was developed in the mid 1990s, using a formal methodologic approach to

maximize construct, content, and criterion validity. The MODS score is the sum of 6 different

categorical scores representing 6 organ systems (respiratory, renal, hepatic, cardiovascular,

hematologic, and neurologic) (see Figure 9). Scoring is performed on a daily basis and so allows

a day-by-day prediction for patients.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 14

Figure 9: MODS Scoring System

Source: J.C. Marshall, Multiple Organ Dysfunction Score, Critical Care Medicine, 1995; (23): 1638-52

Accumulative scores of 9-12 points represent an approximate 25% ICU mortality rate, 50% at 13-16 points,

75% at 17-20 points, and a 100% mortality rate at levels more than 20 points.

To reiterate, only those patients in Spectrals EUPHRATES trial with scores above 9 points (an approximate

25% ICU mortality rate) will be used by Spectral to achieve their primary endpoint and considering the

statistical evidence supporting PMXs increased effectiveness treating more severely ill patients, this

amendment could improve Spectrals chances of PMX approval.

Spectrals Standalone Pump Used in Conjunction with the PMX device

The PMX column can be used with existing dialysis or blood pump machines that are equipped at

hospitals. For example, the PMX column can be used with Baxters (formerly Gambro) Prismaflex system.

Figure 10: Baxters Prismaflex pump

Source: Baxter website

Spectral Medical has developed a standalone pump that was developed specifically for the PMX column.

Spectrals proprietary stand-alone pump should reduce reliance on third party pump machines such as

Gambros Prismaflex. Spectrals pump is going to be filed as a 510K in the United States which is targeted

for the first quarter of 2016. The advantage of using Spectrals pump is that it is simpler to operate and has

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 15

a disposal cartridge which can be used for each PMX treatment. Spectral initially intends on installing its

pumps at the same 45 clinical sites from the EUPHRATES trial upon completion of the trial.

Figure 11: Spectrals Pump

Source: Spectral Medical

Figure 12: Spectrals Pump Used in Conjunction with PMX column

Source: Spectral Medical

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 16

Figure 13: Spectrals Disposable Blood Pump Cartridge used in Conjunction with PMX column

Source: Spectral Medical

Diagnostic Reagents

Spectrals potential success is likely going to be tied to the development and commercialization of PMX,

along with its complimentary revenue stream coming from their EAA diagnostic test. That being said,

Spectral has tried to diversify their revenue base by developing, producing, and marketing recombinant

cardiac proteins, antibodies, and calibrators. These products are sold for use in research and development,

as well as in products manufactured by other diagnostic companies. Spectral has actively marketed its

capability to develop and manufacture monoclonal and polyclonal antibodies and recombinant proteins.

Theyve entered into license and supply agreements with diagnostic product manufacturers for the use of

its proprietary Troponin I recombinant protein molecules for the calibration of commercial Troponin I

assays. Customers include Beckman Coulter, Abbott Labratories and BioMerieux, where Spectral

generates royalty revenues based on a percentage of end user sales of Troponin I.

FINANCIAL FORECASTS

We expect a PMX launch in third quarter of 2017, if approved. U.S. sales of PMX are estimated at C$27.3M,

C$113.8M, C$172.9M, and C$227.5M, (peak sales) from FY17 to FY20, respectively. As mentioned in the

Products section, Spectral sells the EAA diagnostic and proprietary reagents worldwide. The EAA

diagnostic is the only approved kit by the FDA to measure circulating endotoxin levels in patients. We

expect U.S. sales of the EAA diagnostic to increase after PMX is commercialized in 2017 because the kit will

be sold in conjunction with PMX. We estimate EAA diagnostic and proprietary reagents sales to be

C$3.1M, C$3.8M, C$5.8M, C$7.2M, and C$8.6M from FY16 to FY20, respectively. We estimate Spectrals

total sales revenue from FY16 to FY20 to be C$3.1M, C$31.1M, C$119.6M, C$180.1M, and C$236.1M,

respectively.

In terms of operating expenses, we estimate R&D from FY16 to FY20 to be C$7.2M, C$9.8M, C$9.9M,

C$10M, and C$10.1M, respectively. SG&A estimates are C$3.0M, C$6.2M, C$13.5M, C$18.7M, and

C$23.5M from FY16 to FY20, respectively.

Net income (loss) from FY16 to FY20 are estimated at C($11.9M), C$0.3M, C$47.6M, C$72.7M, and

C$100.5M, respectively. Basic and fully diluted EPS estimates are C($0.06M)/C($0.06M), C$0.00/C$0.00,

C$0.23/ C$0.23, C$0.35/C$0.35, and C$0.49/C$0.48 from FY16 to FY20, respectively.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 17

Figure 14: Annual Estimates (FY2017-2020)

In Millions (CAD)

PMX Sales

EAA/Reagent Sales

Total Sales

R&D Expenses

SG&A Expenses

Net Income

FY17

FY18

FY19

FY20

$27.3

$3.8

$31.1

$9.8

$6.2

$0.3

$113.8

$5.8

$119.6

$9.9

$13.5

$47.6

$172.9

$7.2

$180.1

$10.0

$18.7

$72.7

$227.5

$8.6

$236.1

$10.1

$23.5

$100.5

$0.35

$0.35

$0.49

$0.48

$/Share

EPS

F.D. EPS

$0.00

$0.00

$0.23

$0.23

Source: Mackie Research

Figure 15: Quarterly Income Statement FY2014-2016 (Actual & Estimates)

Quarterly Income (C$, '000)

FYE December 31

FY2014A Q1 FY15A Q2 FY15A Q3 FY15A Q4 FY15E FY2015E Q1 FY16E Q2 FY16E Q3 FY16E Q4 FY16E FY2016E

Revenue

$2,964

COGS (Raw materials and consumables used) $444

$2,520

Gross Profit

$877

$100

$777

$818

$107

$711

$679

$133

$546

$700

$110

$590

$3,074

$450

$2,624

$900

$125

$775

$800

$110

$690

$675

$95

$580

$725

$100

$625

$3,100

$430

$2,670

Changes in inventories of finished goods and

work-in-process

Employee benefits

R&D

SG&A

Depreciation and Amortization

Foreign exchange loss (gain)

Other expenses (income)

Total Operating Expenses

$310

$24

$56

$28

$130

$238

$100

$85

$75

$80

$340

$3,460

$7,157

$989

$205

$54

$506

$12,681

$947

$1,742

$203

$43

($17)

$124

$3,066

$872

$1,808

$189

$44

$4

$128

$3,101

$846

$1,664

$329

$43

$8

$141

$3,059

$846

$1,714

$429

$43

$0

$141

$3,303

$3,511

$6,928

$1,150

$173

($5)

$534

$12,529

$846

$1,910

$439

$43

$0

$141

$3,479

$846

$1,961

$449

$43

$0

$141

$3,525

$846

$1,765

$1,000

$43

$0

$141

$3,870

$846

$1,588

$1,100

$43

$0

$141

$3,798

$3,384

$7,224

$2,988

$172

$0

$564

$14,672

Operating Income (Loss), EBIT

($10,161) ($2,289)

($2,390)

($2,513)

($2,713)

($9,905)

($2,704)

($2,835)

($3,290)

($3,173) ($12,002)

Finance Income

EBT

Tax expenses (recovery)

$60

$24

($10,101) ($2,265)

($609)

$0

$24

($2,366)

$0

$20

($2,493)

$0

$28

($2,685)

$0

$96

($9,809)

$0

$19

($2,685)

$0

$42

($2,793)

$0

$33

($3,257)

$0

$22

$116

($3,152) ($11,887)

$0

$0

Net Income (Loss)

($9,492)

($2,265)

($2,366)

($2,493)

($2,685)

($9,809)

($2,685)

($2,793)

($3,257)

($3,152) ($11,887)

($0.06)

($0.06)

($0.01)

($0.01)

($0.01)

($0.01)

($0.01)

($0.01)

($0.01)

($0.01)

($0.05)

($0.05)

($0.01)

($0.01)

($0.01)

($0.01)

($0.02)

($0.02)

($0.02)

($0.02)

($0.06)

($0.06)

Weighted average number of common O/S

Basic ('000)

154,541

Diluted ('000)

159,219

179,750

185,669

190,804

196,475

190,831

196,475

191,331

195,975

188,179

193,649

205,164

208,808

205,664

208,308

206,164

207,808

206,664

207,308

205,914

208,058

EPS-Basic

EPS-Diluted

Source: Mackie Research, Company Reports

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 18

Figure 16: Annual Income Statement FY2013-2020 (Actual & Estimates)

Annual Income (C$, '000)

FYE December 31

2013A

2014A

2015E

2016E

2017E

2018E

PMX

EAA and Proprietary reagents

Revenue

$2,672

$2,964

$2,964

$3,074

$3,074

$3,100

$3,100

$27,300

$3,780

$31,080

$113,750

$5,825

$119,575

$172,900 $227,500

$7,240

$8,550

$180,140 $236,050

COGS (Raw materials and consumables used)

Gross Profit

$593

$2,079

$444

$2,520

$450

$2,624

$430

$2,670

$7,354

$23,726

$29,253

$90,322

$35,594

$46,697

$144,546 $189,353

Changes in inventories of finished goods and workin-process

Employee benefits

R&D

SG&A

Depreciation and Amortization

Foreign exchange loss (gain)

Other expenses

Total Operating Expenses

$274

$3,332

$7,924

$1,191

$238

$14

$496

$13,469

$310

$3,460

$7,157

$989

$205

$54

$506

$12,681

$238

$3,511

$6,928

$1,150

$173

($5)

$534

$12,529

$340

$3,384

$7,224

$2,988

$172

$0

$564

$14,672

$3,400

$3,384

$9,808

$6,172

$172

$0

$564

$23,500

$12,900

$3,384

$9,908

$13,487

$172

$0

$564

$40,415

$15,480

$3,384

$10,008

$18,657

$172

$0

$564

$48,266

$18,576

$3,384

$10,108

$23,508

$172

$0

$564

$56,312

Operating Income (Loss), EBIT

($11,390) ($10,161) ($9,905) ($12,002)

$225

$49,907

$96,281

$133,041

Finance Income

EBT

Tax expenses (recovery)

$83

$60

$96

$116

($11,307) ($10,101) ($9,809) ($11,887)

$0

($609)

$0

$0

$45

$271

$0

($8)

$49,899

$2,300

$613

$96,894

$24,223

$939

$133,980

$33,495

Net Income (Loss)

($11,307) ($9,492)

$271

$47,599

$72,670

$100,485

($9,809) ($11,887)

2019E

2020E

EPS-Basic

EPS-Diluted

($0.09)

($0.09)

($0.06)

($0.06)

($0.05)

($0.05)

($0.06)

($0.06)

$0.00

$0.00

$0.23

$0.23

$0.35

$0.35

$0.49

$0.48

Weighted average number of common O/S

Basic ('000)

Diluted ('000)

128,265

132,133

154,541

159,219

188,179

193,774

205,914

208,558

205,914

208,558

205,914

208,558

205,914

208,558

205,914

208,558

Margin Analysis

% of PMX in Total Revenue

% of EAA and Proprietary reagents in Total Revenue

% of R&D in Total Revenue

% of SG&A in Total Revenue

Gross Margin

Operating Margin

Net Profit Margin

2013A

0%

0%

297%

45%

78%

-426%

-423%

2014A

0%

100%

241%

33%

85%

-343%

-320%

2015E

0%

100%

225%

37%

85%

-322%

-319%

2016E

0%

100%

233%

96%

86%

-387%

-383%

2017E

88%

12%

32%

20%

76%

1%

1%

2018E

95%

5%

8%

11%

76%

42%

40%

2019E

96%

4%

6%

10%

80%

53%

40%

2020E

96%

4%

4%

10%

80%

56%

43%

YoY Analysis

EAA and Proprietary reagents sales

PMX sales

Total revenue

R&D

SG&A

EBIT

Net Income

2013A

2014A

2015E

4%

2016E

1%

2017E

22%

11%

-10%

-17%

4%

-3%

16%

1%

4%

160%

903%

36%

107%

2018E

54%

317%

285%

1%

119%

22033%

17469%

2019E

24%

52%

51%

1%

38%

93%

53%

2020E

18%

32%

31%

1%

26%

38%

38%

Source: Mackie Research, Company Reports

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 19

Figure 17: Quarterly & Annual Cash Flow/Selected Balance Sheets FY2014-2020 (Actual & Estimates)

FY2014A

Q1 FY15A

Q2 FY15A

Q3 FY15A

Q4 FY15E

FY2015E

Q1 FY16E

Q2 FY16E

Q3 FY16E

Q4 FY16E

FY2016E

FY2017E

FY2018E

FY2019E

FY2020E

Operating Activities

Net income

Depreciation and amortization

Share-based compensation

Loss on disposal of PP&E

Deferred tax recovery

Changes in working capital

Total CF from Operating Activities

($9,492)

$205

$348

$1

($609)

($461)

($10,008)

($2,265)

$43

$105

$0

$0

($739)

($2,856)

($2,366)

$44

$32

$0

$0

$121

($2,169)

($2,493)

$43

$46

$0

$0

$209

($2,195)

($2,685)

$43

$46

$0

$0

$209

($2,387)

($9,809)

$173

$229

$0

$0

($200)

($9,607)

($2,685)

$43

$46

$0

$0

($100)

($2,696)

($2,793)

$43

$46

$0

$0

($100)

($2,804)

($3,257)

$43

$46

$0

$0

($100)

($3,268)

($3,152)

$43

$46

$0

$0

($100)

($3,163)

($11,887)

$172

$184

$0

$0

($400)

($11,931)

$271

$172

$184

$0

$0

($1,000)

($373)

$47,599

$172

$184

$0

$0

($1,300)

$46,655

$72,670

$172

$184

$0

$0

($1,690)

$71,336

$100,485

$172

$184

$0

$0

($2,197)

$98,644

Investing Activities

Net PP&E expenditures

Total CF from Investing Activities

($44)

($44)

($118)

($118)

($73)

($73)

($44)

($44)

($44)

($44)

($279)

($279)

($25)

($25)

($25)

($25)

($25)

($25)

($25)

($25)

($100)

($100)

($200)

($200)

($200)

($200)

($200)

($200)

($200)

($200)

$12,816

$61

$0

$12,877

$0

$43

($55)

($12)

$6,021

$89

$0

$6,110

$0

$7

($300)

($293)

$0

$50

($150)

($100)

$6,021

$189

($505)

$5,705

$9,500

$25

$0

$9,525

$0

$25

$0

$25

$0

$25

$0

$25

$0

$25

$0

$25

$9,500

$100

$0

$9,600

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$2,825

$0.02

($2,986)

($0.02)

$3,868

$0.02

($2,532)

($0.01)

($2,531)

($0.01)

($4,181)

($0.02)

$6,804

$0.03

($2,804)

($0.01)

($3,268)

($0.02)

($3,163)

($0.02)

($2,431)

($0.01)

($573)

($0.00)

$46,455

$0.23

$71,136

$0.35

$98,444

$0.48

FY2014A

$10,054

$0

$8,820

0%

$0.06

-108%

Q1 FY15A

$7,068

$0

$6,648

0%

$0.04

-34%

Q2 FY15A

$10,936

$0

$10,424

0%

$0.05

-23%

Q3 FY15E

$8,404

$0

$7,638

0%

$0.04

-33%

Q4 FY15E

$5,873

$0

$4,853

0%

$0.03

-55%

FY2015E

$5,873

$0

$4,853

0%

$0.03

-202%

Q1 FY16E

$12,677

$0

$11,693

0%

$0.06

-23%

Q2 FY16E

$9,873

$0

$8,925

0%

$0.04

-31%

Q3 FY16E

$6,605

$0

$5,693

0%

$0.03

-57%

Q4 FY16E

$3,442

$0

$2,566

0%

$0.01

-123%

FY2016E

$3,442

$0

$2,566

0%

$0.01

-463%

FY2017E

$2,869

$0

$2,837

0%

$0.01

10%

FY2018E

$49,324

$0

$50,436

0%

$0.24

94%

FY2019E

$120,461

$0

$123,107

0%

$0.60

59%

FY2020E

$218,904

$0

$223,591

0%

$1.09

45%

Cash Flow (C$, '000)

FYE December 31

Financing Activities

Common share issuance

Share options and warrants exercised

Shares repurchased under the NCIB

Total CF from Financing Activities

Total Cash Flow

CFPS

Selected Balance Sheet (C$, '000)

Cash and cash equivalents

Long-term debt

Total equity

Debt as % of Equity (D/E Ratio)

Book value/Share

ROE

Source: Mackie Research, Company Reports

MANUFACTURING

Spectral manufactures the EAA at its Canadian facility in Toronto, Ontario. The facility complies with the

requirements of Current Good Manufacturing Practices (CGMPs) and regulating authorities including the

FDA and Health Canadas Therapeutic Product Programme. Spectrals manufacturing facilities were

upgraded in 2007 and is self-sufficient for the manufacture of its EAA product and the manufacture of its

proprietary biological reagents. Spectrals patented recombinant single-chain Troponin I-C polypeptide

has gained worldwide recognition as a superior reagent for calibration of cardiac Troponin I assays.

The PMX device is manufactured by Toray. Recent construction of Torays new plant facilities have been

completed and the new plant complies with FDA regulatory requirements and is expected to be fully

operational before the U.S. market launch of PMX.

Spectrals stand alone blood pump is manufactured by a private dialysis equipment company in

Switzerland.

MARKET OVERVIEW

The market for sepsis treatment is largely an unmet medical need. In the United States, approximately

750,000 cases of sepsis occur each year, of which at least 225,000 are fatal (Journal of Clinical Medicine

Research 7, No.1 (2015) p.18-20). Approximately 40% of all intensive care unit patients have sepsis on

admission to the intensive care unit or experience sepsis during their stay in the intensive care unit. CDCs

(Centers for Disease Control and Prevention) National Center for Health Statistic, based upon information

collected for billing purposes, estimates that the amount of hospital visits of patients with sepsis or

septicemia (another word for sepsis) increased from 621,000 in the year 2000 to 1,141,000 in 2008. As noted

in Figure 18, hospitalization rates for sepsis (in contrast from the previous statistic, this focuses on patients

admitted to the hospital for sepsis) more than doubled from 2000 through 2008.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 20

Figure 18: Hospitalizations for and with Septicemia and Sepsis

Source: CDC/NCHS, National Hospital Discharge, 2008 - from NCHSH Data Brief No.62 June 2011

Organ failure occurs in about one-third of patients with sepsis, and severe sepsis is associated with an

estimated mortality rate of 30-50% (Journal of Clinical Medicine Research 7, No.1 (2015) p.18-20). There is

wide variation in the incidence of sepsis and severe sepsis in the general ICU setting, with reported rates

ranging from 20% to 80%, and reported mortality of 20% to 50% (Journal of Clinical Medicine Research 7,

No.1 (2015) p.18-20).

Approximately two-thirds of sepsis occurs in patients over the age of 65 years (CDC/NCHS, National

Hospital Discharge, 2008 - from NCHSH Data Brief No.62 (June 2011)). Patients over 85 years old are 30

times more likely to be hospitalized for sepsis. The length of stay is prolonged by 75% and mortality is 8

times higher in septic patients for all who end up in the ICU (National Vital Statistics Reports No.58 (2010) p.

1-135). According to the CDC, severe sepsis accounts for approximately 40% of ICU expenditures. The

United States healthcare cost is six times greater in patients with sepsis, resulting in an estimated US$14.6

billion, as reported by the CDC.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 21

Figure 19: Rates of hospitalization for Sepsis, by sex and age for 2008

Source: CDC/NCHS, National Hospital Discharge, 2008 - from NCHSH Data Brief No.62 June 2011

Figure 20 further illustrates the fact that sepsis treatment is an unmet medical need, as patients

hospitalized for sepsis were more severely ill than patients hospitalized for another diagnosis.

Figure 20: Percentage of hospital stays where the patient had seven or more diagnosis, 2008

Source: CDC/NCHS, National Hospital Discharge, 2008 - from NCHSH Data Brief No.62 June 2011

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 22

We estimate PMXs target population to be around 175,000 patients per year, which represents a

consumption of around 350,000 PMX cartridges and 875,000 EAA diagnostic tests.

Conventional Sepsis Treatments:

Common conventional sepsis treatments include antibiotics to treat the infection, fluids, and medication

through intravenous (IV) to maintain the blood pressure, correct any clotting problems, and stabilize blood

circulation, oxygen, and plasma (or other blood products). However, clinical reports suggest controversial

results with these treatments. Currently, there are no approved drugs available in both U.S. and EU

markets.

Eli Lillys Xigris was the only approved drug for patients with severe sepsis, who had a high risk of death.

This human activated protein C recombinant was originally approved by the FDA in November 2001,

however, the manufacturers aggressive strategies in marketing its use in severe sepsis were criticized, and

on October 25, 2011, Eli Lilly withdrew Xigris from global markets after a major study showed no efficacy

for the treatment of sepsis. The study, called PROWESS-SHOCK, reported a 28-day all-cause mortality rate

of 26.4% in patients treated with Xigris compared with 24.2% in the placebo group, and did not deem the

difference statistically significant. There were also claims following a 2009 study that the drug led to an

increased risk of serious bleeding and death, but were later refuted with an additional study. Due to the

lack of current efficacious treatments for severe sepsis to control mortality, we believe theres an

extraordinary market opportunity for Spectral.

Available clinical data could strengthen doctors confidence in PMX usage:

Polymyxin B-immobilized fiber hemoperfusion column (PMX) has been used in Japan and covered by the

Japanese Ministry of Health since 1994. The efficacy and safety data has been reported in peer-reviewed

articles. Over a span of 22 years to date, published articles on the use of PMX have reported on over 140

individual studies that included approximately 4,400 patients, who have received approximately 7,600

PMX perfusions. Discussing the wealth of clinical data available on PMX, Spectral has stated that the

safety profile continues to be excellent, with the number of treatment-related, serious events, being very

low. The majority of the product use has been in Japan, but utilization of PMX in Europe and other regions

is now increasing.

Systematic review of available data from randomized controlled trials (RCT) indicated that the use of PMX

was associated with a significant 26% increase in MAP (mean arterial pressure) when compared to a

conventional treatment paradigm. Patients with a worse MAP profile before treatment benefited after the

column treatment. Overall mortality rates (14 days, 28 days, 30 days, and 60 days) were 61.5% in the

conventional therapy group and 33.5% in the PMX group a very statistically significant result. It is

important to note that when the analysis was limited to a 28-to-30-day mortality, the results were also

statistically significant. Endotoxin levels were decreased by 33-80% after the column treatment. We believe

that the current wealth of available clinical data could increase U.S. doctors confidence and use of PMX.

The ease of use provides another marketing advantage:

The PMX cartridge is ordered by the physician and attached to Spectrals new pump system. The new

pump requires less expertise than needed for dialysis and can be administered by nurses in the ICU.

Generally patients are in the ICU with a 1:1 or 1:2 patient-to-nurse ratio, therefore, no additional

manpower is required to administer PMX. PMX is currently designed to be used in the ICU, but given its

ease of use we can see it being used in other areas, such as in emergency, etc.

Cost-effective characteristics of both PMX and EAA represent an opportunity:

Sepsis is highly prevalent within ICUs and is associated with high costs the cost of caring for sepsis

patients has been shown to be 6 times higher than caring for ICU patients without sepsis. U.S. data has

shown that each adult sepsis patient consumes between US$21,000 and US$25,000 (direct costs) during

hospitalization (Chalfin D, et al., The economics of critical care medicine: Critical care clinics). Given around

750,000 sepsis hospitalization cases each year, the total direct economic burden from sepsis is around $15

billion. This figure may increase when patients progress to severe sepsis, septic shock, and multiple organ

dysfunctions, ultimately leading to longer hospital stays. For these reasons, healthcare providers,

drug/medical device manufacturers, government authorities, and payors have focused their attention on

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 23

strategies that could reduce the economic burden of sepsis. However, studies have shown that current

treatment of sepsis has not been cost efficient. An analysis of more than 166,000 sepsis patients at 309

hospitals found wide variation in mortality and cost (Chalfin D, et al., The economics of critical care medicine:

Critical care clinics). One third of hospitals exceeded expected costs of care by at least 10% and there was no

significant association found between hospital spending and mortality. The study found that more

hospitals had higher-than-expected costs and higher-than-expected mortality rates (10% of hospitals) than

hospitals that had lower-than-expected costs and mortality rates (7% of hospitals). These findings serve to

highlight the opportunity of finding a more cost effective treatment program.

PMXs cost of treatment is expected to be priced near US$20,000 and that should include all tubes and

accessories needed; there should not be any additional cost. One 2011 study based on PMX use in Italy

showed that, compared to conventional sepsis therapy, PMX plus conventional therapy provided a better

profile in terms of number of life years gained at additional cost. This pharmacoeconomic study suggested

that PMX was a cost-effective intervention for the treatment of severe sepsis/septic shock of abdominal

origin (Berto P, et al., Blood Purif (2001)).

We expect PMX to achieve maximum cost efficiency in selected patients with high endotoxin measured by

the EAA diagnostic and would likely be preferred by U.S. payors.

COMPETITION/NEW ENTRANTS

Aethlon Medical (NASDAQ: AEMD) Early clinical stage in U.S.

On September 30, 2011, Aethlon signed a $6.8 million contract with the Defense Advanced Research

Projects Agency (DARPA) to develop a medical device that would reduce the incidence of sepsis in

combat-injured soldiers and civilians. No detailed information is available.

Cytosorbents (NASDAQ: CTSO) Early clinical stage in EU and IDE in U.S.

Cytosorbents CytoSorb is a first-in-class extracorporeal cytokine absorber, now approved in EU, and

broadly indicated for use in any clinical situation where cytokines are elevated (ie. different from Spectrals

PMX used for elevated endotoxin levels). CytoSorbents has conducted a small-scale clinical trial in sepsis

patients within Europe (European Sepsis Trial). In the randomized, controlled, multi-center study in

Germany, CytoSorb significantly reduced 28-day all-cause mortality (0.0% vs. 62.5% in control, p = 0.03,

n=14) in 43 patients with septic shock and respiratory failure 60-day mortality and ICU stay was nonsignificantly improved by CytoSorb treatment. Other independent trials also showed that CytoSorb was

safe and well tolerated in more than 300 treatments in very sick patients with the worst forms of sepsis and

lung injury. Cytosorbents also has an FDA-approved IDE application to run a small sepsis trial in the U.S.

The company is currently collaborating with Dr. John Kellum at the University of Pittsburgh Medical

Center to target severe sepsis and septic shock. Investors should note that CytoSorb is designed to treat

sepsis patients with high cytokine level, which serves to differentiate their product from PMX (designed to

treat sepsis patients with high endotoxin levels). The causes of sepsis are still relatively unknown, so

assuming both of these products make it to market, both treatments could potentially be used to treat

sepsis depending on the symptoms (elevated cytokines vs. endotoxins).

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 24

Figure 21: Cytosorbents CytoSorb

Source: Cytosorbents corporate presentation

Alteco Medical Approved in EU for endotoxin removal in 2007

Altecos LPS Adsorber is a Class IIa medical device (column) approved for endotoxin removal in an ICU

setting. The column does not contain any pharmaceutical or toxic components. Its high affinity to the Lipid

A moiety of the endotoxin molecule by hydrophobic and ionic interactions ensures efficient reduction of

endotoxins from different bacteria species, as this component of the endotoxin molecule is constant. The

capturing component is a specially designed synthetic peptide. More than 2,000 treatments have been

carried out worldwide using LPS Adsorber. The clinical reports and published data indicate the efficacy of

LPS Adsorber to remove endotoxin and to improve organ function in patients suffering from severe Gram

negative sepsis and septic shock. However, LPS Adsorber did not achieve significant mortality and ICUstay reduction. Alteco has not disclosed its U.S. commercialization plan. We believe Alteco would likely

need to conduct a U.S. pivotal trial that achieves statistical significance to obtain FDA approval.

www.mackieresearch.com

Initiating Coverage SPECTRAL MEDICAL INC.

Page 25

Figure 22: Alteco LPS Adsorber

Source: Altecos corporate presentation

All in all, there has not been any other major direct therapeutic competitor identified in this particular

market segment, although there are a number of companies that either are, or were, engaged in clinical