Académique Documents

Professionnel Documents

Culture Documents

Economy 10 Lecture Notes

Transféré par

PrateekKumarCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Economy 10 Lecture Notes

Transféré par

PrateekKumarDroits d'auteur :

Formats disponibles

ECONOMY 10

Constraints faced to control Inflation

Constraints in controlling cost push inflation

Prices of imported commodities crude oil prices increased

Depreciation of rupee

Food inflation because of defective supply chain

Low growth of agriculture sector

Increase in interest rates

Increase in Public Expenditure and Budgetary deficit

Constraints in controlling demand pull

Foreign investment is increasing

Depreciation of rupee

Note: Out of the two types of Inflation, it is the Cost-Push type of inflation that is hard to control

because these are real problems faced by the economy (like droughts, floods, supply chain

management problems). On the other hand, Demand-Pull type of inflation can be controlled by

controlling money side factors.

Impact of Inflation

Positive Impact

Inflation is good for the economy upto

reasonable limits. This according to RBI is 5%.

Moderate inflation stimulates growth.

Negative Impact

Real income of people would decrease.

Inflation is regressive in nature.

Would increase income inequalities.

Capital formation is adversely affected.

Interest rates were increased by RBI.

Distorts Resource allocation.

Promotes generation of Black Money.

Standard of living would reduce.

Promote hoarding and speculation.

Adversely effects BOP situation.

Phillips curve

Measurement of Inflation

Inflation is measured with the help of Index numbers. Index numbers are numbers that measure

change in any variable.

There are two types of Index numbers

Wholesale Price Index (WPI)

Based in 676 commodities

Estimated by Min of Industry and Commerce

Measured on a monthly basis, but with a lag of 14 days.

Base year is 2004-05

Item Groups

No of Items

Weightage (%)

Primary articles

102

20.12

Fuel and Power

19

14.91

Manufactured Items

555

64.97

Total

676

100

ECONOMY 10

Note: WPI was revised in 2010. It was revised on the recommendation of Prof. Abhijit Sen

committee. Earlier the base year for WPI was 1993-94.

In India, general rate of inflation is measured by WPI.

Different methods to measure WPI

Point to Point inflation

Inflation is compared between two points in time, usually a months inflation rate.

52 week average method

Average of previous 52 weeks point to point inflation is taken.

Consumer Price Index (CPI)

It shows the impact of inflation on a common man (increase in cost of living).

CPI is considered to provide Dearness Allowance to Central government employees.

CPI is based on retail prices.

Is available on a monthly basis.

There are four types of CPI:

CPI for Industrial Workers (CPI-IW)

o Base year: 2001

o Weightage of food items is 46%

o Measured by Labour Bureau

o This is used for the grant of DA

CPI for Urban Non-Manual Employees (CPI-UNME)

o Base year: 1984-85

o This is used to provide grant by some MNCs

CPI for Agricultural Labourers (CPI-AL)

o Base year: 1986-87

o Used for the fixation of minimum wages

o This is used for revision of wages under MNREGA

CPI for Rural Labourers (CPI-RL)

o Base year: 1986-87

New CPI introduced by CSO

In 2011, CSO introduced three new CPIs

CPI Urban

CPI Rural

CPI Combined

The reason to introduce these new CPIs was that there was no single CPI that could give the effect of

inflation as a common man residing in India would experience. Base year for all the three CPIs is

2010.

Why Inflation is high on CPI as compared to WPI?

Weightage of food is high in CPI than when compared to WPI.

ECONOMY 10

Sub-Prime loans

These are loans that are provided to risky borrowers or in other words, clients who have high

probability of defaulting.

Impact of Sub-prime crisis on Indian Economy

Banks and Financial Institutions suffered loses as a result withdrawal of money by Financial

Institutions. This resulted in demand being reduced. This in turn resulted in inflation decreasing in

India.

Remedies: Government provided Fiscal stimulus (taxes reduced, govt expenditure increased),

Expansionary monetary policy was adopted by RBI and Support packages was required.

Terms Related with Inflation

1. Inflation: Persistent increase in price level

2. Disinflation: Reduction in the rate of inflation

- Price level decreases

- No adverse effect on economy

3. Deflation: Persistent decrease in price level (negative inflation)

4. Reflation: Price level increases when economy recovers from recession

Based on value of inflation

1. Creeping inflation If rate of inflation is low (upto 3%)

2. Walking/Trotting inflation Rate of inflation is moderate (3-7%)

3. Running/Galloping inflation Rate of inflation is high (>10%)

4. Runaway/Hyper Inflation Rate of inflation is extreme

New terms

1. Stagflation: Inflation + Recession (Unemployment)

2. Misery index: Rate of inflation + Rate of unemployment

3. Inflationary gap: Aggregate demand > Aggregate supply (at full employment level)

4. Deflationary gap: Aggregate supply > Aggregate demand (at full employment level)

5. Suppressed / Repressed inflation: Aggregate demand > Aggregate supply. Here govt will not

allow rising of prices.

6. Open inflation: Situation where price level rises without any price control measures by the

government.

7. Core inflation: Based on those items whose prices are non-volatile.

8. Headline inflation: All commodities is covered in this.

9. Structural inflation: Due to structural problems like infrastructural bottlenecks.

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- 3final Syllabus CSE 3rd Semester4,5,6,7,8Document112 pages3final Syllabus CSE 3rd Semester4,5,6,7,8karunPas encore d'évaluation

- ReadmeDocument1 pageReadmegigi_cerneaPas encore d'évaluation

- Fixed Term Research Associates - 2018 - 19Document9 pagesFixed Term Research Associates - 2018 - 19PrateekKumarPas encore d'évaluation

- Advt No 36 2018 PDFDocument4 pagesAdvt No 36 2018 PDFLucky KapoorPas encore d'évaluation

- FLIR ITC Courses India 09th To 13th Sept. 2019 1Document2 pagesFLIR ITC Courses India 09th To 13th Sept. 2019 1PrateekKumarPas encore d'évaluation

- Enabling Virtual AAA Management in SDN-Based IoT NetworksDocument24 pagesEnabling Virtual AAA Management in SDN-Based IoT NetworksPrateekKumarPas encore d'évaluation

- Fixed Term Research Associates - 2018 - 19Document9 pagesFixed Term Research Associates - 2018 - 19PrateekKumarPas encore d'évaluation

- Fixed Term Research Associates - 2018 - 19Document9 pagesFixed Term Research Associates - 2018 - 19PrateekKumarPas encore d'évaluation

- Advertisement RA NP 09-2018Document1 pageAdvertisement RA NP 09-2018PrateekKumarPas encore d'évaluation

- TCS Affidavit Notarized Undertaking FormatDocument2 pagesTCS Affidavit Notarized Undertaking Formatvanmathim_14814484379% (14)

- Advertisement - Donghoon Image Processing 121217Document1 pageAdvertisement - Donghoon Image Processing 121217PrateekKumarPas encore d'évaluation

- Schedule For G.S Batch-26: Date Timing Venue SubjectDocument2 pagesSchedule For G.S Batch-26: Date Timing Venue SubjectPrateekKumarPas encore d'évaluation

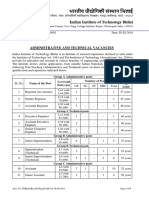

- IIT Bhilai Administrative and Technical Vacancies 08-08-2018Document9 pagesIIT Bhilai Administrative and Technical Vacancies 08-08-2018PrateekKumarPas encore d'évaluation

- Energy Consumption Analysis of ZigBeeDocument5 pagesEnergy Consumption Analysis of ZigBeePrateekKumarPas encore d'évaluation

- List of Important Committees in India During 2015 and 2016.Document5 pagesList of Important Committees in India During 2015 and 2016.PrateekKumarPas encore d'évaluation

- ReferencesDocument11 pagesReferencesPrateekKumarPas encore d'évaluation

- Wireless Sensor NetworksDocument22 pagesWireless Sensor NetworksPrateekKumarPas encore d'évaluation

- Economy 5 Lecture Notes PDFDocument5 pagesEconomy 5 Lecture Notes PDFSri HarshaPas encore d'évaluation

- 186872e4 Role of Civil Services in A Democracy WWW - Visionias.inDocument0 page186872e4 Role of Civil Services in A Democracy WWW - Visionias.inruchiawasthyPas encore d'évaluation

- Simulation in OpnetDocument8 pagesSimulation in OpnetPrateekKumarPas encore d'évaluation

- Economy 13 - Budget 634977588926137753 - 1221562Document5 pagesEconomy 13 - Budget 634977588926137753 - 1221562Amit GuptaPas encore d'évaluation

- Ias Baba Air DecDocument18 pagesIas Baba Air DecPrateekKumarPas encore d'évaluation

- Economy 14 IndustryDocument3 pagesEconomy 14 IndustryPrateekKumarPas encore d'évaluation

- (Vision - Ias) Separation - Of.powersDocument11 pages(Vision - Ias) Separation - Of.powerscompete_with_self50% (4)

- Elections in IndiaDocument7 pagesElections in IndiaPrateekKumarPas encore d'évaluation

- Short EssayDocument6 pagesShort EssayPrateekKumarPas encore d'évaluation

- Rohit PaymentDocument1 pageRohit PaymentPrateekKumarPas encore d'évaluation

- MicroeconomicsDocument9 pagesMicroeconomicsPrateekKumarPas encore d'évaluation

- DropboxDocument36 pagesDropboxPrateekKumarPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Rigged PDFDocument263 pagesRigged PDFScott KlairPas encore d'évaluation

- HRM AssignmentDocument17 pagesHRM AssignmentFaheem JuttPas encore d'évaluation

- The HP WayDocument6 pagesThe HP WayMaman Afzal0% (1)

- Performance Appraisal and Management: Muhammad Naeem Ahmed Department of Business AdministrationDocument12 pagesPerformance Appraisal and Management: Muhammad Naeem Ahmed Department of Business AdministrationBUS18F029 MansoorkhanPas encore d'évaluation

- Case 3Document1 pageCase 3Marjurie QuincePas encore d'évaluation

- Criminologists - Bacolod PDFDocument44 pagesCriminologists - Bacolod PDFPhilBoardResultsPas encore d'évaluation

- H&S Induction Training PresentationDocument10 pagesH&S Induction Training PresentationSanthosh MechPas encore d'évaluation

- Plant Manager Manufacturing Operations in Syracuse NY Resume Samuel BeamanDocument3 pagesPlant Manager Manufacturing Operations in Syracuse NY Resume Samuel BeamanSamuelBeamanPas encore d'évaluation

- Antunes, Ricardo The Meanings of Work Essay On The Affirmation and Negation of WorkDocument272 pagesAntunes, Ricardo The Meanings of Work Essay On The Affirmation and Negation of WorkKainara MirandaPas encore d'évaluation

- Faculty Manual Update 20051Document68 pagesFaculty Manual Update 20051Ronaldyn DabuPas encore d'évaluation

- Task 01 Complete (A, B, C)Document3 pagesTask 01 Complete (A, B, C)Mohd Sami Uddin100% (1)

- Jack Pasmore CVDocument3 pagesJack Pasmore CVapi-272712444Pas encore d'évaluation

- Utrecht ScaleDocument58 pagesUtrecht ScaleMaya CamarasuPas encore d'évaluation

- MB0043 Human Resource Management Set1Document18 pagesMB0043 Human Resource Management Set1Ayaz AnsariPas encore d'évaluation

- Canadian Opportunities v. DalanginDocument4 pagesCanadian Opportunities v. DalanginYvette MoralesPas encore d'évaluation

- Human Resource Development: Bangladesh PerspectiveDocument8 pagesHuman Resource Development: Bangladesh PerspectiveEnamul HaquePas encore d'évaluation

- Defining Diversity:: 1. Power TheoryDocument4 pagesDefining Diversity:: 1. Power TheoryEthan ChristopherPas encore d'évaluation

- Health and Safety Hazards in The Construction IndustryDocument10 pagesHealth and Safety Hazards in The Construction Industryayie55Pas encore d'évaluation

- Connor Vaughn ResumeDocument2 pagesConnor Vaughn Resumeapi-666641423Pas encore d'évaluation

- Upper Intermediate Test File 2006 PDFDocument37 pagesUpper Intermediate Test File 2006 PDFbelen100% (4)

- 6th Pay Arrear With Office OrderDocument13 pages6th Pay Arrear With Office Orderazazahmed shaikh100% (2)

- 2-2-1 Pengembangan Pemimpin Unggul by Djohan Nurjadi PDFDocument15 pages2-2-1 Pengembangan Pemimpin Unggul by Djohan Nurjadi PDFheruwahyuPas encore d'évaluation

- Letter of Offer Part 2 Gems Programme-Mohd Sahrin Bin SaatDocument2 pagesLetter of Offer Part 2 Gems Programme-Mohd Sahrin Bin SaatJunaidah MusaPas encore d'évaluation

- MIS (Management Information System) in HR ApplicationsDocument18 pagesMIS (Management Information System) in HR Applicationsabhijitsamanta175% (8)

- Mikan Puli General Manager Country Manager Philippines ResumeDocument2 pagesMikan Puli General Manager Country Manager Philippines Resumemikan_puliPas encore d'évaluation

- Accounting For Labor Slides LMSDocument33 pagesAccounting For Labor Slides LMSPrince Nanaba EphsonPas encore d'évaluation

- Write Up Interview DoughboysDocument6 pagesWrite Up Interview DoughboysMa Rhodora Andaya AldayPas encore d'évaluation

- Business Mathematics - Module 15 - Spreadsheet For Computation and PresentationDocument17 pagesBusiness Mathematics - Module 15 - Spreadsheet For Computation and Presentationluxtineury2310Pas encore d'évaluation

- Knowledge Assistant: by Lumos LearningDocument23 pagesKnowledge Assistant: by Lumos LearningJasvinder SinghPas encore d'évaluation

- PAS 96 2008 - Defending Food & DrinkDocument32 pagesPAS 96 2008 - Defending Food & DrinkMark KwanPas encore d'évaluation