Académique Documents

Professionnel Documents

Culture Documents

Form 1040NR-EZ Tax Return for Nonresident Aliens

Transféré par

Elena Alexandra CărăvanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form 1040NR-EZ Tax Return for Nonresident Aliens

Transféré par

Elena Alexandra CărăvanDroits d'auteur :

Formats disponibles

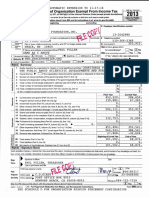

Form

1040NR-EZ

U.S. Income Tax Return for Certain

Nonresident Aliens With No Dependents

OMB No. 1545-0074

2015

Department of the Treasury

Information about Form 1040NR-EZ and its instructions is at www.irs.gov/form1040nrez.

Internal Revenue Service

Your first name and initial

Identifying number (see instructions)

Last name

Elena A

Caravan

Foreign country name

Foreign province/state/county

885-97-8757

Please print Present home address (number, street, and apt. no., or rural route). If you have a P.O. box, see instructions.

or type.

Str. Ritmului, Nr.4, Bloc. 438, Scara 1, Etaj 8, Apt. 40

See

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

separate

instructions. Bucharest

Romania

Filing Status

Check only one box.

Attach

Form(s)

W-2 or

1042-S

here.

Also

attach

Form(s)

1099-R if

tax was

withheld.

Refund

Direct

deposit?

See

instructions.

Amount

You Owe

Third

Party

Designee

Sign

Here

Paid

Preparer

Use Only

Bucharest

Single nonresident alien

021677

Married nonresident alien

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18a

b

19

20

21

22

23a

b

d

e

Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . .

Taxable refunds, credits, or offsets of state and local income taxes . . . . . .

Scholarship and fellowship grants. Attach Form(s) 1042-S or required statement. .

Total income exempt by a treaty from page 2, Item J(1)(e) .

6

Add lines 3, 4, and 5 . . . . . . . . . . . . . . . . . . . . .

Scholarship and fellowship grants excluded . . . . .

8

Student loan interest deduction . . . . . . . . .

9

Subtract the sum of line 8 and line 9 from line 7. This is your adjusted gross income .

Itemized deductions (see instructions) . . . . . . . . . . . . . . .

Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . .

Exemption (see instructions) . . . . . . . . . . . . . . . . . . .

Taxable income. Subtract line 13 from line 12. If line 13 is more than line 12, enter -0Tax. Find your tax in the tax table in the instructions . . . . . . . . . . .

Unreported social security and Medicare tax from Form: a 4137

b 8919

Add lines 15 and 16. This is your total tax . . . . . . . . . . . . .

Federal income tax withheld from Form(s) W-2 and 1099-R

18a

Federal income tax withheld from Form(s) 1042-S . . .

18b

2015 estimated tax payments and amount applied from 2014 return

19

Credit for amount paid with Form 1040-C . . . . .

20

Add lines 18a through 20. These are your total payments . . . . . . . .

If line 21 is more than line 17, subtract line 17 from line 21. This is the amount you overpaid

Amount of line 22 you want refunded to you. If Form 8888 is attached, check here

Routing number

c Type:

Checking

Savings

Account number

If you want your refund check mailed to an address outside the United States not

shown above, enter that address here:

24

25

26

Amount of line 22 you want applied to your 2016 estimated tax

24

Amount you owe. Subtract line 21 from line 17. For details on how to pay, see instructions

Estimated tax penalty (see instructions) . . . . . . .

26

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Designees

name

10

11

12

13

14

15

16

17

21

22

23a

25

Yes. Complete the following.

No

Personal identification

number (PIN)

Phone

no.

3

4

5

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct, and accurately list all amounts and sources of U.S. source income I received during the tax year. Declaration of

preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Keep a copy of

this return for

your records.

Foreign postal code

Your signature

Print/Type preparers name

Firms name

Firm's address

Date

Your occupation in the United States

Preparer's signature

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see instructions.

Date

If the IRS sent you an Identity Protection

PIN, enter it

here (see inst.)

PTIN

Check

if

self-employed

Firm's EIN

Phone no.

Cat. No. 21534N

Form 1040NR-EZ (2015)

Page 2

Form 1040NR-EZ (2015)

Schedule OI- Other Information (see instructions)

Answer all questions

A

Of what country or countries were you a citizen or national during the tax year?

In what country did you claim residence for tax purposes during the tax year?

Have you ever applied to be a green card holder (lawful permanent resident) of the United States? .

Yes

No

Were you ever:

1.

A U.S. citizen? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

A green card holder (lawful permanent resident) of the United States?

. . . . . . . . .

If you answer Yes to (1) or (2), see Pub. 519, chapter 4, for expatriation rules that may apply to you.

.

.

.

.

Yes

Yes

No

No

Romania

If you had a visa on the last day of the tax year, enter your visa type. If you did not have a visa, enter your U.S. immigration

status on the last day of the tax year.

Have you ever changed your visa type (nonimmigrant status) or U.S. immigration status? .

If you answered Yes, indicate the date and nature of the change.

List all dates you entered and left the United States during 2015 (see instructions).

Note. If you are a resident of Canada or Mexico AND commute to work in the United States at frequent

intervals, check the box for Canada or Mexico and skip to item H . . . . . . . . . . . .

Date entered United States

mm/dd/yy

Date departed United States

mm/dd/yy

Date entered United States

mm/dd/yy

Yes

Canada

No

Mexico

Date departed United States

mm/dd/yy

Give number of days (including vacation, nonworkdays, and partial days) you were present in the United States during:

2013

, 2014

, and 2015

Did you file a U.S. income tax return for any prior year?

If Yes, give the latest year and form number you filed

Yes

.

No

2013

Income Exempt from TaxIf you are claiming exemption from income tax under a U.S. income tax treaty with a foreign country,

complete (1) through (3) below. See Pub. 901 for more information on tax treaties.

1.

Enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the

treaty benefit, and the amount of exempt income in the columns below. Attach Form 8833 if required (see instructions).

(a) Country

(b) Tax treaty

article

(d) Amount of exempt

income in current tax year

(c) Number of months

claimed in prior tax years

(e) Total. Enter this amount on Form 1040NR-EZ, line 6. Do not enter it on line 3 or line 5 . . . .

2.

Were you subject to tax in a foreign country on any of the income shown in 1(d) above?

3.

Are you claiming treaty benefits pursuant to a Competent Authority determination? . .

If Yes, attach a copy of the Competent Authority determination letter to your return.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

Yes

No

No

Form 1040NR-EZ (2015)

Vous aimerez peut-être aussi

- Submitting Your U.S. Tax Documents: Print, Sign, MailDocument5 pagesSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- Guarding Against Pandemics 2021 990Document20 pagesGuarding Against Pandemics 2021 990Teddy SchleiferPas encore d'évaluation

- SCC Irs Form 990 2013Document27 pagesSCC Irs Form 990 2013L. A. PatersonPas encore d'évaluation

- Bloomberg 2012Document316 pagesBloomberg 2012josephlordPas encore d'évaluation

- Interest and Ordinary DividendsDocument1 pageInterest and Ordinary DividendsBetty Ann LegerPas encore d'évaluation

- Reporting Agent Authorization Form 8655Document2 pagesReporting Agent Authorization Form 8655bilalPas encore d'évaluation

- Instructions For Form 1120Document31 pagesInstructions For Form 1120A.F. GRANADAPas encore d'évaluation

- 5 XVFPSVKDocument1 page5 XVFPSVKIrma AsaroPas encore d'évaluation

- Bankruptcy Complaint Against Alan Spiegel & Steven Spiegel of 26MGMT LLCDocument44 pagesBankruptcy Complaint Against Alan Spiegel & Steven Spiegel of 26MGMT LLCLoron DurondPas encore d'évaluation

- John Hancock Committee 2010 990Document28 pagesJohn Hancock Committee 2010 990nemesis2013Pas encore d'évaluation

- Received: Return of Organization Exempt From Income TaxDocument16 pagesReceived: Return of Organization Exempt From Income Taxcmf8926Pas encore d'évaluation

- Introduction:-: WorksheetDocument24 pagesIntroduction:-: WorksheetbharatPas encore d'évaluation

- SFF IRS Form990 2013Document27 pagesSFF IRS Form990 2013Space Frontier FoundationPas encore d'évaluation

- p4012 (2018)Document349 pagesp4012 (2018)Center for Economic ProgressPas encore d'évaluation

- Donors Capital Fund541934032 2007 048EED01SearchableDocument28 pagesDonors Capital Fund541934032 2007 048EED01Searchablecmf8926Pas encore d'évaluation

- Advanced Scenario 7: Quincy and Marian Pike (2017)Document10 pagesAdvanced Scenario 7: Quincy and Marian Pike (2017)Center for Economic Progress100% (1)

- Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsDocument1 pageAnnual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsCarolina AldanaPas encore d'évaluation

- Complaint: Federal Trade Commission (FTC) : Complaints Against Sean Hannity, Freedom Concerts and Freedom Alliance: 3/29/10 - FTC Complaint CitationsDocument254 pagesComplaint: Federal Trade Commission (FTC) : Complaints Against Sean Hannity, Freedom Concerts and Freedom Alliance: 3/29/10 - FTC Complaint CitationsCREWPas encore d'évaluation

- Breach of Covenant Against Lender and ServicerDocument31 pagesBreach of Covenant Against Lender and Servicerdsnetwork100% (1)

- US Internal Revenue Service: f9325Document2 pagesUS Internal Revenue Service: f9325IRSPas encore d'évaluation

- IRS Form 4868Document4 pagesIRS Form 4868Anil AletiPas encore d'évaluation

- Secretary of State LLC Filing for DSJ Real Estate HoldingsDocument2 pagesSecretary of State LLC Filing for DSJ Real Estate HoldingsDoo Soo KimPas encore d'évaluation

- Let Them Play LawsuitDocument77 pagesLet Them Play LawsuitScott McClallenPas encore d'évaluation

- 202PetitionRYC PDFDocument9 pages202PetitionRYC PDFRYCPas encore d'évaluation

- US Internal Revenue Service: f1099msc - 1993Document9 pagesUS Internal Revenue Service: f1099msc - 1993IRSPas encore d'évaluation

- US Internal Revenue Service: f1099c - 2005Document6 pagesUS Internal Revenue Service: f1099c - 2005IRSPas encore d'évaluation

- Southern Florida: United States Bankruptcy CourtDocument38 pagesSouthern Florida: United States Bankruptcy CourtMy-Acts Of-SeditionPas encore d'évaluation

- Project Homeless Connect 2012 990Document14 pagesProject Homeless Connect 2012 990auweia1Pas encore d'évaluation

- Electronically Available FSA-2041 Form AssignmentDocument2 pagesElectronically Available FSA-2041 Form AssignmentSteve NguyenPas encore d'évaluation

- Reporting Agent Authorization: Sign HereDocument1 pageReporting Agent Authorization: Sign HereSam OziegbePas encore d'évaluation

- IRS Publication Form 706 GSTDocument3 pagesIRS Publication Form 706 GSTFrancis Wolfgang UrbanPas encore d'évaluation

- Irs Form 14039Document2 pagesIrs Form 14039waterfordpolicePas encore d'évaluation

- Ken Strange IRS CompaintDocument2 pagesKen Strange IRS CompaintReform AustinPas encore d'évaluation

- IRS LetterDocument5 pagesIRS LetterJames LynchPas encore d'évaluation

- Processed: Form6 Full and Public Disclosure of 2012 Financial InterestsDocument2 pagesProcessed: Form6 Full and Public Disclosure of 2012 Financial InterestsMy-Acts Of-SeditionPas encore d'évaluation

- Transcript SEC Fundamentals Part 1Document10 pagesTranscript SEC Fundamentals Part 1archanaanuPas encore d'évaluation

- Circus Circus ComplaintDocument18 pagesCircus Circus ComplaintFOX5 VegasPas encore d'évaluation

- Us Loan AuditorsDocument28 pagesUs Loan Auditorsdean6265Pas encore d'évaluation

- I 843Document6 pagesI 843ayi imaduddinPas encore d'évaluation

- Application For Drivers License RenewalDocument2 pagesApplication For Drivers License RenewalJames neteruPas encore d'évaluation

- Donors Trust 2019 990Document113 pagesDonors Trust 2019 990jpeppardPas encore d'évaluation

- FL DMV ManualDocument21 pagesFL DMV Manualgodesi11100% (1)

- Cash 1099Document6 pagesCash 1099Shub OutPas encore d'évaluation

- Verification of Reported IncomeDocument3 pagesVerification of Reported IncomepdizypdizyPas encore d'évaluation

- Monthly Tax Return For Wagers: (Section 4401 of The Internal Revenue Code)Document4 pagesMonthly Tax Return For Wagers: (Section 4401 of The Internal Revenue Code)IRSPas encore d'évaluation

- Tax Form w3Document34 pagesTax Form w3hossain ronyPas encore d'évaluation

- Certificate of Payment of Foreign Death Tax: For Paperwork Reduction Act Notice, See The Back of This FormDocument2 pagesCertificate of Payment of Foreign Death Tax: For Paperwork Reduction Act Notice, See The Back of This FormFrancis Wolfgang UrbanPas encore d'évaluation

- Federal Deposit Insurance Corporation v. Avery Cashion, III, 4th Cir. (2013)Document33 pagesFederal Deposit Insurance Corporation v. Avery Cashion, III, 4th Cir. (2013)Scribd Government DocsPas encore d'évaluation

- Request BeneficiaryDocument1 pageRequest BeneficiaryMar NievesPas encore d'évaluation

- UnpublishedDocument23 pagesUnpublishedScribd Government DocsPas encore d'évaluation

- House Hearing, 112TH Congress - Oversight of The Federal Deposit Insurance Corporation's Structured Transaction ProgramDocument260 pagesHouse Hearing, 112TH Congress - Oversight of The Federal Deposit Insurance Corporation's Structured Transaction ProgramScribd Government DocsPas encore d'évaluation

- Form 4868 TaxesDocument4 pagesForm 4868 TaxesAdam GlassnerPas encore d'évaluation

- GKEDC Form 990 Page 1 For 2013 Through 2019Document7 pagesGKEDC Form 990 Page 1 For 2013 Through 2019Don MoorePas encore d'évaluation

- 2020 Instructions For Schedule C: Profit or Loss From BusinessDocument19 pages2020 Instructions For Schedule C: Profit or Loss From BusinessI'm JuicyPas encore d'évaluation

- Chapter 13 Model PlanDocument13 pagesChapter 13 Model Planjarabbo0% (1)

- Wachovia (Wells Fargo) FHA Sabat Modification Scam ComplaintDocument28 pagesWachovia (Wells Fargo) FHA Sabat Modification Scam ComplaintForeclosure FraudPas encore d'évaluation

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Adam AkbarPas encore d'évaluation

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryD'EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryPas encore d'évaluation

- Flashcards Without WordsDocument2 pagesFlashcards Without WordsElena Alexandra CărăvanPas encore d'évaluation

- Expresii Din Limba EnglezaDocument247 pagesExpresii Din Limba Englezahpples96% (28)

- Uppercase Alphabet Flashcards PDFDocument26 pagesUppercase Alphabet Flashcards PDFElena Alexandra CărăvanPas encore d'évaluation

- High Street After Cross - Queensferry: Mondays To FridaysDocument1 pageHigh Street After Cross - Queensferry: Mondays To FridaysElena Alexandra CărăvanPas encore d'évaluation

- DV-2017 Instructions and FAQs PDFDocument18 pagesDV-2017 Instructions and FAQs PDFShpetim MaloPas encore d'évaluation

- Scriasoare 3 - ToMY TOYS LTDDocument1 pageScriasoare 3 - ToMY TOYS LTDElena Alexandra CărăvanPas encore d'évaluation

- Romanian - English DictionaryDocument1 402 pagesRomanian - English DictionaryAntal100% (76)

- GoGEAR Minidot Fitdot EnglishDocument16 pagesGoGEAR Minidot Fitdot EnglishElena Alexandra CărăvanPas encore d'évaluation

- Scrisoare 5 - Souveniers LTDDocument1 pageScrisoare 5 - Souveniers LTDElena Alexandra CărăvanPas encore d'évaluation

- Scriasoare 3 - ToMY TOYS LTDDocument1 pageScriasoare 3 - ToMY TOYS LTDElena Alexandra CărăvanPas encore d'évaluation

- Establish Business Relations with Rolls Royce Motor CarsDocument1 pageEstablish Business Relations with Rolls Royce Motor CarsElena Alexandra CărăvanPas encore d'évaluation

- Scrisoare 1Document1 pageScrisoare 1Elena Alexandra CărăvanPas encore d'évaluation

- Modul de Citare HarvardDocument45 pagesModul de Citare HarvardMaria CatrinescuPas encore d'évaluation

- ARIOUS HOLDING - CompressPdfDocument29 pagesARIOUS HOLDING - CompressPdfAlpha KiloPas encore d'évaluation

- Mr. Dawood Raza Ashraf: Career SummaryDocument3 pagesMr. Dawood Raza Ashraf: Career SummaryDawood VirkPas encore d'évaluation

- PTC India Financial Services Limited Vs VenkateswaSC202216052210144135COM574704Document40 pagesPTC India Financial Services Limited Vs VenkateswaSC202216052210144135COM574704Shaurya RanjanPas encore d'évaluation

- Filinvest v. Phil. Acetylene Digest, G.R. No. L-50449Document1 pageFilinvest v. Phil. Acetylene Digest, G.R. No. L-50449Lourdes LorenPas encore d'évaluation

- Semester FeeDocument1 pageSemester FeeMeghal SivanPas encore d'évaluation

- Unit 2 - Project AnalysisDocument46 pagesUnit 2 - Project Analysissandy candyPas encore d'évaluation

- Natwest - Student Living Index 2015Document54 pagesNatwest - Student Living Index 2015Pedro BertonciniPas encore d'évaluation

- Customers - Investors Perception About Investing in Real Estate1Document60 pagesCustomers - Investors Perception About Investing in Real Estate1someshmongaPas encore d'évaluation

- Central Bank of SudanDocument12 pagesCentral Bank of SudanYasmin AhmedPas encore d'évaluation

- Bangladesh Accounting Standard (BAS-1)Document8 pagesBangladesh Accounting Standard (BAS-1)Simon Haque91% (11)

- Metrobank Card Terms in 40 CharactersDocument13 pagesMetrobank Card Terms in 40 CharactersMark Titus Montoya RamosPas encore d'évaluation

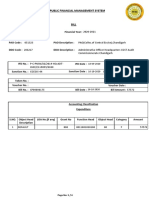

- Cgegis PFMS Charanjit Lal Ac RetdDocument4 pagesCgegis PFMS Charanjit Lal Ac RetdDDO Division-2Pas encore d'évaluation

- BFIN Week 11-20Document14 pagesBFIN Week 11-20KingDyther Velasco92% (13)

- Cha 7 SDocument63 pagesCha 7 SRekik TeferaPas encore d'évaluation

- Fall 203Document6 pagesFall 203mehdiPas encore d'évaluation

- Heirs of Zoilo Espiritu v. Sps. LandritoDocument3 pagesHeirs of Zoilo Espiritu v. Sps. LandritoGrace Ann TamboonPas encore d'évaluation

- Irreversible InvestmentDocument11 pagesIrreversible InvestmentRaju RajendranPas encore d'évaluation

- Fund Flow AnalysisDocument20 pagesFund Flow AnalysisSoumya DakshPas encore d'évaluation

- CB vs Organization Banking ActivitiesDocument3 pagesCB vs Organization Banking ActivitiesJohn Marco LopezPas encore d'évaluation

- BFW3121 Tutorial Answers For Week 3 (Semester 2, 2018)Document2 pagesBFW3121 Tutorial Answers For Week 3 (Semester 2, 2018)hi2joeyPas encore d'évaluation

- Esma 2020 - guideline-ENGLISHDocument49 pagesEsma 2020 - guideline-ENGLISHjohnPas encore d'évaluation

- Treasury Management BookDocument109 pagesTreasury Management BookJennelyn MercadoPas encore d'évaluation

- Investment Decisions of Investors Based On Generation Groups: A Case Study in Indonesia Stock ExchangeDocument8 pagesInvestment Decisions of Investors Based On Generation Groups: A Case Study in Indonesia Stock Exchangewaleed mahmudPas encore d'évaluation

- Working Capital FinancingDocument10 pagesWorking Capital FinancingARCHANA A MCOMPas encore d'évaluation

- MCB Bank Limited 2007 Financial Statements ReviewDocument83 pagesMCB Bank Limited 2007 Financial Statements Reviewusmankhan9Pas encore d'évaluation

- F2 Mock Exam 3Document11 pagesF2 Mock Exam 3smartlearning1977Pas encore d'évaluation

- 58&67-PICOP v. CA, Et Al. G.R. Nos. 106949-50 December 1, 1995Document29 pages58&67-PICOP v. CA, Et Al. G.R. Nos. 106949-50 December 1, 1995Jopan SJPas encore d'évaluation

- Chapter 17 ReportingDocument6 pagesChapter 17 ReportingAngel Jasmin TupazPas encore d'évaluation

- Suncity, Sunway To Combine? Analysts See A Current Trend of M&AsDocument12 pagesSuncity, Sunway To Combine? Analysts See A Current Trend of M&AsFazlin GhazaliPas encore d'évaluation

- Circular Flow Model Explained in 40 CharactersDocument26 pagesCircular Flow Model Explained in 40 CharactersErra PeñafloridaPas encore d'évaluation