Académique Documents

Professionnel Documents

Culture Documents

Il 19 PDF

Transféré par

The Indian ExpressDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Il 19 PDF

Transféré par

The Indian ExpressDroits d'auteur :

Formats disponibles

WWW.INDIANEXPRESS.

COM

19 ECONOMY

THE INDIAN EXPRESS, THURSDAY, JANUARY 21, 2016

GOLD

RUPEE

`26,295

`67.95

OIL

SILVER

$25.31*

`34,715

*Indian basket as on January 19, 2016

SENSEX: 24,062.04 417.80 NIFTY 50: 7,309.30 125.80 NIKKEI 225: 16,416.19 632.18 HANG SENG: 18,886.30 749.51 FTSE-100: 5,691.65 185.15 DAX: 9,380.84 283.37

Oil fall, global

woes pull Sensex

418 points down

The BSE index has lost 7.87% or 2,055 points in Jan

ENS ECONOMIC BUREAU

NEW DELHI, JANUARY 20

THE SENSEX crashed 1.7 per cent or 417

points on Wednesday under pressure from a

decline in Asian markets due to global

growth worries, fall in crude oil prices and a

weakening rupee. Wednesdays fall took the

Sensex to a 20-month low below its May

16,2014,levelwhentheNDAemergedvictorious in the 2014 General Elections.

Global factors notwithstanding, experts

said that investors should take the fall as an

opportunitytoinvest.EventhebroaderNifty

at the National Stock Exchange fell 1.69 per

cent or 125 points to close at 7,309. The closing was, however, marginally above the May

16, 2014 closing of Nifty.

During the day, the two indices declined

byupto2.6percentandtheSensexandNifty

hit intra-day lows of 23,839 and 7,241, respectively.

The fall in Indian markets on Wednesday

wasinlinewithglobalmarkets.WhileNikkei

in Japan closed with a fall of 3.7 per cent, the

Hang Seng in Hong Kong lost 3.8 per cent.

Even premier indices Germany, France and

UK were down by around 3 per cent in the

afternoon trading hours.

Equity markets across the world have

been under pressure since the beginning of

this month and the BSE Sensex has lost 7.87

per cent or 2,055 points. If that drop was initially led by fall in China, which witnessed

trade suspension twice in a week after the

countrys indices fell around 7 per cent, the

continuing decline in global crude oil prices

andforeigninstitutionalinvestorspullingout

money from the equity markets weakened

the sentiments further.

According to data available with the BSE,

foreign institutional investors (FIIs) pulled

out a net Rs 1,324 crore from domestic equities and their overall net outflow for the

month of January amounted to Rs 8,470

crore.However,despitethesharpFIIoutflow,

theIndianequitieshaveperformedrelatively

better on account of support from domestic

institutional investors (DIIs) who have invested a net of Rs 9,249 crore in the same period. On Wednesday DIIs invested a net of Rs

1,383 crore. As a result, even large blue-chip

companies lost heavily.

While Adani Ports was the biggest loser

on Sensex with a fall of 5.5 per cent, State

Bank of India declined 5.1 per cent. Reliance

Crude plumbs new

lows below $27/bbl

New York: US oil prices crashed below

$27 a barrel on Wednesday for the

first time since 2003, caught in a

broad slump across world financial

markets with traders also fearful that

the crude supply glut could last

longer. US crude for February delivery, which expires at the end of the

day,slid$2.05,or7.2percentto$26.41

at2:05p.m.EST(1902GMT).Brentfutures for March delivery fell 98 cents,

or 3.3 percent to $27.80 a barrel. It

touched a new contract low of $27.10.

Energy market watchers expect the

global crude glut to persist through at

least the end of this year, adding to

stockpilesthatinsomeplacesaretesting tank limits. REUTERS

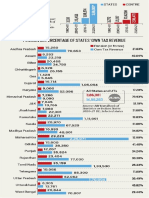

Despite crash, Sensex ahead of other major mkts

While the Sensex has lost 7.87% in January alone, it scores over the performance of other major markets which have fallen

more this month. Even the rupee figures among the relatively stable ones against the strengthening US dollar.

`9,249

crore

has been the net investment from

domestic institutional investors in

January. Inflow from DIIs provided

some strength to Indian markets and

acted as a counterbalance to the net

FII outflow of Rs 8,470 crore from

Indian equities in January.

24,062

points

Sensex closing on Wednesday is the

lowest since the Narendra Modi-led

NDA emerged victorious in the

general elections on May 16, 2014.

INDIANMARKETS

EMERGESTRONGEST

Jan 20* Change (%)

BSE Sensex (India)

24,062 -7.87

FTSE (UK)

5,697

-8.73

Dow Jones Ind (US)

15,678

-10.03

CAC 40 (France)

4,126

-11.02

DAX (Germany)

9,408

-12.43

Nikkei 225 (Japan)

16416

-13.75

`RELATIVELYMORESTABLE

Jan 20*

Change

6.58

-1.39

Hang Seng (Hong Kong) 18,886

-13.82

Yuan Renminbi

Shanghai Comp (China) 2976

-15.91

Phillipine Peso

47.84

-1.94

INR

68.01

-2.72

Brazilian Real

4.09

-3.28

Argentine Peso

13.46

-4.02

Mexican Peso

18.39

-7.04

SA Rand

16.77

-8.33

Russian Ruble

80.7

-10.55

Figures denote index values Figures till 9 pm IST

15.9%

has been the fall

witnessed by Shanghai Composite.

Concerns over slowdown in China,

has raised concerns over global

growth recovery, pulling the global

markets down.

All currencies against US dollar

Rupee revisits 2013, recovers

from below 68 against dollar

The Indian currency is down 15.60% from 58.78 after NDA poll victory in 2014

Industriesthatannouncedstrongthirdquarter result on Tuesday also fell 3.8 per cent.

While global concerns have weighed

heavily on the Indian markets in the recent

past, experts feel that India may outperform

the markets worldwide on account of domestic strengths. If government spending is

expected to lead the recovery along with

crowing in private sector spending, a revival

in earnings growth for India Inc may provide

the recipe for a reversal in equity market

movement. Some experts, however, say that

the markets may remain under pressure in

the short term.

Expectations of the markets going

downhill are likely to strengthen as the double whammy impact of oversupply in crude

and the concerns in Chinese economy will

dampen the investors preference towards

equities. Stabilisation in the currency market and oil prices will be the focus area during the near-term, said Vinod Nair, head of

research at Geojit BNP Paribas Financial

Services.

Jayant Manglik of Religare Securities,

however,saidthatinvestorsshouldcontinue

toinvest.Incurrentsituation,tradersshould

avoid leveraged trades and stick to strong

companiesfortrading.Investorsshouldcontinue to invest in quality companies for long

term investment, he said.

ENS ECONOMIC BUREAU

MUMBAI, JANUARY 20

THE FOREIGN exchange market is in turmoil

again with the rupee testing the 28-month

lowof 68tothedollar,lastseeninSeptember

2013, on capital outflows and the sustained

fall in equity markets. With this decline, the

rupee has fallen 15.60 per cent from 58.78

against the dollar on May 16, 2014, the day

BJP swept to power in the last General

Elections.

The domestic currency opened sharply

lowerat67.77fromitspreviouscloseof 67.65

and breached 68 level for the time since

September 4, 2013, to hit an intra-day low of

68.07, down 42 paise, and closed at 67.95/96

againstthedollar.Publicsectorbanksreportedly sold dollars on behalf of the Reserve

Bank of India to prevent the local currency

from weakening further. The rupee had hit

the record intra-day low of 68.85 in

September 2013. On September 6, 2013, the

rupeeclosedatarecordlowof 68.80perdollar as uncertainty over a possible US-led militarystrikeagainstSyriaknockeddownAsian

equities and currencies.

However,thistimeitistheChinesefearof

a major slowdown, which has been reiter-

ated by the IMF forecast, coupled with low

crude oil prices which together portend to a

major global economic slowdown.

The rupee started at just above 66 on

January1,2016butsincethenhasbeenmoving sharply downwards with the currency

crossing the 67 level on the January 14, 2016

and the 68 mark on the January 20. This

movementwasquiteunexpectedasthefundamentalshadjustifiedalevelof 65-66,said

a CARE Rating report. The market, which

does not rule out the rupee falling below 70

level, is now waiting for guidance from the

RBI in the form of intervention or announcement on the rupee. In FY14, when the rupee

fell,theRBIhadintervenedbyrestrictingoutflows on current account and later invoked

the swap on FCNR deposits to bring in dollars. The RBI has already indicated that it

would bring in measures to stabilise the rupee if the forex market turns volatile.

According to analysts, the RBI has to be

watchful on how speculative activity behaves as there is a tendency for such triggers

tobeunleashedwith exportersholdingback

their earnings and importers rushing in. The

problem this time is less acute compared

with 2013 when the oil companies had

rushed in to buy their dollars at a time when

the crude oil price was high.

Das: FinMin, RBI

keeping close watch

New Delhi: The finance ministry on

Wednesday said it is keeping a close

watch, along with RBI, on the domestic currencys movement and hoped

that market volatility will stabilise

soon. Economic Affairs Secretary

ShaktikantaDassaidtheongoingcurrencyandstockmarketvolatilitystem

from investor expectation of rate increase by the US Federal Reserve as

well as uncertainty around the

Chinese economy. PTI

WHY RUPEE IS FALLING?

GLOBAL ECONOMIC slowdown,

with China being the major factor

FALL IN crude oil prices and the

sell-off in stock markets

FIIs HAVE been in the selloff mode

in equity segment for last 3 months

At Davos, leaders

look beyond the global

market mayhem

REUTERS

DAVOS, JANUARY 20

BLOOD-LETTING IN global markets is dominating corridor talk as business leaders and

policymakers meet in Davos, although so far

the view is that it doesnt signal a financial

crisis. As the World Economic Forums annual meeting in Switzerland wrestled with

topics ranging from the impact of robots on

jobs to gender and wealth inequality, the

MSCI World equity index fell to its lowest

level since July 2013.

I dont believe this is a repeat of

2008...that is not to say that there are not

some very significant risks impacting the

market-notleastof whichisChinasslowing

growth, John Veihmeyer, global chairman

of KPMG, said in the Reuters Global Markets

Forum on Wednesday.

The International Monetary Fund cut its

global growth forecasts for the third time in

less than a year to 3.4 per cent on Tuesday,

as new figures showed that the Chinese

economy grew at its slowest rate in a quarter

of a century in 2015. While Chinas rapid

slowdown, combined with a dramatic fall in

thepriceof oil,hasspookedinvestorsaround

the

globe,

European

Economics Commissioner

Pierre Moscovici told Reuters

Television he too did not believe there would be any return to an international financial crisis. I dont feel that the

crisis is coming back... but

there are downsides that we need to address, he said.

However, some in Davos were less confident about the outlook for 2016 after the

rocky start to the year. Market turmoil can

be a harbinger that something is wrong and

even if it is irrational, can have real consequences. What is going on now is a message

that the excessive optimism that has been

spreading around is wrong, Nobel Prizewinning US economist Joseph Stiglitz said.

Veteran British businessman Roger Carr,

who is chairman of British defence group

BAE Systems, said the future was not looking bright. This time last year in Davos there

was a very different environment, it was

quite benign. The issue was the haves and

the have nots, it wasnt: are we all going to

have less?. It is very pessimistic at the moment, he said.

However, bankers such as

former Barclays chief executive

Bob Diamond said the slowdown in Chinese growth was a

healthy correction which,

while serious, was needed.

This was echoed by Professor

Ding Yuan, vice-president and dean of the

China Europe International Business School

in Shanghai, who said it would be wrong to

take the small devaluation of the Chinese

yuan and the falls in the Shanghai 300 index

as indicators of Chinas economic health. For

CEOs at Davos trying to navigate the year

ahead, the price of oil remains the great unknown. In many of the markets we operate

in, the oil price is a major factor of the health

of the economy. Were expecting governments to adapt to this new order..., whether

theyreat$30orlowerorhigher.Whoknows

whats going to happen in 2016?

Vimpelcom CEO Jean-Yves Charlier said.

PRESS TRUST OF INDIA

DAVOS, JANUARY 20

SEEKING TO allay concerns over volatility in

currency and stock markets, RBI Governor

Raghuram Rajan on Wednesday said things

would stabilise and emphasised that monetarypoliciesalonecannotchangetheworld.

While expressing optimism that people

will look at stable emerging markets (EMs),

including India, Rajan said the falls in these

economies are actually markets problem

and not of the economy.

Therupee,Rajansaid,hasbeenrelatively

strong in the EM currency basket, but India

is affected by the same kind of jitters impacting other world markets.

Asserting that monetary policies alone

cannot change the world, the RBI Governor

said at the World Economic Forum (WEF)

thattherearevariousothertoolstocarryforward reforms and boost growth.

The good news across the world is that

we have realised that monetary policies are

not going to change the world and there are

much more to the reforms.

Not just enabling but also creating the

underlying framework for growth is the one

which will take us a long way, he said,

adding that monetary stimulus has largely

run its course.

The RBI Governor also downplayed concernsaboutChinaandsaidthatcountrykeep

making fresh efforts to resolve their economic problems.

My sense is that after the initial volatility, things will stabilise, people will try and

look for the good, stable emerging markets.

India is one of them. Our growth is pretty

good, all the other indicators seem to be going well, he told CNBC.

... at this point if you are an emerging

market, you focus on fundamentals, try and

get inflation down, try and get your current

accountdeficitdown,keepyourfiscalontarget, do all the good things, and then people

reward you, he said. Commenting on terror

attacks and war-like situation in various

countries, Rajan, at a session on the growth

illusion, said wars should never be seen as

opportunities to push economic growth.

Wardoescreateopportunityforgrowth,

but it certainly destroys your GDP. I am sure

people would love to have bigger GDP rather

than a higher growth. I dont think war is an

option, Rajan said.

Hewasreplyingtoaquestiononwhether

thecountriesshouldcreatewarfundstofight

wars rather than printing more money.

SNAPSHOTS

PopetellsDavoselite:

Consideryourrolein

creatingpoverty

8-9% growth

doable: Jaitley

Davos:Withglobalheadwindshitting

emerging markets as well, finance

minister Arun Jaitley on Wednesday

said volatility has become a global

norm, but India can certainly grow at

8-9 per cent in a friendlier global climate. Certainly, the world is facing a

difficult and challenging situation. I

dont think we are going into extreme

conditions because there is predictability but volatility today is the

norm and no country is immune to

it, Jaitley said. Also, in signs of no

thawwithCongressonGST,Jaitleydescribed as preposterous the partys

demand for putting a cap on tax rate

in the Constitution Bill saying

nowhere in the world tariffs are mentioned in the statute. PTI

Monetary

policies

alone cant

change the

world: Rajan

MAHINDRA INVOKES STAR WARS: TECH IS LIKE FORCE

Microsoft Corporation CEO Satya Nadella, Sheryl Sandberg, Chief Operating Officer and Member of the Board, Facebook, and

Anand Mahindra, Chairman and Managing Director of Mahindra Group during the session The Transformation of

Tomorrow at the World Economic Forum meet in Davos on Wednesday. PTI

Referring to the Star Wars series,

Mahindra said, Technology is like the

Force and depends on how we use.

Question is do we want Jedis or Sith.

Microsoft CEO Satya Nadella said world

cant afford another digital divide and it

was to see that the fourth industrial

revolution leads to digital dividends.

Facebook COO Sheryl Sandberg

pitched for ending gender disparity

saying, Men still rule the world and I am

not sure it is going that well... PTI

Fourth industrial revolution coming:

Bosses worldwide brace for tech shocks

REUTERS

DAVOS, JANUARY 20

IMPLANTABLE MOBILE phones. 3D-printed

organs for transplant. Clothes and readingglasses connected to the Internet.

Such things may be science fiction today

but they will be scientific fact by 2025 as the

world enters an era of advanced robotics, artificial intelligence and gene editing, according to executives surveyed by the World

Economic Forum (WEF). Nearly half of those

questioned also expect an artificial intelligence machine to be sitting on a corporate

board of directors within the next decade.

After steam, mass production and information technology, the so-called fourth industrial revolution will bring ever faster cycles of innovation, posing huge challenges to

companies, workers, governments and societiesalike.Thereisaneconomicsurplusthat

HUBO, a multifunctional walking

humanoid robot in Davos. Reuters

is going to be created as a result of this fourth

industrial revolution, Satya Nadella, chief

executive of Microsoft, said in Davos.

One of the most in-demand participants

inDavosthisyearisnotacentralbanker,CEO

or politician but a prize-winning South

KoreanrobotcalledHUBO,whichisstrutting

its stuff amid a crowd of smartphone-clicking delegates. But there are deep worries, as

well as awe, at what technology can do.

A new report from UBS released in Davos

predicts that extreme levels of automation

and connectivity will worsen already deepening inequalities by widening the wealth

gap between developed and developing

economies. An analysis of major economies

by the Swiss bank concludes that

Switzerland is the country best-placed to

adapt to the new robot world, while

Argentina ranks bottom. There will be winners and losers among companies, too, as

new players move into established industries with disruptive new technologies.

That is something uppermost in the

minds of Davos attendees such as GM CEO

Mary Barra, who is confronting the threat of

driverless cars or bank boss Jamie Dimon at

JPMorgan Chase , facing competition from

digital fintech start-ups.

POPE FRANCIS told members of the

worlds wealthy political and economic elite on Wednesday that they

should not be deaf to the cry of the

poor and must consider their own

role in creating inequality. New technologies such as robotics must also

not be allowed to replace humans

with soulless machines, he said in a

message to the World Economic

Forum in Davos. To all of you I appeal

once more: Do not forget the poor!,

he said. REUTERS

Jobscopehuge,need

rightskills:Sikka

WITH A new WEF study warning

about a net loss of over five million

jobs in next five years due to the

fourth industrial revolution, IT giant

Infosys CEO Vishal Sikka on

Wednesday said there are huge employment opportunities in India but

there is a need to impart right skills

and training. Speaking at a session on

The Promise of Progress on the job

marketimpactof thefourthindustrial

revolution, Sikka said there would

certainly be disruptions but the new

technologywouldnotnecessarilycreate imbalances if right kind of education, connectivity and training is provided to the people. PTI

Perceptionabout

largebankslow

THE PERCEPTION about large

global banks remains low and

was worse last year than what was

seen after the 2008 financial meltdown, says a report. Trust Meltdown

report by Media Tenor International

has

been

released

as

the rich and influential gather at

the World Economic Forum

(WEF) meet here. The report has

been focusing on the image of global

banking industry that is projected

across media. PTI

Vous aimerez peut-être aussi

- Congress Karnataka Manifesto - 2023Document62 pagesCongress Karnataka Manifesto - 2023The Indian Express100% (1)

- Karnataka Polls: BJP's Third List of CandidatesDocument1 pageKarnataka Polls: BJP's Third List of CandidatesThe Indian ExpressPas encore d'évaluation

- UPSC Civil Services Prelims 2023 Question PaperDocument21 pagesUPSC Civil Services Prelims 2023 Question PaperThe Indian Express100% (4)

- Guidelines For Designation of Senior Advocates by The Supreme Court of IndiaDocument15 pagesGuidelines For Designation of Senior Advocates by The Supreme Court of IndiaThe Indian ExpressPas encore d'évaluation

- Karnataka 2023 Congress Candidate ListDocument11 pagesKarnataka 2023 Congress Candidate ListThe Indian ExpressPas encore d'évaluation

- Padma Awardees 2023Document5 pagesPadma Awardees 2023Abhinav Bhatt100% (3)

- Karnataka Polls: BJP's First List of 189 CandidatesDocument8 pagesKarnataka Polls: BJP's First List of 189 CandidatesThe Indian ExpressPas encore d'évaluation

- Roger Federer Retires QuixplainedDocument6 pagesRoger Federer Retires QuixplainedThe Indian ExpressPas encore d'évaluation

- Karnataka Polls: BJP Second List of CandidatesDocument1 pageKarnataka Polls: BJP Second List of CandidatesThe Indian ExpressPas encore d'évaluation

- 14.12.2022 Press ReleaseDocument3 pages14.12.2022 Press ReleaseThe Indian ExpressPas encore d'évaluation

- Tamil Nadu MinistersDocument3 pagesTamil Nadu MinistersThe Indian ExpressPas encore d'évaluation

- Delhi Pollution: Graded Action Responce PlanDocument5 pagesDelhi Pollution: Graded Action Responce PlanThe Indian ExpressPas encore d'évaluation

- Old Pension BillDocument1 pageOld Pension BillThe Indian ExpressPas encore d'évaluation

- Himachal Pradesh Elections - BJP List of CandidatesDocument4 pagesHimachal Pradesh Elections - BJP List of CandidatesThe Indian ExpressPas encore d'évaluation

- Changing City 1Document4 pagesChanging City 1The Indian ExpressPas encore d'évaluation

- Letter To ISP 24-09-2022 OW 303 of 2022Document3 pagesLetter To ISP 24-09-2022 OW 303 of 2022The Indian Express50% (2)

- Ponniyin Selvan and Chola Rule - QuixplainedDocument5 pagesPonniyin Selvan and Chola Rule - QuixplainedThe Indian ExpressPas encore d'évaluation

- DigiYatra ExplainedDocument4 pagesDigiYatra ExplainedThe Indian ExpressPas encore d'évaluation

- Stray DogsDocument3 pagesStray DogsThe Indian ExpressPas encore d'évaluation

- Ghulam Nabi Azad Resignation LetterDocument5 pagesGhulam Nabi Azad Resignation LetterNDTV100% (8)

- Us Stocks ListDocument4 pagesUs Stocks ListThe Indian ExpressPas encore d'évaluation

- Beating Retreat Republic DayDocument6 pagesBeating Retreat Republic DayThe Indian Express100% (1)

- INC '24 Presentation Updates VFinal 18 June 21Document85 pagesINC '24 Presentation Updates VFinal 18 June 21The Indian Express100% (3)

- Biden Fiscal 2Document1 pageBiden Fiscal 2The Indian ExpressPas encore d'évaluation

- Quixplained - US Taiwan China ControversyDocument4 pagesQuixplained - US Taiwan China ControversyThe Indian ExpressPas encore d'évaluation

- Full List of Padma Awardees 2022Document7 pagesFull List of Padma Awardees 2022Sumana Nandy50% (2)

- Given. - : (Printed On A Separate List)Document46 pagesGiven. - : (Printed On A Separate List)The Indian ExpressPas encore d'évaluation

- Us Stocks ListDocument4 pagesUs Stocks ListThe Indian ExpressPas encore d'évaluation

- Quixplained CorbevaxDocument3 pagesQuixplained CorbevaxThe Indian ExpressPas encore d'évaluation

- PR Candidates Punjab 86 SeatsDocument3 pagesPR Candidates Punjab 86 SeatsRishabh SharmaPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- PPT04 - Creating Your Business ModelDocument28 pagesPPT04 - Creating Your Business ModelAgus PriyonoPas encore d'évaluation

- Prof. SARPV Chaturvedi - Business Management ProfileDocument8 pagesProf. SARPV Chaturvedi - Business Management Profileलक्षमी नृसिहंन् वेन्कटपतिPas encore d'évaluation

- End-Of-Chapter Answers Chapter 2 PDFDocument18 pagesEnd-Of-Chapter Answers Chapter 2 PDFSiphoPas encore d'évaluation

- JLL Asia Pacific Property Digest 2q 2014Document72 pagesJLL Asia Pacific Property Digest 2q 2014maywayrandomPas encore d'évaluation

- ABM 101 All Types of Financial ModelsDocument3 pagesABM 101 All Types of Financial ModelsElla FuentePas encore d'évaluation

- Parabolic SAR (Wilder)Document12 pagesParabolic SAR (Wilder)Subhadip NandyPas encore d'évaluation

- Sample Question Paper, 12 EconomicsDocument7 pagesSample Question Paper, 12 EconomicsSubhamita DasPas encore d'évaluation

- Collective Efficiency and Increasing Returns: by Hubert SchmitzDocument28 pagesCollective Efficiency and Increasing Returns: by Hubert SchmitzFakhrudinPas encore d'évaluation

- Promotion Management: By: Priyanka Dang Subrata Jadon Prashant Gupta Farid Ashraf Anurag PrashantDocument23 pagesPromotion Management: By: Priyanka Dang Subrata Jadon Prashant Gupta Farid Ashraf Anurag PrashantAnurag PrashantPas encore d'évaluation

- TOApr 2013Document56 pagesTOApr 2013Vassilis MillasPas encore d'évaluation

- BT - The Business Organisation, Stakeholders and The External EnvironmentDocument40 pagesBT - The Business Organisation, Stakeholders and The External Environmentrafiulbiz12Pas encore d'évaluation

- Course Outline 2Document3 pagesCourse Outline 2sinicynaalisaPas encore d'évaluation

- Microeconomics End Term Exam Academic Year: 2021-22 Time: 2 HoursDocument7 pagesMicroeconomics End Term Exam Academic Year: 2021-22 Time: 2 HoursKartik GurmulePas encore d'évaluation

- 34 48 48 39 66 64 46 24 53 64 54 56 83 31 Total Result 442 268 710 38%Document89 pages34 48 48 39 66 64 46 24 53 64 54 56 83 31 Total Result 442 268 710 38%Agus MaulanaPas encore d'évaluation

- Chapter 1 Introduction (Microeconomics)Document9 pagesChapter 1 Introduction (Microeconomics)AishleyPas encore d'évaluation

- Demand and Determinants of DemandDocument2 pagesDemand and Determinants of DemandousoulegrandPas encore d'évaluation

- Michael Porter'S Five Competitive Forces Analysis For "Bhor Led TV"Document10 pagesMichael Porter'S Five Competitive Forces Analysis For "Bhor Led TV"Md Nazmus SakibPas encore d'évaluation

- Impact of GST On LogisticsDocument18 pagesImpact of GST On LogisticsSharath ReddyPas encore d'évaluation

- Development Measureeeeeeeeeeeeeee PDFDocument438 pagesDevelopment Measureeeeeeeeeeeeeee PDFNino PapachashviliPas encore d'évaluation

- SYJCECOLMRDocument61 pagesSYJCECOLMRAvni S. PatilPas encore d'évaluation

- A3 - Time Value of MoneyDocument33 pagesA3 - Time Value of MoneyNoel GatbontonPas encore d'évaluation

- Chapter 8 Material Quantitative Models For Planning and ControlDocument12 pagesChapter 8 Material Quantitative Models For Planning and ControlAhtisham Ahsan0% (1)

- Exchange Rates JBDocument9 pagesExchange Rates JBboss9921Pas encore d'évaluation

- Market Structures and Pricing DecisionsDocument24 pagesMarket Structures and Pricing DecisionsKimberly parciaPas encore d'évaluation

- C KESTELOOT - Informal SpacesDocument20 pagesC KESTELOOT - Informal SpacesevelynevhPas encore d'évaluation

- Strategic Management: Mini Case StudyDocument4 pagesStrategic Management: Mini Case StudyMuhammad AbdullahPas encore d'évaluation

- Analyzing The Movie Office Space Through Marx's PhilosophyDocument4 pagesAnalyzing The Movie Office Space Through Marx's Philosophymartindgr8100% (2)

- Procurement and Supplies Professionals A PDFDocument115 pagesProcurement and Supplies Professionals A PDFNyeko FrancisPas encore d'évaluation

- 9707 Business Studies: MARK SCHEME For The May/June 2013 SeriesDocument8 pages9707 Business Studies: MARK SCHEME For The May/June 2013 Series8jnmvbvqvwPas encore d'évaluation

- Labour Market ReformsDocument9 pagesLabour Market ReformsGauri RaoPas encore d'évaluation