Académique Documents

Professionnel Documents

Culture Documents

Assured - Tax Newsletter

Transféré par

Syed Kamran Zaidi0 évaluation0% ont trouvé ce document utile (0 vote)

42 vues2 pagesThe 2015 tax filing season is now open, with a deadline of April 18, 2016 to file personal, partnership or trust tax returns. Standard deductions and personal exemptions have increased for the 2015 tax year. Itemized deductions are limited for higher incomes over $258,250 individually or $309,900 for joint filers. The top tax bracket of 39.6% now applies to single filers with over $413,200 in income. Mileage deductions and rates have been adjusted for 2015. The health insurance penalty is significantly higher this year at 2% of household income or $325 per individual. Strict rules now apply to IRA rollovers allowing only one 60-day rollover per year.

Description originale:

2640 Old Denton Road Suite 264, Carrollton, Texas 75007 | info@assuredbats.com | 972-242-5700

Titre original

Assured- Tax Newsletter

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe 2015 tax filing season is now open, with a deadline of April 18, 2016 to file personal, partnership or trust tax returns. Standard deductions and personal exemptions have increased for the 2015 tax year. Itemized deductions are limited for higher incomes over $258,250 individually or $309,900 for joint filers. The top tax bracket of 39.6% now applies to single filers with over $413,200 in income. Mileage deductions and rates have been adjusted for 2015. The health insurance penalty is significantly higher this year at 2% of household income or $325 per individual. Strict rules now apply to IRA rollovers allowing only one 60-day rollover per year.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

42 vues2 pagesAssured - Tax Newsletter

Transféré par

Syed Kamran ZaidiThe 2015 tax filing season is now open, with a deadline of April 18, 2016 to file personal, partnership or trust tax returns. Standard deductions and personal exemptions have increased for the 2015 tax year. Itemized deductions are limited for higher incomes over $258,250 individually or $309,900 for joint filers. The top tax bracket of 39.6% now applies to single filers with over $413,200 in income. Mileage deductions and rates have been adjusted for 2015. The health insurance penalty is significantly higher this year at 2% of household income or $325 per individual. Strict rules now apply to IRA rollovers allowing only one 60-day rollover per year.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

2015 Season Tax Changes

2015 tax season is now open. April 18, 2016 is the

deadline for filing a 2015 personal, partnership, or

calendar year estates/trusts tax returns or extension.

Standard Deduction amounts have increased.

Standard deduction amounts have increased

to:

$12,600 for married couples whose filing status

is married filing jointly and surviving spouses

$6,300 for singles and married couples whose

filing status is married filing separately

Standard mileage allowance

The business standard mileage allowance for

2015 is 57.5 cents per mile. The rate for

medical or moving expenses is actually down

half a cent, to 23 cents per mile. For miles

driven in service of charitable organizations,

its still 14 cents.

$9,250 for taxpayers whose filing status is

head of household

Personal Exemption amount have increased

Personal Exemption amount has increased to

$4000

Higher income levels for limitation on itemized

deductions.

Itemized deductions are limited if incomes are

$258,250 or more ($309,900 for married couples

filing jointly).

Higher tax bracket.

39.6% tax rate affects singles whose income

exceeds $413,200 ($464,850 for married

taxpayers filing a joint return).

Earned Income Credit

The maximum EIC amount is $6,242 for

taxpayers filing jointly with three or more

qualifying children. The maximum amounts

for your clients with other filing statuses and

numbers of children are also adjusted.

Deduction for state income tax

This deduction makes a huge difference to

residents of TX.

Deduction for small business equipment

purchases of up to $2 million

This is extended and now includes computer

software.

The health insurance penalty is going up

significantly

If you dont have health insurance in 2015, you

will pay $325 per person, or 2 percent of their

household income, whichever is greater in

penalty. Thats a steep increase.

IRS is getting strict with IRA

Rollovers

Clients can only withdraws money

from one IRA and move it into

another IRA within a 60 day period

only once.

Health Flexible Spending Accounts

If you dont use all the FSA amounts by the end

of the year, you could roll over $500 from an

FSA into the next plan year. However, you will

be ineligible to participate in a Health Savings

Account (HSA) for 2016.

Pell Grants

Pell Grants can now be allocated as living

expenses. Doing so may increase the amount

of education expense, such as tuition, that you

can use to claim one of the education credits.

myRAs are a reality

Even if you qualify for one of the many

exclusions, some exceptions require you to

apply for a certificate from the state or federal

marketplace. You should do this in plenty of

time so you have the required exemption

certificate number for tax preparation.

These new introductory retirement accounts

are now being offered through employers. The

myRA, or my Retirement Account, charges

no fees and offers modest, guaranteed

growth. Thats a plus for risk-averse clients and

those who are new to investing. They can start

a myRA with just $25 and add as little as $5 at

a time. When their accounts are worth $15,000,

they must roll them over into private-sector

Roth IRAs.

We can help you with all your tax needs. Please

call with any questions.

2640 Old Denton Road Suite 264, Carrollton, Texas 75007

info@assuredbats.com

Phone: 972-242-5700

Vous aimerez peut-être aussi

- Forbes 2018 Tax GuideDocument16 pagesForbes 2018 Tax GuideJerry WhittonPas encore d'évaluation

- IRS Form 1040es 2016Document12 pagesIRS Form 1040es 2016Freeman Lawyer100% (1)

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This PackageCaliCain MendezPas encore d'évaluation

- Individual Retirement Account: For New Accounts OnlyDocument24 pagesIndividual Retirement Account: For New Accounts OnlyHeidi LopezPas encore d'évaluation

- F1040es 2018Document18 pagesF1040es 2018diversified1Pas encore d'évaluation

- Tax Impact of Job LossDocument7 pagesTax Impact of Job LossbullyrayPas encore d'évaluation

- Year-End Tax Guide 2015/16Document10 pagesYear-End Tax Guide 2015/16api-311814387Pas encore d'évaluation

- Redundancy Payments Are TaxedDocument2 pagesRedundancy Payments Are TaxedVivian KongPas encore d'évaluation

- Form 1040-ES: Estimated Tax For IndividualsDocument2 pagesForm 1040-ES: Estimated Tax For IndividualsХемингуэйХлебушкинPas encore d'évaluation

- ACC 330 Final Project Formal Letter To Client TemplateDocument4 pagesACC 330 Final Project Formal Letter To Client TemplateBREANNA JOHNSONPas encore d'évaluation

- Income Splitting Strategies enDocument6 pagesIncome Splitting Strategies eneriklicanadaPas encore d'évaluation

- $26,000 Retirement OpportunityDocument2 pages$26,000 Retirement OpportunityRobert GrantPas encore d'évaluation

- Strategies To Pay Less TaxDocument4 pagesStrategies To Pay Less TaxblkdwgPas encore d'évaluation

- Spring 2013 Tax, Retirement & Estate PlanningDocument4 pagesSpring 2013 Tax, Retirement & Estate PlanningBusiness Bank of Texas, N.A.Pas encore d'évaluation

- An Overview of Itemized DeductionsDocument19 pagesAn Overview of Itemized DeductionsRock Rose100% (1)

- 2018 Year End Tax TipsDocument4 pages2018 Year End Tax TipsMichael CallahanPas encore d'évaluation

- Year-Round Tax Saving Tips: Vow To Be More EfficientDocument4 pagesYear-Round Tax Saving Tips: Vow To Be More EfficientSrinivas ThoutaPas encore d'évaluation

- US Internal Revenue Service: p4128Document6 pagesUS Internal Revenue Service: p4128IRSPas encore d'évaluation

- Viewpoint: The Value of Income ProtectionDocument8 pagesViewpoint: The Value of Income ProtectionSenecaReidPas encore d'évaluation

- Retirement Topics - IRA Contribution LimitsDocument3 pagesRetirement Topics - IRA Contribution LimitsSriniPas encore d'évaluation

- ACC 330 Final Project Three Formal Letter To Client Sarai SternzisDocument3 pagesACC 330 Final Project Three Formal Letter To Client Sarai SternzisSarai SternzisPas encore d'évaluation

- Who Should File A 2012 Tax Return?Document2 pagesWho Should File A 2012 Tax Return?Landmark Tax Group™Pas encore d'évaluation

- Tax Tips 2022Document26 pagesTax Tips 2022Mary Juvy Ramao100% (1)

- Synergy Financial Group: Your Personal CFODocument4 pagesSynergy Financial Group: Your Personal CFOgvandykePas encore d'évaluation

- Tax Topics: Blanche Lark ChristersonDocument6 pagesTax Topics: Blanche Lark Christersonapi-301040925Pas encore d'évaluation

- 16 Don'T-Miss Tax DeductionsDocument4 pages16 Don'T-Miss Tax DeductionsGon FloPas encore d'évaluation

- En 05 10022Document2 pagesEn 05 10022Jeremy WebbPas encore d'évaluation

- Chapter 7 - SeniorsDocument48 pagesChapter 7 - SeniorsRyan YangPas encore d'évaluation

- F 1040 EsnDocument10 pagesF 1040 EsnTedPas encore d'évaluation

- 1040es Estimated Tax 2014 For IndividualsDocument12 pages1040es Estimated Tax 2014 For IndividualsClaudia MaldonadoPas encore d'évaluation

- Ways To Wealth - in Your 60'S Start Ensuring That Your Money Lasts Longer!Document6 pagesWays To Wealth - in Your 60'S Start Ensuring That Your Money Lasts Longer!LandaLeighPas encore d'évaluation

- What Is An IRA? - RKB Accounting & Tax ServicesDocument6 pagesWhat Is An IRA? - RKB Accounting & Tax ServicesRKB AccountingPas encore d'évaluation

- F 1040 EsDocument12 pagesF 1040 EsEndu EnduroPas encore d'évaluation

- 10 Big Deductions Too Many People MissDocument4 pages10 Big Deductions Too Many People MissSly GrinkoPas encore d'évaluation

- Hilton Sharp Clarke Financial Services Money Talk Winter 2014Document4 pagesHilton Sharp Clarke Financial Services Money Talk Winter 2014nathan8848Pas encore d'évaluation

- 10 CPF Hacks To Grow Your Nest EggDocument4 pages10 CPF Hacks To Grow Your Nest EggTomPas encore d'évaluation

- Ten Income and Estate Tax Planning Strategies For 2014: Ideas From PutnamDocument4 pagesTen Income and Estate Tax Planning Strategies For 2014: Ideas From PutnamPrince McGershonPas encore d'évaluation

- Your RRSP Contribution LimitDocument15 pagesYour RRSP Contribution LimitMadia AbdelrahmanPas encore d'évaluation

- Students and Income Tax: (Including Apprenticeships)Document38 pagesStudents and Income Tax: (Including Apprenticeships)RajeshKP65Pas encore d'évaluation

- US Individual RegulationDocument3 pagesUS Individual RegulationDarab AkhtarPas encore d'évaluation

- Tax Law Snapshot 2014Document4 pagesTax Law Snapshot 2014HosameldeenSalehPas encore d'évaluation

- p969 PDFDocument22 pagesp969 PDFstalker1841Pas encore d'évaluation

- More Information About Tax Credits: R T - L 8 - HDocument1 pageMore Information About Tax Credits: R T - L 8 - HKevin MangumPas encore d'évaluation

- Tax Return in CanadaDocument75 pagesTax Return in CanadaAlejandro VelizPas encore d'évaluation

- Preparing For EOFY June 2011Document2 pagesPreparing For EOFY June 2011nsfpPas encore d'évaluation

- Centorbi - AE Taxes White Paper - DL - GGDocument8 pagesCentorbi - AE Taxes White Paper - DL - GGchad centorbiPas encore d'évaluation

- Form 1040-ES 2013Document11 pagesForm 1040-ES 2013Zeeshan AliPas encore d'évaluation

- Guide To Taxation of Married Couples and Civil PartnersDocument12 pagesGuide To Taxation of Married Couples and Civil PartnerspetermhanleyPas encore d'évaluation

- Before You Rush To Buy RRSPsDocument3 pagesBefore You Rush To Buy RRSPsJohn JeanPas encore d'évaluation

- Sipp Guide UkDocument20 pagesSipp Guide UkRobertPas encore d'évaluation

- An Assignment of Tax Planning On "Tax System in United States of America"Document23 pagesAn Assignment of Tax Planning On "Tax System in United States of America"Akash NathwaniPas encore d'évaluation

- td1 Fill 04 16eDocument2 pagestd1 Fill 04 16eAlec RichardsonPas encore d'évaluation

- F 1040 EsDocument12 pagesF 1040 EsHyun SeonPas encore d'évaluation

- Factsheet: Family Tax BenefitDocument5 pagesFactsheet: Family Tax BenefitdhibuPas encore d'évaluation

- IRS Retirement Plan Adjustments For 2014Document3 pagesIRS Retirement Plan Adjustments For 2014Doug PotashPas encore d'évaluation

- General Income Tax and Benefit Guide 2015: How To Fill in and File Your 2015 Tax ReturnDocument79 pagesGeneral Income Tax and Benefit Guide 2015: How To Fill in and File Your 2015 Tax ReturnEmad MerganPas encore d'évaluation

- 7 Big Mistakes Small Business Owners Make at Tax Time: UPDATED 2019Document25 pages7 Big Mistakes Small Business Owners Make at Tax Time: UPDATED 2019nnauthooPas encore d'évaluation

- Flow Bill Explanation (Papiamentu)Document2 pagesFlow Bill Explanation (Papiamentu)Shanon OsbornePas encore d'évaluation

- PAYTMDocument19 pagesPAYTMVirat GautamPas encore d'évaluation

- M Surana and Company: Chartered AccountantDocument15 pagesM Surana and Company: Chartered AccountantSanjay PurohitPas encore d'évaluation

- Inventory Management and Risk Pooling: Prepared byDocument74 pagesInventory Management and Risk Pooling: Prepared byCastiel DavidPas encore d'évaluation

- Terms & Conditions HP Scheme Gen Items (Army) PDFDocument10 pagesTerms & Conditions HP Scheme Gen Items (Army) PDFMuhammad Yasir50% (2)

- circular-CBDT Clarifies Provisions RelatingDocument6 pagescircular-CBDT Clarifies Provisions RelatingYogesh KanojiyaPas encore d'évaluation

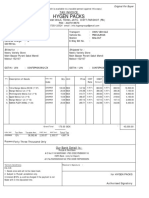

- FS Export Invoice 17.07.2017Document3 pagesFS Export Invoice 17.07.2017Sudhansu SabatPas encore d'évaluation

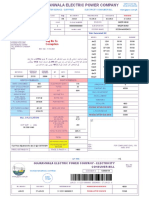

- Bill Malout PDFDocument2 pagesBill Malout PDFCuber Anay GuptaPas encore d'évaluation

- Incoterms Unit 6 - Trade Terms in International Sale of Goods or International Commercial TermsDocument12 pagesIncoterms Unit 6 - Trade Terms in International Sale of Goods or International Commercial Termsrenatus APOLINARYPas encore d'évaluation

- Registration Tax Exemption in Afghanistan Info Sheet February 9 - 2010Document8 pagesRegistration Tax Exemption in Afghanistan Info Sheet February 9 - 2010Hussain MeskinzadaPas encore d'évaluation

- Chair. Comm. On Appropriations: Jeann T. EcleDocument17 pagesChair. Comm. On Appropriations: Jeann T. EcleAida AntipoloPas encore d'évaluation

- Invoice 197Document2 pagesInvoice 197miroljubPas encore d'évaluation

- Booking Details: Route Airline Flight # Departure ArrivalDocument4 pagesBooking Details: Route Airline Flight # Departure ArrivalCasareo LabPas encore d'évaluation

- Electronic Ticket Receipt, April 05 For MR JEMUEL LABRADORDocument2 pagesElectronic Ticket Receipt, April 05 For MR JEMUEL LABRADORJemuel LabradorPas encore d'évaluation

- BIR Ruling 415-93Document2 pagesBIR Ruling 415-93Russell PagePas encore d'évaluation

- 227Document1 page227Yuuvraj SinghPas encore d'évaluation

- 2016-2016 Order Form From 591371316@Document196 pages2016-2016 Order Form From 591371316@Nepumoseno PalmaPas encore d'évaluation

- Final Business ProposalDocument2 pagesFinal Business ProposalTine DimaunahanPas encore d'évaluation

- Common Errors in APP (Automatic Payment Program) - SAP BlogsDocument5 pagesCommon Errors in APP (Automatic Payment Program) - SAP BlogsAman VermaPas encore d'évaluation

- Gepco Online Bill - Muhammad HussainDocument1 pageGepco Online Bill - Muhammad HussainUsman AmjadPas encore d'évaluation

- 10 Defining Trends in Asian Travel & TourismDocument6 pages10 Defining Trends in Asian Travel & TourismTatianaPas encore d'évaluation

- Varo Bank Account Statement: AmountDocument6 pagesVaro Bank Account Statement: AmountWilson BruePas encore d'évaluation

- Oneyricvkl338700 PDFDocument1 pageOneyricvkl338700 PDFOnkar Madhukar Mahajan0% (1)

- 3 MonthDocument25 pages3 MonthUpendra SamadhiyaPas encore d'évaluation

- Planning Commission Working Group Report On The Logistics SectorDocument57 pagesPlanning Commission Working Group Report On The Logistics SectorPiyush KhandelwalPas encore d'évaluation

- E-Ticket: Trip 1: Patna To SuratDocument2 pagesE-Ticket: Trip 1: Patna To Suratenjoy begening lifePas encore d'évaluation

- Incoterms, Incoterms 2000 - 2009, Incoterms 2010, Incoterm ChartDocument2 pagesIncoterms, Incoterms 2000 - 2009, Incoterms 2010, Incoterm Charttstar_libyaPas encore d'évaluation

- Bank Statement Template 20Document4 pagesBank Statement Template 20Shanique Findley100% (3)

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocument1 pageIncome Payee'S Sworn Declaration of Gross Receipts/SalesJan DoePas encore d'évaluation

- BBAV Bank StatementDocument1 pageBBAV Bank StatementTommy CliftonPas encore d'évaluation