Académique Documents

Professionnel Documents

Culture Documents

Doubled-Up Worst of Barrier Reverse Convertible

Transféré par

api-25889552Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Doubled-Up Worst of Barrier Reverse Convertible

Transféré par

api-25889552Droits d'auteur :

Formats disponibles

Doubled-Up Worst of Barrier Reverse Convertible on BHP Billiton, Rio Tinto and

Xstrata

Coupon 10,30% Guaranteed + 10,30% Conditional - American Barrier at 69% - 1 Year - Quanto

AUD

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 15.04.2010 Client pays AUD 1000 (Denomination)

Rating: Fitch A

Underlying BHP BILLITON PLC RIO TINTO PLC XSTRATA PLC On 15.04.2011

Bbg Ticker BLT LN Equity RIO LN Equity XTA LN Equity Scenario 1: if the Underlyings have never traded at or below the Barrier level

Strike Level (100%) GBp 2235,5 GBp 3930 GBp 1272,5 a. If all the Underlyings are above their Strike Level on the Valuation Date,

Barrier Level (69%) GBp 1542,56 GBp 2711,7 GBp 878,0 the Investor will receive a Cash Settlement in AUD equal to:

Conversion Ratio TBD TBD TBD Denomination + 2 Coupons of 10,30% (Total return: 120,60%)

Initial Fixing Date 08,04,2010 b. If at least one Underlying is at or below its Strike Level on the Valuation Date,

Payment Date 15,04,2010 the Investor will receive a Cash Settlement in AUD equal to:

Valuation Date 08,04,2011 Denomination + 1 Coupon of 10,30% (Total return: 110,30%)

Maturity Date 15,04,2011

EU Saving Tax Option Premium Component 9,37% p.a. Scenario 2: if one or more Underlyings traded at least once at or below the Barrier

Interest Component 0,93% p.a. a. If all the Underlyings are above their Strike Level on the Valuation Date,

Details Physical Settlement American Barrier the Investor will receive a Cash Settlement in AUD equal to:

ISIN CH0111528086 Denomination + 2 Coupons of 10,30% (Total return: 120,60%)

Valoren 11152808 b. If at least one Underlying is at or below its Strike Level on the Valuation Date,

SIX Symbol Not Listed the Investor will receive a predefined round number (i.e. Conversion Ratio) of

the Underlying with the Worst Performance per Denomination + 1 Coupon of

10,30%

Characteristics

Underlying____________________________________________________________________________________________________________________________________________________________________

- BHP Billiton Plc is an international resources company. The Company's principal business lines are mineral exploration and production, including coal, iron ore, gold, titanium, ferroalloys,

nickel and copper concentrate, as well as petroleum exploration, production, and refining.

- Rio Tinto plc is an international mining company. The Company has interests in mining for aluminum, borax, coal, copper, gold, iron ore, lead, silver, tin, uranium, zinc, titanium dioxide

feedstock, diamonds, talc and zircon. Rio Tinto's various mining operations are located in Australia, New Zealand, South Africa, the United States, South America, Europe, and Indonesia.

- Xstrata plc, a diversified mining group, explores for and mines copper, coking coal, thermal coal, ferrochrome, vanadium, zinc, gold, lead, and silver. The Group conducts operations in

Australia, South Africa, Germany, Argentina, and the United Kingdom.

Opportunities_________________________________________________________________ Risks______________________________________________________________________________

1. A guaranteed Coupon of 10,30% in fine 1. Maximum return limited to 20,60% in fine

2. Opportunity to double the Coupon if all the Underlyings close abov e their Strike lev el 2. Exposure to v olatility changes

3. Protection against 31% drop in Underlyings' price

4. Low er v olatility than direct equity exposure

5. Secondary market as liquid as a share

6. Optimization of EU Tax components

Best case scenario____________________________________________________________ Worst case scenario_______________________________________________________________

One or more Underlyings traded at least once at or below the Barrier Lev el,

All the Underlyings close abov e their respectiv e Strike lev el

and at least one Underlying closes below its Strike Lev el on the Valuation Date

Redemption: Shares of the Worst performing Underlying + Coupon of 10,30% in

Redemption: Denomination + 20,60% in fine ( Tw o coupons of 10,30%)

fine

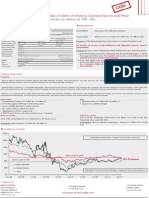

Historical Chart

200% BHP Billit on

importer depuis la deuxieme feuille

Redemption:

180%

Rio Tint o Denomination + Coupon of 20,6% in fine

160%

Xst rat a

140%

120%

Strike: 100% of Spot Reference

100%

Redemption:

Denomination + Coupon of 10,3% in fine

80% Barrier: 69% of Strike Level 31% Protection

60%

Redemption: Shares of the Worst Performing

40% Underlying + Coupon of 10,30% in fine

20%

0%

Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10

Contacts

Filippo Colombo Christ ophe Spanier Nat hanael Gabay

Bruno Frat eschi +41 58 800 10 45 Sofiane Zaiem

St anislas Perromat +41 22 918 70 05

Alejandro Pou Cut uri Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves o nly fo r info rmatio n purpo ses and is no t research; it co nstitutes neither a reco mmendatio n fo r the purchase o f financial instruments no r an o ffer o r an invitatio n fo r an o ffer. No respo nsibility is taken fo r the co rrectness o f this info rmatio n. The financial instruments mentio ned in

this do cument are derivative instruments. They do no t qualify as units o f a co llective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct o n Co llective Investment Schemes (CISA ) and are therefo re neither registered no r supervised by the Swiss Financial M arket Superviso ry A utho rity

FINM A . Investo rs bear the credit risk o f the issuer/guaranto r. B efo re investing in derivative instruments, Investo rs are highly reco mmended to ask their financial adviso r fo r advice specifically fo cused o n the Investo r´s financial situatio n; the info rmatio n co ntained in this do cument do es no t substitute

such advice. This publicatio n do es no t co nstitute a simplified pro spectus pursuant to art. 5 CISA , o r a listing pro spectus pursuant to art. 652a o r 1156 o f the Swiss Co de o f Obligatio ns. The relevant pro duct do cumentatio n can be o btained directly at EFG Financial P ro ducts A G: Tel. +41 (0)58 800 1111, Fax

+41(0)58 800 1010, o r via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Euro pe, Ho ng Ko ng, Singapo re, the USA , US perso ns, and the United Kingdo m (the issuance is subject to Swiss

law). The Underlyings´ perfo rmance in the past do es no t co nstitute a guarantee fo r their future perfo rmance. The financial pro ducts' value is subject to market fluctuatio n, what can lead to a partial o r to tal lo ss o f the invested capital. The purchase o f the financial pro ducts triggers co sts and fees. EFG

Financial P ro ducts A G and/o r ano ther related co mpany may o perate as market maker fo r the financial pro ducts, may trade as principal, and may co nclude hedging transactio ns. Such activity may influence the market price, the price mo vement, o r the liquidity o f the financial pro ducts. © EFG Financial

P ro ducts A G A ll rights reserved.

Vous aimerez peut-être aussi

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552Pas encore d'évaluation

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDocument1 pageCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552Pas encore d'évaluation

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDocument1 pageCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552Pas encore d'évaluation

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552Pas encore d'évaluation

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDocument1 pageCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552Pas encore d'évaluation

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDocument1 pageExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552Pas encore d'évaluation

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDocument1 pageCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552Pas encore d'évaluation

- 6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDDocument1 page6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDapi-25889552Pas encore d'évaluation

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Pas encore d'évaluation

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDDocument1 page7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552Pas encore d'évaluation

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552Pas encore d'évaluation

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocument1 pageCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552Pas encore d'évaluation

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552Pas encore d'évaluation

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552Pas encore d'évaluation

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDocument1 pageCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552Pas encore d'évaluation

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552Pas encore d'évaluation

- Coupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFDocument1 pageCoupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFapi-25889552Pas encore d'évaluation

- Coupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPDocument1 pageCoupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPapi-25889552Pas encore d'évaluation

- 153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010Document1 page153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010api-25889552Pas encore d'évaluation

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDocument1 pageCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552Pas encore d'évaluation

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDocument1 pageCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552Pas encore d'évaluation

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDocument1 page1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552Pas encore d'évaluation

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Document1 page86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552Pas encore d'évaluation

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552Pas encore d'évaluation

- Coupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDDocument1 pageCoupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDapi-25889552Pas encore d'évaluation

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552Pas encore d'évaluation

- 61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010Document1 page61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010api-25889552Pas encore d'évaluation

- Single Barrier Reverse Convertible On GERDAU SADocument1 pageSingle Barrier Reverse Convertible On GERDAU SAapi-25889552Pas encore d'évaluation

- Coupon 10% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 10% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Pas encore d'évaluation

- Bonus Certificate On The EURO STOXX 50Document1 pageBonus Certificate On The EURO STOXX 50api-25889552Pas encore d'évaluation

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDocument1 pageCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552Pas encore d'évaluation

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Document1 page98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552Pas encore d'évaluation

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Document1 page1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552Pas encore d'évaluation

- Coupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTDocument1 pageCoupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTapi-25889552Pas encore d'évaluation

- Format - Termsheet - CE18029CAWDocument5 pagesFormat - Termsheet - CE18029CAWBuchotPas encore d'évaluation

- Coupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDDocument1 pageCoupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDapi-25889552Pas encore d'évaluation

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552Pas encore d'évaluation

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDocument1 pageCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552Pas encore d'évaluation

- 6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDDocument1 page6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDapi-25889552Pas encore d'évaluation

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Document1 pageCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856Pas encore d'évaluation

- 67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEDocument1 page67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEapi-25889552Pas encore d'évaluation

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDocument1 pageCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552Pas encore d'évaluation

- 75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10Document1 page75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10api-25889552Pas encore d'évaluation

- 83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010Document1 page83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010api-25889552Pas encore d'évaluation

- 6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURDocument1 page6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURapi-25889552Pas encore d'évaluation

- 12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURDocument1 page12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURapi-25889552Pas encore d'évaluation

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDocument1 pageCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552Pas encore d'évaluation

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDocument1 page15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552Pas encore d'évaluation

- Structured Products: (Market Linked Debentures)Document1 pageStructured Products: (Market Linked Debentures)ghodababuPas encore d'évaluation

- Coupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCDocument1 pageCoupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCapi-25889552Pas encore d'évaluation

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDDocument1 page4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552Pas encore d'évaluation

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDocument1 pageCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552Pas encore d'évaluation

- 74% Strike - 88% Stop Loss - 2 Months - EUR: Bullish Mini-Future On NASDAQ 100 E-Mini June 2010Document1 page74% Strike - 88% Stop Loss - 2 Months - EUR: Bullish Mini-Future On NASDAQ 100 E-Mini June 2010api-25889552Pas encore d'évaluation

- Continue To Next Pagee ...Document2 pagesContinue To Next Pagee ...Javed MojanidarPas encore d'évaluation

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDocument1 pageCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552Pas encore d'évaluation

- xs2396246931 Phoenix Autocall Stepdown Memory On CCL NCLH RCLDocument6 pagesxs2396246931 Phoenix Autocall Stepdown Memory On CCL NCLH RCLvmakeienkoPas encore d'évaluation

- 6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURDocument1 page6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURapi-25889552Pas encore d'évaluation

- Taxation - F6 Fa 2020 Volume Ii (4706)Document75 pagesTaxation - F6 Fa 2020 Volume Ii (4706)Jemila ChowrimotooPas encore d'évaluation

- 95% Capital Protected Autocallable Certificate With MemoryDocument1 page95% Capital Protected Autocallable Certificate With Memoryapi-25889552Pas encore d'évaluation

- In Search of Returns: Making Sense of the Financial MarketsD'EverandIn Search of Returns: Making Sense of the Financial MarketsPas encore d'évaluation

- CG European Income Fund: StrategyDocument2 pagesCG European Income Fund: Strategyapi-25889552Pas encore d'évaluation

- CG European Capital Growth Fund: StrategyDocument2 pagesCG European Capital Growth Fund: Strategyapi-25889552Pas encore d'évaluation

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- Global Financial Centres: March 2010Document41 pagesGlobal Financial Centres: March 2010api-25889552Pas encore d'évaluation

- NullDocument41 pagesNullapi-25889552Pas encore d'évaluation

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- NullDocument10 pagesNullapi-25889552Pas encore d'évaluation

- Morning News 1 June 2010Document3 pagesMorning News 1 June 2010api-25889552Pas encore d'évaluation

- Weekly Markets UpdateDocument39 pagesWeekly Markets Updateapi-25889552Pas encore d'évaluation

- NullDocument6 pagesNullapi-25889552Pas encore d'évaluation

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- NullDocument15 pagesNullapi-25889552Pas encore d'évaluation

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocument1 pageGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552Pas encore d'évaluation

- Daily Markets UpdateDocument30 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- Morning News 1 June 2010Document3 pagesMorning News 1 June 2010api-25889552Pas encore d'évaluation

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552Pas encore d'évaluation

- Daily Markets UpdateDocument38 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- Daily Markets UpdateDocument33 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Document1 page1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552Pas encore d'évaluation

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDocument65 pagesUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552Pas encore d'évaluation

- NullDocument6 pagesNullapi-25889552Pas encore d'évaluation

- Morning News 28 May 2010Document3 pagesMorning News 28 May 2010api-25889552Pas encore d'évaluation

- Worldwide Real Estates: Gibraltar LettingsDocument8 pagesWorldwide Real Estates: Gibraltar Lettingsapi-25889552Pas encore d'évaluation

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Document1 page1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552Pas encore d'évaluation

- Daily Markets UpdateDocument36 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- NullDocument3 pagesNullapi-25889552Pas encore d'évaluation

- NullDocument1 pageNullapi-25889552Pas encore d'évaluation

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Pas encore d'évaluation

- NullDocument1 pageNullapi-25889552Pas encore d'évaluation

- NullDocument39 pagesNullapi-25889552Pas encore d'évaluation

- Acquisition Goodwill CalculationsDocument21 pagesAcquisition Goodwill CalculationsJack Herer100% (1)

- The Time Value of Money Concept in Islamic FinanceDocument24 pagesThe Time Value of Money Concept in Islamic FinanceZulyaniPas encore d'évaluation

- Audit Report by Four MusketeersDocument12 pagesAudit Report by Four MusketeersIubianPas encore d'évaluation

- Chapter 2 HWDocument4 pagesChapter 2 HWFarah Nader GoodaPas encore d'évaluation

- Questionnaire ActDocument6 pagesQuestionnaire ActLorainne AjocPas encore d'évaluation

- Ca Final Audit MCQDocument9 pagesCa Final Audit MCQKarthik Srinivas Narapalle0% (1)

- MBF13e Chap20 Pbms - FinalDocument11 pagesMBF13e Chap20 Pbms - FinalAnonymous 8ooQmMoNs1100% (3)

- NPODocument3 pagesNPOkanika_mcsePas encore d'évaluation

- Audit UniverseDocument4 pagesAudit UniverseabcdefgPas encore d'évaluation

- BasicDocument12 pagesBasicrajesh_natarajan_4Pas encore d'évaluation

- Company RegistrationDocument2 pagesCompany RegistrationTsitsi AbigailPas encore d'évaluation

- International Business - SybillusDocument5 pagesInternational Business - SybillusaminarizwanPas encore d'évaluation

- Assignment On New Economic EnviornmentDocument13 pagesAssignment On New Economic EnviornmentPrakash KumawatPas encore d'évaluation

- Acca Paper P5 Advanced Performance Management Final Mock ExaminationDocument20 pagesAcca Paper P5 Advanced Performance Management Final Mock ExaminationMSA-ACCAPas encore d'évaluation

- Andrews' PitchforkDocument23 pagesAndrews' PitchforkDoug Arth100% (8)

- Super 60 Steady Multicap BuilderDocument2 pagesSuper 60 Steady Multicap BuildersumonPas encore d'évaluation

- Year Overview 2012 FinalDocument65 pagesYear Overview 2012 FinalArjenvanLinPas encore d'évaluation

- Glencore 31 5 11Document6 pagesGlencore 31 5 11Chandra ChadalawadaPas encore d'évaluation

- Stipulation and Order of Discontinuance by KBC Investments Cayman Islands V Ltd.Document5 pagesStipulation and Order of Discontinuance by KBC Investments Cayman Islands V Ltd.Thierry DebelsPas encore d'évaluation

- BANKING LAWS: KEY ROLES OF THE BANGKO SENTRAL NG PILIPINASDocument17 pagesBANKING LAWS: KEY ROLES OF THE BANGKO SENTRAL NG PILIPINASJanice F. Cabalag-De VillaPas encore d'évaluation

- Financial Management Assignment: Cash Flow Analysis OF Kwality Dairy LTDDocument4 pagesFinancial Management Assignment: Cash Flow Analysis OF Kwality Dairy LTDishant7890Pas encore d'évaluation

- ECN 171 Midterm 2011 KEYDocument5 pagesECN 171 Midterm 2011 KEYAlvinKYuPas encore d'évaluation

- Case Analysis Massey Ferguson 1980Document7 pagesCase Analysis Massey Ferguson 1980Muhammad Faisal Hayat100% (2)

- An Introduction To SwapsDocument5 pagesAn Introduction To SwapsCh RajkamalPas encore d'évaluation

- Loctite Case SolutionDocument5 pagesLoctite Case SolutionRonakkumar Patel50% (2)

- B18 LabuanDocument4 pagesB18 LabuanhativernPas encore d'évaluation

- Investment Patterns and Banking ProductsDocument21 pagesInvestment Patterns and Banking ProductsMelvin Mathew100% (1)

- Tutorial 5 PDFDocument2 pagesTutorial 5 PDFBarakaPas encore d'évaluation

- Screening opportunities for feasibilityDocument21 pagesScreening opportunities for feasibilityZayda LaugoPas encore d'évaluation

- QuizDocument55 pagesQuizMuhammad Ben Mahfouz Al-ZubairiPas encore d'évaluation