Académique Documents

Professionnel Documents

Culture Documents

Financial Results For Dec 31, 2015 (Standalone) (Result)

Transféré par

Shyam SunderTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Results For Dec 31, 2015 (Standalone) (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

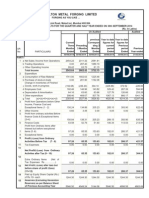

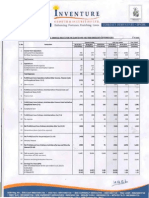

PRIMAAGRO LTD

Registered Office i'Door No. V.679iC,lndu

rt

al DevelopmentArea, Muppathadam,Edayar, Cochin.683110

ANNEXUREN TO

LAUSE 41

STATEMENT OF UNAUDITED FINANCiAL RESULTS FORTHE QUARTER ENDED 31ST DECEMBER,2O15

PARTN

Standalone/Consolidated unaudited Financial Resulis forthe 3rd quade ended 3'|.12.2015

(Figures in Lacks RupEer

Particulars

3rd

Standalone

Otrended

0uader Ended

Consolidated

Year Ended

31.12.2015

30,9.2015 31.12.2014 31.12-2015 31.12.2014

Unaudited

tlnaudited

Unaudited

Unaudited

Unaudited

Audited

282.89

290 64

274.U

856.81

826.24

1114.11

282.89

290.M

274.34

856.81

826.24

1114.11

10.30

26.90

30.51

48.31

(0.89)

1.38

0.23

(0.44)

(0.48)

3t.3.2015

1. lncome from operationr

a) Net Sales/

b)otheroDeraUnq ncome

fotal Income from operations

L Erpenses

1.

Coisumption ofraw matenas /Purchase

7.98

). Purchase ofstock in Trade

Increase/decrease in stock in lrade and wod( n progrcss

061

d.Power& Fuel

45.56

60.08

68 78

176.86

213.02

299.19

e. Employees cost

66.21

4618

50.7'l

157.37

146.74

158.74

f. Depreclation and Amodsation Expenses

10.00

10 00

7.12

28.00

21.36

31.65

1. Other expenses

87.88

79.00

77.52

234.65

182.32

478.55

218.24

242.69

215.81

624.01

593.51

1015.S6

64.65

87.95

58.53

232.80

232.73

98.15

2.82

Total Expenses

(Any item exceedifg 10% of the total expendilure lo be

shown separalely)

3, Profiu(Loss) fiom Operatlons before other

lncome,finance cost and Exceptional ltems (,l.2)

+.

Other lncome

i.

Prof U(Loss)from

od

nary activilies before linance cost

2.56

2.99

67.21

90.94

(0.33)

(0.83)

67.21

90.61

60.52

0.00

8.21

9.83

4.04

241.41

242 56

1A2.19

(0.45)

(2.86)

(5.50)

240.56

x9.7A

96.69

000

0.00

239.7A

96.69

d Exceptional Ltems (3+4)

6. Finence Cost

7.

Profit (loss) from ordinary activlt es afler linance cost but

before exceptiona ltems (5-6)

8. Exceptional items

67.21

s0.61

60.52

(21-80)

{30.00)

(19.63)

(78.64)

177.76)

(61.77)

45.41

60.61

40.89

161.92

161.94

34.92

0.00

0.00

45,41

60.61

161.92

161.94

34.92

14 Share of Proilt /Loss of,Associates

0.00

0.00

15. [4inority interest

0.00

0.00

9. Plofit (+)/ Loss (-)from ordinary Aclivl|es beforctax{7+8)

10. Tax

expense

11. Net Profit (+)/ Loss (-)from ordinary activites ailer lax

(s-10)

12. Extlaordinary ltem (net oi 1ax expense

Rs.

13. Net Prcit(+)/ Loss(.) afler taxes bul beforc share of

profiuloss of assoc ates and mino.ity inleresl(l1+12)

16.

Net Prcf Uloss for lhe period(1 3+14+1

5)

17. Paid-up equity share capilal

(Face Value of lhe Sharc shallbe indlcated)

18. ReseNe exc uding Revaluation ReseNes as perbalance

sheel of plevlous accounUng year

000

40.89

45.41

60.61

40.89

161.92

161.94

34.92

519.49

519.49

519.49

519.49

519.49

519.49

10.00

10.00

10.00

10.00

10.00

(668.06)

(668.06)

(668.06)

(702.98)

(668.06)

i,...-:it

'10

(702.98)

t.-

-t!

00

aGl

.a1:

, ,,,.1!

.:,

: i -rr.r:i,.,lr:..,i,.ii.a, i-

----=\ta--'-"P

tEa-

19.i. Eamings Per Share (EPS)

a) Basic EPS before Exlraodinary iiems for the period, for

the year to date and for the previous year (not to be

b) Dlluted EPS before Extraodinary

items

forlhe period, for

4.81

186

4.63

4.61

1.86

0.79

3.12

3.12

0.67

079

3.12

3.12

0.67

1.29

1.74

1.17

1.29

1.74

1.17

0.87

117

0.87

117

lhe year to date and for the prevlous year (not to be

annualized)

l9.liEamlnos Per Share IEPS)

a)Basic EPS after Extraordinary items for lhe peiod, forthe

year to date and forlhe prcvious year (not to be anfualized)

b) Diluled EPS after Exlraordinary

items for the period, for

the year to date and for the previous year (not lo be

annualized)

PARTII: SELECT lNFoRlilATloN FoRTHE QUARTER ENDED 31.12.20'15

A Particulars of Shareholdings

'1.

Public Shareholding

- No.

ofshares

3451700

3451700

3451700

3451700

3451700

3451700

diiq

66.44

66.44

66.44

66.44

66.44

66.44

2. PromoterB and promotergroup Shareholdings

1143240

1743204

17432A0

1743200

17r'l2]]

1743200

- Percenlaqe of shareho

a)Pledged/Encumbercd

- Percenlage ofshares (as a %

ofthe total shareholdiig of

promoler and promoler group)

- Percentage ofshares (as a% of the totalsharc

capilalof

1743200

17$2A0

1743200

1743240

1743200

1743200

100

100.00

100.00

100.00

100.00

100.00

33.56

33.56

33.56

33 56

33.56

33.56

company)

b) Non-encumbered

- NumberofShares

- Perce^raqe

o' .^a'es (as a% oflne loral sl'arc'ro.d:na of

promoler and promoter group)

- Percentage of shares (as a % of the totalshare

capitalof

comoanY)

B. lnvestor Complaints

Padiculars

3 months ended 31.12.2015

Pendino atthe beoinn no of the ouarter

Nit

Received duriiq the quarler

NI

Disposed dudig the quader

Ni

Remaininq unreso ved at the end of lhe quarler

NI

Note

The above resu ls were laken on recod by lhe Board at their rneeling held on 30 01.2016

(li)Provision for taxes includes provislon fordeferred Tax.

(iii)During the Perod conrpany has not received any comp ainls from lnvestors. There are no unsolved complalnts atthe opening orclos

of the Period

Previous year s figures have been regrouped/rearranged wherever necessary.

:

acer Kochi

ale:30.1.2016

Vous aimerez peut-être aussi

- Standalone Financial Results & Limited Review Report For December 31, 2015 (Result)Document3 pagesStandalone Financial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document6 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document23 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document3 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Document1 pagePDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- GUJARAT APOLLO INDUSTRIES LIMITED FINANCIAL RESULTSDocument2 pagesGUJARAT APOLLO INDUSTRIES LIMITED FINANCIAL RESULTSTushar PatelPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Result)Document5 pagesFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document1 pageStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Document6 pagesStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- BATA INDIA 1Q FY2011 Earnings ReportDocument1 pageBATA INDIA 1Q FY2011 Earnings ReportSagar KadamPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiPas encore d'évaluation

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Document1 pageUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaPas encore d'évaluation

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Statement of Assets & Liabilities As On September 30, 2015. (Result)Document3 pagesStatement of Assets & Liabilities As On September 30, 2015. (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- BSNL Financial AnalysisDocument16 pagesBSNL Financial AnalysisAyushi JainPas encore d'évaluation

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiPas encore d'évaluation

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Rectification On Financial Results For The Period Ended June 30, 2015. (Result)Document2 pagesRectification On Financial Results For The Period Ended June 30, 2015. (Result)Shyam SunderPas encore d'évaluation

- BHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Document3 pagesBHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Shubham TrivediPas encore d'évaluation

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument2 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Constitutional Law of India-II CCSU LL.B. Examination, June 2015 K-2002Document3 pagesConstitutional Law of India-II CCSU LL.B. Examination, June 2015 K-2002Mukesh ShuklaPas encore d'évaluation

- Grid Xtreme VR Data Sheet enDocument3 pagesGrid Xtreme VR Data Sheet enlong bạchPas encore d'évaluation

- CIGB B164 Erosion InterneDocument163 pagesCIGB B164 Erosion InterneJonathan ColePas encore d'évaluation

- March 29, 2013 Strathmore TimesDocument31 pagesMarch 29, 2013 Strathmore TimesStrathmore TimesPas encore d'évaluation

- Examples 5 PDFDocument2 pagesExamples 5 PDFskaderbe1Pas encore d'évaluation

- GPU Programming in MATLABDocument6 pagesGPU Programming in MATLABkhaardPas encore d'évaluation

- Medhat CVDocument2 pagesMedhat CVSemsem MakPas encore d'évaluation

- Counsel For Plaintiff, Mark Shin: United States District Court Northern District of CaliforniaDocument21 pagesCounsel For Plaintiff, Mark Shin: United States District Court Northern District of CaliforniafleckaleckaPas encore d'évaluation

- The New Breed of Rally BDA: Motor SportDocument8 pagesThe New Breed of Rally BDA: Motor SportHarold MorleyPas encore d'évaluation

- Market & Industry Analysis CheckDocument2 pagesMarket & Industry Analysis CheckAndhika FarrasPas encore d'évaluation

- 38-St. Luke - S vs. SanchezDocument25 pages38-St. Luke - S vs. SanchezFatzie MendozaPas encore d'évaluation

- Aegis SGR BrochureDocument2 pagesAegis SGR BrochureAmazonas ManutençãoPas encore d'évaluation

- 110 TOP Single Phase Induction Motors - Electrical Engineering Multiple Choice Questions and Answers - MCQs Preparation For Engineering Competitive ExamsDocument42 pages110 TOP Single Phase Induction Motors - Electrical Engineering Multiple Choice Questions and Answers - MCQs Preparation For Engineering Competitive Examsvijay_marathe01Pas encore d'évaluation

- PhysRevResearch 4 043041Document6 pagesPhysRevResearch 4 043041marco juradoPas encore d'évaluation

- M88A2 Recovery VehicleDocument2 pagesM88A2 Recovery VehicleJuan CPas encore d'évaluation

- TVS Sport User Manual BS6Document69 pagesTVS Sport User Manual BS6tonemetonePas encore d'évaluation

- Structure and Mechanism of The Deformation of Grade 2 Titanium in Plastometric StudiesDocument8 pagesStructure and Mechanism of The Deformation of Grade 2 Titanium in Plastometric StudiesJakub BańczerowskiPas encore d'évaluation

- Accor vs Airbnb: Business Models in Digital EconomyDocument4 pagesAccor vs Airbnb: Business Models in Digital EconomyAkash PayunPas encore d'évaluation

- VectorsDocument9 pagesVectorsdam_allen85Pas encore d'évaluation

- GFRDDocument9 pagesGFRDLalit NagarPas encore d'évaluation

- Audit Report of CompaniesDocument7 pagesAudit Report of CompaniesPontuChowdhuryPas encore d'évaluation

- November 2022 Examination: Indian Institution of Industrial Engineering Internal Assignment For IIIE StudentsDocument19 pagesNovember 2022 Examination: Indian Institution of Industrial Engineering Internal Assignment For IIIE Studentssatish gordePas encore d'évaluation

- PNB V. Se, Et Al.: 18 April 1996 G.R. No. 119231 Hermosisima, JR., J.: Special Laws - Warehouse Receipts LawDocument3 pagesPNB V. Se, Et Al.: 18 April 1996 G.R. No. 119231 Hermosisima, JR., J.: Special Laws - Warehouse Receipts LawKelvin ZabatPas encore d'évaluation

- Kinds of ObligationDocument50 pagesKinds of ObligationKIM GABRIEL PAMITTANPas encore d'évaluation

- MockupDocument1 pageMockupJonathan Parra100% (1)

- FINC 301 MQsDocument40 pagesFINC 301 MQsMichael KutiPas encore d'évaluation

- Break-Even Analysis: Margin of SafetyDocument2 pagesBreak-Even Analysis: Margin of SafetyNiño Rey LopezPas encore d'évaluation

- Term Paper Mec 208Document20 pagesTerm Paper Mec 208lksingh1987Pas encore d'évaluation

- CSCE 3110 Data Structures and Algorithms NotesDocument19 pagesCSCE 3110 Data Structures and Algorithms NotesAbdul SattarPas encore d'évaluation

- MongoDB vs RDBMS - A ComparisonDocument20 pagesMongoDB vs RDBMS - A ComparisonShashank GuptaPas encore d'évaluation