Académique Documents

Professionnel Documents

Culture Documents

Penalties For White Collar Crime Inquiry

Transféré par

SenateBriberyInquiryTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Penalties For White Collar Crime Inquiry

Transféré par

SenateBriberyInquiryDroits d'auteur :

Formats disponibles

Criminal, civil and administrative penalties for white collar crime

Submission 1

SUBMISSION TO THE

SENATE

INQUIRY INTO PENALTIES FOR WHITE

COLLAR CRIME

Criminal, civil and administrative penalties for white collar crime

Submission 1

Committee Secretary

Senate Inquiry into

White-Collar Crime Penalties

Parliament House

Senate.eco@Aph.gov.au

Dear Senators

Thank you for the opportunity to contribute to this very important area

which dovetails into many other Parliamentary Inquiries, eg into ASIC,

Foreign Bribery, and anti-corruption measures.

US 'CLASS ACTION' EVIDENCE

1.

As you may be aware, US authorities like the Consumer Finance

Protection Bureau carry out investigations, initiate prosecutions, and recover

compensation for victims without the need for private litigation. We feel it is

vitally important that these types of prosecutors have clear guidelines on the

class of victims they can recover compensation for as part of the penalty.

Furthermore the compensation should not go to the Crown office, would

rather should go directly to the relevant victims. We strongly urge you to cut

out as many of the middlemen as possible in order to maximise the returns

to victims.

The US evidentiary system is worth examining for major 'class' prosecutions

that commonly involve millions of pages of documents, such as 25,000,000

mortgages in a case that penalised Citigroup $7,000,000,000 in July 2014.

Apart from speeding up trials, cases can be brought before limitations

periods expire, and staff can work on other cases.

Criminal, civil and administrative penalties for white collar crime

Submission 1

Streamlining evidence with international cooperating agencies:

We also think it would be beneficial if rules of evidence were streamlined

with Britain and the USA to better ensure that all the cooperating

international investigators can use the others' evidence. It might be

necessary to pass an act that simply says that the evidence for an Australian

trial will be admissible if it is admissible in the country of origin.

2. The thinking in the now famous "Yates memo" has criminal and

administrative penalty prosecutors working together, along with the IRS and

international white-collar crime investigators, to penalise the corporation

while always keeping the responsible individuals in sight for personal

prosecution.

The evidentiary standards should be streamlined so be various prosecutors

sing from the same hymn book to the juries. There must be nothing more

frustrating and costly than having to redo different presentations, and of

course there is any administration cost of justice that can benefit from

streamlining.

3. Complete statements of admission of guilt should be public and admissible

in other cases (including civil litigation by victims of corporate wrongdoing,

e.g. shareholders and customers).

4. Cooperating witnesses should be included in standard form release

clauses of governmental prosecutors, the state and the Commonwealth, and

related agencies. In other words, potential witnesses, actual witnesses, and

whistleblowers should be granted immunity, protection from retaliation,

and exoneration of (for example) mortgage debt. As in a matter we have

in mind from Fos, the mortgage was written off 90% in accordance with the

general ex turpi causa principles that does not allow the perpetrator to

keep his ill gotten gains. In our opinion, perpetrators should not keep their ill

gotten gains, and should be barred from taking steps to inflict financial harm

on potential witnesses.

5. Important witnesses should be given guaranteed immunity from

prosecution (subject to appropriate qualifications) to encourage the small

fish to finger Mister Big. In our view, part of the penalties should be

allocated towards rewarding witnesses in a carrot and stick approach as in

the appended opinion of U.S. SEC Deputy Commissioner Kara Stein.

3

Criminal, civil and administrative penalties for white collar crime

Submission 1

Full disclosure of plea-bargain to the Court:

Attached are other concerns of a Victorian Supreme Court judge with the

expectation is simply to rubberstamp deals done by ASIC and defendants.

The same views are shared by Judge Rackoff of New York. In the cases after

be global financial crisis, it was too common for the shareholders and

consumers to wear the ultimate consequences of managers. Rackoff gave

the analogy of traffic on the freeway. Most people stuck to the speed limit,

some drove at 120 mph, and others had 200 miles an hour weaving in and

out of traffic. A calamity was inevitable. The traffic tickets were not paid by

the perpetrators. Accordingly we support the idea that the perpetrators be

required to disgorge profits, disgorge bonuses, and generally be kept

honest.

Disgorgements:

With creative accountancy, it is relatively easy to inflate profit and thereby

inflate one's bonus. The false accounting may never be noticed, or if it is

noticed, it is noticed long after the statute of limitations has expired. We

suggest the concept of tolling which keeps the statue limitations rolling

along. As senators may be aware, in the USA some prosecutions and

recoveries by retrospective to the 1990s. We firmly believe that the ill gotten

gains should be recoverable with retrospective effect.

We also believe that it is unacceptable to simply hand over the ill gotten

gains if one happens to be caught. The typical criminal mind thinks it'll never

get caught because they are too clever, and if caught, they think they need

only hand over the cookies in their pocket. We think they should be sent to

the principal for the strap. Crime should not pay.

Mens rea:

For some offences in the USA, no intention is required. An example is in the

field of the laws of bribery of foreign government officials. (See the

attached). The " I didn't know it was illegal" is too often a copout. In our

experience, and that of many of the submitters to the Senate Inquiry into

Foreign Bribery, we have encountered wilful defiance of extraterritorial U.S.

foreign corrupt practices legislation. Appallingly that defiance extended to

purported legal ethics guardians that the Victorian Ombudsman

recommended be referred to the local anticorruption commission, IBAC. (We

4

Criminal, civil and administrative penalties for white collar crime

Submission 1

urge that white-collar criminal penalties be extended to individuals in

governmental prosecutorial positions that, in our experience, has preferred

to cover things up to save their own skins).

Evidentiary standards: the reverse onus of proof adopted by the

British Financial Conduct Authority.

If we understand how colleagues from the legal services community, there is

a standard of proof called the Briginshaw Standard. It is apparently

somewhere between the balance of probabilities and the Beyond Reasonable

Doubt standard in blue-collar criminal cases. According to our colleagues,

this standard is a barrier to them successfully prosecuting top tier

gatekeepers such as multinational law firms. We therefore recommend a

lower standard of proof, such as the balance of probabilities. In fact we

believe that they have reversed the onus of proof and placed it squarely on

the directors, thanks to an initiative by the British Financial Conduct

Authority. We fully support that reverse onus of proof. We also think our

friends at the Financial Ombudsman Service are correct in saying that the

Inquisitorial System has merit. Under the genuine inquisitorial system

throughout Europe, the bank would have to prove its innocence. In our view,

it is about time that these sociopathic unsympathetic corporate executives

were held to a count. In the same breath we have to stress that legal

profession legislation actually says the prosecutor is immune from improper

actions, and the prosecutor is entitled to legal costs even if the prosecution

loses. A Stalinist as that sounds, we think it would be an excellent idea if the

same concepts apply to governmental boards that carry out disciplinary or

regulatory functions. The public simply want to see fairness and equity,

proper and ethical prosecutorial investigations, and the holding to account of

excessive greed.

Penalties for Corporations that impersonate government agencies:

There are hundreds of submissions from victims of bank tactics as seen on

60 Minutes in the case of a bank and an 85-year-old farmer who never

missed a payment. Customers are directed towards the so-called

ombudsman schemes which are corporations that have permission from

ASIC to not add Ltd to their name. (We think these misleading names

should be banned). As a result of the misleading name, consumers assume

they will get a service from an impartial government investigator rather than

a bank-operated arbitration scheme with rules drafted by the banks to stack

the deck in the bank's favour. A common theme in lots of media reports and

Parliamentary hearings are the blocking tactics used to literally drive people

to suicide, as in the case of the average four farm suicides per week in

Queensland (refer to Senator Bob Katter).

5

Criminal, civil and administrative penalties for white collar crime

Submission 1

The most common tactic we come across is known in psychology as gas

lighting. Basically nothing the victim puts forward to the so-called

ombudsman is good enough. In our case, our material came from the US

Department of Justice and the Reserve Bank of Australia, which was not

good enough for the financial ombudsman, but turned out to be worth

billions in losses for a global credit card company. Unlike the ombudsman's

customers, the bank are given extensions of time and are permitted to

destroy it or lose documents that go against them, as in the case of falsified

loan application forms. The delays and frustration, combined with banks

seizing assets and investment funds, are calculated to bully the victim into

submission or suicide. Things get even worse as the ombudsman scheme

seek to create rights to seize your assets that are in another bank

altogether. (We can see why people hide money in the Cayman Islands!).

We therefore think that these falsely described corporate ombudsman should

be identified as corporate arbitration schemes, and we also think that the

penalties should include a white-collar crime penalty akin to manslaughter

by reckless indifference. We are appalled and disgusted at how these

impersonators of government officials so readily throw their victims on the

scrapheap. It is time that they ship up or ship out. The same goes for their

directors on numerous government boards which are infamous for rewarding

yes-men who rubberstamp anything the CEO says. We firmly believe the

directors, and all of the staff who are complicit, should be held to account.

We fully support the ideas in the Memo of US Deputy Attorney General Sally

Yates to all of her international crimebusting agencies.

Thank you for this opportunity to comment.

Kindest regards

Criminal, civil and administrative penalties for white collar crime

Submission 1

Attachments:

SAMPLE: NO NEED TO PROVE GUILTY INTENT:

INQUISITORIAL SYSTEM:

Criminal, civil and administrative penalties for white collar crime

Submission 1

Criminal, civil and administrative penalties for white collar crime

Submission 1

Criminal, civil and administrative penalties for white collar crime

Submission 1

HOLD INDIVIDUALS RESPONSIBLE

10

Criminal, civil and administrative penalties for white collar crime

Submission 1

11

Criminal, civil and administrative penalties for white collar crime

Submission 1

12

Criminal, civil and administrative penalties for white collar crime

Submission 1

13

Criminal, civil and administrative penalties for white collar crime

Submission 1

HOLD RESPONSIBLE THOSE BUREAUCRATS WHO 'GASLIGHT', DELAY, OBFUSCATE, AND ALTER

EVIDENCE, FABRICATE FILE NOTES

14

Criminal, civil and administrative penalties for white collar crime

Submission 1

CIRCUMLOCUTIVE SENTENCES

15

Criminal, civil and administrative penalties for white collar crime

Submission 1

US PROSECUTION COSTS 'ONLY' $3.5M THANKS TO RULES OF EVIDENCE:

16

Criminal, civil and administrative penalties for white collar crime

Submission 1

FESS UP EARLY FOR A NON PROSECUTION OR DEFERRED PROSECUTION DEAL:

SAMPLE OF EVIDENCE

PRESENTED TO COURT IN US & 17 STATES V AMERICAN EXPRESS:

17

Criminal, civil and administrative penalties for white collar crime

Submission 1

LET'S NOT FORGET THE VICTIMS

18

Criminal, civil and administrative penalties for white collar crime

Submission 1

SAMPLE RECOVERY ORDER IN BRITAIN WITH EXTRADITION OF AN AUSTRALIAN TO SERVE TIME

19

Criminal, civil and administrative penalties for white collar crime

Submission 1

20

Criminal, civil and administrative penalties for white collar crime

Submission 1

21

Criminal, civil and administrative penalties for white collar crime

Submission 1

22

Criminal, civil and administrative penalties for white collar crime

Submission 1

23

Criminal, civil and administrative penalties for white collar crime

Submission 1

24

Criminal, civil and administrative penalties for white collar crime

Submission 1

25

Criminal, civil and administrative penalties for white collar crime

Submission 1

26

Criminal, civil and administrative penalties for white collar crime

Submission 1

NO RUBBER STAMP PLEA DEALS:

27

Criminal, civil and administrative penalties for white collar crime

Submission 1

28

Vous aimerez peut-être aussi

- Get a Second Opinion before You Sign: What to do when the Bank says 'No' ? How to survive and thrive with Private Lending.D'EverandGet a Second Opinion before You Sign: What to do when the Bank says 'No' ? How to survive and thrive with Private Lending.Pas encore d'évaluation

- UNDERSTANDING MAIL FRAUD AND WIRE FRAUD: A Nonattorney's GuideD'EverandUNDERSTANDING MAIL FRAUD AND WIRE FRAUD: A Nonattorney's GuidePas encore d'évaluation

- This Content Downloaded From 141.211.4.224 On Wed, 05 Aug 2020 17:16:17 UTCDocument28 pagesThis Content Downloaded From 141.211.4.224 On Wed, 05 Aug 2020 17:16:17 UTCRaymond Behnke [STUDENT]Pas encore d'évaluation

- Credit Derivatives Not InsuranceDocument59 pagesCredit Derivatives Not InsuranceGlobalMacroForumPas encore d'évaluation

- Law of Trusts and Equity: Lecture-IDocument17 pagesLaw of Trusts and Equity: Lecture-IKanwal ZehraPas encore d'évaluation

- Railroad Stockman: Passbooks Study GuideD'EverandRailroad Stockman: Passbooks Study GuidePas encore d'évaluation

- Was Frankenstein Really Uncle Sam? Vol Ix: Notes on the State of the Declaration of IndependenceD'EverandWas Frankenstein Really Uncle Sam? Vol Ix: Notes on the State of the Declaration of IndependencePas encore d'évaluation

- Important Notes in Constitutional Law IIDocument147 pagesImportant Notes in Constitutional Law IIThe man with a Square stachePas encore d'évaluation

- Beginners Guide To Understanding Roaming Fraud in The Developing MarketDocument9 pagesBeginners Guide To Understanding Roaming Fraud in The Developing Marketfraudmanagement86% (7)

- UNITED STATES of America Ex Rel. Donald TILLERY v. Angelo C. CAVELL, Warden, Western State Penitentiary, Pittsburgh 33, Pennsylvania, AppellantDocument17 pagesUNITED STATES of America Ex Rel. Donald TILLERY v. Angelo C. CAVELL, Warden, Western State Penitentiary, Pittsburgh 33, Pennsylvania, AppellantScribd Government DocsPas encore d'évaluation

- Conservatives Versus Wildcats: A Sociology of Financial ConflictD'EverandConservatives Versus Wildcats: A Sociology of Financial ConflictPas encore d'évaluation

- Strangers to the Constitution: Immigrants, Borders, and Fundamental LawD'EverandStrangers to the Constitution: Immigrants, Borders, and Fundamental LawPas encore d'évaluation

- Zarro Inference 3 The Affidavits of Michael ZarroDocument190 pagesZarro Inference 3 The Affidavits of Michael ZarroDeontosPas encore d'évaluation

- A Guide to Ethical Practices in the United States Tax IndustryD'EverandA Guide to Ethical Practices in the United States Tax IndustryPas encore d'évaluation

- Cooter-Freedman91 Fiduciary Relationship - Economic Character and Legal Consequence PDFDocument32 pagesCooter-Freedman91 Fiduciary Relationship - Economic Character and Legal Consequence PDFKaipichit RuengsrichaiyaPas encore d'évaluation

- Solution Manual Ethics Across The ProfessionDocument14 pagesSolution Manual Ethics Across The ProfessionAnPas encore d'évaluation

- The Business of Policing: Volume I: Crimes & PunishmentsD'EverandThe Business of Policing: Volume I: Crimes & PunishmentsPas encore d'évaluation

- Liberty of Contract: Rediscovering a Lost Constitutional RightD'EverandLiberty of Contract: Rediscovering a Lost Constitutional RightPas encore d'évaluation

- The Appropriations Law Answer Book: A Q&A Guide to Fiscal LawD'EverandThe Appropriations Law Answer Book: A Q&A Guide to Fiscal LawPas encore d'évaluation

- Broader Perspectives 2014 03 Compre AnswersDocument13 pagesBroader Perspectives 2014 03 Compre Answersnej200695Pas encore d'évaluation

- Intelligence Surveillance, Security Sector Reforms, Accountability Principles and National Security Challenges within European UnionD'EverandIntelligence Surveillance, Security Sector Reforms, Accountability Principles and National Security Challenges within European UnionPas encore d'évaluation

- Our Virtuous Republic: The Forgotten Clause in the American Social ContractD'EverandOur Virtuous Republic: The Forgotten Clause in the American Social ContractPas encore d'évaluation

- 2014 Economics of JusticeDocument32 pages2014 Economics of Justiceaurelio.arae713100% (1)

- Scope of Interest Taken: Citizens Bank & Trust v. Gibson Lumber Co., Page 97Document11 pagesScope of Interest Taken: Citizens Bank & Trust v. Gibson Lumber Co., Page 97agothermailPas encore d'évaluation

- Letter From Brian Glicklich To Twitter General Counsel Vijaya GaddeDocument18 pagesLetter From Brian Glicklich To Twitter General Counsel Vijaya GaddeBrian GlicklichPas encore d'évaluation

- Roll Number Wise RankingDocument304 pagesRoll Number Wise RankingChristopher GarrettPas encore d'évaluation

- Understand Bill of Lading TermsDocument15 pagesUnderstand Bill of Lading TermsRahulPas encore d'évaluation

- Enforcement and Corporate Governance - Three ViewsDocument88 pagesEnforcement and Corporate Governance - Three ViewsBonoPas encore d'évaluation

- TE OutlineDocument113 pagesTE OutlineJavier RosadoPas encore d'évaluation

- ODonnell Monitor Second Report v. 31Document101 pagesODonnell Monitor Second Report v. 31The TexanPas encore d'évaluation

- Letter To U. S. Secret Service From :David-Lee Buess: September 24, 2010Document2 pagesLetter To U. S. Secret Service From :David-Lee Buess: September 24, 2010Truth Press MediaPas encore d'évaluation

- Transunion Offering DocumentDocument440 pagesTransunion Offering DocumentWHRPas encore d'évaluation

- Combating Money Laundering in Nigeria - A Legal Perspective On The Role of Central and Commercial Banks, ChitengiDocument84 pagesCombating Money Laundering in Nigeria - A Legal Perspective On The Role of Central and Commercial Banks, ChitengiCHITENGI SIPHO JUSTINE, PhD Candidate- Law & Policy100% (1)

- Pinciples of Constitution LawDocument6 pagesPinciples of Constitution LawZÅîb MëýmÖñPas encore d'évaluation

- JAN LOHFELDT vs. NEDBANK LTD - Cape Town High Court Judge Goliath (24.02.2014) & Judge Zondi (25.02.2014)Document24 pagesJAN LOHFELDT vs. NEDBANK LTD - Cape Town High Court Judge Goliath (24.02.2014) & Judge Zondi (25.02.2014)willPas encore d'évaluation

- History of Crime and Criminal Justice in America EditedDocument7 pagesHistory of Crime and Criminal Justice in America EditedcarolinePas encore d'évaluation

- Corruption of Foreign Public Officials ActDocument15 pagesCorruption of Foreign Public Officials Actjonkhan84Pas encore d'évaluation

- Boy Scouts of America StatementDocument1 pageBoy Scouts of America Statementpatriciaborns100% (1)

- Theft Revision NotesDocument27 pagesTheft Revision NotesSergio SantosPas encore d'évaluation

- Anti KickbackDocument12 pagesAnti KickbackrijderunnerPas encore d'évaluation

- Philippine Constitution Article 3 outline on Bill of RightsDocument32 pagesPhilippine Constitution Article 3 outline on Bill of RightsKristine Jade OdtujanPas encore d'évaluation

- Law On Sales AssignmentDocument13 pagesLaw On Sales AssignmentGennia Mae MartinezPas encore d'évaluation

- Facilitating Electronic Bills of LadingDocument22 pagesFacilitating Electronic Bills of LadingbiondimiPas encore d'évaluation

- US Terrorism DocsDocument113 pagesUS Terrorism DocsTRUMPET OF GODPas encore d'évaluation

- Toxic Document Fallout 10-12-10Document14 pagesToxic Document Fallout 10-12-10Richard Franklin KesslerPas encore d'évaluation

- Merscorp, Inc.: Rules of MembershipDocument48 pagesMerscorp, Inc.: Rules of MembershipDinSFLAPas encore d'évaluation

- Carnell Inquiry 030217-ASBFEO - ReportDocument85 pagesCarnell Inquiry 030217-ASBFEO - ReportSenateBriberyInquiryPas encore d'évaluation

- LSBC Jeannie Pakula To Waldron SgargettaDocument2 pagesLSBC Jeannie Pakula To Waldron SgargettaSenateBriberyInquiryPas encore d'évaluation

- Park City Jenni Smith 2012 0815 Redacted 2nd Dec Jenni Smith Without ExhibitsDocument5 pagesPark City Jenni Smith 2012 0815 Redacted 2nd Dec Jenni Smith Without ExhibitsSenateBriberyInquiryPas encore d'évaluation

- Spencer Murray's Submission To Parliament's Inquiry Into Whistleblowers Sub - 016-1Document2 pagesSpencer Murray's Submission To Parliament's Inquiry Into Whistleblowers Sub - 016-1SenateBriberyInquiryPas encore d'évaluation

- Referral To IRS by Marsha Blackburn To Clinton Foundation July 15 LetterDocument7 pagesReferral To IRS by Marsha Blackburn To Clinton Foundation July 15 LetterSenateBriberyInquiryPas encore d'évaluation

- Australia and Clinton Foundation Memorandum of Understanding in Child Welfare ProgramsDocument10 pagesAustralia and Clinton Foundation Memorandum of Understanding in Child Welfare ProgramsBeverly TranPas encore d'évaluation

- Mastercardantitrust 711replyMTVDocument36 pagesMastercardantitrust 711replyMTVSenateBriberyInquiryPas encore d'évaluation

- Whistleblowers QLD Submission 23 - Whistleblowers Action Group QueenslandDocument8 pagesWhistleblowers QLD Submission 23 - Whistleblowers Action Group QueenslandSenateBriberyInquiryPas encore d'évaluation

- Spencer Murray's Submission To Parliament's Inquiry Into Whistleblowers Sub - 016-1Document2 pagesSpencer Murray's Submission To Parliament's Inquiry Into Whistleblowers Sub - 016-1SenateBriberyInquiryPas encore d'évaluation

- Clinton Foundation-Charles Ortel Letter 1 May 2016Document8 pagesClinton Foundation-Charles Ortel Letter 1 May 2016BigMamaTEAPas encore d'évaluation

- Did CBA Lawyer David Cohen Act Ethically With ParliamentDocument10 pagesDid CBA Lawyer David Cohen Act Ethically With ParliamentSenateBriberyInquiryPas encore d'évaluation

- Victorian-Ombudsman Submission by PsychiatristsDocument8 pagesVictorian-Ombudsman Submission by PsychiatristsSenateBriberyInquiryPas encore d'évaluation

- IBAC's Limitations by Stephen O'Bryan QC Sub - 042Document4 pagesIBAC's Limitations by Stephen O'Bryan QC Sub - 042SenateBriberyInquiryPas encore d'évaluation

- 150324-Filed Clinton RICO ComplaintDocument59 pages150324-Filed Clinton RICO ComplaintDeanna Lutz100% (1)

- Garaufis Permanent Injunction Order May 19 2015 After Amex Execs Share SaleDocument19 pagesGaraufis Permanent Injunction Order May 19 2015 After Amex Execs Share SaleSenateBriberyInquiryPas encore d'évaluation

- Elliot Sgargetta To Dear MR Martin PakulaDocument5 pagesElliot Sgargetta To Dear MR Martin PakulaSenateBriberyInquiryPas encore d'évaluation

- Letter by Email To Fred Lester at Clarke & GeeDocument2 pagesLetter by Email To Fred Lester at Clarke & GeeSenateBriberyInquiryPas encore d'évaluation

- Sperm Donor Site Recruits Only Gay and Bisexual Donors - Porters Lawyers Evidence at The Royal Commission Ctjh.053.12001.1886 - RDocument5 pagesSperm Donor Site Recruits Only Gay and Bisexual Donors - Porters Lawyers Evidence at The Royal Commission Ctjh.053.12001.1886 - RSenateBriberyInquiryPas encore d'évaluation

- Letter by Email To Fred Lester at Clarke & GeeDocument2 pagesLetter by Email To Fred Lester at Clarke & GeeSenateBriberyInquiryPas encore d'évaluation

- Nick Kudeweh Letter Regarding Elliot SgargettaDocument2 pagesNick Kudeweh Letter Regarding Elliot SgargettaSenateBriberyInquiryPas encore d'évaluation

- Melvin Feliz Charges With Keila RaveloDocument11 pagesMelvin Feliz Charges With Keila RaveloSenateBriberyInquiryPas encore d'évaluation

- Jeff Sessions Responses To Whitehouse QFRs - Poltical Campaign Funding and Foreign BriberyDocument15 pagesJeff Sessions Responses To Whitehouse QFRs - Poltical Campaign Funding and Foreign BriberySenateBriberyInquiryPas encore d'évaluation

- Before 7news Broadcast Arrests On CBA IT Bribery Executive Keith HunterDocument2 pagesBefore 7news Broadcast Arrests On CBA IT Bribery Executive Keith HunterSenateBriberyInquiryPas encore d'évaluation

- LSBC Jeannie Pakula To Waldron SgargettaDocument2 pagesLSBC Jeannie Pakula To Waldron SgargettaSenateBriberyInquiryPas encore d'évaluation

- The Commonwealth Bank Case Keith Hunter Jon Waldron Eic Pulier Bradley Twynham Hans Gyllstrom Andrew Goldstein CSC CaseDocument18 pagesThe Commonwealth Bank Case Keith Hunter Jon Waldron Eic Pulier Bradley Twynham Hans Gyllstrom Andrew Goldstein CSC CaseSenateBriberyInquiryPas encore d'évaluation

- Sonterra Anz Macquarie SIBOR-ComplaintDocument59 pagesSonterra Anz Macquarie SIBOR-ComplaintSenateBriberyInquiryPas encore d'évaluation

- Tolling Ombudsman Arbitration Geneva, Michael Fraser Arbitration Ip AuDRP-ComplaintDocument18 pagesTolling Ombudsman Arbitration Geneva, Michael Fraser Arbitration Ip AuDRP-ComplaintSenateBriberyInquiryPas encore d'évaluation

- DNC Fraud Suit Email AvocadosforJustice@Gmail - ComDocument3 pagesDNC Fraud Suit Email AvocadosforJustice@Gmail - ComSenateBriberyInquiryPas encore d'évaluation

- Jaynes Et Al V Amex - Antitrust - Complaint March 2015Document43 pagesJaynes Et Al V Amex - Antitrust - Complaint March 2015SenateBriberyInquiryPas encore d'évaluation

- Mytton Watson's Report On Michael McGarvie's Legal Services Board of Victoria AustraliaDocument1 pageMytton Watson's Report On Michael McGarvie's Legal Services Board of Victoria AustraliaSenateBriberyInquiryPas encore d'évaluation

- Padilla v. CA, L-39999, 129 SCRA 558 (1984)Document16 pagesPadilla v. CA, L-39999, 129 SCRA 558 (1984)AudreyPas encore d'évaluation

- Section 83 of The Wakf Act, 1995: BriefDocument9 pagesSection 83 of The Wakf Act, 1995: BriefazizbinnaserPas encore d'évaluation

- JRN 101 Full Semester PackageDocument19 pagesJRN 101 Full Semester PackageNerdy Notes Inc.Pas encore d'évaluation

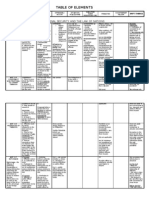

- CRIM2 Table of ElementsDocument40 pagesCRIM2 Table of Elementssaintkarri100% (9)

- Nueva Era Vs MarcosDocument2 pagesNueva Era Vs MarcosKim AmorPas encore d'évaluation

- 13 - Chapter 4 PDFDocument39 pages13 - Chapter 4 PDFHrudai TejPas encore d'évaluation

- Divinagracia v. CBS (2009): NTC lacks power to cancel CPCsDocument2 pagesDivinagracia v. CBS (2009): NTC lacks power to cancel CPCsbatusay575100% (1)

- Starbucks SWOT analysisDocument22 pagesStarbucks SWOT analysisPratik PatilPas encore d'évaluation

- Government Report Into Phillip Smith EscapeDocument149 pagesGovernment Report Into Phillip Smith EscapeNewshubPas encore d'évaluation

- Salazar EssayDocument4 pagesSalazar Essayapi-209165393Pas encore d'évaluation

- Solving Problems Through Clothing BusinessesDocument19 pagesSolving Problems Through Clothing Businessesansah consultingPas encore d'évaluation

- VA Bar ComplaintDocument13 pagesVA Bar ComplaintABC7 WJLAPas encore d'évaluation

- Salient Points of RA 11201 - An Act Creating The Dept of Human Settlements and Urban DevtDocument3 pagesSalient Points of RA 11201 - An Act Creating The Dept of Human Settlements and Urban DevtJeric TexonPas encore d'évaluation

- Speech of Corazon AquinoDocument24 pagesSpeech of Corazon AquinoSitti Sufyan OdoyaPas encore d'évaluation

- Sandiganbayan Jurisdiction Over UP Student RegentDocument4 pagesSandiganbayan Jurisdiction Over UP Student RegentJ CaparasPas encore d'évaluation

- Cases From Other SourcesDocument18 pagesCases From Other SourcesChe ChePas encore d'évaluation

- Boundary Dispute Between Laguna Municipalities Over Two BarangaysDocument2 pagesBoundary Dispute Between Laguna Municipalities Over Two BarangaysCyrus Dait100% (2)

- HR Worksheet guides students through historyDocument11 pagesHR Worksheet guides students through historyPsic. Ó. Bernardo Duarte B.Pas encore d'évaluation

- Tinker V Des Moines Points To PonderDocument2 pagesTinker V Des Moines Points To Ponderapi-362440038Pas encore d'évaluation

- JOSE MIGUEL T. ARROYO v. DEPARTMENT OF JUSTICEDocument2 pagesJOSE MIGUEL T. ARROYO v. DEPARTMENT OF JUSTICESally ChinPas encore d'évaluation

- MeToo CLE Packet RS PDFDocument370 pagesMeToo CLE Packet RS PDFMaya DeviPas encore d'évaluation

- Don Mariano Marcos Memorial State University Mid La Union CampusDocument5 pagesDon Mariano Marcos Memorial State University Mid La Union CampusSam Bernardo100% (2)

- Alarcon vs. Court of AppealsDocument2 pagesAlarcon vs. Court of AppealsSarahPas encore d'évaluation

- Social Problems of BangladeshDocument2 pagesSocial Problems of BangladeshAhmed Tawhidur Rahman67% (9)

- INFO5MoralDimensionsDocument1 pageINFO5MoralDimensionskhanrorgsp123100% (2)

- Advertising Planning & StrategyDocument29 pagesAdvertising Planning & StrategyMALAY KUMARPas encore d'évaluation

- Neighbouring Rights Protection in India: Sanjay PandeyDocument15 pagesNeighbouring Rights Protection in India: Sanjay PandeyVicky VermaPas encore d'évaluation

- Future of Collegium System Transforming Judicial Appointments For TransparencyDocument5 pagesFuture of Collegium System Transforming Judicial Appointments For TransparencyTanay BansalPas encore d'évaluation

- John Livingston Nevius - A Historical Study of His Life and Mission MethodsDocument398 pagesJohn Livingston Nevius - A Historical Study of His Life and Mission MethodsGladston CunhaPas encore d'évaluation

- Republic Act No. 6955 June 13, 1990 Republic Act No.Document2 pagesRepublic Act No. 6955 June 13, 1990 Republic Act No.rlg2vmmcPas encore d'évaluation