Académique Documents

Professionnel Documents

Culture Documents

Venture Capital - An Inspiration .Why?: Prof. K. R. Prabhu Dean

Transféré par

Prasath PreciousTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Venture Capital - An Inspiration .Why?: Prof. K. R. Prabhu Dean

Transféré par

Prasath PreciousDroits d'auteur :

Formats disponibles

VENTURE CAPITAL - AN INSPIRATION .WHY?

PROF. K. R. PRABHU

DEAN

PREAMBLE: Economic activity is a must to full-fill the needs and

possible needs of humanity. It is the foundation on which the

National Economy stands. Creativity and business skills are

essential to become an Entrepreneur. It is ultimately the business

entrepreneurs whether private or public are responsible to meet

our needs on one hand and generate the revenues to the state

nationally or internationally held transactions.

In todays STARTUPs or VENTURES are of Global status with

upgraded technologies or upgraded systems require higher

magnitude of finance to produce higher scales of output both in

production sector as well as in service sector.

Venture Capital companies are becoming more and more

important and they are prospered than the normal financing

agencies like Development banks, Investment Corporations,

commercial banks etc.

ENTREPRENUERS AS A COMMUNITY: Technocrats, people with

experience in the relevant fields are more ambitious to become

owners than employees. They get the full knowledge of the

business in different angles. We find that traditional business

houses and family business startups are having many positive

points to get the Investment partner like Venture Capital easily.

Today, there is a different kind of Entrepreneur Community is

coming up. They are qualified, having track record in the field that

venture. They have strong business plan projections. Strong data

back up and the courage to venture. Professional community like

Engineers, Doctors, Chartered Accountants, Scientists, and

Practicing Managers from industry/service segments are planning

STARTUPs in a mushroom manner. All of them are going ahead

with the support of VENTURE CAPITALS.

1

VENTURE CAPITAL A FINANCIAL PARTNER: Venture Capital

or Venture Capital Companies are Business Partners be it a

Partnership firm or joint stock company. They take more business

risk and invest more than the Promoter. Venture Capital company

holds equity shares may join as an active partner or not. Most of

the time they represent on the Board of Management to safe

guard the entire investment. A Venture Capital Company is a

good advisor on finance and navigates the future plans of the

company as a partner with promoter (Entrepreneur) as the former

is more exposed to the international business trends. A Venture

Capital Company overcomes the negative effect of relative or

friend as partner. Pure professional management runs the unit.

In the event of requiring more equity support, that becomes more

easy than going to funding agencies formalities which either time

consuming and the chances of leakage of plans as the same is

moving in the hands of many. If profits are there, the Venture

Capital Company gets as much as the promoter. If there are

losses, both the Venture Capital Company and promoter have to

bear. Hence there is complete transparency in the deal.

FUTURE TRENDS:In India with the new policy of the Government

to make India as MAKE IN INDIA, with the sole idea of converting

India into an Export hub to the world, a new environment is

created to promote more and more Entrepreneurs to enter the

fray. Foreign business Export & Imports get strengthened. The

formula is simple Export more than Import.

International

Venture Capital Companies are forming a Q to fund the projects.

Commercial Banks, Investment Banks, Development Banks have

to lose a big slice to Venture Capital which is more compatible,

fast in processing . Promoting Entrepreneurs are negotiating with

the Venture Capital companies.

2

In total, we have to know that Venture Capital Companies are

more shrewd to select and negotiate their terms. They have high

confidence on the project and they are sure that Export Import

will build the business prospects either in their own country or

elsewhere. The share values are going at higher rates in Stock

Exchanges because of the high profits in the operation. A venture

capital will either continue or comeback by selling their stake

even at lower rates of Stock Exchange and reinvest in other

Ventures. Hence, Venture Capital Companies are a barometer for

the performance of a business entity in product/service sector.

Whatever is said and done, an Entrepreneur gets Venture Capital,

he runs less risk in servicing the large equities. It is an Equity

Capital that a Venture Capital Company brings which safe guards

the unit from day one from risk.

According to Times of India, the foreign active Venture Capital

Companies entered into Indian Startups are, 2010 49, 2011 89,

2012 113, 2013 164, 2014 222, by April 2015 125. (PAYTM

- $585M, OLA - $400M, QUIKR - $150M, SJP[C;IES -$100M.

FREECJARGE - $80M

crossing $2.36 billion by April alone.

Whereas the Merger & Acquisition zoomed to 7 times in 34 deals

compared to 5 in the last year.

CONCLUSION: In todays business environment Venture Capital

as a business is growing rapidly and becomes visible along with

new STARTUPs. Employees have become Employers. Creativity,

Innovation, Technological up gradation, business system in every

aspect of management for HR to Supply Chain is getting more

energized because people have aware that TIME IS MONEY.

Internet business is more visible today than in the past. We play

with higher volumes and cheaper to the customers and

consumers. It is a vicious circle and that makes the wheels of

industry and business move, satisfying all stake holders. Govt higher revenues, better balance of payment, employees higher

3

pay packets & incentives, consumers better product at relatively

cheaper rate , management higher rates of return, banker

prospective top-lines. Nation higher position on the business

scales. Thus, Startups and Venture Capital are thetwo faces

of the same coin in todays world.

===================

MESSAGE FROM CEOs DESK

Dear Patrons, Dean, Members of faculty and students,

I am highly indebted to my class-mates for unanimously selecting

my candidature for the position of CEO ship of S & M Journal an

unique opportunity for me to present this journal. I am more

indebted to Dear Sirs and other staff members to help me in

selecting the subject VENTURE CAPITAL - a hot subject of the

day for this Journal.

My team members and my self visited a number of companies,

professionals and individuals who placed their appreciation on the

subject Selected by us as VENTURE CAPITAL which has a logical

relation to the subject STARTUPs - These two subjects are the

two faces of the same coin in - in todays Business World.

I once again thank all for their contributing interms of time,

effort

and guidance, to make this Journal

placed in your

esteemed hands.

Regards

(T. AJAY)

CEO

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Thirukkural With MeaningDocument164 pagesThirukkural With Meaningவினோத்94% (88)

- Sales & MarketingDocument16 pagesSales & MarketingPrasath PreciousPas encore d'évaluation

- Venture Capital: Athul Kudwa Executive Director Omnesys Technologies PVT LTDDocument6 pagesVenture Capital: Athul Kudwa Executive Director Omnesys Technologies PVT LTDPrasath PreciousPas encore d'évaluation

- PRAKASH - Snapshot of VenturecapitalDocument7 pagesPRAKASH - Snapshot of VenturecapitalPrasath PreciousPas encore d'évaluation

- Message From Dean'S Desk: Prof. K. R. PrabhuDocument2 pagesMessage From Dean'S Desk: Prof. K. R. PrabhuPrasath PreciousPas encore d'évaluation

- Short Term CourseDocument2 pagesShort Term CoursePrasath PreciousPas encore d'évaluation

- SwotDocument39 pagesSwotGil Angelo De LeonPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Bass vs. de La Rama DigestDocument2 pagesBass vs. de La Rama Digestdexter lingbananPas encore d'évaluation

- Accenture Social Banking RetailDocument12 pagesAccenture Social Banking RetailMikhail DashkovPas encore d'évaluation

- Ramakar Jha CBSE FMM I Book Final VersionDocument279 pagesRamakar Jha CBSE FMM I Book Final Versionmilan senPas encore d'évaluation

- HSBCDocument21 pagesHSBCHarsha SanapPas encore d'évaluation

- Module 2 FM105Document24 pagesModule 2 FM105Lagran, Micah AndreaPas encore d'évaluation

- Beat The Forex Dealer PDFDocument238 pagesBeat The Forex Dealer PDFbhamti91% (11)

- Fact Sheet: CasinoDocument4 pagesFact Sheet: CasinosafinditPas encore d'évaluation

- CDCS Study GuideDocument68 pagesCDCS Study GuideRoshni Narayanan100% (7)

- Going To The BeachDocument3 pagesGoing To The BeachIndah Dwi CahayanyPas encore d'évaluation

- Cash and Cash Equivalents: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument66 pagesCash and Cash Equivalents: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenPas encore d'évaluation

- Imf ProjectDocument7 pagesImf ProjectDeepali MestryPas encore d'évaluation

- Indian CEO's List in Big U.S. Companies: Indira NooyiDocument12 pagesIndian CEO's List in Big U.S. Companies: Indira Nooyishubham_garg_15100% (1)

- ICORPFIN Executive Optical Business Plan - CARBONELLDocument10 pagesICORPFIN Executive Optical Business Plan - CARBONELLZhanika Marie CarbonellPas encore d'évaluation

- Banking Awareness EbookDocument467 pagesBanking Awareness EbookSivaji Haldar50% (2)

- Deed of Sale With MortgageDocument4 pagesDeed of Sale With Mortgagecess_rmtPas encore d'évaluation

- Project ReportDocument68 pagesProject ReportPanav MohindraPas encore d'évaluation

- Investing in Private Equity: UBS Alternative InvestmentsDocument7 pagesInvesting in Private Equity: UBS Alternative InvestmentsAnonymous c7llQBcnPas encore d'évaluation

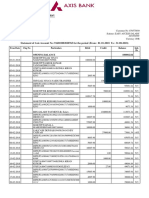

- Statement of Axis Account No:916010083028765 For The Period (From: 01-01-2018 To: 31-08-2018)Document9 pagesStatement of Axis Account No:916010083028765 For The Period (From: 01-01-2018 To: 31-08-2018)Saran ManiPas encore d'évaluation

- 아너스기출 고2 천재이재영3과 - 답지Document5 pages아너스기출 고2 천재이재영3과 - 답지채린Pas encore d'évaluation

- G.R. No. L-16106 December 30, 1961Document1 pageG.R. No. L-16106 December 30, 1961Mildred Donaire Cañoneo-ClemeniaPas encore d'évaluation

- Banking Ch03 - Bank Fund Management (Extended)Document23 pagesBanking Ch03 - Bank Fund Management (Extended)Indo WalelengPas encore d'évaluation

- STARR V BAC CHL BNY-Deposition-Of-Renee-Hertzler-02 19 2010 (Bank Fraud/securities Fraud/bankruptcy Fraud/forgery)Document67 pagesSTARR V BAC CHL BNY-Deposition-Of-Renee-Hertzler-02 19 2010 (Bank Fraud/securities Fraud/bankruptcy Fraud/forgery)Tim Bryant100% (1)

- Debt SecuritizationDocument19 pagesDebt SecuritizationJames RossPas encore d'évaluation

- RFBTDocument8 pagesRFBTRizza OmalinPas encore d'évaluation

- Examples of Loan TransactionsDocument2 pagesExamples of Loan TransactionsVimal AnbalaganPas encore d'évaluation

- NetbankDocument3 pagesNetbankjambroo100% (1)

- Week 1: Derivatives Markets: Week 2: Probability and StatisticsDocument5 pagesWeek 1: Derivatives Markets: Week 2: Probability and StatisticsAshvini KumarPas encore d'évaluation

- Panel de Control Obras Civiles - Luceli - Semana 09.1Document48 pagesPanel de Control Obras Civiles - Luceli - Semana 09.1Leydi BecerraPas encore d'évaluation

- Sap Fi Accounts PayableDocument87 pagesSap Fi Accounts Payablethaheer0009100% (1)

- Pnadk 970Document64 pagesPnadk 970Kasolo DerrickPas encore d'évaluation