Académique Documents

Professionnel Documents

Culture Documents

BGM - ST Audit - CA Bimal Jain 26042014

Transféré par

rohitDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BGM - ST Audit - CA Bimal Jain 26042014

Transféré par

rohitDroits d'auteur :

Formats disponibles

SEMINAR ON SERVICE TAX

Service Tax Audit: Steps & Procedures

WHEN AUDIT OF ASSESSEES ACCOUNTS DONE BY DEPARTMENT OFFICERS:

Audit of accounts of service tax providers can be done by Central audit parties as per norms

prescribed by the department A comprehensive Service Tax Audit Manual 2011 has been

prescribed to provide guidelines to department officers conducting audit Directorate

Service Tax Circular no. 135/4/2011 dated 19-4-2011.

Selective Audit will be done by jurisdictional central excise officer or by an audit party

deputed by C&AG vides Circular Not. 97/8/2007-ST dated 23-8-2007.

Selection of assessee and auditing will be as per guidelines in Service tax Audit Manual. The

Audit selection guidelines, therefore, would apply to the non-mandatory taxpayers, forming

part of the discretionary workload. These taxpayers should be selected on the basis of

assessment of the risk potential to revenue. This process, which is an essential feature of

audit selection, is known as Risk Assessment. It involves the ranking of taxpayers according

to a quantitative indicator of risk known as a risk parameter. It is also suggested that the

taxpayers whose returns were selected for detailed scrutiny, may not be taken up for Audit

that year, to avoid duplication of work. Similarly, the taxpayers who have been selected for

Audit, may not be taken up for detailed scrutiny of their ST-3 Returns during that year.

TYPE OF AUDIT:

EA 2000 Audit (Done by Department/ C&AG)

Section 72A Audit (Done by Chartered Accountant w.e.f. 28-05-2012)

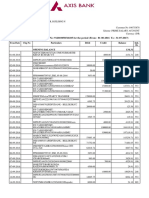

The frequency of audit will be on basis of service tax paid annually and the tax paid means

paid by cash plus through Cenvat Credit. The frequency is as follows:

S. No.

Quantum of annual duty payment

(in cash + CENVAT credit)

Frequency of audit

1.

Taxpayers paying more than Rs 3 Crore

Every year

2.

Taxpayers paying between Rs 1 to 3 Crore

Once in two years

3.

Taxpayers paying between Rs 25 lakh to 1 Crore Once in five years

4.

Taxpayers paying below Rs 25 lakh

2% of the total number every year

SEMINAR ON SERVICE TAX

No audit if turnover less than Rs 60 lakhs per annum The Finance minister in his budget

2011 speech has announced that there will be no audit of assessee whose turnover is less

than Rs 60 lakhs per annum. Num Para 191 of his speech delivered on 28-2-2011 reads as

follows

the number of assessee in service tax has grown manifold I find that a large number

of them comprise individual or sole proprietors with shall turnover Any Audit at their

premises tends to dislocate their activities for the duration of the audit I therefore

propose to free all individual and sole proprietor taxpayers with a turnover upto 60

lakhs from the formalities of Audit this will give relief to a large number of taxpayers I

also intend to give all assesses with turnover uptoRs 60 lakhs benefit points in

interest on delayed payment.

SPECIAL AUDIT BY CHARTERED/ COST ACCOUNTANT:

Section 72A of Finance Act, 1994 (as inserted w.e.f 28-5-2012) makes provision for special

audit by practicing Chartered/Cost Accountant [earlier, section 14AA of Central Excise Act

was made applicable to service tax, this section provided only for special audit of Cenvat

credit availed].

Special audit can be ordered by Commissioner of Central Excise.

Such audit can be ordered by Commissioner of Central Excise has reason to believe that the

any person liable to pay service tax

Has failed by to declare or determine the value of a taxable service correctly: or

Has availed and utilized credit of duty or tax paid (a) which is not within the normal

limits having regard to the nature of taxable servicer provided the extant of capital

goods used or the type of inputs of input services used, or any other relevant factors

as he may been appropriate: or (b) by means of fraud. Collusion or any willful

misstatement or suppression of facts: or

Has operations spread out in multiple location and it is not possible or practicable to

obtain a true to and compete picture of his accounts from the registered premises

falling under the jurisdiction of the Commissioner [section 72A(i) of Finance Act.

1994].

In such cases, the Commissioner may direct such person to get his accounts audited by a

Chartered accountant or Cost accountant nominated by him, to the extent and for the

period as may be specified by the Commissioner [section 72A(2)(i) of Finance Act, 1994

inserted w.e.f. 28-5-2012]

SEMINAR ON SERVICE TAX

CHARTERED ACCOUNTANTS ROLE IN SERVICE TAX AUDIT:

Review before the Service Tax Audits by Department

Assistance during the Service tax audits by Department

Reply to Audit objections

General Service Tax Audit of Assessee

Service Tax Audit U/S 72A of the Finance Act, 1994

SERVICE TAX AUDIT REVIEW:

This is the first stage of the audit exercise done in the office.

On receiving the documents along with filled up questionnaire and reconciliation data sheet

in the prescribed proforma, if any, and carry out detailed examination of the records and

information (including that already captured in the master file on taxpayer.

For carrying out the detailed analysis, the following points should be kept in mind.

A.

Check whether the description of the service has been changed during the past three

to four years, without affecting the nature of the service provided. To illustrate, a

management consultant attracting tax under section 65 (105)(r) of the finance act

1994 may declare himself as a law practitioner attracting tax under section 65

(105)(zzzzm) of the finance act, 1994 without essentially altering the nature of

service provided.

B.

Auditor should check the data provided by the taxpayer for reconciliation with other

documents such as gross trial balance, annual accounts, ledgers etc. Collected by

them and carry out a preliminary reconciliation for the purpose of identifying any

amount that might have escaped service tax.

C.

Auditor has to be careful when the services are for personal consumption because in

such cases, there is a possibility of non-availment of cenvat by the service recipient

or his not likely to claim expenses as deductions under income tax. To illustrate, if

the individual consumer is not eligible to get cenvat credit of input tax received

because he is not a provider of any taxable output service, he may like to make

payment to the service provider in cash. The service provider may also oblige such

individual by accepting the consideration in cash without charging service tax,

though it will not result in any saving to him so far as service tax is concerned. It may

because of any of the following reasons:I)

savings of direct taxes (income tax)

SEMINAR ON SERVICE TAX

Ii) making its business more competitive vis-a vis other competitions.

D.

Auditor should analyse both debit and credit side of the profit & loss a/c, trial

balance, ledgers etc., because it is a myth that while ascertaining the service tax

liability of the taxpayer, one has to look only at the credit side of p&l a/c. Debit side

is equally important or rather more prone to frauds and errors. Therefore, the

auditor needs to pay attention towards debit side also. Debit side is important

because of

I)

Reverse charge mechanism under this mechanism, the recipient of services is

liable to pay service tax (e.g. GTA services, services received from abroad, etc).

Therefore nothing appears on the credit side of the P&L a/c. However, service

tax has to be calculated on the amount paid towards taxable services received.

Ii) Reimbursement unless the concept of pure agent is applicable,

reimbursements are includible in the value of taxable service. Reconciliation

should cover all receivables including reimbursements, sale of goods etc

E.

Auditor should check as to whether there is any netting of income with amount

payable e.g. a person is acting as a commission agent and receives commission

amounting to Rs. 5000/- taxable under the category of business auxiliary services

(bas). He is also engaged in trading of goods wherein he is required to pay a

commission of Rs. 3000. It may be possible that the amount of commission

appearing in the P&L a/c is only Rs. 2000/- the detail of which is given in notes on

accounts or is available from the gross trial balance. In this case, if notes to accounts

are not studied properly or the gross trial balance is not studies, then the auditor

may not be able to determine the correct value of taxable service rendered by the

taxpayer.

SCRUTINY OF VAT RETURNS:

The vat returns should be scrutinized for ensuring that the value of services which attract

both service tax & vat are consistently reported. Some of such services which attract both

service tax & vat are:Commercial or industrial construction services

Complex construction services

Works contract services

Repairs & maintenance services

Outdoor caterer services

SEMINAR ON SERVICE TAX

Mandap keeper services

Pandal or shamiana contractor services

Rent a- cab services

Right to use of movable goods

SCRUTINY OF THE TAX AUDIT REPORT IN FORM 3CD:

Clause 14 of the tax audit report (form 3CD) provides information about amount of

depreciation under section 32 of the income tax act, 1961 and that of cenvatcredit

availed by the service providers on capital goods.

Clause 22 of the tax audit report (form 3CD) gives the details of cenvat credit claimed

by the service provider. It also provides the details of credit available and carried

forward to the next year. Hence, the auditor can authenticate the amount of credit

carried forward in the service tax returns with the information provided in terms of

this clause.

Clause 22 of the tax audit report (form 3CD) also gives information regarding prior

period incomes and expenses booked in the year under tax audit. The auditor shall

ensure that service tax is paid on these amounts in case they are subject to service

tax.

Clause 30 of the tax audit report (form 3CD) provides the information relating to cost

audit. If such an audit has been carried out, the auditor should examine the cost

audit report.

Clause 32 of the tax audit report (form 3CD) provides the important accounting

ratios.

SCRUTINY OF TAX DEDUCTED AT SOURCE (TDS) CERTIFICATES:

The total receipts for services can be verified from TDS certificates in the following manner:A.

By deducting the amount of service tax from the value on which tax has been

deducted at source, the receipts appearing in the books of accounts can be

reconciled.

B.

Nature of services can also be confirmed from these certificates and in case of any

discrepancy in the categorization of services under proper head, elaborate checks

need to be carried out by the auditor.

C.

Details of TDS credit claimed in the income tax return may also be examined.

SEMINAR ON SERVICE TAX

STUDY OF VARIOUS FINANCIAL RECORDS:

Notes on accounts: in case of debtors, notes indicate debtors which are outstanding for a

period exceeding 6 months. Foreign exchange related transactions are also given in the

notes on accounts. Management can use these figures to show book profit to suit their

requirements. Netting of amounts of revenue or expenditure can also be resorted to by the

management although as per accounting standards it is mandatory to specify the figures

separately.

Scrutiny of notes will also reveal whether there was any change in the system of accounting.

For example a taxpayer changes from cash system of accounting to mercantile accrual

system. The notes also indicate the impact of accounting policies on various liabilities

including the tax liability of the taxpayer. Therefore, the auditor must read the notes

carefully.

Director Report: Directors report may, interalia, contain information about.

Foreign exchange earned during the year

Foreign exchange paid during the year, e.g. may be on account of taxable services

availed by the taxpayer where he is liable to pay service tax under reverse charge

mechanism.

Information on the operations carried out by the taxpayer during the year under

report. This may help in finding the exact nature of services provided by the

taxpayer.

Facts stated in directors report should be reconciled with the ST 3 returns.

Statutory auditors report: it is the most important report contained in the annual accounts

of a company. The statutory auditor certifies as to whether the books of account of the

company are properly maintained or not and also whether exist internal control mechanism

commensurate with the size and extent of business of the company. Any adverse noting of

the statutory auditor has to be replied by the management of the company.

Trial balance: the most important use of gross trial balance is that is contains balances of

individual accounts whereas in balance sheet and P&L a/c. Many accounts are grouped

together, e.g.,

A.

P&L A/C - All the incomes are clubbed together under the head gross receipt, sales

as the case may be. However trial balance shows income earned under each

category of revenue separately.

SEMINAR ON SERVICE TAX

B.

Not only trial balance is important in relation to income side, but it is very important

in relation to expenditure side also. For instance payment made towards

sponsorship services may be clubbed in the category of advertisement and sales

promotion expenses which can be identified only from the trial balance.

C.

Similarly, freight paid may be clubbed with purchases of fixed assets.

Indicative list of items to be examined in the trial balance / profit & loss account / balance

sheet / tax audit report.

The perusal of the trial balance could achieve the following:

Familiarization with chart of accounts / account code and understand as to what

extent the information is detailed and integrated with other subsystems ; few

sample journal vouchers may also be seen to understand the information mentioned

therein.

Understand the grouping of sub accounts under main accounts for the purposes of

summarization into profit & loss account and the balance sheet.

Identification of accounts, which have a prima facie relevance for service tax

payment (may be direct or indirect). These accounts may have to be seen in detail at

later stage of audit depending upon the result of subsequent audit processes ;

Understand the tax accounting system in so far as it pertains to service tax payment

and treatment of credit of service tax on input services.

During the study of the trial balance / profit & loss account all income accounts could be

studied in detail. Normally, the profit & loss account would show a consolidated entry for

business income from all sources. According to accounting standards, non-business income

such as interest income or dividend income is required to be shown separately.

To begin with, auditors should call for the groupings of business income shown in the profit

& loss account. The said groupings would show the different heads under which the

incomes have been accounted for. They should carefully study the nature of business

income some of which may have accrued from the sale of taxable services and the balance

from the sale of non-taxable services. The exact nature of these services may be determined

from the supporting documents such as vouchers, bills or contracts in doing so, auditors

need to guided by the nomenclature (used for each of these services) in the trial balance or

annexures to the profit & loss account. It is possible that the true nature of the service is

obscured or disguised by using a nomenclature that is either non-taxable or exempted.

SEMINAR ON SERVICE TAX

Through the study of trial balance, the auditor should familiarize himself with chart of

accounts / account codes and understand as to what extent the information is detailed and

integrated with other subsystems and a few sample journal vouchers may also be seen to

understand the information mentioned therein. The auditor should also understand the

grouping of sub accounts under main accounts for the purposes of summarization into profit

& loss account and the balance sheet and understand the identification of accounts. Which

have a prima facie relevance for service tax payment (may be direct or indirect). These

accounts may have to be seen in detail at later stage of audit depending upon the result of

subsequent audit processes. He should understand the tax accounting system in so far as it

pertains to service tax payment and treatment of credit of service tax on input services.

SERVICE TAX AUDIT SUBSTANTIVE:

Substantive procedures (or substantive tests) are the activities performed by an auditor to

detect material misstatement or fraud at the assertion level of the management. The

assertions made by the management are usually with respect to

The accounting balances, the different assertions are - completeness, existence,

rights + obligations, valuation + allocation, and presentation + disclosure, and

The transactions, the different assertions are - occurrence (validity), completeness,

accuracy, cut-off and classification.

Management implicitly asserts that account balances and underlying classes of transaction

do not contain any material misstatements: in other words, that they are materially

complete, valid and accurate. Auditors use substantive procedures to validate these

assertions. For example, an auditor may inspect supporting documents like invoices and

bank statements to confirm that sales or provision of service did occur (occurrence); and

arrange for suppliers to confirm in writing the details of the amount owing at balance date

as evidence that accounts payable is a liability (rights and obligation assertion).

There are two categories of substantive procedures - analytical procedures and tests of

detail. Analytical procedures generally provide less reliable evidence than the tests of detail.

Note also that analytical procedures are applied in several different audit stages, whereas

tests of detail are only applied in the substantive testing stage.

The auditor's reliance on substantive tests to achieve an audit objective related to a

particular assertion may be derived from tests of details, from analytical procedures, or

from a combination of both. The decision about which procedure or procedures should be

used to achieve a particular audit objective is based on the auditor's judgment on the

expected effectiveness and efficiency of the available procedures.

SEMINAR ON SERVICE TAX

Analytical procedures (the comparison of sets of financial information, and financial with

non-financial information, to see if the numbers 'make sense' and that unexpected

movements can be explained) are an important part of the audit process and consist of

evaluations of financial information made by a study of possible relationships among both

financial and nonfinancial data. Analytical procedures range from simple comparisons to the

use of complex models involving many relationships and elements of data.

A basic premise underlying the application of analytical procedures is that plausible

relationships among data may reasonably be expected to exist and continue in the absence

of known conditions to the contrary. Particular conditions that can cause variations in these

relationships include, for example, specific unusual transactions or events, accounting

changes, business changes, random fluctuations, or misstatements.

Analytical procedures involve comparisons of recorded amounts, or ratios developed from

recorded amounts, to expectations developed by the auditor. The auditor develops such

expectations by identifying and using plausible relationships that are reasonably expected to

exist based on the auditor's understanding of the assessee and of the industry in which the

client operates. Following are examples of sources of information for developing

expectations, i.e., identifying the areas where gaps could be found:

Comparison of the financial information with information for the comparable prior

period(s), e.g. service turnover of say three consecutive financial years can be

compared with the corresponding manpower deployed ( thru direct employees and

thru external agencies) and major equipment purchases/deployment for provision of

service ( in case equipments are required for provision of such service), number of

sites on which services are being performed etc.- this comparison would give a broad

idea about the reasonableness of the turnover. However, for using this data as basis

for developing an expectation, i.e. gap in the reported figures, adjustment should

be made for the known factors like closure of particular line of services, industry

market position etc.

Relationships among elements of financial information within the period - monthly

amounts can be compared (which are more effective from annual amounts), e.g.,

monthly value of goods procured may be compared with the monthly expense on

gta services. Further, comparisons by location or line of business can also be very

effective.

Study of the relationships among elements of financial information that would be

expected to conform to a predictable pattern based on the entitys experience (e.g.,

gross margin percentages);

SEMINAR ON SERVICE TAX

Comparison of the financial information with similar information based on industry

averages, results of competitors or other operations in the same industry for

example, gross margin information

Study of the relationships between the financial information and relevant

nonfinancial information (e.g., in cable industry receipts can be matched with the

number of set top boxes installed).

Some of the examples of the ratios which could be particularly relevant for service tax audot

are as under

A.

Ratio - major inputs service cost: value of taxable service

Source document: profit & loss account and ST 3 return

Compare the annual ratio for a period of 3-4 years. If the ratio is increasing, there is

possibility of the following irregularities.

-

Rendering of unaccounted output services.

Undervaluation of output services.

Splitting of output service income into non-taxable services income.

B.

Ratio credit availed: total service tax payable

Source document: ST 3 return

This ratio should have some parallel relation with the above ratio. If there is a gap in these

two ratios, there is a need to look into the reason there could be a situation of wrong

credit availment.

C.

Ratio other incomes not charged to service tax : value of taxable services

Source document: Profit & loss account and ST 3 return

Compare the ratio over a period of 3-4 years or with the taxpayers rendering the same

services. If the ratio is increasing over a period of time or it is more as compared to the

other service providers, there is a possibility of under-valuation by splitting of output service

income into non taxable/exempted service income. For example, income from renting of

immovable property may be incorrectly bifurcated into income from renting of residential

dwelling which is not taxable.

D.

Ratio additions to plant and machinery/ fixed assets during the year: total value of

assets at the beginning of the year

SEMINAR ON SERVICE TAX

Source document: fixed assets schedule in the balance sheet)

A comparison of this ratio with the rate of growth of the value of taxable service during the

year may be useful in verifying whether the value of taxable service has been correctly

declared particularly in cases where the additions to plant and machinery/ fixed assets

directly impact the volume of sales. For instance, the installation of additional processing

equipment by a photographic laboratory would normally result in some increase in its value

of taxable service. In the same manner, increase in the number of computers in an internet

caf would generate additional business for the taxpayer.

Like the above rations, many more ratios may be developed depending upon the nature of

industry being audited which may be very useful for the purpose of service tax audit.

Analytical review procedures vary from simple comparisons to reasonably complex

regression analysis and time series modelling. The expected effectiveness and efficiency of

an analytical procedure in identifying potential misstatements depends on, among other

things, (a) the nature of the assertion, (b) the plausibility and predictability of the

relationship, (c) the availability and reliability of the data used to develop the expectation,

and (d) the precision of the expectation. I.e. identified gap.

When an analytical procedure is used as the principal substantive test of a significant

financial statement assertion, the auditor should document all important results and

exceptions.

The auditor should evaluate significant unexpected differences and should use the concept

of materiality to decide where further investigation is required and what should be

dropped. Reconsidering the methods and factors used in developing the expectation and

inquiry of management may assist the auditor in this regard. Management responses,

however, should ordinarily be corroborated with other evidential matter. Here the role of

detailed test procedures comes.

A test of details is the most significant substantive procedure for audit. This involves

selecting a sample of items from the major account balances, and finding hard evidence

(e.g. invoices, bank statements) for those items and verifying and reconciling them with the

physical material as well as with the records or details submitted with the various statutory

or other authorities. The tests which are more relevant for a service tax audit are Inspection of records or documents - it consists of examining records or documents

whether internal or external, in paper form, electronic form, or other media.

Inspection provides evidence of varying degrees of reliability depending on their

nature and source and in the case of internal records, on effectiveness of controls

over their production.

SEMINAR ON SERVICE TAX

Inspection of tangible assets it consists of physical examination of the assets. It may

provide reliable audit evidence of their existence cannot necessarily about other

assertions.

Inquiry - it means seeking information of knowledgeable persons throughout the

entity or outside the entity. Those may be formal written or informal oral. It provides

an auditor with new information or corroborative evidences. It may also bring to

high information different from the one possessed by the auditor. Certain oral

inquiries might be got confirmed through written representations.

Confirmations it is a specific type of inquiry. It is the process of obtaining a

representation of information or an existing condition directly from a third party.

Confirmations are sought from debtors, creditors, bankers, legal advisors etc.

Reconciliation matching two independent sets of records.

Out of the above audit procedures, the procedure which requires discussion in detail is

inspection of records and documents in view of the fact that identifying the document

which needs to be inspected, the relevant data in that document and sourcing that

document is an area where one may add good value particularly from the perspective of

service tax audit.

Some of the documents which are particularly useful in substantive audit are

Basic financial documents - financial statements, credit registers, invoices etc.

Service tax records of the assessee service tax returns, respective ledgers and

invoices etc.

Income tax records of the assessee balance sheet along with the P&L account

submitted with income tax authorities, TDS return, form 3CD ( tax audit report) if

applicable, form 26AS (TDS deduction form)

ROC records Balance sheet and P&L account submitted with the ROC

Bank statements and the financial details submitted to bankers in case of loan etc.

Vat records copies of vat returns

Relevant data from regulatory authorities

All the above records may contain relevant information supporting to assess service tax

liability/credit position depending upon the mix of turnover of a company and the nature of

SEMINAR ON SERVICE TAX

industry. Some of the records provide the relevant data independently and some other

records

Some of the examples of the manner in which the above records may be used are as under:

Bank statement of an assessee may be cross verified with the income/revenue

receipts shown in the st-3 returns of the assessee this may identify the gaps in the

income which people may net off at times.

TDS return filed by an assessee contains the details of expenses on which they

deduct TDS many of these are input services chargeable to service tax this data

can highlight the possible leakage of service tax in case of input services where

service tax is payable on reverse charge.

Form 26AS is a form which lists out the incomes of an assessee on which others have

deducted TDS, most of which relates to the taxable services this form may be very

useful in identifying the taxable income of an assessee.

A reconciliation of service turnover shown in the ST3 return with the turnover shown

in the P&L account of an assessee would be helpful in identifying the possible tax

leakage.

A figure of sales shown in the P&L account can be reconciled with the figures of sale

in the vat returns of the assessee to ensure the correctness of this data.

Data from regulatory authorities may be very useful. For example, in case of

insurance brokers, they are supposed to file an annual return of commission earned

to the IRDA. This data may be very useful in identifying the respective service tax

position of the assessee.

Apart from the inspection of records and documents, reconciliation, enquiries,

confirmations and physical checking are other tools for test in detail for the audit. Given the

so many tools of substantive audit, the point is that how to balance out the needs of a given

audit in terms of selecting the most appropriate audit procedure and the tool. This would

largely depend upon the nature of industry and the size and complexity of the business of

an assessee and thus availability of an industry wise database with the service tax

department may prove to be a big asset for the purposes of service tax audit.

Vous aimerez peut-être aussi

- 1040 Exam Prep Module XI: Circular 230 and AMTD'Everand1040 Exam Prep Module XI: Circular 230 and AMTÉvaluation : 1 sur 5 étoiles1/5 (1)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- BIR Audit ManualDocument89 pagesBIR Audit ManualRivera RwlrPas encore d'évaluation

- Provisions of Audit Under Service Tax LawDocument3 pagesProvisions of Audit Under Service Tax Lawanon_922292293Pas encore d'évaluation

- Service TaxDocument3 pagesService Taxapi-3822396Pas encore d'évaluation

- Tax Administration 2021Document81 pagesTax Administration 2021zulfikriPas encore d'évaluation

- Service Tax1Document8 pagesService Tax1Suman pendharkarPas encore d'évaluation

- TX102 Topic 1 Module 3Document21 pagesTX102 Topic 1 Module 3Richard Rhamil Carganillo Garcia Jr.Pas encore d'évaluation

- TAX 2 Group 1 Handout PDFDocument6 pagesTAX 2 Group 1 Handout PDFMi-young SunPas encore d'évaluation

- And Prescribed by The National Office." (Italics and Emphasis Supplied)Document2 pagesAnd Prescribed by The National Office." (Italics and Emphasis Supplied)Ckey ArPas encore d'évaluation

- Revenue Memorandum Order No. 20-2012: Bureau of Internal RevenueDocument6 pagesRevenue Memorandum Order No. 20-2012: Bureau of Internal RevenueGedan TanPas encore d'évaluation

- Liability of Service TaxDocument7 pagesLiability of Service TaxkasiriverPas encore d'évaluation

- Service Tax Changes Process Amounting To Manufacture or Production of Goods Excluding Alcoholic Beverages For Human ConsumptionDocument5 pagesService Tax Changes Process Amounting To Manufacture or Production of Goods Excluding Alcoholic Beverages For Human ConsumptionYesBroker InPas encore d'évaluation

- Service Tax - 1.1Document18 pagesService Tax - 1.1Arun ChopraPas encore d'évaluation

- Provisons On Service TaxDocument37 pagesProvisons On Service TaxSunita NitinPas encore d'évaluation

- Inome Tax April 15Document2 pagesInome Tax April 15brainPas encore d'évaluation

- Amendments - 23rd August, 2011Document52 pagesAmendments - 23rd August, 2011Vipul MallickPas encore d'évaluation

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDocument15 pagesREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGooglePas encore d'évaluation

- Reverse Charge Mechanism by Bimal Jain Tax ExpertDocument4 pagesReverse Charge Mechanism by Bimal Jain Tax ExpertYogesh ChaudhariPas encore d'évaluation

- Service Tax: Aiaims Mms-ADocument31 pagesService Tax: Aiaims Mms-AAbbas Haider NaqviPas encore d'évaluation

- Indian Service TaxDocument13 pagesIndian Service Taxanon_993677Pas encore d'évaluation

- Indirect TaxationDocument16 pagesIndirect Taxationharshiniag2004Pas encore d'évaluation

- Returns PDFDocument109 pagesReturns PDFKrishna VamsiPas encore d'évaluation

- Stax ManualDocument97 pagesStax ManualSamartha Raj SinghPas encore d'évaluation

- Tax Audit PresentationDocument12 pagesTax Audit PresentationChirag KarmadwalaPas encore d'évaluation

- CA Roopa NayakDocument40 pagesCA Roopa NayakAayushi AroraPas encore d'évaluation

- Service TAXDocument27 pagesService TAXSamiya KhanPas encore d'évaluation

- Paper 16Document71 pagesPaper 16pkaul1Pas encore d'évaluation

- Tax2 RemediesDocument15 pagesTax2 RemediesValianted07Pas encore d'évaluation

- Ovw1 1 - ST Ataglance 19may16Document4 pagesOvw1 1 - ST Ataglance 19may16Sanjog DewanPas encore d'évaluation

- New Valuation & Reimbursement Rules in Service Tax: Taxation TaxationDocument5 pagesNew Valuation & Reimbursement Rules in Service Tax: Taxation Taxationkrazy_kuki2000Pas encore d'évaluation

- Vat Audit ManualDocument47 pagesVat Audit ManualViswanadham ChallaPas encore d'évaluation

- Service TaxDocument17 pagesService Taxvenky_1986100% (2)

- Cenvat Credit PDFDocument38 pagesCenvat Credit PDFsaumitra_mPas encore d'évaluation

- TAX AUDIT PresentationDocument124 pagesTAX AUDIT PresentationCA Shivam Luthra100% (1)

- Project Report ON Service Tax: Information Technology ProgrammeDocument19 pagesProject Report ON Service Tax: Information Technology ProgrammemayankkrishnaPas encore d'évaluation

- RMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFDocument12 pagesRMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFCkey ArPas encore d'évaluation

- Chapter 9 - Service TaxDocument5 pagesChapter 9 - Service TaxNURKHAIRUNNISAPas encore d'évaluation

- PWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionDocument5 pagesPWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionAnonymous FnM14a0Pas encore d'évaluation

- Assignment No:1 Name: Waleed Tariq Submitted To: Sir Hamza Subject: TAX Assignment Topic: Audit Class: LLM Semester 2 Campus: University of LahoreDocument6 pagesAssignment No:1 Name: Waleed Tariq Submitted To: Sir Hamza Subject: TAX Assignment Topic: Audit Class: LLM Semester 2 Campus: University of Lahorenauman tariqPas encore d'évaluation

- 2 Service TaxDocument10 pages2 Service TaxArchana ThirunagariPas encore d'évaluation

- Responsibilities of TaxpayersDocument10 pagesResponsibilities of Taxpayers'Aisyah Roselan0% (1)

- Service Tax: Q.No.1. What Is The Need of Introduction of Service Tax?Document5 pagesService Tax: Q.No.1. What Is The Need of Introduction of Service Tax?Kiran RaviPas encore d'évaluation

- General Audit Procedures and Documentation-BirDocument3 pagesGeneral Audit Procedures and Documentation-BirAnalyn BanzuelaPas encore d'évaluation

- Tax Brief August 2010Document10 pagesTax Brief August 2010jae123Pas encore d'évaluation

- Taxation - Procedural Due ProcessDocument3 pagesTaxation - Procedural Due ProcessjorgPas encore d'évaluation

- Income Tax in GeneralDocument6 pagesIncome Tax in GeneralMatt Marqueses PanganibanPas encore d'évaluation

- Audit Mannual - PPT FinalDocument25 pagesAudit Mannual - PPT FinalitelsindiaPas encore d'évaluation

- Re: Service Tax-Change in CENVAT Credit Rules 2004Document7 pagesRe: Service Tax-Change in CENVAT Credit Rules 2004Prakash BatwalPas encore d'évaluation

- PROJECT of Service TaxDocument34 pagesPROJECT of Service TaxPRIYANKA GOPALE100% (2)

- Office of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002Document11 pagesOffice of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002pmPas encore d'évaluation

- EA 2000 Desk Review & ReconciliationDocument43 pagesEA 2000 Desk Review & ReconciliationSushant SaxenaPas encore d'évaluation

- RMO No. 59-2016Document6 pagesRMO No. 59-2016theo toaPas encore d'évaluation

- Servicetaxandvat 130420194223 Phpapp01Document65 pagesServicetaxandvat 130420194223 Phpapp01Ram ShiralkarPas encore d'évaluation

- SPDF May 2007Document8 pagesSPDF May 2007BfpCamarinesNortePas encore d'évaluation

- Taxpayer Bill of RightsDocument9 pagesTaxpayer Bill of Rightsabc360shellePas encore d'évaluation

- What Is GSTR-9C?: ReconciliationDocument7 pagesWhat Is GSTR-9C?: ReconciliationJatin ChoudaryPas encore d'évaluation

- GST Audit – Types, Objective, Applicability - Taxguru - inDocument3 pagesGST Audit – Types, Objective, Applicability - Taxguru - inAtin KumarPas encore d'évaluation

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsD'EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsPas encore d'évaluation

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018D'EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Pas encore d'évaluation

- Training GuideDocument9 pagesTraining GuideVishal AgarwalPas encore d'évaluation

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountRitik MaheshwariPas encore d'évaluation

- TAX Management: Amanita Novi Yushita, SE, M.SiDocument13 pagesTAX Management: Amanita Novi Yushita, SE, M.SiAl-ReskyPas encore d'évaluation

- Info Edge (India) LTD: Tax InvoiceDocument1 pageInfo Edge (India) LTD: Tax Invoicephani raja kumarPas encore d'évaluation

- Reagan Vs CIRDocument1 pageReagan Vs CIRemmaniago08Pas encore d'évaluation

- Statements 1232Document2 pagesStatements 1232josepaticaPas encore d'évaluation

- Nitesh JhaDocument16 pagesNitesh JhaSoleman DewanPas encore d'évaluation

- Order Form 4.2018 FinalDocument1 pageOrder Form 4.2018 FinallskerponfblaPas encore d'évaluation

- Group Gratuity Schemes: BY: Manjusha Arora Ankur GargDocument15 pagesGroup Gratuity Schemes: BY: Manjusha Arora Ankur GargManjusha AroraPas encore d'évaluation

- Customs andDocument9 pagesCustoms andtoga22Pas encore d'évaluation

- BIR Form 1702-ExDocument7 pagesBIR Form 1702-ExShiela PilarPas encore d'évaluation

- SavingsAccount History 05072023114939Document2 pagesSavingsAccount History 05072023114939Farid AyidPas encore d'évaluation

- Invoice: Payment Your SWIFT InvoiceDocument4 pagesInvoice: Payment Your SWIFT InvoiceClément MinougouPas encore d'évaluation

- 1 Laporan Laba RugiDocument1 page1 Laporan Laba Rugisastra watiPas encore d'évaluation

- Phil Guaranty Co Vs Commissioner, G.R. No. L-22074 April 30, 1965Document3 pagesPhil Guaranty Co Vs Commissioner, G.R. No. L-22074 April 30, 1965Antonio Palpal-latocPas encore d'évaluation

- Demand1 PDFDocument1 pageDemand1 PDFMonu KumarPas encore d'évaluation

- Total 244.53: Thanks For Riding, NagendraDocument4 pagesTotal 244.53: Thanks For Riding, NagendraNagendra KommuriPas encore d'évaluation

- Oasis Golf Club PDFDocument2 pagesOasis Golf Club PDFAtif JaveadPas encore d'évaluation

- Acc 202 Notes StudentsDocument43 pagesAcc 202 Notes StudentsPhebieon MukwenhaPas encore d'évaluation

- Strengths: Weaknesses: InternalDocument2 pagesStrengths: Weaknesses: InternalBen Ritche LayosPas encore d'évaluation

- VerbiageDocument5 pagesVerbiageTuan Ku Rao100% (1)

- Residence 2 AirportDocument3 pagesResidence 2 AirportinfinitelovePas encore d'évaluation

- Debit Card SMS Application FormDocument2 pagesDebit Card SMS Application FormTasneef ChowdhuryPas encore d'évaluation

- Bill Preparation and Submission User ManualDocument512 pagesBill Preparation and Submission User Manualudham sudanPas encore d'évaluation

- 912010058516105Document6 pages912010058516105Darshan DhadukPas encore d'évaluation

- Mathematics Challenge Wiskunde-Uitdaging Umceli-Mngeni NgezibaloDocument7 pagesMathematics Challenge Wiskunde-Uitdaging Umceli-Mngeni NgezibaloJoseph VijuPas encore d'évaluation

- Incomeor Losson HousepropertyDocument1 pageIncomeor Losson Housepropertybarickbikash296Pas encore d'évaluation

- Circular No 4 2023Document2 pagesCircular No 4 2023NESL WebsitePas encore d'évaluation

- PrintDupBill1 PDFDocument1 pagePrintDupBill1 PDFWaheed GulPas encore d'évaluation

- Thori Rural Municipality: No. Ward OfficeDocument4 pagesThori Rural Municipality: No. Ward OfficeDhurba Bahadur BkPas encore d'évaluation