Académique Documents

Professionnel Documents

Culture Documents

Capital RQ

Transféré par

masudul9islamCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Capital RQ

Transféré par

masudul9islamDroits d'auteur :

Formats disponibles

Practice Problems: A Model of Production

Econ520. Spring 2015. Prof. Lutz Hendricks. January 3, 2016

Jones, Macroeconomics, exercises 4.3, 4.5, 4.6.

Methodology

Suppose you want to find out how income taxes affect aggregate consumption.

One approach would be to get data on income tax rates (t ) and on aggregate

consumption since 1950 (Ct ). Then one could run an OLS regression of the

form

Ct = + t + t

(1)

1. Intuitively, what does an OLS regression do?

2. What is the interpretation of ?

3. Why does not answer the question: a 10% increase in taxes would

reduce consumption by 10%?

4. How could one answer the question: how do taxes affect consumption?

Production function

1. What properties of the Cobb-Douglas production function, Y = AK L1 ,

lead us to believe that it is a good approximation of the data?

2. How could one estimate the important parameter ?

3. For the production function Y = AK L find the marginal products

of capital and labor.

4. If + = 1, what share of income goes to capital and labor? The rest

goes to pure profits. What is the profit share? Assume that capital

and labor are paid their marginal products.

1

5. If + < 1, what share of income goes to capital, labor, and profits?

6. If + = 1, by how much does doubling K/L increase Y /L? By how

much does a 10-fold increase of K/L increase Y /L? If = 0.3, why is

the effect of the 10-fold increase so much less than 5 times the effect of

doubling K/L?

7. Repeat the previous exercise for = 0.8. How does your answer

change?

8. For = 0.3 and = 0.8, plot Y /L and the marginal product of capital

as you vary K/L over a 10-fold range. What do you find? What does it

mean for cross-country interest rate differences (keeping in mind that

the real interest rate is r = M P K )?

2.1

Answers: Production function

1. Constant returns to scale and constant capital and labor shares.

2. Show that capital receives fraction of total output. In the data, the

share of GDP that goes to capital is about 1/3. See the slides for

details.

3. See slides.

4. Capital receives and labor receives = 1. Nothing left for profits.

5. Profits get 1 . No change in shares that go to K and L.

6. Increase K/L by factor increases Y /L by factor . Diminishing

returns to capital make added capital less and less valuable.

7. Now the production function is closer to linear. Less diminishing returns.

Measuring Productivity

1. Given data on capital, labor, and output, how can the production model

be used to measure total factor productivity (A)?

2

2. Why is the value of critical for answering the question: How important is capital for cross-country income gaps?

3.1

Answers: Measuring Productivity

1. Assume a production function. For reasons we discussed, a CobbDouglas function makes sense: Y = AK L1 . Get data on Y, K, L.

Solve the production function for A: A = K LY 1 . Plug in the data

values to estimate A for each country.

2. Low means quickly diminishing MPK. A given cross-country gap in

capital implies a small gap in output. The opposite is true with high

.

Country comparisons

Consider two countries: the U.S. with Y /L = $42, 000 and K/L = $100, 000

and China with Y /L = $3, 000 and K/L = $6, 000. Assume the production

1/3 L2/3 .

function Y = AK

1. The actual output gap between the U.S. and China is 42/3 = 14. Which

output gap does the model attribute to the fact that K/L in the U.S.

is 16 times higher than in China?

2. How large is the ratio of A of the U.S. relative to China implied by the

model?

3. Plot the production functions of the two countries (not to scale). Show

the contributions of K/L and A to the Y /L gap between the 2 countries.

4.1

Answer

1. Start from the production function y = Ak . yU S /yCHN = (kU S /kCHN )1/3 =

161/3 = 2.52. Of, if you use exact numbers: (100/6)1/3 = 2.55.

USA

y gap due to k

CHN

y gap due to A

kUSA

kCHN

Figure 1: Decomposition of output gaps

2. Solve the production function for y and plug in numbers. Or, more

easily, 14 = 2.5 AU S /ACHN so that AU S /ACHN = 5.6. Or, if you use

1/3

exact numbers: AU S /ACHN = (42/3)/(16

) = 5.56.

3. See figure 1.

CES Production Function [Hard]

What happens to the conclusions if we relax the assumption that the production function is of the Cobb-Douglas form? Assume that

Yc = Ac [Kc + (1 )Lc ]1/

c indexes the country. Otherwise the notation is unchanged. Note that we

can write

Yc = Ac Lc [(Kc /Lc ) + 1 ]1/

This shows that output per worker (Y /L) depends on capital per worker

(K/L) and it is useful below.

This is a CES production function, which you should have seen in micro.

The parameter governs the elasticity of substitution between capital and

labor. In case you care, that elasticity is (1/1 ). When 1 the

production function becomes Cobb-Douglas (not an obvious point, but true).

4

Suppose that KU S = LU S = 1, so that U.S. output is also 1. (This is just

choosing units to make the math nice.)

Consider 3 values of : 1 (Cobb-Douglas), 0.2 and 5.

1. Calculate the marginal products of capital and labor.

2. How much does an increase in Kc by a factor of 10 raise output? How

does the answer depend on ?

3. What happens to the shares of income that go to capital and labor as

you raise K? How does this depend on ?

Comparative statics

The production model postulates the aggregate production function Yt =

L1

. Assume = 1/3, unless stated otherwise. Countries differ in

AK

t t

their values of the productivity parameter A.

1. If = 1/3, how much does output per worker (Y /L) rise when K/L

increases 5-fold?

2. How does your answer change when = 2/3? Explain the intuition

underlying the difference.

3. In cross-country data, per capita GDP and capital per worker are

closely related. Should one conclude that differences in capital are

an important cause of differences in GDP? Explain your answer.

4. The following table shows data for 2 countries.

(a) According to the production model, how large an output gap

does the 20-fold capital gap

K/LA

K/LB

cause?

(b) Calculate the productivity parameters A for both countries.

Country A

B

Y /L

100 10

K/L

400 20

5

Y /LA

Y /LB

6.1

Answer

1. y = Ak . 51/3 = 1.7. This is the increase in y.

2. Now 52/3 = 2.9. The difference: MPK diminishes less quickly with the

higher .

3. No. Correlation has nothing to do with causation. k could be high

because y is high or both could be high because of other common

causes. This is why we need models.

4. The model attributes factor (kA /kB ) to capital. 201/3 = 2.7. To

calculate productivity we solve the production function for A = ky .

For A: 100/4001/3 = 13.6. For B: 10/201/3 = 3.7.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Hey Friends B TBDocument152 pagesHey Friends B TBTizianoCiro CarrizoPas encore d'évaluation

- Specificities of The Terminology in AfricaDocument2 pagesSpecificities of The Terminology in Africapaddy100% (1)

- Lithuania DalinaDocument16 pagesLithuania DalinaStunt BackPas encore d'évaluation

- Activity # 1 (DRRR)Document2 pagesActivity # 1 (DRRR)Juliana Xyrelle FutalanPas encore d'évaluation

- Damodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaDocument25 pagesDamodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaSumanth RoxtaPas encore d'évaluation

- Sam Media Recruitment QuestionnaireDocument17 pagesSam Media Recruitment Questionnairechek taiPas encore d'évaluation

- in Strategic Management What Are The Problems With Maintaining A High Inventory As Experienced Previously With Apple?Document5 pagesin Strategic Management What Are The Problems With Maintaining A High Inventory As Experienced Previously With Apple?Priyanka MurthyPas encore d'évaluation

- Role of Personal Finance Towards Managing of Money - DraftaDocument35 pagesRole of Personal Finance Towards Managing of Money - DraftaAndrea Denise Lion100% (1)

- Module 1: Overview of Applied Behaviour Analysis (ABA)Document37 pagesModule 1: Overview of Applied Behaviour Analysis (ABA)PriyaPas encore d'évaluation

- Bana LingaDocument9 pagesBana LingaNimai Pandita Raja DasaPas encore d'évaluation

- Opc PPT FinalDocument22 pagesOpc PPT FinalnischalaPas encore d'évaluation

- Cisco SDWAN Case Study Large Global WANDocument174 pagesCisco SDWAN Case Study Large Global WANroniegrokPas encore d'évaluation

- 2009 2011 DS Manual - Club Car (001-061)Document61 pages2009 2011 DS Manual - Club Car (001-061)misaPas encore d'évaluation

- Tplink Eap110 Qig EngDocument20 pagesTplink Eap110 Qig EngMaciejPas encore d'évaluation

- B.SC BOTANY Semester 5-6 Syllabus June 2013Document33 pagesB.SC BOTANY Semester 5-6 Syllabus June 2013Barnali DuttaPas encore d'évaluation

- Pavement Design1Document57 pagesPavement Design1Mobin AhmadPas encore d'évaluation

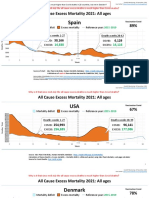

- Countries EXCESS DEATHS All Ages - 15nov2021Document21 pagesCountries EXCESS DEATHS All Ages - 15nov2021robaksPas encore d'évaluation

- PyhookDocument23 pagesPyhooktuan tuanPas encore d'évaluation

- Emea 119948060Document31 pagesEmea 119948060ASHUTOSH MISHRAPas encore d'évaluation

- FMC Derive Price Action GuideDocument50 pagesFMC Derive Price Action GuideTafara MichaelPas encore d'évaluation

- KP Tevta Advertisement 16-09-2019Document4 pagesKP Tevta Advertisement 16-09-2019Ishaq AminPas encore d'évaluation

- The Use of Air Cooled Heat Exchangers in Mechanical Seal Piping Plans - SnyderDocument7 pagesThe Use of Air Cooled Heat Exchangers in Mechanical Seal Piping Plans - SnyderJaime Ocampo SalgadoPas encore d'évaluation

- Turn Around Coordinator Job DescriptionDocument2 pagesTurn Around Coordinator Job DescriptionMikePas encore d'évaluation

- SMR 13 Math 201 SyllabusDocument2 pagesSMR 13 Math 201 SyllabusFurkan ErisPas encore d'évaluation

- Business Plan 3.3Document2 pagesBusiness Plan 3.3Rojin TingabngabPas encore d'évaluation

- ME Eng 8 Q1 0101 - SG - African History and LiteratureDocument13 pagesME Eng 8 Q1 0101 - SG - African History and Literaturerosary bersanoPas encore d'évaluation

- The Construction of Optimal Portfolio Using Sharpe's Single Index Model - An Empirical Study On Nifty Metal IndexDocument9 pagesThe Construction of Optimal Portfolio Using Sharpe's Single Index Model - An Empirical Study On Nifty Metal IndexRevanKumarBattuPas encore d'évaluation

- B122 - Tma03Document7 pagesB122 - Tma03Martin SantambrogioPas encore d'évaluation

- Carriage RequirementsDocument63 pagesCarriage RequirementsFred GrosfilerPas encore d'évaluation

- The Doshas in A Nutshell - : Vata Pitta KaphaDocument1 pageThe Doshas in A Nutshell - : Vata Pitta KaphaCheryl LynnPas encore d'évaluation