Académique Documents

Professionnel Documents

Culture Documents

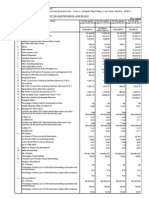

Five Year Record: Shareholder Information

Transféré par

Salim Abdulrahim BafadhilDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Five Year Record: Shareholder Information

Transféré par

Salim Abdulrahim BafadhilDroits d'auteur :

Formats disponibles

Shareholder Information

Five Year Record

Consolidated income statement

Underlying revenue(1)

Percentage change

2011/12

million

8,186.7

0.4%

Underlying operating prot / EBIT(2)

Underlying net nance (costs) / income(1)

115.1

(44.3)

Underlying prot before tax(1)

Percentage change

Closed businesses

Acquired intangible amortisation

Net restructuring charges

Business impairment charges

Other items

Changes in pension benets

Prot on sale of investment

Net fair value remeasurements

70.8

(17.0)%

(2.9)

(4.5)

(16.3)

(196.0)

32.9

(2.8)

(Loss) / prot before tax continuing operations

Income tax expense

(118.8)

(44.1)

(Loss) / prot after tax continuing operations

Loss after tax discontinued operations

(162.9)

(Loss) / prot for the period

(162.9)

Underlying diluted earnings per share (pence)(1)

Percentage change

Consolidated cash ow

1.1p

(31.3)%

2011/12

million

Underlying prot before tax(1)

Closed businesses loss before tax

Depreciation and amortisation

Working capital movements

Taxation

Net capital expenditure

Other

70.8

(2.9)

138.8

15.8

(26.8)

(31.3)

9.7

Free Cash Flow before restructuring items(3)

Net restructuring and other one-off items

174.1

(43.8)

Free Cash Flow(4)

130.3

Closing net (debt) / funds

Less restricted funds(5)

(104.0)

(114.0)

Unrestricted net debt(5)

(218.0)

132

Dixons Retail plc

Annual Report and Accounts 2011/12

Consolidated balance sheet

Non-current assets

Goodwill

Intangible assets

Tangible assets

Other non-current assets

2012

million

740.7

98.1

480.4

182.3

1,501.5

Current assets

Inventories

Other current assets

Short term investments

Cash and cash equivalents

874.2

346.6

7.3

316.8

1,544.9

Assets held for sale

Total assets

3,046.4

Current liabilities

Bank overdrafts

Other borrowings

Obligations under nance leases

Other current liabilities

Provisions

(15.8)

(162.5)

(3.1)

(1,634.7)

(18.6)

(1,834.7)

Net current liabilities

(289.8)

Non-current liabilities

Borrowings

Obligations under nance leases

Retirement benet obligations

Other non-current liabilities

Provisions

(147.8)

(98.9)

(266.0)

(275.4)

(19.6)

(807.7)

Liabilities associated with assets classied as held for sale

Total liabilities

(2,642.4)

Net assets

404.0

Equity shareholders funds

Equity non-controlling interests

391.4

12.6

Total equity

404.0

Notes:

(1) Underlying gures exclude the effects of trading results of closed businesses, amortisation of acquired intangibles, net restructuring and business impairment charges and other one-off,

non-recurring items, prots on sale of investments and net fair value remeasurements of nancial instruments, and where applicable, discontinued operations.

(2) EBIT equates to underlying operating prot.

Shareholder

(3) Free Cash Flow before restructuring items includes dividend payments to non-controlling interests (minority shareholders).

(4) Free Cash Flow relates to continuing operations and comprises net cash ow generated from operations before special pension contributions, less net nance expense, less income tax Information

and

net capital expenditure.

(5) Unrestricted net debt comprise cash and cash equivalents, short term investments and borrowings and exclude restricted funds which predominantly comprise funds held under trust to

fund potential customer support agreement liabilities.

Annual Report and Accounts 2011/12 Dixons Retail plc

133

Vous aimerez peut-être aussi

- Financial Statements PDFDocument91 pagesFinancial Statements PDFHolmes MusclesFanPas encore d'évaluation

- Fsap Template in EnglishDocument34 pagesFsap Template in EnglishDo Hoang HungPas encore d'évaluation

- Statement of Operations For The Fiscal Year Ended January 2, 2011 RevenuesDocument5 pagesStatement of Operations For The Fiscal Year Ended January 2, 2011 RevenuesVasantha ShetkarPas encore d'évaluation

- Reformulating Financial StatementsDocument17 pagesReformulating Financial Statementsteguh100% (1)

- Finance BookkeepingDocument9 pagesFinance BookkeepingNienke OzingaPas encore d'évaluation

- Lecture 2Document24 pagesLecture 2Bình MinhPas encore d'évaluation

- Roadshow Natixis Mar09Document47 pagesRoadshow Natixis Mar09sl7789Pas encore d'évaluation

- C4A Income StatementDocument6 pagesC4A Income StatementSteeeeeeeephPas encore d'évaluation

- Balance Sheet AnalysisDocument42 pagesBalance Sheet Analysismusadhiq_yavarPas encore d'évaluation

- COM670 Chapter 4Document28 pagesCOM670 Chapter 4aakapsPas encore d'évaluation

- Introduction To Financial Statements: Income Statement: Topic 4bDocument31 pagesIntroduction To Financial Statements: Income Statement: Topic 4bsarahPas encore d'évaluation

- Cash Flow Solutions2Document6 pagesCash Flow Solutions2mithun mohanPas encore d'évaluation

- Fa-I Chapter Four1Document27 pagesFa-I Chapter Four1Hussen AbdulkadirPas encore d'évaluation

- Business Activities and Financial StatementsDocument23 pagesBusiness Activities and Financial StatementsUsha RadhakrishnanPas encore d'évaluation

- Chapter 4 - Reporting Financial PerformanceDocument6 pagesChapter 4 - Reporting Financial PerformanceCait PostPas encore d'évaluation

- Wiley - Chapter 4: Income Statement and Related InformationDocument42 pagesWiley - Chapter 4: Income Statement and Related InformationIvan Bliminse86% (7)

- Investment Evaluation: Professor Tim Thompson Kellogg School of ManagementDocument36 pagesInvestment Evaluation: Professor Tim Thompson Kellogg School of ManagementAmund BremerPas encore d'évaluation

- 02 - Basic Perf MeasuresDocument14 pages02 - Basic Perf MeasureshoalongkiemPas encore d'évaluation

- SBRIFRS5 TutorSlidesDocument24 pagesSBRIFRS5 TutorSlidesDipesh MagratiPas encore d'évaluation

- Statement of Cash Flow - Ias 7Document5 pagesStatement of Cash Flow - Ias 7Benjamin JohnPas encore d'évaluation

- Cash Flow Analysis and Value Added MeasuresDocument19 pagesCash Flow Analysis and Value Added MeasuresShruti MaindolaPas encore d'évaluation

- of Revised Schdule Vi1Document43 pagesof Revised Schdule Vi1Jay RoyPas encore d'évaluation

- Statement of Comprehensive Income (Reviewer)Document4 pagesStatement of Comprehensive Income (Reviewer)ChinPas encore d'évaluation

- Annual Report Financial Statements and AnalysisDocument164 pagesAnnual Report Financial Statements and AnalysisDhananjay DubeyPas encore d'évaluation

- The Income Statement: - Dated For A Period of Time - Multiple-Step FormatDocument27 pagesThe Income Statement: - Dated For A Period of Time - Multiple-Step Formatapi-19974928Pas encore d'évaluation

- Income STDocument23 pagesIncome STKholoud LabadyPas encore d'évaluation

- Cash Flow Statement Classification of ActivitiesDocument4 pagesCash Flow Statement Classification of ActivitiesAanchal MahajanPas encore d'évaluation

- Statement of Comprehensive Income (Income Statement)Document29 pagesStatement of Comprehensive Income (Income Statement)Alphan SofyanPas encore d'évaluation

- Accounting Report FinalDocument10 pagesAccounting Report FinalAhmer FarooqPas encore d'évaluation

- Return On Invested CapitalDocument3 pagesReturn On Invested CapitalZohairPas encore d'évaluation

- Chapter 4 & 5Document136 pagesChapter 4 & 5Bangtan RuniPas encore d'évaluation

- 6.income Statement and Related InformationDocument45 pages6.income Statement and Related InformationShajidur RashidPas encore d'évaluation

- Chapter 3 - Understanding The Income StatementDocument68 pagesChapter 3 - Understanding The Income StatementNguyễn Yến NhiPas encore d'évaluation

- Qfs 1q 2012 - FinalDocument40 pagesQfs 1q 2012 - Finalyandhie57Pas encore d'évaluation

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeePas encore d'évaluation

- Financial Statements, Cash Flow, and TaxesDocument44 pagesFinancial Statements, Cash Flow, and TaxesrePas encore d'évaluation

- CA CheatSheetDocument3 pagesCA CheatSheetJonathanChanPas encore d'évaluation

- Cash Flow Statement AnalysisDocument5 pagesCash Flow Statement Analysisjatinag990Pas encore d'évaluation

- MBTC and BPI RatiosDocument11 pagesMBTC and BPI RatiosarianedangananPas encore d'évaluation

- Income Statement 2022Document37 pagesIncome Statement 2022Vinay MehtaPas encore d'évaluation

- (5414) Specialized Design Services Sales Class: $500,000 - $999,999Document15 pages(5414) Specialized Design Services Sales Class: $500,000 - $999,999Christyne841Pas encore d'évaluation

- Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonDocument9 pagesNet Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonvenkeeeeePas encore d'évaluation

- Accounting Assignment (Group 3)Document5 pagesAccounting Assignment (Group 3)Ayush SatyamPas encore d'évaluation

- Afs FinalDocument21 pagesAfs FinalAjit ShindePas encore d'évaluation

- TableDocument1 pageTableparasshah90Pas encore d'évaluation

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisSaema JessyPas encore d'évaluation

- Annual Report 2014 RevisedDocument224 pagesAnnual Report 2014 RevisedDivya AhujaPas encore d'évaluation

- Company AccountsDocument77 pagesCompany AccountsNamish GuptaPas encore d'évaluation

- Asics CorporationDocument6 pagesAsics Corporationasadguy2000Pas encore d'évaluation

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaPas encore d'évaluation

- F1 May 2011 AnswersDocument11 pagesF1 May 2011 AnswersmavkaziPas encore d'évaluation

- Comprehensive Income TemplateDocument20 pagesComprehensive Income TemplateRyou ShinodaPas encore d'évaluation

- Analytical Income Statement and Balance SheetDocument38 pagesAnalytical Income Statement and Balance SheetSanjayPas encore d'évaluation

- CH 02 - Financial Stmts Cash Flow and TaxesDocument32 pagesCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- Accounting Income and Assets: The Accrual ConceptDocument40 pagesAccounting Income and Assets: The Accrual ConceptMd TowkikPas encore d'évaluation

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745Pas encore d'évaluation

- Philips Annual Report 2012Document0 pagePhilips Annual Report 2012Pradeep HemachandranPas encore d'évaluation

- Accounting and Finance Formulas: A Simple IntroductionD'EverandAccounting and Finance Formulas: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (8)

- Carmix Auto Spares (T) LTDDocument7 pagesCarmix Auto Spares (T) LTDSalim Abdulrahim BafadhilPas encore d'évaluation

- Grade One Test ThreeDocument3 pagesGrade One Test ThreeSalim Abdulrahim BafadhilPas encore d'évaluation

- Biology Results Form Two: Wrong ArrangementDocument1 pageBiology Results Form Two: Wrong ArrangementSalim Abdulrahim BafadhilPas encore d'évaluation

- Form One NotesDocument2 pagesForm One NotesSalim Abdulrahim Bafadhil50% (2)

- E D K Matokeo F IiDocument2 pagesE D K Matokeo F IiSalim Abdulrahim BafadhilPas encore d'évaluation

- Memonpre&Pri Maryschool Engli Shgradei V-2020 Lessoni I-Prefi Xes, I NFI Xesandsuffi XESDocument2 pagesMemonpre&Pri Maryschool Engli Shgradei V-2020 Lessoni I-Prefi Xes, I NFI Xesandsuffi XESSalim Abdulrahim BafadhilPas encore d'évaluation

- STD I Marking Guide: No Developing Sport and Arts B Health Care and EnvironmentDocument2 pagesSTD I Marking Guide: No Developing Sport and Arts B Health Care and EnvironmentSalim Abdulrahim BafadhilPas encore d'évaluation

- Company Account Solution 2Document19 pagesCompany Account Solution 2Salim Abdulrahim BafadhilPas encore d'évaluation

- SupplierRegistrationCertificate PDFDocument1 pageSupplierRegistrationCertificate PDFSalim Abdulrahim BafadhilPas encore d'évaluation

- Figures in Millions. Currency Is GBPDocument1 pageFigures in Millions. Currency Is GBPSalim Abdulrahim BafadhilPas encore d'évaluation

- SupplierRegistrationCertificate PDFDocument1 pageSupplierRegistrationCertificate PDFSalim Abdulrahim BafadhilPas encore d'évaluation

- QM Statistic NotesDocument24 pagesQM Statistic NotesSalim Abdulrahim BafadhilPas encore d'évaluation

- Earnings Per Share Net Income Available To Shareholder Number of Shares OutstandingDocument5 pagesEarnings Per Share Net Income Available To Shareholder Number of Shares OutstandingSalim Abdulrahim BafadhilPas encore d'évaluation

- The Institute of Finance ManagementDocument4 pagesThe Institute of Finance ManagementSalim Abdulrahim BafadhilPas encore d'évaluation

- Safe and Gentle Ventilation For Little Patients Easy - Light - SmartDocument4 pagesSafe and Gentle Ventilation For Little Patients Easy - Light - SmartSteven BrownPas encore d'évaluation

- Rectangular Wire Die Springs ISO-10243 Standard: Red Colour Heavy LoadDocument3 pagesRectangular Wire Die Springs ISO-10243 Standard: Red Colour Heavy LoadbashaPas encore d'évaluation

- ABMOM q2 mod5OrgAndMngmnt Motivation - Leadership and Communication in Organizations-V2Document18 pagesABMOM q2 mod5OrgAndMngmnt Motivation - Leadership and Communication in Organizations-V2Zoren Jovillanos EmbatPas encore d'évaluation

- Eletrical InstallationDocument14 pagesEletrical InstallationRenato C. LorillaPas encore d'évaluation

- BMW Speakers Install BSW Stage 1 E60 Sedan Logic7Document13 pagesBMW Speakers Install BSW Stage 1 E60 Sedan Logic7StolnicuBogdanPas encore d'évaluation

- Kajian Sistematik: Strategi Pembelajaran Klinik Di Setting Rawat JalanDocument5 pagesKajian Sistematik: Strategi Pembelajaran Klinik Di Setting Rawat JalanrhiesnaPas encore d'évaluation

- Philippine Multimodal Transportation and Logistics Industry Roadmap - Key Recommendations - 2016.04.14Document89 pagesPhilippine Multimodal Transportation and Logistics Industry Roadmap - Key Recommendations - 2016.04.14PortCalls50% (4)

- Consumer Research ProcessDocument78 pagesConsumer Research ProcessShikha PrasadPas encore d'évaluation

- Compose Testing CheatsheetDocument1 pageCompose Testing CheatsheetEstampados SIn ApellidoPas encore d'évaluation

- Fine Fragrances After Shave, Eau de Parfum, Eau de Cologne, Eau de Toilette, Parfume Products (9-08)Document6 pagesFine Fragrances After Shave, Eau de Parfum, Eau de Cologne, Eau de Toilette, Parfume Products (9-08)Mustafa BanafaPas encore d'évaluation

- National Geographic - April 2020 PDFDocument160 pagesNational Geographic - April 2020 PDFIbn ZubairPas encore d'évaluation

- Juniper M5 M10 DatasheetDocument6 pagesJuniper M5 M10 DatasheetMohammed Ali ZainPas encore d'évaluation

- Polyhouse Gerbera CultivationDocument5 pagesPolyhouse Gerbera CultivationArvindVPawar100% (2)

- Aditya Birla Sun Life Insurance Secureplus Plan: Dear MR Kunjal Uin - 109N102V02Document7 pagesAditya Birla Sun Life Insurance Secureplus Plan: Dear MR Kunjal Uin - 109N102V02kunjal mistryPas encore d'évaluation

- Review On A Protective Scheme For Wind Power Plant Using Co-Ordination of Overcurrent Relay-NOTA TECNICADocument5 pagesReview On A Protective Scheme For Wind Power Plant Using Co-Ordination of Overcurrent Relay-NOTA TECNICAEdgardo Kat ReyesPas encore d'évaluation

- MEdia and Information Sources QuizDocument1 pageMEdia and Information Sources QuizRizi Mae Codal100% (5)

- National Action Plan Implementation Gaps and SuccessesDocument8 pagesNational Action Plan Implementation Gaps and SuccessesHamza MinhasPas encore d'évaluation

- Advanced Machining User Guide PDFDocument250 pagesAdvanced Machining User Guide PDFDaniel González JuárezPas encore d'évaluation

- Sterling PumpeDocument20 pagesSterling PumpesrdzaPas encore d'évaluation

- Consolidated Companies ListDocument31 pagesConsolidated Companies ListSamir OberoiPas encore d'évaluation

- AngularJS Cheat SheetDocument3 pagesAngularJS Cheat SheetZulqarnain Hashmi100% (1)

- KINDRED HEALTHCARE, INC 10-K (Annual Reports) 2009-02-25Document329 pagesKINDRED HEALTHCARE, INC 10-K (Annual Reports) 2009-02-25http://secwatch.comPas encore d'évaluation

- Caselet - LC: The Journey of The LCDocument5 pagesCaselet - LC: The Journey of The LCAbhi JainPas encore d'évaluation

- ABES Engineering College, Ghaziabad Classroom Photograph: (Ramanujan Block, First Floor)Document21 pagesABES Engineering College, Ghaziabad Classroom Photograph: (Ramanujan Block, First Floor)Avdhesh GuptaPas encore d'évaluation

- Geometric Entities: Basic Gear TerminologyDocument5 pagesGeometric Entities: Basic Gear TerminologyMatija RepincPas encore d'évaluation

- Retail Marketing Course Work 11Document5 pagesRetail Marketing Course Work 11Ceacer Julio SsekatawaPas encore d'évaluation

- Taller Sobre Preposiciones y Vocabulario - Exhibición Comercial SergioDocument5 pagesTaller Sobre Preposiciones y Vocabulario - Exhibición Comercial SergioYovanny Peña Pinzon100% (2)

- Tech Bee JavaDocument57 pagesTech Bee JavaA KarthikPas encore d'évaluation

- (The Nineteenth Century Series) Grace Moore - Dickens and Empire - Discourses of Class, Race and Colonialism in The Works of Charles Dickens-Routledge (2004) PDFDocument223 pages(The Nineteenth Century Series) Grace Moore - Dickens and Empire - Discourses of Class, Race and Colonialism in The Works of Charles Dickens-Routledge (2004) PDFJesica LengaPas encore d'évaluation

- The 9 Best Reasons To Choose ZultysDocument13 pagesThe 9 Best Reasons To Choose ZultysGreg EickePas encore d'évaluation