Académique Documents

Professionnel Documents

Culture Documents

Risks of Aadhaar - Moneylife

Transféré par

Ashwini Anaokar ShahTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Risks of Aadhaar - Moneylife

Transféré par

Ashwini Anaokar ShahDroits d'auteur :

Formats disponibles

Risks of Aadhaar-linked banking - Moneylife

http://www.moneylife.in/article/risks-of-aadhaar-linked-banki...

Signup Login Free Helplines

PERSONAL FINANCE

INVESTING

COMPANIES & SECTORS

ECONOMY & NATION

Feedback

LIFE

Connect with Us

Moneylife Life UID/Aadhaar How Aadhaar linkage can destroy banks

How Aadhaar linkage can destroy

banks

91 comments

+ COMMENT

DR ANUPAM SARAPH | 11/09/2014 01:09 PM |

Even if Aadhaar numbers were proof of identity, which it is not, its use to

make money transfers make financial transfers un-auditable, propagate

money laundering and financial fraud. There is no justification for

introducing an unverified and un-audited number to allow payments and

settlements

The Reserve Bank of India (RBI) is empowered by the Payment and Settlement Systems

Act, 2007 to regulate various payment systems in the country. About 59 organisations are

authorised by the RBI under this Act for setting up and operating payment systems in

India. In its vision document 2012-15 the RBI states its mission is to ensure payment and

settlement systems in the country are safe, efficient, interoperable, authorised, accessible,

inclusive and compliant with international standards. In compliance with international

1 of 7

10/02/2016, 12:11

Risks of Aadhaar-linked banking - Moneylife

http://www.moneylife.in/article/risks-of-aadhaar-linked-banki...

standards, therefore, all key systems should be secure (that is, have access controls, be

equipped with adequate safeguards to prevent external intrusions, and provide audit

trails), reliable, scalable and

able to handle volume under stress conditions.

101

A payment can be effected through electronic funds transfers and includes point of sale

transfers,

ATM transactions,Ourdirect

deposits or withdrawal

of funds, transfers initiated

by

Overview

Approach

My Moneylife account

FAQs

telephone, internet and, card

payment.

Founders

Stock

Screener

Subscriber Billing Info

Feedback

More in Moneylife

Moneylife Magazine

Write for us

How to subscribe?

Contact Us

Moneylife

Dailyuse

News

& Views

Partner banking

with Moneylife

Serviceyour accountSite

When you

your

banks online

to transfer Customer

money from

tomap

a

Moneylife Foundation

Privacy Policy

Mail us

recipient

youSavers

use a system called

ElectronicCall

Funds

Moneylife Smart

Terms ofNational

Use

us Transfer or NEFT. NEFT is

Advertise

with us

RBIs

own

electronic money transfer system. Your money is transferred to the recipient's

VIDEOS

PK's Romp through India's Financial

account in the hourly schedules to settle the payables and receivables

from

eachFinancial

bank that

Safe And

Smart

Sector

Signup Login Free Helplines

Feedback

Career with Moneylife

Join Moneylife Foundation

Moneylife on Facebook

Moneylife on Twitter

Moneylife on LinkedIn

Get Free Newsletter

For

Students

result from all the NEFT transactions in the hour. In case, yourAdvice

transfer

fails,

your money

+6855 views

is back in your account. If you make larger transfers, say Rs2 lakh and above, then you

will

have toTOP

use STORIES

RBIs Real Time Gross Settlement or RTGS system toStudents

make theSpe...

transfer.

TODAY'S

In this case the gross amount is moved from your account to the recipient account

directly. In case the transaction fails your money is reversed back to you.

PACL Scam: The Australian connection

Moneylife Digital Team

You need to be logged into your bank account to initiate an NEFT or RTGS transfer. Only

a valid bank account can receive funds making electronic transfers the bank. The transfers

leave a permanent audit trail that inhibits money laundering.

The other

side of

intolerance

NPCIs electronic

money

transfer

system

LATEST

COMMENT

Sakuntala Narasimhan

Thanks for the

The National Payments Corp of India or NPCI, a section 25 company, also runs its own

information. Please keep

payment system. The Aadhaar-Enabled Payment System or AEPS, as it is called,

me updated with further

facilitates the deposit of money to and withdrawal of money from Aadhaar-Enabled Bank

news about the PACL.

Accounts (AEBA). AEBA accounts are bank accounts where an Thanks....

Aadhaar number is

mapped to the bank account. This is done by a process called as seeding an Aadhaar

Arjun

number to a bank account with designated banks.

Comment*:

Post your Comment

MORE

How Safe Is Your Identity

Under Aadhar?

Sucheta Dalal

Alert me when new comment is posted on this article

No Aadhaar during Bihar

elections

Please read our Moderation Policy and Terms of Use before posting

Moneylife Digital Team

POST COMMENT

Comment

91 Comments

Prabhakar V Hegde 1 year ago

After receiving the Aadhaar number from the customer, the bank uploads such numbers

Has this been brought to the attention of the PMO? It need to be done now. This

into a NPCI mappergovernment

or a repository

Aadhaar

numbers

for

purpose of routing

has an of

open

mind, I aam

sure heused

will do

thethe

needfull.

transactions to the destination banks. The NPCI mapper contains Aadhaar number along

Reply Link Report abuse

with an Institution Identification

Number or IIN, a unique 6-digit number issued by NPCI

to the participating bank. If you or anyone else change the bank account associated with

your Aadhaar number only the current banks IIN will be associated with the Aadhaar

number.

PACL Scam: The Australian

Now you are all set to make deposits, withdraw money and even make money transfers

2 of 7

10/02/2016, 12:11

Risks of Aadhaar-linked banking - Moneylife

http://www.moneylife.in/article/risks-of-aadhaar-linked-banki...

Signup Login Free Helplines

Feedback

sites to know more about fake Aadhaar cards and how these are 'officially' given:

Financial Inclusion?

You can go with fake documents or say you have none to your enrolment agency

and just getCorrespondent

a card made. Here is

sting thataccess

shows how

this isbanking

done in Delhi

Banks can appoint a Business

toa provide

to basic

services

(http://www.cobrapost.com/index.php/news-....

using a micro-ATM. These

include

the

ability

to

take

deposits,

dispense

cash

for

You may also like to read the following tip of the iceberg:

http://daily.bhaskar.com/news/RAJ-JPR-sh...

withdrawals, process #funds

transfers, or answer balance inquiries. The Banking

# http://timesofindia.indiatimes.com/City/...

Correspondent is the #last-mile

to replace the village money lender. The Banking

http://uidai.gov.in/parliament-questions... also how money transfers are enabling

money parking,

tax from

evasion:

While

Correspondent only collects

moneylaundering

or handsand

it out

hismoneylife.in/article/how-aa

own account with a parent

the RBI is raising the same concern it is suggesting a solution that will only

bank. The Banking Correspondent

may

issue

a

receipt

for

the

transaction.

There

is

no

amplify fraud See: bit.ly/1AWKDYL!

passbook for AEBA. There are only receipts of transactions. The parent bank has nothing

Reply

Link individual

Report abuse accounts. It only settles payable and receivable

to do with payments to

or from

to the Banking Correspondent.

Now, Good Samaritans can help

victims without the worry of

harassment

Big data help banks but benefits

should be passed on to customers

as well

Don't break law, bend it for

helping citizens, says Dr RC

Sinha

Sudhir Jatar 1 year ago

I shall ask questions, which everyone would understand:

# Why does any one at all need to substitute IFSC numbers issued by RBI with IIN

numbers issued by NPCI (a private company) & account numbers with UID

numbers?

# The above indicates lack of confidence in RBI; why this lack of confidence?

# What is the way ISACA would audit transactions on ABPS and what would they

certify?

Enter your email id here

1,00,000 Readers

Reply Link Report abuse

Sandeep 1 year ago in reply to Sudhir Jatar

IIN is code for a Bank like SBI and IFSC is a code given to specify branch of Bank

like local branch of SBI. Batch files are sent at bank level and not at single branch

level. Also NPCI is under the wings of RBI only. ISaCA is international audit

agency so just google it, there is tons of info about it.

Reply Link Report abuse

Sudhir Jatar 1 year ago in reply to Sudhir Jatar

I viewed on Times Now that a Khalistani was in possession of TWO Aadhaar cards

with two different bank accounts!!

No further

comments!would be allowed the option to either open a new

The UIDAI explains that

The resident

bank account or link an existing bank account to Aadhaar at the time of enrolment. Also,

Reply Link Report abuse

the person can always approach the bank concerned for linking the existing bank account

to Aadhaar. Such accounts are not subject to the requirements of the Anti-Money

M S Prabhakar 1 year ago in reply to Sudhir Jatar

Laundering Rules. The

banks have been pushed to open AEBA accounts repeatedly by the

Ha, ha,

I just saw the reportdated

http://www.youtube.com/watch?v=NXDDOSRMh...

RBI. Through its circular

noha!

17015/14/2012/FI

06 February 2014 the UIDAI

enabled the process of opening new bank accounts through micro ATMs or linkage of

Aadhaar is truly becoming the joke of our nation. I have a solution. If the

existing bank accounts

with Aadhaar.

government

can't understand the technicalities of Aadhaar's pitfalls (neither could

Rupay Cards

they understand schemes of Saradha, Sahara and Lehman Bros.) and leave it to

some minions to defend, it would be wise of them to consider adding a disclaimer:

"Aadhaar Enabled Payment Systems (AEPS) are subject to biometric risks. Please

The Rupay card, a pre-paid

debit card, was launched as the Dhan Aadhaar card in

read your palm (especially, fate line) or consult a palmist before enrolment."

December 2011. It has been co-branded with different financial institutions with differing

Reply and

Linkfees

Report

abuse of these cards are branded as pre-paid cash

operational requirements

. Some

cards and do not require a bank account. Since all Rupay cards would require the ABPS it

is no surprise that all Sandeep

banks were

pushed to enable biometrics and Aadhaar to enable the

1 year ago in reply to M S Prabhakar

Rupay. When there was some resistance to burden all account holders with this new

You should appreciate the point that with Aadhaar in place, future of this guy is

infrastructure pin-based

Rupay

been

sealed

for lifehave

and you

canintroduced.

track this person's criminal history by CCTNS once

those two Aadhaar card are verified in the system. That's where UID is different

From the limited information

onhad

thetwo

specifics

the

Pradhan

Jan

Dhan

from paperavailable

IDs. He also

passports

which

cannotMantri

be verified

anywhere.

Yojana launched on 28 August 2014 promises an Aadhaar Enabled Bank Account (AEBA),

a Rupay Debit Card and

the Accident Insurance cover most banks were offering with the

Reply Link Report abuse

Rupay Debit card.

It is therefore surprising to learn that that 2.5 crore accounts have been opened without

3 of 7

10/02/2016, 12:11

Risks of Aadhaar-linked banking - Moneylife

http://www.moneylife.in/article/risks-of-aadhaar-linked-banki...

Signup Login Free Helplines

misled completely.

Feedback

his biometric indicators?

No further comments.(for those who believe Cursory seeing is believing!)

The risks of Aadhar-enbaled

Payment

System (AEPS)

Reply Link Report

abuse

The AEPS is based on the following premises.

Sudhir Jatar 1 year ago in reply to Bal krishna Gupta

1. An existing accountThat

number

and IFSC

code

is precisely

the point.

I am happy that you have grasped the essence.

that uniquely identifies a branch of any bank

Link Report abuse

are not sufficient to doReply

a legitimate

transaction.

2. An account not linked

with

an Aadhaar

sohan

modak

1 year ago

number lacks the KYCI don't

or may

be a fake

think any one is against a national Id card. The problem is that Aadhar is

account.

based on bad software, enrollment methodologies, execution and lack of audit. As

simplean

asAadhaar

that. Nonauditability

3. An account linked with

number = fraud potential. PERIOD.

is genuine and cannotReply

be aLink

fake one.

Report abuse

4. Auditability of Aadhaar number to Aadhaar number bank transfer is identical to an

account number to account number transfer.

Bal krishna Gupta 1 year ago in reply to sohan modak

5. The costs of ABPS are less than the costs of NEFT or RTGS.

MONEYLIFE MAGAZINE

Current | Download | Back Issue

SUBSCRIBE

Are Voter cards, Bank accounts, passports audited?

so theRTGS

CAs will

become

over

and over rich!

The RBI should close Ifdown

and

NEFT

if busy

assumption

1 is true. It is completely

unclear why a third party number should be associated with a genuine account

Reply Link Report abuse

for identifying the account or the branch.

If assumption 2 holdsSandeep

and accounts

not linked with Aadhaar are fake ones, or lack KYC,

1 year ago in reply to sohan modak

the RBI should be closed down for having enabled such accounts and money transfers

Constructive criticism is always good for any system/society. So any changes that

within and between them

in India.

is surprising

thatsoftware,

the Government

of India does

you would

like toItpropose

for Aadhaar

enrollment methodologies,

execution

and

audit

that

can

make

it

better?

not trust these accounts when it comes to transferring any benefits when its

Income Tax department has used them all along to assess income and even make

Reply Link Report abuse

refund payments.

Let us examine assumption

3. When

the

Aadhaar number is merely a 12-digit

Bal krishna

Gupta

1 year ago in reply to Sandeep

number assigned to demographic and biometric data submitted by private

Their role is only to criticise a system which will reduce misdirected subsidies by

parties; it cannot be

a proof

at least

80%. of identity, address or even existence. There has

been no verification or audit of the Aadhaar database and therefore it is very conceivable

Link Report abuse

that, as was the case ofReply

Satyam,

huge number of non-existent persons is assigned an

Aadhaar number. There is no basis to regard any bank accounts linked to an Aadhaar

number as belonging Sudhir

to genuine

even

Jataror1 year

ago existing individuals.

Mr. Sandeep,

Mr.

Ananthram to

andchange

Bal Krishna

Gupta perhapsinyou

to make a

Let us examine assumption

4. It is

impossible

the beneficiary

anneed

account

disclosure of your affiliations as you are trolling the website and making baseless

number to account number

transfer.

It isofhowever

possible

to re-associate

statements

in defence

Aadhaar that

is not even

the subject of an

the account

article. You

have even

got personal,

which

shows

that youto

do create

not have different

adequate reasoning to

associated with an Aadhaar

number.

In fact

it is

possible

put across.

accounts and is link

the

same

Aadhaar

different

times.

It isthem

strangeto

that

you

are willing

to ignorenumber

the ruin ofat

a banking

system

if the

Students Special: ...

assumptions behind the Aaadhaar Based Payment System are as highlighted by

If you have the demographic

and biometric details of various real persons, as you would, if

the author.

are advised

to reread

the article

the 5 specific

assumptions

in

you were an Aadhaar You

enrolment

agency,

it would

notparticularly

be impossible

to create

an account

justifying Aadhaar Based Payment Systems reproduced here in case you have an

linked with their Aadhaar

numbers without their knowledge. If you were a financial

open mind:

institution enrolling people it would not be impossible to open multiple accounts in

"The risks of Aadhar-enbaled Payment System (AEPS)

different branches and

link

theissame

number

with them at different times.

The

AEPS

based Aadhaar

on the following

premises.

Safe And Smart Financial

Advice For Students

1. An existing account number and IFSC code that uniquely identifies a branch of

any bank

are not sufficient

to do

a legitimate

Why would one do that?

Different

accounts

can

parktransaction.

money at different times

2. An account not linked with an Aadhaar number lacks the KYC or may be a fake

or even become conduits

for laundering money. Considering that the RBI

account.

suspended the requirements

of anti-money

laundering

rules

tocannot

Aadhaar

3. An account linked

with an Aadhaar

number is genuine

and

be a fake one.

4. Auditability

of Aadhaar

to Aadhaar

number

bank transfer

is identical to

based bank accounts

and enabled

thenumber

opening

of such

accounts

in the

an account number to account number transfer.

absence of a branch

or an

infrastructure

makes

this

very plausible.

5. The

costsaudit

of ABPS

are less than the costs

of NEFT

or RTGS.

Such accounts can also become conduits to claim undeserved benefits from

The RBI should close down the time-tested RTGS and NEFT if assumption 1 is

Government that would

be traced

once

released.

This

is abe

recipe

forwith a

true. It isnever

completely

unclear why

a third

party number

should

associated

embezzling government treasury with no complaints, no audit trail and no

4 of 7

10/02/2016, 12:11

Risks of Aadhaar-linked banking - Moneylife

http://www.moneylife.in/article/risks-of-aadhaar-linked-banki...

Signup Login Free Helplines

international

exposure

I do

understand

the basics

of

Uniqueness

transferstransfer.

within

and

between

them

in maintains

India.

It is surprising

Government

number to account number

Since

the

NPCI

noneed

log of

ofthat

thethe

previous

identifier(i.e.UID/NPR)

for aaccounts

country when

as populous

as to

India

where fake/ghost

of India does not trust these

it comes

transferring

any benefits

account numbers associated

with

an Aadhaar

numberare

it makes the

such

transfers

completely

/duplicate

and middlemen

beneficiary

govt.

when

its Income

Tax department

has used looting

them all along

tosystem.

assess income and

unauditable.

even make refund payments. In fact, these systems are put in place so that there is

Feedback

How not to become a

victim of cyberfraud.

By Dr Anupam

Saraph

Markets in Turmoil:

What should you do?

by Mr Debashis Basu

How can citizens

participate in the

Make in India effort?

How Safe Is Your

Building

Every

development

country(USA,

Canada, UK, Australia, NZ etc.) you

transparency

and tooriented

curb corruption

in IT Department.

name

it have some

sorttransactions

of uniqueness on

identifier

channelize

the government

Let us examine the 5th

assumption

that

ABPStocost

less than

other

benefits

to common

citizens.3. When the Aadhaar number is merely a 12-digit

Let us examine

assumption

payment systems. In making

such

a

claim

the

NPCI

does

not

do

an

actual

end-to-end

cost

number assigned to demographic and biometric data submitted by private parties;

simplebequestion

tocosts

you/author

is "A or

single

can point

to how

many

people

it

cannot

a proof

identity,

evenUID

existence.

There

hasare

been

no

comparison with any My

alternatives.

Theof

ofaddress

ABPS

that

NPCI

ignores

the

in

a government

database

you combine

the and

demographics"?

verification

or audit

of the ifAadhaar

database

therefore it is very conceivable

cost of the Aadhaar

infrastructure

and maintenance.

It

ignores the costs of

that, as was the case of Satyam, huge number of non-existent persons is assigned

fraud and leakage.Also

ItAadhaar

ignores

the cost

of

the

infrastructure

ofaccounts

micro

ATMs

would you/author

please

share

the

AEPS

premises

quoted

above

an

number.

There

is no

basis

tosource

regardofany

bank

linked

to an or

are

they just

by author?

Aadhaar

number

asup

belonging

to genuine

or even

individuals.

By proper

and having banks switch

to made

enabling

their

accounts

forexisting

Aadhaar.

These

costs

audit, we mean audit carried out in terms of the guidelines issues by the various

would ultimately be

passed

toauthorities

the customer.

regulatory

other

e.g. Association of CAs for financial audits.

Reply

Linkor

on

Report

abuse

Let us examine

assumption

4. identity,

It is impossible

to change

beneficiary

an

Even if Aadhaar numbers

were

proof of

which

it isthe

not,

its useinto

account number to account number transfer. It is however possible to re-associate

Anand 1 year

ago

in reply

to Sudhir

Jatar

make financial transfers,

is

the

best

way

to

make

financial

transfers

an account associated with an Aadhaar number. In fact it is possible to create

unauditable, propagate

financial

is notimes.

different

accountslaundering

and link them toand

the same

Aadhaarfraud.

number There

at different

Dear Mrmoney

Jatar

rational justification for introducing an unverified and unaudited number to allow

If

you have

demographic

various

real persons,

as you

I think

yourthe

arguments

as areand

the biometric

argumentsdetails

in thisofpiece

is making

some basic

payments and settlements.

would,

if youFor

were

an Aadhaar enrolment agency, it would not be impossible to

logical flaws

Example:

create

an account linked with their Aadhaar numbers without their knowledge.

.......................

This

actually

and

reported

in lacks

casesthe

in Mumbai

and be

Chennai.

2. Anhas

account

nothappened

linked with

anwidely

Aadhaar

number

KYC or may

a fake

If

you were a financial institution enrolling people it would not be impossible to

account.

accounts

in several

differentdisruptive

branches and

link the same

Aadhaar

There is no doubt thatopen

themultiple

future may

hold

business

models

for number

with

at different

Fromthem

this you

jump to times.

The way ahead

payments and settlements many of which may be enabled by technology. While

Why

that?

Different

accounts

canwith

park

money

at

different

times

or

encouraging innovation,

itwould

is theone

role

of the

regulator

ensure

that

theseare

dofake

notones,

bring

If assumption

2 do

holds

and

accounts

nottolinked

Aadhaar

or lack

even

become

conduits

for

laundering

money.

Considering

thataccounts

the RBI and

has money

KYC,

the

RBI

should

be

closed

down

for

having

enabled

such

ruin to the nations financial

system.

suspended

the requirements of anti-money laundering rules to Aadhaar based

transfers within and between them in India.

bank accounts and enabled the opening of such accounts in the absence of a

...............................

In an NYU paper titled

Theor

Precautionary

Principle:

Fragility

BlackSuch

Swans

fromcan

branch

an audit infrastructure,

makes

this veryand

plausible.

accounts

also

become

conduits

to claim

undeserved

benefits

from

that would

Basically,

you

are jumping

from

Some

which is

logical

fallacy.

Existence

of

Policy Actions, Nassim

Taleb

argues

that

taking

risks=isAll,

necessary

forGovernment

the

functioning

and

never

beAccounts

traced once

released.

Thishave

is a recipe

Benami

proves

that KYC

failed.for embezzling government treasury

advancement of society.

all risks

aretrail

notand

equal.

Taking into account the

withHowever,

no complaints,

no audit

no punishment.

What's your say?

Can Governor Dr Rajan's

challenge make the RBI staff to

bring in efficiency in work

culture at the 81-year old

central bank?

Yes

No

Can't Say

Enter Code :

change code

VOTE

structure of randomness

in aChartered

given system

can have

a dramatic

onAudit,

which

kinds

of

Second,

Accountants

are not

competenteffect

to do IT

What

you are

Clearly Aadhaar

to Aadhaar

number

bank transfer

is not wants

identical

to an a

and I number

have reasons

to suspect,

Chartered

Accountants

to corner

actions are, or are not,suggesting

justified.

account number to account number transfer. Since the NPCI maintains no log of

piece of cake that is not theirs. And I suspect......

the previous account numbers associated with an Aadhaar number it makes such

transfers

completely

un-auditable.

With the help of probability

asserts that

when

impacts

are not

localized

and

Before, Itheory,

am

in noTaleb

way

whatsoever

related

to Aadhar

Scheme

but instead

I know

quite a few things

about ITpropagating

Audit.

non spreading, interdependence

increases

impacts resulting in irreversible

Let us examine the 5th assumption that transactions on ABPS cost less than other

and widespread damage

and

the probability

ofsuch

devastation,

ultimately

to

thepeople.

point

payment

systems.

In making

claim

NPCI

does

not

actual of

Even

if System

Audit

is required,

itacan

andthe

should

be

done

bydoITan

end-to-end

cost

comparison

with

any

alternatives.

The

costs

of

ABPS

that NPCI

Chartered Accountants

cant IBA,

even do

financial

audit

properly

:)

certainty. The interdependence

of the NPCI,

RBI,

UIDAI

and

the various

government

ignores are the cost of the Aadhaar infrastructure and maintenance. It ignores the

departments are engineered

for what

Taleb characterizes

asofruin.

costs of fraud

and leakage.

It ignores the cost

the infrastructure of micro ATMs

Reply Link Report abuse

and having banks switch to enabling their accounts for Aadhaar. These costs

ultimately

be passed

to theaccounts,

customer. the RBI has enabled fraud

By enabling ABPS andwould

Aadhaar

linkages

withonbank

propagation across the

entire1 year

banking

industry

that will result in widespread and

Anand

ago innumbers

reply to Anand

Even if Aadhaar

were proof of identity, which it is not, its use to make

irreversible damage. It

is evident

thatisthe

failed

protect

the nations

banking

financial

transfers,

theRBI

best has

way to

maketo

financial

transfers

unauditable,

Before

should

readlaundering

as Before you

little

mixThere

in para

propagate

money

and Ask...a

financial

fraud.

is as

nowell.

rational justification

system from an increased

probability

of devastation.

What you said

Is the govts decision to

withdraw LPG subsidy for

taxpayer with income of over

Rs10 lakh fair?

Yes

No

Can't Say

28.8%

68.3%

for introducing an unverified and unaudited number to allow payments and

Apologies.

settlements.

In the interest of financial prudence the RBI governor, the IBA and the various banks

The

main

points

It will

be useful

tostand

hearthough.

if youimmediately

have any arguments

to justify

these assumptions

and

must invoke the precautionary

principle

and

suspend

all linkage

of Aadhaar

the consequences of the failure of the banking system that follow rather than the

to any financial instrument.

The

RBI

governor

ought

to

declare

a

financial

Reply

Link have

Report

abuse

hot

air you

been

emitting and making personal remarks, which expose your

emergency and freeze

all Aadhaar linked bank accounts and reverse these

ignorance.

transactions.

Thanks for casting your votes!

View Previous Polls

Reply Link Report abuse

The PMO must revisit the UPA projects that have been allowed to be carried

forward. Given the multiple institutions involved, it would be fitting to set up an inquiry

commission that will include voices that have raised caution in the interest of the nation

and have a mandate to minimize the damage to the country and suggest the way ahead. In

the meanwhile, it would only be prudent to suspend all linkages to the Aadhaar number.

The Supreme Court of India has several pending public interest litigations (PILs) on

Aadhaar linkages and it would prudent to have a special court to issue a stay on all

Aadhaar linkages till the cases are heard and at the same time hear the PILs expeditiously

given the extent of financial ruin that Aadhaar can bring to India.

5 of 7

10/02/2016, 12:11

Risks of Aadhaar-linked banking - Moneylife

http://www.moneylife.in/article/risks-of-aadhaar-linked-banki...

Signup Login Free Helplines

Feedback

of arguments and have to resort to replicating the arguments of the author of the

prudent banker lose sleep,

may not have any prudent bankers left anymore. It is

originalwe

article!

evident that our policy makers have neither the time nor inclination to apply themselves

It appears you have not either had the time to peruse or the ability to comprehend

to the implications ofthe

their

actions nor to seek counsel to protect the nation and its assets.

arguments that have been put up all this while. All contrarian arguments are

therefore

air mess

and why

not financial

- they needinclusion

to be understood

Embroiling the unbanked

intohot

this

is no

- it is first!

a debt warrant.

Firstly there are no 'Riskless' systems in existence. All that can be done is to try

and reduce the risks in any system to an acceptable level. Additionally the risks

Some important Dates

have to be balanced against the returns.

In the case of Govt benefits disbursal the risks of NOT having a system (which is

Date

Particulars current state wherein leakage is costing the country billions)far outweighs the risk

of having a system like Aadhar which off course can be improved upon based on

actual learning on the ground.

Dec-08

Incorporation of

National the

Payments

of India

Secondly

cost ofCorporation

each day of

delay(NPCI)

in implementation is also horrendous and

thus the argument is for not delaying any further.

28-Jan-09

Planning Commission of India Notifies the UIDAI with mandate to create a UID.

Apr-09

Certificate of Commencement of Business issued to National Payments Corporation

14-Dec-09

NPCI takes over ATM switching service to banks in India through National Financial

Thirdly the argument that Dr Saraph's article is more researched and well founded

to the extent that Aadhar needs to be scrapped essentially derides the competency

of institutions like RBI besides off course the PM and all policy making bodies.

of India (NPCI)The underlying charge that all these institutions beside being incompetent are also

bent upon harming the national interests is also simply ridiculous.

Reply Link Report abuse

Switch from Institute of Development and Research in Banking Technology (IDRBT)

Apr-2010

UIDAI whitepaper: From Exclusion to Inclusion with Micropayments

13-Dec-11

credentials

are inand

public

http://in.linkedin.com/in/baalkee

The Standing My

Committee

on Finance

urgeddomain.

the government

to reconsider and

Bal krishna Gupta 1 year ago in reply to Sudhir Jatar

I am an IITK graduate and have served a leading PSU Bank for 36 years. I have no

direct/indirect; oblique/hidden link with anybody interest in the business of

ramifications. Aadhar at any micro/macro level.

review the UID scheme and also the proposals contained in the Bill in all its

27-Jan-11

AsRBI/2010-11/389

there are 100sDBOD.AML.No.

of millions of 77

non

Aadhar Bank accounts

RBI Notification

/14.01.001/2010-11

making also and will remain

and would be used for financial transactions of bigger magnitude, NEFT and

anti-money laundering

rulesnot

applicable

bank accounts

openeddown.

with Aadhaar.

RTGS need

be andfor

should

not be closed

2. The transfers thru AAdhar based accounts will be only for Subsidies or by the

28-Sep-11

marginal

labourersRBI/2011.

who maintain

at banks at relaxing

their place of work as well

RBI Notification

12/207DBOD.AML

BC. No.accounts

36/14.01.001/2011-12

as at native places, for frauds to take place staff at both places should also collude

with them that too for petty gains as the amounts transferred would be only a few

thousand rupees.

anti-money laundering rules for bank accounts opened with Aadhaar.

Dec-2011

Dhan Aadhaar Yojana launched

17-May-12

phones

or ATM Debit

cards.

RBI Notification

RBI/2011-12/566

DBOD.

No. BL. BC. 105/22.01.009/2011-12 on

3. Even now people have facility of transferring money anywhere through mobile

financial inclusion

and banking

4. How

money correspondents.

laundering would increase overnight is not understood.

12-Mar-13

5. As

the scheme

runs

theSeries)

experience

gained

problems faced can be tackled

RBI Circular RBI

/ 2012-13

/ 436 A.P.

(DIR

Circular

No. 89and

on revised

and due precautions can be built viz maximum annual limit per Adhar Card or

Aadhar Linked bank Account.

guidelines for money transfer schemes.

1-Jul-13

RBI Master Circular

RBI/2013-14/1

Master

No.1transactions.

/2013-14 on money

6. Money

launderers

dontCircular

do chindi

Theytransfer

follow hawala/angadiya or

courier routes to do their "business"

service scheme.

7. Please stop beating around the bush and come to the brass tacks.

1-Jul-13

RBI Notification RBI/ 2013-14/31 UBD.BPD. (PCB).MC.No.16 /12.05.001/2013-14

8. Nilikeni

the board

much later.

What

axe he was

to grind in tUIDAI I

specifying obligations

of thecame

bankstounder

the prevention

of money

laundering

act of

dont know or answer as I dont know the gentlemamn oither than the news about

him in the public domain. 9.As far as finding fault is concerned, their are

shortcomings in the Voter machines too, Voter cards and rations cards are also

issued

in wrong names.

But opening

such cases

not the

reasons

that VCs or ration card

UIDAI Notification

17015/14/2012/FI

enabling

new are

accounts

through

micro

system should be ignored.

2002.

6-Feb-14

ATMs

Why is the "Dr", "Professor" silent and not answering the criticism?

28-Aug-14

Pradhan Mantri Jan Dhan Yojana launched

Reply Link Report abuse

(Dr Anupam Saraph is a Professor, Future Designer, former governance and IT advisor to

Bal krishna

Guptaand

1 yearthe

ago in

reply to Bal

krishna Gupta Forum)

Goa Chief Minister Manohar

Parrikar

World

Economic

The naysayers wanted disclosures and after disclosures they have started new sets

of comments.

Bura jo dekhan main chala....

Reply Link Report abuse

6 of 7

10/02/2016, 12:11

Risks of Aadhaar-linked banking - Moneylife

http://www.moneylife.in/article/risks-of-aadhaar-linked-banki...

Signup Login Free Helplines

Feedback

to defend Aadhar as is done by Anantharaman. Oh, Modi, who was against

Aadhar, is now convinced otherwise and how can he make a mistake ? This is the

kind of argument that produces no-brainers. Of course, Geeks have a vested

interest in defending Aadhar that has been a huge baked (oops, cooked) bread and

butter for them. Their trishuls (computers) cannot make mistakes nor can their

programming be faulty, viz based on incomplete parameters! Wake up call is again

due, come what Modi and his cohorts think. Nilekani's fraud is being owned by

Modi?

Reply Link Report abuse

Page

7 of 7

10/02/2016, 12:11

Vous aimerez peut-être aussi

- Transcript Q1FY17Document21 pagesTranscript Q1FY17Ashwini Anaokar ShahPas encore d'évaluation

- Biocon AR 2016 Consolidated ARDocument236 pagesBiocon AR 2016 Consolidated ARAshwini Anaokar ShahPas encore d'évaluation

- Policy Changes For Inclusion - Indicus Centre For Financial Inclusion - BlogDocument1 pagePolicy Changes For Inclusion - Indicus Centre For Financial Inclusion - BlogAshwini Anaokar ShahPas encore d'évaluation

- Mobile BankingDocument23 pagesMobile Bankingdm_ngos100% (1)

- BSC (IT) College ListDocument10 pagesBSC (IT) College ListAshwini Anaokar ShahPas encore d'évaluation

- Upload@Document1 pageUpload@Ashwini Anaokar ShahPas encore d'évaluation

- Upload - BooksDocument1 pageUpload - BooksAshwini Anaokar ShahPas encore d'évaluation

- Agencies Room Maindoor Safety Door Passage KitchenDocument6 pagesAgencies Room Maindoor Safety Door Passage KitchenAshwini Anaokar ShahPas encore d'évaluation

- Untitled 1Document1 pageUntitled 1Ashwini Anaokar ShahPas encore d'évaluation

- JanuaryDocument1 pageJanuaryBrittany BellacosaPas encore d'évaluation

- TintinDocument2 pagesTintinAshwini Anaokar ShahPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- BSC (IT) College ListDocument10 pagesBSC (IT) College ListAshwini Anaokar ShahPas encore d'évaluation

- TintinDocument2 pagesTintinAshwini Anaokar ShahPas encore d'évaluation

- Halls in Western MumbaiDocument14 pagesHalls in Western MumbaiAshwini Anaokar ShahPas encore d'évaluation

- AaaDocument3 pagesAaaAshwini Anaokar ShahPas encore d'évaluation

- Convert any video file for iPod with VLC media player guideDocument11 pagesConvert any video file for iPod with VLC media player guideAshwini Anaokar ShahPas encore d'évaluation

- TemplateDocument1 pageTemplateRajkumarPas encore d'évaluation

- Hpjsilg 2Document13 pagesHpjsilg 2Ashwini Anaokar ShahPas encore d'évaluation

- BankokDocument3 pagesBankokAshwini Anaokar ShahPas encore d'évaluation

- BankokDocument3 pagesBankokAshwini Anaokar ShahPas encore d'évaluation

- Hpjsilg 2Document13 pagesHpjsilg 2Ashwini Anaokar ShahPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Input 9050Document9 pagesInput 9050Raghavendra PrabhuPas encore d'évaluation

- Northern Region Vocational Education Courses Prospectus 2019Document214 pagesNorthern Region Vocational Education Courses Prospectus 2019K PUNNA REDDYPas encore d'évaluation

- Non-Face to Face Customer KYC GuidelinesDocument205 pagesNon-Face to Face Customer KYC GuidelinesUday GopalPas encore d'évaluation

- E-Governance in India Concept Initiatives and IssuesDocument13 pagesE-Governance in India Concept Initiatives and IssuesAmit Bardhan MohantyPas encore d'évaluation

- Genesis-September 2015 Issue I PDFDocument42 pagesGenesis-September 2015 Issue I PDFDivyesh PatelPas encore d'évaluation

- 601 ECMP EnrolmentClient OperatorManual Multiplatform PDFDocument96 pages601 ECMP EnrolmentClient OperatorManual Multiplatform PDFSheikh YounisPas encore d'évaluation

- SBI FASTag Application Form - IndividualDocument4 pagesSBI FASTag Application Form - Individualpp ddPas encore d'évaluation

- Shubhankar Rawat - SCMHRD - Project ReportDocument25 pagesShubhankar Rawat - SCMHRD - Project ReportPrajapati BhavikMahendrabhaiPas encore d'évaluation

- Uid in Jammu and Kashmir by Zameer BandhDocument31 pagesUid in Jammu and Kashmir by Zameer Bandhzameer_suoPas encore d'évaluation

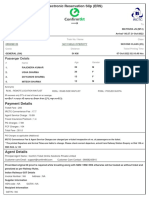

- Tax Invoice Cum Acknowledgement Receipt of PAN Application (Form 49A)Document1 pageTax Invoice Cum Acknowledgement Receipt of PAN Application (Form 49A)NATIONAL XEROXPas encore d'évaluation

- Notice To Shareholders To Update KYC DetailsDocument229 pagesNotice To Shareholders To Update KYC Detailskanianbalayam1983Pas encore d'évaluation

- JVD Five Step Validation Form for Student Financial AidDocument1 pageJVD Five Step Validation Form for Student Financial AidRishika Internet0% (1)

- E Book On ADC ProductsDocument29 pagesE Book On ADC ProductsSudharani YellapragadaPas encore d'évaluation

- Kotak RegistrationDocument65 pagesKotak RegistrationHare KrishnaPas encore d'évaluation

- 19226/jat Ju Express Sleeper Class (SL)Document2 pages19226/jat Ju Express Sleeper Class (SL)Ganesh Kumar Sharma BalesarPas encore d'évaluation

- Claims Management System (IMA)Document2 pagesClaims Management System (IMA)Abdul Qhadar K100% (1)

- DIT NAD & ABC Registration For StudentsDocument3 pagesDIT NAD & ABC Registration For StudentsSanu SKPas encore d'évaluation

- EAF Employee Application Form - RevisedDocument2 pagesEAF Employee Application Form - RevisedGani GaddalaPas encore d'évaluation

- Dr. B. R. Ambedkar Schools of Specialised Excellence: Asose Admission Test - 2023Document2 pagesDr. B. R. Ambedkar Schools of Specialised Excellence: Asose Admission Test - 2023Khushboo MishraPas encore d'évaluation

- Confirmtkt AGC - MTJ - 2022-10-21T00 - 00 - 001665091496429Document2 pagesConfirmtkt AGC - MTJ - 2022-10-21T00 - 00 - 001665091496429UshaPas encore d'évaluation

- HDFC ERGO General Insurance Company Limited: Know Your Customer (Kyc) Application FormDocument8 pagesHDFC ERGO General Insurance Company Limited: Know Your Customer (Kyc) Application FormAdesh SharmaPas encore d'évaluation

- TELANGANA TREI-RB NOTIFICATION APPLICATIONDocument5 pagesTELANGANA TREI-RB NOTIFICATION APPLICATIONVenkata Ramana PothulwarPas encore d'évaluation

- IC 1928-2020union MudraDocument11 pagesIC 1928-2020union Mudraamit_200619Pas encore d'évaluation

- Nagpur GondiaDocument2 pagesNagpur GondiaSumeet SoniPas encore d'évaluation

- 12733/narayanadri Exp Third Ac Economy (3E)Document2 pages12733/narayanadri Exp Third Ac Economy (3E)tsasidharPas encore d'évaluation

- Sarvatra Brochure Bank On Move POSDocument2 pagesSarvatra Brochure Bank On Move POSAnonymous loKgur100% (1)

- Loan AgreementDocument10 pagesLoan AgreementManoj KolanPas encore d'évaluation

- MEA Online Appointment Receipt for Fresh Passport ApplicationDocument3 pagesMEA Online Appointment Receipt for Fresh Passport ApplicationSukhPas encore d'évaluation

- JAM Trinity ConclusionDocument3 pagesJAM Trinity ConclusionMohit KumarPas encore d'évaluation

- TelegramDocument2 pagesTelegramShobhit GajbhiyePas encore d'évaluation