Académique Documents

Professionnel Documents

Culture Documents

2 Social Security System vs. Moonwalk Development and Housing Corporation

Transféré par

cool_peachCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2 Social Security System vs. Moonwalk Development and Housing Corporation

Transféré par

cool_peachDroits d'auteur :

Formats disponibles

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

VOL. 221, APRIL 7, 1993

119

Social Security System vs. Moonwalk Development and

Housing Corporation

*

G.R. No. 73345. April 7, 1993.

SOCIAL

SECURITY

SYSTEM,

petitioner,

vs.

MOONWALK

DEVELOPMENT

&

HOUSING

CORPORATION, ROSITA U. ALBERTO, ROSITA U.

ALBERTO, JMA HOUSE, INC., MILAGROS SANCHEZ

SANTIAGO, in her capacity as Register of Deeds for the

Province of Cavite, ARTURO SOLITO, in his capacity as

Register of Deeds for Metro Manila District IV, Makati,

Metro Manila and the INTERMEDIATE APPELLATE

COURT, respondents.

Contracts Penal Clause Function.A penal clause is an

accessory undertaking to assume greater liability in case of

breach. It has a double function: (1) to provide for liquidated

damages, and (2) to strengthen the coercive force of the obligation

by the threat of greater responsibility in the event of breach.

From the foregoing, it is clear that a penal clause is intended to

prevent the obligor from defaulting in the

_______________

*

SECOND DIVISION.

120

120

SUPREME COURT REPORTS ANNOTATED

Social Security System vs. Moonwalk Development and Housing

Corporation

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

1/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

performance of his obligation. Thus, if there should be default, the

penalty may be enforced.

Obligations Requisites in order that debtor may be in default

Necessity of demand.To be in default x x x is different from

mere delay in the grammatical sense, because it involves the

beginning of a special condition or status which has its own

peculiar effects or results. In order that the debtor may be in

default it is necessary that the following requisites be present: (1)

that the obligation be demandable and already liquidated (2) that

the debtor delays performance and (3) that the creditor requires

the performance judicially and extrajudicially. Default generally

begins from the moment the creditor demands the performance of

the obligation. Nowhere in this case did it appear that SSS

demanded from Moonwalk the payment of its monthly

amortizations. Neither did it show that petitioner demanded the

payment of the stipulated penalty upon the failure of Moonwalk

to meet its monthly amortization. What the complaint itself

showed was that SSS tried to enforce the obligation sometime in

September, 1977 by foreclosing the real estate mortgages

executed by Moonwalk in favor of SSS. But this foreclosure did

not push through upon Moonwalks requests and promises to pay

in full. The next demand for payment happened on October 1,

1979 when SSS issued a Statement of Account to Moonwalk And

in accordance with said statement, Moonwalk paid its loan in full.

What is clear, therefore, is that Moonwalk was never in default

because SSS never compelled performance.

PETITION for review on certiorari of the decision of the

then Intermediate Appellate Court.

The facts are stated in the opinion of the Court.

The Solicitor General for petitioner.

K.V. Faylona & Associates for private respondents.

CAMPOS, JR., J.:

1

Before Us is a petition for review on certiorari of a decision

of

_______________

1

ACG.R. CV No. 68692, Social Security System vs. Moonwalk

Development & Housing Corporation, et al., penned by Associate Justice

Eduardo P. Caguioa, Associate Justices Abdulwahid A. Bidin and

Floreliana C. Bartolome, concurring with dissenting opinion of

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

2/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

121

VOL. 221, APRIL 7, 1993

121

Social Security System vs. Moonwalk Development and

Housing Corporation

the then Intermediate Appellate Court affirming in toto the

decision of the former Court of First Instance of Rizal,

Seventh Judicial District, Branch XXIX, Pasay City.

The facts as found by the Appellate Court are as follows:

On February 20, 1980, the Social Security System, SSS for

brevity, filed a complaint in the Court of First Instance of Rizal

against Moonwalk Development & Housing Corporation,

Moonwalk for short, alleging that the former had committed an

error in failing to compute the 12% interest due on delayed

payments on the loan of Moonwalkresulting in a chain of errors

in the application of payments made by Moonwalk and, in an

unpaid balance on the principal loan agreement in the amount of

P7,053.77 and, also in not reflecting in its statement of account an

unpaid balance on the said penalties for delayed payments in the

amount of P7,517,178.21 as of October 10, 1979.

Moonwalk answered denying SSS claims and asserting that

SSS had the opportunity to ascertain the truth but failed to do so.

The trial court set the case for pretrial at which pretrial

conference, the court issued an order giving both parties thirty

(30) days within which to submit a stipulation of facts.

The Order of October 6, 1980 dismissing the complaint followed

the submission by the parties on September 19, 1980 of the

following stipulation of Facts:

1. On October 6, 1971, plaintiff approved the application of

defendant Moonwalk for an interim loan in the amount of

THIRTY MILLION PESOS (P30,000,000.00) for the

purpose of developing and constructing a housing project

in the provinces of Rizal and Cavite

2. Out of the approved loan of THIRTY MILLION PESOS

(P30,000,000.00) the sum of P9,595,000.00 was released to

defendant Moonwalk as of November 28, 1973

3. A third Amended Deed of First Mortgage was executed on

December 18, 1973 Annex D providing for restructuring

of the payment of the released amount of P9,595,000.00.

4. Defendants Rosita U. Alberto and Rosita U. Alberto,

mother and daughter respectively, under paragraph 5 of

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

3/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

the aforesaid Third Amended Deed of First Mortgage

substituted

_______________

Presiding Justice Ramon G. Gaviola, Jr. and Associate Justice Ma. Rosario

QuetulioLosa, concurring.

122

122

SUPREME COURT REPORTS ANNOTATED

Social Security System vs. Moonwalk Development and Housing

Corporation

Associated Construction and Surveys Corporation,

Philippine Model Homes Development Corporation,

Mariano Z. Velarde and Eusebio T. Ramos, as solidary

obligors

5. On July 23, 1974, after considering additional releases in

the amount of P2,659,700.00, made to defendant

Moonwalk, defendant Moonwalk delivered to the plaintiff

a promissory note for TWELVE MILLION TWO

HUNDRED FIFTY FOUR THOUSAND SEVEN

HUNDRED PESOS (P12,254,700.00) Annex E, signed by

Eusebio T. Ramos, and the said Rosita U. Alberto and

Rosita U. Alberto

6. Moonwalk made a total payment of P23,657,901.84 to SSS

for the loan principal of P12,254,700.00 released to it. The

last payment made by Moonwalk in the amount of

P15,004,905.74 were based on the Statement of Account,

Annex F prepared by plaintiff SSS for defendant

7. After settlement of the account stated in Annex F

plaintiff issued to defendant Moonwalk the Release of

Mortgage for Moonwalks mortgaged properties in Cavite

and Rizal, Annexes G and H on October 9, 1979 and

October 11, 1979 respectively.

8. In letters to defendant Moonwalk, dated November 28,

1979 and followed up by another letter dated December

17, 1979, plaintiff alleged that it committed an honest

mistake in releasing defendant.

9. In a letter dated December 21, 1979, defendants counsel

told plaintiff that it had completely paid its obligations to

SSS 10. The genuineness and due execution of the

documents marked as Annex (sic) A to O inclusive of the

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

4/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

Complaint and the letter dated December 21, 1979 of the

defendants counsel to the plaintiff are admitted.

2

Manila for Pasay City, September 2, 1980.

On October 6, 1990, the trial court issued an order

dismissing the complaint on the ground that the obligation

was already extinguished by the payment by Moonwalk of

its indebtedness to SSS and by the latters act of cancelling

the real estate mortgages executed in its favor by

defendant Moonwalk. The Motion for Reconsideration filed

by SSS with the trial court was likewise dismissed by the

latter.

_______________

2

Annex A of Petition, pp. 13 Rollo, pp. 4446.

123

VOL. 221, APRIL 7, 1993

123

Social Security System vs. Moonwalk Development and

Housing Corporation

These orders were appealed to the Intermediate Appellate

Court. Respondent Court reduced the errors assigned by

the SSS into this issue: x x x are defendantsappellees,

namely, Moonwalk Development and Housing Corporation,

Rosita U. Alberto, Rosita U. Alberto, JMA House, Inc. still

liable for the unpaid penalties as claimed 3 by plaintiff

appellant or is their obligation extinguished? As We have

stated earlier, the respondent Court held that Moonwalks

obligation was extinguished and affirmed the trial court.

Hence, this Petition wherein SSS raises the following

grounds for review:

First, in concluding that the penalties due from Moonwalk are

deemed waived and/or barred, the appellate court disregarded

the basic tenet that waiver of a right must be express, made in a

clear and unequivocal manner. There is no evidence in the case at

bar to show that SSS made a clear, positive waiver of the

penalties, made with full knowledge of the circumstances.

Second, it misconstrued the ruling that SSS funds are trust

funds, and SSS, being a mere trustee, cannot perform acts

affecting the same, including condonation of penalties, that would

diminish property rights of the owners and beneficiaries thereof.

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

5/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

(United Christian Missionary Society v. Social Security

Commission, 30 SCRA 982, 988 [1969])

Third, it ignored the fact that penalty at the rate of 12% p.a. is

not inequitable.

Fourth, it ignored the principle4 that equity will cancel a release

on the ground of mistake of fact.

The same problem which confronted the respondent court

is presented before Us: Is the penalty demandable even

after the extinguishment of the principal obligation?

The former Intermediate Appellate Court, through

Justice Eduardo P. Caguioa, held in the negative. It

reasoned, thus:

2. As we have explained under No. 1, contrary to what the

plaintiffappellant states in its Brief, what is sought to be

recovered in

_______________

3

Decision, p. 13 Rollo, p. 56.

Petition, p. 12 Rollo, p. 27.

124

124

SUPREME COURT REPORTS ANNOTATED

Social Security System vs. Moonwalk Development and Housing

Corporation

this case is not the 12% interest on the loan but the 12% penalty

for failure to pay on time the amortization. What is sought to be

enforced therefore is the penal clause of the contract entered into

between the parties.

Now, what is a penal clause. A penal clause has been defined

as

an accessory obligation which the parties attach to a principal obligation

for the purpose of insuring the performance thereof by imposing on the

debtor a special prestation (generally consisting in the payment of a sum

of money) in case the obligation is not fulfilled or is irregularly or

inadequately fulfilled (3 Castan 8th Ed. p. 118)

Now an accessory obligation has been defined as that attached

to a principal obligation in order to complete the same or take its

place in the case of breach (4 Puig Pea Part 1 p. 76). Note

therefore that an accessory obligation is dependent for its

existence on the existence of a principal obligation. A principal

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

6/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

obligation may exist without an accessory obligation but an

accessory obligation cannot exist without a principal obligation.

For example, the contract of mortgage is an accessory obligation

to enforce the performance of the main obligation of indebtedness.

An indebtedness can exist without the mortgage but a mortgage

cannot exist without the indebtedness, which is the principal

obligation. In the present case, the principal obligation is the loan

between the parties. The accessory obligation of a penal clause is

to enforce the main obligation of payment of the loan. If therefore

the principal obligation does not exist the penalty being accessory

cannot exist.

Now then when is the penalty demandable? A penalty is

demandable in case of non performance or late performance of the

main obligation. In other words in order that the penalty may

arise there must be a breach of the obligation either by total or

partial non fulfillment or there is non fulfillment in point of time

which is called mora or delay. The debtor therefore violates the

obligation in point of time if there is mora or delay. Now, there is

no mora or delay unless there is a demand. It is noteworthy that

in the present case during all the period when the principal

obligation was still subsisting, although there were late

amortizations there was no demand made by the creditor,

plaintiffappellant for the payment of the penalty. Therefore up to

the time of the letter of plaintiffappellant there was no demand

for the payment of the penalty, hence the debtor was not in mora

in the payment of the penalty.

However, on October 1, 1979, plaintiffappellant issued its

statement of account (Exhibit F) showing the total obligation of

Moonwalk

125

VOL. 221, APRIL 7, 1993

125

Social Security System vs. Moonwalk Development and Housing

Corporation

as P15,004,905.74, and forthwith demanded payment from

defendantappellee. Because of the demand for payment,

Moonwalk made several payments on September 29, October 9

and 19, 1979 respectively, all in all totalling P15,004,905.74

which was a complete payment of its obligation as stated in

Exhibit F. Because of this payment the obligation of Moonwalk

was considered extinguished, and pursuant to said

extinguishment, the real estate mortgages given by Moonwalk

were released on October 9, 1979 and October 10, 1979 (Exhibits

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

7/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

G and H). For all purposes therefore the principal obligation of

defendantappellee was deemed extinguished as well as the

accessory obligation of real estate mortgage and that is the

reason for the release of all the Real Estate Mortgages on October

9 and 10, 1979 respectively.

Now, besides the Real Estate Mortgages, the penal clause

which is also an accessory obligation must also be deemed

extinguished considering that the principal obligation was

considered extinguished, and the penal clause being an accessory

obligation cannot exist without a principal obligation. That being

the case, the demand for payment of the penal clause made by

plaintiffappellant in its demand letter dated November 28, 1979

and its follow up letter dated December 17, 1979 (which

parenthetically are the only demands for payment of the

penalties) are therefore ineffective as there was nothing to

demand. It would be otherwise, if the demand for the payment of

the penalty was made prior to the extinguishment of the

obligation because then the obligation of Moonwalk would consist

of: 1) the principal obligation 2) the interest of 12% on the

principal obligation and 3) the penalty of 12% for late payment for

after demand, Moonwalk would be in mora and therefore liable

for the penalty.

Let it be emphasized that at the time of the demand made in

the letters of November 28, 1979 and December 17, 1979 as far as

the penalty is concerned, the defendantappellee was not in

default since there was no mora prior to the demand. That being

the case, therefore, the demand made after the extinguishment of

the principal obligation which carried with it the extinguishment

of the penal clause being merely an accessory obligation, was an

exercise in futility. 3. At the time of the payment made of the full

obligation on

October 10, 1979 together with the 12% interest by defendant

appellee Moonwalk, its obligation was extinguished. It being

extinguished, there was no more need for the penal clause. Now,

it is to be noted that penalty at anytime can be modified by the

Court. Even substantial performance under Art. 1234 authorizes

the Court to consider it as complete performance minus damages.

Now, Art. 1229 Civil Code of the Philippines provides:

126

126

SUPREME COURT REPORTS ANNOTATED

Social Security System vs. Moonwalk Development and Housing

Corporation

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

8/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

ART. 1229. The judge shall equitably reduce the penalty when the

principal obligation has been partly or irregularly complied with by the

debtor. Even if there has been no performance, the penalty may also be

reduced by the courts if it is iniquitous or unconscionable.

If the penalty can be reduced after the principal obligation has

been partly or irregularly complied with by the debtor, which is

nonetheless a breach of the obligation, with more reason the penal

clause is not demandable when full obligation has been complied

with since in that case there is no breach of the obligation. In the

present case, there has been as yet no demand for payment of the

penalty at the time of the extinguishment of the obligation, hence

there was likewise an extinguishment of the penalty.

Let Us emphasize that the obligation of defendantappellee

was fully complied with by the debtor, that is, the amount loaned

together with the 12% interest has been fully paid by the

appellee. That being so, there is no basis for demanding the penal

clause since the obligation has been extinguished. Here there has

been a waiver of the penal clause as it was not demanded before

the full obligation was fully paid and extinguished. Again,

emphasis must be made on the fact that plaintiffappellant has

not lost anything under the contract since it got back in full the

amount loan (sic) as well as the interest thereof. The same thing

would have happened if the obligation was paid on time, for then

the penal clause, under the terms of the contract would not apply.

Payment of the penalty does not mean gain or loss of plaintiff

appellant since it is merely for the purpose of enforcing the

performance of the main obligation. Since the obligation has been

fully complied with

and extinguished, the penal clause has lost its

5

raison d entre

We find no reason to depart from the appellate courts

decision. We, however, advance the following reasons for

the denial of this petition.

Article 1226 of the Civil Code provides:

Art. 1226. In obligations with a penal clause, the penalty shall

substitute the indemnity for damages and the payment of

interests in case of noncompliance, if there is no stipulation to the

contrary. Nevertheless, damages shall be paid if the obligor

refuses to pay the penalty or is guilty of fraud in the fulfillment of

the obligation.

_______________

5

Rollo, pp. 6266.

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

9/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

127

VOL. 221, APRIL 7, 1993

127

Social Security System vs. Moonwalk Development and Housing

Corporation

The penalty may be enforced only when it is demandable in

accordance with the provisions of this Code. (Italics Ours.)

A penal clause is an accessory6 undertaking to assume

greater liability in case of breach. It has a double function:

(1) to provide for liquidated damages, and (2) to strengthen

the coercive force of the obligation by

the threat of greater

7

responsibility in the event of breach. From the foregoing, it

is clear that a penal clause is intended to prevent the

obligor from defaulting in the performance of his obligation.

Thus, if there should be default, the penalty may be

enforced. One commentator of the Civil Code wrote:

Now when is the penalty deemed demandable in accordance with

the provisions of the Civil Code? We must make a distinction

between a positive and a negative obligation. With regard to

obligations which are positive (to give and to do), the penalty is

demandable when the debtor is in mora hence, the necessity

of

8

demand by the debtor unless the same is excused. x x x

When does delay arise? Under the Civil Code, delay begins

from the time the obligee judicially or extrajudicially

demands from the obligor the performance of the

obligation.

Art. 1169. Those obliged to deliver or to do something incur in

delay from the time the obligee judicially or extrajudicially

demands from them the fulfillment of their obligation.

There are only three instances when demand is not

necessary to render the obligor in default. These are the

following:

(1) When the obligation or the law expressly so

declares

(2) When from the nature and the circumstances of the

obligation it appears that the designation of the

time when the thing is to be

_______________

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

10/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

6

4 TOLENTINO, CIVIL CODE OF THE PHILIPPINES 259 (1991 ed.).

Ibid.

4 E.P. CAGUIOA, COMMENTS AND CASES ON CIVIL LAW 280

(1983 ed.).

128

128

SUPREME COURT REPORTS ANNOTATED

Social Security System vs. Moonwalk Development and

Housing Corporation

delivered or the service is to be rendered was a

controlling motive for the establishment of the

contract or

(3) When the demand would be useless, as when the

obligor has

rendered it beyond his power to

9

perform.

This case does not fall within any of the established

exceptions. Hence, despite the provision in the promissory

note that (a)ll amortization payments shall be made every

first five (5) days of the calendar month until the principal

and interest on the loan or any

portion thereof actually

10

released has been fully paid, petitioner is not excused

from making a demand. It has been established that at the

time of payment of the full obligation, private respondent

Moonwalk has long been delinquent in meeting its monthly

arrears and in paying the full amount of the loan itself as

the obligation matured sometime in January, 1977. But

mere delinquency in payment does not necessarily mean

delay in the legal concept. To be in default x x x is

different from mere delay in the grammatical sense,

because it involves the beginning of a special condition

or

11

status which has its own peculiar effects or results. In

order that the debtor may be in default it is necessary that

the following requisites be present: (1) that the obligation

be demandable and already liquidated (2) that the debtor

delays performance and (3) that the creditor requires

the

12

performance judicially and extrajudicially.

Default

generally begins from the moment

the creditor demands

13

the performance of the obligation.

Nowhere in this case did it appear that SSS demanded

from Moonwalk the payment of its monthly amortizations.

Neither did it show that petitioner demanded the payment

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

11/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

of the stipulated penalty upon the failure of Moonwalk to

meet its monthly amortization. What the complaint itself

showed was that SSS tried to enforce the obligation

sometime in September, 1977 by foreclosing the real estate

mortgages executed by Moonwalk in favor of

_______________

9

CIVIL CODE, Art. 1169.

10

Annex C of the Petition, Record on Appeal, p. 10.

11

Supra, note 6.

12

Ibid.

13

Ibid.

129

VOL. 221, APRIL 7, 1993

129

Social Security System vs. Moonwalk Development and

Housing Corporation

SSS. But this foreclosure did not push through upon

Moonwalks requests and promises to pay in full. The next

demand for payment happened on October 1, 1979 when

SSS issued a Statement of Account to Moonwalk. And in

accordance with said statement, Moonwalk paid its loan in

full. What is clear, therefore, is that Moonwalk was never

in default because SSS never compelled performance.

Though it tried to foreclose the mortgages, SSS itself

desisted from doing so upon the entreaties of Moonwalk. If

the Statement of Account could properly be considered as

demand for payment, the demand was complied with on

time. Hence, no delay occurred and there was, therefore, no

occasion when the penalty became demandable and

enforceable. Since there was no default in the performance

of the main obligationpayment of the loanSSS was

never entitled to recover any penalty, not at the time it

made the Statement of Account and certainly, not after the

extinguishment of the principal obligation because then, all

the more that SSS had no reason to ask for the penalties.

Thus, there could never be any occasion for waiver or even

mistake in the application for payment because there was

nothing for SSS to waive as its right to enforce the penalty

did not arise.

SSS, however, in buttressing its claim that it never

waived the penalties, argued that the funds it held were

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

12/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

trust funds and as trustee, the petitioner could not perform

acts affecting the funds that would diminish property

rights of the owners and beneficiaries thereof. To support

its claim, SSS cited the case of United 14

Christian Missionary

Society v. Social Security Commission.

We looked into the case and found out that it is not

applicable to the present case as it dealt not with the right

of the SSS to collect penalties which were provided for in

contracts which it entered into but with its right to collect

premiums and its duty to collect the penalty for delayed

payment or nonpayment of premiums. The Supreme

Court, in that case, stated:

No discretion or alternative is granted respondent Commission in

the enforcement of the laws mandate that the employer who fails

to

_______________

14

30 SCRA 982, 987 (1969).

130

130

SUPREME COURT REPORTS ANNOTATED

Social Security System vs. Moonwalk Development and Housing

Corporation

comply with his legal obligation to remit the premiums to the

System within the prescribed period shall pay a penalty of three

(3%) per month. The prescribed penalty is evidently of a punitive

character, provided by the legislature to assure that employers do

not take lightly the States exercise of the police power in the

implementation of the Republics declared policy to develop,

establish gradually and perfect a social security system which

shall be suitable to the needs of the people throughout the

Philippines and (to) provide protection to employers against the

hazards of disability, sickness, old age and death. x x x.

Thus, We agree with the decision of the respondent Court

on the matter which We quote, to wit:

Note that the above case refers to the condonation of the penalty

for the non remittance of the premium which is provided for by

Section 22(a) of the Social Security Act x x x. In other words, what

was sought to be condoned was the penalty provided for by law for

non remittance of premium for coverage under the Social Security

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

13/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

Act.

The case at bar does not refer to any penalty provided for by

law nor does it refer to the non remittance of premium. The case

at bar refers to a contract of loan entered into between plaintiff

and defendant Moonwalk Development and Housing Corporation.

Note, therefore, that no provision of law is involved in this case,

nor is there any penalty imposed by law nor a case about non

remittance of premium required by law. The present case refers to

a contract of loan payable in installments not provided for by law

but by agreement of the parties. Therefore, the ratio decidendi of

the case of United Christian Missionary Society vs. Social

Security Commission which plaintiffappellant relies is not

applicable in this case clearly, the Social Security Commission,

which is a creature of the Social Security Act cannot condone a

mandatory provision of law providing for the payment of

premiums and for penalties for non remittance. The life of the

Social Security Act is in the premiums because these are the

funds from which the Social Security Act gets the money for its

purposes and the nonremittance of the premiums is penalized not

by the Social Security Commission but by law.

xxxxxx

It is admitted that when a government created corporation

enters into a contract with private party concerning a loan, it

descends to the level of a private person. Hence, the rules on

contract applicable to private parties are applicable to it. The

argument therefore that the

131

VOL. 221, APRIL 7, 1993

131

Social Security System vs. Moonwalk Development and Housing

Corporation

Social Security Commission cannot waive or condone the

penalties which was applied in the United Christian Missionary

Society cannot apply in this case. First, because what was not

paid were installments on a loan but premiums required by law to

be paid by the parties covered by the Social Security Act.

Secondly, what is sought to be condoned or waived are penalties

not imposed by law for failure to remit premiums required by law,

but a penalty for non payment provided for by15 the agreement of

the parties in the contract between them. x x x

WHEREFORE, in view of the foregoing, the petition is

DISMISSED and the decision of the respondent court is

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

14/15

2/19/2016

SUPREMECOURTREPORTSANNOTATEDVOLUME221

AFFIRMED.

SO ORDERED.

Narvasa (C.J., Chairman), Padilla, Regalado and

Nocon, JJ., concur.

Petition dismissed. Decision affirmed.

Note.Default generally begins from the moment the

creditor demands the performance of an obligation, without

such demand, the effect of default will not arise (Rose

Packing Co., Inc. vs. Court of Appeals, 167 SCRA 309).

o0o

_______________

15

Supra, note 3, pp. 1718.

132

Copyright2016CentralBookSupply,Inc.Allrightsreserved.

http://www.central.com.ph/sfsreader/session/00000152f8ad835afa34c21b003600fb002c009e/t/?o=False

15/15

Vous aimerez peut-être aussi

- Air-Fryer-Book FDL PDFDocument94 pagesAir-Fryer-Book FDL PDFMinh Triều75% (4)

- SBA Loans GuideDocument5 pagesSBA Loans GuideHotmansam EvonyPas encore d'évaluation

- Materials For How To Handle BIR Audit Procedures of BIR Audit - 2021 Sept 21Document83 pagesMaterials For How To Handle BIR Audit Procedures of BIR Audit - 2021 Sept 21cool_peach100% (2)

- How To Choose The Best Funding Path For Your Startup - Lighter CapitalDocument17 pagesHow To Choose The Best Funding Path For Your Startup - Lighter Capitalyousef0% (1)

- Road Traffic Signs Pavement Markings - v2 PDFDocument43 pagesRoad Traffic Signs Pavement Markings - v2 PDFDante Renegado50% (2)

- Bir Ruling Da 081 03Document2 pagesBir Ruling Da 081 03CzarPaguio100% (1)

- Article 1181 Obi DigestDocument9 pagesArticle 1181 Obi DigestsakuraPas encore d'évaluation

- Manual of BankDocument518 pagesManual of Banksadhuyadav100% (3)

- Fortuitous Event Case - OBLICONDocument43 pagesFortuitous Event Case - OBLICONGe LatoPas encore d'évaluation

- Materials For How To Handle BIR Audit Common Issues - 2021 Sept 21Document71 pagesMaterials For How To Handle BIR Audit Common Issues - 2021 Sept 21cool_peach100% (1)

- Florention vs. EscarnacionDocument2 pagesFlorention vs. EscarnacionRed-gelo Matuts AgbayaniPas encore d'évaluation

- RCBC vs. CA Insurance Proceeds DisputeDocument11 pagesRCBC vs. CA Insurance Proceeds Disputechelsimaine100% (1)

- 2016 PreBar Notes in Constitutional Law2Document67 pages2016 PreBar Notes in Constitutional Law2RmLyn MclnaoPas encore d'évaluation

- ManagementLetter - Possible PointsDocument103 pagesManagementLetter - Possible Pointsaian joseph100% (3)

- CALTEX Vs IAC CASE DIGESTDocument5 pagesCALTEX Vs IAC CASE DIGESTKazumi ShioriPas encore d'évaluation

- UnderwritingDocument10 pagesUnderwritingAslam AnsariPas encore d'évaluation

- Domitorio v. Fernandez 72 SCRA 388 1976Document2 pagesDomitorio v. Fernandez 72 SCRA 388 1976Ayanna Noelle VillanuevaPas encore d'évaluation

- Adorable vs. CADocument1 pageAdorable vs. CAphoebe apayyoPas encore d'évaluation

- The Concept of Debt Recovery ManagementDocument3 pagesThe Concept of Debt Recovery ManagementgharmabasPas encore d'évaluation

- Script For Teaching DemoDocument10 pagesScript For Teaching DemoIris Cadet MacaspacPas encore d'évaluation

- RODOLFO G. CRUZ and ESPERANZA IBIAS, Petitioners, - ATTY. DELFIN GRUSPE, RespondentDocument9 pagesRODOLFO G. CRUZ and ESPERANZA IBIAS, Petitioners, - ATTY. DELFIN GRUSPE, RespondentReyna RemultaPas encore d'évaluation

- Andamo Vs IACDocument6 pagesAndamo Vs IACArmen MagbitangPas encore d'évaluation

- Abella v. Francisco, 55 Phil. 447 (1931)Document2 pagesAbella v. Francisco, 55 Phil. 447 (1931)Sei CortezPas encore d'évaluation

- February 6, 2013 Winnieclaire: Posted On byDocument9 pagesFebruary 6, 2013 Winnieclaire: Posted On bySam LagoPas encore d'évaluation

- Ponce de Leon v. Santiago Syjuco Inc.20170309-898-1ifyr63Document15 pagesPonce de Leon v. Santiago Syjuco Inc.20170309-898-1ifyr63Roseanne MateoPas encore d'évaluation

- Oracle Banking Platform (OBP) Sales SpecialistDocument6 pagesOracle Banking Platform (OBP) Sales SpecialistMohammed AkanPas encore d'évaluation

- CrimcasesDocument20 pagesCrimcasesPat P. MontePas encore d'évaluation

- Oblicon-DBP Vs CADocument16 pagesOblicon-DBP Vs CASuiPas encore d'évaluation

- Sss vs. Moonwalk Development & Housing CorporationDocument15 pagesSss vs. Moonwalk Development & Housing CorporationAngelo Raphael B. DelmundoPas encore d'évaluation

- OBLIGATIONS AND CONTRACTSDocument715 pagesOBLIGATIONS AND CONTRACTSShalini KristyPas encore d'évaluation

- ALTO Surety vs Guerrero Indemnity Agreement UpheldDocument1 pageALTO Surety vs Guerrero Indemnity Agreement UpheldAnonymous eNHo872Pas encore d'évaluation

- Arrieta v NARIC Breach of Contract for Failure to Open Letter of CreditDocument2 pagesArrieta v NARIC Breach of Contract for Failure to Open Letter of CreditTryzz dela MercedPas encore d'évaluation

- Consti Law II Mid-Term Review 2014Document2 pagesConsti Law II Mid-Term Review 2014Audrey MartinPas encore d'évaluation

- Gan Tion vs. Court of Appeals, 28 SCRA 235 No. L-22490, May 21, 1969Document1 pageGan Tion vs. Court of Appeals, 28 SCRA 235 No. L-22490, May 21, 1969Jocelyn Yemyem Mantilla VelosoPas encore d'évaluation

- Land Ownership UpheldDocument2 pagesLand Ownership UpheldDanielle DacuanPas encore d'évaluation

- Development Bank of The Philippines Vs CADocument1 pageDevelopment Bank of The Philippines Vs CAdruglordjfcPas encore d'évaluation

- So V Food Fest LandDocument3 pagesSo V Food Fest LandFranz BiagPas encore d'évaluation

- Pichel Vs AlonzoDocument7 pagesPichel Vs Alonzobrida athenaPas encore d'évaluation

- Cembrano vs. City of ButuanDocument1 pageCembrano vs. City of ButuanGil Emmanuel BancudPas encore d'évaluation

- Gonzales V Heirs of Thomas 314 SCRA 585 (1999)Document2 pagesGonzales V Heirs of Thomas 314 SCRA 585 (1999)Korinna Cardona100% (1)

- TMAP - DOF-BLGF Policy UpdatesDocument35 pagesTMAP - DOF-BLGF Policy UpdatesPena Tn100% (1)

- Mondragon Vs SolaDocument1 pageMondragon Vs SolaJuris Renier MendozaPas encore d'évaluation

- People V BaluyotDocument4 pagesPeople V BaluyotMhaliPas encore d'évaluation

- CHAPTER 3 (Arts. 1356-1358)Document3 pagesCHAPTER 3 (Arts. 1356-1358)Chey DumlaoPas encore d'évaluation

- Carbonell v. PoncioDocument1 pageCarbonell v. PoncioSabritoPas encore d'évaluation

- Siguan vs. LimDocument2 pagesSiguan vs. LimDongkae100% (1)

- Laguna vs. Manabat: FactsDocument2 pagesLaguna vs. Manabat: Factsrach casimPas encore d'évaluation

- Edres - Parks vs. Province of TarlacDocument1 pageEdres - Parks vs. Province of TarlacDerek JamzyPas encore d'évaluation

- Supreme Court rules property part of deceased estateDocument6 pagesSupreme Court rules property part of deceased estateAngelina Villaver ReojaPas encore d'évaluation

- New Nri Poa For IdbiDocument3 pagesNew Nri Poa For Idbihameed05100% (1)

- Contract Dispute Over Chattel Mortgage AffirmedDocument2 pagesContract Dispute Over Chattel Mortgage AffirmedKimberly Claire CaoilePas encore d'évaluation

- Agcaoili V GSISDocument1 pageAgcaoili V GSISJudy RiveraPas encore d'évaluation

- Juan Nakpil & Sons Vs CA 144 SCRA 597 (1986)Document1 pageJuan Nakpil & Sons Vs CA 144 SCRA 597 (1986)Benitez GheroldPas encore d'évaluation

- Romero vs. Ca ObliconDocument2 pagesRomero vs. Ca Oblicongrego centillasPas encore d'évaluation

- Criminal LawDocument21 pagesCriminal LawDee WhyPas encore d'évaluation

- Dumaual - Crim Rev DigestsDocument18 pagesDumaual - Crim Rev DigestsJanjan DumaualPas encore d'évaluation

- Villanueva Vs CA 294 SCRADocument5 pagesVillanueva Vs CA 294 SCRAPatrick Marz AvelinPas encore d'évaluation

- Obligations and Contract Assignment No.4 - Felibeth D. LingaDocument7 pagesObligations and Contract Assignment No.4 - Felibeth D. LingaFELIBETH LINGAPas encore d'évaluation

- 19 Casino JR V CaDocument11 pages19 Casino JR V CaPeachChioPas encore d'évaluation

- Spouses Dela Cruz vs. Concepcion G.R. No. 172825 October 11, 2012 FactsDocument1 pageSpouses Dela Cruz vs. Concepcion G.R. No. 172825 October 11, 2012 Factscarol annePas encore d'évaluation

- Parol Evidence Rule Bars Changing Loan Maturity DateDocument1 pageParol Evidence Rule Bars Changing Loan Maturity DateSzsPas encore d'évaluation

- 4.cruz v. Gruspe - DigestDocument2 pages4.cruz v. Gruspe - DigestMarichu Castillo HernandezPas encore d'évaluation

- Romero vs. Ca G.R. No. 107207 November 23, 1995Document2 pagesRomero vs. Ca G.R. No. 107207 November 23, 1995Jeff Cacayurin TalattadPas encore d'évaluation

- Garcia 417 Scra 292Document12 pagesGarcia 417 Scra 292Mp CasPas encore d'évaluation

- Jacinto Vs Kaparaz - G.R. No. 81158 May 22, 1992Document1 pageJacinto Vs Kaparaz - G.R. No. 81158 May 22, 1992Renz MacionPas encore d'évaluation

- LG Foods Vs AgraviadorDocument2 pagesLG Foods Vs AgraviadorPaula GasparPas encore d'évaluation

- 46-Valdellonv TengcoDocument3 pages46-Valdellonv TengcoBeeya EchauzPas encore d'évaluation

- Supreme Court of the Philippines rules no obligation for Central BankDocument2 pagesSupreme Court of the Philippines rules no obligation for Central BankSheryl CortesPas encore d'évaluation

- Heirs of Bacus VDocument5 pagesHeirs of Bacus VNeil Aubrey GamidoPas encore d'évaluation

- Government Seeks Payment for Lost Firearm Under BondDocument25 pagesGovernment Seeks Payment for Lost Firearm Under BondJaninePas encore d'évaluation

- Song Fo and Wellex CaseDocument5 pagesSong Fo and Wellex Casemaica_prudentePas encore d'évaluation

- UNITED STATES v. LUCIANO BARBERAN G.R. No. L-5790 December 16, 1910 PDFDocument3 pagesUNITED STATES v. LUCIANO BARBERAN G.R. No. L-5790 December 16, 1910 PDFZack SeiferPas encore d'évaluation

- Jaucian Vs Querol.Document2 pagesJaucian Vs Querol.Stephanie Gaile BermudezPas encore d'évaluation

- Vermen Realty vs. CA, GR 101762, July 6, 1993Document4 pagesVermen Realty vs. CA, GR 101762, July 6, 1993Fides DamascoPas encore d'évaluation

- Laperal, Jr. v. Katigbak, G.R. No. L-16991, (March 31, 1964)Document4 pagesLaperal, Jr. v. Katigbak, G.R. No. L-16991, (March 31, 1964)Alan Jay CariñoPas encore d'évaluation

- 15 SSS v. Moonwalk DevtDocument6 pages15 SSS v. Moonwalk DevtRobert Jayson UyPas encore d'évaluation

- RMO No. 20-07Document4 pagesRMO No. 20-07cool_peachPas encore d'évaluation

- Revenue Regulations No. 04-12: Abatement or Cancellation of Internal Revenue Tax LiabilitiesDocument3 pagesRevenue Regulations No. 04-12: Abatement or Cancellation of Internal Revenue Tax Liabilitiescool_peachPas encore d'évaluation

- Revenue Memorandum Circular No. 002-08: January 4, 2008Document4 pagesRevenue Memorandum Circular No. 002-08: January 4, 2008cool_peachPas encore d'évaluation

- Annex B - 0621-DA - RR 4-2019Document1 pageAnnex B - 0621-DA - RR 4-2019cool_peachPas encore d'évaluation

- Annex C - RR 4-2019Document1 pageAnnex C - RR 4-2019James Salviejo PinedaPas encore d'évaluation

- Annex B - 0621-DA - RR 4-2019Document1 pageAnnex B - 0621-DA - RR 4-2019cool_peachPas encore d'évaluation

- RR No. 4-2019Document7 pagesRR No. 4-2019donsPas encore d'évaluation

- RMO No. 004-16Document10 pagesRMO No. 004-16cool_peachPas encore d'évaluation

- DT - RMC 30-2019Document2 pagesDT - RMC 30-2019Miming BudoyPas encore d'évaluation

- "4" Amnesty On: Tax De!Inqllencies IlllDocument2 pages"4" Amnesty On: Tax De!Inqllencies IlllRonald Allan Valdez Miranda Jr.Pas encore d'évaluation

- Annex C - RR 4-2019Document1 pageAnnex C - RR 4-2019James Salviejo PinedaPas encore d'évaluation

- 218502-2019-Amendments To Rule 5.8.2 of The Investment20190402-5466-1mss8w PDFDocument1 page218502-2019-Amendments To Rule 5.8.2 of The Investment20190402-5466-1mss8w PDFcool_peachPas encore d'évaluation

- SGV & Co.: BIR RULING (DA-224-07)Document3 pagesSGV & Co.: BIR RULING (DA-224-07)cool_peachPas encore d'évaluation

- FDA - Clinical Trial Guidelines Consultation PDFDocument31 pagesFDA - Clinical Trial Guidelines Consultation PDFCzarPaguioPas encore d'évaluation

- CIR v. Transnational Plans, Inc. (CTA EB Case Nos. 1337 & 1339)Document71 pagesCIR v. Transnational Plans, Inc. (CTA EB Case Nos. 1337 & 1339)cool_peachPas encore d'évaluation

- c1030 PDFDocument114 pagesc1030 PDFcool_peachPas encore d'évaluation

- 218502-2019-Amendments To Rule 5.8.2 of The Investment20190402-5466-1mss8w PDFDocument1 page218502-2019-Amendments To Rule 5.8.2 of The Investment20190402-5466-1mss8w PDFcool_peachPas encore d'évaluation

- Stock Corporation General Instructions:: General Information Sheet (Gis)Document11 pagesStock Corporation General Instructions:: General Information Sheet (Gis)Kleoffe Guarin100% (1)

- FDA - Clinical Trial Guidelines Consultation PDFDocument31 pagesFDA - Clinical Trial Guidelines Consultation PDFCzarPaguioPas encore d'évaluation

- Manual of Regulations On Foreign Exchange TransactionsDocument104 pagesManual of Regulations On Foreign Exchange TransactionsmisakiPas encore d'évaluation

- ITAD BIR Ruling No. 311-14Document9 pagesITAD BIR Ruling No. 311-14cool_peachPas encore d'évaluation

- Palting v. San Jose PetroleumDocument19 pagesPalting v. San Jose Petroleumcool_peach0% (1)

- BIR Ruling (DA - (C-312) 766-09)Document5 pagesBIR Ruling (DA - (C-312) 766-09)cool_peachPas encore d'évaluation

- Implementing Rules and Regulations of RA 7042Document28 pagesImplementing Rules and Regulations of RA 7042cool_peachPas encore d'évaluation

- Bir Ruling (Da 146 04)Document4 pagesBir Ruling (Da 146 04)cool_peachPas encore d'évaluation

- Housing Finance PDFDocument5 pagesHousing Finance PDFAlisha SharmaPas encore d'évaluation

- G2 - Analysis of The Consumer Protection Act, 2012Document34 pagesG2 - Analysis of The Consumer Protection Act, 2012LEENIE MUNAHPas encore d'évaluation

- Sss Loan Form 2013Document3 pagesSss Loan Form 2013John Carlo M. SamaritaPas encore d'évaluation

- Breakeven analysis and leverage measures for multiple companiesDocument6 pagesBreakeven analysis and leverage measures for multiple companiesYaseen SaleemPas encore d'évaluation

- Financial Inclusion As Tool For Combating Poverty: Governor, Bangladesh Bank EmailDocument8 pagesFinancial Inclusion As Tool For Combating Poverty: Governor, Bangladesh Bank EmailMakame Mahmud DiptaPas encore d'évaluation

- Asia Academic School, IncDocument3 pagesAsia Academic School, IncZahra Margrette SchuckPas encore d'évaluation

- Scholarship Application FormDocument17 pagesScholarship Application FormDuncoh DunPas encore d'évaluation

- DBP v. Confesor G.R. No. 48889Document1 pageDBP v. Confesor G.R. No. 48889Rizchelle Sampang-ManaogPas encore d'évaluation

- Vetted Prospectus - Saiham Cotton Mills LTDDocument115 pagesVetted Prospectus - Saiham Cotton Mills LTDimranhvcPas encore d'évaluation

- Lee Vs SimandoDocument10 pagesLee Vs SimandoAJ SantosPas encore d'évaluation

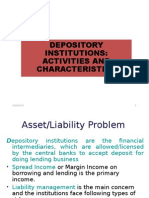

- Depository Institutions: Activities and CharacteristicsDocument15 pagesDepository Institutions: Activities and Characteristicschhassan7Pas encore d'évaluation

- Consumer Handbook On Adjustable Rate MortgagesDocument21 pagesConsumer Handbook On Adjustable Rate MortgagesSajan RajagopalPas encore d'évaluation

- Book - International Financial Institutions PDFDocument28 pagesBook - International Financial Institutions PDFasadPas encore d'évaluation

- Metro Board of Directors Meeting April 2020Document19 pagesMetro Board of Directors Meeting April 2020Metro Los AngelesPas encore d'évaluation

- Sumit KishoreDocument24 pagesSumit KishoreSumitPas encore d'évaluation

- Sample Study Materials For Sebi Grade A 2020 PDFDocument36 pagesSample Study Materials For Sebi Grade A 2020 PDFupendarPas encore d'évaluation

- In-School Deferment Request: XXX-XX-6651 Minh-Tam L Pham 2213 Stratford DR Milpitas, CA, 950350000 408 813-5031Document4 pagesIn-School Deferment Request: XXX-XX-6651 Minh-Tam L Pham 2213 Stratford DR Milpitas, CA, 950350000 408 813-5031minphamtasticPas encore d'évaluation

- An Evaluation of The Services Quality of Standard Bank Limited, Pabna BranchDocument59 pagesAn Evaluation of The Services Quality of Standard Bank Limited, Pabna BranchNafiz FahimPas encore d'évaluation