Académique Documents

Professionnel Documents

Culture Documents

Financial Results, Limited Review Report For December 31, 2015 (Result)

Transféré par

Shyam SunderDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Results, Limited Review Report For December 31, 2015 (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

c.lpolfuldeniityNUn6e.

u69l2rclgs2Plcoo*2

3 Prcnqr/LGn )non optr

ionsb

in.nc con rnd e:.epriond ems (r,)

5.

Prcnq, Losn ) bdore

Profltlrrrossl.lafr*aian...osrburbdoreEx.eptona

Prcnt(+)/ Los3l)nom

r.

13.

Nd proft 1r)rLoss (.)

odi yad

6nanc con 3 Excepriona

oidhiry

ron

riesaherbr

leio

Nd Prca(r)i Los31)rorrhe p*iod

lf r4

km13r4)

nemsi5.6)

(Netsa es/ lncoms rrom opecr ois)

sesmertR6urrs (Prointl/Loss(

erore rx and linme cod)

robr Prornt)/Lossl.) Beforc rax

lseqme asses

seqmenr

Lab

1-l

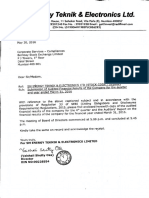

I(S. Rao &

Co.

CHARIERED ACCOUNTANTS

TO

THE BOARD OF DIRECTORS

KEERTHI INDUSTRIES LIIVITED

HYDERABAD.

REVIEW REPORT ON FINANCIAL INFORMATION OF KEERTHI INDUSTRIES LIMITED FOR

THE QUARTER AND NINE MONTHS ENDED 3I't DECEMBER 2015 TO BE SUBMITTED TO

STOCK EXCHANGES

1. We heve reviewed the accompanying statement of uneudited financial results of KEERTHI

INDUSTRIES LIMITED, Plot No.40,lDA,Balanagar, ltydeEbad - 500 037,Telangana ("the

company') for the Quarter and Nine months ended 31"' DECEMBER, 20'15 being

submitted by the Company pursuant to the requirements of Clause 41 of the Listing

Agreement with the Stock Exchanges except for the disclosures regarding 'Public

Shareholding' and 'Promoter Group Shareholding' wl'rich have been traced from the

disclosures made by the management and have not been reviewed by us. This statement

is the responsibility of the Company's Management aiC has been approved by the Board

of Directors. Our responsibility is tq issue a report on these financial statements based on

our review. .

Scope of Review-

2.

!\'e contiucied our review in accoidance u,i!h the StanCard orr Revie\r,i Engagement (SRE)

2410, "Review of- interim Financial lnformation perfojhed by the lndependent Auditor oi

the Entity" issued by the lnstitute of Chartered Accountants of India. This standard

requires that we plan and perform the review to obtain oderate assurance as to whether

the financial statements are free of malerial misstatements. A review is limited primarily to

inquiries of company personnel and analytical procedures applied to financial data and

lhus provides less assurdnce than audit. We have noi'[erformed an audit and accordingly,

we do not express an audit opirrion.

Conclusion

3.

Based on our rc.view condulxed as above, ngthin h^s come to our attention that causes

us io believe th'trt tl're a.cornh3 ,,:ng siatj,yrent of uj:oubiie<l financial resulls prepared in

accordance lviih appiicable accouning standards specified unCer section 133 of the

Companies Aci 2013 read with Fiule 7 cf Companies (Accounts) Rules 2014 and oiher

recognized accounting praci.ice.i and policies has not disclosed the informaiion required to

be disclosed in terms of Regulaiion 33 of the SEbl(Listing Obligations and Disclosure

Requirements) Regulations,2ol5, including the manner in which it is to be disclosed, or

that it ccniaini anyinateiial misstdiement.

'',,\l

Place :Hyderabad

Dale

: 12.02.2016

ljor K.S.RAO & CO.,

Ci'iarteied Accountants

.. F'.ir Regn. N0.0031 09S^

r

P, GOVAR

Partner

L4embership No. 029193

6 a6a, 66i6p- 1,.o". apa,l- e r. rLn [,4d'.1, ro o' . -.oe .o"o ' 0 08.

o1o-". or'b:233-000 d.a. 0;0 3)-000- e-.a f!ooa o" c. .r

. 46.

Vous aimerez peut-être aussi

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Revised Financial Results For March 31, 2016 (Result)Document8 pagesRevised Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Document11 pagesStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Company Update)Document6 pagesFinancial Results & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Corrected Financial Result For Dec 31, 2015 (Company Update)Document5 pagesCorrected Financial Result For Dec 31, 2015 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document5 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results - Dec 2022Document10 pagesFinancial Results - Dec 2022mehtaarian1Pas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Document13 pagesStandalone & Consolidated Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report, Results Press Release For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report, Results Press Release For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Applied Drilling Circulation Systems: Hydraulics, Calculations and ModelsD'EverandApplied Drilling Circulation Systems: Hydraulics, Calculations and ModelsÉvaluation : 5 sur 5 étoiles5/5 (4)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Assignment Ishan SharmaDocument8 pagesAssignment Ishan SharmaIshan SharmaPas encore d'évaluation

- Advantage and Disadvantages of Business OrganizationDocument3 pagesAdvantage and Disadvantages of Business OrganizationJustine VeralloPas encore d'évaluation

- The U.S.-China Trade War and Options For TaiwanDocument5 pagesThe U.S.-China Trade War and Options For TaiwanThe Wilson CenterPas encore d'évaluation

- 2016 QP Paper 1 PDFDocument16 pages2016 QP Paper 1 PDFAfra SadafPas encore d'évaluation

- ROSHNI RAHIM - Project NEWDocument37 pagesROSHNI RAHIM - Project NEWAsif HashimPas encore d'évaluation

- Competency Framework SMA-FINALDocument39 pagesCompetency Framework SMA-FINALAbubakar IsmailPas encore d'évaluation

- Marketing Plan For Ready-Made Canned Foo PDFDocument10 pagesMarketing Plan For Ready-Made Canned Foo PDFHussain0% (1)

- Far-1 Revaluation JE 2Document2 pagesFar-1 Revaluation JE 2Janie HookePas encore d'évaluation

- Worksheet - Rectification of ErrorsDocument3 pagesWorksheet - Rectification of ErrorsRajni Sinha VermaPas encore d'évaluation

- Lecture Notes - 2 - The Hospitality and Tourist Market and SegmentationDocument5 pagesLecture Notes - 2 - The Hospitality and Tourist Market and SegmentationDaryl VenturaPas encore d'évaluation

- Government of Karnataka's Chief Minister's Self-Employment Program DetailsDocument4 pagesGovernment of Karnataka's Chief Minister's Self-Employment Program DetailsHajaratali AGPas encore d'évaluation

- Central Bank of SudanDocument12 pagesCentral Bank of SudanYasmin AhmedPas encore d'évaluation

- Homework 5 - Gabriella Caryn Nanda - 1906285320Document9 pagesHomework 5 - Gabriella Caryn Nanda - 1906285320Cyril HadrianPas encore d'évaluation

- Airbus A3XX PowerpointDocument31 pagesAirbus A3XX PowerpointRashidPas encore d'évaluation

- Havell's Group Company ProfileDocument94 pagesHavell's Group Company ProfileMohit RawatPas encore d'évaluation

- BAIN REPORT Global Private Equity Report 2017Document76 pagesBAIN REPORT Global Private Equity Report 2017baashii4Pas encore d'évaluation

- Keputusan Lokasi Fasilitas Dalam Jaringan DistribusiDocument44 pagesKeputusan Lokasi Fasilitas Dalam Jaringan DistribusiEman Muhammad AriefPas encore d'évaluation

- MEFADocument4 pagesMEFABangi Sunil KumarPas encore d'évaluation

- Children's Book Financials for Year Ended May 1997Document3 pagesChildren's Book Financials for Year Ended May 1997fazatiaPas encore d'évaluation

- Insead AmpDocument23 pagesInsead AmpJasbir S RyaitPas encore d'évaluation

- NikeDocument33 pagesNikeRocking Heartbroker DebPas encore d'évaluation

- Research Project Report of Nidhi SoniDocument104 pagesResearch Project Report of Nidhi SoniVipin VermaPas encore d'évaluation

- The Phuket Beach CaseDocument4 pagesThe Phuket Beach Casepeilin tongPas encore d'évaluation

- S.amutha A Study On Inventory Management in Izon Technologies Ramco Cement LimitedDocument30 pagesS.amutha A Study On Inventory Management in Izon Technologies Ramco Cement LimitedeswariPas encore d'évaluation

- 2 - OFW Reintegration Program Generic PresentationDocument19 pages2 - OFW Reintegration Program Generic PresentationReintegration CagayanPas encore d'évaluation

- Unit 2 Income From SalariesDocument21 pagesUnit 2 Income From SalariesShreya SilPas encore d'évaluation

- Ms-4 Combined BookDocument380 pagesMs-4 Combined Bookanandjaymishra100% (1)

- Sip ReportDocument72 pagesSip ReporthemanthreddyPas encore d'évaluation

- Mahindra & Mahindra Financial Services Limited Corporate Social Responsibility (CSR) PolicyDocument5 pagesMahindra & Mahindra Financial Services Limited Corporate Social Responsibility (CSR) PolicyVishwesh KoundilyaPas encore d'évaluation

- Case Study On Customary Land in PNGDocument349 pagesCase Study On Customary Land in PNGPeterson MathiusPas encore d'évaluation