Académique Documents

Professionnel Documents

Culture Documents

REPORT

Transféré par

Carmel ThereseCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

REPORT

Transféré par

Carmel ThereseDroits d'auteur :

Formats disponibles

MeziMedia.

On July 30, 2007, the Company completed the acquisition of MeziMedia, a leading operator

of U.S. comparison shopping websites. Under the terms of the agreement, the Company acquired all

outstanding equity interests in MeziMedia for initial cash consideration of $96.3 million, net of cash

acquired of $18.9 million, plus approximately $600,000 in transaction costs, resulting in total initial cash

consideration of $96.9 million. In addition to the initial cash consideration, the shareholders of MeziMedia

may be entitled to additional cash consideration based on the achievement by MeziMedia of certain

revenue and earnings performance targets from the closing date through December 31, 2009. Total cash

consideration, which includes the $96.9 million initial cash consideration, will range between $96.9 million

and $348.7 million, depending on whether such performance targets are met. Any contingent

consideration paid after the closing date will be accounted for as additional purchase price and added to

goodwill at the time the Company is able to determine the amount of such consideration.

MeziMedia provides the Company with additional opportunities to monetize online traffic and expand

its overall comparison shopping presence in the United States, China and Japan. This factor contributed

to a purchase price in excess of the fair value of MeziMedia's net tangible and intangible assets acquired,

and, as a result, the Company has recorded goodwill in connection with this transaction. The results of

MeziMedia's operations are included in the Company's consolidated financial statements beginning on

the date of acquisition.

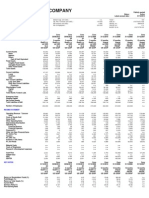

The preliminary allocation of the purchase price to the assets acquired and liabilities assumed based

on the estimated fair values, and the preliminary useful lives, in years, assigned to intangible assets were

as follows (in thousands):

Cash acquired

Other tangible assets acquired

18,944

9,540

Weighted-Average

Useful life

Amortizable intangible assets:

Customer relationships

2,100

Trademarks, trade names and domain names

10,400

Developed technologies

26,700

Covenants not to compete

7,500

Total identifiable intangible assets

Goodwill

Total assets acquired

46,700

57,766

132, 950

Liabilities assumed

(17,100)

Total

115,850

13

The intangible assets were valued using a combination of valuation methods, including future

discounted cash flows expected to be generated from the assets, comparison of market prices for other

similar assets, and the cost of replacing the assets. The Company will amortize each intangible asset on

a straight-line basis over the asset's useful life as this method approximates the pattern in which the

economic benefits of the assets are consumed. The identifiable intangible assets and goodwill resulting

from this acquisition are based upon preliminary valuation assumptions and may change based on final

analysis. Any such change may result in reclassification between identifiable intangible assets and

goodwill. All of the goodwill resulting from this acquisition is tax deductible.

Vous aimerez peut-être aussi

- Pas 32 Pfrs 9 Part 2Document8 pagesPas 32 Pfrs 9 Part 2Carmel Therese100% (1)

- Job Order: Please Undertake The Following ServicesDocument3 pagesJob Order: Please Undertake The Following ServicesCarmel TheresePas encore d'évaluation

- Pas 40Document5 pagesPas 40Carmel Therese100% (1)

- 518 Assignment FinalDocument12 pages518 Assignment FinalCarmel TheresePas encore d'évaluation

- Setting of Little Match GirlDocument2 pagesSetting of Little Match GirlCarmel TheresePas encore d'évaluation

- Rationale For The Use of International Accounting StandardsDocument8 pagesRationale For The Use of International Accounting StandardsCarmel TheresePas encore d'évaluation

- Tarunga Sayaw Megzzai Ha Hahaha Derikuyo!Document1 pageTarunga Sayaw Megzzai Ha Hahaha Derikuyo!Carmel TheresePas encore d'évaluation

- The ProcessDocument43 pagesThe ProcessCarmel TheresePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Forecasting FCFF & FCFEDocument26 pagesForecasting FCFF & FCFEAstrid TanPas encore d'évaluation

- Eric Khrom of Khrom Capital 2012 Q1 LetterDocument4 pagesEric Khrom of Khrom Capital 2012 Q1 Letterallaboutvalue100% (1)

- 206 PFP MCQDocument18 pages206 PFP MCQPratik DixitPas encore d'évaluation

- Pre BoardDocument16 pagesPre BoardPatrick WaltersPas encore d'évaluation

- EngagementDocument47 pagesEngagementJean CabigaoPas encore d'évaluation

- Advanced Financial Accounting 3 AnswersDocument5 pagesAdvanced Financial Accounting 3 AnswersJayagokul SaravananPas encore d'évaluation

- Assignment Solution Weekend Nov18Document6 pagesAssignment Solution Weekend Nov18Lp SaiPas encore d'évaluation

- Chapter 17 - Working Capital ManagementDocument34 pagesChapter 17 - Working Capital Managementcharry anonuevoPas encore d'évaluation

- Analisis Pengaruh Free Cash Flow Dan Financial Good Corporate Governance Sebagai Variabel ModerasiDocument15 pagesAnalisis Pengaruh Free Cash Flow Dan Financial Good Corporate Governance Sebagai Variabel Moderasirevita agustinaPas encore d'évaluation

- Binus Financial Analyst Academy CFA Program Level 1 Semester 2 Batch 34 2018 V4eDocument5 pagesBinus Financial Analyst Academy CFA Program Level 1 Semester 2 Batch 34 2018 V4eBudiman SnowiePas encore d'évaluation

- Working Capital Management in BhelDocument86 pagesWorking Capital Management in BhelDipesh Gandhi100% (1)

- ResaerchDocument3 pagesResaerchFarhad ChakariPas encore d'évaluation

- CS 280323 Prog Bil 2022 KME EnglDocument14 pagesCS 280323 Prog Bil 2022 KME EnglChipasha MwelwaPas encore d'évaluation

- Wealth-Insight - Jul 2023Document106 pagesWealth-Insight - Jul 2023Dhanunjai Guptha100% (1)

- Monthly BaronDocument55 pagesMonthly BaronEstate BaronPas encore d'évaluation

- Final Examination in Management Strategic Business Analysis Name: Date: Score: Course/Year/Section: Student #Document2 pagesFinal Examination in Management Strategic Business Analysis Name: Date: Score: Course/Year/Section: Student #Jessa Mae LavadoPas encore d'évaluation

- Question Paper: Bms College of EngineeringDocument2 pagesQuestion Paper: Bms College of EngineeringShivaPas encore d'évaluation

- Balance Sheet Income StatementDocument50 pagesBalance Sheet Income Statementgurbaxeesh0% (1)

- Alerion Annual Report 2022Document220 pagesAlerion Annual Report 2022Muhammad Uzair PanhwarPas encore d'évaluation

- Contract Costing PPT FinalDocument15 pagesContract Costing PPT FinalShivamPas encore d'évaluation

- GM Financial ReportDocument2 pagesGM Financial ReportLiliana VarricchioPas encore d'évaluation

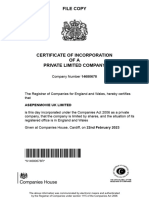

- Asepenmovie Uk LimitedDocument7 pagesAsepenmovie Uk LimitedMed AnouarPas encore d'évaluation

- XdocmulationDocument4 pagesXdocmulationKuthe Prashant GajananPas encore d'évaluation

- Introduction To InvestmentsDocument16 pagesIntroduction To InvestmentsWilyn Grace AljasPas encore d'évaluation

- FINANCIAL MARKETS AND SERVICES Question BankDocument2 pagesFINANCIAL MARKETS AND SERVICES Question BankJackson DiasPas encore d'évaluation

- TB Chapter02Document54 pagesTB Chapter02Dan Andrei BongoPas encore d'évaluation

- CA Inter Taxation A MTP 2 May 23Document13 pagesCA Inter Taxation A MTP 2 May 23olivegreen52Pas encore d'évaluation

- SSRN Id3550293 PDFDocument143 pagesSSRN Id3550293 PDFKojiro Fuuma100% (1)

- Chapter 1 Notes Far210Document23 pagesChapter 1 Notes Far210Muzzammil Azfar Merzuki100% (1)