Académique Documents

Professionnel Documents

Culture Documents

2951041

Transféré par

Emre SatıcıCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2951041

Transféré par

Emre SatıcıDroits d'auteur :

Formats disponibles

Economic History Association

In the Absence of Domestic Currency: Debased European Coinage in the Seventeenth-Century

Ottoman Empire

Author(s): evket Pamuk

Source: The Journal of Economic History, Vol. 57, No. 2 (Jun., 1997), pp. 345-366

Published by: Cambridge University Press on behalf of the Economic History Association

Stable URL: http://www.jstor.org/stable/2951041

Accessed: 08-02-2016 21:18 UTC

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at http://www.jstor.org/page/

info/about/policies/terms.jsp

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content

in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship.

For more information about JSTOR, please contact support@jstor.org.

Economic History Association and Cambridge University Press are collaborating with JSTOR to digitize, preserve and extend

access to The Journal of Economic History.

http://www.jstor.org

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

In the Absence of Domestic Currency.

Debased European Coinage in the

Seventeenth-CenturyOttomanEmpire

~EVKETPAMUK

The Near East was subject to many of the same fiscal and monetaryforces that

affectedEuropeand partsof Asia duringthe earlymodem era. For almost two decades duringthe seventeenthcentury,debasedEuropeancoinage circulatedwidely

in Ottomanmarketsat valuesfarabovetheirspecie content.This articleprovidesan

explanationin tenmsof Ottomanfiscal deficits,currencyinstability,currencysubstitution,anddeclinein local silvermines all of which led to the closureof mints. The

reasons behind the conspicuousabsence of Ottomancopper coinage duringthis

period are also explored.

Foralmost two decades duringthe middle of the seventeenthcentury,

French,Italian,andDutchmerchantsmintedin southernFrance,northern Italy, and elsewhere in Europe large amountsof Europeancoinage

whose specie contenthad been reducedto mostly copperwith a thin silver

coating. These coins were then transportedacross the Mediterraneanand

used as paymentfor Ottomangoods or even sold wholesale to local merchantsandmoneychangers.

Initiallytheyfetchedpricesfarabovetheirmetal

content,but thesepremiumsdeclinedover time with the increasingvolume

of tradethateventuallyinvolvedhundredsof shipsandclose to 200 million

pieces of coin. The gross revenuesof the Europeanmerchantshave been

estimatedat more thanten million Spanishpieces of eight or somewhere

between six to eight million Venetiangold ducats.

This episode has been describedin detailby at least half a dozen Europeantravelersincludingthe authorsof well-knownvolumessuchas Chevalier Chardin,J. B. Tavernier,andPaul Rycaut.'Publisheddocumentsfrom

the archivesof mints in northernItalyalso confirmthe productionof these

coins.2In addition,the numismaticsliteratureprovidesa detailedinventory

and descriptionof these coins, includingtheir inscriptionsand dates of

The Journal of Economic History, Vol. 57, No. 2 (June 1997). C The Economic History

Association.All rightsreserved.ISSN 0022-0507.

aevketPamukis Professor,Department

of Economics,Bogazi9iUniversity,Bebek,Istanbul80815,

Turkey.

He wouldlike to thankEmreAlper,CihanBilginsoy,MuratCizak9a,HasanErsel,MehmetGen9,

Halil Sahillioglu,OsmanSan, two anonymousrefereesof this JOURNAL,

andJoel Mokyrfor valuable

commentson earlierversions.He is also indebtedto Re?atKasabafor help with sourcematerialsand

TurkanRadofor expertassistancewiththe Latininscriptionson Europeancoinage.Researchsupport

fromthe Academyof Sciencesof Turkeyis gratefullyacknowledged.

'Chardin,Voyages,pp. 7-22; Rycaut,History,pp. 258-68; andTavemier,New Relation,pp. 15-33.

2Hasluck,"LevantineCoinage",pp. 58-59.

345

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

346

Pamuk

Manyof these coins are now availablein numismaticscollecproduction.3

tions throughoutEurope.

ContemporaryEuropeanobserverswere incredulousthatdebasedcoins

couldbe so popularin the marketsof the Levant.Rycautlamentedthatthe

In an article

whatwas happening.4

Turks"hadno wit enoughto understand"

publishedin the earlypartof this century,F. W. Hasluckprovidedthe most

detailedtreatmentof the coins involvedandinsistedthat"theTurkishpublic

refusedto be undeceived."He concludedthat"in all times certainforeign

currencieshave had special vogue among alien, and especially illiterate

nations.... The scandalousexploitationof the Turkishmarketsby the importers of luigini was neitherthe first attemptof its kind nor the last. It

differedfromothersby the scale on whichit was carriedout, by the success

thatattendedit, in spiteof repeatedprotestandexposure,down to the final

abolitionof the traffic,andperhapsby the morethanordinaryshamelessness

Turkeyhave accepted

of those engagedin it."5Writersin twentieth-century

andarguedthatin this "biggestcounterfeitingscheme in

this interpretation

history,"the unscrupulousEuropeanmerchantsrobbedthe unsuspecting

Ottomans.6It is also interestingthatthe Ottomanarchives,which offer extensiverecordson a wide varietyof phenomenaaroundthe empire,have so

far revealedlittle aboutthis episode.7

There are two relatedpuzzles here. The first concernsthe popularityof

the Europeancoins. Attemptsat counterfeitingcoins arenot alwayssuccessful and rarelyat this scale. It was always easy for the local merchantsand

moneychangerswho initiallyacceptedthese coins fromthe Europeanmerchants to assay them, a practiceknown in the Near East for almost two

millennia.Even if the moneychangerswere reluctantto divulge theirtrade

secrets,the silver contentof these coins could not possibly have remained

hiddenfor so manyyears.Clearly,it remainsto be explainedwhy the Ottomanpublicwas willingto acceptthemat ratesfarabovetheirspecie content

at this particulartime.

I will providean explanationfromthe Ottomanside, in termsof the fiscal

andmonetaryconditionsprevailingin the OttomanEmpireat the time. I will

the periodfromthe 1560s

show thatat the easternend of the Mediterranean,

until late in the seventeenthcenturywas at least as turbulentfor state financesandmoneyas it was at the westernend. The Ottomansfaced severe

fiscal pressuresand struggledwith rising military expendituresand the

adverseconsequencesof the silverinflationduringthisperiod.Oneresponse

3Ibid,pp. 68-76.

4Rycaut,History,p. 258.

5Hasluck,"LevantineCoinage,"pp. 59, 63.

6Berkes,TurkiyeIktisatTarihi, vol. 2, pp. 183-91.

7RobertMantranis the firstto drawattentionto the silence of the Ottomanarchiveson this episode.

Mantran,Istanbul,book 2, chap.2 and"Politique,Economieet Monnaie."

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Debased European Coinage in the OttomanEmpire 347

was currencydebasementsthat providedtemporaryfiscal relief but also

addednew momentumto priceincreases.ThemassiveOttomandebasement

of 1585 to 1586 was followed by a periodof wars, rebellions,fiscal crises,

and extremeinstabilityof the silver akSe,the leadingOttomanunit, lasting

until the middleof the seventeenthcentury.8

One importantquestionthese debasementsraise is whetherthe government employedthem as a long-termstrategyfor generatingrevenue.This

questionhas been debatedin some detailin the recentliteratureon the monetaryhistoryof the latemedievalandearlymodemperiods.On the one side,

HarryMiskiminhas arguedthatin fourteenth-andfifteenth-centuryFrance

debasementsreflected,morethananythingelse, the despairof the rulersand

did not help them fiscally.MichaelD. Bordohas questionedthis argument

andin recentcontributionspublishedin this JOURNAL,NathanSussmanand

AkiraMotomurahave arguedthatdebasementswere employedas a rational

and sometimes long-termstrategyfor raising fiscal revenue in fifteenthSpain.In his detailedstudyof the

centuryFranceand seventeenth-century

monetaryhistoryof medievalEurope,PeterSpuffordalso arguesthatcentral

governmentsbenefitedfromdebasementsduringthe fourteenthandfifteenth

centuries.9This articleprovidesevidence from the Ottomandebasements

thatsupportthe latterposition.

I will also show thatthis extendedperiodof monetaryvolatilityresulted

in considerableamountof currencysubstitution:loss of confidencein the

Ottomancurrencyand a shift by the publictowardsEuropeancoinage that

had always circulatedin Ottomanlands.Not coincidentally,this was a period when manyEuropeanstatesandeconomiesalso facedsilvershortages.

The flow of silverfromAmericaandEuropethroughthe NearEasttowards

Asia must have also contributedto this common pattern.When silver

stopped coming to the mints and the Ottomangovernmentwas unableto

acquire additionalsupplies most of the mints were closed down and the

productionof the silver ak!e came to a virtualhalt in the 1640s. It was in

this context that the debased European coinage found widespread

acceptance.This perspectiveis eithermissing altogetheror not adequately

8Twodecadesago, OmerLuitfiBarkanlinkedthesefiscal,economic,andmonetarydifficultiesto the

arrivalof Americansilverandthe PriceRevolutionof the sixteenthcentury.Labelingthe PriceRevolution "a turningpoint" in the historyof the Near East, he arguedthat the price increasesled to the

decline of industryfromwhich the empireneverrecovered.Barkan,"PriceRevolution."Recentresearchhas shown thatBarkan'sclaims aboutthe impactof inflationon the Ottomaneconomywere

of thecausesandconsequencesof the PriceRevolutionin the Ottoman

exaggerated.A reexamination

Empirefalls outsidethe scopeof thepresentarticle,however.A partialcritiqueof Barkanwas provided

by Sundhaussen,"Die Preisrevolution."

9Miskimin,

Money,p. 59; Bordo,"Money";Sussman,"Debasements";

Motomura,"Bestand Worst

of Currencies";

andSpufford,Money,pp. 289-318. CarloCipollahas also underlinedthe fiscal motive

in medievaland earlymodemdebasements.Cipolla,Money,p. 28 and "CurrencyDepreciation."

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

348

Pamuk

consideredin the writingsof contemporaryEuropeanobserversas well as

in more recentinterpretations

based on those accounts.

The second andrelatedpuzzle concernsthe absenceof Ottomancopper

coinage underthese circumstances.For most of the seventeenthcentury,

fiscal pressuresas well as the disappearanceof silver forced the governmentsin Spain,France,Sweden,Poland,Russia,and elsewherein Europe

to place greateremphasison coppercoinage both in orderto raise fiscal

revenueandalso providea mediumof exchange.'0In contrast,the Ottoman

governmentabandonedthe productionnot only of silver but also copper

coinagesome time duringthe secondquarterof the century.The absenceof

coppercoinagein the Ottomancase certainlycontributedto the sharpdifferences between the Europeanand Ottomanexperiencesduringthis period

despitethe apparentsimilarityof fiscalandmonetaryconditions.I will argue

that the governmentwas aware of the opportunitiesprovidedby copper

coinage,but due to a combinationof technologicaland organizationallimitations,it could not pursuethis alternative.

DEBASED COINS IN OTTOMAN MARKETS

It is well knownthatEuropeexperiencedlargetradedeficitstowardsAsia

duringthe sixteenthandseventeenthcenturies.Oftenunableto find a sufficientvolumeof goodsto sell to the marketsin the East,Europeanmerchants

paid the differencewith bullion and coinage importedfromthe Americas.

There are many accountsof Europeanships leaving for the Near East and

Asia loaded with cargoesof silver and silver coinage and, less frequently,

with gold. As a result, large silver coins minted in America and Europe

known as grosso or groschen,the most popularof which was the Spanish

piece of eight, circulatedextensively in Ottomanmarketsand Asia after

1550. A largepartof these coins continuedto move towardsIranandports

on the IndianOcean, however, since the Ottomaneconomy experienced

tradedeficitstowardsthe eastwhile it enjoyedsurplusestowardsthe west."

The episodeto be examinedherealso beganwith the effortsof European

merchantstryingto securecoinagebeforeanothertripto the Levantin 1653.

Fromthatpoint on, however,it unfoldedin a new direction;the tradebalancesbetweenthe westernandeasternends of the Mediterranean

ceased to

be the driving force for the ensuing monetaryflows. Instead,fiscal and

monetaryconditionsin the OttomanEmpireemergedas the primaryexplanationfor what happened,as I shall show.

?0Spooner,

InternationalEconomy,pp. 33-53, 171-96.

11Chaudhuri

relates,for example,how the shipsof the EastIndiaCompanyoccasionallyexperienced

forAsia. Chaudhuri,TradingWorldofAsia,

difficultyin securingsilvercoinagebeforetheirdeparture

p. 135; see also Attman,"Flow";Barrett,"WorldBullion Flows";and Gaastra,"Exports."

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Debased European Coinage in the OttomanEmpire 349

WhenFrenchmerchantscouldnot obtainthe Spanishpieces of eight due

to politicaltensionsbetweenSpainandFrance,theybroughtfromMarseilles

a five-sols piece originallyissued in 1641 for

to the easternMediterranean

Louis XIII. This was an attractivecoin, probablyone of the earliestexamples of milled coins to be seen in the Levant.In additionto serving as a

mediumof exchange,the coin was also used, at leastinitially,as ornamentation by peasantwomenwho couldnot affordthe more expensive silver and

gold pieces. 2

In France12 of these five-sols pieces exchangedfor one gold ecu or one

Spanishpiece of eight.Soon aftertheirarrivalin the Ottomanmarkets,eight

of these coins began to exchangefor one piece of eight.'3 At this rate,the

purchasingpowerof the five-solspiece was not at all small. If an unskilled

constructionworkerin Istanbulwas paidwith these coins, he would receive

approximatelytwo of them for one day's work.'4Given the substantial

differencein theirexchangeratesbetweenthe westernand easternends of

the Mediterranean,

the Frenchmerchantssoon beganto importthe five-sols

pieces in bulk.Aftera numberof years,they also beganto manufactureon

a largescale coins of identicalweightandappearancebutcontainingsmaller

amounts of silver and a largerpercentageof alloy. The Italiansand the

Dutch soon joined the trade.

The methodusedwas to approacha localpotentatein southernFranceor

northernItalywho possessedthe rightof coinageandcontracthim or her for

the use of the seignorialmintin orderto strike,with his knowledge,a large

numberof base coins bearinghis name."5Verysoon, debasedcoins minted

with the namesof the Princessof Trevoux,theprincesof Dombes,Oranges,

Monaco,Masse,Avignon,Genova,andotherswere circulatingin the Ottoman markets.16In his examinationof anotherepisode of tradein debased

coinage, CharlesKindlebergeremphasizesthat this was not an unusual

practicein Europe.Accordingto Kindleberger,

"manystatesin Europewere

interestedin raising seignioragewithin their boundaries,but it was soon

discoveredthat debasedmoney could be takenabroadand exchangedfor

'2Hasluck,"LevantineCoinage,"p. 56.

'3Chardin,Voyages,p. 7; and Hasluck"LevantineCoinage,"p. 56. In the Ottomanmarketsthese

coins were calledsumun(or tumn),which meantone-eighthin Arabic-Ottoman.

The standardak9e

exchanged at 80 to 90 for one piece of eight duringthis period(see Table2 below). The physical

appearanceof these coins may have contributedto but can not entirelyexplainthe higherratethey

fetchedin the Ottomanmarkets,as I will arguebelow. Similarly,the largedifferencesin the exchange

ratesof the five-solspiecebetweenwesternEuropeandthe easternMediterranean

cannot be explained

away by the east-westdifferencesin gold-silverratios.Recentresearchhas shown the differencesin

the gold-silverratiosbetweenthetwo endsof the Mediterranean

rarelyexceeded 10 percentduringthe

sixteenthand seventeenthcenturies.Pamuk,"Money,"tablesA-2, A-5.

'4Thiswagerateis takenfromconstructionaccountbooksin the Ottomanarchivesas partof a longtermprice andwage studybeing undertakenby the author.

'5Tavernier,

New Relation,pp.16-24.

'6For a full list, see the catalogueprovidedby Hasluck,"Levantine

Coinage,"pp. 65-71.

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

350

Pamuk

good money,whichcouldin turnbe broughtbackandrecoinedwith greater

seigniorage.""'7

Thiswas not a simplepropagationof a monetarycrisis from

one partof the Mediterranean

to the other,however.As far as I can determine, this substandardcoinagedid not circulatein any significantamount

in southernEuropeat this time.

As the silver contentof the coins began to fall, the inscriptionson the

coins began to change.Bonitatisunciarumsex (six-twelfths)gave way to

bonitatisunciarumquinque(five) andthen to bonitatisunciarumquatuor

(four) and even trium.In some cases, an Arabic numeralindicatingthe

finenesswas insertedat the end of the corresponding

legendin Latin.There

arealso examplesof coins on whichthe Arabicnumeralsarehigherthanthe

standardinscribedin Latin.18Withthe disappearanceof the silver and the

increasingvolumeof trade,the marketratesof the coins sunkas low as 20

for one Spanishpiece of eight, thus makingthem even more suitablefor

dailytransactions.In the meantime,the mintauthoritieswantedto prevent

the circulationof thesecoins in Europe.Onemethodwas to differentiatethe

coins from export from those circulatingin Europe.Inscriptionslike per

totamasiamcvrrens(currentin all of Asia) or VoluithancAsia mercemDe

proculpretiumeius (paymentfor goods in distantAsia) were addedto some

of the coins to warnEuropeansaboutthe boundariesof theircirculation.'9

The peak in the traffic was reached between 1656 and 1669. J. B.

Tavernierestimatesthe totalvolumeof Europeancoinagethatwent through

the Ottomancustoms at 180 million pieces, or at more than ten million

Spanishpieces of eight.In gold, this correspondedto morethansix million

Venetianducats.In addition,some unknownquantitywas smuggledinto

Ottomanterritoryin partby bribingcustomsofficials.Accordingto another

estimate,an averageof 22 shipsarrivedat the portof Izmirevery yearduring thisperiod,all loadedwiththesedebasedpieces.20Suchvolumessuggest

thattheremaininggood coins in the Ottomanmarketswerebeingtakenback

to southernEuropeand remintedas base luigini and re-importedto the

Ottomanmarkets.21

MONETARYAND FISCAL CONDITIONS IN THE OTTOMAN EMPIRE

To understandthe willingness of the Ottomanpublic to accept the debasedcoins, it is essentialto examinethe fiscal andmonetaryconditionsin

the Ottomanempireduringthis period.Moregenerally,this episodeneeds

to be placedin the contextof deterioratingeconomic,fiscal, andmonetary

'7Kindleberger,

"EconomicCrisis,"p. 158.

'8Hasluck,"LevantineCoinage,"p. 59.

'9Ibid.,pp. 65-71, 86.

20Tavemier,

New Relation.

2'Hasluck,"LevantineCoinage,"p. 59.

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Debased European Coinage in the OttomanEmpire 351

conditionsin the coreregionsof the empirebeginningin the last quarterof

the sixteenthcentury.Manyof thesetrendswere quitesimilarto the difficulties experiencedin manypartsof EuropeandAsia. Locatedbetweenthese

two continents,the NearEastwas verymuchpartof the fiscal andmonetary

processesthataffectedthe Old Worldduringthe sixteenthand seventeenth

centuries.It still needs to be explained,however,why Ottomanmonetary

difficultiesunfoldedso differentlythanthose of Europeanstatesduringthe

same period.

Money

In andaroundthe Mediterranean

basin,the Ottomanswere influencedby

and becamethe carriersof the greatmonetarytraditionsof the Old World,

fromthe RomanandByzantineempiresto the medievalIslamicstates,to the

Mongolsof Persiaandthe Italiancity states.The Ottomanstateneededsome

formof moneyin orderto collect taxes andmakepaymentsto the soldiers,

andsuppliersof the armyandthe palace.Moreimportantly,

the

bureaucrats,

bureaucracywas very much awarethatthereexisted a stronglink between

the availabilityof moneyandthe prosperityof tradeandthe economy especially sincethe Ottomanstatehadbeen locatedon long-distancetraderoutes

ever since the earliestdays in the fourteenthcentury.

Recentresearchhas shownthatthe use of moneyin the Ottomaneconomy

was not limitedto narrowsegmentsof the urbanpopulation.Throughtheir

participationin marketsand because of state taxationof a wide range of

economic activities, large segments of the ruralpopulationcame to use

coinage,especiallythe smalldenominations,duringthe sixteenthcentury.22

A close examinationof the provincial legal codes (kanunname)of this

periodpointto an economywith strongurbanandrurallinkages,considerable marketorientationand frequentcollectionsof small amountsof taxes

in moneyfromthe artisansandmerchantsas well as the nomadsand sedentarypeasants.3 In addition,small-scalebut intensivenetworksof creditrelationsdevelopedin andaroundthe urbancenters.Peasantsas well as urban

A considerablepartof

residentstook partin these monetarytransactions.24

the Ottomaneconomyas well as statefinancesthusdependedon moneyand

monetarystability,andthe Ottomanadministrators

were well awareof that.

During the sixteenthcentury,the Ottomanmonetarysystem in the Balkans, Anatolia and, parts of Syria was based on gold, silver, and copper

coinage. The centralpiece was the silver akSe, the basic unit of account

datingbackto the fourteenthcentury.Formost of the sixteenthcentury,this

22Faroqhi,"EarlyHistory"and "SixteenthCenturyPeriodicMarkets";Jennings,"Loans";and

Inalclk, "Osmanli."

23Acompilationof theseprovincialcodes areavailablefromBarkan,ZiraiEkonomi.

24Pamuk,

"Money,"pp. 950-61.

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Pamuk

352

was a small coin weighing about 0.7 grams.25The official standardsthat

were closely followedby the local mintsuntilthe 1570s,requiredthatak9es

be minted from "clean"silver without any alloy.26The gold sultani that

began to be minted in the 1470s with standardsidenticalto those of the

Venetianducatwas used in largetransactions,includinginternationaltrade

and also for storingwealth. The purchasingpower of these two coins was

determinedby their specie content, which remainedstable between the

1480s and the 1580s. At the bottomof the hierarchywere coppercoinage

called mangirorpul with nominalvalues and for small daily transactions.

During the sixteenthcentury,eight of the largecoppercoins and 24 of the

smallcoppercoins equaledone ak9ein value.The statedid not acceptcopper coinageas payment,however.One shortcomingof the Ottomancoinage

system was the absenceof largersilver coins for medium-sizedpayments.

Multiplesof the ak9e such as the ten-ak9epiece were occasionallyminted

but thesewere discontinued.Thus,thereexisteda largegap in the hierarchy

of coins between the gold sultani, whose exchangerateedged up from 55

to 65 ak9es duringthe sixteenthcenturyandthe small ak9e itself. As a result, the pressureon the sultani and the ducatpersisted.Whenevergold

coinagewas not availablein sufficientquantities,largerpaymentshad to be

made with piles of ak9es.27

Foreigncoins circulatedextensivelyandwithoutany formof government

intervention.In local markets,Ottomanandforeigncoins changedhandson

the basis of their marketrates of exchange, which closely reflectedtheir

specie content.For example,the Ottomansultani and the Venetianducat,

with identical gold contents,exchangedat par until late in the sixteenth

century.The governmentoften announcedthe official ratesat which gold

andsilvercoins, Ottomanas well as foreign,wouldbe acceptedas payment.

For the most part,the mints were kept open for the coinage of both silver

and gold subjectto seignioragepaymentsto the state.28

StateFinances

Until the last quarter,the sixteenthcenturywas a period of fiscal and

monetarystabilitycoupledwithdemographicandeconomicexpansionin the

OttomanEmpire.Duringthe earlierpartof the centurynew territoriesininto

cludingHungary,Syria,Mesopotamia,andEgypthadbeen incorporated

the empire.Statefinancesbenefitedfromthesesuccessfulcampaignsandthe

25SeeTable2 and Pamuk,"Money,"for greaterdetail.

261tis not clearwhat"clean"meantin practice.The specie contentof the availablecoins have not

been studiedin detail.Most specialistsassumethatstandardakes were mintedfromsilverapproximately90 percentpuresilver.

27Thisgap becomesmore evidentwhen comparedwith the coinage patternsof sixteenth-century

Europe,for example.Grierson,"MonetaryPattern."

"Money,"pp. 950-61; and Sahillioglu,"Role."

28Pamuk

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Debased European Coinage in the OttomanEmpire 353

inflows of annualremittancesfromtheseprovinces,most importantlyfrom

Egypt.Along with increasesin populationandlandundercultivation,internal and long-distancetrade expanded.With growing commercialization,

economic ties between the countrysideand urbanareasbecame stronger.

The increasingmonetaryneeds of this economywere met by the increased

availabilityof gold, primarilyfrom Egypt, and silver arrivingfrom the

Americasby way of Europe.

These favorablefiscal and economic trends were reversed, however,

duringthe lastquarterof the century.One importantchangewas the deteriorationof statefinances.As militarycampaignsagainstIranin the east and

the Habsburgsin the west turnedinto long, protractedaffairs,the budget

surplusesenjoyedin the earlierpartof the centurybeganto disappear.Since

some of the staterevenueswere fixed in nominalterms,the silver inflation

of the sixteenthcenturyalso had adverseconsequencesfor statefinances.29

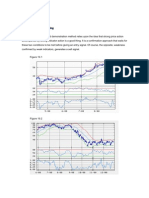

A compilationof the availableimperialbudgetsas summarizedin Table 1

showsthatdeficitsbecamemoreor less permanentby the end of the century.

This new patternlasted for most of the seventeenthcentury,eventually

exhaustingthe reservesof the imperialtreasuryaccumulatedduringearlier

periods. The inflation-adjustedseries presentedin Table 1 indicates that

revenues enteringthe imperialtreasuryfailed to keep pace with inflation

while nominalexpendituresrose fasterthaninflationafterthe middle of the

sixteenthcentury.At the very least, it is clearthatexpendituresrose faster

thanrevenuesduringthis period.30

Social andpoliticalupheavalsknown as the Celali rebellionsthatbegan

latein the sixteenthandlastedwell intothe seventeenthcenturyonly exacerbated these fiscal difficulties.As the peasantstook flight or returnedto

nomadism, agriculture,especially commercialagriculture,was adversely

affected. Moreover,the discoveryof the sea routeto Asia finallybegan to

show its effectson the intercontinental

traderoutesduringthe earlydecades

of the seventeenthcentury.While the ocean triumphedover the mainland,

after a lag of one century,many towns of the Levantas well as Ottoman

statefinancesbeganto feel the decline in commercialactivity.31As a result

of these developments,it appearsthatin the BalkansandAnatoliaandperhaps even in Syria,the demographicand economic expansionof the sixteenth centurycame to an end in the 1580s or soon thereafter.Population

andeconomicactivitystagnatedandmay have even declinedin manyparts

of the empireduringthe seventeenthcentury.32

29Barkan,

"PriceRevolution";and Inalclk,"MilitaryandFiscal Transfonnation."

30SeeTable1, note 3.

3'Steensgaard, Asian TradeRevolution,p. 9.

32Faroqhi

andErder,"Population";

Inalclk,"MilitaryandFiscalTransformation";

and,mostrecently,

Faroqhi,"Crisis."

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

354

Pamuk

TABLE1

A COMPILATION

OF THEAVAILABLEBUDGETSOF THEOTTOMANCENTRAL

GOVERNMENT,1523-1688

Revenues

Year

CurrentAkfes

(millions)

1523-1524

1524-1525

1527-1528

116.9

141.3

221.6

1546-1547

1547-1548

1565-1566

1567-1568

241.7

198.9

183.1

348.5

1582-1583

1592-1593

1608

313.7

293.4

503.7

1643-1644

1650

1652-1653

1654

1661-1662

1666-1667

1669-1670

1687-1688

514.5

532.9

517.3

537.4

581.3

553.4

612.5

700.4

Expenditures

Indexin

ConstantAk!es

CurrentAk!es

(millions)

100.0

118.8

126.6

150.2

}

}

}

}

128.4

}

}

}

70.4

}

}

}

}

}

}

}

}

}

92.8

171.9

112.0

189.7

221.5

277.6

363.4

599.2

513.8

687.2

528.9

658.4

593.6

631.9

637.2

901.0

Balance

Indexin

ConstantAkes

CurrentAk!es

(millions)

100.0

-1.9

+14.7

+71.4

}

}

}

}

111.3

}

}

}

95.4

}

}

}

}

}

}

127.4

}

}

+69.8

+86.9

-6.6

+127.0

+36.1

-70.0

-95.5

+0.7

-154.3

-11.6

-21.0

-12.3

-78.5

-24.7

-200.6

Notes:Thesebudgetdocumentsdo not includeall revenuesandexpenditures

of the state.Mostnotably,

theyexcluderevenuesandexpenditures

collectedandspentin theprovincesincludingmostof thetaxes

in kindcollectedfromagriculturalproducersand spentto equipandtraina cavalry-basedprovincial

army.The provincialrevenuesthatdid not reachthe capitalwereroughlyequalin magnitudeto the

figuresappearingin thesebudgets.

The revenueandexpenditurefiguresgiven in currentakvesareadjustedfor inflationwith the help

of a foodpriceindexfortheIstanbulregionconstructedby Barkan.His index,which beginswith 100

for the base year 1489-1490, rose to 142 in 1555-1556, 180 in 1573, 182 in 1585-1586, 442 in

1595-1596, 630 in 1605-1606 andthendeclinedto 504 in 1632-1633, 470 in 1648-1649, and462

in 1655-1656. Since Barkan'spriceindexis availablefor selectedyearsonly, I chose to provide,for

the revenueandexpenditureindicesabove,averagevaluesonly for each of the subperiods.

It is well knownthatthe termsof trademovedin favorof agricultureduringthe sixteenth-century

PriceRevolutionin Europe.Availableevidencesuggeststhatthiswas thecase in the easternend of the

Mediterranean

as well. Barkan,"PriceRevolution";

andCizak9a,"PriceHistory."If so, thenthe foodpriceindex abovetendsto overstatethe extentof overallpriceincreases.

Sources: The budgetaryfiguresare takenfromTabakoglu,GerilemeDoneminde,pp. 14-15. For a

shorterlist of budgetsthatpointto the samepatternanda detaileddiscussionin English,see Barkan,

"PriceRevolution,"pp. 17-21. The food-priceindexfor Istanbulwas takenfromibid, pp. In 11.

Debasements

These adversetrendsculminatedin the debasementof 1585 or 1586,

whichreducedthe silvercontentof the Ottomanunitby 44 percentafterone

centuryof stability.33

This operationdid not end the fiscal and monetary

33Whereasthe mintsused to strike450 ak~esfrom 100 dirhamsof "clean"silver,they were now

instructedto mint 850 akes fromthe same amount.See Table2 and also Kafadar,"Les Troubles

Monetaires,"pp. 381-89. The exactdateof the debasementremainsunclear.

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Debased European Coinage in the OttomanEmpire 355

TABLE2

THE OTTOMANAKfE AND ITS EXCHANGERATEAT ISTANBUL,1500-1640

Years

1500

1550

1584

1586

1596

1600

1618

1620

1622

1623

1624

1624

1628

1634

1640

1641

1650

Ak9esminted

from 100

dirhamsof silver

Weightin

Grams

420

420

450

800

0.73

0.73

0.68

0.38

950

1,000

0.32

0.31

1,000

0.31

1,000

0.31

Venetian

Ducat

SpanishPiece

of Eight

54

60

65-70

120

220-230

125

150

160

180-210

210-280

330-420

130

190

230

270

168

175

40

40-42

80

78

100

100

120-150

120-170

170-320

100-110

110-120

125

80

90

Notes:The Ilkhaniddirhamof Tabrizusedby the Ottomansin monetarypracticesequaled3.072 grams.

Pamuk,"Money,"p. 954.

Until 1585 the standardake was mintedfrom"clean"silverwithoutany alloys. See note 26. For

this earlyperiod,the standardsof the ake areavailablefrommintrecordsand imperialordersto the

mints.

Afterthedebasementof 1585-1586, however,unknownamountsof copperbeganto be addedto the

silver.Forthis latterperiod,the standardsof the ak?eareavailablefromarchivalevidencefor the years

1600, 1618, 1624,and 1640 sincethesewereyearsof correctionof coinageoperations.Forotheryears

the silvercontentof theake canbe approximated

butnotdetermined

preciselyfromits exchangerates

against the Spanishpieces of eight since Europeancoins may have enjoyeda premiumagainstthe

Ottomanunit basedon respectivespecie contents.

Sources:Pamuk,"Money,"tablesA-2, A-3, A-5, and A-6; and Sahillioglu,"XVII.Asnn,"p. 233.

difficulties, however. The period until the 1640s was one of exceptional

instabilityfor theak!e; the fluctuationsof the currencycanbe followedfrom

a combinationof sources.As shown in Table2, the availablemint records

provideinformationaboutthe weightandsilvercontentof the standardak~e

only for selected years of this period.For most years of this period,however,ak!es producedby the mintsfell below those standards.Althoughthe

silvercontentof the substandard

or defective(hurde)coins can not be determined precisely, court recordsprovide detailed informationabout their

marketexchangeratesagainstthe stableducatand otherleadingEuropean

coins on a monthlybasis. Fromthese exchangerates, it is possible to approximatethe sharpfluctuationsin the silver contentof the Ottomanunit.

For example,fromthe last columnof Table2 it appearsthatduring1623 to

1624 the silver contentof the ak!e droppedto aboutone-thirdand during

1638 to 1640 to abouthalf of its standardlevels. Eachtime the deterioration

of the ak!e reachedcrisis proportions,the governmentattemptedto return

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

356

Pamuk

to the old standardor establisha new one. Theseoperations,called tashih-I

sikke (correctionof coinage), were carriedout in 1600, 1618, 1624, and

1640. Adding to the confusionwere the clipped versions of the standard

ak!es thatcirculatedtogetherwith the substandardversions.34

Two relatedquestionsthathave been debatedin the recentliteratureon

the monetaryhistory of the late medieval and early modem periods are

whethergovernmentsbenefitedfromdebasementsandwhetherdebasements

were used as a long-termstrategyfor generatingrevenue.35In the Ottoman

case, thereis overwhelmingevidencethatthe debasementswere the result

of fiscal difficultiesand that the state benefitedin the shortrun from the

productionof substandardcoinage. The availableevidence also indicates

that there did not exist such a long-termstrategyduring this particular

period.The frequencyof correctionof coinageoperationsthatincreasedthe

silvercontentof the ak!e also suggeststhatthe governmenttriedto maintain

the standardsof coinagebut was unableto do so.36

Perhapsthe most importantreason for the government'sstrugglefor a

stable currencyand the majorconstraintagainsta more systematicuse of

debasementas a fiscal tool was the oppositionof thejanissariesin Istanbul,

who werepaidwith this coinage.Afterthe debasementof 1585-1586, they

revolted,demanded,andobtainedthe executionof the vizierresponsiblefor

Thejanissariesremaineda force to be reckonedwith in the

the currency.37

turbulentpoliticsof the capitalcity duringthis period.They were involved

in the depositionof threesultansin 1618, 1622, and 1623.38 Thereis detailed evidence, at least for laterperiods, that guild membersjoined the

soldiers in oppositionto debasements.Of the four correction-of-coinage

operationsundertakenduringthis period,the last threetook place afterthe

accessionto the throneof new sultans.It is clearthatthese operationsrepre-

34Sahillioglu,"Role";and Gerber,"MonetarySystem,"pp. 310-14.These operationswere similar

to the reinforcements

of westernEurope.Munro,"Deflation,"pp. 392-93. Aftereach of these operations,the statefacedthetaskof forcingthepricesdown. Forthis purpose,local governmentsprepared

very detailed lists of price ceilings (narh) for hundredsof goods. These lists now constituteuseful

sourcesnot only for price historybut also for studyingthe rangeof economicactivity in the urban

centers.Kittiukoglu,

Osmanlilarda

Narh.Foran interestingaccountof the Ottomanperceptionsof these

monetarydifficulties,see Kafadar,"LesTroublesMonetaires."

35Seenote 9.

36Sincethe relevantmintrecordsarenot available,the volumeof coinproductionfor each subperiod

can notbe established.It appears,however,thatthemintvolumeremainedsporadicandthatcoins were

producedwheneverthe statewas ableto acquirespecie.Yearsof maximumdebasementoftencoincided

with the lack of specie and low outputand not vice versa.

37Knownas the "beylerbeyiincident,"this was only the second time in Ottomanhistorythat the

janissariesorganizedto protesta debasement.Thefirsthadoccurredin 1444andhadled to a pay raise.

The reason for the long interimwas the stabilityof the Ottomancurrency.The specie contentof the

akcechangedvery littlefromthe 1480s untilthe 1580s. See Table2.

38Shaw,History,pp. 193-94.

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Debased European Coinage in the OttomanEmpire 357

sentedattemptsby the sultansto win the good will of the soldiers,andmore

generally,of the urbanpopulation.39

CurrencySubstitution

In additionto the instability,the debasementsreducedthe ak!e into an

exceptionallysmall and thin coin. Its weight and silver content declined

fromabout0.7 gramsuntil the 1580s to 0.3 gramsin 1640. It thus became

very difficultto handle;largenumbersof ak!es were neededeven for small,

dailytransactions.Largersilver coins such as ten-ak!epieces were minted

only occasionallyand these disappearedquicklywhen substandardak!es

floodedthe markets.40

The governmentalso beganto minta new coin called

para, which was based on the monetaryunit in circulationin Egypt and

partsof Syriaandcarriedthreetimes as much silver as the akve.41The volume of para productionremainedlimited,however.

It appearsthathalf a centuryof instabilityandthe inconvenienceof using

ak!es in dailytransactionsled to a considerabledegreeof currencysubstitution. The publicbecameincreasinglyreluctantto hold the ak!e or take bullion andforeigncoins to local mints.Instead,thereemergedgreaterdemand

for the morestableEuropeancoinage,especiallythe well-knownand large

silver pieces of the seventeenthcentury.42It is possible that duringthese

extendedperiodsof deterioration

of the Ottomanunit,Europeancoins began

to circulateat a premiumover theirsmall Ottomancounterparts,measured

in termsof theirrespectivesilvercontent.Sincethe precisemintrecordsare

not available,however,exceptfor the yearsof correctionof coinage operations,the existenceandmagnitudeof thesepremiumscan not be established

from the availableevidence summarizedin Table2.

39Peter

Spuffordpointsoutto similarstrugglesin manypartsof westernEuropeduringthe fourteenth

andfifteenthcenturiesbetweenthemonarchswho stoodto gain andthe landedaristocracywith fixed

rentincomeswho stood to lose fromdebasements.Spufford,Money,pp. 289-318.

40Schaendlinger,

OsmanischeNumismatik,pp. 100-12.

41Itappearsthatthe firstmintingof para in Istanbulwas undertakenduringthe reignof MuradIV

(1623-1640). Schaendlinger,OsmanischeNumismatik,p. 110.

42Therearea numberof documentedepisodesof currencysubstitutionin late medievalEurope.For

a discussion of the consequencesof the recurrentdebasement-reinforcements

cycles observed in

fourteenth-andfifteenth-century

FranceandBurgundy,see Bordo,"Money,"pp. 344-45. Cipollahas

examined anotherepisode in the "Affairof the Quattrini,"which occurredin fourteenth-century

Florence.Cipolla,MonetaryPolicy, pp. 63-85.

43Until 1642 when its silvercontentwas reducedby 20 percent,the Spanishrealwas mintedat 67

permarcof 230.05 grams.The piece of eightthus contained27.46 gramsof silver.Motomura,"Best

andWorstof Currencies,"

pp. 106-07; and Shaw,Historyof Currency,pp. 340-41. Consideringthat

the akce was mintedfromapproximately90 percentpuresilver,the exchangeratesgiven in Table2

for the yearsof correctionof coinageoperationsdo not pointto the existenceof such premiums.

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

358

Pamuk

IntercontinentalMonetaryFlows

Another source of instabilityfor the ak!e was the decline of Ottoman

silvermines.Untilthe sixteenthcenturythe Ottomanmintshadreliedon the

state-operatedsilver mines of SerbiaandBosnia as the principalsourceof

specie.44The arrivalof largeamountsof silver fromthe New World,however, loweredthe relativeprice of thatmetal,leadingfirstto the decline of

theiroutputafterthe turnof the centuryandthento theirclosureduringthe

1640s.45Whenfiscalpressuresbeganto intensify,therefore,the statecould

not fall back on the earliersourcesto maintainsteadysuppliesof coinage.

It is also possible that intercontinentalmonetaryflows contributedto

Ottomanmonetarydifficultiesmoredirectly.Despitethe continuedflows of

silverfromthe Americas,Europebeganto experienceincreasingscarcities

of silver towardsthe end of the sixteenthcenturyand this tendencylasted

Recently,Dennis 0. Flynn and

throughmost of the seventeenthcentury.46

ArturoGiraldezand RichardVon Glahnhave put forwardthe thesis thata

large part of the output of the Americansilver mines was absorbedby

China,eitherby directshipmentsto Asia or via Europe.The increaseddemand in Chinawas due to the monetizationof silver in the 1570s.47The

Ottomanempirehappenedto be on the lattertraderoutes,and the growing

monetarydifficultiesexperiencedin the Ottomanlandsmay have been due

flows as well as the fiscal deficits.At the moment,

to these intercontinental

however, there is not sufficientevidence for or againstthis explanation.

Thereis a good dealof evidencethatthe Ottomangovernmentwelcomedthe

arrivalof silver and silver coinage from Europe,but it could not prevent

their outflow towardsIranand Indiaas the empirecontinuedto run trade

deficitstowardsthe east. This overlandtransittradeof goods fromAsia to

Europediminishedafterthe turnof the century,however.48Althoughit is

impossibleto establishempiricallythe overalltradebalancefor the Ottoman

Empireduringthe sixteenthandseventeenthcenturies,the continuedcirculationof Europeangroschen,especiallythe Spanishpieces of eight and the

Dutch thaler,throughoutthe empireconfirmsthatsilver did not disappear

from Ottomanmarkets.

44Sahillioglu,"Role."

BirAsirltk,p. 14; andMurphey,"SilverProduction."EventhoughRhoadsMurphey

45Sahillioglu,

arguesthat the outputof silvermines did not declineuntil afterthe 1630s, the considerabledropin

outputafterthe turnof the centuryis in fact clearfromthe tableshe provides.This is especiallytrue

of theminein Uskiip(Skopje),whichaccountedformorethanhalfof thetotaloutputof Ottomansilver

minesin Serbia.Ibid.,pp. 82-86. Fortheclosureof Europeanminesas a resultof the arrivalof American silver,see Spooner,InternationalEconomy,pp. 24-53.

46Ibid.,pp. 33-53.

47Flynnand Giraldez,"Bornwith a SilverSpoon";andVonGlahn,"Myth."

Asian TradeRevolution.

48Steensgaard,

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Debased European Coinage in the OttomanEmpire 359

Closureof the Mints

In additionto the problemsassociatedwith attractingsilver and foreign

coinageto the mints,the continuingfiscalpressuresandthe decline in mine

outputmade it increasinglydifficultfor the stateto supplythe mints itself,

thus leading to a deteriorationin the qualityof coinage, especially in the

provinces.As a resultof these difficulties,the governmentbegan to close

down the mints. In orders sent to provincial mints, the government

expressed its reluctanceto maintaintheir operationsin view of the poor

qualityof coinagebeingproduced.49

Evidencefromnumismaticcollections

andcataloguesalso indicatesthatthe numbersof provincialmintsproducing

the silver ak(e declined sharplyduringthe second quarterof the century,

especially in the 1640s.50The outputof the mint in Istanbulalso remained

sharplylower until the mid-1680s. The limitedvolume of gold and silver

coins producedin the capitalcity duringthis periodwere used primarilyas

paymentsto soldiersat war andby the sultanandhis retinuein ceremonial

occasions.51Both archivalandnumismaticevidencethuspoint to a decline

in the productionof silver and gold coinage for at least four decades.52

Whenthe Ottomangovernmentcouldnot or did not meet the economy's

demandfor money,this need was met increasinglyby Europeancoins, initially silverandgold. Althoughforeigncoins hadalwayscirculatedin Ottoman lands,theyplayeda qualitativelydifferentrole duringthe seventeenth

century.As Ottomancoinage disappeared,the ak(e was reducedto little

more than a unit of account. Gold and especially silver Europeancoins

becamethe leadingformsof actualmoneyfromthe BalkansandIstanbulto

Anatoliaand Syria.Localcourtrecordsandrecentstudiesby economic and

social historianson Ottomanprovincesprovideampleevidence in this respect.53The Ottomangovernmentdid not attemptto restrictthe circulation

49Sahillioglu,Bir Asirlik,pp. 18-37.

50SincemostOttomancoinscarriedthe nameof the sultan,theyearof his accession,andthe location

of the mint, it is possibleto follow fromthe availablecoins the decline in the numbersof provincial

mintsactive duringeach reign.At the sametime, since the coins of this perioddid not featureregnal

years,it is not possible fromthis evidenceto establishhow manymintswere activeduringany given

year.Mostof thisnumismaticevidenceis summarizedin Schaendlinger,OsmanischeNumismatik,pp.

102-13; and Eruireten,

"OsmanliAk9eleri,"pp. 18-19. RhoadsMurpheyalso considersthe reignof

IbrahimI (1640-1648) the criticalperiod for the cessation of activity in Ottomansilver mines.

Murphey,"SilverProduction,"pp. 76, 82-86.

5 Sahillioglu,Bir Astrlik,pp. 18-36.

52Formoredetail,see Pamuk"Disintegration,"

pp. 74-75.

53Tavemier,

New Relation;and Chardin,Voyages.RobertMantranwas one of the firstto point out

the declineof the akVein localmarkets.His accountis especiallystrikingsince it describesthe conditionsnot in the distantprovincesbut in the capitalcity. Mantran,Istanbul,book 2, chap.2. Withthe

appearanceduringthe lastdecadeof new studieson the economicand social historyof the provincial

citiesthatmakeextensiveuse of localcourtrecords,it is now possibleto get a geographicallydetailed

accountof the disappearanceof the ak!e and the spreadof Europeancoinage.See Masters,Origins;

Establetand Pascual,"DamasceneProbateInventories";

andZe'evi, OttomanCentury,pp. 143-45.

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

360

Pamuk

of these coins. In fact, it regularlyacceptedand sometimeseven demanded

paymentin Europeancoinage.54

WHY NOT COPPER COINAGE?

The popularityof debasedEuropeancoinage was, therefore,closely relatedto the inabilityof the Ottomanstateto supplysilvercoinageafter1640.

This raisesa secondpuzzle,namelythe cessationof the productionof copper coinagein additionto silver.Justas it was the case with silver and gold

coinage,the numismaticevidencepointsto an almostcompleteabsenceof

Ottomancoppercoinagefor almosthalf a century,fromthe 1630s until the

late 1680s.5 Thisis quiteintriguingsincemanystatesin Europe,fromSpain

andFranceto Germany,Sweden,Poland,andRussiareliedon coppercoinage duringthis periodboth as a mediumof exchangeandto raise seigniorage revenue.56

The absenceof coppercoinageis all the morepuzzlingbecausetowards

the end of the century,duringanotherfiscal crunchfrom 1689 to 1691, the

governmentdid exactly what it had failed to do earlier.It issued, within a

30-monthperiod,as manyas 600 millionpieces of coppermangirweighing

half dirhams(1.6 grams)each.57Initially,thesepieces were given the nominal value of one-halfake, but the govermnentquicklyraisedthat to one

ak(!e.Even thoughsome merchantsin the provincesrefusedto acceptthe

new coins, on the whole, this was a reasonablysuccessfuloperationfor the

shortperiodit was employed.It also providedthe statewith much needed

58

seignioragerevenue.

It appearsthatthe failureor inabilityof the centralgovernmentto issue

coppercoinageduringthe midcenturywas not due to one single reasonbut

to a combinationof factors. One possibility is that adequatesupplies of

540neof the moreprominentsilvercoins in circulationfromthe Balkansto Egyptwas the Dutch

thaler.Evenmoreimportant

was the Spanishpiece of eight(realesde a ocho). Therewere otherssuch

as the Austrianrix-thalerand the Polish isolette. Most of these Europeansilver coins were called

gurush, which was the local adaptationof groschen,a diminutivefor gross or grosso,termsused for

largesilvercoins in Europesincethethirteenthcentury.The Venetianducattogetherwith the Hungarianpiece in theBalkansremainedthemostimportant

goldcoins.Fractionsof thesecoins also circulated

but in a morelimitedfashion.Pamuk,"Money",pp. 950-66.

55Tavernier,

for example,is unequivocal:"In all the OttomanEmpire,there is not any money of

copper to be seen."Tavernier,New Relation,p. 15. For a summaryof the numismaticevidence on

coppercoinagein the seventeenthcentury,see SchaendlingerOsmanischeNumismatik,pp. 106-14.

56Spooner,

InternationalEconomy,pp. 10-86.

57Aboutone-thirdof this amountwas due to the remintingof the samecoins with the accessionof

a new sultan,AhmedII, in 1691.

58Thedetailedaccountbooksof the mintat Istanbulindicatethatafterall expenditures,includingthe

shareof the privateentrepreneurs

who managedthe mintaresubtracted,as muchas 70 percentof the

nominalvalue of the coins thus struckwas left as net revenuefor the state.Sahillioglu,"Bakir

Para,"

pp. 16-19. The seignioragerevenuesobtainedoverthistwo-and-a-half-year

periodexceeded10 percent

of thetotalrevenuesof the imperialtreasuryduringthe sameperiod.Thereis no doubtthatthis experimentprovideda significantboost to the hardpressedtreasury.

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Debased European Coinage in the OttomanEmpire 361

copper were simply not available. Of the two Anatolian mines in

GtimuhaneandKire, which were active duringthe 1690s and which supplied partof the copperfor thatexperiment,the latterwas not activein midcentury.The availabilityof copperwas not a significantbottleneck,however, since the governmentcould have acquired,at least in the shortrun,

substantialvolumes of used copperfrom the local marketsas it did in the

1690s.

andtechnologicalreasonswere probablymuch more

The organizational

to

important.The right issue coppercoinagein the provinceswere typically

as was the case for

auctionedoff by the governmentto privateentrepreneurs

value of the

nominal

the

Since

silver

coinage.

mints

producing

the

of

some

mangirhadalwaysbeen in fractionsof the ak!e, suchas one-eighthor onefourth,the decline in the value andpurchasingpower of the ak(e afterthe

debasementof 1585-1586 broughtthe costs of productionof coppercoinage

closer to theirnominalvalues andreducedthe marginfor seigniorage.The

private entrepreneurswere thus reluctantto purchasethe regionalmangir

monopoliesunderthose circumstances.This was probablythe most importantreasonfor the breakdownof the networkof provincialmintsproducing

coppercoinage.Onepossiblesolutionwouldhave been to raisethe nominal

value of coppercoins to at least one-halfak(e or even to one ak(e, which

was done in the 1690swhen the mintin Istanbuland not the regionalmints

issued the coppercoinage. The provincialmarketsmay not have accepted

locally producedcoppercoinagewith highernominalvalues, however.

Another importantshortcomingof the Ottomanmint system around

midcenturywas technological.Until the 1690s the Ottomanscontinuedto

use the traditionalhammerandproducedcoins of inferiorquality.Perhaps

more importantly,this technology limited the volume of productionand

dictateda more decentralizedapproachto the coin supply.Thereexisted a

network of coppermints in the provinces and these were able to supply

coppercoinage in sufficientquantitiesuntil the seventeenthcentury.After

the governmentdecided at the end of the 1680s to adopt the mechanical

technologyand build new mintingequipmentwith the help of a European

convert, it was possible to issue a much largervolume of higher-quality

coinagefromthe centralmintin Istanbul.The governmentwas able then to

raisethe nominalvalue of the coppercoins anddistributethem in the provinces as well as in the capital.59

Finally,the 1650s and 1660s,whenthis episodetook place, was an especially difflcultperiodfor the Ottomangovernmentbecauseit was engaged

in a long andprotractedwarwith Veniceoverthe islandof Crete.It is clear

couldnot bringtogetherthe time, energy,and

thatthe Ottomanbureaucracy

resourcesto devise a solutionto theirmonetaryproblemsduringtheseyears.

59Sahillioglu,"BakirPara."

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

362

Pamuk

The willingness of the Ottomanpublic to acceptthe debasedEuropean

coinage, then, can not be understoodwithout this context. The Ottoman

marketswere in needof money,especiallythe smalldenominationsfor daily

use. They were willing to pay a premiumfor these coins. The Ottoman

governmenthad earliersuppliedthis subsidiarycoinage and enjoyed the

seigniorage.When it could not or did not fulfill this function,European

entrepreneurswere only happyto serve as suppliersof money.

CONCLUSION

The arrivalof enormousvolumes of debasedcoinage eventuallyglutted

the Ottomanmarketsandcreatedadverseconsequencesforthe economyand

for Europeantrade.Europeanaccountsemphasizethatwhile merchantswho

brought debased coinage were willing to offer high prices for Ottoman

goods, thosethatdid not couldnot competefor Ottomanexports.The English merchantswho were prohibitedby the English consul in Izmir from

participatingin this tradewerethusdrivenout of Ottomanmarkets.In turn,

they andthe Englishrepresentatives

beganto pressurethe Ottomanauthorities to prohibitthe circulationof base coinage. Otherunfavorableconsequenceswere being felt in those regionsof southernEuropeexportingthe

base coinage.Facedwith a net outflowof silver,the parliamentof Provence

as well as the Chamberof Commerceof Marseillesattemptedto ban this

trafficin 1665.

The Ottomanauthoritieswere not necessarilypleasedwith the outcome,

buttheywere deeplyinvolvedin a long andprotractedwarwith Veniceover

Crete.As long as the warcontinued,the governmentcouldnot mobilize the

necessaryfinancialresourcesto stabilizeor reformthe currency.Until that

time debasedcoinage was betterthanno coinage. The economyhad come

to depend on the debasedcoinage for its daily functioning.Similarly,the

statecontinuedto receivetax revenuesandmakepaymentswith the debased

coins. This pragmatismmay help explainwhy so little materialhas so far

been locatedin the Ottomanarchivesaboutthe debasedcoins while European observerspaid so much attentionto the samephenomenon.Ottoman

authoritiesdid make several attemptsto restrictthe importationof these

coins and seized some of the cargoes.As long as the war continued,however, these half-heartedattemptsto ban base coinageprovedunsuccessful.

As the war came to an end, the governmentmoved to take more serious

action. In 1669 it was announcedthat base coinage would no longer be

acceptedin tax payments.The governmentalso demandedthatall debased

coinagebe broughtto the mintsandremintedat the earlierstandards.Later

in the sameyear,riotsbrokeout in BursaandAnkarawhen defaulterswho

couldnot find "good"moneyto paytheirtaxeswere imprisonedby the local

authorities."Thetorrentof the peoples' ragewas not appeasedwithoutthe

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Debased EuropeanCoinage in the OttomanEmpire 363

bloodandlives of someof theirofficers,allegingwithgood reasonthattheir

ministers and governors, having introducedor permittedthis money

amongstthem,andallowedit as currentin thatmanner,as theyhadfor some

yearsknownno otherfor all the fruitsof theirlabourandtheirpossessions,

they oughtnot now refuseto receivethatwhich they themselveshad made

passable."60

The apparentreluctanceof the Ottomanadministrationto prohibitthe

circulationof debasedcoinageneed not imply thatthe decline and disappearanceof the ak!e did not pose seriouschallengesto them.Withoutcontrol overthe currency,theircontroloverthe economydiminishedconsiderably. In addition,withoutits own currencythe statecould not use debasement as a meansof obtainingfiscal revenuein times of difficulty.It is for

these reasonsas well as the moreobviousreasonof coinageas a symbolof

sovereigntythatthe Ottomangovernmentattemptedto establisha new currencyas the seriesof demandingwarsbeganto wind downtowardsthe end

of the century.Not surprisingly,this new unit was called the Ottoman

gurush,afterthe largeEuropeangroschenin circulation.The first Ottoman

gurushes, containingroughlythe same amountof silver as theirEuropean

beganto be mintedafter 1690. In financingthis majoreffort,

counterparts,

the governmentreceived considerablesupportfrom the large volume of

coppercoinageit issued duringthe years 1689 to 1691. In the earlypartof

the seventeenthcenturya new standardin which 1gurushequaled120akQes

was adopted.Fractionsof thenewgurushwerealso issuedto facilitatesmall

Becauseof fiscal andeconomicdifficulties,however,it took

transactions.6'

a long time for the new coinageto be establishedin the provinces.

The studyof this episodeshouldserve as a reminderthatthe easternend

was subjectto manyof the same fiscal andmonetary

of the Mediterranean

forces thataffectedEuropeandAsia duringthe sixteenthand seventeenth

centuries.Althoughthe underlyingforces were similar,however,the outcomeswereverydifferentin the Ottomancase.Theinvasionof the Ottoman

marketsby debasedEuropeancoinage,theirwidespreadacceptanceandthe

premiathey fetchedoverandabovetheirspeciecontentwere due to the absence of subsidiarycoinagefor the daily functioningof the economy.If the

governmenthadbeen able to issue coppercoinagein sufficientvolumes as

the silverak!e beganto disappearin the 1640s,it wouldhavemet the economy's demandfor a mediumof exchangeand,at the sametime, raisedsubstantialamountsof revenuefor the muchdeprivedimperialtreasury,especially duringthe war. In the absence of copper coinage, however, those

seignioragerevenueswere capturedby the mints and merchantsfrom the

otherend of the Mediterranean.

"LevantineCoinage,"p. 61, citingRycault,Historyof the TurkishEmpire,App. VIII.

60Hasluck,

61Sahillioglu, BirAsirlik,pp. 90-122 and "Role";and Pamuk,"Disintegration."

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

364

Pamuk

REFERENCES

Atman, Artur."TheFlow of PreciousMetalsalongthe TradeRoutesbetweenEuropeand

Asia up to 1800."In Asian TradeRoutes,editedby KarlReinholdHaellquist,7-20.

London:ScandinavianInstituteof Asian Studies, 1991.

Barkan,OmerLutfi. ZiraiEkonomininMali ve HukukiTemelleri,Kanunnameler,Cilt 1.

Istanbul,1942.

Barkan,OmerLutfi. "ThePriceRevolutionof the SixteenthCentury:A TurningPoint in

the EconomicHistoryof theNearEast."InternationalJournalof MiddleEast Studies

6 (1975): 3-28.

Barrett,Ward."WorldBullion Flows, 1450-1800." In TheRise of MerchantEmpires,

editedby JamesD. Tracy, 224-54. Cambridge:CambridgeUniversityPress, 1990.

Berkes,Niyazi. TiirkiyeIktisatTarihi,CiltII, Istanbul:Ger9ekYayinlarn,1970.

Bordo,MichaelD. "Money,DeflationandSeignioragein the FifteenthCentury."Journal

of MonetaryEconomics 18 (1986): 337-46.

Chardin,Chevalier. Voyagesdu ChevalierChardinen Perse et aux Indes Orientales.

London, 1686.

Chaudhuri,K. N. The Trading Worldof Asia and the English East India Company

1660-1760. CambridgeandNew York:CambridgeUniversityPress, 1978.

CipollaCarloM. Money,Prices and Civilizationin the MediterraneanWorld.Princeton:

PrincetonUniversityPress, 1956.

. "CurrencyDepreciationin MedievalEurope."EconomicHistory Review 15

(1963): 413-22.

. The Monetary Policy of Fourteenth-CenturyFlorence. Berkeley: University of

CaliforniaPress, 1982.

(izaksa, Murat."PriceHistoryandthe BursaSilk Industry:A Studyin OttomanIndustrial

Decline, 1550-1650." this JOURNAL40, (1980): 533-49.

Eruireten,Metin. "OsmanliAkseleri Darp Yerleri".The TurkishNumismaticSociety

Biulten,17 (1985): 12-21.

Establet,Colette,and Jean-PaulPascal."DamasceneProbateInventoriesof the 17thand

18th Centuries: Some PreliminaryApproachesandResults."InternationalJournal

of MiddleEast Studies24 (1992): 373-93.

Flynn,DennisO., andGiraldezArturo."Bornwith a 'Silver Spoon': The Originof World

Tradein 1571."Journalof WorldHistory6 (1995): 201-21

Faroqhi,Suraiya."TheEarlyHistoryof BalkanFairs."Siidost-Forschungen37 (1978):

50o68.

. "Sixteenth Century Periodic Markets in Various Anatolian Sancaks." Journal of

the Economicand Social Historyof the Orient22 (1979): 32-80.

."Crisisand Change, 1590-1699", In The OttomanEmpire : Its Economy and

Society: 1300-1914," editedby H. Inalcikand D. Quataert, 411-636. Cambridge:

CambridgeUniversityPress, 1994.

Faroqhi,Suraiya,and Leila Erder."PopulationRise and Fall in Anatolia, 1550-1620."

MiddleEasternStudies 15 (1979): 322-45.

Gaastra,F. S. "TheExportsof PreciousMetals from Europeto Asia by the Dutch East

IndiaCompany."InPreciousMetalsin theLaterMedievalandEarlyModernWorlds,

editedby J. F. Richards,447-76. Durham,NorthCarolina:CarolinaAcademicPress,

1983.

Gerber,Haim."TheMonetarySystemof the OttomanEmpire."Journalof the Economic

and Social Historyof the Orient25 (1982): 308-24.

Grierson,Philip. "TheMonetaryPatternof SixteenthCenturyCoinage".Transactionsof

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Debased European Coinage in the OttomanEmpire 365

the Royal HistoricalSociety,Fifth Series 21 (1971): 45-60.

Hasluck,F. W. "TheLevantineCoinage."NumismaticChronicle,Fifth Series 1 (1921):

339-91.

Inalclk,Halil. "Militaryand Fiscal Transformation

in the OttomanEmpire,1600-1700."

ArchivumOttomanicum6 (1980): 283-337.

. "OsmanliIdare,Sosyal ve EkonomikTarihiyleIlgili Belgeler: Bursa Kadi

SicillerindenSecmeler."TurkTarihKurumu,Belgeler 10, no. 14 (1981): 1-91.

Jennings,RonaldC. "LoansandCreditin Early17thCenturyOttomanJudicialRecords."

Journal of the Economicand Social Historyof the Orient 16 (1973): 168-216.

Kafadar,Cemal. "LesTroublesMonetairesde la Fin du XVIe Siecle et la Prise de ConscienceOttomanedu Declin."Annales,Economies,Societes, Civilisations46 (1991):

381-400.

Kindleberger,CharlesP. "TheEconomic Crisis of 1619 to 1623."this JOURNAL51, no.

1(1991): 149-175.

Kutiikoglu,MuibahatS. OsmanlilardaNarh Miuessesesive 1640 TarihliNarh Defteri.

Istanbul:EnderunYayinevi, 1983.

Mantran,Robert.Istanbuldans la secondeMoitie duXVIIeSiecle . Paris, 1962.

"Politique,Economie et Monnaie dans l'Empire Ottomanau XVIIeme

Siecle." In Social and EconomicHistoryof Turkey(1071-1920), Papers Presented

to theFirst InternationalCongress, editedby O.OkyarandH.Inalcik, 123-25. Ankara, 1980.

Masters,Bruce. TheOriginsof WesternEconomicDominancein the MiddleEast: Mercantilism and the Islamic Economyin Aleppo, 1600-1750. New York:New York

UniversityPress, 1988.

Miskimin,Harry.Moneyand Power in FifteenthCenturyFrance. New Haven:Yale UniversityPress, 1984.

Motomura,Akira."TheBest andWorstof Currencies:Seigniorageand CurrencyPolicy

in Spain, 1597-1650." this JOURNAL

54, no. 1(1994), 104-27.

Munro,JohnH. "Deflationandthe PettyCoinageProblemin the Late-MedievalEconomy:

The Case of Flanders,1334-1484." Explorationsin EconomicHistory 25 (1988):

387-423.

Murphey,Rhoads."SilverProductionin RumeliaAccordingto an OfficialOttomanReport

Circa 1600."Siidost-Forschungen39 (1980): 75-104.

Pamuk,~evket. "TheDisintegrationof the OttomanMonetarySystem duringthe SeventeenthCentury."PrincetonPapers in Near EasternStudies2 (1993): 67-81.

. "Moneyin the OttomanEmpire,1326 to 1914."In The OttomanEmpire: Its

Economyand Society: 1300-1914," editedby H. InalclkandD. Quataert,947-85.

Cambridge:CambridgeUniversityPress, 1994.

Rycaut,Paul.Historyof the TurkishEmpirefromtheyear 1623 to theyear 1677. London,

1680.

Sahillioglu,Halil. "BirAsirlikOsmanliParaTarihi."Diss. for docent.Universityof Istanbul, 1965.

_. "XVII.Asnn ilk YansindaIstanbul'daTedaviildekiSikkelerinRaici." Turk

TarihKurumu,Belgeler 1, No. 2 (1965), Ankara,227-34.

. "BaklrParaUzerinebirEnflasyonDenemesi(H. 1099-1103/M. 1687-1691)."

The TurkishNumismaticSocietyBulten 10 (1982): 7-40.

. "The Role of InternationalMonetaryand Metal Movements in Ottoman

Monetary History. In Precious Metals in the Later Medieval and Early Modern

Worlds,editedby J. F. Richards,269-304. Durham,NorthCarolina,1983.

Schaendlinger,Anton C. OsmanischeNumismatik.Braunschweig,1973.

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

366

Pamuk

Shaw,StanfordJ. Historyof the OttomanEmpireandModernTurkey.Vol. 1. 1280-1808.

CambridgeandNew York:CambridgeUniversityPress, 1976.

Shaw, W. A. The History of Currency,1252 to 1894. New York and London: G. P.

Putnam'sSons and ClementWilson, 1896.

Spooner,FrankC. TheInternationalEconomyandMonetaryMovementsin France. Cambridge,MA: HarvardUniversityPress, 1972.

Spufford,Peter.MoneyandIts Use in MedievalEurope.Cambridge:CambridgeUniversity

Press, 1988.

Steensgaard,Niels. TheAsian TradeRevolutionof the SeventeenthCentury:The East

India Companiesand the Decline of the CaravanTrade.Chicago:The Universityof

ChicagoPress, 1974.

Sundhaussen,Holm. "Die 'Preisrevolution'im OsmanischenReich wahrendder zweiten

Halfte des 16. Jahrhundrets."

Siidost-Forschungen42 (1983): 169-81.

Sussman, Nathan. "Debasements,Royal Revenues and Inflation in France during the

HundredYears'War,1415-1422." this JOURNAL

53, no.1(1993): 44-70.

Tabakoglu,Ahmet. GerilemeDonemindeOsmanliMaliyesi. Istanbul:DergahYayinlan,

1985.

Tavernier,J. B. A New Relationof the Inner-Portof the GrandSeignor's Seraglio. London, 1677.

VonGlahn,Richard."MythandRealityof China'sSeventeenthCenturyMonetaryCrisis."

this JOURNAL56, no. 2 (1996): 429-54.

Ze'evi, Dror.An OttomanCentury,TheDistrict of Jerusalemin the 1600s . Albany: State

Universityof New YorkPress 1996.

This content downloaded from 194.27.40.19 on Mon, 08 Feb 2016 21:18:20 UTC

All use subject to JSTOR Terms and Conditions

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Cambridge University Press School of Oriental and African StudiesDocument3 pagesCambridge University Press School of Oriental and African StudiesEmre SatıcıPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Cambridge University Press School of Oriental and African StudiesDocument3 pagesCambridge University Press School of Oriental and African StudiesEmre SatıcıPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- 43385090Document5 pages43385090Emre SatıcıPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- 654939Document21 pages654939Emre SatıcıPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- 43577515Document27 pages43577515Emre SatıcıPas encore d'évaluation

- 1291294Document59 pages1291294Emre SatıcıPas encore d'évaluation

- Maisonneuve & LaroseDocument32 pagesMaisonneuve & LaroseEmre SatıcıPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Changes in Factor Markets in The Ottoman Empire, 1500-1800: F Cambridge University Press 2009Document31 pagesChanges in Factor Markets in The Ottoman Empire, 1500-1800: F Cambridge University Press 2009Emre SatıcıPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Ottoman Craft GuildsDocument19 pagesOttoman Craft GuildsEmre SatıcıPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Cambridge Economic History of India, Volume 1Document551 pagesThe Cambridge Economic History of India, Volume 1Emre Satıcı100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- OttomanDocument10 pagesOttomanEmre SatıcıPas encore d'évaluation

- The Muslim World Apr 2007 97, 2 Proquest CentralDocument15 pagesThe Muslim World Apr 2007 97, 2 Proquest CentralEmre SatıcıPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Guilds of Ottoman Jerusalem - CohenDocument314 pagesGuilds of Ottoman Jerusalem - CohenEmre SatıcıPas encore d'évaluation

- Medieval Economic ThoughtDocument275 pagesMedieval Economic ThoughtEmre Satıcı90% (10)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Travel of Evliya Celebi, Volume 2Document262 pagesTravel of Evliya Celebi, Volume 2Linas KondratasPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Market Welfare in The Early-Modern Ottoman Economy, A Historiographic Overview With Many QuestionsDocument25 pagesMarket Welfare in The Early-Modern Ottoman Economy, A Historiographic Overview With Many QuestionsEmre SatıcıPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Necmi ÜlkerDocument345 pagesNecmi ÜlkerEmre SatıcıPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Craft Guilds in The Ottoman Empire (C. 1650-1826), A SurveyDocument24 pagesCraft Guilds in The Ottoman Empire (C. 1650-1826), A SurveyEmre SatıcıPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Medieval Economic ThoughtDocument275 pagesMedieval Economic ThoughtEmre Satıcı90% (10)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Guilds of Ottoman Jerusalem - CohenDocument314 pagesGuilds of Ottoman Jerusalem - CohenEmre SatıcıPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Economic Factors in The Decline of The Byzantine EmpireDocument14 pagesEconomic Factors in The Decline of The Byzantine EmpireEmre SatıcıPas encore d'évaluation

- Fresh MarketDocument17 pagesFresh MarketJafeth AgueroPas encore d'évaluation