Académique Documents

Professionnel Documents

Culture Documents

Assignment: Role of Accounting Information and Concept: A Practical Approach

Transféré par

JoshBarettTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Assignment: Role of Accounting Information and Concept: A Practical Approach

Transféré par

JoshBarettDroits d'auteur :

Formats disponibles

Assignment

Role of Accounting Information and Concept:

A Practical Approach

Type of Documents

No of Words

:

:

Assignment

2000

Disclaimer: This is a sample document prepared by globalassignmenthelp.com and has

been submitted on turnitin. To order the similar paper please contact at:

Email :help@globalassignmenthelp.com

Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

ROLE OF ACCOUNTING INFORMATION AND CONCEPT:

PRACTICAL APPROACH

For complete project contact

Call now : +44 203 3555 345

Email Address : help@globalassignmenthelp.com

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

Table of Contents

INTRODUCTION ............................................................................................................................... 1

TASK 1 ............................................................................................................................................. 1

Solution: ...................................................................................................................................... 2

TASK 2 ............................................................................................................................................. 3

Solution. ...................................................................................................................................... 4

Content. ................................................................................................................................... 6

Purpose.................................................................................................................................... 7

Calculations..............................................................................................................................7

Comparison and analysis of the ratios for the two companies calculated in task 2. ................... 7

Efficiency ratio. ........................................................................................................................8

Liquidity ratio .......................................................................................................................... 8

CONCLUSION................................................................................................................................. 10

REFERENCE ................................................................................................................................... 11

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

INTRODUCTION

Accounting or better the financial accounting is the heart of any business as by this the

supply of life blood to the rest of the organization is controlled. Accounting information and

concepts provides the ground for any financial analysis. By knowing the importance of any

entity, thought process can be improvised. Here, in the present report, attempt is made to explain

the role and importance of accounting information and concepts. This is done by applying the

concepts in a practical problem. In the course, different computer packages such as MS-excel etc

are being applied for data processing. Different performance measures in terms of ratios are

being calculated and interpreted. For these calculations and interpretations, a detailed report has

been draft indicating the analysis findings. Entire work has been segregated in three tasks. In the

first one, method of carving out financial statements from the trial balance is demonstrated with a

real time question. Task 2 deals with calculation of different ratios. In the last task i.e. task 3, a

detailed report for both the above task findings has been drafted.

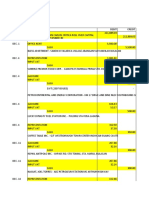

TASK 1

Trial balance extracted from the accounting books of Mr Sunshine as on 31 December 2011

Trial balance as on 31st Dec, 2011

DR

CR

150,000

Purchases

Capital

213,000

Long term Loan

80,000

Printing and Stationery

5,000

Drawings

16,000

General expenses

50,000

Sales

452,000

Trade Receivables

95,000

Trade Payables

40,000

Bank overdraft

13,000

Selling and distribution expenses

10,000

Light and Heat

7,000

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

5,000

Interest Paid

Furniture

Cost

300,000

Accumulated Depreciation

Motor Vehicles

90,000

50,000

Cost

Accumulated Depreciation

15,000

3,000

Allowances for Trade receivables

Wages and Salaries

86,000

Rent and Rates

52,000

Inventory at 1 January 2011

80,000

906,000

906,000

Given Additional Information:

1.

Inventory as at 31 December 2011 was valued at 60,000.

2.

Depreciation is to be charged as follows:-

3.

Furniture:

30% on reducing balance basis.

Motor vehicles:

30% on straight-line basis.

The allowances for trade receivables should be made equal to

5% of outstanding trade

receivables as at 31 December 2011.

st

4.

Included in rent and rates is one months rent paid in advance amounting to 4,000.

5.

General expenses amounting to 5,000 are still outstanding for the year ending 31

December 2011.

Solution:

Income Statement for Mr Sunshine for the year ended 31 December 2011

Particular

Note

Amount ()

Amount ()

Sales revenue

452000

cost of goods sold

(311000)

raw material

Light and Heat

170000

7,000

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

Outstanding general expenses

(5,000)

Provision for receivables

3,000

Noncurrent liabilities

Long term Loan

80,000

Capital

213,000

7

Net profit (earnings)

Total Liabilities and capital

60,000

404,000

Notes:

1. Raw Material consumed:

Inventory as on Jan 1st, 2011 = 80000

Inventory as on Dec 1st, 2011 = 60000

Total purchase during the year = 150000

Raw material consumed = 170000 (80000+150000-70000)

2. Rent paid during the year = 52000

Rent paid advance for the next year = 4000

3. Furniture worth = 300000

Depreciation = 90000 (30% with written down method)

Current worth of furniture = 210000

4. Motor vehicle price = 50000

Depreciation = 15000 (30% with written down method)

Current worth of vehicle = 35000

5. Outstanding general expenses = -5000 (given)

6. Provision for trade receivables = 3000

As given that the allowance must be 5% of the total outstanding receivables but that will

be charged in the coming years liability side.

7. Net profit = 55000

(Taken from the income statement after adjusting the drawings)

TASK 2

Given accounts for the two businesses are shown in the below tables:

Income Statement for the year ended 31 December 2011

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

Oliver

Stan

000s

000s

Sales Revenue

1,200

1,700

Cost of goods sold

(900)

(1,248)

Gross profit

300

452

Administration expenses

(128)

(106)

Distribution expenses

(56)

(110)

Sundry expenses

(40)

(40)

Net Profit before Interest

76

196

Statement of Financial Position as at 31 December 2011

Oliver

Stan

000s

000s

124

263

Inventory

140

104

Accounts receivables

180

134

Bank

16

Total Assets

460

502

Capital plus profits

200

320

Long term loan

180

10

Accounts payables

80

172

Total liabilities and capital

460

502

Non Current Assets

Current Assets

Capital & Liabilities

Solution

Ratios calculated for both Oliver and Stan are as given below:Oliver

Stan

Gross Profit Margin

25.00%

26.59%

Net profit margin

6.33%

11.53%

Return on Capital Employed

0.61

1.58

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

For complete project contact

Call now : +44 203 3555 345

Email Address : help@globalassignmenthelp.com

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

income statements cover business proceedings for three months period. Time frame for which

the statement has been prepared should clearly be mentioned on the income statement (Brigham

and Hrharted, 2004). Here, in the task 1, an income statement for Mr. Sunshine has been

prepared for the duration of one year i.e. for 1 Jan, 2011 to 31

st

Dec, 2011. Contrasting with the

st

income statement, the balance sheet reflects the financial condition of the business at a specified

point of time. Balance sheet always contains a specific date not a time period and the values

expressed in this are applicable and accurate for that date only. Here, in the task 1, balance sheet

i.e. statement of position has been prepared as on 31

Dec, 2011 on the basis of the provided

st

information and trial balance. Thus, both statements prepared above differ as far as the time

frame is considered.

Content

Income statement covers all the income and expenses of any business accrued during a

period of time. If the two sided of the book keeping system are considered, revenues are recorded

at the credit side in income statement whereas

expenses at the debit side. Here, in the task 1,

sales revenue has been the income whereas the rent and rates, light and heat, wages and salaries,

raw material consumption, interest payment, general expenses and other operating expenses such

as stationary etc are the costing or the expenditure for Sunshine. Balance sheet gives a picture of

finances in a company (Gazely and Lambert, 2006). Largely, it portrays 3 items i.e. assets,

liabilities and owners' equity or capital. Assets further can be current or noncurrent. Assets are

basically the properties belonging to the company. Liabilities are monetary obligations in

account of the company. Capital or the owners' equity is the aggregate worth of a company.

Profits become parts of the capital at the end of an accounting period.

Here, the balance sheet

prepared contains the current assets in the form of trades receivables, advance payments and

inventories and the noncurrent assets are the fixed or long-lasting assets such as the motor

vehicles, furniture etc. As far as the constituents of the liability side are considered, current

liabilities include trade payables, bank over drafts, outstanding expenses, allowances for

receivables etc. while the non current liability is the long term loan of the business. Capital is the

total capital plus the current years retained profit.

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

Purpose

Purpose behind preparation of the income statement is to determine the profits earned or

losses made by a company over a period of time. In income statement, earnings and expenses are

broken down into categories, which makes it much clear for the manager to comprehend

bottleneck items of expenses and sources of profits and losses. As in the above prepared income

statement, profit has been segregated in three parts, i.e. gross profit, operating profit and net

profit. Gross profit is the raw profit after considering the functional expenses only whereas the

operating profit is the profit adjusted for the operating expenses. Net profit comes after making

adjustments for interest payments, depreciations, taxes etc. Purpose behind preparation of

balance sheet is to have an overview of companys current standing in terms of financing

(Bagad, 2004).

Calculations

For preparing the income statement, just a simple set of calculations are required. For

this, company's revenue are added up and at the same time the

expenses also. By subtracting

expenses from revenue will give company's profit or loss. Net retained profit in the business is

added in the capital side of the balance sheet. Also some basic calculations are also required for

the balance sheet as well (Bagad, 2004).

Thus on the basis of above given points, both, statement of financial position and

statement of income differ from each other.

Comparison and analysis of the ratios for the two companies calculated in task 2

In finance, ratio expresses the relationship existing b/w different financial variable

concerning the company's activities or financial position. Ratios are generally calculated on the

basis of data supplied by the financial statements such as income statement, balance sheet or the

cash flow statement (Rudas, 1997). The ratios, basically, aid in identifying the strength or

soundness of firm in financial terms. Ratio analysis is considered as the strongest tool for

Financial Management decisions and to comprehend the financial viability of a business.

Different ratios are suits different purposes (Reimers, 2007).

Ratios calculated are as described below:

Gross Profit Margin

Oliver

Stan

25.00%

26.59%

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

Efficiency ratio

Inventory turnover: This ratio measures the time (days) required to convert the inventory in cash

i.e. the average time of keeping the inventory in a business. Low value is better for the business.

Formula for this ratio is as given:

365

=

Receivables turnover: This ratio measure the time required for converting the credit sales in cash.

The lower the value better is for the business. Formula for calculating this ratio is:

365

=

Payables turnover: This ratio measure the time required for keeping the trade credit

(Mayes and

Shank, 2011). The higher the value better is for the business. Formula for calculating this ratio is:

365

=

Here, the inventory turnover for Oliver is 42.54 4 3 days and for Stan it is 22.33 22

days. Also, Accounts receivable turnover for Stan is 22.77 23 days, whereas the same for

Oliver has been calculated to be 54.75 55 days. The accounts payable turnover for Oliver, as

calculated is 28.08 28 days and the same for Stan is 46.43

46 days. After analyzing all the

three efficiency ratios, it can be observed that, Stan holds a better position.

Liquidity ratio

Current ratio: This ratio indicates the ability of business to meet its current liabilities. It is

calculated by dividing the current assets by the current liabilities. Current assets cover the

inventory, accounts receivables, cash, bank balance etc. Current liabilities cover the accounts

payable, overdrafts, other provisions etc. Standard value of this ratio lays b/w 1 to 1.5 (Reimers,

2007).

Quick ratio: Quick ratio is the modified form of current ratio, representing the real time liquidity

in the business. Here, the quick assets, i.e. the cash plus

accounts receivables and bank balance

are divided by the current liabilities. Standard value of the ratio lays b/w 0.5 to 1 (Reimers,

2007).

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

For complete project contact

Call now : +44 203 3555 345

Email Address : help@globalassignmenthelp.com

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

Here, Current ratio for Oliver has been calculated to be 4.2 and for Stan it is 1.39. Also

the Quick ratio for Oliver is 2.45 and the same for Stan is 0.78. Thus it is obvious that Stan is

holding better liquid position than Oliver. Oliver is having significantly higher liquidity which is

a dangerous thing for any business.

On the ground of entire analysis, it is obvious that, Sunshine should preferably invest in

Stan.

CONCLUSION

From the above entire, analysis and work it is clear that accounting concepts and

accounting information plays a vital role in financial management. For preparing a financial

statement, strong background of accounting and book keeping is a must.

Here, in the present

report, the role and importance of accounting information and concepts

are demonstrated by a

real time question of Mr. Sunshines business.

Also, different computer packages such as MS-

excel etc are quite important. Different performance measures in terms of ratios are being

calculated and interpreted. Ratio analysis clears the picture of any businesss performance, which

can be seen in the above report.

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

This is a sample document owned by www.globalassignmenthelp.com

REFERENCE

Bagad, V. S., 2004. Management and Finance, Pune: Pragati Book House.

Brigham, E. F. and Hrharted, M. C., 2004. Financial management theory and practice.

southern-western Cengage learning.

Chadwick, L., 1998. Management Accounting. 2

USA:

ed. London: International Thomson Business

nd

Press.

Gazely, M. A., and Lambert, M., 2006. Management Accounting. SAGE.

Lucey, T., 2003. Management Accounting. 5th ed. Cengage Learning EMEA.

Mayes, T. R., and Shank, T. M., 2011. Financial Analysis with Microsoft Excel. 6 ed. Cengage

th

Learning.

Reimers, A., 2007. Financial Accounting. India: Pearson Education.

Email: help@globalassignmenthelp.com, Phone: (UK) +44 203 3555 345

Website: www.globalassignmenthelp.com

Vous aimerez peut-être aussi

- Final Upload Buad 280 Practice Exam Midterm 3Document7 pagesFinal Upload Buad 280 Practice Exam Midterm 3Connor JacksonPas encore d'évaluation

- 101 Finals Departmental-JenDocument8 pages101 Finals Departmental-Jenmarie patianPas encore d'évaluation

- Calculate Bank Reconciliation and Cash BalanceDocument10 pagesCalculate Bank Reconciliation and Cash BalanceLinda FangPas encore d'évaluation

- Accounting For Special Transactions First Grading ExaminationDocument22 pagesAccounting For Special Transactions First Grading Examinationaccounts 3 life94% (18)

- Dmp3e Ch03 Solutions 02.17.10 FinalDocument83 pagesDmp3e Ch03 Solutions 02.17.10 Finalmichaelkwok1Pas encore d'évaluation

- Lecture Notes Chapters 1-4Document28 pagesLecture Notes Chapters 1-4BlueFireOblivionPas encore d'évaluation

- AC100 Exam 2012Document17 pagesAC100 Exam 2012Ruby TangPas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- EngineeringDocument29 pagesEngineeringi aPas encore d'évaluation

- CH 03 Review and Discussion Problems SolutionsDocument23 pagesCH 03 Review and Discussion Problems SolutionsArman Beirami57% (7)

- DocxDocument12 pagesDocxTina AntonyPas encore d'évaluation

- Lecture 1 - Seminar QuestionsDocument5 pagesLecture 1 - Seminar Questionsbehzadji7Pas encore d'évaluation

- Seminar 11answer Group 11Document115 pagesSeminar 11answer Group 11Shweta SridharPas encore d'évaluation

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument8 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnwingssPas encore d'évaluation

- Unique Consultancy and Training Center Solution Mannual 2023Document25 pagesUnique Consultancy and Training Center Solution Mannual 2023Firdows SuleymanPas encore d'évaluation

- Seminar 11answer Group 10Document75 pagesSeminar 11answer Group 10Shweta Sridhar40% (5)

- Anggaran Berdasarkan Fungsi Dan AktivitasDocument42 pagesAnggaran Berdasarkan Fungsi Dan AktivitasAri SuryadiPas encore d'évaluation

- Final Answer Key Buad 280 Practice Exam Midterm 3Document7 pagesFinal Answer Key Buad 280 Practice Exam Midterm 3Connor JacksonPas encore d'évaluation

- Ac1025 Excza 11Document18 pagesAc1025 Excza 11gurpreet_mPas encore d'évaluation

- Master Budgeting Video SlidesDocument35 pagesMaster Budgeting Video SlidesArefeen HridoyPas encore d'évaluation

- Afa Revision - Final Session Activities QsDocument2 pagesAfa Revision - Final Session Activities Qshaddad2020Pas encore d'évaluation

- AccountingDocument3 pagesAccountingNaiya JoshiPas encore d'évaluation

- Module 2 - Topic 3 - Lecture SlidesDocument27 pagesModule 2 - Topic 3 - Lecture SlidesJesta ZillaPas encore d'évaluation

- Master Budget ASISTENSI 3 AKUNTANSI MANAJEMENDocument4 pagesMaster Budget ASISTENSI 3 AKUNTANSI MANAJEMENLupita WidyaningrumPas encore d'évaluation

- Finance Accounting 3 May 2012Document15 pagesFinance Accounting 3 May 2012Prasad C MPas encore d'évaluation

- ExampleDocument4 pagesExampleMuhammad HaroonPas encore d'évaluation

- Objectives of BudgetingDocument13 pagesObjectives of BudgetingChandanN81Pas encore d'évaluation

- f3 Financial AccountingDocument11 pagesf3 Financial AccountingSam KhanPas encore d'évaluation

- Management AccountingDocument5 pagesManagement AccountingHamdan SheikhPas encore d'évaluation

- Cipfawb15 - wb3 Format 19Document45 pagesCipfawb15 - wb3 Format 19Sayed RahmanPas encore d'évaluation

- Learning Guide: Accounts and Budget ServiceDocument33 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuPas encore d'évaluation

- Problem 1: It Is Required To PrepareDocument7 pagesProblem 1: It Is Required To PrepareGaurav ChauhanPas encore d'évaluation

- Finals SolutionsDocument9 pagesFinals Solutionsi_dreambig100% (3)

- Unit 2 - Essay QuestionsDocument8 pagesUnit 2 - Essay QuestionsJaijuPas encore d'évaluation

- 2 Fmaf: Management Accounting FundamentalsDocument52 pages2 Fmaf: Management Accounting Fundamentalsdigitalbooks100% (1)

- Financial Analysis and Investment AppraisalDocument4 pagesFinancial Analysis and Investment AppraisalNguyen Dac ThichPas encore d'évaluation

- 2014 Web AccountingDocument67 pages2014 Web AccountingpankajauwaPas encore d'évaluation

- Budgeting and Variance Analysis QuestionsDocument13 pagesBudgeting and Variance Analysis QuestionsAli Rizwan100% (1)

- Assignment: Managing Financial Principles and TechniquesDocument11 pagesAssignment: Managing Financial Principles and TechniquesAdeirehs Eyemarket BrissettPas encore d'évaluation

- AccountingDocument4 pagesAccountingNaiya JoshiPas encore d'évaluation

- Financial Accounting Sample Paper 21Document31 pagesFinancial Accounting Sample Paper 21Jayasankar SankarPas encore d'évaluation

- Budgetary Control and Classification of BudgetsDocument27 pagesBudgetary Control and Classification of BudgetsManjunath VaskuriPas encore d'évaluation

- Sold Equipment (Cost $10,000, Accumulated Depreciation $7,000) For $1,200. InstructionsDocument3 pagesSold Equipment (Cost $10,000, Accumulated Depreciation $7,000) For $1,200. InstructionsAshish BhallaPas encore d'évaluation

- ACCA MA - Fma Study School Budgeting Part B SolutionsDocument16 pagesACCA MA - Fma Study School Budgeting Part B Solutionsmaharajabby81Pas encore d'évaluation

- FA Mod1 2013Document551 pagesFA Mod1 2013Anoop Singh100% (2)

- Qe: Auditing: For Questions 1-5: How Much Is The Net Loss On Disposal of Trucks in 2017?Document47 pagesQe: Auditing: For Questions 1-5: How Much Is The Net Loss On Disposal of Trucks in 2017?Aivan KielPas encore d'évaluation

- Chap 9 NotesDocument15 pagesChap 9 Notes乙คckคrψ YTPas encore d'évaluation

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezPas encore d'évaluation

- AC557 W5 HW Questions/AnswersDocument5 pagesAC557 W5 HW Questions/AnswersDominickdad100% (3)

- MOJAKOE UTS AM Genap 2010-2011Document11 pagesMOJAKOE UTS AM Genap 2010-2011Fildzah Dessyana MannanPas encore d'évaluation

- Accounting Online Test With AnswersDocument10 pagesAccounting Online Test With AnswersAuroraPas encore d'évaluation

- Accounting For Managers-Assignment MaterialsDocument4 pagesAccounting For Managers-Assignment MaterialsYehualashet TeklemariamPas encore d'évaluation

- Accounting Final RufDocument9 pagesAccounting Final RufSyed HoquePas encore d'évaluation

- Management Accounting HWDocument5 pagesManagement Accounting HWHw SolutionPas encore d'évaluation

- P10Document7 pagesP10auliciPas encore d'évaluation

- Learning Guide: Accounts and Budget ServiceDocument33 pagesLearning Guide: Accounts and Budget ServiceramePas encore d'évaluation

- 04 QuestionsDocument7 pages04 QuestionsfaizthemePas encore d'évaluation

- SITXFIN003 HandoDocument11 pagesSITXFIN003 HandoonurPas encore d'évaluation

- 5 6116113633723285546Document45 pages5 6116113633723285546Renelyn David100% (1)

- Accounting-2009 Resit ExamDocument18 pagesAccounting-2009 Resit ExammasterURPas encore d'évaluation

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Document7 pagesDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartPas encore d'évaluation

- Practical Accounting Problems 1Document4 pagesPractical Accounting Problems 1Eleazer Ego-oganPas encore d'évaluation

- Lancaster University: January 2014 ExaminationsDocument6 pagesLancaster University: January 2014 Examinationswhaza7890% (1)

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Resa Afar 2205 Quiz 2Document14 pagesResa Afar 2205 Quiz 2Rafael Bautista100% (1)

- Accounting Chapter 5 SolutionsDocument13 pagesAccounting Chapter 5 Solutionsali sherPas encore d'évaluation

- Laporan Keuangan BOLT 31-12-2020Document137 pagesLaporan Keuangan BOLT 31-12-2020Chelsea SofiaPas encore d'évaluation

- Tugas CompletingDocument6 pagesTugas CompletingWidad NadiaPas encore d'évaluation

- Notes Adjusting EntriesDocument14 pagesNotes Adjusting EntriesGelesabeth Garcia100% (1)

- Ifric 17Document8 pagesIfric 17Sofiya BayraktarovaPas encore d'évaluation

- Partnership FormationDocument8 pagesPartnership FormationAira Kaye MartosPas encore d'évaluation

- Test 3 QuestionsDocument8 pagesTest 3 QuestionsArt and Fashion galleryPas encore d'évaluation

- Cfap 01 Aafr ST 2017 Castar - PKDocument830 pagesCfap 01 Aafr ST 2017 Castar - PKYousaf JamalPas encore d'évaluation

- Jenica Company COGS and Marj Company sales revenue calculationsDocument2 pagesJenica Company COGS and Marj Company sales revenue calculationsGloria Beltran100% (1)

- Laporan Keuangan WIKA Per 31 Maret 2019-DikonversiDocument170 pagesLaporan Keuangan WIKA Per 31 Maret 2019-DikonversiRatna ShafaPas encore d'évaluation

- Account Name Header Balance Account NumberDocument4 pagesAccount Name Header Balance Account NumberEster VhandeliaPas encore d'évaluation

- 12linsteel Book of Account DecemberDocument54 pages12linsteel Book of Account DecemberCarlos_CriticaPas encore d'évaluation

- Ex 2-20 Identificando Errores en El Balance de Comprobación Mascot Co. July 31, 2016Document9 pagesEx 2-20 Identificando Errores en El Balance de Comprobación Mascot Co. July 31, 2016Christian Del Moral BraceroPas encore d'évaluation

- CNXX JV 2012 Verkort 5CDocument77 pagesCNXX JV 2012 Verkort 5CgalihPas encore d'évaluation

- Topic 4Document18 pagesTopic 4Sharmilah UthyasuriyanPas encore d'évaluation

- FinancialStatement 2019Document298 pagesFinancialStatement 2019Tonga ProjectPas encore d'évaluation

- IAS Vs IFRSDocument1 pageIAS Vs IFRSShimelis TesemaPas encore d'évaluation

- Passion For Education But at What Cost Preview Copy 3Document8 pagesPassion For Education But at What Cost Preview Copy 3Mark ButayaPas encore d'évaluation

- Ch08 Property, Plant & EquipmentDocument6 pagesCh08 Property, Plant & EquipmentralphalonzoPas encore d'évaluation

- Soalan Presentation FA 3Document12 pagesSoalan Presentation FA 3Vasant SriudomPas encore d'évaluation

- Intro To Financial StatementsDocument20 pagesIntro To Financial StatementsSaima FazalPas encore d'évaluation

- PT DARMA HENWA Tbk Interim Financial Report Q1 2022Document102 pagesPT DARMA HENWA Tbk Interim Financial Report Q1 2022shinta kiraniaPas encore d'évaluation

- CH 01 Intercorporate Acquisitions and Investments in Other EntitiesDocument38 pagesCH 01 Intercorporate Acquisitions and Investments in Other Entitiesosggggg67% (3)

- Chap2 A MergedDocument30 pagesChap2 A Mergedjamel008Pas encore d'évaluation