Académique Documents

Professionnel Documents

Culture Documents

Corporate Governance

Transféré par

Krishna ThapaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Corporate Governance

Transféré par

Krishna ThapaDroits d'auteur :

Formats disponibles

Corporate Governance

INTRODUCTION

Corporate governance refers to the system by which corporations are directed and controlled.

The governance structure specifies the distribution of rights and responsibilities among different

participants in the corporation (such as the board of directors, managers, shareholders, creditors,

auditors, regulators, and other stakeholders) and specifies the rules and procedures for making

decisions in corporate affairs. Governance provides the structure through which corporations set

and pursue their objectives, while reflecting the context of the social, regulatory and market

environment. Governance is a mechanism for monitoring the actions, policies and decisions of

corporations. Governance involves the alignment of interests among the stakeholders

There has been renewed interest in the corporate governance practices of modern corporations,

particularly in relation to accountability, since the high-profile collapses of a number of large

corporations during 20012002, most of which involved accounting fraud. Corporate scandals of

various forms have maintained public and political interest in the regulation of corporate

governance. In the U.S., these include Enron Corporation and MCI Inc. (formerly WorldCom).

Their demise is associated with the U.S. federal government passing the Sarbanes-Oxley Act in

2002, intending to restore public confidence in corporate governance. Comparable failures in

Australia (HIH, One.Tel) are associated with the eventual passage of the CLERP 9 reforms.

Similar corporate failures in other countries stimulated increased regulatory interest (e.g.,

Parmalat in Italy).

Corporate governance has also been defined as "a system of law and sound approaches by which

corporations are directed and controlled focusing on the internal and external corporate structures

with the intention of monitoring the actions of management and directors and thereby mitigating

agency risks which may stem from the misdeeds of corporate officers. In contemporary business

corporations, the main external stakeholder groups are shareholders, debt holders, trade creditors,

suppliers, customers and communities affected by the corporation's activities. Internal

stakeholders are the board of directors, executives, and other employees.

1|Page

Corporate Governance

Much of the contemporary interest in corporate governance is concerned with mitigation of the

conflicts of interests between stakeholders. Ways of mitigating or preventing these conflicts of

interests include the processes, customs, policies, laws, and institutions which have an impact on

the way a company is controlled. An important theme of governance is the nature and extent of

corporate accountability.

A related but separate thread of discussions focuses on the impact of a corporate governance

system on economic efficiency, with a strong emphasis on shareholders' welfare. In large firms

where there is a separation of ownership and management and no controlling shareholder, the

principalagent issue arises between upper-management (the "agent") which may have very

different interests, and by definition considerably more information, than shareholders (the

"principals"). The danger arises that rather than overseeing management on behalf of

shareholders, the board of directors may become insulated from shareholders and beholden to

management. This aspect is particularly present in contemporary public debates and

developments in regulatory policy.

Economic analysis has resulted in a literature on the subject. One source defines corporate

governance as "the set of conditions that shapes the ex post bargaining over the quasi-rents

generated by a firm."The firm itself is modelled as a governance structure acting through the

mechanisms of contract. Here corporate governance may include its relation to corporate finance.

2|Page

Corporate Governance

PRINCIPLES OF CORPORATE GOVERNANCE

Contemporary discussions of corporate governance tend to refer to principles raised in three

documents released since 1990: The Cadbury Report (UK, 1992), the Principles of Corporate

Governance (OECD, 1998 and 2004), the Sarbanes-Oxley Act of 2002 (US, 2002). The Cadbury

and OECD reports present general principles around which businesses are expected to operate to

assure proper governance. The Sarbanes-Oxley Act, informally referred to as Sarbox or Sox, is

an attempt by the federal government in the United States to legislate several of the principles

recommended in the Cadbury and OECD reports.

Rights and equitable treatment of shareholders:

Organizations should respect the rights of shareholders and help shareholders to exercise those

rights. They can help shareholders exercise their rights by openly and effectively communicating

information and by encouraging shareholders to participate in general meetings.

Interests of other stakeholders:

Organizations should recognize that they have legal, contractual, social, and market driven

obligations to non-shareholder stakeholders, including employees, investors, creditors, suppliers,

local communities, customers, and policy makers.

Role and responsibilities of the board:

The board needs sufficient relevant skills and understanding to review and challenge

management performance. It also needs adequate size and appropriate levels of independence

and commitment.

3|Page

Corporate Governance

Integrity and ethical behavior:

Integrity should be a fundamental requirement in choosing corporate officers and board

members. Organizations should develop a code of conduct for their directors and executives that

promotes ethical and responsible decision making.

Disclosure and transparency:

Organizations should clarify and make publicly known the roles and responsibilities of board and

management to provide stakeholders with a level of accountability. They should also implement

procedures to independently verify and safeguard the integrity of the company's financial

reporting. Disclosure of material matters concerning the organization should be timely and

balanced to ensure that all investors have access to clear, factual information.

4|Page

Corporate Governance

NEED FOR CORPORATE GOVERNANCE

Corporate governance is important for the following reasons:

It lays down the framework for creating long-term trust between companies and the external

providers of capital.

It improves strategic thinking at the top by inducting independent directors who bring a

wealth of experience, and a host of new ideas

It rationalizes the management and monitoring of risk that a firm faces globally

It limits the liability of top management and directors, by carefully articulating the decision

making process

It has long term reputational effects among key stakeholders, both internally (employees) and

externally (clients, communities, political/regulatory agents)

5|Page

Corporate Governance

OBJECTIVES

OF

CORPORATE

GOVERNANCE

Good governance is integral to the very existence of a company.

It inspires and strengthens investors confidence by ensuring companys commitment to higher

growth and profits.

It seeks to achieve following objectives:

That a properly structured Board capable of taking independent and objective decisions is in

place at the helm of affairs;

That the Board is balanced as regards the representation of adequate number of nonexecutive who will take care of the interests and well-being of the independent directors and

all the stakeholders;

That the Board adopts transparent procedures and practices and arrives at decisions on the

strength of adequate information;

That the Board has an effective machinery to sub serve the concerns of stakeholders;

That the Board keeps the shareholders informed of relevant developments impacting the

company;

That the Board effectively and regularly monitors the functioning of the management team,

and

That the Board remains in effective control of the affairs of the company at all times, The

overall endeavor of the Board should be to take the organization forward to maximize longterm value and shareholders wealth.

6|Page

Corporate Governance

ELEMENTS OF GOOD CORPORATE GOVERNANCE

Role and powers of Board:

Good governance is decisively the manifestation of personal beliefs and values, which configure

the organizational values, beliefs and actions of its Board. The foremost requirement of good

governance is the clear identification of powers, roles, responsibilities and accountability of the

Board, CEO, and the Chairman of the Board.

Legislation

Clear and unambiguous legislation and regulations are fundamental to effective corporate

governance. Legislation that requires continuing legal interpretation or is difficult to interpret on

a day-to-day basis can be subject to deliberate manipulation or inadvertent misinterpretation.

Management environment:

Management environment includes setting-up of clear objectives and appropriate ethical

framework, establishing due processes, providing for transparency and clear enunciation of

responsibility and accountability, implementing sound business planning, encouraging business

risk assessment, having right people and right skill for the jobs, establishing clear boundaries for

acceptable behavior, establishing performance evaluation measures and evaluating performance

and sufficiently recognizing individual and group contribution.

Board independence:

7|Page

Corporate Governance

Independent Board is essential for sound corporate governance. This goal may be achieved by

associating sufficient number of independent directors with the board. Independence of directors

would ensure that there are no actual or perceived conflicts of interest.

Code of conduct:

It is essential that the organizations explicitly prescribed norms of ethical practices and code of

conduct are communicated to all stakeholders and are clearly understood and followed by each

member of the organization. Systems should be in place to periodically measure adherence to

code of conduct and the adherence should be periodically evaluated and if possible recognized.

Strategy setting:

The objectives of the company must be clearly documented in a long-term corporate strategy and

an annual business plan together with achievable and measurable performance targets and

milestones.

Business and community consultation:

Though basic activity of a business entity is inherently commercial yet it must also take care of

communitys obligations. Commercial objectives and community service obligations should be

clearly documented after approval by the Board. The stakeholders must be informed about the

proposed and ongoing initiatives taken to meet social responsibility obligations.

Financial and operational reporting:

8|Page

Corporate Governance

The Board requires comprehensive, regular, reliable, timely, correct and relevant information in a

form and of a quality that is appropriate to discharge its function of monitoring corporate

performance.

Audit Committees:

The Audit Committee is inter alia responsible for liaison with the management; internal and

statutory auditors, reviewing the adequacy of internal control and compliance with significant

policies and procedures, reporting to the Board on the key issues. The quality of Audit

Committee significantly contributes to the governance of the company.

Risk management:

Risk is an important element of corporate functioning and governance. There should be a clearly

established process of identifying, analyzing and treating risks, which could prevent the company

from effectively achieving its objectives. For this purpose the company should subject itself to

periodic external and internal risk reviews.The above improves public understanding of the

structure, activities and policies of the organization. Consequently the organization is able to

attract investors, and to enhance the trust and confidence of the stakeholders.

9|Page

Corporate Governance

MECHANISMS AND CONTROLS

Corporate governance mechanisms and controls are designed to reduce the inefficiencies that

arise from moral hazard and adverse selection. There are both internal monitoring systems and

external monitoring systems. Internal monitoring can be done, for example, by one (or a few)

large shareholder(s) in the case of privately held companies or a firm belonging to a business

group. Furthermore, the various board mechanisms provide for internal monitoring. External

monitoring of managers' behavior occurs when an independent third party (e.g. the external

auditor) attests the accuracy of information provided by management to investors. Stock analysts

and debt holders may also conduct such external monitoring. An ideal monitoring and control

system should regulate both motivation and ability, while providing incentive alignment toward

corporate goals and objectives. Care should be taken that incentives are not so strong that some

individuals are tempted to cross lines of ethical behavior, for example by manipulating revenue

and profit figures to drive the share price of the company up. It can be further controlled with

the help of two methods :

Internal corporate governance controls

External corporate governance controls

INTERNAL CORPORATE GOVERNANCE CONTROLS

10 | P a g e

Corporate Governance

Internal corporate governance controls monitor activities and then take corrective action to

accomplish organizational goals. Examples include:

Monitoring by the board of directors:

The board of directors, with its legal authority to hire, fire and compensate top management,

safeguards invested capital. Regular board meetings allow potential problems to be identified,

discussed and avoided. Whilst non-executive directors are thought to be more independent, they

may not always result in more effective corporate governance and may not increase performance.

Different board structures are optimal for different firms. Moreover, the ability of the board to

monitor the firm's executives is a function of its access to information. Executive directors

possess superior knowledge of the decision-making process and therefore evaluate top

management on the basis of the quality of its decisions that lead to financial performance

outcomes, ex ante. It could be argued, therefore, that executive directors look beyond the

financial criteria.

Internal control procedures and internal auditors:

Internal control procedures are policies implemented by an entity's board of directors, audit

committee, management, and other personnel to provide reasonable assurance of the entity

achieving its objectives related to reliable financial reporting, operating efficiency, and

compliance with laws and regulations. Internal auditors are personnel within an organization who

test the design and implementation of the entity's internal control procedures and the reliability

of its financial reporting.

Balance of power:

The simplest balance of power is very common; require that the President be a different person

from the Treasurer. This application of separation of power is further developed in companies

where separate divisions check and balance each other's actions. One group may propose

company-wide administrative changes, another group review and can veto the changes, and a

third group check that the interests of people (customers, shareholders, employees) outside the

three groups are being met.

11 | P a g e

Corporate Governance

Remuneration:

Performance-based remuneration is designed to relate some proportion of salary to individual

performance. It may be in the form of cash or non-cash payments such as shares and share

options, superannuation or other benefits. Such incentive schemes, however, are reactive in the

sense that they provide no mechanism for preventing mistakes or opportunistic behavior, and can

elicit myopic behavior.

Monitoring by large shareholders and/or monitoring by banks and other large creditors:

Given their large investment in the firm, these stakeholders have the incentives, combined with

the right degree of control and power, to monitor the management.

In publicly traded U.S. corporations, boards of directors are largely chosen by the President/CEO

and the President/CEO often takes the Chair of the Board position for his/herself (which makes it

much more difficult for the institutional owners to "fire" him/her). The practice of the CEO also

being the Chair of the Board is fairly common in large American corporations.

While this practice is common in the U.S., it is relatively rare elsewhere. In the U.K., successive

codes of best practice have recommended against duality.

12 | P a g e

Corporate Governance

EXTERNAL CORPORATE GOVERNANCE CONTROLS

External corporate governance controls encompass the controls external stakeholders exercise

over the organization. Examples include:

Competition

Debt Covenants

Demand for and assessment of performance information (especially financial statements)

Government Regulations

Managerial Labour Market

Media Pressure

Takeovers

13 | P a g e

Corporate Governance

REGULATIONS

Legal environment

Corporations are created as legal persons by the laws and regulations of a particular jurisdiction.

These may vary in many respects between countries, but a corporation's legal person status is

fundamental to all jurisdictions and is conferred by statute. This allows the entity to hold

property in its own right without reference to any particular real person. It also results in the

perpetual existence that characterizes the modern corporation. The statutory granting of

corporate existence may arise from general purpose legislation (which is the general case) or

from a statute to create a specific corporation, which was the only method prior to the 19th

century.

In addition to the statutory laws of the relevant jurisdiction, corporations are subject to common

law in some countries, and various laws and regulations affecting business practices. In most

jurisdictions, corporations also have a constitution that provides individual rules that govern the

corporation and authorize or constrain its decision-makers. This constitution is identified by a

variety of terms; in English-speaking jurisdictions, it is usually known as the Corporate Charter

or the [Memorandum] and Articles of Association. The capacity of shareholders to modify the

constitution of their corporation can vary substantially

The U.S. passed the Foreign Corrupt Practices Act (FCPA) in 1977, with subsequent

modifications. This law made it illegal to bribe government officials and required corporations to

maintain adequate accounting controls. It is enforced by the U.S. Department of Justice and the

14 | P a g e

Corporate Governance

Securities and Exchange Commission (SEC). Substantial civil and criminal penalties have been

levied on corporations and executives convicted of bribery.

The UK passed the Bribery Act in 2010. This law made it illegal to bribe either government or

private citizens or make facilitating payments (i.e., payment to a government official to perform

their routine duties more quickly). It also required corporations to establish controls to prevent

bribery.

CORPORATE GOVERNANCE MODELS AROUND THE WORLD

There are many different models of corporate governance around the world. These differ

according to the variety of capitalism in which they are embedded. The Anglo-American

"model" tends to emphasize the interests of shareholders. The coordinated or Multi Stakeholder

Model associated with Continental Europe and Japan also recognizes the interests of workers,

managers, suppliers, customers, and the community. A related distinction is between marketorientated and network-orientated models of corporate governance.

Continental Europe

Some continental European countries, including Germany and the Netherlands, require a twotiered Board of Directors as a means of improving corporate governance. In the two-tiered board,

the Executive Board, made up of company executives, generally runs day-to-day operations

while the supervisory board, made up entirely of non-executive directors who represent

shareholders and employees, hires and fires the members of the executive board, determines their

compensation, and reviews major business decisions.

India

India's SEBI Committee on Corporate Governance defines corporate governance as the

"acceptance by management of the inalienable rights of shareholders as the true owners of the

corporation and of their own role as trustees on behalf of the shareholders. It is about

commitment to values, about ethical business conduct and about making a distinction between

personal & corporate funds in the management of a company." It has been suggested that the

Indian approach is drawn from the Gandhian principle of trusteeship and the Directive Principles

15 | P a g e

Corporate Governance

of the Indian Constitution, but this conceptualization of corporate objectives is also prevalent in

Anglo-American and most other jurisdictions.

United States, United Kingdom

The so-called "Anglo-American model" of corporate governance emphasizes the interests of

shareholders. It relies on a single-tiered Board of Directors that is normally dominated by nonexecutive directors elected by shareholders. Because of this, it is also known as "the unitary

system". Within this system, many boards include some executives from the company (who are

ex officio members of the board). Non-executive directors are expected to outnumber executive

directors and hold key posts, including audit and compensation committees. The United States

and the United Kingdom differ in one critical respect with regard to corporate governance: In the

United Kingdom, the CEO generally does not also serve as Chairman of the Board, whereas in

the US having the dual role is the norm, despite major misgivings regarding the impact on

corporate governance.

In the United States, corporations are directly governed by state laws, while the exchange

(offering and trading) of securities in corporations (including shares) is governed by federal

legislation. Many US states have adopted the Model Business Corporation Act, but the dominant

state law for publicly traded corporations is Delaware, which continues to be the place of

incorporation for the majority of publicly traded corporations. Individual rules for corporations

are based upon the corporate charter and, less authoritatively, the corporate bylaws. Shareholders

cannot initiate changes in the corporate charter although they can initiate changes to the

corporate bylaws.

16 | P a g e

Corporate Governance

FINANCIAL REPORTING AND THE INDEPENDENT AUDITOR

The board of directors has primary responsibility for the corporation's external financial

reporting functions. The Chief Executive Officer and Chief Financial Officer are crucial

participants and boards usually have a high degree of reliance on them for the integrity and

supply of accounting information. They oversee the internal accounting systems, and are

dependent on the corporation's accountants and internal auditors.

Current accounting rules under International Accounting Standards and U.S. GAAP allow

managers some choice in determining the methods of measurement and criteria for recognition

of various financial reporting elements. The potential exercise of this choice to improve apparent

performance (see creative accounting and earnings management) increases the information risk

for users. Financial reporting fraud, including non-disclosure and deliberate falsification of

values also contributes to users' information risk. To reduce this risk and to enhance the

perceived integrity of financial reports, corporation financial reports must be audited by an

independent external auditor who issues a report that accompanies the financial statements.

One area of concern is whether the auditing firm acts as both the independent auditor and

management consultant to the firm they are auditing. This may result in a conflict of interest

which places the integrity of financial reports in doubt due to client pressure to appease

management. The power of the corporate client to initiate and terminate management consulting

services and, more fundamentally, to select and dismiss accounting firms contradicts the concept

of an independent auditor. Changes enacted in the United States in the form of the Sarbanes17 | P a g e

Corporate Governance

Oxley Act (following numerous corporate scandals, culminating with the Enron scandal) prohibit

accounting firms from providing both auditing and management consulting services. Similar

provisions are in place under clause 49 of Standard Listing Agreement in India.

Systemic problems of corporate governance

Demand for information: In order to influence the directors, the shareholders must combine with

others to form a voting group which can pose a real threat of carrying resolutions or appointing

directors at a general meeting.

Monitoring costs:

A barrier to shareholders using good information is the cost of processing it, especially to a small

shareholder. The traditional answer to this problem is the efficient market hypothesis (in finance,

the efficient market hypothesis (EMH) asserts that financial markets are efficient), which

suggests that the small shareholder will free ride on the judgments of larger professional

investors.

Supply of accounting information:

Financial accounts form a crucial link in enabling providers of finance to monitor directors.

Imperfections in the financial reporting process will cause imperfections in the effectiveness of

corporate governance. This should, ideally, be corrected by the working of the external auditing

process.

18 | P a g e

Corporate Governance

DEBATES IN CORPORATE GOVERNANCE

Executive pay

Increasing attention and regulation (as under the Swiss referendum "against corporate Rip-offs"

of 2013) has been brought to executive pay levels since the financial crisis of 20072008.

Research on the relationship between firm performance and executive compensation does not

identify consistent and significant relationships between executives' remuneration and firm

performance. Not all firms experience the same levels of agency conflict, and external and

internal monitoring devices may be more effective for some than for others. Some researchers

have found that the largest CEO performance incentives came from ownership of the firm's

shares, while other researchers found that the relationship between share ownership and firm

performance was dependent on the level of ownership. The results suggest that increases in

ownership above 20% cause management to become more entrenched, and less interested in the

welfare of their shareholders.

Some argue that firm performance is positively associated with share option plans and that these

plans direct managers' energies and extend their decision horizons toward the long-term, rather

than the short-term, performance of the company. However, that point of view came under

substantial criticism circa in the wake of various security scandals including mutual fund timing

19 | P a g e

Corporate Governance

episodes and, in particular, the backdating of option grants as documented by University of Iowa

academic Erik Lie and reported by James Blander and Charles Forelle of the Wall Street Journal.

Even before the negative influence on public opinion caused by the 2006 backdating scandal, use

of options faced various criticisms. A particularly forceful and long running argument concerned

the interaction of executive options with corporate stock repurchase programs. Numerous

authorities (including U.S. Federal Reserve Board economist Weisbenner) determined options

may be employed in concert with stock buybacks in a manner contrary to shareholder interests.

These authors argued that, in part, corporate stock buybacks for U.S. Standard & Poors 500

companies surged to a $500 billion annual rate in late 2006 because of the impact of options.

A combination of accounting changes and governance issues led options to become a less

popular means of remuneration as 2006 progressed, and various alternative implementations of

buybacks surfaced to challenge the dominance of "open market" cash buybacks as the preferred

means of implementing a share repurchase plan.

Separation of Chief Executive Officer and Chairman of the Board roles

Shareholders elect a board of directors, who in turn hire a Chief Executive Officer (CEO) to lead

management. The primary responsibility of the board relates to the selection and retention of the

CEO. However, in many U.S. corporations the CEO and Chairman of the Board roles are held by

the same person. This creates an inherent conflict of interest between management and the board.

Critics of combined roles argue the two roles should be separated to avoid the conflict of interest.

Advocates argue that empirical studies do not indicate that separation of the roles improves stock

market performance and that it should be up to shareholders to determine what corporate

governance model is appropriate for the firm.

In 2004, 73.4% of U.S. companies had combined roles; this fell to 57.2% by May 2012. Many

U.S. companies with combined roles have appointed a "Lead Director" to improve independence

of the board from management. German and UK companies have generally split the roles in

nearly 100% of listed companies. Empirical evidence does not indicate one model is superior to

20 | P a g e

Corporate Governance

the other in terms of performance. However, one study indicated that poorly performing firms

tend to remove separate CEO's more frequently than when the CEO/Chair roles are combined.

CORPORATE GOVERNANCE BIG ISSUE FOR INVESTORS

Corporate governance is an important criterion while investing, says a survey by proxy advisory

firm Institutional Investor Advisory Services (IiAS) titled 'Institutional Investors' Attitudes to

Corporate Governance'. The survey says more than a quarter of the respondents chose to invest

in a company purely because of high standards of corporate governance while 79 per cent

refrained from investing in a high-growth company solely because of corporate governance

issues.

A large 73 per cent of respondents exited a company because of corporate governance concerns,

the survey points out. According to more than three-fourth of the respondents, well-governed

companies will always command a premium to their industry peers.

The second is an annual survey-based on a poll of more than 70 participants across mutual funds,

insurance companies, high net worth individuals and other institutional investors-has some

interesting insights into sectors and companies rated high on corporate governance.

For instance, IT services has been rated the highest on the corporate governance standards

followed by FMCG and consumer products, pharmaceuticals, automotive and financial services.

21 | P a g e

Corporate Governance

Sectors with the poorest governance practices include real estate, infrastructure, mining and

metals, and media and entertainment.

The best-governed companies, according to investor perceptions, include TCS, Infosys, HUL,

HDFC and HDFC Bank, M&M, and Nestle. Professionally managed companies and MNCs

feature more prominently in this list, as compared to promoter-managed firms or public sector

units (PSUs).

Although Infosys emerged as a favorite with investors, respondents were divided about N.R.

Narayana Murthy's return to Infosys as executive chairman with nearly 49 per cent seeing his

move as a repudiation of corporate governance principles. Interestingly, more foreign institutions

disapproved of Murthy's comeback than domestic institutions.

So, what are the biggest issues that investors look for when it comes to corporate governance?

The survey says clarity in business and accounting practices are considered the most important

dimension in corporate governance. Other important aspects include fair dealing with clients and

suppliers, strong representation from independent directors, compliance and remuneration.

The survey shows two-thirds of respondents indicated they would initiate action against the

company for their grievances. The Companies Act 2013 provides for filing class action suits

against companies."When faced with a company proposal that they disagree with, nearly 60 per

cent of the respondents are willing to engage with the company - either directly or indirectly.

However, a sizeable share of the respondents (28 per cent) said that they would exit the

company," the survey adds.While 54 per cent respondents said the Companies Act was sufficient

to address corporate governance concerns, 40 per cent said it was not sufficient.

22 | P a g e

Corporate Governance

CORPORATE GOVERNANCE OF RELIANCE INDUSTRIES LIMITED

Growth through Governance

Reliance is in the forefront of implementation of Corporate Governance best practices

Corporate Governance at Reliance is based on the following main principles:

Constitution of a Board of Directors of appropriate composition, size, varied expertise and

commitment to discharge its responsibilities and duties.

Ensuring timely flow of information to the Board and its Committees to enable them to

discharge their functions effectively.

Independent verification and safeguarding integrity of the Companys financial reporting

A sound system of risk management and internal control.

Timely and balanced disclosure of all material information concerning the Company to all

stakeholders.

23 | P a g e

Corporate Governance

Transparency and accountability.

Compliance with all the applicable rules and regulations.

Fair and equitable treatment of all its stakeholders including employees, customers,

shareholders and investors.

CONCLUSION

Corporate Governance has become the latest buzzword today. Almost every country has

institutionalized a set of Corporate Governance codes, spelt out best practices and has sought to

impose appropriate board structures. Despite the Corporate Governance revolution there exists

no universal benchmark for effective levels of disclosure and transparency. There are several

corporate governance structures available in the developed world but there is no one structure,

which can be singled out as being better than the others. There is no one size fits all structure

for corporate governance. Corporate governance extends beyond corporate law.

Its fundamental objective is not the mere fulfillment of the requirements of law but in ensuring

commitment of the board in managing the company in a transparent manner for maximizing long

term shareholder value. Effectiveness of corporate governance system cannot merely be

legislated by law. As competition increases, technology pronounces the death of distance and

speeds up communication. The environment in which companies operate in India also changes.

In this dynamic environment the systems of corporate governance also need to evolve.

The recommendations made by different expert committees will go a long way in raising the

standards of corporate governance in Indian companies and make them attractive destinations for

24 | P a g e

Corporate Governance

local and global capital. These recommendations will also form the base for further evolution of

the structure of corporate governance in consonance with the rapidly changing economic and

industrial environment of the country in the new millennium.

WEBLIOGRAPHY

www.wikipedia.org

www.investopedia.com

www.indiatimes.com

25 | P a g e

Vous aimerez peut-être aussi

- Curricullam Vitae: Wahid-Ur-RehmanDocument2 pagesCurricullam Vitae: Wahid-Ur-RehmanKrishna ThapaPas encore d'évaluation

- Merchant Banking in IndiaDocument52 pagesMerchant Banking in IndiaKrishna ThapaPas encore d'évaluation

- Merchant Banking in IndiaDocument52 pagesMerchant Banking in IndiaKrishna ThapaPas encore d'évaluation

- Unit 6 FinalbfgDocument23 pagesUnit 6 FinalbfgKrishna ThapaPas encore d'évaluation

- Merchant Banking in IndiaDocument52 pagesMerchant Banking in IndiaKrishna ThapaPas encore d'évaluation

- Front PagesDocument5 pagesFront PagesKrishna ThapaPas encore d'évaluation

- Front PagesDocument5 pagesFront PagesKrishna ThapaPas encore d'évaluation

- Project 2Document61 pagesProject 2Krishna ThapaPas encore d'évaluation

- Imran PathanDocument42 pagesImran PathanKrishna ThapaPas encore d'évaluation

- PLC PC KFC..Document48 pagesPLC PC KFC..Krishna Thapa75% (8)

- Front PagesDocument4 pagesFront PagesKrishna ThapaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- CBSE Class 6 Whole Numbers WorksheetDocument2 pagesCBSE Class 6 Whole Numbers WorksheetPriyaprasad PandaPas encore d'évaluation

- Qad Quick StartDocument534 pagesQad Quick StartMahadev Subramani100% (1)

- KPUPDocument38 pagesKPUPRoda ES Jimbert50% (2)

- Corporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Document18 pagesCorporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Lia asnamPas encore d'évaluation

- United States Bankruptcy Court Southern District of New YorkDocument21 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsPas encore d'évaluation

- MA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Document10 pagesMA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Sit LucasPas encore d'évaluation

- Weone ProfileDocument10 pagesWeone ProfileOmair FarooqPas encore d'évaluation

- Manual WinMASW EngDocument357 pagesManual WinMASW EngRolanditto QuuisppePas encore d'évaluation

- Meet Your TeamDocument2 pagesMeet Your TeamAyushman MathurPas encore d'évaluation

- Mounting InstructionDocument1 pageMounting InstructionAkshay GargPas encore d'évaluation

- Fast Aldol-Tishchenko ReactionDocument5 pagesFast Aldol-Tishchenko ReactionRSLPas encore d'évaluation

- Philippine Population 2009Document6 pagesPhilippine Population 2009mahyoolPas encore d'évaluation

- List of Reactive Chemicals - Guardian Environmental TechnologiesDocument69 pagesList of Reactive Chemicals - Guardian Environmental TechnologiesGuardian Environmental TechnologiesPas encore d'évaluation

- Kate Elizabeth Bokan-Smith ThesisDocument262 pagesKate Elizabeth Bokan-Smith ThesisOlyaGumenPas encore d'évaluation

- Maxx 1657181198Document4 pagesMaxx 1657181198Super UserPas encore d'évaluation

- Chromate Free CoatingsDocument16 pagesChromate Free CoatingsbaanaadiPas encore d'évaluation

- UD150L-40E Ope M501-E053GDocument164 pagesUD150L-40E Ope M501-E053GMahmoud Mady100% (3)

- Seminar Course Report ON Food SafetyDocument25 pagesSeminar Course Report ON Food SafetyYanPas encore d'évaluation

- Copula and Multivariate Dependencies: Eric MarsdenDocument48 pagesCopula and Multivariate Dependencies: Eric MarsdenJeampierr Jiménez CheroPas encore d'évaluation

- Checklist of Requirements For OIC-EW Licensure ExamDocument2 pagesChecklist of Requirements For OIC-EW Licensure Examjonesalvarezcastro60% (5)

- A Reconfigurable Wing For Biomimetic AircraftDocument12 pagesA Reconfigurable Wing For Biomimetic AircraftMoses DevaprasannaPas encore d'évaluation

- Wheeled Loader L953F Specifications and DimensionsDocument1 pageWheeled Loader L953F Specifications and Dimensionssds khanhPas encore d'évaluation

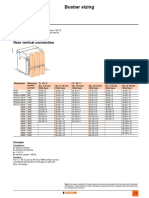

- Busbar sizing recommendations for Masterpact circuit breakersDocument1 pageBusbar sizing recommendations for Masterpact circuit breakersVikram SinghPas encore d'évaluation

- DBMS Architecture FeaturesDocument30 pagesDBMS Architecture FeaturesFred BloggsPas encore d'évaluation

- Public Private HEM Status AsOn2May2019 4 09pmDocument24 pagesPublic Private HEM Status AsOn2May2019 4 09pmVaibhav MahobiyaPas encore d'évaluation

- Prac Res Q2 Module 1Document14 pagesPrac Res Q2 Module 1oea aoueoPas encore d'évaluation

- PowerPointHub Student Planner B2hqY8Document25 pagesPowerPointHub Student Planner B2hqY8jersey10kPas encore d'évaluation

- Link Ratio MethodDocument18 pagesLink Ratio MethodLuis ChioPas encore d'évaluation

- MQC Lab Manual 2021-2022-AutonomyDocument39 pagesMQC Lab Manual 2021-2022-AutonomyAniket YadavPas encore d'évaluation