Académique Documents

Professionnel Documents

Culture Documents

Form 1040-V: What Is Form 1040-V and Do You Have To Use It? How To Send in Your 2009 Tax Return, Payment, and Form 1040-V

Transféré par

api-26236657Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form 1040-V: What Is Form 1040-V and Do You Have To Use It? How To Send in Your 2009 Tax Return, Payment, and Form 1040-V

Transféré par

api-26236657Droits d'auteur :

Formats disponibles

2009 Form 1040-V

What Is Form 1040-V and Do You Have To How To Send In Your 2009 Tax Return,

Use It? Payment, and Form 1040-V

It is a statement you send with your check or money ● Detach Form 1040-V along the dotted line.

order for any balance due on the “Amount you owe” line ● Do not staple or otherwise attach your payment or Form

of your 2009 Form 1040, Form 1040A, or Form 1040EZ. 1040-V to your return or to each other. Instead, just put

Using Form 1040-V allows us to process your payment them loose in the envelope.

more accurately and efficiently. We strongly encourage

● Mail your 2009 tax return, payment, and Form 1040-V in

you to use Form 1040-V, but there is no penalty if you do

the envelope that came with your 2009 tax return

not.

instruction booklet.

How To Fill In Form 1040-V

Note. If you do not have that envelope or you moved or

Line 1. Enter your social security number (SSN). If you are used a paid preparer, mail your return, payment, and

filing a joint return, enter the SSN shown first on your Form 1040-V to the address shown on the back that

return. applies to you.

Line 2. If you are filing a joint return, enter the SSN shown

second on your return. Paperwork Reduction Act Notice. We ask for the

Line 3. Enter the amount you are paying by check or information on Form 1040-V to help us carry out the

money order. Internal Revenue laws of the United States. If you use

Form 1040-V, you must provide the requested

Line 4. Enter your name(s) and address exactly as shown information. Your cooperation will help us ensure that we

on your return. Please print clearly. are collecting the right amount of tax.

How To Prepare Your Payment You are not required to provide the information

● Make your check or money order payable to the requested on a form that is subject to the Paperwork

“United States Treasury.” Do not send cash. Reduction Act unless the form displays a valid OMB

control number. Books or records relating to a form or its

● Make sure your name and address appear on your instructions must be retained as long as their contents

check or money order. may become material in the administration of any Internal

● Enter “2009 Form 1040,” your daytime phone number, Revenue law. Generally, tax returns and return

and your SSN on your check or money order. If you are information are confidential, as required by Internal

filing a joint return, enter the SSN shown first on your Revenue Code section 6103.

return. If you are filing Form 1040A or Form 1040EZ, enter The average time and expenses required to complete

“2009 Form 1040A” or “2009 Form 1040EZ,” whichever is and file this form will vary depending on individual

appropriate, instead of “2009 Form 1040.” circumstances. For the estimated averages, see the

● To help process your payment, enter the amount on the instructions for your income tax return. If you have

right side of your check like this: $ XXX.XX. Do not use suggestions for making this form simpler, we would be

dashes or lines (for example, do not enter “$ XXX—” or happy to hear from you. See the instructions for your

“$ XXX xx/100”). income tax return.

Cat. No. 20975C Form 1040-V (2009)

Ä Detach Here and Mail With Your Payment and Return Ä

1040-V Payment Voucher OMB No. 1545-0074

Form

Department of the Treasury

Internal Revenue Service (99)

© Do not staple or attach this voucher to your payment or return. 2009

1 Your social security number (SSN) 2 If a joint return, SSN shown second 3 Amount you are Dollars Cents

on your return paying by check

or money order

4 Your first name and initial Last name

Print or type

If a joint return, spouse’s first name and initial Last name

Home address (number and street) Apt. no.

City, town or post office, state, and ZIP code (If a foreign address, enter city, province or state, postal code, and country.)

Cat. No. 20975C

Form 1040-V (2009) Page 2

THEN use this address if you:

Prepared your Used a paid

IF you live in . . . own return . . . preparer . . .

Florida, Georgia, North Carolina, South Carolina Department of the Treasury Internal Revenue Service Center

Internal Revenue Service Center P.O. Box 105017

Atlanta, GA 39901-0102 Atlanta, GA 30348-5017

Alabama, Kentucky, Louisiana, Mississippi, Tennessee, Texas Department of the Treasury Internal Revenue Service Center

Internal Revenue Service Center P.O. Box 1214

Austin, TX 73301-0102 Charlotte, NC 28201-1214

Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Department of the Treasury Internal Revenue Service Center

Montana, Nebraska, North Dakota, Oklahoma, South Dakota, Internal Revenue Service Center P.O. Box 802501

Wisconsin, Wyoming Fresno, CA 93888-0102 Cincinnati, OH 45280-2501

Alaska, Arizona, California, Colorado, Hawaii, Nevada, Department of the Treasury Internal Revenue Service Center

New Mexico, Oregon, Utah, Washington Internal Revenue Service Center P.O. Box 7704

Fresno, CA 93888-0102 San Francisco, CA 94120-7704

Arkansas, Connecticut, Delaware, District of Columbia, Maryland, Department of the Treasury Internal Revenue Service Center

Missouri, Ohio, Rhode Island, Virginia, West Virginia Internal Revenue Service Center P.O. Box 970011

Kansas City, MO 64999-0102 St. Louis, MO 63197-0011

Maine, Massachusetts, New Hampshire, New Jersey, New York, Department of the Treasury Internal Revenue Service Center

Pennsylvania, Vermont Internal Revenue Service Center P.O. Box 37008

Kansas City, MO 64999-0102 Hartford, CT 06176-0008

A foreign country, American Samoa, or Puerto Rico (or are Department of the Treasury Internal Revenue Service Center

excluding income under Internal Revenue Code section 933), or Internal Revenue Service Center P.O. Box 1303

use an APO or FPO address, or file Form 2555, 2555-EZ, or 4563, Austin, TX 73301-0215 USA Charlotte, NC 28201-1303 USA

or are a dual-status alien or nonpermanent resident of Guam or

the Virgin Islands*

*Permanent residents of Guam or the Virgin Islands should not use Form 1040-V.

Vous aimerez peut-être aussi

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)

- f1040v 2009Document2 pagesf1040v 2009enickPas encore d'évaluation

- 1040 Exam Prep: Module II - Basic Tax ConceptsD'Everand1040 Exam Prep: Module II - Basic Tax ConceptsÉvaluation : 1.5 sur 5 étoiles1.5/5 (2)

- f1040v 2008Document2 pagesf1040v 2008enickPas encore d'évaluation

- Doing Your Own Taxes is as Easy as 1, 2, 3.D'EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Évaluation : 1 sur 5 étoiles1/5 (1)

- 1040-V Template 10-03-08Document1 page1040-V Template 10-03-08Justin Vance100% (6)

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsD'Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsPas encore d'évaluation

- 1.4 IRS Form 1040VDocument1 page1.4 IRS Form 1040VBenne James100% (1)

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryD'EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryPas encore d'évaluation

- Form 1040-V: What Is Form 1040-V How To Prepare Your PaymentDocument2 pagesForm 1040-V: What Is Form 1040-V How To Prepare Your PaymentGary KrimsonPas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionPas encore d'évaluation

- Figure L.4 - Color Gamuts (8.6.5.4, "Lab Colour Spaces") : RGB Cmyk L A BDocument2 pagesFigure L.4 - Color Gamuts (8.6.5.4, "Lab Colour Spaces") : RGB Cmyk L A BHermey Marc VillegasPas encore d'évaluation

- This Text Was Added With Javascript!: Form 1040-VDocument1 pageThis Text Was Added With Javascript!: Form 1040-VHermey Marc VillegasPas encore d'évaluation

- What Is Form 1040-VDocument2 pagesWhat Is Form 1040-VLamont RylandPas encore d'évaluation

- F 1040 VDocument2 pagesF 1040 VNotarys To Go0% (1)

- NY CA 01-01-1953 9984 TXPRDocument98 pagesNY CA 01-01-1953 9984 TXPRAdmin OfficePas encore d'évaluation

- Electronic Filing Instructions For Your 2008 Federal Tax ReturnDocument14 pagesElectronic Filing Instructions For Your 2008 Federal Tax ReturnjakePas encore d'évaluation

- 2008 Form 1040 Individual Tax ReturnDocument54 pages2008 Form 1040 Individual Tax ReturnjakePas encore d'évaluation

- US Internal Revenue Service: fw4s - 1995Document2 pagesUS Internal Revenue Service: fw4s - 1995IRSPas encore d'évaluation

- US Internal Revenue Service: fw4s - 2005Document2 pagesUS Internal Revenue Service: fw4s - 2005IRSPas encore d'évaluation

- f1099msc 2019Document8 pagesf1099msc 2019pyatetsky100% (1)

- What Is Form 1040-V?Document2 pagesWhat Is Form 1040-V?camilacorredor1998Pas encore d'évaluation

- Documents (942,202212311058, F99NEE)Document2 pagesDocuments (942,202212311058, F99NEE)LertoraPas encore d'évaluation

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamPas encore d'évaluation

- What Is Form 1040-V?Document2 pagesWhat Is Form 1040-V?Josh VannucciPas encore d'évaluation

- US Internal Revenue Service: fw4s - 1999Document2 pagesUS Internal Revenue Service: fw4s - 1999IRSPas encore d'évaluation

- 1040-V - Payment VoucherDocument2 pages1040-V - Payment Voucherjohnbaptistchruckkdk100% (1)

- US Internal Revenue Service: fw4s - 1994Document2 pagesUS Internal Revenue Service: fw4s - 1994IRSPas encore d'évaluation

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterTony MillerPas encore d'évaluation

- US Internal Revenue Service: F1040ez - 1992Document2 pagesUS Internal Revenue Service: F1040ez - 1992IRSPas encore d'évaluation

- Us 1099 2022Document4 pagesUs 1099 2022mks12Pas encore d'évaluation

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiPas encore d'évaluation

- 2021 - 1099-NEC - GreenWay Waste & Recycling of Indiana LLC - 11367636 - Sol PinedaDocument3 pages2021 - 1099-NEC - GreenWay Waste & Recycling of Indiana LLC - 11367636 - Sol PinedaRolando Pineda100% (1)

- US Internal Revenue Service: fw4s 06Document2 pagesUS Internal Revenue Service: fw4s 06IRSPas encore d'évaluation

- Form 1041-V: What Is Form 1041-V and Do You Have To Use It? No Checks of $100 Million or More AcceptedDocument2 pagesForm 1041-V: What Is Form 1041-V and Do You Have To Use It? No Checks of $100 Million or More AcceptedPnut Hallman100% (1)

- US Internal Revenue Service: fw4s07 AccessibleDocument2 pagesUS Internal Revenue Service: fw4s07 AccessibleIRSPas encore d'évaluation

- US Internal Revenue Service: I941 - 2000Document4 pagesUS Internal Revenue Service: I941 - 2000IRSPas encore d'évaluation

- Instructions For Form IT-201-V: Payment Voucher For Income Tax ReturnsDocument2 pagesInstructions For Form IT-201-V: Payment Voucher For Income Tax ReturnsQunariPas encore d'évaluation

- 2009 Hotrum G Form 1040 Individual Tax Return - Tax2009Document15 pages2009 Hotrum G Form 1040 Individual Tax Return - Tax2009jakePas encore d'évaluation

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrancis Wolfgang UrbanPas encore d'évaluation

- File by Mail Instructions For Your 2009 Federal Tax ReturnDocument11 pagesFile by Mail Instructions For Your 2009 Federal Tax ReturnjakePas encore d'évaluation

- Furqan 21Document15 pagesFurqan 21Furqan HaiderPas encore d'évaluation

- Form 1041-V: What Is Form 1041-V and Do You Have To Use It? No Checks of $100 Million or More AcceptedDocument2 pagesForm 1041-V: What Is Form 1041-V and Do You Have To Use It? No Checks of $100 Million or More AcceptedKingzuluone1Pas encore d'évaluation

- Payroll Accounting 2014 Form1040 Ch4Document4 pagesPayroll Accounting 2014 Form1040 Ch4DanCoppePas encore d'évaluation

- IL-1040 InstructionsDocument16 pagesIL-1040 InstructionsRushmorePas encore d'évaluation

- Instructions For Form 943: Employer's Annual Tax Return For Agricultural EmployeesDocument3 pagesInstructions For Form 943: Employer's Annual Tax Return For Agricultural EmployeesIRSPas encore d'évaluation

- F 1040 VDocument2 pagesF 1040 Vhottadot730@gmail.comPas encore d'évaluation

- US Internal Revenue Service: fw4p - 1996Document3 pagesUS Internal Revenue Service: fw4p - 1996IRSPas encore d'évaluation

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterpdizypdizyPas encore d'évaluation

- Attention:: WWW - Irs.gov/form1099Document8 pagesAttention:: WWW - Irs.gov/form1099kmufti7Pas encore d'évaluation

- FederalDocument24 pagesFederalNeil NitinPas encore d'évaluation

- Instructions For Form 940: Internal Revenue ServiceDocument4 pagesInstructions For Form 940: Internal Revenue ServiceIRSPas encore d'évaluation

- ACC 105 Lesson 4 Assignment 1 3-11bDocument4 pagesACC 105 Lesson 4 Assignment 1 3-11bJennifer BaileyPas encore d'évaluation

- US Internal Revenue Service: I945 - 2002Document4 pagesUS Internal Revenue Service: I945 - 2002IRSPas encore d'évaluation

- US Internal Revenue Service: F8453ol - 1996Document2 pagesUS Internal Revenue Service: F8453ol - 1996IRSPas encore d'évaluation

- US Internal Revenue Service: I941 - 2003Document4 pagesUS Internal Revenue Service: I941 - 2003IRSPas encore d'évaluation

- Filing Your Tax Forms After Selling Your Employee Stock Purchase Plan (ESPP) SharesDocument8 pagesFiling Your Tax Forms After Selling Your Employee Stock Purchase Plan (ESPP) Sharesdc016203Pas encore d'évaluation

- Instructions For Form 943: Pager/SgmlDocument4 pagesInstructions For Form 943: Pager/SgmlIRSPas encore d'évaluation

- US Internal Revenue Service: I941 - 2002Document4 pagesUS Internal Revenue Service: I941 - 2002IRSPas encore d'évaluation

- Instructions For Form 943: Employer's Annual Tax Return For Agricultural EmployeesDocument3 pagesInstructions For Form 943: Employer's Annual Tax Return For Agricultural EmployeesIRSPas encore d'évaluation

- PIT 2 - 916 Nowy Wzór 2023 PDF ENGDocument3 pagesPIT 2 - 916 Nowy Wzór 2023 PDF ENGСофія РудикPas encore d'évaluation

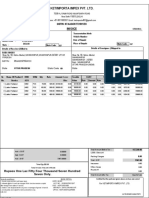

- Ketimporta Impex Pvt. LTD.: InvoiceDocument1 pageKetimporta Impex Pvt. LTD.: Invoicepuneet AroraPas encore d'évaluation

- PKF Worldwide Transfer Pricing Guide 2017 & 2018Document106 pagesPKF Worldwide Transfer Pricing Guide 2017 & 2018Aditya Barmen SaragihPas encore d'évaluation

- NYC Aid PlanDocument4 pagesNYC Aid PlanEric Adams 2021Pas encore d'évaluation

- CTPDocument53 pagesCTPsuraj nairPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Amit SharmaPas encore d'évaluation

- Ca Audit Report 2324Document6 pagesCa Audit Report 2324UmasankarPas encore d'évaluation

- Boat Rockerz 255F Bluetooth Headset With Mic: Grand Total 999.00Document1 pageBoat Rockerz 255F Bluetooth Headset With Mic: Grand Total 999.00PiyushPas encore d'évaluation

- Po SGRCTC 00039Document2 pagesPo SGRCTC 00039rahateyash9Pas encore d'évaluation

- Tax Information InterviewDocument2 pagesTax Information InterviewKIPA TV Pringsewu LampungPas encore d'évaluation

- International TaxationDocument12 pagesInternational TaxationShweta TiwariPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)vanshika mathurPas encore d'évaluation

- Quotation Quotation: Al Kindy Safety Eqpt Sales & Maint EstDocument1 pageQuotation Quotation: Al Kindy Safety Eqpt Sales & Maint EstEmmanuel ToretaPas encore d'évaluation

- VAT ReviewDocument8 pagesVAT ReviewabbyPas encore d'évaluation

- Solved Complete Each of The Following Sentences A Your Tastes Determine TheDocument1 pageSolved Complete Each of The Following Sentences A Your Tastes Determine TheM Bilal SaleemPas encore d'évaluation

- It 2010043015691122654Document1 pageIt 2010043015691122654manzurhussainPas encore d'évaluation

- Real Property Assessment &taxation - Engr NonatoDocument54 pagesReal Property Assessment &taxation - Engr NonatoBrenda Olshopee100% (3)

- PT Pma Guidance and RegulationDocument3 pagesPT Pma Guidance and RegulationRajifakbrPas encore d'évaluation

- Articles About VAT Zero-RatingDocument8 pagesArticles About VAT Zero-RatingkmoPas encore d'évaluation

- GST - HSLDocument24 pagesGST - HSLFharook SyedPas encore d'évaluation

- Saving ProformaDocument2 pagesSaving ProformaRamyasree BadePas encore d'évaluation

- Accounting For Goods & Service Tax GST WorksheetDocument13 pagesAccounting For Goods & Service Tax GST WorksheetsreehariPas encore d'évaluation

- 1 Tax2601Document4 pages1 Tax2601sphamandla kubhekaPas encore d'évaluation

- Chapter 3Document14 pagesChapter 3Fethi ADUSSPas encore d'évaluation

- HP MCQDocument7 pagesHP MCQ887 shivam guptaPas encore d'évaluation

- Tax PPT - DeductionsDocument20 pagesTax PPT - Deductionsjayparekh28Pas encore d'évaluation

- Guidelines BIR Form No. 2000-OTDocument1 pageGuidelines BIR Form No. 2000-OTAnnePas encore d'évaluation

- Final Details For Order #702-2405149-2985825: Shipped On December 3, 2018Document1 pageFinal Details For Order #702-2405149-2985825: Shipped On December 3, 2018Tim HubertPas encore d'évaluation

- Homework - Set - 10 - Spring 2013Document4 pagesHomework - Set - 10 - Spring 2013bizinichiPas encore d'évaluation

- Exercises Ch. 7 - Capital Budgeting - ADocument5 pagesExercises Ch. 7 - Capital Budgeting - AMariam AlraeesiPas encore d'évaluation