Académique Documents

Professionnel Documents

Culture Documents

Case 5.15 Audit 202

Transféré par

DonCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Case 5.15 Audit 202

Transféré par

DonDroits d'auteur :

Formats disponibles

Case 5.

15

B)

When making an inherent risk assessment, I have to assess the risk of

material misstatement of financial statements without examining the

internal controls of IndaCar Inc.

Firstly, I must gain a thorough understanding of the entity level of the

client. IC is operating in a highly competitive location and industry. It is

located right next to Lester B. Pearson Airport, and is also exposed to

competition against the other car rental companies nearby. IC operates

in a niche market because they rent out unique high-end cars. As such,

their revenues might not be as high as other car rental companies that

have a variety of cars to rent from which will lead to greater profit

opportunities. It would also be beneficial to access ICs capability to

adjust to changes in the market. For example, since the company relies

on new unique models to rent out, they must adapt to the changes in

the car industry and their respective models. Other things to consider

about the entity level are the sources of finance that IC is using to

purchase its vehicles (and whether it is obtaining a specific debt to

equity ratio), their reputation within the industry, and ICs major

suppliers of vehicles.

After, a thorough understanding of the industry level must be

developed. Jake is exploring the opportunity to expanding ICs

operations to include Vancouver and Calgary airports, and for this to

happen, there is a high risk that managers might want to overstate

revenues and understate expenses to make financial statements look

more attractive to the potential investors. I will then need to gain a

further understanding of IC and its compensation structure and see

whether managers bonuses are tied with company performance. If so,

that gives a bigger incentive for managers to overstate revenues and

understate expenses to achieve higher expectations.

Finally, the economy level during the time of the audit will be

considered. IC is susceptible to downturns in the economy. For

example, if there was a recession, there would be an overall decrease

in the number of travellers, and people might prefer public

transportation rather than renting a car to save costs.

To conclude, by taking these factors into consideration, I believe that

the inherent risk is high.

C)

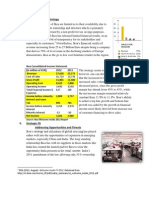

The control risk and inherent risk are both assessed as high, and as

such, detection risk will be set as low. I will take a predominantly

substantive audit approach. I will not rely on clients internal controls

but increase the reliance on detailed substantive procedures that

involve intensive testing of year-end account balances and

transactions from throughout the year. This will definitely impact the

extent of audit testing and the amount of audit work needed to be

performed. This will result in more time needed to investigate

managements assertions on transactions and year-end balances. To

conclude, I must rely on extensive substantive procedures to uncover

any material misstatements presented in the financial statements.

E)

1. Accounts Receivables

Regarding managements balances assertions, existence, rights and

obligations, completeness, and valuation and allocation must be

evaluated. I must trace customer receipts to confirm that the account

receivables amounts that were recorded actually do exist (they are not

faulty or manipulated sales) and that values were reported at the

appropriate amounts. Credit sales and the relationship with credit card

companies must be examined closely because there might be a risk

that customers may not pay their outstanding balances, thus affecting

the valuation of the accounts receivable (bad debts and allowances).

2. Property, plant and equipment

IC is a car rental company and therefore, property, plant, and

equipment would occupy the largest part of the assets. This would

refer to the assortment of cars that IC could offer to rent out. The

assertions that must be evaluated are rights and obligations,

completeness, classification and understandability, and accuracy and

valuation. I have to trace the ownership documents of the vehicles to

ensure that IC has complete legal ownership over the vehicles.

Completeness, classification, and understandability would refer to

checking the notes of the financial statements and making sure the

appropriate depreciation methods have been disclosed for the

vehicles. For accuracy and valuation, I would need to ensure that the

values are mathematically correct taking into consideration the

depreciation method stated in the notes.

3. Account Payable

The assertions that will need to be evaluated are existence, rights and

obligations, completeness, and valuation and allocation. I must trace

the invoices, purchase orders, purchase requisition, receiving reports,

and remittance advices that have been issued to ensure that such an

amount needs to be paid in the future, that the amount stated are

indeed obligations to the company, and all obligations that need to be

recorded have been recorded. I must also ensure that the amount

recorded are correct and have been adjusted for any discounts that the

suppliers may have given.

4. Long- Term Debt

The assertions that will need to be evaluated are occurrence,

completeness, accuracy, cut-off, and classification. I will need to trace

the long-term debt documents (such as written contracts) to

understand the underlying obligations that the company has regarding

its long-term debts. The debt amount recorded must be ensured that it

is mathematically correct, recorded in the correct accounts, and are

complete. This will also take into consideration the occurrence and

accuracy of the interest payments and interest expenses occurred

during the year (assuming an interest rate exists and regular interest

payments have to be made). In addition, it must be clear that the

interest expenses occurred near year-end have also been recorded in

the correct period.

5. Car Rental Sales- Regarding managements transaction assertions,

accuracy, cut-off, completeness, and occurrence must be evaluated.

This can be done through examining customer receipts and their

respective balances and tracing those balances to the general ledger. I

would have to make sure the proper amounts are recorded in the right

period and appropriate accounts (cash or account receivables) and that

the recorded sales amounts have actually occurred. Special attention

must be given to sales or prepaid sales at the end of the period to

ensure that recorded sales amount relate to the 2012-year, especially

near year end.

Vous aimerez peut-être aussi

- Audit of Bonds and LoansDocument5 pagesAudit of Bonds and LoansNEstandaPas encore d'évaluation

- Take The Wheel: The Blueprint for Building a Profitable Trucking CompanyD'EverandTake The Wheel: The Blueprint for Building a Profitable Trucking CompanyPas encore d'évaluation

- Chap 017Document20 pagesChap 017محمود علىPas encore d'évaluation

- CPA Financial Accounting and Reporting: Second EditionD'EverandCPA Financial Accounting and Reporting: Second EditionPas encore d'évaluation

- Solutions of The Audit Process. Principles, Practice and CasesDocument71 pagesSolutions of The Audit Process. Principles, Practice and Casesletuan221290% (10)

- NOTESDocument20 pagesNOTESGraziella CathleenPas encore d'évaluation

- Summary of Gregory R. Caruso's The Art of Business ValuationD'EverandSummary of Gregory R. Caruso's The Art of Business ValuationPas encore d'évaluation

- Kieso15e ContinuingCase Sols Vol1Document41 pagesKieso15e ContinuingCase Sols Vol1HảiAnhInviPas encore d'évaluation

- 3 TDocument3 pages3 TJoe DicksonPas encore d'évaluation

- Mega Project Assurance: Volume One - The Terminological DictionaryD'EverandMega Project Assurance: Volume One - The Terminological DictionaryPas encore d'évaluation

- Week 2 TUTE Chapter 1 SolutionsDocument6 pagesWeek 2 TUTE Chapter 1 SolutionsDylan AdrianPas encore d'évaluation

- CVS 465_Chapter 6_Project AccountingDocument10 pagesCVS 465_Chapter 6_Project AccountingOndari HesbonPas encore d'évaluation

- Analyzing Liability and Equity Reporting ChallengesDocument11 pagesAnalyzing Liability and Equity Reporting ChallengesKacang JombloPas encore d'évaluation

- At The End of This Chapter, You Will Be Able ToDocument29 pagesAt The End of This Chapter, You Will Be Able ToAki GirmPas encore d'évaluation

- Credit C7Document14 pagesCredit C7Chantelle Ishi Macatangay AquinoPas encore d'évaluation

- AUDITINGDocument6 pagesAUDITINGVISAYANA JACQUELINEPas encore d'évaluation

- Research Paper On Credit Appraisal ProcessDocument6 pagesResearch Paper On Credit Appraisal Processgatewivojez3100% (1)

- Analysis of Balance SheetDocument5 pagesAnalysis of Balance Sheetprashant pawarPas encore d'évaluation

- Chapter 7Document7 pagesChapter 7Ronan MonzonPas encore d'évaluation

- Bank Fund Assignment 2Document19 pagesBank Fund Assignment 2Habiba EshaPas encore d'évaluation

- Auditing Assignment Case StudyDocument2 pagesAuditing Assignment Case StudyKenneth BrownPas encore d'évaluation

- CPA firm audit responsibilitiesDocument22 pagesCPA firm audit responsibilitiesFifke Masyie SiwuPas encore d'évaluation

- Interview Related QuestionsDocument8 pagesInterview Related QuestionsAnshita GargPas encore d'évaluation

- Financial Feasibility: A) Current Ratio:-Current Assets Current LiabilitiesDocument5 pagesFinancial Feasibility: A) Current Ratio:-Current Assets Current LiabilitiesSanket TruebluePas encore d'évaluation

- Bva 3Document7 pagesBva 3najanePas encore d'évaluation

- Credit Management: Assessing Customer Creditworthiness and Collecting PaymentsDocument7 pagesCredit Management: Assessing Customer Creditworthiness and Collecting PaymentsPiyush GadePas encore d'évaluation

- Notes On Weighted-Average Cost of Capital (WACC) : Finance 422Document5 pagesNotes On Weighted-Average Cost of Capital (WACC) : Finance 422Dan MaloneyPas encore d'évaluation

- Renew (Corporate ReportingDocument11 pagesRenew (Corporate ReportingBeng PutraPas encore d'évaluation

- AUD 04 Act 1 RamirezDocument2 pagesAUD 04 Act 1 RamirezVann RamirezPas encore d'évaluation

- Assignment: On Financial Statement Analysis and ValuationDocument4 pagesAssignment: On Financial Statement Analysis and ValuationMd Ohidur RahmanPas encore d'évaluation

- 10Document8 pages10farhanPas encore d'évaluation

- Financial - Accounting Assig 1bDocument10 pagesFinancial - Accounting Assig 1btumonekongo02Pas encore d'évaluation

- Sample Project Report For Commercial Vehicle LoanDocument18 pagesSample Project Report For Commercial Vehicle LoanRajveer Mahajan40% (5)

- Case 2.2 and 2.5 AnswersDocument4 pagesCase 2.2 and 2.5 AnswersHeni OktaviantiPas encore d'évaluation

- Auditing and Assurance Services A Systematic Approach 11Th Edition Messier Solutions Manual Full Chapter PDFDocument34 pagesAuditing and Assurance Services A Systematic Approach 11Th Edition Messier Solutions Manual Full Chapter PDFrickeybrock6oihx100% (13)

- Write A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksDocument4 pagesWrite A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksRahulPas encore d'évaluation

- Write A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksDocument4 pagesWrite A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksRahulPas encore d'évaluation

- Factoring Project ReportDocument15 pagesFactoring Project ReportSiddharth Desai100% (3)

- Additional InfoDocument25 pagesAdditional InfoSanthu SaravananPas encore d'évaluation

- Additional InfoDocument25 pagesAdditional InfoSaravananPas encore d'évaluation

- CH - 03financial Statement Analysis Solution Manual CH - 03Document63 pagesCH - 03financial Statement Analysis Solution Manual CH - 03OktarinaPas encore d'évaluation

- Audit of ExpensesDocument3 pagesAudit of ExpensesIG RaheesPas encore d'évaluation

- Question and Answer - 3Document31 pagesQuestion and Answer - 3acc-expertPas encore d'évaluation

- Credit PolicyDocument84 pagesCredit PolicyDan John Karikottu100% (6)

- ACCT 10001 Accounting Reports & Analysis Review Questions - Topic 1 Chapter 1: Introduction To Accounting and Business Decision MakingDocument5 pagesACCT 10001 Accounting Reports & Analysis Review Questions - Topic 1 Chapter 1: Introduction To Accounting and Business Decision MakingHui Ying LimPas encore d'évaluation

- Survey of Accounting 5Th Edition Edmonds Solutions Manual Full Chapter PDFDocument36 pagesSurvey of Accounting 5Th Edition Edmonds Solutions Manual Full Chapter PDFsusan.ross888100% (11)

- Survey of Accounting 5th Edition Edmonds Solutions Manual 1Document86 pagesSurvey of Accounting 5th Edition Edmonds Solutions Manual 1melody100% (46)

- Murabah ProfitDocument15 pagesMurabah ProfitMuhammad ZulkifulPas encore d'évaluation

- Auditing and Other Assurance Services - Paper 15 Suggested Solutions For November 2012 Fast Telecom Group Principal Business RisksDocument12 pagesAuditing and Other Assurance Services - Paper 15 Suggested Solutions For November 2012 Fast Telecom Group Principal Business RisksEdward BiryetegaPas encore d'évaluation

- CH 03Document67 pagesCH 03Khoirunnisa Dwiastuti100% (2)

- Uts Teori AkuntansiDocument6 pagesUts Teori AkuntansiARYA AZHARI -Pas encore d'évaluation

- Definition of Reconciling An AccountDocument10 pagesDefinition of Reconciling An Accountዳግማዊ ጌታነህ ግዛው ባይህPas encore d'évaluation

- Horizontal Analysis - Horizontal Analysis Is Used in Financial Statement Analysis To CompareDocument3 pagesHorizontal Analysis - Horizontal Analysis Is Used in Financial Statement Analysis To CompareShanelle SilmaroPas encore d'évaluation

- 6.12 Explain Each of The Seven Generally Accepted Objectives of Internal Control ActivitiesDocument4 pages6.12 Explain Each of The Seven Generally Accepted Objectives of Internal Control ActivitiesRashi ParwaniPas encore d'évaluation

- Business Entity and Going Concern ConceptsDocument4 pagesBusiness Entity and Going Concern Conceptssantbaksmishra12610% (1)

- Marketing Finance01 1Document8 pagesMarketing Finance01 1Anand YadavPas encore d'évaluation

- Credit AppraisalDocument49 pagesCredit AppraisalRam Vishrojwar50% (2)

- RatiosDocument1 pageRatiosDonPas encore d'évaluation

- Chapter 3Document10 pagesChapter 3DonPas encore d'évaluation

- Tax Answers 2Document280 pagesTax Answers 2Don83% (6)

- Risk Identification QuestionDocument2 pagesRisk Identification QuestionDonPas encore d'évaluation

- Chapter One: Introduction and Overview of Audit and AssuranceDocument16 pagesChapter One: Introduction and Overview of Audit and AssuranceDonPas encore d'évaluation

- Chapter 5 - Audit EvidenceDocument11 pagesChapter 5 - Audit EvidenceDonPas encore d'évaluation

- Ethics AssignmentDocument1 pageEthics AssignmentDonPas encore d'évaluation

- Ethics Assignment - AFM 202Document2 pagesEthics Assignment - AFM 202DonPas encore d'évaluation

- Ethics and Professionalism NotesDocument15 pagesEthics and Professionalism NotesDon100% (1)

- Chapter 4 - Cloud 9 Trial BalanceDocument3 pagesChapter 4 - Cloud 9 Trial BalanceDonPas encore d'évaluation

- Chapter 6Document5 pagesChapter 6DonPas encore d'évaluation

- Inventory - Use Cost Acquired/net Realizable (Whichever Is Lower)Document1 pageInventory - Use Cost Acquired/net Realizable (Whichever Is Lower)DonPas encore d'évaluation

- Chapter 4Document7 pagesChapter 4DonPas encore d'évaluation

- CaseDocument3 pagesCaseDonPas encore d'évaluation

- AFM 202 ReviewDocument2 pagesAFM 202 ReviewDonPas encore d'évaluation

- Quiz 2 AFM 121 With AnswersDocument4 pagesQuiz 2 AFM 121 With AnswersDonPas encore d'évaluation

- Ch01 & WHR - 01Document12 pagesCh01 & WHR - 01DonPas encore d'évaluation

- Sionna Investment Research Competition 2015Document2 pagesSionna Investment Research Competition 2015DonPas encore d'évaluation

- CA RequirementsDocument1 pageCA RequirementsDonPas encore d'évaluation

- UntitledDocument7 pagesUntitledDonPas encore d'évaluation

- Determing Percentage Yield LAb (From Sams Ultrabook)Document4 pagesDeterming Percentage Yield LAb (From Sams Ultrabook)DonPas encore d'évaluation

- Universal Life Insurance Fact SheetDocument2 pagesUniversal Life Insurance Fact Sheetket_nguyen003Pas encore d'évaluation

- Payment of Bonus Act, 1965 & The Rules: ChecklistDocument2 pagesPayment of Bonus Act, 1965 & The Rules: ChecklistparavindPas encore d'évaluation

- CA Amit Goyal-ResumeDocument2 pagesCA Amit Goyal-ResumeKanu ShreePas encore d'évaluation

- 0452 s18 QP 21 PDFDocument20 pages0452 s18 QP 21 PDFIG UnionPas encore d'évaluation

- Final Project ReportDocument29 pagesFinal Project ReportSuleman Ikram100% (1)

- PFRS 16Document34 pagesPFRS 16rena chavez100% (1)

- Sample Problems On Relevant CostsDocument9 pagesSample Problems On Relevant CostsJames Ryan AlzonaPas encore d'évaluation

- Fin PracticaDocument14 pagesFin PracticaChristian Diegho Vacadiez Laporta100% (1)

- EVA Vs CVA AnalysisDocument42 pagesEVA Vs CVA AnalysisMaria Bulgaru100% (1)

- Me Assignment 1 Bbce3013Document8 pagesMe Assignment 1 Bbce3013Murugan RS100% (1)

- PT Davomas Abadi Tbk. Cocoa Company Shareholder and Financial HighlightsDocument4 pagesPT Davomas Abadi Tbk. Cocoa Company Shareholder and Financial HighlightsIshidaUryuuPas encore d'évaluation

- HR Monthly Business Review Sample PresentationDocument10 pagesHR Monthly Business Review Sample PresentationRoxana Butnaru100% (1)

- Modified Chapter 26Document59 pagesModified Chapter 26Wanda BelislePas encore d'évaluation

- SWOT AnalysisDocument2 pagesSWOT Analysisapi-3710417100% (1)

- Visa Annual ReportDocument164 pagesVisa Annual Reportcaoxx274Pas encore d'évaluation

- Basic Methods For Making Economy Study (Written Report)Document9 pagesBasic Methods For Making Economy Study (Written Report)xxkooonxx100% (1)

- Cash and Receivables: True-FalseDocument44 pagesCash and Receivables: True-FalseIzzy B100% (2)

- Capital GainsDocument25 pagesCapital GainsanonymousPas encore d'évaluation

- Commissiober V NLRCDocument2 pagesCommissiober V NLRCanalynPas encore d'évaluation

- Journal EntriesDocument55 pagesJournal Entriesmunna00016100% (1)

- IMF Report Sri LankaDocument95 pagesIMF Report Sri LankaGayan Nayanapriya Heva MasmullaPas encore d'évaluation

- Aud589 - STDNS' Revised Lesson PlanDocument5 pagesAud589 - STDNS' Revised Lesson PlanLANGITBIRUPas encore d'évaluation

- Merger Vodafone & Hutch - AnitaDocument23 pagesMerger Vodafone & Hutch - Anitaravi100% (1)

- MARK SCHEME For The June 2004 Question PapersDocument9 pagesMARK SCHEME For The June 2004 Question PapersRobert EdwardsPas encore d'évaluation

- 5_6338931490453195887Document11 pages5_6338931490453195887martinfaith958Pas encore d'évaluation

- Econ1 Fall2009 Midterm2Document9 pagesEcon1 Fall2009 Midterm2Michael LungPas encore d'évaluation

- De Grey MiningDocument30 pagesDe Grey MiningSergey KPas encore d'évaluation

- Ikea Strategy AssessmentDocument6 pagesIkea Strategy Assessmentc.enekwe8981100% (1)

- QUIZ in AUDIT OF SHAREHOLDERS EQUITYDocument2 pagesQUIZ in AUDIT OF SHAREHOLDERS EQUITYLugh Tuatha DePas encore d'évaluation

- 04 - Notes On Interim ReportingDocument2 pages04 - Notes On Interim ReportingLalaine ReyesPas encore d'évaluation

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantD'EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantÉvaluation : 4.5 sur 5 étoiles4.5/5 (146)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)D'EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Évaluation : 4.5 sur 5 étoiles4.5/5 (24)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideD'Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideÉvaluation : 2.5 sur 5 étoiles2.5/5 (2)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetD'EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetPas encore d'évaluation

- Profit First for Therapists: A Simple Framework for Financial FreedomD'EverandProfit First for Therapists: A Simple Framework for Financial FreedomPas encore d'évaluation

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanD'EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanÉvaluation : 4.5 sur 5 étoiles4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionD'EverandFinancial Accounting For Dummies: 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (10)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyD'EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyÉvaluation : 5 sur 5 étoiles5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Financial Accounting - Want to Become Financial Accountant in 30 Days?D'EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Évaluation : 5 sur 5 étoiles5/5 (1)

- Financial Literacy for Managers: Finance and Accounting for Better Decision-MakingD'EverandFinancial Literacy for Managers: Finance and Accounting for Better Decision-MakingÉvaluation : 5 sur 5 étoiles5/5 (1)

- Business Process Mapping: Improving Customer SatisfactionD'EverandBusiness Process Mapping: Improving Customer SatisfactionÉvaluation : 5 sur 5 étoiles5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItD'EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItÉvaluation : 5 sur 5 étoiles5/5 (13)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesD'EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesÉvaluation : 4.5 sur 5 étoiles4.5/5 (30)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Basic Accounting: Service Business Study GuideD'EverandBasic Accounting: Service Business Study GuideÉvaluation : 5 sur 5 étoiles5/5 (2)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsD'EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsPas encore d'évaluation

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesD'EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesPas encore d'évaluation

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCD'EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCÉvaluation : 5 sur 5 étoiles5/5 (1)

- Accounting: The Ultimate Guide to Understanding More about Finances, Costs, Debt, Revenue, and TaxesD'EverandAccounting: The Ultimate Guide to Understanding More about Finances, Costs, Debt, Revenue, and TaxesÉvaluation : 5 sur 5 étoiles5/5 (4)