Académique Documents

Professionnel Documents

Culture Documents

Illustration:-Mr. Samarathmal Tanted Assests And: Rohit Billore

Transféré par

Jenny MillerDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Illustration:-Mr. Samarathmal Tanted Assests And: Rohit Billore

Transféré par

Jenny MillerDroits d'auteur :

Formats disponibles

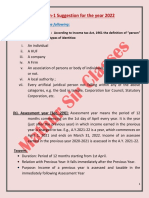

ILLUSTRATION :-

Mr. Samarathmal Tanted assests and

liabilities are as under as on 31st March 2009 :

1.) House properties :

(a) Self-residential house at Ujjain Rs. 9,50,000

(b) Rental house at Indore Rs. 5,50,000. The house in let

out to a bank.

Outstanding loan Rs. 1,62,000.

(c) House at village Rs. 80,000, Let out for residential

purpose for through

out the year.

2.) Household goods ( Furniture and utensils ) Rs. 70,000

3.) Ornaments of gold and silver Rs. 9,45,000

4.) Agricultural land- In India Rs. 85,000 , In foreign Rs. 75,000.

5.) Fixed deposit in Bank of Maharastra ( 1st June, 2003 ) Rs.

85,000.

6.) Shares in Indian Companies ( Purchased on 1st Jan 2005 ) Rs

40,000.

These shares were sold by him on 15.03.09 for Rs.2,60,000

and cash payment received on 31.3.09 . The same was

deposited by him in fixed deposit with a bank on next day i.e.

1.4.09.

7.) Animals Rs. 35,000.

8.) Mortgage Loan on Agriculture Land Rs 80,000; other loan Rs.

40,000; Foreign loan on Agriculture land Rs.60,000.

Rohit Billore Page 32

9.) Motor Car for personal use Rs. 1,60,000. The motor Car is

purchased from bank loan and Rs. 70,000 was outstanding.

Compute Net wealth for the assessment year 2009-10.

SOLUTION :-

Computation of Net wealth of Mr. Samarathmal

For the assessment year 2009-10

Self residential house at Ujjain [ exempted u/s Nil

5(vi) ]

3,88,000

House at Indore let out to bank ( 5,50,000 –

1,62,000 ) Nil

House at village, Let out for residential use [ not Nil

asset u/s 2(ea)]

9,45,000

House hold goods ( not asset )

Nil

Ornaments ( asset u/s 2 (ea)]

Nil

Agricultural land ( not asset )

2,10,000

Bank deposit ( not asset )

Nil

Cash in hand ( 2,60,000 – 50,000 )

Animals ( not asset )

90,000

Motor Car [ asset u/s 2(ea) ]

1,60,000

16,33,000

Less : Loan outstanding

70,000

Rohit Billore Page 33

Net Wealth

Wealth Tax Payable – 1% on above Rs. 15 lacks =

Rs. 1,330

8. Collection and

Recovery of Tax

Whenever assessment of tax is

completed of an assessee, then wealth tax officer

issues notices to deposit tax or penalty or interest.

(1) Time-Period of tax payment – Assessee

has to deposit the amount mentioned in notice

within 30 days of receiving such notice. This amount

should be deposited to mentioned person at

mentioned place. Assessment officer can decrease

or increase the time period if he thinks that it

doesn’t causes any harm to state revenue.

(2) Payment of interest – If an assessee

doesn’t make the payment of the amount as

mentioned in the notice of demand within the

specified period, he will also have to pay the

interest @ 1% for every month.

(3) Canciliation or Reducing the Interest –

On confirmation of the following, the amount of

interest may be reduced or cancelled by the chief

commissioner or the commissioner :

I. When the assessee is finding it difficult to

make the payment of the

interest.

Rohit Billore Page 34

II. Due to the reason beyond the control of

the assessee.

III. The assessee has given due co-operation

in the assessment and its collection.

(4) Default in payment – If the assessee has

not paid the said amount in time he will be a

defaulter and has to pay penalty in the following

way :

I. Penalty on default.

II. Increase in penalty after continuous

default.

III. If there is a genuine reason for default,

assessment officer may cancel the

penalty.

(5) Types of collection – Collection of tax,

interest, penalty or any other amount is done in the

following way :

I. By sending Certificate to the tax-Recovery

officer.

II. Collection by state government.

III. Collection under foreign government.

IV. Collection by suing in court.

Tax should be collected within 3 years of

financial year in which tax is demanded.

Recovery of Tax

According to sec. 22, if assessee is unable to pay

tax, then wealth tax officer issues a certificate duly

signed by him mentioning the amount of tax to the

tax-collection officer. That officer can collect tax in

the following way :

(a) By selling movable or immovable assets of

assessee.

Rohit Billore Page 35

(b) By appointing a receiver to manage the assets

of assessee.

(c) By arresting the assessee and sentencing

them.

Tax-assessement officer can himself, even

after sending certificate to the collection officer, can

collect tax in the following way-

I. By sending a notice to the employer of the

tax payer.

II. By sending a notice to the persons who

have the amount of tax payer.

III. By applying in the court.

IV. By selling movable assets to the tax payer.

V. By state government.

VI. By giving the facility to pay the amount of

tax in installments.

VII. By making the assessee pay tax in case the

assessee appeals in high court or

Supreme Court.

VIII. He can postpone the payment of tax if the

assessee has appealed against his

assessment to commissioner. (Appeals)

Refund of Tax

If the assessee has to be refunded money due to

appeal or other procedure then assessment officer

without any application will refund the said amount.

Right to stop the Refund- When assessee gets

the right to receive the refund u/s 16 (1) but in the

opinion of assessment officer :

I. Assessee is issued a notice u/s 16 (2) or

there is a possibility of issuing such notice,

and

Rohit Billore Page 36

II. If any appeal is going through order of

refund.

III. Any proceding is left under this Act and tax

assessment officer thinks that is case of

refund, state Revenue may be harmed ,

then in such case by permission from

commissioner can stop the refund.

Rohit Billore Page 37

9. Assessment

Procedure

Wealth tax is imposed on the net wealth

of an assessee. Which assessee has to pay how

much tax is decided as under :

(1)Submitting the Return of Wealth Tax [Sec.

14 (1)] – The person whose net wealth exceeds the

exemptions limit i.e. 15 Lakhs as on the valuation

date or March 31 has to submit the return of his

wealth, on the prescribed form ‘A’ in prescribed

manner and duly verified by him. If the assessee is

a business man, he has also to submit the copy of

his balance sheet or trial balance. If a person is

liable to pay tax on the net wealth of some other

person he should also submit the return. Various

dates submitting return are :

(a) Is assessee is a Company

st

31 , October

(b) Assessee other than company whose

account are audited according to law

st

31 ,October

(c) Other Assessees

st

31 , July

(2) Notice for submitting the Return [Sec. 14

(2)]- When the Wealth Tax Officer is convinced that

some person possesses wealth more than the

minimum taxable limit as prescribed, and still he

has not filed the return of wealth tax, he may issue

Rohit Billore Page 38

notice to such person to submit the return of wealth

tax.

(3) Submitting revised Return [Sec. 15] – After

submitting the return of net wealth , if an assessee

feels that there has so signed some mistake in the

return, or some facts have left or omitted, he may,

before the assessment, submit the revised return.

(4) Signatures on the Return

(a) In case of an Individual :

I. The individual should himself sign it.

II. If the individual has gone out of the country,

the signature of the person authorized by him

must be there.

III. If the person is of unsound mind in that case,

it must be signed by his guardian or by some

such person who is just Competent to work on

his behalf.

IV. If for any reason, it is impossible for that

person to sign, in that case, the person

compotent to work on his behalf, may sign.

(b) In case of HUF :

I. The Karta of the family will sign.

II. If the Karta has gone out of India, or is of

unsound mind, any other adult member of the

family will have to sign.

(c) In case of a Company :

I. The managing director, or

II. If there is no managing director, any other

director may sign the return.

Kinds of Assessment

When the wealth tax officer receives the return

of net wealth of the assessee, he commences with

Rohit Billore Page 39

the work of assessment. U/s 16, the regular

assessment is done in the following manner :

(i) On the basis of the Return Submitted – If

the assessment officer is satisfied with the return of

wealth submitted by the assessee, without asking

for any proofs or evidence or without requiring him

to be present, he will assess on the basis of this

return, the net wealth and the wealth tax payable

by the assessee and the interest or the amount of

the refund of wealth tax.

(ii) On the basis of proofs finished – When the

assessment officer is not satisfied with the return

filed by the assessee, he will issue a notice to the

assessee, requiring him to be present in his office,

or sereve the notice for submitting necessary proofs

for justifying and established the correctness of the

return so submitted. The wealth tax officer, after

examining all the evidence as submitted by the

assessee, will issue an order in writing regarding the

assessment of taxable net assets and the net

wealth tax payable or the amount refunded to him.

(iii) Best Judgement assessment – If the

assessee has not submitted return of the net wealth

even after being serve with a notice of being

required to submit such return, or has violated the

notice issued by the assessment officer for

presenting himself or for presenting the evidence or

the account books the assessment officer u/s 16(5),

on the basis of his best judgement, shall assess the

net wealth and the wealth tax payable , keeping in

view the information’s available.

Forwarding to the Valuation Officer – If the

wealth tax officer feels that the assessee has, in his

Rohit Billore Page 40

return of net wealth under valued any property as

compared to the market value, or the certified

values has undervalued the property, he may

forward to the valuation officer, such matter

pertaining to the valuation. The valuation officer

shall serve upon the assessees a notice to send on a

particular date necessary accounts and the

documents etc. pertaining to the property. If the

valuation officer so feels that the assessee has

correctly show, the value of property, he will issue

an order whose one copy will be sent to the

assessee and the other to the assessment officer.

When the valuation officer inhances the

valuation of the property, he will inform the

assessee as to how much has he increased the

valuation and will provide or opportunity to the

assessee to express his views.

Rohit Billore Page 41

10. Appeal and Revision

To give justice to the assessee, a

proper process of appeals and revision is mentioned

in the Wealth-Tax Act.

Appeal under Wealth-Tax Act - When Wealth

Tax assessment of an assessee is done by the

wealth tax officer and if the assessee is not satisfied

with the decision, he has the right to appeal against

such order or decision. Appeal can be done to the

following officials under W.T. Act :

(I) Appeal before the commissioner (Appeals)

If an assessee is not satisfied with the

assessment of Wealth tax authority, he can appeal

to the Commissioner (Appeals). This appeal can be

filed within 30 days of the order received regarding

tax assessment. Even after 30 days, in presence of

genuine reason, appeal can be done.

(1) Cases before Commissioner (Appeals) – The

following are the circumstances under which the

appeal might be filed before the commissioner

(Appeals) :

I. Regarding amount of net wealth.

II. Regarding amount of Wealth Tax payable.

III. Non-acceptability of the assessment.

IV. Regarding the fine or penalty imposed.

V. Not recognizing the division of HUF.

VI. Due to the increase in the amount of tax

resulting from correction of mistake or

reducing the amount of refund.

Rohit Billore Page 42

VII.Regarding Penalty imposed u/s 37(2) for non-

accepting summon.

VIII. Regarding accepting the agent for the non-

resident Indians.

IX. Regarding the orders of the valuing officer, as

a result of which the value of any property

increases.

In any of the above cases, appeal can be filled

before Commissioner (Appeals) within prescribed

period.

(2) Procedure for Appeal before Commissioner

(Appeals) –

I. The appeal must be filed within 30 days of the

order received regarding the assessment.

II. Appeal should be made on the prescribed

Proforma ‘E’ and duly certified in a prescribed

manner.

III. When the assessee has submitted the return

of wealth tax the appeal may be filed only

after the payment of the wealth tax on the

basis of this statement.

IV. After the filing of appeal, the Commissioner

shall fix the date and place of hearing.

(3) Rights of the commissioner (Appeal) –

I. During the hearing, he may also allow the

appellant to mention such matters which have

not mentioned in the appeal.

II. He can make enquiries as deemed necessary,

before deciding the appeal.

III. He has right to give proper or reasonable

judgement regarding the appeals. He is also

authorized to inhance the amount of wealth

Rohit Billore Page 43

tax payable or the fines. But before issuing

such orders, he will have to grant an

opportunity to the assessee to present his

views.

(II) Appeals before the Appellate Tribunal

The right of filling appeal before the Appellate

Tribunal is available to both the assessee and the

assessing authority.

Cases for which the Appeal may be filed

I. Regarding the judgement given u/s 23.

II. Regarding the penalties imposed u/s 18

and 18 (a).

III. Regarding the enhanced liability of tax, as

increased by the Commissioner.

IV. Regarding the penalty imposed u/s 37 (2).

Procedure for Appeal before Appellate

Tribunal

If the assessee is not satisfied with the decision

I.

of Commissioner (Appeals) he can file an

appealbefore the Appellate Tribunal within 60

days of decision.

II. If the commissioner is not satisfied with the

decision of DEPUTY-Commissioner (Appeal),

he may direct the assessing officer to appeal

against such order.

III. Appeal must be submitted on a prescribed

form- F certified in a prescribed manner.

IV. If the appeal is done by the assessee, he has

to deposit a fees of Rs. 200/-.

Rohit Billore Page 44

Revision by Commissioner

The revision may be taken up by the commissioner,

in the following two cases

I. In the interest of the assessee and

II. In the interest of the state revenue.

(I) Revision in the Interest of the Assessee -

When the assessee is not satisfied with the

judgement of the assessing officer or of the

commissioner (Apeeals), he may apply to the

commissioner for revision.

Rules for accepting the revision

I. Along with the application, a fee of Rs. 25/- has

to be compulsorily deposited.

II. This application must be made within a year of

order issued.

III. Such case should not be in hearing under

appeal.

IV. If no time of appeal is left or assessee has left

the right to appeal.

On receiving the application, the commissioner will

issue his judgement after due consideration, but it

can not increase the assesse’s tax liability.

(II) Revision in the Interest of State Revenue

– If the Commissioner so feels that any order issued

by the assessment officer is wrong and not in the

interest of State Revenues, he may revise it. While

revising, the commissioner will either himself

conduct enquiry or will get the enquiry conducted.

After giving proper opportunity to assessee, he will

issue order within 2 years of the financial year.

This revision may increasing the amount or

may issue a fresh assessment of Wealth-tax.

Rohit Billore Page 45

11. Penalties and

Prosecutions

If any assessee does not observe the

provisons of W.T. Act or does not clear the payment

of Wealth Tax in time or commits any offence, in

such cases provision has been made or the

penalties and prosecutions in the following way –

(I) Provisions relating to penalties in Wealth

Tax Act

Under the W.T. Act, the following provisions

have been made for imposing of the penalties :-

(1) Default in furnishing the Return – If the

assessee does not present or after order of tax-

assessment officer does not submit the return,

penalty of 1% on tax payable is imposed.

(2) Not attending – If after serving of a notice, the

assessee does not present himself or does not

submit the books of accounts and other documents,

then a minimum of Rs. 1,000 and maximum of Rs.

25,000 can be imposed as penalty.

(3) Concealing the details of the Property – If

the Wealth tax authorities believe that any assessee

has concealed some particulars of any property or

has deliberately and knowingly submitted wrong

statement, in such case, an amount equivalent to

the tax so saved and upto a maximum of 5times of

such evaded amount may be imposed as penalty.

Rohit Billore Page 46

(4) Not depositing tax on Self-assessment – If

the assesee after self assessment of tax and before

furnishing the return, is unable to pay tax, then he

can be subjected to penalty to the extent of tax

payable.

(5) Not responding to the quarries or refusing

to sign the statement – It is important for tax

assessment that the assessee furnish correct

details. If the assessee refuses to answer the

quarries by the officer or refuses to sign the

statement, he may be imposed a penalty of

minimum Rs. 500 and maximum of Rs. 10,000.

(6) Not furnishing the Information or

Statement Demanded – If any assessee, without

any reasonable or genuine cause, doesn’t submit to

the assessment officer any such informative

statement within the specified time, for furnishing

which he is bound by section 38, he may be

punished with a penalty of Rs. 100 to 200 per day.

(7) Default in the Payment of Tax – If the

assessee, on being served with the notice of

demand, doesn’t clear the tax, in such case

whatever amount the assessing officer thinks

proper, may impose as penalty upon the assessee

but the same must not exceed the amount as due

against him.

(8) Default in the presentation of books of

accounts – If a summon has been issued to any

assessee for giving evidence and presenting the

books of accounts and that person doesn’t present

himself willfully, he may be imposed penalty

between Rs. 5,000 to 10,000.

(II) Prosecution and Sentences

Rohit Billore Page 47

In some cases under W.T. Act, assessee may

be charged or prsecuted and even can be

sentenced. The cases regarding prosecution are as

follows :

(1) Attempt to Evade the Tax deliberately – If

an assessee delebrately makes an attempt to evade

the wealth tax, penalty or interest, he may be

prosecuted as under :

I. If he has tried to evade an amount more than

Rs. 1 Lakh, may be sentenced with a rigorous

imprisonment of minimum 6 months, which

may be extended upto 7 years and penalty

may be imposed.

II. In other cases, a minimum of 3 months and

upto a maximum of 3 years rigorous

imprisonment and fines may be imposed.

(2) Not furnishing the Return on Net Wealth –

If any person delebrately avoids to submit the

return of wealth within the specified time, he may

be sentenced in the following way :

I. If he is not detected and evades a tax of more

than Rs. 1 Lakh, he may be sentenced for a

minimum of 6 months, and maximum of 7

years of rigorous imprisonment and may also

be penalized.

II. In any other case, he may be sentenced for a

minimum of three months but not exceeding

three years imprisonment as well as he may be

fined.

(3) Not submitting the Books of Accounts – If

any assessee even after being served with notice,

doesn’t submit knowingly or wilfully, the books of

accounts or documents within a specified time, he

may be sentenced to one year’s rigorous

Rohit Billore Page 48

imprisonment or and may be fined at a minimum of

Rs. 4/- or Rs. 10/- per day, till the default continues.

(4) Verifying the false Statements – If any

assessee verifies the false statement, or submits

false accounts or statement, he amy be punished as

follows :

I. If his accounts were treated in correct and he

would have evaded tax more than Rs. 1Lakh,

he may be sentenced upto a minimum of 6

months and maximum of 7 years imprisonment

and also be fined.

II. In any other case, he may be imprisoned for a

period from 3 months to 3 years and will also

be fined.

(5) Verification of the false statements by

certified Values – If the valuer verifies the false or

wrong statements, and regarding which he was

confident that it is wrong or false, in that case, he

may be sentenced upto six months simple

imprisonment, or shall be fined or both the

punishments might be imposed.

(6) Encouragement for false statements – If

any person, knowingly or willfully, encourages

another person for submitting false statements

regarding the net wealth, he may be penalized as :

I. On evading tax more than Rs. 1 Lakh,

imprisonment of minimum of 6 months and

maximum of 7 years with fine.

II. In other cases, sentence may be 3 months to 3

years, as well as fines.

Rohit Billore Page 49

Vous aimerez peut-être aussi

- 88 Precepts: David LaneDocument10 pages88 Precepts: David LaneVargPas encore d'évaluation

- Practice Final PB PartialDocument25 pagesPractice Final PB PartialBenedict BoacPas encore d'évaluation

- RemediesDocument53 pagesRemedieslynne tahilPas encore d'évaluation

- RemediesDocument53 pagesRemediesjohnisflyPas encore d'évaluation

- Tax Remedies HandoutssssDocument5 pagesTax Remedies HandoutssssfantasighPas encore d'évaluation

- Tax RemediesDocument4 pagesTax RemediesJosua PagcaliwaganPas encore d'évaluation

- Tax.103 3 Filing of Returns Income Taxation of PET and Other Admin. MattersDocument13 pagesTax.103 3 Filing of Returns Income Taxation of PET and Other Admin. MattersJoana Lyn GalisimPas encore d'évaluation

- Tax RemediesDocument63 pagesTax RemediesImranAbubakarPangilinanPas encore d'évaluation

- Chapter 5 Solutions To Assigned HomeworkDocument9 pagesChapter 5 Solutions To Assigned HomeworkLiyue QiPas encore d'évaluation

- Tax Remedies NotesDocument8 pagesTax Remedies NotesLaurene Ashley Sore-YokePas encore d'évaluation

- W3 Module 3 PPT Tax Administration Part IIDocument32 pagesW3 Module 3 PPT Tax Administration Part IIElmeerajh JudavarPas encore d'évaluation

- Tax RemediesDocument12 pagesTax RemediesMei Leen DanielesPas encore d'évaluation

- 2async023 REMEDIESDocument27 pages2async023 REMEDIESBogs QuitainPas encore d'évaluation

- I. Remedies of The GovernmentDocument12 pagesI. Remedies of The GovernmentJunivenReyUmadhayPas encore d'évaluation

- Tax RemediesDocument5 pagesTax RemediesevaPas encore d'évaluation

- Business Tax NotesDocument14 pagesBusiness Tax Notesrachel banana hammockPas encore d'évaluation

- Tax REv NotesDocument23 pagesTax REv NotesCti Ahyeza DMPas encore d'évaluation

- Tax RemediesDocument13 pagesTax RemediesYan MoretzPas encore d'évaluation

- Concept of Assessment Requisites For A Valid Assessment: 10 Years After DiscoveryDocument5 pagesConcept of Assessment Requisites For A Valid Assessment: 10 Years After DiscoveryJD BarcellanoPas encore d'évaluation

- RemediesDocument32 pagesRemediesrav danoPas encore d'évaluation

- Tax Remedies of Government and Tax PayersDocument3 pagesTax Remedies of Government and Tax PayersHanah Grace DelfinPas encore d'évaluation

- Tax RemediesDocument2 pagesTax RemediesMei Leen DanielesPas encore d'évaluation

- Remedies of The State and TaxpayerDocument12 pagesRemedies of The State and TaxpayerreymardicoPas encore d'évaluation

- LiquidationDocument21 pagesLiquidationMerlin KPas encore d'évaluation

- Government RemediesDocument3 pagesGovernment RemediesShan ElisPas encore d'évaluation

- CS Executive Direct Tax Revision For Dec 19 PDFDocument224 pagesCS Executive Direct Tax Revision For Dec 19 PDFPreeti Ray100% (1)

- RemediesDocument3 pagesRemediesDesiree Ann MiralPas encore d'évaluation

- Chapter 8Document7 pagesChapter 8yebegashetPas encore d'évaluation

- Tax RemediesDocument15 pagesTax RemediesJonard GodoyPas encore d'évaluation

- Guide Notes On Remedies: Appeals Made A Distinction Between A Self-Assessed Tax and ADocument43 pagesGuide Notes On Remedies: Appeals Made A Distinction Between A Self-Assessed Tax and AJim Moriarty100% (1)

- Administrative Remedies of The GovernmentDocument5 pagesAdministrative Remedies of The GovernmentrobbyPas encore d'évaluation

- Joshua Razen E. Nolsol BSA 2-2 Assignment No. 6Document14 pagesJoshua Razen E. Nolsol BSA 2-2 Assignment No. 6Mary Christine Formiloza MacalinaoPas encore d'évaluation

- Shall File A Return Under OathDocument17 pagesShall File A Return Under OathMixx MinePas encore d'évaluation

- Q.18.Write Down The Procedure of Making An Appeal To Commissioner Appeal and Appeal To Appellate TribunalDocument5 pagesQ.18.Write Down The Procedure of Making An Appeal To Commissioner Appeal and Appeal To Appellate Tribunalatia khanPas encore d'évaluation

- Government RemediesDocument7 pagesGovernment RemediesYasha Min HPas encore d'évaluation

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimPas encore d'évaluation

- Tax Remedies 1Document6 pagesTax Remedies 1Marie MAy MagtibayPas encore d'évaluation

- 12 - Handout - 1 RemediesDocument5 pages12 - Handout - 1 RemediesAldrin John HiposPas encore d'évaluation

- Returns PDFDocument27 pagesReturns PDFSohaib AhmedPas encore d'évaluation

- Remedies of The TaxpayerDocument6 pagesRemedies of The Taxpayereds billPas encore d'évaluation

- Tax Finals ReviewerDocument51 pagesTax Finals ReviewerCelestino Law100% (2)

- Tax RemediesDocument6 pagesTax RemediesJustineMaeMillanoPas encore d'évaluation

- Tax RemediesDocument6 pagesTax RemediesPATRICIA ANGELICA VINUYAPas encore d'évaluation

- QuizDocument14 pagesQuizJepoy Nisperos ReyesPas encore d'évaluation

- Taxation: Multiple ChoiceDocument16 pagesTaxation: Multiple ChoiceJomar VillenaPas encore d'évaluation

- Income Tax Recovery of Tax and Modes of Recovery (Sec.220-232)Document8 pagesIncome Tax Recovery of Tax and Modes of Recovery (Sec.220-232)siniPas encore d'évaluation

- UNIT II Tax RemediesDocument17 pagesUNIT II Tax RemediesAl BertPas encore d'évaluation

- Taxation SuggestionDocument7 pagesTaxation SuggestionArpan CHATTERJEEPas encore d'évaluation

- Labor LawDocument29 pagesLabor LawmissyaliPas encore d'évaluation

- Shall Have The Authority To Grant An Injunction To Restrain The Collection of Any National Internal Revenue Tax, Fee or Charge Imposed by This CodeDocument10 pagesShall Have The Authority To Grant An Injunction To Restrain The Collection of Any National Internal Revenue Tax, Fee or Charge Imposed by This CodeSusannie AcainPas encore d'évaluation

- 5.1-Module 5Document3 pages5.1-Module 5Arpita ArtaniPas encore d'évaluation

- CIR v. Phil Daily InquirerDocument5 pagesCIR v. Phil Daily InquirerNichol Uriel ArcaPas encore d'évaluation

- Tax RemediesDocument6 pagesTax RemediesArielle CabritoPas encore d'évaluation

- Tax RemediesDocument22 pagesTax RemediesJezreel CastañagaPas encore d'évaluation

- Remedies in TaxationDocument8 pagesRemedies in TaxationabcyuiopPas encore d'évaluation

- Tax Remedies and IncrementsDocument16 pagesTax Remedies and Incrementscobe.johnmark.cecilioPas encore d'évaluation

- Administrative Guidelines On The Waiver of Penalty and Interest UPDATEDDocument8 pagesAdministrative Guidelines On The Waiver of Penalty and Interest UPDATEDKomla Atsu TachiePas encore d'évaluation

- Tax RemediesDocument5 pagesTax RemediesCherrelyne AlmazanPas encore d'évaluation

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4D'EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Pas encore d'évaluation

- Act No 1120 Friar ActDocument7 pagesAct No 1120 Friar ActWuwu WuswewuPas encore d'évaluation

- Management Accounting AND Finance: Ms. B. AbeysekaraDocument100 pagesManagement Accounting AND Finance: Ms. B. AbeysekaraTgemunuPas encore d'évaluation

- The Finance ResourceDocument10 pagesThe Finance Resourceadedoyin123Pas encore d'évaluation

- Customer's Perception Towards The Loan Product of State Bank of IndiaDocument60 pagesCustomer's Perception Towards The Loan Product of State Bank of IndiaSubodh Sonawane33% (3)

- China Outbound Investment Guide 2015Document80 pagesChina Outbound Investment Guide 2015chinalawandpracticePas encore d'évaluation

- Cir vs. Air India DigestDocument3 pagesCir vs. Air India Digestkarlonov100% (2)

- Lending Policy of Nepal Bank by Nabina RegmiDocument45 pagesLending Policy of Nepal Bank by Nabina RegmiKaran Pandey50% (2)

- Tutorial 6 - Money Growth and InflationDocument2 pagesTutorial 6 - Money Growth and InflationQuy Nguyen QuangPas encore d'évaluation

- The Uncommon InvestorDocument232 pagesThe Uncommon InvestorRodrigo MorenoPas encore d'évaluation

- Formula Sheet - Quantitative FinanceDocument1 pageFormula Sheet - Quantitative FinanceInês SoaresPas encore d'évaluation

- NCSE 2015 Paper II Question FinalDocument15 pagesNCSE 2015 Paper II Question FinalDarryan DhanpatPas encore d'évaluation

- Dirty Secrets of The Temple - How The Federal Reserve Runs The USDocument13 pagesDirty Secrets of The Temple - How The Federal Reserve Runs The USgonzomarx100% (1)

- Long Term Based ChuchuDocument22 pagesLong Term Based ChuchuSharmie Angel TogononPas encore d'évaluation

- Afcat 2017Document41 pagesAfcat 2017vaishu1991Pas encore d'évaluation

- 02 BY-LAWS Amend 3Document28 pages02 BY-LAWS Amend 3Del Callosa100% (1)

- Analysis of AmazonDocument7 pagesAnalysis of Amazonapi-272956173Pas encore d'évaluation

- Dad3Document11 pagesDad3Devanshu SoniPas encore d'évaluation

- Judicial Affidavit SUM of MONEYDocument5 pagesJudicial Affidavit SUM of MONEYAngelina Villaver ReojaPas encore d'évaluation

- Chapter Two: Determination of Interest RatesDocument20 pagesChapter Two: Determination of Interest RatesSagheer MuhammadPas encore d'évaluation

- 604f340b1ee7d20024a3f30d 1615803723 ACC 124 - Week 8 9 - ULObDocument15 pages604f340b1ee7d20024a3f30d 1615803723 ACC 124 - Week 8 9 - ULObFrancine Thea M. LantayaPas encore d'évaluation

- RTP June 2017 AnsDocument23 pagesRTP June 2017 AnsbinuPas encore d'évaluation

- Savings Deposits of RBBDocument34 pagesSavings Deposits of RBBRusan Shakya82% (22)

- Interest Calculation AbstractDocument5 pagesInterest Calculation AbstractTelika RamuPas encore d'évaluation

- Cognitive Psychology EssayDocument4 pagesCognitive Psychology Essayafibkyielxfbab100% (2)

- BB All Written Math Solution PDF (GEM)Document17 pagesBB All Written Math Solution PDF (GEM)Shafiq SumonPas encore d'évaluation

- Recession Normal ExpansionDocument3 pagesRecession Normal ExpansionAshish BhallaPas encore d'évaluation

- Test Bank For Theories of Personality 9th Edition Jess Feist Gregory Feist Tomi Ann RobertsDocument36 pagesTest Bank For Theories of Personality 9th Edition Jess Feist Gregory Feist Tomi Ann Robertsemersiongrime2hs4u100% (30)

- ACTG 2011 Final Exam NotesDocument55 pagesACTG 2011 Final Exam NoteswaysPas encore d'évaluation

- Annual Worth AnalysisDocument12 pagesAnnual Worth AnalysisGlenn Midel Delos SantosPas encore d'évaluation