Académique Documents

Professionnel Documents

Culture Documents

Chapter No-1: Definition of 'Ratio Analysis'

Transféré par

Anonymous GMyUOkIWATitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter No-1: Definition of 'Ratio Analysis'

Transféré par

Anonymous GMyUOkIWADroits d'auteur :

Formats disponibles

1

CHAPTER NO- 1

INTRODUCTION

Ratio analysis is an important tool for analyzing financial statement. The

data given in financial statements either balance sheet or profit and loss

account in absolute form is silent or dump and are unable to say anything.

Ratios are relative from financial data and very useful tool to check upon

the efficiency of a firm. Some ratios indicate the trend or progress or

downfall of the business firm.

Definition of 'Ratio Analysis'

A tool used by individuals to conduct a quantitative analysis of information in a

company's financial statements. Ratios are calculated from current year numbers and are then

compared to previous years, other companies, the industry, or even the economy to judge the

performance of the company. Ratio analysis is predominately used by proponents of

fundamental analysis.

There are many ratios that can be calculated from the financial statements pertaining

to a company's performance, activity, financing and liquidity. Some common ratios include

the price-earnings ratio, debt-equity ratio, earnings per share, asset turnover and working

capital.

Ratio analysis is based on different ratios which are calculated from the accounting

data contained in the financial statements. Different ratios are used for different problems.

MEANING OF RATIO:

A financial ratio (or accounting ratio) is a relative magnitude of two selected numerical

values taken from an enterprise's financial statements. Often used in accounting, there are

many standard ratios used to try to evaluate the overall financial condition of a corporation or

other organization. Financial ratios may be used by managers within a firm, by current and

potential shareholders (owners) of a firm, and by a firm's creditors. Financial analysts use

financial ratios to compare the strengths and weaknesses in various companies. [1] If shares in

a company are traded in a financial, the market price of the shares is used in certain financial

ratios.

Ratios can be expressed as a decimal value, such as 0.10, or given as an

equivalent percent value, such as 10%. Some ratios are usually quoted as percentages,

especially ratios that are usually or always less than 1, such as earnings yield, while others are

usually quoted as decimal numbers, especially ratios that are usually more than 1, such as P/E

ratio

1. The ratio refers to the numerical relationship between two variables

2. The relationship between two figures can be established on the basis, of some logical

methods, which is called ratio.

3. Ratio is an assessment of one number in relation to the other.

1. MODE OF EXPRESSION: This is quantitative relationship may be expressed in

either of the following ways Rate, Proportion and Percentage.

NATURE OF RATIO ANALYSIS:

In financial analysis, ratio is used as an index of yardstick for evaluating the financial

position and performance of the firm. It is a technique of analysis and interpretation of

financial statements. Ratio analysis helps in making decisions as it helps establishing

relationship between various ratios and interpret thereon. Ratio analysis helps analysts to

make quantitative judgment about the financial position and performance of the firm. Ratio

analysis involves following steps:

1. Relevant data selection from the financial statements related to the objectives of the

analysis.

2. Calculation of required ratios from the data and presenting them either in pure ratio

form or in percentage.

3. Comparison of derived different ratios with:

i. The ratio of the same concern over a period of years to know upward or downward trend or

static position to help in estimating the future, or

ii. The ratios of another firm in same line, or

iii. The ratios of projected financial statements, or

iv. The ratios of industry average, or

v. The ratios between the departments of the same concern assessing either the financial

position or the profitability or both.

IMPORTANCE OR OBJECTIVES OF RATIO ANALYSIS:

With this, we can analyze business's financial position. We also check company's short term

and long term solvency with ratio analysis. Following are the main advantages of ratio

analysis.

1. Aid to measure General efficiency

2. Aid in comparison of financial data

3. Financial forecasting

4. Aid in planning

5. Facilitate decision making

6. To test profitability

7. To test solvency positions

8. Aid in Intra firm comparison

9. Taking investment decision

10. Effective tool for management

11. Act as a good communication

12. To achieve desired co-ordination

Helpful in Decision Making

All our financial statements are made for providing information. But this information is not

helpful for decision making because financial statements provide only raw information.

When we calculate different ratios in ratio analysis, at that time, we get useful information.

Helpful in Communication

Ratio analyses are more important from communication point of view. Suppose, we have to

appoint new sales agents for our company, at that time, we can communicate them by using

our company's sales and profit related ratios. There is no need of hi-tech for understanding

the meaning of any specific ratio. For example, our gross profit in 2010 is 26.6% and in 2011,

it is 28.55%. By just telling this ratio, we can understand whether our company is growing or

falling.

Helpful in Co-ordination

No company has all the strength points. Company's financial results show some strength

points and some weak points. Ratio analysis can create co-ordination between strength points

and weak points.

Helps in Control

Ratio analysis can also use for controlling our business. We can easily create the standard of

each financial item of our balance sheet and profit and loss account. On this basis, we can

also calculate standard ratios. By comparing standard ratios with actual accounting ratios, we

can find variance. This variance may be favorable and unfavorable. On this basis, we can

control our business from financial point of view.

LIMITATIONS OF RATIO ANALYSIS:

1. A single ratio in itself is not important or has limited value because trend is more

2.

3.

4.

5.

6.

significant in the analysis

A simple ratio would not be able to convey anything

Lack of proper standard

Differences in definitions

Effect of personal opinion

Ratios may make the comparative study complicated and misleading an account of

changes in price level.

7. Ratio analysis is one of the many techniques of analysis and interpretation

8. Ratio become meaningless if detached from the details from which they are derived.

9. Ratios are computed on the basis of past data. past is not an indicator of future

10. Ratio analysis is not a substitute for sound judgment.

LIMITED USE OF SINGLE RATIO

Sometime, we cannot compare our ratios with others. For example, we have started new

business and our financial results are not still normal. At that time, our profitability ratio

will have limited use because there is not any past data of profitability ratios.

LACK OF ADEQUATE STANDARDS

We could not make standards of all ratios. For example, we cannot tell what is rule of

them of our net profit ratio because there are lots of factors affect it. In the lack of

adequate standards of ratios, we cannot give exact comment on the basis of ratio analysis.

INHERENT LIMITATION OF FINANCIAL ACCOUNTING

Ratio analysis is just like simplification of financial accounting data. But there are lots of

limitations of financial accounting. All these limitation will be absorbed by ratios. This is

the one of the important limitation of ratio. I can say if base is not good, everything will

be wrong. If there is small portion of poison in milk, its effect will be in everything what

you will make.

PERSONAL BIAS

This is reality, I saw many CAs who waste their time to optimize different ratios by

changing the project financial statements figures for making attractive projects. All these

activities are done for getting loan. So, this will make the drawback of ratio analysis.

CHANGES OF ACCOUNTING PROCEDURES

If accounting procedures will change; our accounting ratio will be changed. At that time,

we cannot compare our current year ratios with our past year ratios. For example, in past

year, we had used LIFO but current year; we are using FIFO for inventory valuation. Due

to this, figures of closing stock will be different. On this basis, if we have calculated

current ratio, it will not be comparable with past current ratio.

RATIOS ARE NOT SUBSTITUTE OF FINANCIAL STATEMENTS

Ratio analysis is important part of financial statements analysis. It can never become a

substitute of financial statements. We just use it with cash flow analysis, fund flow

analysis and other analysis.

WRONG INTERPRETATION

For explaining the effect on company's position with ratios, there is big need of

experience. Wrong interpretation will be helpful for wrong decisions. So, it is limitation

of ratio analysis that it does not explain all the facts, it has to explain. For a new accounts

manager, it may be difficult.

INTERESTED PARTIES OF RATIOS:

Ratio analysis of firms financial statement is of interest to a number of parties, mainly

management, creditors, share holders and investors etc. Parties interested and application of

different ratios in short, are given below:

Parties interested

Application of Ratio

To use

Operating Ratio

Return on capital employed

Stock turnover ratio

Debtors turnover ratio

Solvency Ratio

PROFITABILITY

1 Management

a

b

c

d

e

2 Creditors, Money

lenders and Investors

a Current ratio

b Solvency ratio

c Creditors turnover ratio

LIQUIDITY

OR

SOLVENCY

d Fixed asset ratio

e Asset cover

f Interest cover or Debt service ratio

3 Share holders,

Creditors, Employees,

Government

a

b

c

d

e

f

g

Return on share holders fund

Capital gearing ratio

Dividend cover ratio

Yield rate ratio

Proprietary ratio

Dividend rate ratio

Assets cover of share

1. Profitability ratios:

Gross profit ratio

Net profit ratio

Expense ratio

Operating profit ratio

Return on capital

CAPITAL

STRUCTURE

3. Activity ratios:

Stock turnover

Working capital turnover

Fixed asset turnover

Capital turnover

ACCOUNTING RATIOS:

employed ratio

4. Liquidity ratios:

There 2.

are Earning

several ratios

ratios:which can be computed in a firm for various purposes. In view of the

Current ratio

Dividend ratio

Acid

Test

requirements of the various users of ratios we may classify

them

intoratio

the following five

Earning per share

Debt Equity ratio

Price earning ratio

important categories :-)

Long Term Debt Equity

Pay out ratio

Earning power ratio

Ratio

5. Leverage ratio:

10

LIQUIDITY RATIO

1. CURRENT RATIO :

The current ratio is used to evaluate the liquidity, or ability to meet short term debt. High

current ratio are needed for companies that have difficulty borrowing on short term

notice. The generally acceptable current ratio is 2:1. The minimum acceptable current

ratio is 1:1.

Current Ratio = Current Assets/Current Liabilities.

2. Acid Test Ratio :

A stringent test that indicates whether a firm has enough short-term assets to cover its

immediate liabilities without selling inventory. The acid-test ratio is far more strenuous

11

than the working capital ratio, primarily because the working capital ratio allows for the

inclusion of inventory assets.

Acid Test Ratio = Current Assets Stock Prepaid Expenses/ Current Liabilities

Bank Overdraft.

3. Debt Equity Ratio :The debt to equity ratio is a financial, liquidity ratio that compares a company's total debt

to total equity. The debt to equity ratio shows the percentage of company financing that

comes from creditors and investors. A higher debt to equity ratio indicates that more

creditor financing (bank loans) is used than investor financing (shareholders).

Debt Equity Ratio = Total Liabilities/Total Equity.

4. Long Term Debt Equity Ratio:LONG-TERM DEBT TO EQUITY expresses the relationship between long-term capital

contributions of creditors as related to that contributed by owners (investors). As opposed

to DEBT TO EQUITY, Long-Term Debt to Equity expresses the degree of protection

provided by the owners for the long-term creditors.

Long Term Debt Equity Ratio = Long Term Liabilities/ Stockholders Equity.

12

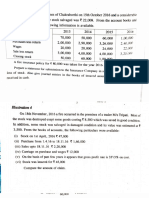

LIQUIDITY ANALYSIS OF SELECTED INDIAN COMPANIES

1. CURRENT RATIO OF 10 COMPANIES FOR THE YEAR 2013-14

Current Ratio = Current Assets

Current Liabilities

(---- in Rs. Cr. -----)

Tata Motors

Ambuja

Cement

Bajaj auto

Company

= 9,681

16,043

=0.61 : 1

=4,811

3,778

=1.27 : 1

= 4,048

5,082

=0.80 : 1

13

Maruti

Suzuki

=7,006

7,872

=0.88: 1

Tech

Mahindra

= 10,347

4,913

=2.11 : 1

Hero

Motocorp.

=2,912

4,497

=0.65 : 1

ACC Ltd

= 3,585

4,436

=0.81 : 1

Shree

Cement

= 2,132

1,539

=1.38 : 1

Bajaj

Finance

= 24,370

4,677

=5.22 : 1

Tata Steel

= 13,604

23,766

=0.57 : 1

COMMENTS :-

Current ratio reflects short term financial position of the company. The standard

current ratio is 2:1. The Current ratio of Bajaj Finance (5.22) is better of all

other companies. The position of current assets of Bajaj Finance is satisfactory

14

as compare to above companies to meet the current obligation out of its current

assets.

2. QUICK RATIO OF 10 COMPANIES FOR THE YEAR 2013-14

Liquid Ratio /

Quick Ratio /

Acid Test Ratio

Tata Motors

Ambuja

Cement

Bajaj auto

Company

= Liquid Assets or Quick Assets

Current Liabilities

(---- in Rs. Cr. -----)

= 5,817

16,043

=0.36 : 1

=3,922

3,778

=1.04: 1

= 3,409

5,082

=0.67 : 1

15

Maruti

Suzuki

=5,300

7,873

=0.67: 1

Tech

Mahindra

= 10,347

4,913

=2.11 : 1

Hero

Motocorp.

=2,243

4,497

=0.49 : 1

ACC Ltd

= 2,329

4,439

=0.53: 1

Shree

Cement

= 1,323

1,539

=0.86 : 1

Bajaj

Finance

= 24,370

4,677

=5.22 : 1

Tata Steel

= 7,596

23,766

=0.32 : 1

COMMENTS:Liquid ratio is designed to indicate the liquid financial position of an enterprise. The

purpose of liquid ratio is to measures the immediate solvency of the business and indicates

the availability of liquid cash to meet its immediate commitment. Thus the liquidity of

Bajaj Finance (5.22) is more than other companies.

16

3. DEBT EQUITY RATIO OF 10 COMPANIES FOR THE YEAR 2013-14

Debt Equity Ratio

= Total Liabilities

Total Equity

(---- in Rs. Cr. -----)

Tata Motors

= 14,515

19,153

=0.76 : 1

= 0019

10,104

=0.03: 1

Bajaj auto

Company

= 0057

9609

=0.05: 1

Maruti

Suzuki

= 1,685

20,978

=0.08: 1

Ambuja

Cement

17

Tech

Mahindra

= 0005

9,820

=0.01 : 1

Hero

Motocorp.

=0000

5,599

=0.00 : 1

ACC Ltd

= 0000

8,235

=0.00: 1

Shree

Cement

= 1,078

4,711

Bajaj

Finance

= 15,951

3,991

=4.00 : 1

Tata Steel

= 26,127

61,148

=0.43: 1

=0.23 : 1

COMMENTS:-

Leverage ratio indicating the relative proportion of shareholders'

equity and debt used to finance a company's assets. A low debt to

equity ratio indicates lower risk, because debt holders have less

claims on the company's assets. A debt to equity ratio of 5 means

that debt holders have a 5 times more claim on

assets than

equity holders. A high debt to equity ratio usually means that a

company has been aggressive in financing growth with debt and

18

often results in volatile earnings. Thus the Debt Equity Ratio of Bajaj Finance

(4.00) is more than other companies.

1. LONG TERM DEBT EQUITY RATIO OF 10 COMPANIES FOR THE YEAR

2013-14

Long Term Debt Equity Ratio

= Long Term Liabilities

Stockholders Equity

(---- in Rs. Cr. -----)

Tata Motors

= 14,515

19,153

=0.76 : 1

= 0019

10,104

=0.03: 1

Bajaj auto

Company

= 0057

9609

=0.05: 1

Maruti

= 1,685

=0.08: 1

Ambuja

Cement

19

Suzuki

20,978

Tech

Mahindra

= 0005

9,820

=0.01 : 1

Hero

Motocorp.

=0000

5,599

=0.00 : 1

ACC Ltd

= 0000

8,235

=0.00: 1

Shree

Cement

= 1,078

4,711

Bajaj

Finance

= 15,951

3,991

=4.00 : 1

Tata Steel

= 26,127

61,148

=0.43: 1

=0.23 : 1

Vous aimerez peut-être aussi

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersD'EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersPas encore d'évaluation

- RATIODocument11 pagesRATIOSireeshaPas encore d'évaluation

- Accounting Ratios by AteeqDocument4 pagesAccounting Ratios by AteeqAteejuttPas encore d'évaluation

- Managerial Focus On Ratios & ImportanceDocument9 pagesManagerial Focus On Ratios & ImportanceMahima BharathiPas encore d'évaluation

- Financial ANalysis Final ReportDocument70 pagesFinancial ANalysis Final ReportNeha Sable DeshmukhPas encore d'évaluation

- Meaning and Limitations of Financial RatiosDocument6 pagesMeaning and Limitations of Financial RatiosThomasaquinos Gerald Msigala Jr.Pas encore d'évaluation

- Ratio AnalysisDocument4 pagesRatio AnalysisKartikeyaDwivediPas encore d'évaluation

- Ratio Analysis-WPS OfficeDocument4 pagesRatio Analysis-WPS OfficeKyeienPas encore d'évaluation

- Finance Project For McomDocument40 pagesFinance Project For McomSangeeta Rachkonda100% (1)

- Ratio AnalysisDocument51 pagesRatio AnalysisSeema RahulPas encore d'évaluation

- Theoretical Framework of The Study: Ratio AnalysisDocument39 pagesTheoretical Framework of The Study: Ratio AnalysisKurt CaneroPas encore d'évaluation

- Analyzing Financial StatementsDocument4 pagesAnalyzing Financial StatementsHameem KhanPas encore d'évaluation

- FINANCIAL ANALYSIS AND REPORTING - Module 1Document11 pagesFINANCIAL ANALYSIS AND REPORTING - Module 1Zarina ChanPas encore d'évaluation

- Devansh Synopsis Ratio AnalysisDocument2 pagesDevansh Synopsis Ratio AnalysisShobhit ShuklaPas encore d'évaluation

- IntroductionDocument5 pagesIntroductionDushyant ChouhanPas encore d'évaluation

- Definition and Explanation of Financial Statement AnalysisDocument9 pagesDefinition and Explanation of Financial Statement AnalysisadaktanuPas encore d'évaluation

- Ratio Analysis Is Very Useful Tool of Management AccountingDocument13 pagesRatio Analysis Is Very Useful Tool of Management AccountingSonal PorwalPas encore d'évaluation

- Synopsis Ratio AnalysisDocument3 pagesSynopsis Ratio Analysisaks_swamiPas encore d'évaluation

- Advantages of Accounting RatiosDocument3 pagesAdvantages of Accounting RatiosNeha BatraPas encore d'évaluation

- Definition and Explanation of Financial Statement AnalysisDocument7 pagesDefinition and Explanation of Financial Statement Analysismedbest11Pas encore d'évaluation

- Ratio AnalysisDocument15 pagesRatio AnalysisChandana DasPas encore d'évaluation

- Proj 3.0 2Document26 pagesProj 3.0 2Shivam KharulePas encore d'évaluation

- Synopsis Ratio AnalysisDocument2 pagesSynopsis Ratio Analysismoshiurrah0% (2)

- AccountsDocument4 pagesAccountsAnita YadavPas encore d'évaluation

- Financial Statement AnalysisDocument67 pagesFinancial Statement AnalysisRicha SaraswatPas encore d'évaluation

- Literature ReviewDocument8 pagesLiterature Reviewjopi60Pas encore d'évaluation

- Minhaj University: Corporate Finance AssignmentDocument6 pagesMinhaj University: Corporate Finance AssignmentNEHA BUTTTPas encore d'évaluation

- Ratio analysis-WPS OfficeDocument4 pagesRatio analysis-WPS OfficeAditi SinghPas encore d'évaluation

- BHEL FinanceDocument44 pagesBHEL FinanceJayanth C VPas encore d'évaluation

- Ratio AnalysisDocument9 pagesRatio Analysisbharti gupta100% (1)

- Dawar Shoe Financial AnalysisDocument92 pagesDawar Shoe Financial AnalysisRohit Soni100% (1)

- Ratio Analysis of BGPPLDocument53 pagesRatio Analysis of BGPPLmayurPas encore d'évaluation

- Ratio Analysis Meaning of Accounting RatiosDocument7 pagesRatio Analysis Meaning of Accounting RatiosShirsendu MondolPas encore d'évaluation

- Ratio AnalysisDocument9 pagesRatio AnalysisSushil RavalPas encore d'évaluation

- Ratio AnalysisDocument11 pagesRatio AnalysisNanndita AggarwalPas encore d'évaluation

- Classification of RatiosDocument10 pagesClassification of Ratiosaym_6005100% (2)

- Ratio AnalysisDocument4 pagesRatio AnalysisJohn MuemaPas encore d'évaluation

- Ratio Analysis: We Will First Explain Why We Are Discussing Ratios?Document15 pagesRatio Analysis: We Will First Explain Why We Are Discussing Ratios?Avneet Kaur Bedi100% (1)

- MANAGEMENT ACCOUNTINg Unit-2Document4 pagesMANAGEMENT ACCOUNTINg Unit-2Vishwas AgarwalPas encore d'évaluation

- Ratio AnalysisDocument47 pagesRatio AnalysisyasarPas encore d'évaluation

- Limitation of Ratio AnalysisDocument5 pagesLimitation of Ratio AnalysisMir Wajahat AliPas encore d'évaluation

- Ratio AnalysisDocument24 pagesRatio Analysisrleo_19871982100% (1)

- Ratio AnalysisDocument8 pagesRatio AnalysisSuresh KakarlaPas encore d'évaluation

- Meaning of Accounting RatiosDocument12 pagesMeaning of Accounting RatiosAkash PradhanPas encore d'évaluation

- Meaning of Accounting RatiosDocument12 pagesMeaning of Accounting RatiosAkash PradhanPas encore d'évaluation

- Keltron Finance PRJC ReportDocument52 pagesKeltron Finance PRJC ReportSumi LatheefPas encore d'évaluation

- Financial Ratios and InterpretationDocument20 pagesFinancial Ratios and Interpretationtkt ecPas encore d'évaluation

- RATIO ANALYSIS Synopsis For IngnouDocument11 pagesRATIO ANALYSIS Synopsis For IngnouAnonymous 5quBUnmvm1Pas encore d'évaluation

- Ratio Analysis ClassDocument20 pagesRatio Analysis ClassRanjith KumarPas encore d'évaluation

- Ratios Made Simple: A beginner's guide to the key financial ratiosD'EverandRatios Made Simple: A beginner's guide to the key financial ratiosÉvaluation : 4 sur 5 étoiles4/5 (5)

- Balanced Scorecard for Performance MeasurementD'EverandBalanced Scorecard for Performance MeasurementÉvaluation : 3 sur 5 étoiles3/5 (2)

- Financial Statement Analysis: Business Strategy & Competitive AdvantageD'EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageÉvaluation : 5 sur 5 étoiles5/5 (1)

- Financial Literacy for Managers: Finance and Accounting for Better Decision-MakingD'EverandFinancial Literacy for Managers: Finance and Accounting for Better Decision-MakingÉvaluation : 5 sur 5 étoiles5/5 (1)

- Applying Lean Thinking: Measuring SuccessD'EverandApplying Lean Thinking: Measuring SuccessÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Management Accounting for New ManagersD'EverandManagement Accounting for New ManagersÉvaluation : 1 sur 5 étoiles1/5 (1)

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesD'EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesPas encore d'évaluation

- What is Financial Accounting and BookkeepingD'EverandWhat is Financial Accounting and BookkeepingÉvaluation : 4 sur 5 étoiles4/5 (10)

- Assigned Activities From IM 1Document3 pagesAssigned Activities From IM 1Marcus MonocayPas encore d'évaluation

- Prequalifying Exam Level 2 3 Set A AK FSUU AccountingDocument9 pagesPrequalifying Exam Level 2 3 Set A AK FSUU AccountingRobert CastilloPas encore d'évaluation

- Final Accounts Proj-2Document34 pagesFinal Accounts Proj-2Anil Barolia33% (6)

- Bac3684 Tutorial Questions 1910Document2 pagesBac3684 Tutorial Questions 1910Mohammed Saeed Al-rashdiPas encore d'évaluation

- Maple Leaf Foods MLF Is A Canadian Manufacturer of MeatDocument1 pageMaple Leaf Foods MLF Is A Canadian Manufacturer of MeatLet's Talk With HassanPas encore d'évaluation

- Trident ACC 201 All Modules Case and SLP - LatestDocument17 pagesTrident ACC 201 All Modules Case and SLP - LatestamybrownPas encore d'évaluation

- 04 Super Projects ExhibitsDocument10 pages04 Super Projects ExhibitsYo shuk singhPas encore d'évaluation

- Bulk DealsDocument63 pagesBulk DealsBhavin SagarPas encore d'évaluation

- Taxation SituationalDocument113 pagesTaxation SituationalDaryl Mae Mansay100% (1)

- A Study On Evaluation of Financial Performance of FMCG Sector Prepared by Krutika R. Tank Under The Guidance of Dr. Hitesh ShuklaDocument16 pagesA Study On Evaluation of Financial Performance of FMCG Sector Prepared by Krutika R. Tank Under The Guidance of Dr. Hitesh ShuklaKRTPas encore d'évaluation

- UntitledDocument5 pagesUntitledShevina Maghari shsnohsPas encore d'évaluation

- Waskita Beton Precast GA 31 Dec 2019 - FinalDocument120 pagesWaskita Beton Precast GA 31 Dec 2019 - Finalokdi pranciscoPas encore d'évaluation

- Adobe Scan Aug 10, 2021Document6 pagesAdobe Scan Aug 10, 2021AnajPas encore d'évaluation

- Tb02 - Test Bank Chapter 2 Tb02 - Test Bank Chapter 2Document45 pagesTb02 - Test Bank Chapter 2 Tb02 - Test Bank Chapter 2Renz AlconeraPas encore d'évaluation

- SCM Mid Term ExamDocument3 pagesSCM Mid Term ExamSandra William100% (2)

- Advanced Accounting1Document8 pagesAdvanced Accounting1precious mlb100% (1)

- Cashflows TestDocument1 pageCashflows TestNonilon RoblesPas encore d'évaluation

- Question 1Document15 pagesQuestion 1Cale HenitusePas encore d'évaluation

- Donald Kieso Chapt 5Document76 pagesDonald Kieso Chapt 5Ridha Ansari100% (1)

- 13Document50 pages13Ovais HussainPas encore d'évaluation

- Individual Dividend Growth Portfolios OutperformDocument1 pageIndividual Dividend Growth Portfolios OutperformrickescherPas encore d'évaluation

- Speciality ChemicalsDocument32 pagesSpeciality ChemicalsKeshav KhetanPas encore d'évaluation

- IB Interview Guide, Module 2: Undergraduate and Recent Graduate Story Templates - Mixed Finance But Non-IB Background To Investment BankingDocument4 pagesIB Interview Guide, Module 2: Undergraduate and Recent Graduate Story Templates - Mixed Finance But Non-IB Background To Investment BankingKerr limPas encore d'évaluation

- Summary and Conclusions: Chapter Review and Self-Test ProblemsDocument4 pagesSummary and Conclusions: Chapter Review and Self-Test ProblemsSyed Asim AliPas encore d'évaluation

- Bonus SharesDocument3 pagesBonus SharesriddhisanghviPas encore d'évaluation

- NPVDocument11 pagesNPVMaNi Rajpoot100% (1)

- FAR WEEK 6 NCAHS RevieweesDocument3 pagesFAR WEEK 6 NCAHS RevieweesAdan NadaPas encore d'évaluation

- Telchi Litel Ltda Eeff 2021Document3 pagesTelchi Litel Ltda Eeff 2021Info Riskma SolutionsPas encore d'évaluation

- Important Definitions Igcse BusinessDocument19 pagesImportant Definitions Igcse BusinessBigBoiPas encore d'évaluation

- Tata Power Company Limited Share Price Today, Stock Price, Live NSE News, Quotes, Tips - NSE IndiaDocument2 pagesTata Power Company Limited Share Price Today, Stock Price, Live NSE News, Quotes, Tips - NSE Indiasantanu_1310Pas encore d'évaluation