Académique Documents

Professionnel Documents

Culture Documents

5 Year Cash Flow

Transféré par

Rith TryCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

5 Year Cash Flow

Transféré par

Rith TryDroits d'auteur :

Formats disponibles

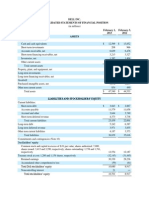

5-year Cash Flow Statement summary 1

(in $ millions)

2011

2012

2013

2014

2015

Cash generated from operations

3,547.5

2,099.0

2,071.1

2,241.6

2,193.9

Payment of fines

(201.8)

(1.3)

(24.0)

(78.3)

(10.4)

(60.5)

(394.9)

(192.7)

(65.2)

(116.3)

3,285.2

1,702.8

1,854.4

2,098.1

2,067.2

Cash flows from operating

activities

Taxation paid

Net cash inflow from operating

activities

Cash flows from investing

activities

Capital expenditure

(1,223.8) (1,641.2) (1,875.4) (2,574.6) (2,600.2)

Purchase of intangible assets

(19.6)

(56.1)

(83.6)

(29.7)

(30.9)

Proceeds from disposal of aircraft

and other property, plant and

equipment

721.4

495.1

647.7

808.7

997.8

(259.6)

(339.0)

(364.4)

(571.6)

(246.7)

2.1

(229.6)

315.1

582.3

164.3

214.0

196.9

214.4

242.2

183.3

48.1

1.8

(1.1)

(54.6)

(281.8)

(72.8)

Purchase of long term investments

Proceeds from disposal of

investments

Cash inflow from investments

Return of capital from associated

companies

Investments in associated

1 Data was extracted from Singapore Airlines Ltds Annual Reports 2011 - 2015

companies and joint ventures

Net cash outflow from investing

activities

(566.6) (1,580.4) (1,146.2) (1,822.7) (1,605.2)

Cash flows from financing

activities

Dividends paid

Interest paid

(428.8) (1,630.5)

(244.4)

(375.2)

(553.2)

(69.3)

(86.9)

(34.2)

(36.4)

(41.5)

Proceeds from borrowings

1.7

1.1

3.5

16.9

8.8

Repayment of borrowings

(900.4)

(0.2)

(0.9)

(38.2)

Proceeds from issuance of bonds

800.0

500.0

Repayment of long-term lease

liabilities

(64.3)

(61.2)

(63.9)

(67.6)

(52.3)

89.4

65.7

38.3

43.4

45.8

100.5

Purchase of treasury shares

(44.5)

(272.1)

(37.7)

(16.0)

(107.0)

Net cash used in financing

activities

284.2 (2,884.3)

(338.6)

(435.8)

(137.1)

Net cash (outflow)/inflow

3,002.8 (2,761.9)

369.6

(160.4)

324.9

Cash and cash equivalents at

beginning of the year

4,471.9

7,434.2

4,702.7

5,059.6

4,883.9

(40.5)

30.4

(12.7)

(15.3)

45.3

Proceeds from exercise of share

options

Proceeds from issuance of rights

shares to non-controlling interests

Effect of exchange rate changes

Cash and cash equivalents at the

end of the year

7,434.2

4,702.7

5,059.6

4,883.9

5,254.1

Summarised Cash Flow

3500

3,003

1750

370

325

-160

Net cash flow ($m)

Net cash flow

-1750

-2,762

-3500

2011

2012

2013

2014

2015

Year

(in $ millions)

2011

2012

2013

2014

2015

Net cash inflow from operating

activities

3,285.2

1,702.8

1,854.4

2,098.1

2,067.2

Net cash outflow from investing

activities

(566.6) (1,580.4 (1,146.2 (1,822.7 (1,605.2

)

)

)

)

Net cash used in financing

activities

Net cash (outflow)/inflow

284.2 (2,884.3

)

(338.6)

(435.8)

(137.1)

3,002.8 (2,761.9

)

369.6

(160.4)

324.9

2 Data was extracted from Singapore Airlines Ltds Annual Reports 2011 - 2015

Cash and cash equivalents at the

end of the year

7,434.2

4,702.7

5,059.6

4,883.9

5,254.1

By looking at the 5-year summary of net cash flow of Singapore Airlines, it is obvious

that net cash flow over the 5 years has fluctuated, especially between 2011 and 2013.

In 2011, net cash flow for SIA was $3,002.8 million and it dramatically plunged to a net

cash outflow of $2,761.9 million in 2012, a 190%. However, in 2013, it has gradually

recovered to a positive net cash flow of $369.6 million.

Net cash flow can be

This net cash flow has fluctuated over the 5 years, despite the fact that cash generated

from operations did not vary significantly for the last 4 years.

Quality of Earnings 3

(in $ millions)

2011

2012

2013

2014

2015

Cash generated from operations

3,547.5

2,099.0

2,071.1

2,241.6

2,193.9

Operating profit

1,148.8

396.8

441.6

424.4

406.7

3.09

5.29

4.69

5.28

5.39

Quality of Earnings

3 Quality of Earnings = Cash generated from operations / Operating profit

Vous aimerez peut-être aussi

- Financial Reporting: Consolidated Statements and NotesDocument66 pagesFinancial Reporting: Consolidated Statements and NotesJorge LazaroPas encore d'évaluation

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosD'EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosPas encore d'évaluation

- IB English L&L Paper 1 + 2 Tips and NotesDocument9 pagesIB English L&L Paper 1 + 2 Tips and NotesAndrei BoroianuPas encore d'évaluation

- Financial Analysis ToolDocument50 pagesFinancial Analysis ToolContessa PetriniPas encore d'évaluation

- Demand To Vacate - Januario MendozaDocument1 pageDemand To Vacate - Januario Mendozaclaudenson18Pas encore d'évaluation

- Sample Management LetterDocument9 pagesSample Management LetterAdil MahmudPas encore d'évaluation

- The Rocky Mountain WestDocument202 pagesThe Rocky Mountain WestYered Canchola100% (1)

- Konosuba! Volume:7Document359 pagesKonosuba! Volume:7SaadAmirPas encore d'évaluation

- Prime Focus - Q4FY12 - Result Update - Centrum 09062012Document4 pagesPrime Focus - Q4FY12 - Result Update - Centrum 09062012Varsha BangPas encore d'évaluation

- (Cooperative) BOD and Secretary CertificateDocument3 pages(Cooperative) BOD and Secretary Certificateresh lee100% (1)

- Dorfman v. UCSD Ruling - California Court of Appeal, Fourth Appellate DivisionDocument20 pagesDorfman v. UCSD Ruling - California Court of Appeal, Fourth Appellate DivisionThe College FixPas encore d'évaluation

- Apollo 11tech Crew DebriefDocument467 pagesApollo 11tech Crew DebriefBob AndrepontPas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Contract Law CasesDocument6 pagesContract Law CasesRith Try100% (2)

- Income Statement: Assets Non-Current AssetsDocument213 pagesIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahPas encore d'évaluation

- FMT Tafi Federal LATESTDocument62 pagesFMT Tafi Federal LATESTsyamputra razaliPas encore d'évaluation

- Assignment Ratio - A4 SizeDocument4 pagesAssignment Ratio - A4 SizekakurehmanPas encore d'évaluation

- Six Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceDocument5 pagesSix Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceraviaxgPas encore d'évaluation

- Quarterly Update: First Half 2014 ResultsDocument4 pagesQuarterly Update: First Half 2014 ResultssapigagahPas encore d'évaluation

- July 2011 Financial Report for St. Vincent Building and Loan AssociationDocument17 pagesJuly 2011 Financial Report for St. Vincent Building and Loan Associationmarlynrich3652Pas encore d'évaluation

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- HYUNDAI Motors Balance SheetDocument4 pagesHYUNDAI Motors Balance Sheetsarmistha guduliPas encore d'évaluation

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument2 pagesInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesMike TruongPas encore d'évaluation

- Bharti Airtel: Concerns Due To Currency VolatilityDocument7 pagesBharti Airtel: Concerns Due To Currency VolatilityAngel BrokingPas encore d'évaluation

- IRRI AR 2013 Audited Financial StatementsDocument62 pagesIRRI AR 2013 Audited Financial StatementsIRRI_resourcesPas encore d'évaluation

- Sime Darby Annual Report 2014 Financial HighlightsDocument11 pagesSime Darby Annual Report 2014 Financial HighlightsDa Nie LPas encore d'évaluation

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Document30 pagesWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawanePas encore d'évaluation

- SpiceJet Result UpdatedDocument9 pagesSpiceJet Result UpdatedAngel BrokingPas encore d'évaluation

- Unaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2014Document21 pagesUnaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2014rikky adiwijayaPas encore d'évaluation

- JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDocument4 pagesJK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDeepa GuptaPas encore d'évaluation

- HOBEE INVESTMENT REVIEWDocument8 pagesHOBEE INVESTMENT REVIEWTheng RogerPas encore d'évaluation

- Mindtree ValuationDocument74 pagesMindtree ValuationAmit RanderPas encore d'évaluation

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadPas encore d'évaluation

- Earth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RDocument4 pagesEarth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RCamarada RojoPas encore d'évaluation

- Financial Statements Year Ended Dec 2010Document24 pagesFinancial Statements Year Ended Dec 2010Eric FongPas encore d'évaluation

- Dell IncDocument6 pagesDell IncMohit ChaturvediPas encore d'évaluation

- Zimplow FY 2012Document2 pagesZimplow FY 2012Kristi DuranPas encore d'évaluation

- Unaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2015Document19 pagesUnaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2015rikky adiwijayaPas encore d'évaluation

- TSAU - Financiero - ENGDocument167 pagesTSAU - Financiero - ENGMonica EscribaPas encore d'évaluation

- African Overseas Enterprises 2012 Annual ReportDocument57 pagesAfrican Overseas Enterprises 2012 Annual ReportAdilNzPas encore d'évaluation

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoPas encore d'évaluation

- 3 Statement Financial Analysis TemplateDocument14 pages3 Statement Financial Analysis TemplateCười Vê LờPas encore d'évaluation

- (A) Nature of Business of Cepatwawasan Group BerhadDocument16 pages(A) Nature of Business of Cepatwawasan Group BerhadTan Rou YingPas encore d'évaluation

- Balance Coca-Cola 2011Document4 pagesBalance Coca-Cola 2011AinMoraPas encore d'évaluation

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument2 pagesInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDaniyal NawazPas encore d'évaluation

- Key RatiosDocument2 pagesKey RatiosKhalid MahmoodPas encore d'évaluation

- 4Q 2006Document2 pages4Q 2006doansiscusPas encore d'évaluation

- BUY Bank of India: Performance HighlightsDocument12 pagesBUY Bank of India: Performance Highlightsashish10mca9394Pas encore d'évaluation

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiPas encore d'évaluation

- Punjab National Bank: Performance HighlightsDocument12 pagesPunjab National Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Mothersum Standalone Results Q3 FY2012Document4 pagesMothersum Standalone Results Q3 FY2012kpatil.kp3750Pas encore d'évaluation

- Ashok Leyland: Performance HighlightsDocument13 pagesAshok Leyland: Performance HighlightsAngel BrokingPas encore d'évaluation

- 06 Financial HighlightsDocument1 page06 Financial HighlightsKhaira UmmatienPas encore d'évaluation

- Financial Statements of State Trading Organization and DhiraaguDocument2 pagesFinancial Statements of State Trading Organization and DhiraagumiraaloabiPas encore d'évaluation

- (Incorporated in Malaysia) : Telekom Malaysia Berhad (128740-P)Document11 pages(Incorporated in Malaysia) : Telekom Malaysia Berhad (128740-P)smallville_shahPas encore d'évaluation

- Apollo Tyres ProjectDocument10 pagesApollo Tyres ProjectChetanPas encore d'évaluation

- GulahmedDocument8 pagesGulahmedOmer KhanPas encore d'évaluation

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohPas encore d'évaluation

- Sri Lanka Telecom 2010 /09Document11 pagesSri Lanka Telecom 2010 /09Inde Pendent LkPas encore d'évaluation

- BGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEDocument5 pagesBGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEmittlePas encore d'évaluation

- CTC - Corporate Update - 10.02.2014Document6 pagesCTC - Corporate Update - 10.02.2014Randora LkPas encore d'évaluation

- Alibaba IPO Financial ModelDocument54 pagesAlibaba IPO Financial ModelPRIYANKA KPas encore d'évaluation

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1Pas encore d'évaluation

- 2011 MAS Annual 2Document9 pages2011 MAS Annual 2Thaw ZinPas encore d'évaluation

- Financial Highlights 2011-2012Document1 pageFinancial Highlights 2011-2012cdcrotaerPas encore d'évaluation

- Bank of India: Performance HighlightsDocument12 pagesBank of India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Financial Highlights: Hinopak Motors LimitedDocument6 pagesFinancial Highlights: Hinopak Motors LimitedAli ButtPas encore d'évaluation

- Life InsuranceDocument8 pagesLife InsuranceKKPas encore d'évaluation

- Financial Highlights FY08: Balance SheetDocument3 pagesFinancial Highlights FY08: Balance SheetWilliam ChandraPas encore d'évaluation

- (WWW - Haiwenku.com) 0c56c90255270722192ef76c 1385606909Document8 pages(WWW - Haiwenku.com) 0c56c90255270722192ef76c 1385606909Rith TryPas encore d'évaluation

- 03.board DutiesDocument18 pages03.board Dutiesoyster333Pas encore d'évaluation

- SssssDocument1 pageSssssRith TryPas encore d'évaluation

- Business Statistics FormulaDocument4 pagesBusiness Statistics FormulaRith TryPas encore d'évaluation

- f6 SGP SG 2016Document12 pagesf6 SGP SG 2016Rith TryPas encore d'évaluation

- Annual Report 2014-15Document157 pagesAnnual Report 2014-15M Umar FarooqPas encore d'évaluation

- Cashflow Statements - ACCA GlobalDocument3 pagesCashflow Statements - ACCA GlobalRith TryPas encore d'évaluation

- Contest Rules 1384Document4 pagesContest Rules 1384Rith TryPas encore d'évaluation

- Key Word ListDocument7 pagesKey Word ListRith TryPas encore d'évaluation

- 5 Year Cash FlowDocument5 pages5 Year Cash FlowRith TryPas encore d'évaluation

- Decision Making LCCIDocument9 pagesDecision Making LCCIRith TryPas encore d'évaluation

- BudgetingDocument3 pagesBudgetingRith TryPas encore d'évaluation

- Growth of Royal Power in England and FranceDocument6 pagesGrowth of Royal Power in England and FrancecharliPas encore d'évaluation

- NS500 Basic Spec 2014-1015Document58 pagesNS500 Basic Spec 2014-1015Adrian Valentin SibiceanuPas encore d'évaluation

- New Wordpad DocumentDocument2 pagesNew Wordpad DocumentJia JehangirPas encore d'évaluation

- 2016-2017 Course CatalogDocument128 pages2016-2017 Course CatalogFernando Igor AlvarezPas encore d'évaluation

- Ola Ride Receipt March 25Document3 pagesOla Ride Receipt March 25Nachiappan PlPas encore d'évaluation

- Mathematics: Textbook For Class XIIDocument14 pagesMathematics: Textbook For Class XIIFlowring PetalsPas encore d'évaluation

- Bautista CL MODULEDocument2 pagesBautista CL MODULETrisha Anne Aranzaso BautistaPas encore d'évaluation

- San Beda UniversityDocument16 pagesSan Beda UniversityrocerbitoPas encore d'évaluation

- Irregular verbs guideDocument159 pagesIrregular verbs guideIrina PadureanuPas encore d'évaluation

- JNMF Scholarship Application Form-1Document7 pagesJNMF Scholarship Application Form-1arudhayPas encore d'évaluation

- United States v. Hernandez-Maldonado, 1st Cir. (2015)Document9 pagesUnited States v. Hernandez-Maldonado, 1st Cir. (2015)Scribd Government DocsPas encore d'évaluation

- The Genesis of The Five Aggregate TeachingDocument26 pagesThe Genesis of The Five Aggregate Teachingcrizna1Pas encore d'évaluation

- Effecting Organizational Change PresentationDocument23 pagesEffecting Organizational Change PresentationSvitlanaPas encore d'évaluation

- Comillas Elementary Class Program Modular Distance LearningDocument24 pagesComillas Elementary Class Program Modular Distance Learningbaldo yellow4Pas encore d'évaluation

- Sana Engineering CollegeDocument2 pagesSana Engineering CollegeandhracollegesPas encore d'évaluation

- Civil Litigation MCQ FeedbackDocument17 pagesCivil Litigation MCQ Feedbackbennyv1990Pas encore d'évaluation

- Chapter 16 Study GuideDocument2 pagesChapter 16 Study GuideChang Ho LeePas encore d'évaluation

- Addressing Menstrual Health and Gender EquityDocument52 pagesAddressing Menstrual Health and Gender EquityShelly BhattacharyaPas encore d'évaluation

- Guidelines For ValuationDocument6 pagesGuidelines For ValuationparikhkashishPas encore d'évaluation

- DEALCO FARMS vs. NLRCDocument14 pagesDEALCO FARMS vs. NLRCGave ArcillaPas encore d'évaluation

- Lesson 2 The Chinese AlphabetDocument12 pagesLesson 2 The Chinese AlphabetJayrold Balageo MadarangPas encore d'évaluation

- Ceramic EthnoarchaeologyDocument336 pagesCeramic EthnoarchaeologyAhmad adelPas encore d'évaluation

- Adw Ethical Stewardship of Artifacts For New Museum ProfessionalsDocument15 pagesAdw Ethical Stewardship of Artifacts For New Museum Professionalsapi-517778833Pas encore d'évaluation