Académique Documents

Professionnel Documents

Culture Documents

Top 5 WAF Power Markets - 2014

Transféré par

Patrick Hervé Baboga0 évaluation0% ont trouvé ce document utile (0 vote)

60 vues3 pagesIn 2014, the top 5 power markets of West Africa were in order Nigeria, Ghana, Ivory Coast, Cameroon and Senegal with consumption amounting to 44.5 Terawatthours. Although, they have been growing over the past few years and are at different stages of their liberalization process. The following factsheet highlights facts and figures on these markets for 2014.

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentIn 2014, the top 5 power markets of West Africa were in order Nigeria, Ghana, Ivory Coast, Cameroon and Senegal with consumption amounting to 44.5 Terawatthours. Although, they have been growing over the past few years and are at different stages of their liberalization process. The following factsheet highlights facts and figures on these markets for 2014.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

60 vues3 pagesTop 5 WAF Power Markets - 2014

Transféré par

Patrick Hervé BabogaIn 2014, the top 5 power markets of West Africa were in order Nigeria, Ghana, Ivory Coast, Cameroon and Senegal with consumption amounting to 44.5 Terawatthours. Although, they have been growing over the past few years and are at different stages of their liberalization process. The following factsheet highlights facts and figures on these markets for 2014.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

FACTS AND FIGURES FOR TOP 5 WAF POWER MARKETS 2014

To solve these issues, the governments of

these countries have chosen to reform their

market to enable private investment in the

power sector.

In 2014, the top 5 power markets of West

Africa (WAF) were in order Nigeria, Ghana,

Ivory Coast, Cameroon and Senegal with

consumption

amounting

to

44.5

Terawatthours. Although, they have been

growing over the past few years and are at

different stages of their liberalization

process, these markets continue to face

the same challenges, namely:

structural shortfall of supply that

usually leads to load shedding;

difficulties in fossil fuels supply;

old and obsolete transmission and

distribution network resulting in:

frequent partial and total

collapse of the national grid;

significant system losses,

especially in distribution.

low end-user prices that jeopardize

the financial health of power

companies.

According to many experts, Ivory Coast is

an example of liberalization of the power

sector. She was one of the first WAF

country to launch the reform its power

market. This process started in 1985 with a

new law governing the power sector that

liberalized electricity generation. The

privatization of the national Company EECI

in 1990, the concession contract signed

with CIE the same year and the beginning

of production of CIPREL, the first Ivoirian

IPP, in 1994, are some milestones of this

process. This country now has 3 IPP, but is

still dominated by the CIE that has enjoyed

a

monopoly

in

transmission

and

distribution.

Nevertheless,

with

the

opening of transmission and distribution to

competition as per the new electricity code

of 2014, this situation will likely evolve in

the short term. The main challenge that

this market will face in future is securing

gas for its thermal generation.

The second country to kick-off the

liberalization of its electricity market was

Ghana, with the acts 538 and 541 of 1997.

Milestones of this process are: the

beginning of production of TICO, first

Ghanaian IPP, in 2000, and the creation of

a transmission company in 2008. In 2014,

there were many utilities active in the

power generation (5) and distribution (3),

transmission being a monopoly as per law.

Although on many aspects Ghana power

market can be considered as the most

mature WAF market, it continues to be

by Patrick Herv BABOGA, M. Eng

1/3

dominated by state-owned companies,

namely VRA, BPA, GRIDCO, ECG and

NEDCO. The main challenge of the

Ghanaian power market for the

foreseeable future will be the setting of

appropriate end-user tariffs that will

reestablish financial health of the sector

without jeopardizing demand.

Senegal was the third of the top 5 WAF

markets to start the reorganization of its

power sector with a law published in 1998.

This process led to a privatization

agreement in 1999 that was cancelled 2000

and to date SENELEC is still a state-owned

company.

Despite

this

unsuccessful

privatization, IPP started production as

early as 1999, with commissioning of the

GTI Dakar Plant. Senegal had in 2014, two

independent

power

producers,

two

dedicated capacity in Malian hydro dams

and is leasing additional engines to meet its

domestics needs. SENELEC remains the

dominant player of this market and is

active in the generation, transmission and

distribution. The main challenge that this

market will face in future is the access

to cheap primary resource or electricity

(Banda Gas project and the FSRU project

are interesting alternatives).

The fourth market to take a step in the

liberalization process in the WAF Zone was

Cameroon with the electricity code of 1998

and the sell-out in 2001, of 56 % interest in

National Company SONEL, by the State.

Some milestones of this process are: the

beginning of production of DPDC, first

private

utility

in

2009

and

the

commissioning in 2013 of the biggest

generation capacity to come online for

more than 30 years (the 216 MW Kribi

plant).

Although

having

two

IPP,

Cameroonian electricity market continues

to be dominated by ENEO the successor of

SONEL that has enjoyed monopoly in

transmission and distribution and also

operates hydro and thermal plants. This

monopoly was ended with the new

electricity code of 2011 and the creation of

a transmission company in 2015. Given the

important generation capacity under

construction, the main challenge of this

market will be to develop and upgrade

the grid (merge the three existing

network).

The poor performance of its electricity

market has obliged Nigeria to start

liberalization of this sector with the

granting of express approvals to some

companies. This approach resulted in the

commissioning of AES Barge in 2001, the

first Nigerian IPP, and of the Agip Okpai

plant in 2005. In parallel, Nigeria kicked-off

the revision of its regulation, to stimulate

private financing. This led to the

enactment in 2005 of the Electric Power

Sector Reform. The main achievement of

this reform occurred in 2013 with the

creation of 5 power generation companies,

one transmission company and 11

distribution companies, all successors of

the Power Holding Company of Nigeria.

This reform has also enabled the arrival of

many additional IPP since 2005. Thus,

Nigeria had at the end of the year 2014,

more than 30 utilities and was the biggest

WAF market. In the coming years, this

market will face two main challenges:

reducing transmission and distribution

losses (46 % in 2014) and setting the

appropriate electricity tariffs.

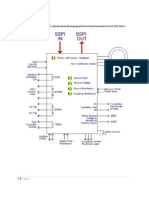

The following factsheet highlights facts and

figures on these markets for 2014.

by Patrick Herv BABOGA, M. Eng

2/3

Rank County

1 Nigeria

Main indicators

Population : 177,500,000

GDP (MUSD) : 568,500

Area : 923,768 km

2 Ghana

Population : 26,790,000

GDP (MUSD) : 38,620

Area : 238,535 km

3 Ivory Coast

Population : 14,670,000

GDP (MUSD) : 15,660

Area : 196,190 km

Population : 22,770,000

GDP (MUSD) : 32,050

Area : 475,440 km

5 Senegal

Population : 22,160,000

GDP (MUSD) : 34,250

Area : 322,463 km

4 Cameroon

Production

Transmission

Ditribution

Consumption

Comments

Installed Capacity : 11.732 GW

Available capacity : 7.485 GW

Net production : 29,244 GWh

Load Factor : 28.5 %

Fuel : Natural gas, hydro

Utilities : 22 producing utilities (PHCN

succesors, IPP, NIPP, IOC)

Peak load 4.144 GW

Network length : 15,022 km

Lines type : 330/132 kV

losses : 9.7 %

Number of networks : 1

Operator : TCN (State owned)

9 collapses of the grid

Lines length : 356,363 km

MV : 33/11 kV

LV: 415/220 V

18 % of netwok losses + 28 % of

collection losses

Operators : 11 distribution

companies

Consumption : 21,654 GWh

Number of subscribers : 8,645,000

Consumption per capita : 126 kWh

Average end-user price : 144.60 USD/MWh

Electricity access 45 %

PHCN historical power company was privatized in 2013

Second Multi-Year Tarrif Order (MYTO 2) is under implentation and

tariffs are more cost reflective

Regulatory agencies : NERC, ECN

Unavailability of gas, water shortages and grid constraints affects

power generation and transmission

Exports power to Togo, Benin and Niger

Gas cost : 3.3 USD/MMBTU

Installed Capacity : 2.830 GW

Net production : 12,963 GWh

Load factor 52.3 %

Fuel : Hydro, natural gas, light crude oil

(LCO), solar

Utilities : VRA, BPA (State owned) TICO, CEL,

SAPP, (IPP)

Peak load 2.061 GW

Network length : 4,450 km

Lines type : 330/225/161/65 kV

Losses : 4.3 %

Number of networks : 1

Operator : GRIDCO (State Owned)

Lines length : 91,382 km

MV : 34,5/33/30/20/11 kV

LV: 415/220 V

losses : 25.2 %

Operators : ECG, NEDCO (State

Owned) and EPC (Private owned)

Installed Capacity : 1.632 GW

Net production : 8,152 GWh

Load factor 57.0 %

Fuel : Natural gas, Hydro, fuel-oil, diesel

Utilities : CIE (15 % State owned), CIPREL,

AGGREKO, AZITO (IPP)

Peak load 1.148 GW

Network length : 4,697 km

Lines type : 225/90 kV

Losses : 6.4 %

Number of networks : 1

Operator : CIE

Lines length : 37,961 km

MV : 30/11 kV

LV: 380/220 V

losses : 17.6 %

Operator : CIE

Consumption : 5,563 GWh

Number of subscribers : 1,311,741

Consumption per capita : 251 kWh

Average end-user price : 138.7 USD/MWh

Electricity access 77 %

SAIDI : 40 hrs per customer

EECI historical power comany was privatized in 1990

Prices are regulated, not cost reflective and rarely modified

Regulatory agency : ANARE

Exports power to Togo, Benin, Burkina, Mali and Ghana

Gas cost : 5.3 USD/MMBTU

Fuel-oil cost : 972.2 USD/MT

Installed Capacity : 1.249 GW

Net production : 6,080 GWh

Load factor 55.6 %

Fuel : Hydro, Natural gas, fuel-oil, diesel,

Solar

Utilities : ENEO (44 % State owned), KPDC,

DPDC (IPP)

Peak load 0.790 GW

Network length : 2,232 km

Lines type : 225/110/90 kV

Losses : 5.6 %

Number of networks : 3

Operator : ENEO

Lines length : 34,358 km

MV : 30/15 kV

LV: 380/220 V

losses : 30.9 %

Operator : ENEO

Consumption : 4,360 GWh

Number of subscribers : 951,496

Consumption per capita : 191 kWh

Average end-user price : 129,40 USD/MWh

Electricity access : 50 %

SAIDI : 105.2 hrs per customer

SAIFI : 305 per customer

SONEL historical power company was privatized in 2001

Prices are regulated and rarely modified

Regulatory agency : ARSEL

Transmission company created in 2015

Fuel-oil cost : 476.2 USD/MT

Diesel cost : 1,213.2 USD/MT

Installed Capacity : 0.828 GW

Net production : 3,227 GWh

Load factor 44.0 %

Fuel : Fuel-oil, hydro, natural gas, diesel

Utilities : SENELEC (State owned), GTI,

KONOUNE (IPP), MANANTALI, FELOU (Dedicated

capacity), AGGREKO, APR Energy (Leased

capcity)

Peak load 0.466 GW1

Network length : 511 km1

Lines type : 225/90 kV

Losses : 2.4 %

Number of networks : 3

Operator : SENELEC

Consumption : 10,182 GWh

1

Number of subscribers : 2,658,602

Consumption per capita : 380 kWh

Average end-user price : 158.07 USD/MWh

Electricity access 80 %

1

SAIDI : 215/106 hrs per customer

1

SAIFI : 135 per customer

Lines length : 16,466 km

MV : 30/6.6 kV

LV: 380/220/127 V

losses : 18.4 %

Operator : SENELEC

Consumption : 2,565 GWh

Number of Subscribers : 1,050,228

Consumption per capita : 194 kWh

Average end-user price : 237.69 USD/MWh

Electricity access : 60 %

END = 21 GWh

IPP generation started in 2000 (commissioning of TICO)

Automatic Adjustment Formula (AAF) is under implementation and

tariffs are more cost reflective

Regulatory agencies : PURC, EC

Poor performance of the WAGP has obliged Ghana to rely on LCO

for thermal production

Exports power to Togo, Benin and Burkina

Gas cost : 8.7 USD/MMBTU

LCO cost : 110.2 USD/bbl

The privatization deal with the consortium of Hydro-Quebec and

Elyo was canceled by Senegal in 2000

Prices are regulated, not cost reflective and rarely modified

Regulatory agency : CRSE

Senegal has 60 and 15 MW of dedicated capacity in Manantali and

Felou hydro dams (Mali)

Fuel-oil cost : 710.0 USD/MT

Diesel cost : 1,083.1 USD/MT

Gas price : 8.9 USD/MMBTU

2012 data

Sources : Regulators, Utilities, Ministries of Enegy, International Energy Agency, World bank, African Development Bank

By Patrick Herv BABOGA, M. Eng.

3/3

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Communications Lab Manual Amplitude Modulation and DSB-SCDocument85 pagesCommunications Lab Manual Amplitude Modulation and DSB-SCMohamedKadry67% (3)

- Capdis-S2+: Voltage Detecting System (VDS) For High VoltageDocument2 pagesCapdis-S2+: Voltage Detecting System (VDS) For High VoltageWhitney HoffmanPas encore d'évaluation

- Cyg PRS-7367Document235 pagesCyg PRS-7367MarkusKunPas encore d'évaluation

- Understanding Electric Demand - US UtilityDocument4 pagesUnderstanding Electric Demand - US UtilityVicente MatamorosPas encore d'évaluation

- Get AttDocument3 pagesGet Attfrank azamarPas encore d'évaluation

- Electrical Commissioning EngineerDocument3 pagesElectrical Commissioning EngineerEngr Irfan AkhtarPas encore d'évaluation

- Henikwon Brochure 2Document23 pagesHenikwon Brochure 2Majho CanilangPas encore d'évaluation

- MicroelectronicsDocument101 pagesMicroelectronicsMac Arthur RamiloPas encore d'évaluation

- Brüel&Kjær 2607 - Measuring Amplifier - Instruction ManualDocument72 pagesBrüel&Kjær 2607 - Measuring Amplifier - Instruction ManualViktor DömePas encore d'évaluation

- Ach400 00Document151 pagesAch400 00João PauloPas encore d'évaluation

- Testing The Bq24210 IcDocument4 pagesTesting The Bq24210 IcShahbaz SarikPas encore d'évaluation

- 48 Volt Battery ChargerDocument5 pages48 Volt Battery ChargerpradeeepgargPas encore d'évaluation

- FLT Eng 1P 110V60 PDFDocument4 pagesFLT Eng 1P 110V60 PDFAra AkramPas encore d'évaluation

- 2UCD030000E009 - D PCS100 SFC Technical CatalogueDocument35 pages2UCD030000E009 - D PCS100 SFC Technical CatalogueAli KhaniPas encore d'évaluation

- Epever: User ManualDocument20 pagesEpever: User ManualroscribPas encore d'évaluation

- 6 L 80Document8 pages6 L 80Transmisiones Guero75% (4)

- Chapter 16Document2 pagesChapter 16velisbarPas encore d'évaluation

- GCL-P6/72: High Efficiency Multicrystalline ModuleDocument2 pagesGCL-P6/72: High Efficiency Multicrystalline ModuleNetoHolandaPas encore d'évaluation

- Design and Working of FM TransmitterDocument6 pagesDesign and Working of FM TransmitterliyuPas encore d'évaluation

- Instrument Transformers CatalogueDocument12 pagesInstrument Transformers CatalogueGanesh DuraisamyPas encore d'évaluation

- Manual UPS DPH 80 120kVA en Us - 501328110000 PDFDocument250 pagesManual UPS DPH 80 120kVA en Us - 501328110000 PDFMohammad KilaniPas encore d'évaluation

- Boss rv6 Manual PDFDocument1 pageBoss rv6 Manual PDFwplaisPas encore d'évaluation

- 21 PrimepowerDocument2 pages21 PrimepowerfernandoPas encore d'évaluation

- Summary Faraday's LawDocument4 pagesSummary Faraday's LawReg TbPas encore d'évaluation

- CS740 A8hDocument10 pagesCS740 A8hPaulo CardosoPas encore d'évaluation

- CW-712 Smart Li-Ion Battery PackDocument8 pagesCW-712 Smart Li-Ion Battery PackBradPas encore d'évaluation

- Micro-Stepping For Stepper MotorsDocument3 pagesMicro-Stepping For Stepper MotorsTanvir S. ShakilPas encore d'évaluation

- 1d679474 D9ed 42f9 848d 2ce5b024a610 PDFDocument2 pages1d679474 D9ed 42f9 848d 2ce5b024a610 PDFHafizna Arsyil FadhliPas encore d'évaluation

- Atkins - PhysicalChemistry F6 Chemical EquilibriumDocument42 pagesAtkins - PhysicalChemistry F6 Chemical EquilibriumJavier Palomino GaratePas encore d'évaluation

- Basics For The GFMDocument6 pagesBasics For The GFMReno BoilardPas encore d'évaluation