Académique Documents

Professionnel Documents

Culture Documents

Islamic Banking - Is It Really Islamic

Transféré par

Mubashir Hassan0 évaluation0% ont trouvé ce document utile (0 vote)

15 vues7 pagesWhether Islamic banking is really Islamic or just name change?

Titre original

Islamic Banking_Is It Really Islamic

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentWhether Islamic banking is really Islamic or just name change?

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

15 vues7 pagesIslamic Banking - Is It Really Islamic

Transféré par

Mubashir HassanWhether Islamic banking is really Islamic or just name change?

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 7

1

Worldwide interest is developing in Islamic Banking

and more such banks are being established even in

countries where Muslims live as minorities for the

reason of their being more resilient to Economic

meltdown. This type of banking is also considered

as

ethical

in

comparison

to

exploitative

conventional (riba based) banks which have lead to

large

scale

disparities

in

wealth.

Some

conventional banks too are establishing Islamic

windows for conducting Sha'ri'ah compliant

business

separate

from

their

conventional

business.

However a question is being asked from many

quarters whether these banks are really conducting

their business on Sha'ri'ah principles or this is just

name change. Some of our scholars opine that real

Islamic Banking does not exist in present world,

just as there cant be an Islamic wine shop so there

cant be an Islamic Bank. Islam not only prohibits

riba but also prohibits Gambling, Speculations and

investing in Haraam activities, these all have to be

taken into account. Murabaah (cost plus) is

particularly under attack and it is the instrument which

is presently most common in comparison to other

instruments of Islamic banking. Mudharabah (Profit

sharing) and Musharakah (Joint venture) are not much

in vogue, owing to social set up and values. These

ventures are more feasible at the community level for

micro-financing small scale and cottage industries.

Another vehement type of criticism comes from those

who have vested interests in present riba based

economy, whose businesses thrive on this exploitative

Economic system. Obviously they might be using the

services of expert economists to put forth their agenda

and propagate it.

There are people who have taken extreme

positions on the subject. While some regard it as

Haraam as a conventional Bank and others think

that it is completely Sha'ri'ah compliant and some

ultra-modernists regard the Conventional Banking

as permissible. These are extreme views and it is

lack of understanding of the mechanism and

operation of these banks which makes one to

regard both as similar.

It cant be denied that no form of Islamic

Banking is at present completely based on

Shariah Principles. Some forms of aversion are

based on genuine points. Theoretically there is

compliance with Sha'ri'ah, but in practice there are

some deviances. There are problems in the field to

implement all the ideals. The trouble arises when

these banks have to deal with conventional banks

they deposit extra liquidity or borrow from these

banks when they are in need which involves Riba.

Completely Shariah based banking is only

possible when whole of the Economy is Sha'ri'ah

based. The transactions occurring within an Economy,

which is not fully Sha'ri'ah based, cant meet all the

basic criterion of the Shariah. Presently whole of the

world economy is integrated and on top is the IMF and

world bank, which are there to safeguard and promote

the interests of the capitalists. It is unthinkable that

these banks shall not be affected by the policies of

these bodies when even the sovereign nations are not

free from their influence. The economic policies of a

sovereign state are affected by these world bodies.

Anyway if these Banks are not performing

completely as per Sha'ri'ah, so why should not they be

closed down? Why should people invest/deposit in them

having illusions of their permissibility? This however is

not the whole truth. Despite shortcomings, these banks

perform important tasks. We cant say that these banks

are fully Islamic, but it has to be admitted that these

banks are not same as the conventional riba based

Banks. It is an option available to us, an alternative.

In future this type of banking is going to be more

refined and the element of the objectionable and

doubtful transactions can be and are slowly

minimized and in phases can be eliminated

completely. If there is no start, how can there be

any progress. The principles of democracy,

liberalism and socialism first started just as ideas

and theories but slowly were put into practice.

These Banks or the Islamic windows are headed

by Shariah board, which consists of ulema who

are well aware of these transactions. They have to

take care to ensure that the business doesnt foray

into the domain of impermissible. Notwithstanding

all this, the present Instruments of Islamic banking

have been devised by the Jurists of repute and

they regard them as permissible. Anyway, it would

provide an alternative to the existing conventional

Banking which is exclusively interest based.

Otherwise a person would have no choice but to

get his saved money deposited in a conventional

bank. Even if he does not take interest, still his

money is used for the purpose of riba based

transactions. On the contrary he has to take loans

from a conventional bank in case he is in need.

Islam does not advocate concentration of

wealth in a few hands, but wants it to be put into

circulation so that inequalities end and the benefits

of wealth percolate to lower rungs of the social

ladder. In todays world every person who has

surplus wealth is not in a position to put the same

in business. This role has to be played by banks: to

collect the surplus capital and to use it where it can

be utilized. To put the money in circulation.

Here I would like to add a precautionary note,

that all those claiming to be based on Islamic

Principles are not really so. There are some

companies which, in the name of Islamic banking,

do fraudulent deeds and their aim is nothing but to

attract investments in the name of Islamic

Banking. One has to be cautious here and not

believe everyone who claims to be doing such

businesses. One should also be careful about as to

who is on the Sha'ri'ah board of that bank. It is not easy

to understand the working of these banks and to

discern whether or not a particular product has some

prohibited element in it or not. For that purpose we

have to rely on ulema to guide us in these matters

We should not discourage Islamic Banks,

even if they do not fully serve our purpose. We

have to learn new ways and techniques to Islamize

the process of Banking and in phased manner

weed out undesired elements. The Islamic banking

and finance would only blossom in a society which

has imbibed Islamic values: where there is no

greed, no selfishness and no extravagance. People

live simple, unassuming and unpretentious lives.

Above all people have an eagerness to help each

other and not to thrive on others compulsions and

helplessness. Not only this at individual levels we

have to change our lifestyles and make it Islamic.

We cant, on one hand be extravagant and waste,

and on the other hand go to an Islamic banks for

loan.

Islamic Banks are in their infancy, they need

some time to get refined. In the current set up, we

should avoid banks as far as possible, but when it

is unavoidable is it not better to opt for Islamic

Banks which, even though have elements of

impermissibility, still are not outright Riba based.

One has to understand the process to some extent

before dealing with these types of banks and deal

in such transactions which are not doubtful. It is

incumbent upon those who have specialized

knowledge to disseminate knowledge about it and

to show us as to how we shall deal with our

economic problems.

Mail: mubashir_07@rediffmail.com

Mobile No. 9419924672

Vous aimerez peut-être aussi

- Absurd Monetary SystemDocument3 pagesAbsurd Monetary SystemMubashir HassanPas encore d'évaluation

- My Response To Maroof Shah's Article "Why Read Nietzsche"Document6 pagesMy Response To Maroof Shah's Article "Why Read Nietzsche"Mubashir HassanPas encore d'évaluation

- Knowledge and The Straight PathDocument5 pagesKnowledge and The Straight PathMubashir HassanPas encore d'évaluation

- Islamic Banking and FinanceDocument4 pagesIslamic Banking and FinanceMubashir HassanPas encore d'évaluation

- Female Foeticide Sham Sun NisaDocument6 pagesFemale Foeticide Sham Sun NisaMubashir HassanPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Dog and Cat Food Packaging in ColombiaDocument4 pagesDog and Cat Food Packaging in ColombiaCamilo CahuanaPas encore d'évaluation

- Voltas Case StudyDocument27 pagesVoltas Case Studyvasistakiran100% (3)

- Lecture 6Document19 pagesLecture 6salmanshahidkhan100% (2)

- Evolution of Taxation in The PhilippinesDocument16 pagesEvolution of Taxation in The Philippineshadji montanoPas encore d'évaluation

- A Study On Performance Analysis of Equities Write To Banking SectorDocument65 pagesA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaPas encore d'évaluation

- Dak Tronic SDocument25 pagesDak Tronic SBreejum Portulum BrascusPas encore d'évaluation

- Technical Question Overview (Tuesday May 29, 7pm)Document2 pagesTechnical Question Overview (Tuesday May 29, 7pm)Anna AkopianPas encore d'évaluation

- Design Analysis of The Lotus Seven S4 (Type 60) PDFDocument18 pagesDesign Analysis of The Lotus Seven S4 (Type 60) PDFChristian Villa100% (4)

- Aus Tin 20105575Document120 pagesAus Tin 20105575beawinkPas encore d'évaluation

- 002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFDocument7 pages002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFBenjamin MartinezPas encore d'évaluation

- Metropolitan Transport Corporation Guindy Estate JJ Nagar WestDocument5 pagesMetropolitan Transport Corporation Guindy Estate JJ Nagar WestbiindduuPas encore d'évaluation

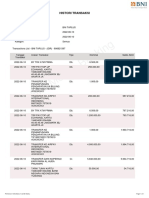

- BNI Mobile Banking: Histori TransaksiDocument1 pageBNI Mobile Banking: Histori TransaksiWebi SuprayogiPas encore d'évaluation

- Approaches To Industrial RelationsDocument39 pagesApproaches To Industrial Relationslovebassi86% (14)

- A View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)Document17 pagesA View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)(FPTU HCM) Phạm Anh Thiện TùngPas encore d'évaluation

- Bye, Bye Nyakatsi Concept PaperDocument6 pagesBye, Bye Nyakatsi Concept PaperRwandaEmbassyBerlinPas encore d'évaluation

- Use CaseDocument4 pagesUse CasemeriiPas encore d'évaluation

- Independent Power Producer (IPP) Debacle in Indonesia and The PhilippinesDocument19 pagesIndependent Power Producer (IPP) Debacle in Indonesia and The Philippinesmidon64Pas encore d'évaluation

- NaftaDocument18 pagesNaftaShabla MohamedPas encore d'évaluation

- MBBcurrent 564548147990 2022-12-31 PDFDocument10 pagesMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinPas encore d'évaluation

- StatementsDocument2 pagesStatementsFIRST FIRSPas encore d'évaluation

- Ethical Game MonetizationDocument4 pagesEthical Game MonetizationCasandra EdwardsPas encore d'évaluation

- Chapter Five: Perfect CompetitionDocument6 pagesChapter Five: Perfect CompetitionAbrha636Pas encore d'évaluation

- RMC 46-99Document7 pagesRMC 46-99mnyng100% (1)

- Clerks 2013Document12 pagesClerks 2013Kumar KumarPas encore d'évaluation

- Bill CertificateDocument3 pagesBill CertificateRohith ReddyPas encore d'évaluation

- TCW Act #4 EdoraDocument5 pagesTCW Act #4 EdoraMon RamPas encore d'évaluation

- Posting Journal - 1-5 - 1-5Document5 pagesPosting Journal - 1-5 - 1-5Shagi FastPas encore d'évaluation

- Aptdc Tirupati Tour PDFDocument1 pageAptdc Tirupati Tour PDFAfrid Afrid ShaikPas encore d'évaluation

- Global Supply Chain Planning at IKEA: ArticleDocument15 pagesGlobal Supply Chain Planning at IKEA: ArticleyashPas encore d'évaluation

- SWCH 01Document12 pagesSWCH 01mahakali23Pas encore d'évaluation