Académique Documents

Professionnel Documents

Culture Documents

AngelBrokingResearch NTPC OFSNote 230216

Transféré par

HitechSoft HitsoftCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

AngelBrokingResearch NTPC OFSNote 230216

Transféré par

HitechSoft HitsoftDroits d'auteur :

Formats disponibles

OFS Note | Power

February 23, 2016

NTPC

SUBSCRIBE

Strong play on the power sector

Issue Open: February 23, 2016

Issue Close: February 24, 2016

Incorporated in 1975, NTPC is Indias largest power company with total installed

Issue Details

capacity of 45,548MW (including JVs) with 18 coal based and 7 gas based

stations and accounts for ~26% of the total power generation in the country.

Capacity additions to drive regulated equity: NTPC is a long term growth

play on the power sector with its strong capacity addition plans. The companys

current consolidated capacity stands at 45,048MW and is expected to add

~23,500MW (~7,500MW by FY2017, ~8,050MW in FY2018 and ~8,200MW

in FY2019) by FY2019. The company has earmarked a consolidated capex of

~`31,500cr this fiscal. With the strong capex plan, Management expects a 45%

Face Value: `10

Present Eq. Paid-up Capital: `8,246cr

Offer Size: 41.2cr Shares

Post Eq. Paid-up Capital: `8,246cr

Issue size (amount): `5,030cr

OFS Floor Price: `122

jump in regulated equity by FY2018 and a 75% increase by FY2019.

Retail Discount: 5%

Well placed to benefit from demand recovery: Power sector woes have

OFS Floor Price (Retail): `116

mostly been related to fuel supply issues and debt issues of State Electricity Boards

(SEB). We believe the government is proactively taking steps to resolve both these

issues. With increasing production at Coal India, coal availability issues have

already been sorted to a large extent. The UDAY scheme can help the SEBs

Post-issue implied market cap:

`104,594cr

Promoters holding Pre-Issue: 75.0%

Promoters holding Post-Issue: 70.0%

restructure their debt and provide long term solutions for the SEBs via tariff hikes

and improvements in operating efficiencies. NTPC is best placed within the power

sector to benefit from any such revival in power demand.

Outlook and valuation: We like NTPC for the growth offered by its regulated

equity model, huge capacity addition plans and expected improvement in

Post Issue Shareholding Pattern

Promoters Group

70.0

MF/Banks/Indian

FIs/FIIs/Public & Others

30.0

demand for power in the country. At the offer-for-sale (OFS) price of `122, the

stock is available at an FY2017E EV/EBITDA of ~8.3x and P/E of 9.2x FY2017E

EPS of `13.3. Retail shareholders will get an additional discount of 5%, implying

an OFS floor price of `116. We remain positive on the stock with a target price of

`146, based on ~1.3x FY2017E BV, implying a 20% upside from the OFS floor

price (26% for retail investors). Hence, we recommend investors to subscribe for

NTPC shares in the OFS.

Key financials (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Revenue

69,377

78,951

80,622

87,271

99,297

% chg

Adj. net profit

5.3

13.8

2.1

8.2

13.8

12,591

11,404

9,986

9,687

10,965

% chg

16.2

0.0

(12.4)

(3.0)

13.2

Adj. EPS (`)

13.8

13.8

12.1

11.7

13.3

OPM (%)

26.2

25.0

21.7

23.4

23.5

P/E (x)

8.0

8.8

10.1

10.4

9.2

P/BV (x)

1.2

1.2

1.2

1.2

1.1

RoE (%)

16.2

13.6

11.8

11.5

12.2

RoCE (%)

10.0

9.3

6.9

8.0

8.6

EV/Sales (x)

2.2

2.1

2.2

2.2

2.0

EV/EBIDTA

8.4

8.4

10.3

9.4

8.3

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

Rahul Dholam

Tel: 022- 3935 7800 Ext: 6847

rahul.dholam@angelbroking.com

NTPC | OFS Note

Company Background

Incorporated in 1975, NTPC is Indias largest power company with total installed

capacity of 45,548MW (including JVs) with 18 coal based and 7 gas based

stations. The company has set a target to have an installed power generating

capacity of 1,28,000MW by the year 2032. The capacity will have a diversified fuel

mix comprising 56% coal, 16% gas, 11% nuclear and 17% renewable energy

sources including hydro. By 2032, non-fossil fuel based generation capacity shall

make up nearly 28% of NTPCs portfolio. NTPC has been operating its plants at

high efficiency levels. Although the company has 17.73% of the total national

capacity, it contributes 25.91% of total power generation due to its focus on high

efficiency.

Issue Details

The Promoter (Government of India), proposes to sell 41,22,73,220 equity shares

of face value of `10 each, representing 5% of the total paid up equity share capital

of the company. NTPC has fixed the OFS floor price at `122 per share (~4%

discount to its closing price as on February 22, 2016). Retail shareholders will get

an additional discount of 5% over their bid price, implying a floor price of `116

(~9% discount to closing price as on February 22, 2016). A minimum of 20% of

the issue is reserved for retail investors.

The offer for sale will be open for subscription to non-retail investors on February

23, 2016. Non-retail investors who have placed their bids on February 23, 2016,

will be allowed to revise their bids on February 24, 2016.

Retail investors shall be allowed to place their bids only on February 24, 2016. We

would advise investors to monitor the bidding pattern and bid accordingly (slightly

above cut-off in case of oversubscription).

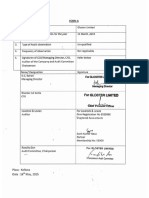

Exhibit 1: Shareholding Pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter and promoter group

6,18,06,14,980

75.0

5,76,83,41,760

70.0

Total public holding

2,06,48,49,420

25.0

2,47,71,22,640

30.0

Total

8,24,54,64,400 100.0

8,24,54,64,400 100.0

Source: Company, Angel Research

February 23, 2016

NTPC | OFS Note

Investment arguments

Strong capacity additions to drive regulated equity

NTPC is a long term growth play on the power sector with the company having

plans to increase its total capacity to 128GW by 2032. The companys current

consolidated capacity stands at 45,548MW. NTPC has a strong capacity addition

plan over the next 4-5 years and is expected to add ~23,500MW by FY2019. The

company will commission 7,500MW by FY2017, ~8,050MW in FY2018 and

~8,200MW in FY2019. The company has earmarked a consolidated capex of

~`31,500cr this fiscal. We expect the strong capex plan to drive the regulated

equity base going forward. The Management has guided for a 45% jump in

regulated equity by FY2018 and a 75% increase by FY2019.

Exhibit 2: Capacity addition to remain strong

Exhibit 3: PLF to stabilise going forward

55

320

50

51

88

300

GW

47

43

40

83

260

44

82

250

240

41

220

37

35

34

237

82

260

251

240

80

80

80

FY2013

Source: Company, Angel Research

February 23, 2016

FY2014

FY2015

FY2016E

FY2017E

80

78

76

FY2011

FY2012

86

84

273

200

30

FY2011

302

85

280

45

90

88

FY2012

FY2013 FY2014

Generation (BU)

FY2015 FY2016E FY2017E

PLF (%)

Source: Company, Angel Research

NTPC | OFS Note

Exhibit 4: Project Pipeline

Project

Target MW

Bongaigaon (Unit 1)

250

Koldam (Unit 3 & 4)

400

Vindhyachal -V (Unit 3)

500

Kanti Subsidiary (Unit 4)

195

Nabinagar (BRBCL) (Unit 1)

250

Kudgi-I (Unit 1)

800

Singrauli Hydro

Total FY16

8

2,403

Barh I (Unit 1)

660

Bongaigaon (Unit 2 & 3)

500

Nabinagar (BRBCL) (Unit 2 & 3)

500

Kudgi (Unit 2)

800

Mouda II (Unit 1 & 2)

1,320

Solapur (Unit 1)

660

Meja

660

Total FY17

5,100

Barh I (Unit 2 & 3)

1,320

Kudgi (Unit 3)

800

Solapur

660

Lara

1,600

Gadarwara

1,600

Unchahar- IV

500

Nabingar (BRBCL JV) (Unit 4)

250

Meja (JV) (Unit 2)

660

Nabinagar (NPGCPL- JV)

660

Total FY18

Tapovan HPP

8,050

520

Daralipali (Unit 1& 2)

1600

North Karanpura (Unit 1, 2 & 3)

1980

Tanda-II

1320

Nabinagar (NPGCPL- JV)

1320

Total FY19

8,200

Rammam (Hydro)

120

Lata Tapovan (Hydro)

171

Khargone

1320

Total FY20 & beyond

1,611

Source: Company, Angel Research

February 23, 2016

NTPC | OFS Note

Well placed to benefit from demand recovery

Power sector woes in recent times have been mostly related to fuel supply issues

and weak demand from SEBs. We believe the constraints in availability of coal

have eased significantly in line with the step up in production at Coal India. The

government has shown strong focus in easing fuel supply issues. Rationalisation

and swapping of coal sources are alone expected to result in significant savings in

freight costs. Cabinet approval for gas pooling also raises expectations of

improved availability of gas. As per the Power Ministry, NTPC is expected to save

`8,570cr per annum through substitution of imported coal and freight cost

reduction through rationalization of coal sourcing.

Exhibit 5: Savings - NTPC

Substituting imported coal, MoU/E-Auction

coal by 100% ACQ coal

Rationalization / swapping of coal sources

including freight charges

Total

Savings (` Cr)

Per Unit (`)

7,300

0.30

1,270

0.05

8,570

0.35

Source: Ministry of Power, Angel Research

We also expect demand to improve going forward as the industrial cycle picks up

and the debt restructuring under the UDAY scheme allows the SEBs to start signing

new power purchase agreements (PPA). Under UDAY, SEBs would be offered a

multi-pronged solution. States shall take over 75% of their debt as on September

2015, while the interest rate for the balance 25% debt will be at lower rates. States

accepting the scheme and performing as per operational milestones will be given

additional / priority funding through various schemes under the power ministries.

The UDAY scheme will also focus on operational efficiencies, reduction in T&D

losses and quarterly increase in tariffs in a bid for permanent resolution of SEB

issues. We believe this is a promising scheme that can help the SEBs restructure

their debt and allowing them to sign new PPAs. NTPC is well placed to benefit from

any such revival in power demand.

February 23, 2016

NTPC | OFS Note

Outlook and valuation

We like NTPC for the growth offered by its regulated equity model, huge capacity

addition plans and expected improvement in demand for power in the country. At

the offer-for-sale (OFS) price of `122, the stock is available at an FY2017E

EV/EBITDA of ~8.3x and P/E of 9.2x FY2017E EPS of `13.3. Retail shareholders

will get an additional discount of 5%, implying an OFS floor price of `116.

We remain positive on the stock with a target price of `146, based on ~1.3x

FY2017E BV, implying a 20% upside from the OFS floor price (26% for retail

investors). Hence, we recommend investors to subscribe for NTPC shares in the

OFS.

Exhibit 6: Valuation

Price / BV

FY2017E Net Worth

Multiple (x)

Equity Value

Target price (`)

(` cr)

92,720

1.3

120,535

146

Source: Company, Angel Research

February 23, 2016

NTPC | OFS Note

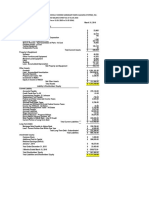

Profit & loss statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Net Sales

67,953

78,479

79,944

86,643

98,583

Other operating income

1,424

472

678

628

714

Total operating income

69,377

78,951

80,622

87,271

99,297

5.3

13.8

2.1

8.2

13.8

Total Expenditure

51,194

59,252

63,110

66,807

75,982

Fuel cost

42,828

47,790

51,461

54,135

61,564

Employee Costs

3,551

4,039

3,890

4,381

4,984

Other Expenses

4,815

7,423

7,759

8,291

9,433

18,182

19,699

17,512

20,464

23,315

% chg

EBITDA

% chg

17.8

8.3

(11.1)

16.9

13.9

(% of Net Sales)

26.2

25.0

21.7

23.4

23.5

Depreciation& Amortisation

EBIT

% chg

(% of Net Sales)

Interest & other Charges

Other Income

4,770

5,565

6,075

6,926

14,929

11,948

14,389

16,389

16.5

4.0

(20.0)

20.4

13.9

20.7

18.9

14.8

16.5

16.5

2,481

3,203

3,570

3,921

4,117

4,732

2,760

2,079

2,120

2,163

16,611

14,486

10,456

12,588

14,435

26.4

(12.8)

(27.8)

20.4

14.7

4,025

3,082

464

2,895

3,464

24.2

21.3

4.4

0.2

0.2

12,586

11,403

9,992

9,693

10,971

(5)

(0)

Reported PAT

12,591

11,404

9,986

9,687

10,965

Adjusted PAT

11,402

11,404

9,986

9,687

10,965

Profit before tax

% chg

Tax Expense

(% of PBT)

Recurring PAT

Minority Interest

Share of associates

February 23, 2016

3,823

14,359

% chg

16.2

0.0

(12.4)

(3.0)

13.2

(% of Net Sales)

16.4

14.4

12.4

11.1

11.0

NTPC | OFS Note

Balance sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity Share Capital

8,245

8,245

8,245

8,245

8,245

Reserves & Surplus

72,995

78,758

73,849

78,522

84,474

Shareholder Funds

81,241

87,003

82,094

86,768

92,719

645

680

888

894

900

70,419

81,455

94,003

98,703

1,03,638

Deferred Tax Liability

1,081

1,239

1,266

1,266

1,266

Other Long term liabilities

4,458

5,914

6,019

6,260

6,511

1,57,843

1,76,293

1,84,270

1,93,891

2,05,034

1,13,804

1,31,394

1,43,394

1,56,606

1,85,406

Less: Acc. Depreciation

41,971

47,186

52,750

58,826

65,751

Net Block

71,833

84,208

90,643

97,780

1,19,654

Capital Work-in-Progress

46,555

53,825

68,764

70,764

55,764

Minority Interest

Total Loans

Total Liabilities

APPLICATION OF FUNDS

Gross Block

Goodwill

Investments

Current Assets

Cash

Inventories

February 23, 2016

4,923

3,300

1,902

1,902

1,902

42,903

42,823

39,904

30,703

37,812

18,738

17,051

14,252

7,636

10,468

4,641

6,062

7,972

6,270

7,174

Debtor

6,096

6,726

9,250

7,367

8,740

Other

13,428

12,985

8,430

9,430

11,430

Current liabilities

20,933

23,820

35,306

26,356

29,959

Net Current Assets

21,970

19,002

4,598

4,348

7,853

Other Assets

12,562.5

15,957.1

18,362.7

19,097.2

19,861.1

Total Assets

1,57,843

1,76,293

1,84,270

1,93,891

2,05,034

NTPC | OFS Note

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Profit before tax

16,611

14,486

10,456

12,588

14,435

3,827

4,774

5,565

6,075

6,926

(410)

(1,281)

1,748

(6,365)

(674)

Depreciation

Change in Working Capital

Others

(541)

1,178

(2,198)

(728)

(758)

Direct taxes paid

(2,980)

(2,687)

(464)

(2,895)

(3,464)

Cash Flow from Operations

16,508

16,469

15,107

8,675

16,465

(Inc.)/ Dec. in Fixed Assets

(20,406)

(18,948)

(26,939)

(15,212)

(13,800)

(Inc.)/ Dec. in Investments

1,629

1,622

1,399

Others

Cash Flow from Investing

Issue of Equity

February 23, 2016

1,932

1,817

(16,845)

(15,509)

(25,540)

(15,212)

(13,800)

Inc./(Dec.) in loans

10,010

9,385

12,548

4,700

4,935

Dividend Paid (Incl. Tax)

(3,550)

(5,019)

(5,019)

(5,019)

(5,019)

Others

(5,472)

(7,014)

105

241

250

Cash Flow from Financing

988

(2,648)

7,634

(78)

167

Inc./(Dec.) in Cash

651

(1,687)

(2,799)

(6,615)

2,832

Opening Cash balances

18,087

18,738

17,051

14,252

7,636

Closing Cash balances

18,738

17,051

14,251

7,636

10,468

NTPC | OFS Note

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E

FY2017E

Reported EPS

15.3

13.8

12.1

11.7

13.3

Adjusted EPS

13.8

13.8

12.1

11.7

13.3

Cash EPS

19.9

19.6

18.9

19.1

21.7

5.8

5.8

5.8

5.8

5.8

98.5

105.5

99.6

105.2

112.4

P/E (on FDEPS)

8.0

8.8

10.1

10.4

9.2

P/CEPS

6.1

6.2

6.5

6.4

5.6

P/BV

1.2

1.2

1.2

1.2

1.1

Dividend yield (%)

4.7

4.7

4.7

4.7

4.7

EV/Sales

2.2

2.1

2.2

2.2

2.0

EV/EBITDA

8.4

8.4

10.3

9.4

8.3

EV/Total Assets

1.0

0.9

1.0

1.0

0.9

ROCE

10.0

9.3

6.9

8.0

8.6

ROE

16.2

13.6

11.8

11.5

12.2

Per Share Data (`)

DPS

Book Value

Valuation Ratio (x)

Returns (%)

Turnover ratios (x)

Asset Turnover (Gross Block)

0.7

0.6

0.6

0.6

0.6

Inventory (days)

23.2

24.7

31.8

29.8

24.7

Receivables (days)

33.6

29.6

36.2

34.7

29.6

Payables (days)

68.4

68.8

98.4

98.5

68.7

WC cycle (ex-cash) (days)

23.4

12.0

(17.4)

(27.1)

(10.9)

Net debt to equity

0.6

0.7

1.0

1.0

1.0

Net debt to EBITDA

0.7

0.8

0.8

0.9

0.9

Interest Coverage (EBIT / Interest)

5.8

4.7

3.3

3.7

4.0

Solvency ratios (x)

February 23, 2016

10

NTPC | OFS Note

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as Angel) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

NTPC

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

over 12 months investment period):

February 23, 2016

Buy (> 15%)

Accumulate (5% to 15%)

Reduce (-5% to -15%)

Neutral (-5 to 5%)

Sell (< -15)

11

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Sally Mann Hold Still - A Memoir With Photographs (PDFDrive)Document470 pagesSally Mann Hold Still - A Memoir With Photographs (PDFDrive)danitawea100% (1)

- Chapter 2 Organizational Behavior - Robbins, JudgeDocument3 pagesChapter 2 Organizational Behavior - Robbins, JudgeRes Gosan100% (2)

- Kierkegaard, S - Three Discourses On Imagined Occasions (Augsburg, 1941) PDFDocument129 pagesKierkegaard, S - Three Discourses On Imagined Occasions (Augsburg, 1941) PDFtsuphrawstyPas encore d'évaluation

- D78846GC20 sg2Document356 pagesD78846GC20 sg2hilordPas encore d'évaluation

- HR Recruiter Interview Question & AnswerDocument6 pagesHR Recruiter Interview Question & AnswerGurukrushna PatnaikPas encore d'évaluation

- Baath Arab Socialist Party - Constitution (Approved in 1947)Document9 pagesBaath Arab Socialist Party - Constitution (Approved in 1947)Antonio de OdilonPas encore d'évaluation

- scn615 Classroomgroupactionplan SarahltDocument3 pagesscn615 Classroomgroupactionplan Sarahltapi-644817377Pas encore d'évaluation

- Quantile Regression (Final) PDFDocument22 pagesQuantile Regression (Final) PDFbooianca100% (1)

- Young Learners Starters Sample Papers 2018 Vol1Document15 pagesYoung Learners Starters Sample Papers 2018 Vol1Natalia García GarcíaPas encore d'évaluation

- 7 Critical Reading StrategiesDocument1 page7 Critical Reading StrategiesWilliam Holt100% (2)

- CH 2 & CH 3 John R. Schermerhorn - Management-Wiley (2020)Document9 pagesCH 2 & CH 3 John R. Schermerhorn - Management-Wiley (2020)Muhammad Fariz IbrahimPas encore d'évaluation

- JindalWorldwide 5315430316Document101 pagesJindalWorldwide 5315430316HitechSoft HitsoftPas encore d'évaluation

- HPCotton 5028730316Document72 pagesHPCotton 5028730316HitechSoft HitsoftPas encore d'évaluation

- Company Analysis and Financial Due Diligence: August 2013Document50 pagesCompany Analysis and Financial Due Diligence: August 2013HitechSoft HitsoftPas encore d'évaluation

- CholaFin AR 20182019Document234 pagesCholaFin AR 20182019HitechSoft HitsoftPas encore d'évaluation

- Jnac 31mar16Document4 pagesJnac 31mar16HitechSoft HitsoftPas encore d'évaluation

- MediaRelease ExtendedWorkOrder MIPDocument3 pagesMediaRelease ExtendedWorkOrder MIPHitechSoft HitsoftPas encore d'évaluation

- Intense 5323260316Document118 pagesIntense 5323260316HitechSoft HitsoftPas encore d'évaluation

- Intense 5323260316Document118 pagesIntense 5323260316HitechSoft HitsoftPas encore d'évaluation

- Sree Rayalseema Alkalies 16 5077530316Document75 pagesSree Rayalseema Alkalies 16 5077530316HitechSoft HitsoftPas encore d'évaluation

- Gloster 5385950315Document121 pagesGloster 5385950315HitechSoft HitsoftPas encore d'évaluation

- Sankhya 5329720316Document77 pagesSankhya 5329720316HitechSoft HitsoftPas encore d'évaluation

- AngelBrokingResearch Cipla 3QFY2016RU 240216Document11 pagesAngelBrokingResearch Cipla 3QFY2016RU 240216HitechSoft HitsoftPas encore d'évaluation

- Gloster 5385950316Document130 pagesGloster 5385950316HitechSoft HitsoftPas encore d'évaluation

- IndTraDeco Annual Report 1516Document49 pagesIndTraDeco Annual Report 1516HitechSoft HitsoftPas encore d'évaluation

- State Bank of India 3Q FY2016 Review IndiaDocument10 pagesState Bank of India 3Q FY2016 Review IndiaHitechSoft HitsoftPas encore d'évaluation

- Gloster 5385950314Document105 pagesGloster 5385950314HitechSoft HitsoftPas encore d'évaluation

- IndoAMines Annual Reort 2015-2016 India CorporateDocument120 pagesIndoAMines Annual Reort 2015-2016 India CorporateHitechSoft HitsoftPas encore d'évaluation

- AngelBrokingResearch GlaxoSmithKlinePharma 3QFY2016RU 180216Document13 pagesAngelBrokingResearch GlaxoSmithKlinePharma 3QFY2016RU 180216HitechSoft HitsoftPas encore d'évaluation

- Lupin: Performance HighlightsDocument12 pagesLupin: Performance HighlightsHitechSoft HitsoftPas encore d'évaluation

- Redmi1s Flash Screens 1s Brick CellDocument1 pageRedmi1s Flash Screens 1s Brick CellHitechSoft HitsoftPas encore d'évaluation

- Bajaj Auto 3Q FY2016Document12 pagesBajaj Auto 3Q FY2016HitechSoft HitsoftPas encore d'évaluation

- AngelBrokingResearch CadilaHealthcare 3QFY0216RU 240216Document11 pagesAngelBrokingResearch CadilaHealthcare 3QFY0216RU 240216HitechSoft HitsoftPas encore d'évaluation

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftPas encore d'évaluation

- BulletProofInvesting TakeawaysDocument3 pagesBulletProofInvesting TakeawaysHitechSoft HitsoftPas encore d'évaluation

- Panamapanama Petroleum 2011 Annual Report India CorporateDocument49 pagesPanamapanama Petroleum 2011 Annual Report India CorporateHitechSoft HitsoftPas encore d'évaluation

- Panama Petro Ar 2010Document40 pagesPanama Petro Ar 2010Inder KalraPas encore d'évaluation

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftPas encore d'évaluation

- Panama Petroleum 2012 Annual Report India CorporateDocument45 pagesPanama Petroleum 2012 Annual Report India CorporateHitechSoft HitsoftPas encore d'évaluation

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftPas encore d'évaluation

- AMU BALLB (Hons.) 2018 SyllabusDocument13 pagesAMU BALLB (Hons.) 2018 SyllabusA y u s hPas encore d'évaluation

- Potato Lab ReportDocument10 pagesPotato Lab ReportsimplylailaPas encore d'évaluation

- List of Festivals in India - WikipediaDocument13 pagesList of Festivals in India - WikipediaRashmi RaviPas encore d'évaluation

- 600 00149 000 R1 MFD Cmax Dug PDFDocument1 page600 00149 000 R1 MFD Cmax Dug PDFenriquePas encore d'évaluation

- Linear Arrangement 3rdDocument30 pagesLinear Arrangement 3rdSonu BishtPas encore d'évaluation

- Jain Gayatri MantraDocument3 pagesJain Gayatri MantraShil9Pas encore d'évaluation

- Pplied Hysics-Ii: Vayu Education of IndiaDocument16 pagesPplied Hysics-Ii: Vayu Education of Indiagharib mahmoudPas encore d'évaluation

- EmanDocument3 pagesEmanCh NawazPas encore d'évaluation

- Classics and The Atlantic Triangle - Caribbean Readings of Greece and Rome Via AfricaDocument12 pagesClassics and The Atlantic Triangle - Caribbean Readings of Greece and Rome Via AfricaAleja KballeroPas encore d'évaluation

- Neurolinguistic ProgrammingDocument9 pagesNeurolinguistic ProgrammingMartin MontecinoPas encore d'évaluation

- English Preparation Guide DAF 202306Document12 pagesEnglish Preparation Guide DAF 202306TIexamesPas encore d'évaluation

- Ryan Brown: Michigan State UniversityDocument2 pagesRyan Brown: Michigan State UniversitybrownteachesPas encore d'évaluation

- Operations Management and Operations PerformanceDocument59 pagesOperations Management and Operations PerformancePauline LagtoPas encore d'évaluation

- Blue Mountain Coffee Case (ADBUDG)Document16 pagesBlue Mountain Coffee Case (ADBUDG)Nuria Sánchez Celemín100% (1)

- Gamify Your Classroom - A Field Guide To Game-Based Learning, Revised EditionDocument372 pagesGamify Your Classroom - A Field Guide To Game-Based Learning, Revised EditionCuong Tran VietPas encore d'évaluation

- Paleontology 1Document6 pagesPaleontology 1Avinash UpadhyayPas encore d'évaluation

- 2009-Journal of Pharmacy and PharmacologyDocument37 pages2009-Journal of Pharmacy and PharmacologyLeticia Bonancio CerqueiraPas encore d'évaluation

- Ingles Nivel 2Document119 pagesIngles Nivel 2Perla Cortes100% (1)

- Module 4 Business EthicsDocument4 pagesModule 4 Business EthicsddddddaaaaeeeePas encore d'évaluation