Académique Documents

Professionnel Documents

Culture Documents

Various Alerts Mean

Transféré par

Arif FaturohmanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Various Alerts Mean

Transféré par

Arif FaturohmanDroits d'auteur :

Formats disponibles

Various Alerts Mean

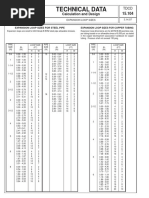

Indica

tor

Alert

EMA

5-13 EMA Crossover

EMA

5-20 EMA Crossover

EMA

5-50 EMA Crossover

EMA

13-20 EMA Crossover

EMA

13-50 EMA Crossover

EMA

20-50 EMA Crossover

EMA

13-5 EMA Crossover

EMA

20-5 EMA Crossover

EMA

50-5 EMA Crossover

EMA

20-13 EMA Crossover

EMA

50-13 EMA Crossover

EMA

50-20 EMA Crossover

Description

The 5 day EMA has crossed above the 13

day EMA within the last two trading

sessions-->short term bullish

The 5 day EMA has crossed above the 20

day EMA within the last two trading

sessions-->short term bullish

The 5 day EMA has crossed above the 50

day EMA within the last two trading

sessions-->short term bullish

The 13 day EMA has crossed above the 20

day EMA within the last two trading

sessions-->mid term bullish

The 13 day EMA has crossed above the 50

day EMA within the last two trading

sessions-->mid term bullish

The 20 day EMA has crossed above the 50

day EMA within the last two trading

sessions-->long term bullish

The 5 day EMA has crossed below the 13

day EMA within the last two trading

sessions-->short term bearish

The 5 day EMA has crossed below the 20

day EMA within the last two trading

sessions-->short term bearish

The 5 day EMA has crossed below the 50

day EMA within the last two trading

sessions-->short term bearish

The 20 day EMA has crossed below the 13

day EMA within the last two trading

sessions-->mid term bearish

The 50 day EMA has crossed below the 13

day EMA within the last two trading

sessions-->mid term bearish

The 50 day EMA has crossed below the 20

day EMA within the last two trading

MACD

Top Bearish Divergence

MACD

top Bullish Divergence

MACD

Bottom Bullish

Divergence

Bottom Bearish

Divergence

Bullish MACD Crossover

at Center

MACD

MACD

MACD

Bearish MACD

Crossover at Center

MACD

Bullish MACD Crossover

MACD

RSI

Bearish MACD

Crossover at Center

RSI Bullish Crossover

RSI

RSI Bearish Crossover

RSI

RSI Over Bought Buried

RSI

RSI Over Sold Buried

RSI

RSI Over Sold

RSI

RSI Over Bought

Stoch

Stochastic OverBought

Buried

Stoch

Stochastic Oversold

Buried

Stoch

Stochastic Overbought

Reversal

Stochastic Oversold

Reversal

Long Term Upward

Stoch

Trend

sessions-->long term bearish

Increasing highs but decreasing MACD for

last two tops->short term bearish

Decreasing highs but increasing MACD for

last two tops->short term bullish

Decreasing lows but increasing MACD for

last two bottoms->short term bullish

Increasing lows but decreasing MACD for

last two bottoms->short term bearish

The MACD fastline has crossed over the

MACD smoothed line at center->short term

very bullish

The MACD fastline has crossed below the

MACD smoothed line at center->short term

very bearish

The MACD fastline has crossed over the

MACD smoothed line ->short term bullish

The MACD fastline has crossed below the

MACD smoothed line ->short term bearish

RSI has crossed over 50 ->short term

bullish

RSI has crossed below 50->short term

bearish

The RSI has been above 70 for a minimum

of 3 trading sessions->short term bullish

The RSI has been below 30 for a minimum

of 3 trading sessions->short term bearish

The RSI is above 65 but not buried->short

term bearish

The RSI is below 25 but not buried->short

term bullish

The fast stochastic is above 80 and has

averaged above 80 for the past 5 trading

sessions->short term bullish

The fast stochastic is below 20 and has

averaged below 20 for the past 5 trading

sessions->short term bearish

The stochastic has fallen below 80 after

being buried ->short term bearish

The stochastic has crossed above 20 after

being buried ->short term bullish

A long term (6 months) upward sloping

Trend

Trend

Trend

Trend

Trend

Trend

Trend

Trend

Trend

Trend

Trend

Sloping Trading Channel trading channel exists with the highs and

lows ->long term very bullish

Intermediate Term

A mid term (3 months) upward sloping

Upward Sloping Trading trading channel exists with the highs and

Channel

lows ->mid term very bullish

Short Term Upward

A short term (1 month) upward sloping

Sloping Trading Channel trading channel exists with the highs and

lows ->short term very bullish

Long Term Downward

A long term (6 months) downward sloping

Sloping Trading Channel trading channel exists with the highs and

lows ->long term very bearish

Intermediate Term

A mid term (3 months) downward sloping

Downward Sloping

trading channel exists with the highs and

Trading Channel

lows ->mid term very bearish

Short Term Downward

A short term (1 month) downward sloping

Sloping Trading Channel trading channel exists with the highs and

lows ->short term very bearish

Long Term Bullish

A long term (6 months) downward trend in

Breakout

the highs has been broken->Long term

bullish

Intermediate Term

A mid term (3 months) downward trend in

Bullish Breakout

the highs has been broken->Mid term

bullish

Short Term Bullish

A mid term (1 month) downward trend in

Breakout

the highs hasbeen broken->Short term

bullish

Long Term Bearish

A long term (6 months) upward trend in the

Breakout

lows has been broken->Long term very

bearish

Intermediate Term

A mid term (3 months) upward trend in the

Bearish Breakout

lows has been broken->Mid term very

bearish

Short Term Bearish

A short term (1 month) upward trend in the

Breakout

lows has been broken->Short term very

bearish

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Coupling AlignmentDocument14 pagesCoupling Alignmentkutts76Pas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Top 10 Candlestick Patterns Cheat SheetDocument1 pageTop 10 Candlestick Patterns Cheat SheetAnthony Filpo100% (2)

- #Homework Bystra: GOLD Perfect EntryDocument27 pages#Homework Bystra: GOLD Perfect Entrymoitaptrade90% (10)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Candlestick Chart Pattern Bangla Forex Book - MkuDocument104 pagesCandlestick Chart Pattern Bangla Forex Book - MkuKamal Uddin50% (2)

- Candlestick Patterns GuideDocument1 pageCandlestick Patterns GuideGoogleuser googlePas encore d'évaluation

- VPA Cheat SheetDocument5 pagesVPA Cheat Sheetashok_66Pas encore d'évaluation

- Thermal Expansion Loop Sizing for Pipes and TubingDocument2 pagesThermal Expansion Loop Sizing for Pipes and Tubingzshehadeh0% (1)

- Harmonic Trend Patterns Cheat SheetDocument3 pagesHarmonic Trend Patterns Cheat SheetSharma comp100% (2)

- VPA FlagsDocument5 pagesVPA FlagsAnonymous L4GY7kqPas encore d'évaluation

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 pageAlphaex Capital Candlestick Pattern Cheat Sheet InfographRyan Vassa PramudyaPas encore d'évaluation

- JMK Strategy Use This OnlyDocument64 pagesJMK Strategy Use This OnlyhafeezPas encore d'évaluation

- Chart Patterns Reference Sheet 1 PDFDocument3 pagesChart Patterns Reference Sheet 1 PDFamrou kasmi100% (1)

- FIST guidelines for permissible loading of oil-immersed transformersDocument28 pagesFIST guidelines for permissible loading of oil-immersed transformersliheber100% (2)

- Bull Trap Pattern Strategy PDFDocument6 pagesBull Trap Pattern Strategy PDFMeechokChokdee100% (1)

- Vibration Effects on Structures and EquipmentDocument2 pagesVibration Effects on Structures and Equipmentirfanajai100% (1)

- All in One IndicatorDocument10 pagesAll in One IndicatorhisgracePas encore d'évaluation

- 8 Indicators TS 3.aflDocument24 pages8 Indicators TS 3.afludhaya kumarPas encore d'évaluation

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 pageAlphaex Capital Candlestick Pattern Cheat Sheet InfographFnudarman Fnudarman100% (1)

- Trendline Breakout Trading SystemDocument3 pagesTrendline Breakout Trading SystemOsama Al ShsmmariPas encore d'évaluation

- Properties of Saturated SteamDocument4 pagesProperties of Saturated SteamArif FaturohmanPas encore d'évaluation

- A. For DF Plant IV60: Description Unit Contract Figures Feed-Stock QualityDocument1 pageA. For DF Plant IV60: Description Unit Contract Figures Feed-Stock QualityArif FaturohmanPas encore d'évaluation

- Pump Calculations EquationDocument3 pagesPump Calculations EquationToan LePas encore d'évaluation

- Control Ball and GlobeDocument1 pageControl Ball and GlobeArif FaturohmanPas encore d'évaluation

- Pump Calculations EquationDocument3 pagesPump Calculations EquationToan LePas encore d'évaluation

- Expansion Loop Sizes For Steel PipeDocument1 pageExpansion Loop Sizes For Steel PipeArif FaturohmanPas encore d'évaluation

- Flange Pressure TemperatureDocument6 pagesFlange Pressure TemperatureDiego1980bPas encore d'évaluation

- Important Considerations Before Starting AlignmentDocument1 pageImportant Considerations Before Starting AlignmentArif FaturohmanPas encore d'évaluation

- King IcariaDocument1 pageKing IcariaArif FaturohmanPas encore d'évaluation

- Expansion Loop Sizes For Steel PipeDocument1 pageExpansion Loop Sizes For Steel PipeArif FaturohmanPas encore d'évaluation

- STK500 Setup Hardware PDFDocument1 pageSTK500 Setup Hardware PDFArif FaturohmanPas encore d'évaluation

- ANSI Flange Pressure Temperature Reference ChartDocument1 pageANSI Flange Pressure Temperature Reference ChartArif FaturohmanPas encore d'évaluation

- Alignment TolerancesDocument1 pageAlignment TolerancesArif FaturohmanPas encore d'évaluation

- Viscosity ReferenceDocument4 pagesViscosity ReferenceNgũ Viên Gia Các100% (1)

- Alignment TolerancesDocument1 pageAlignment TolerancesMohsin MurtazaPas encore d'évaluation

- Psychrometric Chart - Us and Si UnitsDocument1 pagePsychrometric Chart - Us and Si UnitsRaden_Rici_Abi_1914Pas encore d'évaluation

- S-Mart Gasket TypesDocument8 pagesS-Mart Gasket TypesdjvhPas encore d'évaluation

- Shrinkable TubingDocument10 pagesShrinkable TubingArif FaturohmanPas encore d'évaluation

- CRS Guide Steam Traps DeaerationDocument2 pagesCRS Guide Steam Traps DeaerationSarang BondePas encore d'évaluation

- Fibre Optics BasicsDocument12 pagesFibre Optics BasicsSenthilathiban Thevarasa100% (2)

- STK500 Setup HardwareDocument1 pageSTK500 Setup HardwareArif FaturohmanPas encore d'évaluation

- 2 Phase Stepper Motor PDFDocument2 pages2 Phase Stepper Motor PDFArif FaturohmanPas encore d'évaluation

- Catalog Elpro Tray LadderDocument104 pagesCatalog Elpro Tray LadderArif Faturohman0% (1)

- Write Your Own OS KernelDocument32 pagesWrite Your Own OS KernelArif FaturohmanPas encore d'évaluation

- Main and Safety Switches IP ClassificationsDocument1 pageMain and Safety Switches IP ClassificationsArif FaturohmanPas encore d'évaluation

- SizingTransformers PDFDocument1 pageSizingTransformers PDFNaveen ReddyPas encore d'évaluation

- Assignments 1 BFDocument7 pagesAssignments 1 BFAnkita PriyadarsiniPas encore d'évaluation

- Strat SheetDocument1 pageStrat Sheetcourier12Pas encore d'évaluation

- All Bullish Candlestick Pattern by Optrading00 Telegram Optrading00Document25 pagesAll Bullish Candlestick Pattern by Optrading00 Telegram Optrading00Samitm TamhankarPas encore d'évaluation

- Bullish Solid Harami: # Ni Bulish Harami # Cs Bulish (Cs Biru) Close Tidak Melebihi Cs Bearish (Cs Merah)Document2 pagesBullish Solid Harami: # Ni Bulish Harami # Cs Bulish (Cs Biru) Close Tidak Melebihi Cs Bearish (Cs Merah)mmPas encore d'évaluation

- DashboardDocument6 pagesDashboardbicolorfifeiro88Pas encore d'évaluation

- Koshkahfx ChecklistDocument2 pagesKoshkahfx ChecklistKevin Prayogo ChoissPas encore d'évaluation

- Data Mentah18 Desember 2020Document23 pagesData Mentah18 Desember 2020fathur abrarPas encore d'évaluation

- ElitealgoDocument16 pagesElitealgo1125684437Pas encore d'évaluation

- Mang Kanor Trading Blueprint (10!19!15)Document237 pagesMang Kanor Trading Blueprint (10!19!15)Getto Pangandoyon0% (1)

- KSP - Swinger - Trading Process 13feb'22Document24 pagesKSP - Swinger - Trading Process 13feb'22Halimah MahmodPas encore d'évaluation

- Swing TradeDocument105 pagesSwing TradeNithiyanantham BcomcaPas encore d'évaluation

- Rsi Divergence by Traders AcademyDocument2 pagesRsi Divergence by Traders AcademyDemand SupplyPas encore d'évaluation

- [Pieki Algo] Signals and Overlays [v.2.0]Document13 pages[Pieki Algo] Signals and Overlays [v.2.0]Rafael RubioPas encore d'évaluation

- Elliott Wave Analysis Spreadsheet 1Document2 pagesElliott Wave Analysis Spreadsheet 1mohanPas encore d'évaluation

- Sideways - Pengertian, Ciri-Ciri, Dan ContohnyaDocument12 pagesSideways - Pengertian, Ciri-Ciri, Dan ContohnyaasmorowidhiPas encore d'évaluation

![[Pieki Algo] Signals and Overlays [v.2.0]](https://imgv2-1-f.scribdassets.com/img/document/721898224/149x198/85cd0312bf/1712784303?v=1)