Académique Documents

Professionnel Documents

Culture Documents

Accounting & Taxation On Real Estate Transactions by DDV Nov 2015

Transféré par

George Poligratis RicoTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting & Taxation On Real Estate Transactions by DDV Nov 2015

Transféré par

George Poligratis RicoDroits d'auteur :

Formats disponibles

1

TAX ON REAL ESTATE TRANSACTIONS (AND POSESSION)

Tax impositions on Philippine real estate transactions and possession are covered

principally by the National Internal Revenue Code (NIRC) and Local Government Code

(section on local taxation) under the states power of taxation.

NATIONAL TAXATION (PER NIRC)

A. TAX ON INCOME (Title II)

1. Income Tax is a tax on a person's income, emoluments, profits arising from property,

practice of profession, conduct of trade or business or on the pertinent items of gross

income specified in the Tax Code of

2. Minimum Corporate Income Tax (MCIT) RA No. 9337, Sec. 1 (E)

(MCIT is not an additional tax. An MCIT of 2% of the gross income as of the end of

taxable year.

3. Tax on improperly accumulated earnings: 10% - Net taxable income provided that

the gross income from unrelated trade, business or other activity does not exceed 50%

of the total gross income.

B. CAPITAL GAINS TAX (final tax) (Sec.1 (D)(5), RA 9337, amending NIRC of 1997)

Tax Rate: For real property - 6%

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the

seller from the sale, exchange, or other disposition of capital assets located in the

Philippines, including pacto de retro sales and other forms of conditional sale.

Final Capital Gains Tax for Onerous Transfer of Real Property Classified as Capital Assets

(Taxable and Exempt)

Tax Form: BIR Form 1706 Final Capital Gains Tax Return (For Onerous Transfer

of Real Property Classified as Capital Assets -Taxable and Exempt)

(What is ONEROUS? A contract, lease, share, or other right is said to be onerous when the obligations

attaching to it counter-balance or exceed the advantage to be derived from it, either absolutely or with reference

to the particular possessor. Sweet. As used in the civil law and In the systems derived from it, (French, Scotch,

Spanish, Mexican.) the term also means based upon, supported by, or relating to a good and valuable - ONEROUS

- consideration, i. e., one which imposes a burden or charge in return for the benefit conferred.)

1

Documentary Requirements:

1) One original copy and one photocopy of the Notarized Deed of Sale or Exchange

2) Photocopy of the TCT; Original Certificate of Title; or Condominium CT)

3) Certified True Copy of the tax declaration on the lot and/or improvement during

nearest time of sale

4) Certificate of No Improvement issued by the Assessors office where the property

has no declared improvement, if applicable or Sworn Declaration/Affidavit of No

Improvement by at least one (1) of the transferees

5) Copy of BIR Ruling for tax exemption confirmed by BIR, if applicable

6) Duly approved Tax Debit Memo, if applicable

7) Sworn Declaration of Interest as prescribed under Revenue Regulations 13-99, if

the transaction is tax-exempt

8) Documents supporting the exemption.

Procedures:

File the Capital Gains Tax return in triplicate (two copies for the BIR and one copy for

the taxpayer) with the Authorized Agent Bank (AAB) in the Revenue District where the

property is located. In places where there are no AAB, the return will be filed directly

with the Revenue Collection Officer or Authorized City or Municipal Treasurer.

.

Deadline: Within 30 days after each sale, exchange, transfer or other disposition of real

property.

Frequently Asked Questions

1) What is meant by capital asset? - Capital asset means property held by the taxpayer

(whether or not connected with his trade or business), but does not include:

a) stock in trade of the taxpayer or other property of a kind which would properly be

included in the inventory of the taxpayer if on hand at the close of the taxable year; or

b) property held by the taxpayer primarily for sale to customers in the ordinary course

of his trade or business; or

c) property used in the trade or business of a character which is subject to the

allowance for depreciation provided in subsection (F) of Sec. 34 of the Code; or

d) real property used in trade or business of the taxpayer

2) What is meant by ordinary asset?

Ordinary asset refers to all properties specifically excluded from the definition of capital

assets under Sec. 39 (A)(1) of the NIRC.

3) What is meant by real property? - Real property shall have the same meaning

attributed to that term under Article 415 of Republic Act No. 386, otherwise known as

2

the Civil Code of the Philippines.

4) What does a real estate dealer refer to? - A real estate dealer refers to any person

engaged in the business of buying and selling or exchanging real properties on his own

account as a principal and holding himself out as a full or part-time dealer in real estate.

5) What does a real estate developer refer to? - Real estate developer refers to any

person engaged in the business of developing real properties into subdivisions, or

building houses on subdivided lots, or constructing residential or commercial units,

townhouses and other similar units for his own account and offering them for sale or

lease.

6) What does a real estate lessor refer to? - Real estate lessor refers to any person

engaged in the business of leasing or renting real properties on his own account as a

principal and holding himself out as a lessor of real properties being rented out or

offered for rent.

7) Who are considered engaged in the real estate business? - Taxpayers who are

considered engaged in the real estate business refer collectively to real estate dealers,

real estate developers and/or real estate lessors. A taxpayer whose primary purpose of

engaging in business, or whose Articles of Incorporation states that its primary purpose

is to engage in the real estate business shall be deemed to be engaged in the real estate

business.

8) Who are considered not engaged in the real estate business? -Taxpayers who are

considered not engaged in the real estate business refer to persons other than real

estate dealers, real estate developers and/or real estate lessors.

9) Who are considered habitually engaged in the real estate business? - Real estate

dealers or real estate developers who are registered with the Housing and Land Use

Regulatory Board (HULRB) or HUDCC

10) How can you determine whether a particular real property is a capital asset or an

ordinary asset?

a) Real properties shall be classified with respect to taxpayers engaged in the real estate

business as follows:

i) All real properties acquired by the real estate dealer shall be considered as ordinary

assets.

ii) All real properties acquired by the real estate developer, whether developed or

undeveloped as of the time of acquisition, and all real properties which are held by the

real estate developer primarily for sale or for lease to customers in the ordinary course

of his trade or business or which would properly be included in the inventory of the

taxpayer if on hand at the close of the taxable year and all real properties used in the

trade or business, whether in the form of land, building, or other improvements, shall

be considered as ordinary assets.

3

iii) All real properties of the real estate lessor, whether land, building and/or

improvements, which are for lease/rent or being offered for lease/rent, or otherwise for

use or being used in the trade or business shall likewise be considered as ordinary

assets.

iv) All real properties acquired in the course of trade or business by a taxpayer

habitually engaged in the sale of real property shall be considered as ordinary assets.

Note: Registration with the HLURB or HUDCC as a real estate dealer or developer shall

be sufficient for a taxpayer to be considered as habitually engaged in the sale of real

estate.

If the taxpayer is not registered with the HLURB or HUDCC as a real estate dealer or

developer, he/it may nevertheless be deemed to be engaged in the real estate business

through the establishment of substantial relevant evidence (such as consummation

during the preceding year of at least six (6) taxable real estate sale transactions,

regardless of amount; registration as habitually engaged in real estate business with the

Local Government Unit or the Bureau of Internal Revenue, etc.)

b) In the case of taxpayer not engaged in the real estate business, real properties,

whether land, building, or other improvements, which are used or being used or have

been previously used in trade or business of the taxpayer shall be considered as

ordinary assets.

c) In the case of taxpayers who changed its real estate business to a non-real estate

business, real properties held by these taxpayer shall remain to be treated as ordinary

assets.

d) In the case of taxpayers who originally registered to be engaged in the real estate

business but failed to subsequently operate, all real properties acquired by them shall

continue to be treated as ordinary assets.

e) Real properties formerly forming part of the stock in trade of a taxpayer engaged in

the real estate business, or formerly being used in the trade or business of a taxpayer

engaged or not engaged in the real estate business, which were later on abandoned and

became idle, shall continue to be treated as ordinary assets. Provided however, that

properties classified as ordinary assets for being used in business by a taxpayer engaged

in business other than real estate business are automatically converted into capital

assets upon showing proof that the same have not been used in business for more than

two years prior to the consummation of the taxable transactions involving said

properties

f) Real properties classified as capital or ordinary asset in the hands of the

seller/transferor may change their character in the hands of the buyer/transferee. The

classification of such property in the hands of the buyer/transferee shall be determined

in accordance with the following rules:

4

i) Real property transferred through succession or donation to the heir or donee who is

not engaged in the real estate business with respect to the real property inherited or

donated, and who does not subsequently use such property in trade or business, shall

be considered as a capital asset in the hands of the heir or donee.

ii) Real property received as dividend by the stockholders who are not engaged in the

real estate business and who do not subsequently use such property in trade or

business, shall be considered as a capital asset in the hands of the recipients even if the

corporation which declared the real property dividends is engaged in real estate

business.

iii) The real property received in an exchange shall be treated as ordinary asset in the

hands of the case of a tax-free exchange by taxpayer not engaged in real estate business

to a taxpayer who is engaged in real estate business, or to a taxpayer who, even if not

engaged in real estate business, will use in business the property received in exchange.

g) In the case of involuntary transfers of real properties, including expropriations or

foreclosure sale, the involuntariness of such sale shall have no effect on the

classification of such real property in the hands of the involuntary seller, either as

capital asset or ordinary asset as the case may be.

11. What is the basis in the valuation of property?

The value of the real property will be based on the selling price, fair market value as

determined by the Commissioner (zonal value) or the fair market value as shown in the

Assessors schedule of values, whichever is higher. If there is no zonal value, the taxable

base is whichever is higher of the gross selling price per sales documents or the fair

market value that appears in the latest tax declaration.

If there is an improvement, the FMV per latest tax declaration at the time of the sale or

disposition, duly certified by the City/Municipal Assessor shall be used. No adjustments

shall be added on the said value, provided that the tax declaration bears the upgraded

fair market value of the said property pursuant to Section 219 of R.A. No. 7160,

otherwise known as the Local Government Code of 1991 and the last paragraph of the

Local Assessment Regulations No. 1-92 dated October 6, 1992. In case the tax

declaration being presented was issued three (3) or more years prior to the date of sale

or disposition of the real property, the seller/transferor shall be required to submit a

certification from the City/Municipal Assessor whether or not the same is still the latest

tax declaration covering the said real property. Otherwise, the taxpayer shall secure its

latest tax declaration and shall submit a copy thereof duly certified by the said Assessor.

(RAMO 1-2001)

13. Who are required to file the Final Capital Gains Tax return?

Every person, whether natural or juridical, resident or non-resident, including estates

and trusts, who sells, transfers, exchanges or disposes real properties located in the

5

Philippines classified as capital assets, including pacto de retro sales and other forms of

conditional sales or shares of stocks in domestic corporations not traded through the

local stock exchange classified as capital assets.

14) What is the procedure in the filing of Final Capital Gains Tax return?

File the Final Capital Gains Tax return in triplicate (two copies for the BIR and one copy

for the taxpayer) with the Authorized Agent Bank (AAB) in the Revenue District where

the seller or transferor is registered, for shares of stocks or where the property is

located, for real property. In places where there are no AAB, the return will be filed

directly with the Revenue Collection Officer or Authorized City or Municipal Treasurer.

15) Who/what are considered exempt from the payment of Final Capital Gains Tax?

An entity exempt from the payment of income tax under existing investment incentives

and other special laws.

An individual or non-individual exchanging real property solely for shares of stocks

resulting in corporate control

A government entity or government-owned or controlled corporation selling real

property

If the disposition of the real property is gratuitous in nature

Where the disposition is pursuant to the CARP law

Who are conditionally exempt from the payment of Final Capital Gains Tax?

Natural persons who dispose their principal residence, provided that the following

criteria are met:

a. The proceeds of the sale of the principal residence have been fully utilized in

acquiring or constructing new principal residence within eighteen (18) calendar months

from the date of sale or disposition;

b. The historical cost or adjusted basis of the real property sold or disposed will be

carried over to the new principal residence built or acquired;

c. The Commissioner has been duly notified, through a prescribed return, within thirty

(30) days from the date of sale or disposition of the persons intention to avail of the tax

exemption;

d. Exemption was availed only once every ten (10) years; and

e. There is no full utilization of the proceeds of sale or disposition. The portion of the

gain presumed to have been realized from the sale or disposition will be subject to

Capital Gains Tax.

In case of sale/transfer of principal residence, the Buyer/Transferee shall withhold from

the seller and shall deduct from the agreed selling price/consideration the 6% capital

gains tax which shall be deposited in cash or managers check in interest-bearing

account with an Authorized Agent Bank (AAB) under an Escrow Agreement between

6

the concerned Revenue District Officer, the Seller and the Transferee, and the AAB to

the effect that the amount so deposited, including its interest yield, shall only be

released to such Transferor upon certification by the said RDO that the proceeds of the

sale/disposition thereof has, in fact, been utilized in the acquisition or construction of

the Seller/Transferors new principal residence within eighteen (18) calendar months

from date of the said sale or disposition. The date of sale or disposition of a property

refers to the date of notarization of the document evidencing the transfer of said

property. In general, the term Escrow means a scroll, writing or deed, delivered by

the grantor, promisor or obligor into the hands of a third person, to be held by the

latter until the happening of a contingency or performance of a condition, and then by

him delivered to the grantee, promise or obligee.

16. What is a Certificate Authorizing Registration (CAR)?

CAR is a certification issued by the Commissioner or his duly authorized representative

attesting that the transfer and conveyance of land, buildings/improvements or shares of

stock arising from sale, barter or exchange have been reported and the taxes due

inclusive of the documentary stamp tax, have been fully paid. CARs shall now have a

validity of one (1) year from date of issue. In case of failure to present the same to the

Registry of Deeds (RD) within the one (1) year period, the same shall be presented for

revalidation to the District Office where the CAR was issued. The revalidation, evidenced

by stamping the phrase "revalidated on __________ to expire on ___________" in a

conspicuous space in the CAR, shall be good for another one-year period, after which

the CAR losses its validity. (RMO 15-2003)

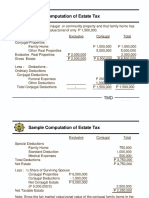

C. Estate Tax

(Observe that many estates still remain in the names of the deceased ancestors due to

the financial inability of the heirs to pay the estate taxes (inheritance taxes) which are

quite substantial.)

The current estate tax rates range from 5% to 20% of the net estate, per table .

The estate tax is payable upon the transfer of the net estate of every decedent,

whether a resident or nonresident of the Philippines. However, if the decedent was

neither a resident nor a citizen of the Philippines at the time of his or her death, only

the portion of the estate in the Philippines shall be included in the taxable estate. For

example, if the decedent was a resident of the United States and became a naturalized

U.S. citizen before death, then only the properties in the Philippines will be subject to

estate tax. The properties in the United States would not be covered by Philippine

estate tax.

7

Basis and computation of the net estate tax:

The estate shall be appraised at its fair market value as of the time of death, which is

either the fair market value as determined by the Commissioner (the zonal value, or

the fair market value as shown in the schedule of values fixed by the Provincial and City

Assessors (the assessed value), whichever is higher.

So, if the decedent died in 1991, then the estate tax will be computed based on its zonal

or assessed value (whichever is higher) in 1991. It is also possible that at that time, the

BIR had not yet come out with a zonal valuation of the property, thus the computation

will have to be based on its 1991 assessed value.

Deadline to file the estate tax return:

Six (6) months from the decedents death. This may still be extended. when the

Commissioner finds that the payment on the due date of the estate tax or of any part

thereof would impose undue hardship upon the estate or any of the heirs,

not to exceed five (5) years, in case the estate is settled through the courts, or

two (2) years in case the estate is settled extrajudicially.

ESTATE TAX is a tax on the right or privilege of the deceased person to

transmit his/her estate to his/her lawful heirs and beneficiaries at the

time of death and on certain transfers, which are made by law as

equivalent to testamentary disposition. It is not a tax on property. The Tax

is based on the laws in force at the time of death notwithstanding the

postponement of the actual possession or enjoyment of the estate by the

beneficiary.

Tax Form: BIR Form 1801 - Estate Tax Return

Documentary Requirements

1. Notice of Death duly received by the BIR, if gross estate exceeds

P20,000 for deaths occurring on or after Jan. 1, 1998; or if the gross estate

exceeds P3,000 for deaths occurring prior to January 1, 1998

2. Certified true copy of the Death Certificate

3. Deed of Extra-Judicial Settlement of the Estate, if the estate is settled

Procedures

The heirs/authorized representative/administrator/executor shall file the

estate tax return (BIR Form 1801) and pay the corresponding estate tax.

Deadlines

File the return within six (6) months from decedent's death. However, the

Commissioner may, in meritorious cases, grant extension not exceeding

thirty (30) days.

Frequently Asked Questions

1. Who are required to file the Estate Tax return?

a) The executor or administrator or any of the legal heirs of the decedent

3. What are included in gross estate?

4. What are excluded from gross estate?

5. What will be used as basis in the valuation of property?

The properties shall be appraised based on its fair market value at the time

of the decedent's death.

6. What are the allowable deductions for Estate Tax purposes?

D. VALUE-ADDED TAX (VAT)

Value-Added Tax is a form of sales tax on consumption levied on the sale, barter,

exchange or lease of goods or properties and services in the Philippines and on

importation of goods into the Philippines. It is an indirect tax, which may be shifted or

passed on to the buyer, transferee or lessee of goods, properties or services.

Tax Rates

On sale of goods and properties - twelve percent (12%) of the gross selling price or

gross value in money of the goods or properties sold, bartered or exchanged

On sale of services and use or lease of properties - twelve percent (12%) of gross

receipts derived from the sale or exchange of services, including the use or lease of

properties

Who Are Required To File VAT Returns

Any person or entity who, in the course of his trade or business, sells, barters,

exchanges, leases goods or properties and renders services subject to VAT, if the

aggregate amount of actual gross sales or receipts exceed One Million Five Hundred

9

10

Thousand Pesos (P1,500,000.00).

A person required to register as VAT taxpayer but failed to register

Any person, whether or not made in the course of his trade or business, who imports

goods

Monthly VAT Declarations

Tax Form: BIR Form 2550 M - Monthly Value-Added Tax Declaration (February 2007

ENCS)

Documentary Requirements

1. Duly issued Certificate of Creditable VAT Withheld at Source (BIR Form No. 2307), if

applicable

2. Summary Alphalist of Withholding Agents of Income Payments Subjected to

Withholding Tax At Source (SAWT), if applicable

3. Duly approved Tax Debit Memo, if applicable

4. Duly approved Tax Credit Certificate, if applicable

5. Authorization letter, if return is filed by authorized representative.

Procedures

1. Fill-up BIR Form No. 2550 M in triplicate copies (two copies for the BIR and one copy

for the taxpayer)

2. If there is payment:

File the Monthly VAT declaration, together with the required attachments, and pay the

VAT due thereon with any Authorized Agent Bank (AAB) under the jurisdiction of the

Revenue District Office (RDO)/Large Taxpayers District Office (LTDO) where the

taxpayer (head office of the business establishment) is registered or required to be

registered.

3. If there is no payment:

File the Quarterly VAT Return, together with the required attachments with the

RDO/LTDO/Large Taxpayers Assistance Division, Collection Agent or duly authorized

Municipal/City Treasurer of Municipality/City where the taxpayer (head office of the

business establishment) is registered or required to be registered.

Reminders:

1. Only one consolidated Monthly VAT Declaration/Quarterly VAT Return shall be filed

10

11

covering the results of operation of the head office as well as the branches for all lines

of business subject to VAT.

2. The Quarterly List of Sales and Purchases shall be submitted in magnetic form using

3.5-inch floppy diskette following the format provided under Section 4.114-3(g) of RR

No. 16-2005.

3. The Quarterly List of Sales and Purchases shall be submitted through electronic filing

facility for taxpayers under the jurisdiction of the Large Taxpayers Service (LTS) and

those enrolled under the eFPS.

Deadline

Within twenty five (25) days following the close of taxable quarter.

Frequently Asked Questions

I. General VAT Queries

Who are liable to register as VAT taxpayers?

Any person who, in the course of trade or business, sells, barters or exchanges

goods or properties or engages in the sale or exchange of services shall be liable to

register if:

His gross sales or receipts for the past twelve (12) months, other than those that

are exempt under Section 109 (A) to (U), have exceeded One Million Five Hundred

Thousand Pesos (P1,500,000.00): or

There are reasonable grounds to believe that his gross sales or receipts for the

next twelve (12) months, other than those that are exempt under Section 109 (A)

to (U), will exceed One Million Five Hundred Thousand Pesos (P1,500,000.00).

When is a new VAT taxpayer required to apply for registration and pay the

registration fee?

New VAT taxpayers shall apply for registration as VAT Taxpayers and pay the

corresponding registration fee of five hundred pesos (P500.00) using BIR Form No.

0605 for every separate or distinct establishment or place of business before the

start of their business following existing issuances on registration.

Thereafter, taxpayers are required to pay the annual registration fee of five

hundred pesos (P500.00) not later than January 31, every year.

What compliance activities should a VAT taxpayer, after registration as such, do

promptly or periodically?

The following compliance activities must be performed by a VAT-registered

taxpayer:

Pay the annual registration fee of P500.00 for every place of business or

11

12

establishment that generates sales;

Register the books of accounts of the business/occupation/calling, including

practice of profession, before using the same;

Register the sales invoices and official receipts as VAT-invoices or VAT official

receipts for use on transactions subject to VAT. (If there are other transaction not

subject to VAT, a separate set of non-VAT invoices or non-VAT official receipts need

to be registered for use on transactions not subject to VAT);

Filing of the Monthly Value-added Tax Declaration on or before the 20th day

following the end of the taxable month (for manual filers)/on or before the

prescribed due dates enunciated in RR No. 16-2005 (for e-filers) using BIR Form No.

2550M and of the Quarterly VAT Return on or before the 25th day following the

end of the taxable quarter using BIR Form No. 2550Q, reflecting therein gross

receipts (for seller of service)/ gross sales (for seller of goods) and output tax (VAT

on sales); purchases of goods and services made in the course of trade or

business/exercise of profession and input tax (VAT on purchases), other allowable

tax credits as in the case of advance VAT payment and VAT withheld by

government payors, and VAT payable or excess input VAT, whichever is applicable,

with the accredited agent banks (AABs) of the BIR or Revenue Collection Officers

(RCOs) of the BIR (in areas without AAB), for returns with payment, or with the

RDO/LTDO having jurisdiction over the taxpayer (home RDO/LTDO), for returns

without payment. (The monthly VAT Declaration and the Quarterly VAT Return

shall reflect the consolidated total for all the taxable lines of activity and all the

establishments - head office and branches);

Submit with the RDO/LTDO having jurisdiction over the taxpayer, on or before the

deadline set in the filing of the Quarterly VAT Return, the soft copy of the Quarterly

Schedule of Monthly Sales and Output Tax (if the quarterly sales exceed

P2,500,000.00), and the soft copy of the Quarterly Schedule of Monthly Domestic

Purchases and Input Tax/ the soft copy of the Schedule of Transactional/Individual

Importation ( if the quarterly total purchases exceed P1,000,000.00), reflecting

therein the required data prescribed under existing revenue issuances.

How do we determine the main or principal business of a taxpayer who is

engaged in mixed business activities?

In determining the main or principal business of a taxpayer, we apply the

predominance test: if more than fifty (50%) of its gross sales and/or gross receipts

comes from its business/es subject to VAT, its main/principal business falls within

the VAT system making its status as a VAT person. Otherwise, he can not be

considered as a VAT person eligible for the election provided for under Section

109(2) of the Tax Code.

12

13

What is the liability of a taxpayer becoming liable to VAT and did not register as

such?

Any person who becomes liable to VAT and fails to register as such shall be liable to

pay the output tax as if he is a VAT-registered person, but without the benefit of

input tax credits for the period in which he was not properly registered.

Who may opt to register as VAT and what will be his liability?

Any person who is VAT-exempt under Sec. 4.109-1 (B) (1) (V) not required to

register for VAT may, in relation to Sec. 4.109-2, elect to be VAT-registered by

registering with the RDO that has jurisdiction over the head office of that person,

and pay the annual registration fee of P500.00 for every separate and distinct

establishment.

Any person who is VAT-registered but enters into transactions which are exempt

from VAT (mixed transactions) may opt that the VAT apply to his transactions which

would have been exempt under Section 109(1) of the Tax Code, as amended [Sec.

109(2)].

Franchise grantees of radio and/or television broadcasting whose annual gross

receipts of the preceding year do not exceed ten million pesos (P10,000,000.00)

derived from the business covered by the law granting the franchise may opt for

VAT registration. This option, once exercised, shall be irrevocable. (Sec. 119, Tax

Code).

Any person who elects to register under optional registration shall not be allowed

to cancel his registration for the next three (3) years.

The above-stated taxpayers may apply for VAT registration not later than ten (10)

days before the beginning of the calendar quarter and shall pay the registration fee

unless they have already paid at the beginning of the year. In any case, the

Commissioner of Internal Revenue may, for administrative reason deny any

application for registration. Once registered as a VAT person, the taxpayer shall be

liable to output tax and be entitled to input tax credit beginning on the first day of

the month following registration.

What are the instances when a VAT-registered person may cancel his VAT

registration?

If he makes a written application and can demonstrate to the commissioner's

satisfaction that his gross sales or receipts for the following twelve (12) months,

other than those that are exempt under Section 109 (A) to (U), will not exceed one

million five hundred thousand pesos (P1,500,000.00); or

If he has ceased to carry on his trade or business, and does not expect to

recommence any trade or business within the next twelve (12) months.

13

14

When will the cancellation for registration be effective?

The cancellation for registration will be effective from the first day of the following

month the cancellation was approved.

What is the invoicing/ receipt requirement of a VAT-registered person?

A VAT registered person shall issue :

A VAT invoice for every sale, barter or exchange of goods or properties; and

A VAT official receipt for every lease of goods or properties and for every sale,

barter or exchange of services.

May a VAT-registered person issue a single invoice/ receipt involving VAT and NonVAT transactions?

Yes. He may issue a single invoice/ receipt involving VAT and non-VAT transactions

provided that the invoice or receipt shall clearly indicate the break-down of the

sales price between its taxable, exempt and zero-rated components and the

calculation of the Value-Added Tax on each portion of the sale shall be shown on

the invoice or receipt.

May a VAT- registered person issue separate invoices/ receipts involving VAT and

Non-VAT transactions?

Yes. A VAT registered person may issue separate invoices/ receipts for the taxable,

exempt, and zero-rated component of its sales provided that if the sales is exempt

from value-added tax, the term "VAT-EXEMPT SALE" shall be written or printed

prominently on the invoice or receipt and if the sale is subject to zero percent (0%)

VAT, the term "ZERO-RATED SALE" shall be written or printed prominently on the

invoice or receipt.

How is the Value-Added Tax presented in the receipt/ invoice?

The amount of the tax shall be shown as a separate item in the invoice or receipt.

Sample:

Sales Price

P 100,000.00

VAT

12,000.00

Invoice Amount

P112,000.00

What is the information that must be contained in the VAT invoice or VAT official

receipt?

Name of Seller

Business Style of the Seller

Business Address of the Seller

Statement that the seller is a VAT-registered person, followed by his TIN

14

15

Name of Buyer

Business Style of Buyer

Address of Buyer

TIN of buyer, if VAT- registered and amount exceed P1,000.00

Date of transaction

Quantity

Unit cost

Description of the goods or properties or nature of the service

Purchase price plus the VAT, provided that:

The amount of tax shall be shown as a separate item in the invoice or receipt;

If the sale is exempt from VAT, the term "VAT-EXEMPT SALE" shall be written or

printed prominently on the invoice or receipt;

If the sale is subject to zero percent (0%) VAT, the term "ZERO-RATED SALE" shall

be written or printed prominently on the invoice receipt; and

If the sale involves goods, properties or services some of which are subject to and

some of which are zero-rated or exempt from VAT, the invoice or receipt shall

clearly indicate the breakdown of the sales price between its taxable, exempt and

zero-rated components, and the calculation of the VAT on each portion of the sale

shall be shown on the invoice or receipt.

Authority to Print Receipt Number at the lower left corner of the invoice or receipt.

What is the liability of a taxpayer not registered as VAT and issues a VAT invoice/

receipt?

The non-VAT registered person shall, in addition to paying the percentage tax

applicable to his transactions, be liable to VAT imposed in Section 106 or 108 of the

Tax Code without the benefit of any input tax credit plus 50% surcharge on the VAT

payable (output tax). If the invoice/ receipts contain the required information,

purchaser shall be allowed to recognize an input tax credit.

What is the liability of a VAT-registered person in the issuance of a VAT invoice/

receipt for VAT-exempt transactions?

If a VAT-registered person issues a VAT invoice or VAT official receipt for a VATexempt transaction but fails to display prominently on the invoice or receipt the

words "VAT-EXEMPT SALE", the transaction shall become taxable and the issuer

shall be liable to pay the VAT thereon. The purchaser shall be entitled to claim an

input tax credit on his purchase.

What is "output tax"?

15

16

Output tax means the VAT due on the sale, lease or exchange of taxable goods or

properties or services by any person registered or required to register under

Section 236 of the Tax Code.

What is "input tax"?

Input tax means the VAT due on or paid by a VAT-registered on importation of

goods or local purchase of goods, properties or services, including lease or use of

property in the course of his trade or business. It shall also include the transitional

input tax determined in accordance with Section 111 of the Tax Code, presumptive

input tax and deferred input tax from previous period.

What comprises "goods or properties"?

The term "goods or properties" shall mean all tangible and intangible objects,

which are capable of pecuniary estimation and shall include, among others:

Real properties held primarily for sale to customers or held for lease in the

ordinary course of trade or business;

The right or the privilege to use motion picture films, films, tapes and discs; and

Radio, television, satellite transmission and cable television time.

What comprises "sale or exchange of services"?

The term "sale or exchange of services" means the performance of all kinds of

services in the Philippines for others for a fee, remuneration or consideration,

whether in kind or in cash, including those performed or rendered by the following:

Construction and service contractors;

Stock, real estate, commercial, customs and immigration brokers;

Lessors of property, whether personal or real;

Persons engaged in warehousing services;

Proprietors, operators or keepers of hotels, motels, rest houses, pension houses,

inns, resorts, theatres, and movie houses;

What is a zero-rated sale?

It is a sale, barter or exchange of goods, properties and/or services subject to 0%

VAT pursuant to Sections 106 (A) (2) and 108 (B) of the Tax Code. It is a taxable

transaction for VAT purposes, but shall not result in any output tax. However, the

input tax on purchases of goods, properties or services, related to such zero-rated

sales, shall be available as tax credit or refund in accordance with RR No. 16-2005.

What is a Contractor's Final Payment Release Certificate and where should

taxpayers file their application for this?

16

17

The Contractor's Final Payment Release Certificate is issued by the BIR before a

government contractor is fully paid for his contract with the government. Taxpayers

may file their application at the BIR National Office at the Audit Information, Tax

Exemption and Incentives Division (AITEID)

What transactions are considered deemed sales?

The following transactions are considered as deemed sales:

Transfer, use or consumption, not in the course of business, of goods or properties

originally intended for sale or for use in the course of business. Transfer of goods or

properties not in the course of business can take place when VAT-registered person

withdraws goods from his business for his personal use;

Distribution or transfer to:

Shareholders or investors as share in the profits of the VAT-registered person; or

Creditors in payment of debt or obligation

Consignment of goods if actual sale is not made within sixty (60) days following the

date such goods were consigned. Consigned goods returned by the consignee

within the 60-day period are not deemed sold;

Retirement from or cessation of business, with respect to all goods on hand,

whether capital goods, stock-in-trade, supplies or materials as of the date of such

retirement or cessation, whether or not the business is continued by the new

owner or successor. The following circumstances shall, among others, give rise to

transactions "deemed sale";

Change of ownership of the business. There is a change in the ownership of the

business when a single proprietorship incorporated; or the proprietor of a single

proprietorship sells his entire business.

Dissolution of a partnership and creation of a new partnership which takes over the

business.

What is VAT-exempt sale?

It is a sale of goods, properties or service and the use or lease of properties which is

not subject to output tax and whereby the buyer is not allowed any tax credit or

input tax related to such exempt sale.

What are the VAT-exempt transactions?

Services subject to percentage tax under Title V of the Code, as amended;

Services by agricultural contract growers and milling for others of palay into rice,

corn into grits, and sugar cane into raw sugar;

Educational services rendered by private educational institutions duly accredited by

the Department of Education (DepED), the Commission on Higher Education (CHED)

and the Technical Education and Skills Development Authority (TESDA) and those

17

18

rendered by the government educational institutions;

Services rendered by individuals pursuant to an employer-employee relationship;

Services rendered by regional or area headquarters established in the Philippines

by multinational corporations which act as supervisory, communications and

coordinating centers for their affiliates, subsidiaries or branches in the Asia-Pacific

Region and do not earn or derive income from the Philippines;

Transactions which are exempt under international agreements to which the

Philippines is a signatory or under special laws except those granted under P.D. No.

529 - Petroleum Exploration Concessionaires under the Petroleum Act of 1949;

Sales by agricultural cooperatives duly registered and in good standing with the

Cooperative Development Authority (CDA) to their members, as well as of their

produce, whether in its original state or processed form, to non-members, their

importation of direct farm inputs, machineries and equipment, including spare

parts thereof, to be used directly and exclusively in the production and/or

processing of their produce;

Gross receipts from lending activities by credit or multi-purpose cooperatives duly

registered and in good standing with the Cooperative Development Authority;

Sales by non-agricultural, non-electric and non-credit cooperatives duly registered

with and in good standing with CDA; Provided, that the share capital contribution

of each member does not exceed Fifteen Thousand Pesos (P15,000.00) and

regardless of the aggregate capital and net surplus ratably distributed among the

members;

Export sales by persons who are not VAT-registered;

The following sales of real properties are exempt from VAT, namely:

Sale of real properties not primarily held for sale to customers or held for lease in

the ordinary course of trade or business;

Sale of real properties utilized for low-cost housing as defined by RA No. 7279,

otherwise known as the "Urban Development and Housing Act of 1992" and other

related laws, such as RA No. 7835 and RA No. 8763;

Sale of real properties utilized for specialized housing as defined under RA No.

7279, and other related laws, such as RA No. 7835 and RA No. 8763, wherein price

ceiling per unit is P225,000.00 or as may from time to time be determined by the

HUDCC and the NEDA and other related laws;

Sale of residential lot valued at One Million Five Hundred Thousand Pesos

(P1,500,000.00) and below, or house and lot and other residential dwellings valued

at Two Million Five Hundred Thousand Pesos (P2,500,000.00) and below where the

instrument of sale/ transfer/ disposition was executed on or after July 1, 2005;

Provided, that not later than January 31, 2009 and every three (3) years thereafter,

18

19

the amounts stated herein shall be adjusted to its present value using the

Consumer Price Index, as published by the National Statistics Office (NSO);

Provided, further, that such adjustment shall be published through revenue

regulations to be issued not later than March 31 of each year.

Lease of residential units with a monthly rental per unit not exceeding Ten

Thousand Pesos (P10,000.00), regardless of the amount of aggregate rentals

received by the lessor during the year; Provided, that not later than January 31,

2009 and every three (3) years thereafter, the amount of P10,000.00 shall be

adjusted to its present value using the Consumer Price Index, as published by the

NSO;

Sale, importation, printing or publication of books and any newspaper, magazine,

review or bulletin which appears at regular intervals with fixed prices for

subscription and sale and which is not devoted principally to the publication of paid

advertisements;

Sale, importation or lease of passenger or cargo vessels and aircraft, including

engine equipment and spare parts thereof for domestic or international transport

operations; Provided, that the exemption from VAT on the importation and local

purchase of passenger and/or cargo vessels shall be limited to those of one

hundred fifty (150) tons and above, including engine and spare parts of said vessels;

Provided, further, that the vessels to be imported shall comply with the age limit

requirement, at the time of acquisition counted from the date of the vessel's

original commissioning, as follows: (a) for passenger and/or cargo vessel, the age

limit is fifteen (15) years old, (b) for tankers, the age limit is ten (10) year old, and

(c) for high-speed passengers crafts, the age limit is five (5) years old; Provided,

finally, that exemption shall be subject to the provisions of Section 4 of Republic

Act No. 9295, otherwise known as "The Domestic Shipping Development Act of

2004";

Importation of life-saving equipment, safety and rescue equipment and

communication and navigational safety equipment, steel plates and other metal

plates including marine-grade aluminum plates, used for shipping transport

operations; Provided, that the exemption shall be subject to the provisions of

Section 4 of Republic Act No. 9295, otherwise known as "The Domestic Shipping

Development Act of 2004".

Importation of capital equipment, machinery, spare parts, life-saving and

navigational equipment, steel plates and other metal plates including marine-grade

aluminum plates to be used in the construction, repair, renovation or alteration of

any merchant marine vessel operated or to be operated in the domestic trade.

Provided, that the exemption shall be subject to the provisions of Section 19 of

19

20

Republic Act No. 9295, otherwise known as the "The Domestic Shipping

Development Act of 2004".

Importation of fuel, goods and supplies engaged in international shipping or air

transport operations; Provided, that the said fuel, goods and supplies shall be used

exclusively or shall pertain to the transport of goods and/or passenger from a port

in the Philippines directly to a foreign port, or vice-versa, without docking or

stopping at any other port in the Philippines unless the docking or stopping at any

other Philippine port is for the purpose of unloading passengers and/or cargoes

that originated form abroad, or to load passengers and/or cargoes bound for

abroad; Provided, further, that if any portion of such fuel, goods or supplies is used

for purposes other that the mentioned in the paragraph, such portion of fuel,

goods and supplies shall be subject to 12% VAT;

Services of banks, non-bank financial intermediaries performing quasi-banking

functions, and other non-bank financial intermediaries, such as money changers

and pawnshops, subject to percentage tax under Sections 121 and 122, respectively

of the Tax Code; and

Sale or lease of goods or properties or the performance of services other than the

transactions mentioned in the preceding paragraphs, the gross annual sales and/or

receipts do not exceed the amount of P1,500,000.00. Provided, that not later than

January 31, 2009 and every three (3) years thereafter, the amount of P1,500,000.00

shall be adjusted to its present value after using the Consumer Price Index, as

published by the NSO.

What are the previously exempt transactions that are now subject to VAT?

Sale of residential lot valued at more than P1,500,000.00;

Sale of residential house & lot/dwellings valued at more than P2,500,000.00;

Lease of residential unit with a monthly rental of more than P10,000;

II. RELIEF-Related Queries

What is "RELIEF"?

RELIEF means Reconciliation of Listing for Enforcement. It supports the third party

information program of the Bureau through the cross referencing of third party

information from the taxpayers' Summary Lists of Sales and Purchases prescribed

to be submitted on a quarterly basis.

Who are required to submit Summary List of Sales?

VAT taxpayers with quarterly total sales/receipts (net of VAT), exceeding Two

Million Five Hundred Thousand Pesos (P2,500,000.00) are required to submit a

Summary List of Sales.

20

21

Who are required to submit Summary List of Purchases?

VAT taxpayers with quarterly total purchases (net of VAT) of goods and services,

including importation exceeding One Million Pesos (P1,000,000.00) are required to

submit Summary List of Purchases.

What are the Summary Lists required to be submitted?

Quarterly Summary List of Sales to Regular Buyers/ Customers Casual Buyers/

Customers and Output Tax

Quarterly Summary of List of Local Purchases and Input tax; and

Quarterly Summary List of Importation.

When is the deadline for submission of the above Summary Lists?

The Summary List of Sales/Purchases, whichever is applicable, shall be submitted on or

before the twney-fifth (25th) day of the month following the close of the taxable

quarter -- calendar quarter or fiscal quarter.

What are the penalties for failure to submit the Summary Lists?

For failure to file, keep or supply a statement, list or information required on the date

prescribed shall pay and administrative penalty of One Thousand Pesos (P1,000.00) for

each such failure, unless it is shown that such failure is due to reasonable cause and

not to willful neglect; and

An aggregate amount to be imposed for all such failures during a taxable year shall not

exceed Twenty-Five Thousand Pesos (P25,000.00).

III. What is the treatment for Withholding of VAT on Government Money Payments?

The government or any of its political subdivisions, instrumentalities or agencies,

including government-owned or controlled corporations (GOCCs) shall, before making

payment on account of each purchase of goods and/or services taxed at twelve percent

(12%) VAT pursuant to Sections 106 and 108 of the Tax Code, deduct and withhold a

Final VAT due at the rate of five percent (5%) of the gross payment.

The five percent (5%) final VAT withholding rate shall represent the net VAT payable of

the seller. The remaining seven percent (7%) effectively accounts for the standard

input VAT for sales of goods or services to government or any of its political

subdivisions, instrumentalities or agencies including GOCCs in lieu of the actual input

VAT directly attributable or ratably apportioned to such sales. Should actual input VAT

attributable to sales to government exceeds seven percent (7%) of gross payments, the

excess may form part of the sellers' expense or cost. On the other hand, if actual input

VAT attributable to sale to government is less than seven percent (7%) of gross

payment, the difference must be closed to expense or cost.

The government or any of its political subdivisions, instrumentalities or agencies

21

22

including GOCCs, as well as private corporation, individuals, estates and trusts, whether

large or non-large taxpayers, shall withhold twelve percent (12%) VAT with respect to

the following payments:

Lease or use of properties or property rights owned by non-residents; and

Other services rendered in the Philippines by non-residents.

IV. In what grounds can the Commissioner of Internal Revenue suspend the business

operations of a taxpayer?

The Commissioner or his authorized representative is empowered to suspend the

business operations and temporarily close the business establishment of any person

for any of the following violations:

(a) In the case of a VAT-registered Person:

Failure to issue receipts or invoices;

Failure to file a value-added-tax return as required under Section 114; or

Understatement of taxable sales or receipts by thirty percent (30%) or more of his

correct taxable sales or receipts for the taxable quarter.

(b) Failure to any Person to Register as Required under Section 236

The temporary closure of the establishment shall be for the duration of not less than

five (5) days and shall be lifted only upon compliance with whatever requirements

prescribed by the Commissioner in the closure order.

E. PERCENTAGE TAX

Description: Percentage tax is a business tax imposed on persons or entities who sell

or lease goods, properties or services in the course of trade or business whose gross

annual sales and/or receipts do not exceed P750,000 and who are not VAT-registered.

Who Are Required To File Percentage Tax Returns

Any person who is not a VAT-registered person (persons exempt from VAT

under Sec. 109z of the Tax Code)

Monthly Percentage Tax

Tax Form: BIR Form 2551 M - Monthly Percentage Tax Return

Documentary Requirements

1.

Duly issued Certificate of Creditable Tax Withheld at Source (BIR Form 2307), if

applicable

2.

Duly approved Tax Debit Memo, if applicable

3.

Copy of Certificate of Registration issued by Cooperative Development Authority

for cooperatives and from the National Electrification Administration for electric

22

23

cooperatives

4.

Previously filed return and proof of payment, for amended return

Procedures

1. Fill-up BIR Form 2551 M in triplicate copies

2.

If there is payment:

Proceed to the nearest Authorized Agent Bank (AAB) of the Revenue District

Office where taxpayer is required to register and present the duly accomplished BIR

Form 2551 M, together with the required attachments and payment. (The Percentage

Tax imposed shall be paid at the time the return is filed by the taxpayer.)

In places where there are no AABs, the duly accomplished BIR Form 2551 M,

together with the required attachments and payment, shall be filed/paid with the

Revenue Collection Officer or duly Authorized Treasurer of the city or municipality

where said business or principal place of business is located.

Receive taxpayer's copy of the duly stamped and validated form from the teller

of the AAB/Revenue Collection Officer/duly Authorized City or Municipal Treasurer.

3.

If there is no payment:

Proceed to the Revenue District Office where taxpayer is required to register

and present the duly accomplished BIR Form 2551M, together with the required

attachments.

Receive taxpayer's copy of the duly stamped and validated form from the RDO

representative.

Note: "No payment" returns filed late shall be imposed the necessary penalties by the

RDO, which shall be paid at the concerned AAB.

Deadline

Manual Filing

Not later than 20th day following the end of each month

Quarterly Percentage Tax

Tax Form: BIR Form 2551 Q - Quarterly Percentage Tax Return

Documentary Requirements

1.

Duly issued Certificate of Creditable Tax Withheld at Source (BIR Form 2307), if

applicable

2.

Duly approved Tax Debit Memo, if applicable

3.

Copy of Certificate of Registration issued by Cooperative Development Authority

for cooperatives and from the National Electrification Administration for electric

23

24

cooperatives

4.

Previously filed return and proof of payment, for amended return

Procedures

1.

Fill-up BIR Form 2551 Q in triplicate copies.

2.

If there is payment:

Proceed to the nearest Authorized Agent Bank (AAB) of the Revenue District

Office where taxpayer is required to register and present the duly accomplished BIR

Form 2551Q, together with the required attachments and payment. (The Percentage

Tax imposed shall be paid at the time the return is filed by the taxpayer.)

In places where there are no AABs, the accomplished BIR Form 2551 Q,

together with the required attachments and payment, shall be filed/paid with the

Revenue Collection Officer or duly Authorized Treasurer of the city or municipality

where said business or principal place of business is located.

Receive taxpayer's copy of the duly stamped and validated form from the teller

of the AAB/Revenue Collection Officer/duly Authorized City or Municipal Treasurer.

3.

If there is no payment:

Proceed to the Revenue District Office where taxpayer is required to register and

present the duly accomplished BIR Form 2551Q, together with the required

attachments.

Receive taxpayer's copy of the duly stamped and validated form from the RDO

representative.

Note: "No payment" returns filed late shall be imposed the necessary penalties by the

RDO, which shall be paid at the concerned AAB.

Deadline

Manual Filing

Not later than 20th day following the end of each quarter

Filing Through Electronic Filing and Payment System (eFPS)

Not later than the 20th day following the end of the quarter

DONORS TAX (Sec. 98, NIRC)

Tax Rates

Effective January 1, 1998 to present (Ranges from 2% to 15%)

Notes:

1. Rate applicable shall be based on the law prevailing at the time of donation.

2. When the gifts are made during the same calendar year but on different dates,

the donor's tax computed on the total net gifts during the year.

24

25

Donation made to a stranger is subject to 30% of the net gift. A stranger is a person who

is not a:

brother, sister (whether by whole or half blood), spouse, ancestor and lineal

descendants; or

. relative by consanguinity in the collateral line within the fourth degree of

relationship (up to first cousin).

Donation made to a stranger is subject to 10% of the net gift. A stranger is a person who

is not a:

brother, sister (whether by whole or half blood), spouse, ancestor and lineal

descendants; or

. relative by consanguinity in the collateral line within the fourth degree of

relationship (up to first cousin).

Effective before July 28, 1992

Description : Donors Tax is a tax on a donation or gift, and is imposed on the

gratuitous transfer of property between two or more persons who are living at the time

of the transfer. It shall apply whether the transfer is in trust or otherwise, whether the

gift is direct or indirect and whether the property is real or personal, tangible or

intangible.

Tax Form : BIR Form 1800 Donors Tax Return

Documentary Requirements

The following requirements must be submitted upon field or office audit of the tax case

before the Tax Clearance Certificate/Certificate Authorizing Registration can be

released:

1. Deed of Donation

2. Sworn Statement of the relationship of the donor to the donee

3. Proof of tax credit, if applicable

4. Certified true copy(ies) of the Original/Transfer/Condominium Certificate of Title

(front and back ) of lot and/or improvement donated, if applicable

5. Certified true copy(ies) of the latest Tax Declaration (front and back pages) of lot

and/or improvement, if applicable

25

26

6.

Certificate of No Improvement issued by the Assessors office where the

properties have no declared improvement, if applicable

7. Proof of valuation of shares of stocks at the time of donation, if applicable

For listed stocks - newspaper clippings or certification issued by the Stock

Exchange as to the par value per share

For unlisted stocks - latest audited Financial Statements of the issuing

corporation with computation of the book value per share

8. Proof of valuation of other types of personal properties, if applicable

9. Proof of claimed deductions, if applicable

10. Copy of Tax Debit Memo used as payment, if applicable

Additional requirements may be requested for presentation during audit of the tax case

depending upon existing audit procedures.

Procedures

File the return in triplicate (two copies for the BIR and one copy for the taxpayer) with

any Authorized Agent Bank (AAB) of the RDO having jurisdiction over the place of the

domicile of the donor at the time of the transfer. In places where there are no AAB, the

return will be filed directly with the Revenue Collection Officer or duly Authorized City

or Municipal Treasurer where the donor was domiciled at the time of the transfer, or if

there is no legal residence in the Philippines, with Revenue District No. 39 - South

Quezon City.

In the case of gifts made by a non-resident alien, the return may be filed with Revenue

District No. 39 - South Quezon City, or with the Philippine Embassy or Consulate in the

country where donor is domiciled at the time of the transfer.

Submit all documentary requirements and proof of payment to the Revenue District

Office having jurisdiction over the place of residence of the donor.

Deadlines

Within thirty days (30) after the date the gift (donation) is made. A separate return will

be filed for each gift (donation) made on the different dates during the year reflecting

therein any previous net gifts made during the same calendar year.

26

27

If the gift (donation) involves conjugal/community/property, each spouse will file

separate returns corresponding to his/ her respective share in the conjugal/community

property. This rule will also apply in the case of co-ownership over the property.

Frequently Asked Questions

1. Who are required to file the Donors Tax Return?

Every person, whether natural or juridical, resident or non-resident, who transfers or

causes to transfer property by gift, whether in trust or otherwise, whether the gift is

direct or indirect and whether the property is real or personal, tangible or intangible.

2. What are the procedures in filing the Donors Tax return?

File the return in triplicate (two copies for the BIR and one copy for the taxpayer) with

any Authorized Agent Bank (AAB) of the RDO having jurisdiction over the place of the

domicile of the donor at the time of the transfer. In places where there are no AAB, the

return will be filed directly with the Revenue Collection Officer or duly Authorized City

or Municipal Treasurer where the donor was domiciled at the time of the transfer, or if

there is no legal residence in the Philippines, with Revenue District No. 39 - South

Quezon City.

In the case of gifts made by a non-resident alien, the return may be filed with Revenue

District No. 39 - South Quezon City, or with the Philippine Embassy or Consulate in the

country where donor is domiciled at the time of the transfer.

Submit all documentary requirements and proof of payment to the Revenue District

Office having jurisdiction over the place of residence of the donor.

3. What donations are tax exempt?

Dowries or donations made on account of marriage before its celebration or within

one year thereafter, by parents to each of their legitimate, recognized natural, or

adopted children to the extent of the first P10,000

Gifts made to or for the use of the National Government or any entity created by

any of its agencies which is not conducted for profit, or to any political subdivision of

the said Government

Gifts in favor of an educational and/or charitable, religious, cultural or social welfare

corporation, institution, accredited non-government organization, trust or

philantrophic organization or research institution or organization, provided not

more than 30% of said gifts will be used by such donee for administration purposes

27

28

Encumbrances on the property donated if assumed by the donee in the deed of

donation

Donations made to the following entities as exempted under special laws:

- Aquaculture Department of the Southeast Asian Fisheries Development Center of

the Philippines

- Development Academy of the Philippines

- Integrated Bar of the Philippines

- International Rice Research Institute

- National Social Action Council

- Ramon Magsaysay Foundation

- Philippine Inventors Commission

- Philippine American Cultural Foundation

- Task Force on Human Settlement on the donation of equipment, materials and

services

4. What are the bases in the valuation of property?

If the gift is made in property, the fair market value at that time will be considered the

amount of gift

In case of real property, the taxable base is the fair market value as determined by the

Commissioner of Internal Revenue (Zonal Value) or fair market value as shown in the

latest schedule of values of the provincial and city assessor (MV per Tax Declaration),

whichever is higher

If there is no zonal value, the taxable base is the fair market value that appears in the

latest tax declaration

If there is an improvement, the value of improvement is the construction cost per

building permit and or occupancy permit plus 10% per year after year of construction,

or the market value per latest tax declaration.

F. DOCUMENTARY STAMP TAX (Title VII)

Description:

Documentary Stamp Tax is a tax on documents, instruments, loan

28

29

agreements and papers evidencing the acceptance, assignment, sale or transfer of an

obligation, right or property incident thereto.

Tax Form: BIR Form 2000 (Documentary Stamp Tax Declaration Return)

Documentary Requirements

1) Photocopy of document(s) to which the documentary stamp shall be affixed, in case

of constructive affixture of Documentary Stamp Tax

2) For metering machine users, a schedule of the details of usage or consumption of

documentary stamp

3) Proof of exemption under special law, if applicable

4) Duly approved Tax Debit Memo, if applicable

Tax Rates

Tax

Code Document

Section

Taxable Unit

Tax Due

Per Unit

% of

Unit

Taxable Base

P1.50

.75%

Face value of

Document

Par value of shares of

stocks actual

consideration for the

issuance of shares of

stocks

174

Debentures and P200.00 or

Certificates of

fraction

Indebtedness

thereof

175

P200.00 or

Original Issue of fraction

Shares of Stock thereof

with par value

P200.00 or

2.00

Original Issue of fraction

2.00

Shares of Stock thereof

without par

based on

value

actual

consideration

1%

1%

176

Sales,

Agreements to

Sell, Memoranda

P200.00 or

of Sales,

fraction

Deliveries or

thereof

Transfer of Duebills, Certificate

of Obligation, or

Par value of such due.75% bills, certificate of

obligation or stocks

1.50

29

30

Shares or

Certificates of

Stock

177

Bonds,

Debentures,

Certificate of

P200.00 or

Stock or

fraction

Indebtedness

thereof

issued in foreign

Countries

1.50

Par value of such

.75% bonds, debentures or

Certificate of Stocks

178

Certificate of

P200.00 or

Profits or Interest

fraction

in Property or

thereof

Accumulation

.50

Face value of such

.25% certificate /

memorandum

179

Bank Checks,

Drafts, Certificate

of Deposit not

On each

bearing interest Document

and other

Instruments

1.50

180

Bonds, Loan

Agreements,

Promissory

Notes, Bills of

Exchange, Drafts,

Instruments and

Securities Issued

by the

P200.00 or

Government or fraction

any of its

thereof

Instrumentalities,

Deposit

Substitutes Debt

Instrument,

Certificates of

Deposit bearing

interest and

.30

.15%

Face value of the

instrument/document

30

31

others not

payable on sight

or demand

(except loan

agreement or

promissory notes

exceeding

P250,000.00 for

personal use or

family use)

181

Bills of Exchange

or order drawn in P200.00 or

foreign country fraction

but payable in

thereof

the Philippines

.30

Face value of such bill

of exchange or order

or the equivalent of

.15%

such value, if

expressed in foreign

currency

182

Foreign Bills of

Exchange and

Letter of Credit

P200.00 or

fraction

thereof

.30

Face value of such bill

of exchange or order

or the equivalent of

.15%

such value, if

expressed in foreign

currency

183

Life Insurance

Policies

P200.00 or

fraction

thereof

.50

.25%

184

Policies Of

Insurance upon

Property

P4.00

premium or

fraction

thereof

.50

12.5% Premium charged

185

Fidelity Bonds

and other

Insurance

Policies

P4.00

premium or

fraction

thereof

.50

12.5% Premium charged

186

Policies of

P200.00 or

Annuities,

fraction

Annuity or other

thereof

instruments

1.50

75%

Amount Insured by

the Policy

Capital of annuity, or

if unknown 33 1/3

times the annual

income

31

32

186

Pre-Need Plans

P500.00 or

fraction

thereof

Value or amount of

the Plan

.50

.10%

187

P4.00 or

Indemnity Bonds fraction

thereof

.30

7.5% Premium charged

188

Certificates of

Damage or

otherwise and

Certificate or

document issued

by any customs

officers, marine Each

surveyor, notary Certificate

public and

certificate

required by law

or by rules and

regulations of a

public office

15.00

193

Powers of

Attorney

Each

Document

5.00

Lease and other

Hiring

agreements of

memorandum or

contract for hire,

use or rent of

any land or

tenements or

portions thereof

First 2,000

For every

P1,000 or

fractional

part thereof

3.00

in excess of

1.00

the first

P2,000 for

each year of

the term of

the contract

194

1.5%

1%

32

33

or agreement

195

First 5,000

Mortgages

On each

Pledges of lands, P5,000 or

20.00

estate, or

fractional

10.00

property and

part thereof

Deeds of Trust

in excess of

5,000

.4%

.2%

196

Deed of Sale,

instrument or

writing and

Conveyances of

Real Property

(except grants,

patents or

original

certificate of the

government)

Consideration or Fair

Market Value,

1.5% whichever is higher (if

1.5% government is a

party, basis shall be

the consideration)

First 1,000

For each

additional

P1,000 or

15.00

fractional

15.00

part thereof

in excess of

P1,000

Amount Secured

Amount Secured

Procedures

File BIR Form No. 2000 in triplicate (two copies for the BIR and one copy for the

taxpayer) with the Authorized Agent Bank (AAB) in the Revenue District where the seller

or transferor is registered, for shares of stocks or where the property is located, for real

property. In places where there are no AAB, the return will be filed directly with the

Revenue Collection Officer or Authorized City or Municipal Treasurer.

Submit all documentary requirements and proof of payment to the Revenue District

Office having jurisdiction over the place of residence of the seller.

Deadlines

The Documentary Stamp Tax return (BIR Form 2000) shall be filed in triplicate (two

copies for the BIR and one copy for the taxpayer) within five (5) days after the close of

the month when the taxable document was made signed, issued, accepted or

transferred; when reloading a metering machine becomes necessary; or upon

remittance by Collection Agents of collection from sale of loose stamps. The

Documentary Stamp Tax shall be paid upon filing of the return.

33

34

Frequently Asked Questions

1) Who are required to file Documentary Stamp Tax Declaration Return?

a) In case of constructive affixture of documentary stamps, by the persons making,

signing, issuing, accepting or transferring documents, instruments, loan agreements and

papers, acceptances, assignments, sales and conveyances of the obligation, right or

property incident thereto wherever the document is made, signed, issued, accepted or

transferred when the obligation or right arises from Philippine sources or the property is

situated in the Philippines at the same time such act is done or transaction had;

b) By metering machine user who imprints the Documentary Stamp Tax due on the

taxable documents; and

c) By Revenue Collection Agent, for remittance of sold loose documentary stamps.

Note: Wherever one party to the taxable document enjoys exemption from the tax

imposed, the other party who is not exempt will be the one directly liable to file

Documentary Stamp Tax Declaration and pay the applicable stamp tax.

2) Where is the Documentary Stamp Tax Declaration Return filed?

In the Authorized Agent Bank (AAB) within the territorial jurisdiction of the RDO which

has jurisdiction over the residence or principal place of business of the taxpayer or

where the property is located in case of sale of real property or where the Collection

Agent is assigned. In places where there is no Authorized Agent Bank, the return will be

filed with the Revenue Collection Officer or duly authorized City or Municipal Treasurer

where the taxpayer's residence or principal place of business is located or where the

property is located in case of sale of real property or where the Collection Agent is

assigned.

3) What are the documents/papers not subject to Documentary Stamp Tax?

Policies of insurance or annuities made or granted by a fraternal or beneficiary society,