Académique Documents

Professionnel Documents

Culture Documents

Form 16

Transféré par

neel721507Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form 16

Transféré par

neel721507Droits d'auteur :

Formats disponibles

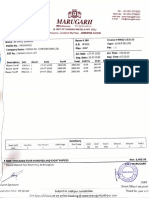

FORMNO.

16

[See Rule 31 (1)(A)]

Certificate under section 203 of the Income Tax Act, 1961 For tax deducted at source from income chargeable under the head SALARIES

Name & Address of the employer

PAN of the Deductor

Name & Designation of the Employee

TAN of Deductor

PAN of Employee

CIT (TDS) Address

Assesment Year

Period

From

Address

City

PIN

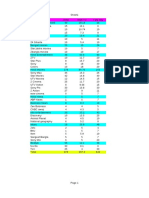

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter

Acknowledgement No

Amount of tax deducted in respect of

the employee

Amount of tax deposited or remitted

with respect of the employee

Quarter 1

Quarter 2

Quarter 3

Quarter 4

Total

DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

Book Identification Number (BIN)

Serial No

Receipt numbers of Form No. 24G

DDO serial number in Form No. 24G

Date of transfer

voucher

March, 2013

April, 2013

May, 2013

June, 2013

July, 2013

Aug, 2013

Sept, 2013

Oct, 2013

Nov, 2013

Dec, 2013

Jan, 2014

Feb, 2014

Total Rs

I,................., son/daughter of .............working in the capacity of ....... (designation) do hereby certify that a sum of Rs. .............. [Rs. .............(in

words)] has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete

and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Details of Salary paid and any other income and tax deducted

1.Gross Salary

Salary as per provisions contained in sec.17(1)

Value of perquisites u/s 17(2) (as per Form No.12BA, wherever applicable)

Profits in lieu of salary u/s 17(3) as per Form No.12BB,

Total

2.Less: Allowance to the extent exempt u/s 10

H.R.A

Medical Reimbursement

Conveyance Allowances

3.Balance(1-2)

4.Deduction U/S 16

Professional Tax

H.B Loan interest paid

Rs

RS

Children Educational Allowances

Entertainment Allowances

5.Aggregate of 4a-4d:

6.Income chargeable under Head of Salaries: 3-5

7.Add other income reported by employee

Income from house property(put -ve sign if loss)

Income from other sources (Bank int,etc..)

8.Gross Total Income:

9.Deduction under chapter VI-A

Section 80C:(Max qualify amount 100000)

GPF

GSLI

PLI

PPF

ULIP

TUTION FEES

NSC

STAMP DUTIES AND REGISTRATION FEES

HB LOAN PRINCIPAL

FIXED DEPOSIT ABOVE 5 YEAR

EQUITY LINK SAVINGS BOND

Section 80CCC

Section 80CCD

Total of U/S 80C+80CCC+80CCD (Max qualify amount 100000)

Section 80E

Section 80G

Section 80CCF

Section 80D

Section 80GG

Section 80GGA

Section 80GGC

Section 80U

Section 80DD

Section 80DDB

10.Aggregate of Deductible amount under chapter VI-A

11.Total Income (8-10) [Rounded off]

12. tax on Total Income:

13.Education & Cess @3% on tax computed sl no 12

14.Tax payable:

15.Less: Relief under section 89 (attach details)

16.Net Tax payable:

17.Tax deducted at source u/s 192(1)

18.Tax paid by the employer on behalf of the employee u/s 192(1A)

19.Tax Payable/Refundable

Verification

I,.............................., son/daughter of .............................. working in the capacity of ...........................

(designation) do hereby certify that a sum of Rs. .............................. [Rs. .............................. (in words)] has

been deducted and deposited to the credit of the Central Government. I further certify that the information given about is

true, complete and correct and is based on the books of account, documents, TDS statement, TDS deposited and other

available records.

Place

Date

Signature of person responsible for deduction of tax.

Designation

Full Name:

d SALARIES

yee

Period

To

deposited or remitted

ct of the employee

USTMENT

Status of matching

.....(in

ue, complete

Rs

ut is

Vous aimerez peut-être aussi

- Tax Free Retirement WebinarDocument28 pagesTax Free Retirement Webinarphillies1111Pas encore d'évaluation

- Taxation H01 - Fundamental Principles of TaxationDocument9 pagesTaxation H01 - Fundamental Principles of TaxationAnna TaylorPas encore d'évaluation

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawD'EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- Kim Gilbert 2018 PDFDocument25 pagesKim Gilbert 2018 PDFKim Gilbert50% (2)

- F 1099 ADocument6 pagesF 1099 AIRS100% (1)

- Tax HandbookDocument37 pagesTax HandbookChouchir SohelPas encore d'évaluation

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraPas encore d'évaluation

- Form16Document5 pagesForm16er_ved06Pas encore d'évaluation

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1D'EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Pas encore d'évaluation

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiPas encore d'évaluation

- Commissioner of Internal Revenue vs. CA (301 SCRA 152, 1999)Document4 pagesCommissioner of Internal Revenue vs. CA (301 SCRA 152, 1999)eunice demaclidPas encore d'évaluation

- 1604-CFDocument8 pages1604-CFmamasita25Pas encore d'évaluation

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersD'EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersPas encore d'évaluation

- Form 16Document3 pagesForm 16Alla VijayPas encore d'évaluation

- Internal Audit Procedures Manual - Vol 2Document31 pagesInternal Audit Procedures Manual - Vol 2Daryl Angeles100% (1)

- TAX SITUS-It Is The Place or Authority That Has The Right To Impose and Collect TaxesDocument58 pagesTAX SITUS-It Is The Place or Authority That Has The Right To Impose and Collect TaxesTJ Julian BaltazarPas encore d'évaluation

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriPas encore d'évaluation

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavPas encore d'évaluation

- LSD-NEERI - Water Quality AnalysisDocument68 pagesLSD-NEERI - Water Quality AnalysisSubrahmanyan EdamanaPas encore d'évaluation

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilPas encore d'évaluation

- Income Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDocument6 pagesIncome Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDesh PremiPas encore d'évaluation

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajPas encore d'évaluation

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaPas encore d'évaluation

- 1 Form 16 16a LatestDocument25 pages1 Form 16 16a LatestNishant GhasePas encore d'évaluation

- Summary of Tax Deducted at Source: TotalDocument2 pagesSummary of Tax Deducted at Source: Totaladithya604Pas encore d'évaluation

- Form No. 16: Finotax 1 of 3Document3 pagesForm No. 16: Finotax 1 of 3dugdugdugdugiPas encore d'évaluation

- Form 16Document3 pagesForm 16tid_scribdPas encore d'évaluation

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Pas encore d'évaluation

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahPas encore d'évaluation

- FORM No. 16Document31 pagesFORM No. 16sebastianksPas encore d'évaluation

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediPas encore d'évaluation

- Form 16Document4 pagesForm 16Aruna Kadge JhaPas encore d'évaluation

- Form No 16 in Excel With FormuleDocument3 pagesForm No 16 in Excel With FormuleSayal Ji33% (6)

- Income TaxDocument6 pagesIncome TaxKuldeep HoodaPas encore d'évaluation

- Form 16 For The AY 2017-18Document4 pagesForm 16 For The AY 2017-18Suman HalderPas encore d'évaluation

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankPas encore d'évaluation

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123Pas encore d'évaluation

- Summary of Tax Deducted at Source: Part-ADocument5 pagesSummary of Tax Deducted at Source: Part-Achakrala_sirishPas encore d'évaluation

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekalePas encore d'évaluation

- 1 - Form 16Document5 pages1 - Form 16premsccPas encore d'évaluation

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilPas encore d'évaluation

- Form16fy10 11Document3 pagesForm16fy10 11atishroyPas encore d'évaluation

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarPas encore d'évaluation

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaPas encore d'évaluation

- Form 16Document3 pagesForm 16Bijay TiwariPas encore d'évaluation

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976Pas encore d'évaluation

- 103497Document5 pages103497Ashok PuttaparthyPas encore d'évaluation

- Form 16Document6 pagesForm 16Ravi DesaiPas encore d'évaluation

- Form 16aa and 12ba (Dev)Document6 pagesForm 16aa and 12ba (Dev)jindalyash1234Pas encore d'évaluation

- Form No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument2 pagesForm No. 16: Details of Salary Paid and Any Other Income and Tax DeductedSundaresan ChockalingamPas encore d'évaluation

- 3657 Atmpa0825cDocument5 pages3657 Atmpa0825cnithinmamidala999Pas encore d'évaluation

- Thirumoorthy Form16Document4 pagesThirumoorthy Form16sundar1111Pas encore d'évaluation

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuPas encore d'évaluation

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxPas encore d'évaluation

- Select Applicable Sheets Below by Choosing Y/N and Click On ApplyDocument69 pagesSelect Applicable Sheets Below by Choosing Y/N and Click On ApplysreetomapaulPas encore d'évaluation

- Ashokkumar Form 16Document4 pagesAshokkumar Form 16sundar1111Pas encore d'évaluation

- PDF ReportsDocument3 pagesPDF ReportsSIVAPas encore d'évaluation

- From 16 & 12ba (Dev)Document6 pagesFrom 16 & 12ba (Dev)jindalyash1234Pas encore d'évaluation

- Babu Form 16Document4 pagesBabu Form 16sundar1111Pas encore d'évaluation

- 1604 CFDocument6 pages1604 CFromarcambriPas encore d'évaluation

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionPas encore d'évaluation

- Socialisation: The Meaning, Features, Types, Stages and ImportanceDocument39 pagesSocialisation: The Meaning, Features, Types, Stages and Importanceneel721507100% (1)

- Form of Last Pay-Certificate For High School (Aided) TeachersDocument1 pageForm of Last Pay-Certificate For High School (Aided) Teachersneel721507Pas encore d'évaluation

- Some Issues in Indian Education: PGED, P. I, U. 10Document19 pagesSome Issues in Indian Education: PGED, P. I, U. 10neel721507Pas encore d'évaluation

- Smartbut Order - 100055395Document1 pageSmartbut Order - 100055395neel721507Pas encore d'évaluation

- PGED Part-I Paper-II Unit-4: Transfer of Learning: Concept and Types of Transfer Papiyaupadhyay@wbnsou - Ac.inDocument27 pagesPGED Part-I Paper-II Unit-4: Transfer of Learning: Concept and Types of Transfer Papiyaupadhyay@wbnsou - Ac.inneel721507Pas encore d'évaluation

- No LiabilityDocument1 pageNo Liabilityneel721507Pas encore d'évaluation

- WHO 2019 nCoV Clinical 2020.5 EngDocument62 pagesWHO 2019 nCoV Clinical 2020.5 EngTemis Edwin Guzman MartinezPas encore d'évaluation

- PGED - Reduced SyllabusDocument18 pagesPGED - Reduced Syllabusneel721507Pas encore d'évaluation

- Education - English June 2019Document8 pagesEducation - English June 2019sudip surPas encore d'évaluation

- NG CalciumDocument36 pagesNG CalciumSandeep ElluubhollPas encore d'évaluation

- Ivermectin MedRxivDocument15 pagesIvermectin MedRxivneel721507Pas encore d'évaluation

- JhargramDocument3 pagesJhargramneel721507Pas encore d'évaluation

- Basaran 2013Document2 pagesBasaran 2013neel721507Pas encore d'évaluation

- Application For General Transfer SSCDocument3 pagesApplication For General Transfer SSCneel721507Pas encore d'évaluation

- Aldol Condensation Reaction: Charles-Adolphe Wurtz in 1872Document11 pagesAldol Condensation Reaction: Charles-Adolphe Wurtz in 1872neel721507Pas encore d'évaluation

- Carbonyl ChemistryDocument63 pagesCarbonyl Chemistryelgendy1204100% (3)

- Chapter 12 Mechanism of Reaction: Aldol CondensationDocument17 pagesChapter 12 Mechanism of Reaction: Aldol CondensationTiya KapoorPas encore d'évaluation

- Aldol CondensationDocument18 pagesAldol CondensationAnurag Uniyal100% (1)

- Publication 2 1424 1587Document12 pagesPublication 2 1424 1587neel721507Pas encore d'évaluation

- LSD-NEERI - Water Quality AnalysisDocument8 pagesLSD-NEERI - Water Quality Analysisneel721507Pas encore d'évaluation

- Chapter 3Document17 pagesChapter 3neel721507Pas encore d'évaluation

- Anti Tpo Vs PregnancyDocument9 pagesAnti Tpo Vs Pregnancyneel721507Pas encore d'évaluation

- Journal of Advanced Research: Muhammad Adnan Shereen, Suliman Khan, Abeer Kazmi, Nadia Bashir, Rabeea SiddiqueDocument8 pagesJournal of Advanced Research: Muhammad Adnan Shereen, Suliman Khan, Abeer Kazmi, Nadia Bashir, Rabeea SiddiqueAnmol YadavPas encore d'évaluation

- CH307 Inorganic Kinetics: Dr. Andrea Erxleben Room C150 Andrea - Erxleben@nuigalway - IeDocument50 pagesCH307 Inorganic Kinetics: Dr. Andrea Erxleben Room C150 Andrea - Erxleben@nuigalway - Ieneel721507Pas encore d'évaluation

- ChannelDocument1 pageChannelneel721507Pas encore d'évaluation

- Form 16Document4 pagesForm 16neel721507Pas encore d'évaluation

- Bents RuleDocument1 pageBents Ruleneel721507Pas encore d'évaluation

- Escudero CaseDocument24 pagesEscudero CaseWendy PeñafielPas encore d'évaluation

- Sa Lesson13Document1 pageSa Lesson13api-263754616Pas encore d'évaluation

- Part 2 Tax SyllabusDocument5 pagesPart 2 Tax SyllabusRyoPas encore d'évaluation

- Withholding Return SampleDocument15 pagesWithholding Return Sampleoyesigye DennisPas encore d'évaluation

- Yamaha Music India Private Limited Proforma Invoice: Total 781.00 0.00 0.00Document1 pageYamaha Music India Private Limited Proforma Invoice: Total 781.00 0.00 0.00sammyPas encore d'évaluation

- Invoice 27.07-29.07Document1 pageInvoice 27.07-29.07VIPUL SHARMAPas encore d'évaluation

- System of Cess in India: What Is A Cess?Document6 pagesSystem of Cess in India: What Is A Cess?Srikanth RollaPas encore d'évaluation

- Ageasfederal: February 18, 2021Document3 pagesAgeasfederal: February 18, 2021Jayanth RPas encore d'évaluation

- Accounting - UCO Bank - Assignment4Document1 pageAccounting - UCO Bank - Assignment4KummPas encore d'évaluation

- Kendriya Vidyalaya: Bulandshahar: Near Numaise Ground, Bulandshahar (U.P.) - 203001Document10 pagesKendriya Vidyalaya: Bulandshahar: Near Numaise Ground, Bulandshahar (U.P.) - 203001Nihit SandPas encore d'évaluation

- CS Ratio Analysis - March 2020Document2 pagesCS Ratio Analysis - March 2020Onaderu Oluwagbenga EnochPas encore d'évaluation

- Rmo No. 7-2015 Annex ADocument12 pagesRmo No. 7-2015 Annex Ablackcholo100% (1)

- Mvat f231Document5 pagesMvat f231pgotaphoePas encore d'évaluation

- Taxaation Sankalp'Document12 pagesTaxaation Sankalp'Sankalp PariharPas encore d'évaluation

- Ecojen Holdings LimitedDocument1 pageEcojen Holdings LimitedABOBO 254Pas encore d'évaluation

- Taxes To Be Subsumed Under GSTDocument3 pagesTaxes To Be Subsumed Under GSTShreyaPas encore d'évaluation

- Bank of America NT & Sa, The Commissioner of Internal RevenueDocument4 pagesBank of America NT & Sa, The Commissioner of Internal RevenueHADTUGIPas encore d'évaluation

- Search and SeizureDocument26 pagesSearch and SeizureShivansh JaiswalPas encore d'évaluation

- Ias 10 Q7Document2 pagesIas 10 Q7natlyhPas encore d'évaluation

- Gross-Estate-Lecture-January-7-2020 2Document12 pagesGross-Estate-Lecture-January-7-2020 2jonahPas encore d'évaluation

- Income Tax Return For Senior CityzenDocument27 pagesIncome Tax Return For Senior CityzenAbhay SinghPas encore d'évaluation

- RPH 1Document2 pagesRPH 1Amor VillaPas encore d'évaluation