Académique Documents

Professionnel Documents

Culture Documents

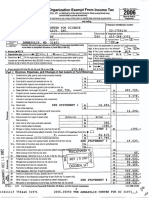

Short Form .EZ Return of Organization Exempt From Income Tax 2012

Transféré par

FIXMYLOANTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Short Form .EZ Return of Organization Exempt From Income Tax 2012

Transféré par

FIXMYLOANDroits d'auteur :

Formats disponibles

l efile GRAPHIC

Form

p rint

- DO NOT PROCESS

Internal Revenue Service

DLN: 93492226013563

Short Form

Return of Organization Exempt From Income Tax

990 .EZ

Department of the Treasury

As Filed Data -

0- Sponsoring organizations of donor advised funds, organizations that operate one or more hospital facilities, and

certain controlling organizations as defined in section 512(b)(13) must file Form 990 (see instructions)

All other organizations with gross receipts less than $200,000 and total assets less than $500,000 at the end of the

year may use this form

1- The organization may have to use a copy of this return to satisfy state reporting requirements

For the 2012 calendar year, or tax year beginning 01-01-2012

Check if applicable

C Name of organization

EDUCATING FOR JUSTICE

IlAddress change

D Employer identification number

81-0550209

E Telephone number

(732) 988-7322

r-Terminated

F

, and ending 12-31-2012

Number and street (or P 0 box, if mail is not delivered to street address) Room/suite

646 COOKMAN AVENUE

Initial return

2012

Under section 501 (c), 527, or 4947(a)(1) of the Internal Revenue Code

(except black lung benefit trust or private foundation)

A

B

I! Name change

OMB No 1545-1150

City or town, state or country, and ZIP + 4

ASBURY PARK, NJ 07712

Amended return

F Group Exemption

Number

1-

IlApplication pending

H

G Accounting Method

I Website: I

F'Cash

r'Accrual

Check - F if the organization is not

required to attach Schedule B

(Form 990, 990-EZ, or 990-PF)

Other (specify) 0-

N/A

3 Tax-exempt status (check only one)-I_ 501(c)(3)9fl 501(c)(

) A(insert no )fl 4947(a)(1) or r- 527

K Check 0-1

if the organization is not a section 509(a)(3) supporting organization or a section 527 organization and its gross receipts are

normally not more than $50,000 A Form 990-EZ or Form 990 return is not required though Form 990-N (e-postcard) may be required (see

instructions) But if the organization chooses to file a return, be sure to file a complete return

L Add lines 5b, 6c, and 7b, to line 9 to determine gross receipts If gross receipts are $200,000 or more, or if total assets (Part II, line 25,

column (B) below) are $500,000 or more, file Form 990 instead of Form 990-EZ

0-$ 78,329

Revenue , Expenses, and Changes in Net Assets or Fund Balances (see the instructions for Part I)

Check if the organization used Schedule 0 to respond to any question in this Part I

F

1

Contributions, gifts, grants, and similar amounts received

Program service revenue including government fees and contracts

Membership dues and assessments

Investment income

5a

?D

1

a

CD

Cc

. .

. .

. .

. .

. .

. .

. .

23,359

54,970

Sc

6d

Gross amount from sale of assets other than inventory

cost or other basis and sales expenses

5a

Less

Gain or (loss) from sale of assets other than inventory (Subtract line 5b from line 5a)

Sb

0

.

Gaming and fundraising events

Gross income from gaming (attach Schedule G if greater than $15,000)

Gross income from fundraising events (not including $

from fundraising events reported on line 1) (attach Schedule G if the

direct expenses from gaming and fundraising events

6a

6b

6c

of contributions

Less

Net income or (loss) from gaming and fundraising events (add lines 6a and 6b and subtract line 6c)

7a

. .

sum of such gross income and contributions exceeds $15,000)

a,

. .

Gross sales of inventory, less returns and allowances

cost of goods sold

Less

7c

10

11

Benefits paid to or for members

11

12

Salaries, other compensation, and employee benefits

12

13

Professional fees and other payments to independent contractors

13

14

Occupancy, rent, utilities, and maintenance

Grants and similar amounts paid (list in Schedule O)

10

Total revenue . Add lines 1, 2, 3, 4, 5c, 6d, 7c, and 8

7b

.

Other revenue (describe in Schedule O )

7a

Gross profit or (loss) from sales of inventory (Subtract line 7b from line 7a)

.

42,000

14

15

4 , 692

16

32,029

111k.

17

84,776

Printing , publications , postage , and shipping

16

Other expenses (describe in Schedule O)

17

Total expenses . Add lines 10 through 16

18

Excess or (deficit) for the year (Subtract line 17 from line 9)

19

Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with

78,329

15

end-of-year figure reported on prior year's return)

.

.

20

Other changes in net assets or fund balances (explain in Schedule O)

21

Net assets or fund balances at end of year Combine lines 18 through 20

For Paperwork Reduction Act Notice, see the separate instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18

-6,447

19

-4,568

20

.

.

Cat No 106421

6,055

.

.

.

.

21

-11,015

Form 990-EZ (2012)

Form 990-EZ ( 2012)

Page 2

Balance Sheets ( see the instructions for Part II)

Check if the organization used Schedule 0 to respond to any question in this Part II

. .

. .

. .

. .

(A) Beginning of year

22 Cash, savings, and investments

. .

. .

. .

. .

.F-

(B) End of year

9,432 22

23

24

9,432 25

14,000 26

15,917

27 Net assets or fund balances (line 27 of column ( B) must agree with line 21 )

-4,568 27

-11,015

23 Land and buildings

24 Other assets (describe in Schedule 0)

25 Total assets

26 Total liabilities (describe in Schedule 0)

1:M-Oili$

Statement of Program Service Accomplishments

(see the instructions for Part III)

Check if the organization used Schedule 0 to respond to any question in this Part III

What is the organization's primary exempt purpose?

AWARENESS ABOUT SOCIAL INJUSTICE

Describe the organization's program service accomplishments for each of its three largest program services, as

measured by expenses In a clear and concise manner, describe the services provided, the number of persons

benefited, and other relevant information for each program title

28TRAVEL, MEETING, GRASSROOTS ACTIVISM CONCERNING AWARENESS ABOUT ISSUES OF SOCIAL

INJUSTICE

(Grants $ )

If this amount includes foreign grants, check here .

0- F

29

(Grants $

4,902

4,902

Expenses

(Required for section 501

(c)(3) and 501(c)(4)

organizations and section

4947(a)(1) trusts,

optional for others

28a

If this amount includes foreign grants, check here

0- (-

29a

If this amount includes foreign grants, check here

0- (-

30a

23,848

30

(Grants $

31 Other program services (describe in Schedule O )

(Grants $ )

If this amount includes foreign grants, check here

32 Total program service expenses (add lines 28a through 31a)

j

v,

0- F

^

31a

32

23,848

List of Officers, Directors , Trustees, and Key Employees List each one even if not compensated (see the instructions for Part IV)

Check if the organization used Schedule 0 to respond to any question in this Part IV.

.

.

.

.

.

.

.

.

.

.

(a) Name and title

JAMES W KEADY

PRESIDENT

(b) Average

hours per week

devoted to position

40 00

(c)Reportable

compensation

(Forms W-2/1099MISC) (if not paid ,

enter -0-)

(d) Health benefits,

contributions to

employee benefit plans,

and deferred

compensation

42,000

2,509

(e) Estimated amount

of other compensation

Form 990-EZ (2012)

Form 990-EZ (2012)

Page 3

NZW Other Information (Note the Schedule A and personal benefit contract statement requirements in the

instructions for Part V ) Check if the organization used Schedule 0 to respond to any question in this Part V

.F

Yes

33

34

35a

No

Did the organization engage in any significant activity not previously reported to the IRS? If "Yes," provide a

detailed description of each activity in Schedule 0

. . . . . . . . . . . . . . . .

33

No

Were any significant changes made to the organizing or governing documents? If "Yes," attach a conformed copy

of the amended documents if they reflect a change to the organization's name Otherwise, explain the change

on Schedule 0 (see instructions)

. . . . . . . . . . . . . . . . . . . . . . .

34

No

35a

No

Did the organization have unrelated business gross income of $1,000 or more during the year from business

activities (such as those reported on lines 2, 6a, and 7a, among others) ?

. . . . . . . . . . .

If "Yes," to line 35a, has the organization filed a Form 990-T for the year? If "No," provide an explanation in Schedule 0 35b

Was the organization a section 501 (c)(4), 501 (c)(5), or 501(c)(6) organization subject to section 6033(e)

notice, reporting, and proxy tax requirements during the year? If "Yes," complete Schedule C, Part III

35c

No

36

Did the organization undergo a liquidation, dissolution, termination, or significant disposition of net assets during

the year? If"Yes,"complete applicable parts of Schedule N

. . . . . . . . . . . . .

36

No

37a

Enter amount of political expenditures, direct or indirect, as described in the instructions 0-

37b

No

38a

No

40b

No

40e

No

b

38a

Did the organization file Form 1120 -POL for this year?

1 37a

Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or were

any such loans made in a prior year and still outstanding at the end of the tax year covered by this return?

b

39

If "Yes," complete Schedule L, Part II and enter the total amount involved

38b

Section 501(c)(7) organizations Enter

Initiation fees and capital contributions included on line 9

Gross receipts, included on line 9, for public use of club facilities

40a

39a

39b

Section 501(c)(3) organizations Enter amount of tax imposed on the organization during the year under

section 49111111111

, section 4912 1111111

, section 4955 1111111

Section 501(c)(3) and 501(c)(4) organizations Did the organization engage in any section 4958 excess benefit

transaction during the year, or did it engage in an excess benefit transaction in a prior year that has not been

reported on any of its prior Forms 990 or 990-EZ? If "Yes," complete Schedule L, Part I

. . . . . .

Section 501(c)(3) and 501(c)(4) organizations Enter amount of tax imposed on organization managers or

disqualified persons during the year under sections 4912, 4955, and 4958

. . .

Section 501(c)(3) and 501(c)(4) organizations Enter amount of tax on line 40c reimbursed by the organization

. . . . . . . . . . . . . . . . . . . . . . . . . . .

All organizations At any time during the tax year, was the organization a party to a prohibited tax shelter

transaction? If "Yes," complete Form 8886-T

. . . . . . . . . . . . . . . . . . . .

41

42a

List the states with which a copy of this return is filed 1Pr

The organization's books are in care ofd ]AMES W KEADY

Telephone no lk- (732) 988-7322

Located at 1111111 1201 THIRD AVENUE SPRING LAKE, NE

ZIP +4

07762

b At any time during the calendar year, did the organization have an interest in or a signature or other authority

over a financial account in a foreign country (such as a bank account, securities account, or other financial

account) ?

Yes

No

42b

No

42c

No

If "Yes," enter the name of the foreign country 0See the instructions for exceptions and filing requirements for Form TD F 90- 22.1, Report of Foreign Bank and

Financial Accounts.

c

At any time during the calendar year, did the organization maintain an office outside the U S ?

If "Yes," enter the name of the foreign country 0-

43

Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 -Check here .

.

and enter the amount of tax-exempt interest received or accrued during the tax year

. . . .

I 43

Yes

44a

Did the organization operate one or more hospital facilities during the year? If "Yes,"Form 990 must be completed

instead of Form 990-EZ

. . . . . . . . . . . . . . . . . . . . . . . . . .

Did the organization receive any payments for indoor tanning services during the year? .

If "Yes," to line 44c, has the organization filed a Form 720 to report these payments? If "No, "provIde an

explanation in Schedule 0

. . . . . . . . . . . . . . . . . . . . . . . . .

45a

No

Did the organization maintain any donor advised funds during the year? If "Yes," Form 990 must be completed instead of

Form 990- EZ

Did the organization have a controlled entity within the meaning of section 512(b)(13)? .

44a

No

44b

No

44c

No

44d

.

45b Did the organization receive any payment from or engage in any transaction with a controlled entity within the

meaning of section 512(b)(13)? If "Yes," Form 990 and Schedule R may need to be completed instead of

Form 990-EZ (see instructions)

45a

No

45b

No

Form 990-EZ (2012)

Form 990-EZ (2012)

Page 4

No

46

Did the organization engage, directly or indirectly, in political campaign activities on behalf of or in opposition to

candidates for public office? If "Yes," complete Schedule C, Part I

. . . . . . . . . . .

46

No

Section 501 ( c)(3) organizations only

All section 501(c)(3) organizations must answer questions 47-49b and 52, and complete the tables for lines 50

and 51

Milil"i

Check if the organization used Schedule 0 to respond to any question in this Part VI

. .

. .

. .

. .

. .

. .

. .

. .1

Yes

47

No

Did the organization engage in lobbying activities or have a section 501(h) election in effect during the tax year?

If "Yes," complete Schedule C, Part II

. . . . . . . . . . . . . . . . . . . .

47

No

48

Is the organization a school as described in section 170(b)(1)(A)(ii)? If "Yes," complete Schedule E

48

No

49a

Did the organization make any transfers to an exempt non-charitable related organization?

No

If "Yes," was the related organization a section 527 organization? .

50

49a

49b

Complete this table for the organization's five highest compensated employees (other than officers, directors, trustees and key

employees) who each received more than $100,000 of compensation from the organization If there is none, enter "None "

(a) Name and title of each employee paid

more than $100,000

(b) Average

hours per week

devoted to position

(c) Reportable

compensation

(Forms W-2/1099MISC)

(d) Health benefits,

contributions to

employee benefit plans,

and deferred

compensation

(e) Estimated amount

of other compensation

NONE

Total number of other employees paid over $100,000

51

. sk.

Complete this table for the organization's five highest compensated independent contractors who each received more than $100,000

of compensation from the organization If there is none, enter "None "

(a) Name and address of each independent contractor paid more than $100,000

NONE

d

52

Total number of other independent contractors each receiving over $10

Did the organization complete Schedule A? NOTE: All Section 501(c)(

nonexempt charitable trusts must attach a completed Schedule A .

Under penalties of perjury, I declare that I have examined this return , including acco

knowledge and belief, it is true, correct , and complete . Declaration of preparer (othe

knowledge.

Sign

Signature of officer

Here

JAMES W KEADY JAMES W KEADY

Type or print name and title

Print/Type preparer' s name

Paid

Pre pare r

Use Only

Firm's name

Preparers signature

PAUL] KEADY CPA

I

0- HUDY MCCARTHY DE LUCA LLP

Firm's address 1-104 UNION AVENUE

MANASQUAN, NJ

08736

May the IRS discuss this return with the preparer shown above? See instructio

(b) Type of service

(c) Compensation

l efile GRAPHIC p rint - DO NOT PROCESS

As Filed Data -

DLN: 93492226013563

OMB No 1545-0047

SCHEDULE A

Public Charity Status and Public Support

(Form 990 or 990EZ)

2012

Complete if the organization is a section 501(c)( 3) organization or a section

4947( a)(1) nonexempt charitable trust.

Department of the Treasury

Internal Revenue Service

^ Attach to Form 990 or Form 990-EZ. ^ See separate instructions.

Name of the organization

EDUCATING FOR JUSTICE

Employer identification number

1 81-0550209

Reason for Public Charity Status (All organizations must complete this part.) See instructions.

The organi zation is not a private foundation because it is (For lines 1 through 11, check only one box )

1

A church, convention of churches, or association of churches described in section 170 ( b)(1)(A)(i).

A school described in section 170 (b)(1)(A)(ii). (Attach Schedule E )

A hospital or a cooperative hospital service organization described in section 170(b)(1)(A)(iii).

fl

A medical research organization operated in conjunction with a hospital described in section 170 (b)(1)(A)(iii). Enter the

hospital's name, city, and state

An organization operated for the benefit of a college or university owned or operated by a governmental unit described in

section 170 ( b)(1)(A)(iv ). (Complete Part II )

fl

A federal, state, or local government or governmental unit described in section 170(b)(1)(A)(v).

An organization that normally receives a substantial part of its support from a governmental unit or from the general public

described in section 170 ( b)(1)(A)(vi ). (Complete Part II )

A community trust described in section 170 ( b)(1)(A)(vi ) (Complete Part II )

An organization that normally receives

(1) more than 331/3% of its support from contributions, membership fees, and gross

receipts from activities related to its exempt functions-subject to certain exceptions, and (2) no more than 331/3% of

its support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses

acquired by the organization after June 30, 1975 See section 509 ( a)(2). (Complete Part III )

10

fl

An organization organized and operated exclusively to test for public safety See section 509(a)(4).

11

An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of

one or more publicly supported organizations described in section 509 ( a)(1) or section 509(a )( 2) See section 509 ( a)(3). Check

the box that describes the type of supporting organization and complete lines Ile through 11 h

a

fl Type I

b

1 Type II

c

fl Type III - Functionally integrated

d

(- Type III - Non - functionally integrated

(-

By checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified persons

other than foundation managers and other than one or more publicly supported organizations described in section 509 ( a)(1 ) or

section 509(a)(2)

If the organization received a written determination from the IRS that it is a Type I, Type II, orType III supporting organization,

check this box

(Since August 17, 2006, has the organization accepted any gift or contribution from any of the

following persons?

(i) A person who directly or indirectly controls , either alone or together with persons described in (ii)

Yes

No

f

g

and (iii) below, the governing body of the supported organization?

11g(i)

(ii) A family member of a person described in (i) above?

11g(ii)

(iii) A 35% controlled entity of a person described in (i) or (ii) above?

11g(iii)

Provide the following information about the supported organization(s)

(i) Name of

supported

organization

(ii) EIN

(iii) Type of

organization

(described on

lines 1- 9 above

or IRC section

(see

instructions))

(iv) Is the

organization in

col (i) listed in

your governing

document?

Yes

No

(v) Did you notify

the organization

in col (i) of your

support?

Yes

(vi) Is the

organization in

col (i) organized

in the U S ?

No

Yes

(vii) Amount of

monetary

support

No

Total

For Paperwork Reduction Act Notice, see the Instructions for Form 990 or 990EZ .

Cat No 11285F

ScheduleA(Form 990 or 990-EZ)2012

Schedule A (Form 990 or 990-EZ) 2012

MU^

Page 2

Support Schedule for Organizations Described in Sections 170(b )( 1)(A)(iv) and 170 ( b)(1)(A)(vi)

(Complete only if you checked the box on line 5, 7, or 8 of Part I or if the organization failed to qualify under

Part III. If the organization fails to qualify under the tests listed below, please complete Part III.)

Section A . Public Support

Calendar year ( or fiscal year beginning

in) 11111

1

Gifts, grants, contributions, and

membership fees received (Do not

include any "unusual

grants ")

2

Tax revenues levied for the

organization's benefit and either

paid to or expended on its

behalf

3

The value of services or facilities

furnished by a governmental unit to

the organization without charge

4

Total .Add lines 1 through 3

5

The portion of total contributions

by each person (other than a

governmental unit or publicly

supported organization) included on

line 1 that exceeds 2% of the

amount shown on line 11, column

(f)

6

Public support . Subtract line 5 from

line 4

(a) 2008

(b) 2009

(c) 2010

(d) 2011

(e) 2012

(f) Total

(d) 2011

(e) 2012

(f) Total

Section B. Total Su pp ort

Calendar year ( or fiscal year beginning

(a) 2008

(b) 2009

in) ^

7

Amounts from line 4

Gross income from interest,

8

dividends, payments received on

securities loans, rents, royalties

and income from similar

sources

9

Net income from unrelated

business activities, whether or not

the business is regularly carried

on

Other income Do not include gain

10

or loss from the sale of capital

assets (Explain in Part IV )

Total support (Add lines 7 through

11

10)

12

Gross receipts from related activities, etc (see instructions)

13

(c) 2010

12

First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a 501(c)(3) organization, check

this box and stop here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .ItE

Section C. Com p utation of Public Su pp ort Percenta g e

14

Public support percentage for 2012 (line 6, column (f) divided by line 11, column (f))

14

15

Public support percentage for 2011 Schedule A, Part II, line 14

15

0 %

16a

331 / 3%support test - 2012 . If the organization did not check the box on line 13, and line 14 is 33 1/3% or more, check this box

and stop here . The organization qualifies as a publicly supported organization

b 331 / 3%support test - 2011 . If the organization did not check a box on line 13 or 16a, and line 15 is 33 1/3% or more, check this

box and stop here . The organization qualifies as a publicly supported organization

17a 10%-facts-and -circumstances test-2012 . If the organization did not check a box on line 13, 16a, or 16b, and line 14

is 10% or more, and if the organization meets the "facts-and-circumstances" test, check this box and stop here . Explain

in Part IV how the organization meets the "facts-and-circumstances" test The organization qualifies as a publicly supported

organization

b 10%-facts-and-circumstances test - 2011 . If the organization did not check a box on line 13, 16a, 16b, or 17a, and line

15 is 10% or more, and if the organization meets the "facts- and-circumstances" test, check this box and stop here.

Explain in Part IV how the organization meets the "facts-and-circumstances" test The organization qualifies as a publicly

supported organization

18

Private foundation . If the organization did not check a box on line 13, 16a, 16b, 17a, or 17b, check this box and see

instructions

Schedule A (Form 990 or 990-EZ) 2012

Schedule A (Form 990 or 990-EZ) 2012

Page 3

Support Schedule for Organizations Described in Section 509(a)(2)

(Complete only if you checked the box on line 9 of Part I or if the organization failed to qualify under

Part II. If the organization fails to qualify under the tests listed below, please complete Part II.)

Section A . Public Support

IMMITM

Calendar year ( or fiscal year beginning

in) 11111

1

Gifts, grants, contributions, and

membership fees received (Do not

include any "unusual grants ")

2

Gross receipts from admissions,

merchandise sold or services

performed, or facilities furnished in

any activity that is related to the

organization's tax-exempt

purpose

3

Gross receipts from activities that

are not an unrelated trade or

business under section 513

4

Tax revenues levied for the

organization's benefit and either

paid to or expended on its

behalf

5

The value of services or facilities

furnished by a governmental unit to

the organization without charge

6

Total . Add lines 1 through 5

(a) 2008

(b) 2009

(c) 2010

(d) 2011

(e) 2012

(f) Total

21,960

14,653

29,072

29,735

23,359

118,779

42,788

76,213

80,782

68,692

54,970

323,445

64,748

90,866

109,854

98,427

78,329

442,224

7a

Amounts included on lines 1, 2,

and 3 received from disqualified

persons

b Amounts included on lines 2 and 3

received from other than

disqualified persons that exceed

the greater of$5,000 or 1% of the

amount on line 13 for the year

c Add lines 7a and 7b

8

Public support (Subtract line 7c

from line 6 )

442,224

Section B. Total Su pp ort

Calendar year ( or fiscal year beginning

in) ^

9

10a

Amounts from line 6

(a) 2008

(b) 2009

(c) 2010

64,748

90,866

21

(d) 2011

109,854

(e) 2012

98,427

78,329

(f) Total

442,224

Gross income from interest,

dividends, payments received on

securities loans, rents, royalties

and income from similar

22

sources

Unrelated business taxable

income (less section 511 taxes)

from businesses acquired after

June 30, 1975

1

22

21

c

Add lines 10a and 10b

Net income from unrelated

11

business activities not included

in line 10b, whether or not the

business is regularly carried on

Other income Do not include

12

gain or loss from the sale of

capital assets (Explain in Part

IV )

Total support . (Add lines 9, 1Oc,

13

442,246

11, and 12 )

14

First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a 501(c)(3) organization,

check this box and stop here

Section C. Computation of Public Support Percentage

15

Public support percentage for 2012 (line 8, column (f) divided by line 13, column (f))

15

100 000 %

b

16

Public support percentage from 2011 Schedule A, Part III, line 15

16

95 690 %

Section D . Com p utation of Investment Income Percenta g e

17

Investment income percentage for 2012 (line 10c, column (f) divided by line 13, column (f))

17

0 %

18

Investment income percentage from 2011 Schedule A, Part III, line 17

18

0 %

19a

331 / 3%support tests-2012 . If the organization did not check the box on line 14, and line 15 is more than 33 1/3%, and line 17 is not

more than 33 1/3%, check this box and stop here . The organization qualifies as a publicly supported organization

331 / 3%support tests- 2011 . If the organization did not check a box on line 14 or line 19a, and line 16 is more than 33 1/3% and line 18

is not more than 33 1/3%, check this box and stop here . The organization qualifies as a publicly supported organization

lk'FPrivate foundation . If the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions

b

20

Schedule A (Form 990 or 990- EZ) 2012

Schedule A (Form 990 or 990-EZ) 2012

Page 4

Supplemental Information . Complete this part to provide the explanations required by Part II, line 10;

Part II, line 17a or 17b; and Part III, line 12. Also complete this part for any additional information. (See

instructions).

Facts And Circumstances Test

Explanation

Schedule A (Form 990 or 990-EZ) 2012

efile GRAPHIC p rint - DO NOT PROCESS

As Filed Data -

DLN: 93492226013563

OMB No 1545 0047

SCHEDULE 0

Supplemental Information to Form 990 or 990-EZ

(Form 990 or 990-EZ)

Complete to provide information for responses to specific questions on

Form 990 or to provide any additional information .

Department of the Treasury

Internal Revenue Service

Identifier

Return

Reference

Open

Inspection

1- Attach to Form 990 or 990-EZ.

Name of the organization

EDUCATING FOR JUSTICE

2012

Employer identification number

Explanation

Form 990EZ, Part

I, Line 16

BANK FEES 784 CHARGE CARD INTEREST 1980 INSURANCE 3345 MARKETING 885 OFFICE EXPENSE

856 OTHER MISC EXPENSES 215 PAYROLL TAXES 3519 PROGRAM EXPENSES 6632 TELEPHONE 1289

TRAVEL 12524

Form 990EZ, Part

II, Line 26

CHARGE CARD PAYABLE 11799 11643 PAYROLL TAXES PAYABLE 2201 4274

Form 990, Part IX,

Line 24f

SOCIAL JUSTICE FILM PRODUCTION UTILITIES TELEPHONE

Vous aimerez peut-être aussi

- EVM CalculatorDocument1 pageEVM CalculatoranthonyconnorPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionPas encore d'évaluation

- Donors Capital Fund541934032 2007 048EED01SearchableDocument28 pagesDonors Capital Fund541934032 2007 048EED01Searchablecmf8926Pas encore d'évaluation

- Big 12 990 Report: Fiscal Year 2009Document45 pagesBig 12 990 Report: Fiscal Year 2009HuskieWirePas encore d'évaluation

- Uang Planner - Monthly Budget (English)Document20 pagesUang Planner - Monthly Budget (English)Jhoody Tandjung100% (1)

- CVP NotesDocument7 pagesCVP NotesKerrice RobinsonPas encore d'évaluation

- Accounting For Managerial Decisions Commerce DuniyaDocument477 pagesAccounting For Managerial Decisions Commerce DuniyaJignesh Togadiya100% (3)

- CIR vs. Lednicky (1964)Document1 pageCIR vs. Lednicky (1964)Emil BautistaPas encore d'évaluation

- Foundations of Modern Macroeconomics: B. J. Heijdra & F. Van Der PloegDocument46 pagesFoundations of Modern Macroeconomics: B. J. Heijdra & F. Van Der PloegWilliam Wilmer Quispe Vargas100% (2)

- Presentation David EatockDocument22 pagesPresentation David EatockpensiontalkPas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public Inspectiongeoffb1Pas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionpittscherylPas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionFrancis Wolfgang UrbanPas encore d'évaluation

- West Hempstead, NY Rotary Foundation IRS 990s, 2011-2013Document39 pagesWest Hempstead, NY Rotary Foundation IRS 990s, 2011-2013Peter M. HeimlichPas encore d'évaluation

- katrinaBlairDirectsVolunteers2011 841141304 - 201112 - 990EZDocument13 pageskatrinaBlairDirectsVolunteers2011 841141304 - 201112 - 990EZuncleadolphPas encore d'évaluation

- Short Form Form 990-EZ Return of Organization Exempt From Income TaxDocument9 pagesShort Form Form 990-EZ Return of Organization Exempt From Income TaxTheSceneOfTheCrimePas encore d'évaluation

- Threshold Foundation 2007 990Document28 pagesThreshold Foundation 2007 990TheSceneOfTheCrimePas encore d'évaluation

- United Council Form 990 2010Document18 pagesUnited Council Form 990 2010Signe BrewsterPas encore d'évaluation

- Justice 990 2009Document12 pagesJustice 990 2009TheSceneOfTheCrimePas encore d'évaluation

- DT 2007 990Document34 pagesDT 2007 990shimeralumPas encore d'évaluation

- NCCF 990Document235 pagesNCCF 990Anita LiPas encore d'évaluation

- FTG Irs Form 990-Ez 2010Document12 pagesFTG Irs Form 990-Ez 2010L. A. PatersonPas encore d'évaluation

- Threshold Foundation 2006 990Document29 pagesThreshold Foundation 2006 990TheSceneOfTheCrimePas encore d'évaluation

- Irs 990-Ez 2007Document3 pagesIrs 990-Ez 2007api-18678301Pas encore d'évaluation

- Institute For Liberty 202641983 2008 076b44aeDocument4 pagesInstitute For Liberty 202641983 2008 076b44aecmf8926Pas encore d'évaluation

- Short Form - EZ Return of Organization Exempt From Income TaxDocument6 pagesShort Form - EZ Return of Organization Exempt From Income TaxTheSceneOfTheCrime100% (1)

- FTG Irs Form 990-Ez 2008Document12 pagesFTG Irs Form 990-Ez 2008L. A. PatersonPas encore d'évaluation

- Return of Organization Exempt From Income Tax: HE Heartland Institute) 03 (312) 377-4000Document20 pagesReturn of Organization Exempt From Income Tax: HE Heartland Institute) 03 (312) 377-4000shimeralumPas encore d'évaluation

- Stanford 990Document208 pagesStanford 990coo9486Pas encore d'évaluation

- Tides Foundation 2006 990Document82 pagesTides Foundation 2006 990TheSceneOfTheCrimePas encore d'évaluation

- Form 990-EZ: Short Form Return of Organization Exempt From Income TaxDocument8 pagesForm 990-EZ: Short Form Return of Organization Exempt From Income TaxJakara MovementPas encore d'évaluation

- GPTMC - 2011 990Document47 pagesGPTMC - 2011 990juliabergPas encore d'évaluation

- 2013 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationDocument26 pages2013 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationNeil GillespiePas encore d'évaluation

- THE MS HERSHEY FOUNDATION 990 Return 2013Document41 pagesTHE MS HERSHEY FOUNDATION 990 Return 2013OpDeathEatersUS100% (1)

- ICIRR Money and OrganizationsDocument73 pagesICIRR Money and OrganizationsOmar Jonathan Pérez MoralesPas encore d'évaluation

- Return of Organization Exempt From Income TaxDocument11 pagesReturn of Organization Exempt From Income TaxEnvironmental Working GroupPas encore d'évaluation

- Harrisburg University's 2007 990 FormDocument39 pagesHarrisburg University's 2007 990 FormPennLivePas encore d'évaluation

- Justice 990 2003Document2 pagesJustice 990 2003TheSceneOfTheCrimePas encore d'évaluation

- PDC 2006Document10 pagesPDC 2006NC Policy WatchPas encore d'évaluation

- Return of Organization Exempt From Income TaxDocument30 pagesReturn of Organization Exempt From Income TaxshimeralumPas encore d'évaluation

- LJ LJ: Return of Organization Exempt From Income TaxDocument20 pagesLJ LJ: Return of Organization Exempt From Income Taxcmf8926Pas encore d'évaluation

- (Jjo Jmt4 - : Return of Organization Exempt From Income TaxDocument18 pages(Jjo Jmt4 - : Return of Organization Exempt From Income Taxcmf8926Pas encore d'évaluation

- NCJC 561348186 - 200712 - 990Document28 pagesNCJC 561348186 - 200712 - 990A.P. DillonPas encore d'évaluation

- Big 12 990 Report: Fiscal Year 2008Document35 pagesBig 12 990 Report: Fiscal Year 2008HuskieWirePas encore d'évaluation

- 990 Return of Organization Exempt From Income Tax: Use IRS East Carolina Development CO, INC 56-2044953Document10 pages990 Return of Organization Exempt From Income Tax: Use IRS East Carolina Development CO, INC 56-2044953NC Policy WatchPas encore d'évaluation

- 2014 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationDocument26 pages2014 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationNeil GillespiePas encore d'évaluation

- FreedomWorks Foundation 521526916 2006 0317E2DASearchableDocument25 pagesFreedomWorks Foundation 521526916 2006 0317E2DASearchablecmf8926Pas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921Document3 pagesShort Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921lesliebrodiePas encore d'évaluation

- Return of Organization Exempt From Income TaxDocument19 pagesReturn of Organization Exempt From Income TaxshimeralumPas encore d'évaluation

- Return of Organization Exempt From Income Tax: - Ogden, UtDocument24 pagesReturn of Organization Exempt From Income Tax: - Ogden, Utcmf8926Pas encore d'évaluation

- Return of Organization Exempt From Income TaxDocument30 pagesReturn of Organization Exempt From Income TaxChad BrewbakerPas encore d'évaluation

- Tides Foundation 2008 990Document163 pagesTides Foundation 2008 990TheSceneOfTheCrimePas encore d'évaluation

- 2013 Tax Return Documents Military Assistance MisignatureDocument25 pages2013 Tax Return Documents Military Assistance Misignatureapi-158836832Pas encore d'évaluation

- Cfi - Fy2004 - F990Document37 pagesCfi - Fy2004 - F990Didi RemezPas encore d'évaluation

- Silicon Valley Community Foundation 2008 990Document481 pagesSilicon Valley Community Foundation 2008 990TheSceneOfTheCrimePas encore d'évaluation

- KippdeltaDocument24 pagesKippdeltaapi-227462198Pas encore d'évaluation

- PDC - 2009 Tax ReturnDocument19 pagesPDC - 2009 Tax ReturnNC Policy WatchPas encore d'évaluation

- Wep 990 2006 581518182 - 200606 - 990Document34 pagesWep 990 2006 581518182 - 200606 - 990A.P. DillonPas encore d'évaluation

- Griffin Hospital, Derby, CT, IRS 990s, 2011-2014Document417 pagesGriffin Hospital, Derby, CT, IRS 990s, 2011-2014Peter M. HeimlichPas encore d'évaluation

- PSU Right To Know Report 2011Document71 pagesPSU Right To Know Report 2011OpDeathEatersUSPas encore d'évaluation

- ECDC 2009 Tax ReturnDocument27 pagesECDC 2009 Tax ReturnNC Policy WatchPas encore d'évaluation

- Silicon Valley Community Foundation 2009 990Document220 pagesSilicon Valley Community Foundation 2009 990TheSceneOfTheCrime100% (1)

- Institute For Humane Studies 941623852 2006 03A6717CDocument15 pagesInstitute For Humane Studies 941623852 2006 03A6717Ccmf8926Pas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryD'EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Mac ArthurDocument8 pagesMac ArthurPeter SullivanPas encore d'évaluation

- "LaVergne V U.S. House of Representatives." Docket # 1:17-cv-00793 ExhibitsDocument97 pages"LaVergne V U.S. House of Representatives." Docket # 1:17-cv-00793 ExhibitsFIXMYLOANPas encore d'évaluation

- Mac ArthurDocument8 pagesMac ArthurPeter SullivanPas encore d'évaluation

- Frederick John LaVergne Grew Up in West Long BranchDocument3 pagesFrederick John LaVergne Grew Up in West Long BranchFIXMYLOANPas encore d'évaluation

- Collateral Damage To Satellites From An EMP Attack: August 2010Document165 pagesCollateral Damage To Satellites From An EMP Attack: August 2010Nate LevinePas encore d'évaluation

- "LaVergne V U.S. House of Representatives." Docket # 1:17-cv-00793Document75 pages"LaVergne V U.S. House of Representatives." Docket # 1:17-cv-00793FIXMYLOAN100% (1)

- Lavergne V House - Complaint04292017 PDFDocument75 pagesLavergne V House - Complaint04292017 PDFFIXMYLOANPas encore d'évaluation

- Transparency and Anti-CorruptionDocument16 pagesTransparency and Anti-CorruptionFIXMYLOANPas encore d'évaluation

- DevelopmentDocument5 pagesDevelopmentFIXMYLOANPas encore d'évaluation

- State-Owned Enterprises and Designated MonopoliesDocument34 pagesState-Owned Enterprises and Designated MonopoliesFIXMYLOANPas encore d'évaluation

- Filed ComplaintDocument42 pagesFiled ComplaintFIXMYLOANPas encore d'évaluation

- Administrative and Institutional ProvisionsDocument5 pagesAdministrative and Institutional ProvisionsFIXMYLOANPas encore d'évaluation

- Exceptions and General ProvisionsDocument10 pagesExceptions and General ProvisionsFIXMYLOANPas encore d'évaluation

- Dispute SettlementDocument21 pagesDispute SettlementFIXMYLOANPas encore d'évaluation

- Final ProvisionsDocument5 pagesFinal ProvisionsFIXMYLOANPas encore d'évaluation

- Cooperation and Capacity BuildingDocument3 pagesCooperation and Capacity BuildingFIXMYLOANPas encore d'évaluation

- Intellectual PropertyDocument75 pagesIntellectual PropertyFIXMYLOANPas encore d'évaluation

- Small and Medium-Sized EnterprisesDocument3 pagesSmall and Medium-Sized EnterprisesFIXMYLOANPas encore d'évaluation

- Financial ServicesDocument55 pagesFinancial ServicesFIXMYLOANPas encore d'évaluation

- On Fundamental Principles and Rights at Work and Its Follow-Up (1998)Document14 pagesOn Fundamental Principles and Rights at Work and Its Follow-Up (1998)FIXMYLOANPas encore d'évaluation

- Regulatory CoherenceDocument7 pagesRegulatory CoherenceFIXMYLOANPas encore d'évaluation

- Cross-Border Trade in ServicesDocument17 pagesCross-Border Trade in ServicesFIXMYLOANPas encore d'évaluation

- Competition PolicyDocument8 pagesCompetition PolicyFIXMYLOANPas encore d'évaluation

- Government ProcurementDocument28 pagesGovernment ProcurementFIXMYLOANPas encore d'évaluation

- Competitiveness and Business FacilitationDocument3 pagesCompetitiveness and Business FacilitationFIXMYLOANPas encore d'évaluation

- EnvironmentDocument26 pagesEnvironmentFIXMYLOANPas encore d'évaluation

- Technical Barriers To TradeDocument38 pagesTechnical Barriers To TradeFIXMYLOANPas encore d'évaluation

- National Treatment and Market Access For GoodsDocument66 pagesNational Treatment and Market Access For GoodsFIXMYLOANPas encore d'évaluation

- Temporary Entry For Business PersonsDocument5 pagesTemporary Entry For Business PersonsFIXMYLOANPas encore d'évaluation

- Initial Provisions and General DefinitionsDocument11 pagesInitial Provisions and General DefinitionsFIXMYLOANPas encore d'évaluation

- Bienville Capital Managment - Presentation (December 2010)Document52 pagesBienville Capital Managment - Presentation (December 2010)bienvillecapPas encore d'évaluation

- Overhead Variance AnalysisDocument4 pagesOverhead Variance AnalysisKumardeep SinghaPas encore d'évaluation

- Development and Contemporary Issues in Management AccountingDocument15 pagesDevelopment and Contemporary Issues in Management AccountingFaizah MK67% (3)

- William Kristol's 1993 Memo - Defeating President Clinton's Health Care ProposalDocument5 pagesWilliam Kristol's 1993 Memo - Defeating President Clinton's Health Care Proposaldailykos75% (4)

- Cost Accounting Importance and Advantages of Cost Accounting PapaDocument14 pagesCost Accounting Importance and Advantages of Cost Accounting PapaCruz MataPas encore d'évaluation

- Chief Accountant duties and financial statements explainedDocument4 pagesChief Accountant duties and financial statements explainedANGIE BERNALPas encore d'évaluation

- Government Banking Relationship Manager in Portland ME Resume John QuartararoDocument3 pagesGovernment Banking Relationship Manager in Portland ME Resume John QuartararoJohnQuartararoPas encore d'évaluation

- ICSC - European Service Charge GuideDocument71 pagesICSC - European Service Charge GuideMiguel KreiselerPas encore d'évaluation

- Case 9-47 PDFDocument5 pagesCase 9-47 PDFMicha Maalouly33% (3)

- Assignment On Monetary Policy in BangladeshDocument6 pagesAssignment On Monetary Policy in BangladeshAhmed ImtiazPas encore d'évaluation

- Agamata Chapter 15Document18 pagesAgamata Chapter 15Pol AnduLanPas encore d'évaluation

- Text Messages From The BIR National Office: MemorandumDocument18 pagesText Messages From The BIR National Office: MemorandumFREMA BAGUHINPas encore d'évaluation

- FIAT Final ReportDocument51 pagesFIAT Final ReportbilljohnsonPas encore d'évaluation

- LGSF Notice To LGUsDocument2 pagesLGSF Notice To LGUsEmily SuazoPas encore d'évaluation

- Budgeting: Planning For Future Success Through Effective Resource AllocationDocument24 pagesBudgeting: Planning For Future Success Through Effective Resource AllocationM Javaid BokhariPas encore d'évaluation

- FRS 15, Tangible Fixed Assets - Technical Articles - ACCADocument7 pagesFRS 15, Tangible Fixed Assets - Technical Articles - ACCARamen PandeyPas encore d'évaluation

- Business FInance Quiz 2Document2 pagesBusiness FInance Quiz 2Pao C EspiPas encore d'évaluation

- Linhhoang Yearly BudgetDocument1 pageLinhhoang Yearly Budgetapi-402116735Pas encore d'évaluation

- Flexible Budgets, Variances, and Management Control: IIDocument44 pagesFlexible Budgets, Variances, and Management Control: IIkoolyogeshPas encore d'évaluation

- Thu Cs CostDocument31 pagesThu Cs CostthulasikPas encore d'évaluation

- Complex AssignmentDocument3 pagesComplex AssignmentvaniuchkaPas encore d'évaluation

- Monetary Policy: Fiscal Policy, Measures Employed by Governments To Stabilize TheDocument3 pagesMonetary Policy: Fiscal Policy, Measures Employed by Governments To Stabilize TheYan Lean DollisonPas encore d'évaluation