Académique Documents

Professionnel Documents

Culture Documents

US Department of Justice Official Release - 01259-096 HTM

Transféré par

legalmatters0 évaluation0% ont trouvé ce document utile (0 vote)

57 vues2 pagesTitre original

US Department of Justice Official Release - 01259-096 htm

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

57 vues2 pagesUS Department of Justice Official Release - 01259-096 HTM

Transféré par

legalmattersDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

FOR IMMEDIATE RELEASE CIV

TUESDAY, MARCH 3, 1998

U.S. SUES FIVE INDIVIDUALS FOR FRAUDULENT SCHEME

CONTRIBUTING TO THE FAILURE OF COREAST SAVINGS BANK

WASHINGTON, D.C. -- The United States has sued five

individuals alleging they engaged in a fraudulent conspiracy that

contributed to the failure of CorEast Savings Bank by funneling

millions of dollars in loans from CorEast and its predecessors

into several dubious New York City construction projects in which

the banks' chairman, Arthur G. Cohen, had secret, pecuniary

interests, the Department of Justice announced today.

The complaint--which alleges bank fraud, misapplication of

funds of a financial institution, bank bribery, illegal

participation in loans, falsification of bank records, false

statements to bank regulators, and conspiracy to violate federal

banking laws--asked for civil penalties of more than $100 million

under the provisions of the Financial Institutions Reform,

Recovery, and Enforcement Act of 1989 (FIRREA, 12 USC, § 1833a).

Assistant Attorney General Frank Hunger of the Civil

Division and U.S. Attorney Robert P. Crouch Jr. of Roanoke said

the complaint was filed under seal February 25 in U.S. District

Court in Roanoke, Virginia. The case was assigned to Chief Judge

Samuel G. Wilson, and the complaint was made public today.

Named as defendants were Arthur G. Cohen, a New York City

real estate developer who served on the boards and executive

committees of the Virginia banks; Marvin B. Tepper of Sands

Point, New York, and Steven M. Terk of New York City, who both

served on the boards and executive committees of the Virginia

banks; Lawrence M. Goodman of New York City, who is Cohen's

nephew and borrowed millions of dollars from the banks; and Ilyne

R. Mendelson of New York City, who was a lawyer for the banks.

The banks included First Federal Savings and Loan

Association of Roanoke; Colonial Savings and Loan Association of

Richmond; and CorEast Savings Bank, which was formed through the

merger of Colonial and First Federal in 1988. Cohen acquired

control of Colonial in 1984, First Federal in 1986 and CorEast in

1988. All were insured through the Federal Savings and Loan

Insurance Corporation and later through its successor, the

Federal Deposit Insurance Corporation (FDIC).

Hunger said, "Congress enacted FIRREA to combat and deter

fraudulent conduct that threatens the safety and soundness of the

nation's financial institutions. The message to the financial

community from the complaint should be clear and unambiguous: law

enforcement will not tolerate attempts to circumvent federal

banking laws or conceal unlawful conduct. The law requires, and

law enforcement expects, that individuals entrusted with the

management of financial institutions will abide by the law, all

regulatory requirements, and the highest standards of corporate

citizenship."

The Department also asked the court for an injunction to

enjoin Cohen from dissipating assets while the suit was pending.

In 1985, the complaint said, the Federal Home Loan Bank

Board (FHLBB) advised Cohen that federal regulations prohibited

direct and indirect transactions between federally-insured banks

and Cohen or his affiliates. The complaint alleged that Cohen

repeatedly told the FHLBB that he understood that he could not

have a personal interest in any project financed by the Virginia

banks.

Nonetheless, according to the complaint, Cohen caused the

Virginia banks to make $34.1 million in loans to New York City

cooperative conversion projects, while concealing from the

regulators and the boards of the banks that he shared in the

proceeds of loans and had other pecuniary interests in the

projects.

The complaint also asserts that Cohen's companies secretly

shared in the proceeds of loans from the Virginia banks.

According to the complaint, Cohen's companies were DCI

Contracting Corporation (an interior and architectural design

company), Kingswood Management Corp. (a real estate management

company), and Fleetwood Realty Corp. (a sales agent for various

projects). The scheme, according to the complaint, was

accomplished with the active participation of all defendants, and

concealed through fraudulent bank records and false statements to

bank regulators.

The complaint alleges that Cohen committed 23 violations of

federal banking law, including conspiracy, bank fraud,

misapplication of bank funds, bank bribery, illegal participation

in loans, false statements to bank regulators, and falsification

of bank records.

According to the complaint, Terk and Tepper allegedly

conspired to violate the law and caused the falsification of

board minutes, while Mendelson allegedly aided the conspiracy by

distributing loan proceeds for the benefit of Cohen and his

companies and through other actions. The complaint alleged that

Goodman, in conspiring to violate federal law, entered into an

unlawful quid pro quo arrangement by which Goodman agreed to use

Cohen's companies and pay them $1 million in overcharges and, in

exchange, Cohen caused CorEast to lend funds to Goodman to

compensate for the overcharges.

Under FIRREA, if found liable, the defendants face civil

penalties of up to $1 million for each violation and civil

penalties for the pecuniary losses to the Virginia banks and the

United States and the pecuniary gains of the defendants and

others.

Hunger praised the Federal Bureau of Investigation for its

efforts in conducting the investigation of this matter.

#####

98-096

Vous aimerez peut-être aussi

- 294 - $43 Trillion Dollar Lawsuit Awaits Obama White House and BanksDocument2 pages294 - $43 Trillion Dollar Lawsuit Awaits Obama White House and BanksDavid E RobinsonPas encore d'évaluation

- 11-04-01 Florida - Apparently Bankers Can Get Criminally IndictedDocument3 pages11-04-01 Florida - Apparently Bankers Can Get Criminally IndictedHuman Rights Alert - NGO (RA)Pas encore d'évaluation

- PENDING RICO CASE Part 1 Pages 1-100 Cheeks V Fort MyerDocument101 pagesPENDING RICO CASE Part 1 Pages 1-100 Cheeks V Fort MyerRonjoebonPas encore d'évaluation

- In Re First Alliance Mortgage Company, 471 F.3d 977, 1st Cir. (2006)Document37 pagesIn Re First Alliance Mortgage Company, 471 F.3d 977, 1st Cir. (2006)Scribd Government DocsPas encore d'évaluation

- 2010 0114 EnforcementMeasuresDocument2 pages2010 0114 EnforcementMeasuresShyamal PatelPas encore d'évaluation

- 5 Banks Sued For Illegal Foreclosures - Read Story and Complaint Here!!! Attorney General Coakley Sues Five Big Banks in Connection With Illegal Foreclosures and Loan Servicing Dec 1 2011Document62 pages5 Banks Sued For Illegal Foreclosures - Read Story and Complaint Here!!! Attorney General Coakley Sues Five Big Banks in Connection With Illegal Foreclosures and Loan Servicing Dec 1 201183jjmackPas encore d'évaluation

- Certified For Publication: Filed 8/24/11Document13 pagesCertified For Publication: Filed 8/24/11aorozcoirellPas encore d'évaluation

- 2014-05-12 US (Szymoniak) V Ace Doc 349, Order of Dismisal - First To File BarDocument12 pages2014-05-12 US (Szymoniak) V Ace Doc 349, Order of Dismisal - First To File Barlarry-612445Pas encore d'évaluation

- MRS V JPMC Doc 151-1, Fourth Amended Complaint, March 6, 2017Document88 pagesMRS V JPMC Doc 151-1, Fourth Amended Complaint, March 6, 2017FraudInvestigationBureau100% (2)

- Let The Lawsuits BeginDocument8 pagesLet The Lawsuits BegingoldkennyPas encore d'évaluation

- Elizabeth Warren "Government Hasn't Sufficiently Investigated Mortgage Abuses' See Video Link HereDocument5 pagesElizabeth Warren "Government Hasn't Sufficiently Investigated Mortgage Abuses' See Video Link Here83jjmackPas encore d'évaluation

- United States v. Cornier-Ortiz, 361 F.3d 29, 1st Cir. (2004)Document16 pagesUnited States v. Cornier-Ortiz, 361 F.3d 29, 1st Cir. (2004)Scribd Government DocsPas encore d'évaluation

- December 8, 2011 - The Federal Crimes Watch DailyDocument2 pagesDecember 8, 2011 - The Federal Crimes Watch DailyDouglas McNabbPas encore d'évaluation

- Not PrecedentialDocument8 pagesNot PrecedentialScribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Seventh CircuitDocument12 pagesUnited States Court of Appeals, Seventh CircuitScribd Government DocsPas encore d'évaluation

- Prosecuting Mortgage Document FraudDocument2 pagesProsecuting Mortgage Document FraudForeclosure Fraud100% (3)

- Class Action IL Amended Complaint FinalDocument75 pagesClass Action IL Amended Complaint FinalrodclassteamPas encore d'évaluation

- United States v. Wester, 90 F.3d 592, 1st Cir. (1996)Document12 pagesUnited States v. Wester, 90 F.3d 592, 1st Cir. (1996)Scribd Government DocsPas encore d'évaluation

- OcwensuitDocument123 pagesOcwensuitpatamia100% (1)

- Angela Sacchi V Mers June 24 2011 - HOMEOWNER SURVIVES MOTION TO DISMISS FAC IN CALIFORNIA-THIS JUDGE GETS ITDocument18 pagesAngela Sacchi V Mers June 24 2011 - HOMEOWNER SURVIVES MOTION TO DISMISS FAC IN CALIFORNIA-THIS JUDGE GETS IT83jjmackPas encore d'évaluation

- Aktham Abuhouran v. Christopher Melloney, 3rd Cir. (2010)Document9 pagesAktham Abuhouran v. Christopher Melloney, 3rd Cir. (2010)Scribd Government DocsPas encore d'évaluation

- 11-02-20 Exoneration of Countrywide's Angelo Mozilo Signals Ongoing Integrity Crisis of The US Justice SystemDocument3 pages11-02-20 Exoneration of Countrywide's Angelo Mozilo Signals Ongoing Integrity Crisis of The US Justice SystemHuman Rights Alert - NGO (RA)Pas encore d'évaluation

- Conway Release Aug 21Document4 pagesConway Release Aug 21mgreenPas encore d'évaluation

- United States v. Anthony F. Previte, 648 F.2d 73, 1st Cir. (1981)Document18 pagesUnited States v. Anthony F. Previte, 648 F.2d 73, 1st Cir. (1981)Scribd Government DocsPas encore d'évaluation

- United States v. Angela Khorozian, 333 F.3d 498, 3rd Cir. (2003)Document13 pagesUnited States v. Angela Khorozian, 333 F.3d 498, 3rd Cir. (2003)Scribd Government DocsPas encore d'évaluation

- Larry E. Clark and J. Elliott Knoll v. United Bank of Denver National Association, A National Banking Association, 480 F.2d 235, 10th Cir. (1973)Document7 pagesLarry E. Clark and J. Elliott Knoll v. United Bank of Denver National Association, A National Banking Association, 480 F.2d 235, 10th Cir. (1973)Scribd Government DocsPas encore d'évaluation

- United States v. R. Peter Stanham, 11th Cir. (2010)Document44 pagesUnited States v. R. Peter Stanham, 11th Cir. (2010)Scribd Government DocsPas encore d'évaluation

- Complaint Final (B&W Petition)Document85 pagesComplaint Final (B&W Petition)jeremybwhitePas encore d'évaluation

- United States Court of Appeals, Second CircuitDocument9 pagesUnited States Court of Appeals, Second CircuitScribd Government DocsPas encore d'évaluation

- Intengan V CADocument2 pagesIntengan V CAMelissa S. Chua0% (1)

- United States v. Watlington, 4th Cir. (2008)Document28 pagesUnited States v. Watlington, 4th Cir. (2008)Scribd Government DocsPas encore d'évaluation

- American Surety Co. of New York v. Greek Catholic Union, 284 U.S. 563 (1931)Document5 pagesAmerican Surety Co. of New York v. Greek Catholic Union, 284 U.S. 563 (1931)Scribd Government DocsPas encore d'évaluation

- Superior Court of The State of California For The County of Los AngelesDocument31 pagesSuperior Court of The State of California For The County of Los AngelesmelaniesandlinPas encore d'évaluation

- Robert R. Wisdom Nancy J. Wisdom v. First Midwest Bank, of Poplar Bluff Jerry F. McLane Jerry Dorton Joey McLane, 167 F.3d 402, 1st Cir. (1999)Document9 pagesRobert R. Wisdom Nancy J. Wisdom v. First Midwest Bank, of Poplar Bluff Jerry F. McLane Jerry Dorton Joey McLane, 167 F.3d 402, 1st Cir. (1999)Scribd Government DocsPas encore d'évaluation

- United States v. Thomas A. Wilkinson, Iii, United States of America v. Edward M. Conk, 137 F.3d 214, 4th Cir. (1998)Document28 pagesUnited States v. Thomas A. Wilkinson, Iii, United States of America v. Edward M. Conk, 137 F.3d 214, 4th Cir. (1998)Scribd Government DocsPas encore d'évaluation

- Major Mortgage Firms Accused of Fraud May 2011 - From CONFIDENTIAL FEDERAL AUDITSDocument4 pagesMajor Mortgage Firms Accused of Fraud May 2011 - From CONFIDENTIAL FEDERAL AUDITS83jjmack100% (1)

- 23 RICO StatementDocument32 pages23 RICO Statementlarry-612445Pas encore d'évaluation

- Doc. 178 - Plaintiff Reply HSBC Motion To DismissDocument28 pagesDoc. 178 - Plaintiff Reply HSBC Motion To DismissR. Lance Flores100% (1)

- Filed U.S. Court of Appeals Eleventh Circuit NOV 25, 2008 Thomas K. Kahn ClerkDocument35 pagesFiled U.S. Court of Appeals Eleventh Circuit NOV 25, 2008 Thomas K. Kahn Clerkhakan.sengezenPas encore d'évaluation

- United States v. William H. Fairbanks, 541 F.2d 862, 10th Cir. (1976)Document5 pagesUnited States v. William H. Fairbanks, 541 F.2d 862, 10th Cir. (1976)Scribd Government DocsPas encore d'évaluation

- OCC - THE REGULATOR Stands in The Way of Potential Multi Billion Dollar Settlement - ForeclolsuresDocument6 pagesOCC - THE REGULATOR Stands in The Way of Potential Multi Billion Dollar Settlement - Foreclolsures83jjmackPas encore d'évaluation

- Hunton Williams Bar ComplaintDocument14 pagesHunton Williams Bar Complaintmary engPas encore d'évaluation

- Real Estate Fraud - Judge Charlene Edwards HoneywellDocument45 pagesReal Estate Fraud - Judge Charlene Edwards HoneywellRealEstateFraudPas encore d'évaluation

- 158-13 Ex M Proposed Fourth Amended Complaint Dated 3 6 2017Document89 pages158-13 Ex M Proposed Fourth Amended Complaint Dated 3 6 2017larry-612445Pas encore d'évaluation

- United States Court of Appeals, Sixth CircuitDocument8 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsPas encore d'évaluation

- Quiet TitleDocument35 pagesQuiet Titleboathook67% (9)

- United States v. Farhad Bakhtiar and Anthony McDonald, 994 F.2d 970, 2d Cir. (1993)Document14 pagesUnited States v. Farhad Bakhtiar and Anthony McDonald, 994 F.2d 970, 2d Cir. (1993)Scribd Government DocsPas encore d'évaluation

- Marshall Home Press ReleaseDocument2 pagesMarshall Home Press ReleaseZf4Bx9QPas encore d'évaluation

- FinalDocument9 pagesFinalnkirich richuPas encore d'évaluation

- Lopez v. JP Morgan Chase Huey Jen Chui Vice President Wamu Robo Signer 10-24-12 WWW - Courts.ca - Gov - OpinionsDocument19 pagesLopez v. JP Morgan Chase Huey Jen Chui Vice President Wamu Robo Signer 10-24-12 WWW - Courts.ca - Gov - Opinionstraderash1020Pas encore d'évaluation

- United States v. Mario Biaggi, Stanley Simon, Richard Biaggi, Peter Neglia, John Mariotta, and Bernard Ehrlich, 909 F.2d 662, 2d Cir. (1990)Document44 pagesUnited States v. Mario Biaggi, Stanley Simon, Richard Biaggi, Peter Neglia, John Mariotta, and Bernard Ehrlich, 909 F.2d 662, 2d Cir. (1990)Scribd Government DocsPas encore d'évaluation

- United States v. Robert J. McCarthy, 271 F.3d 387, 2d Cir. (2001)Document16 pagesUnited States v. Robert J. McCarthy, 271 F.3d 387, 2d Cir. (2001)Scribd Government DocsPas encore d'évaluation

- Jesner V Arab Bank (138 S.CTDocument40 pagesJesner V Arab Bank (138 S.CTJean MazeaudPas encore d'évaluation

- United States v. Henry C. Harenberg, 732 F.2d 1507, 10th Cir. (1984)Document12 pagesUnited States v. Henry C. Harenberg, 732 F.2d 1507, 10th Cir. (1984)Scribd Government DocsPas encore d'évaluation

- Jeff Brown Amended Complaint 2Document47 pagesJeff Brown Amended Complaint 2rodclassteam100% (2)

- United States v. O'Donnell, 1st Cir. (2016)Document14 pagesUnited States v. O'Donnell, 1st Cir. (2016)Scribd Government DocsPas encore d'évaluation

- Compliance Huawei Meng Wanzhou Case - Indictment: Compliance Huawei Meng Wanchou case, #2D'EverandCompliance Huawei Meng Wanzhou Case - Indictment: Compliance Huawei Meng Wanchou case, #2Pas encore d'évaluation

- Democracy Inc.: How Members of Congress Have Cashed In On Their JobsD'EverandDemocracy Inc.: How Members of Congress Have Cashed In On Their JobsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.D'EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.Pas encore d'évaluation

- PX2879Document37 pagesPX2879legalmattersPas encore d'évaluation

- Pentagon Comprehensive Review of Don't Ask, Don't Tell PolicyDocument267 pagesPentagon Comprehensive Review of Don't Ask, Don't Tell PolicyShane Vander HartPas encore d'évaluation

- DoD "Don't Ask, Don't Tell" Repeal Support Plan For Implementation, 30 November 2010Document95 pagesDoD "Don't Ask, Don't Tell" Repeal Support Plan For Implementation, 30 November 2010legalmattersPas encore d'évaluation

- San Bruno Fire: NTSB Preliminary ReportDocument3 pagesSan Bruno Fire: NTSB Preliminary Reportlegalmatters100% (2)

- Phone Pbone: (Eastern IimejDocument6 pagesPhone Pbone: (Eastern IimejlegalmattersPas encore d'évaluation

- PX2566Document8 pagesPX2566legalmattersPas encore d'évaluation

- PX2853Document23 pagesPX2853legalmattersPas encore d'évaluation

- PX2334Document7 pagesPX2334legalmattersPas encore d'évaluation

- PX2096Document6 pagesPX2096legalmattersPas encore d'évaluation

- Starting With 029:03: Trial DB - v2 Trial DB - v2Document6 pagesStarting With 029:03: Trial DB - v2 Trial DB - v2legalmattersPas encore d'évaluation

- PX2403Document63 pagesPX2403legalmattersPas encore d'évaluation

- PX2545Document7 pagesPX2545legalmattersPas encore d'évaluation

- Associação Americana de Psicologia - Orientação HomossexualDocument6 pagesAssociação Americana de Psicologia - Orientação HomossexualLorena FonsecaPas encore d'évaluation

- PX2335Document29 pagesPX2335legalmattersPas encore d'évaluation

- PX2337Document31 pagesPX2337legalmattersPas encore d'évaluation

- PX2310Document2 pagesPX2310legalmattersPas encore d'évaluation

- PX2322Document11 pagesPX2322legalmattersPas encore d'évaluation

- PX2153Document2 pagesPX2153legalmattersPas encore d'évaluation

- PX2281Document21 pagesPX2281legalmattersPas encore d'évaluation

- PX1867Document124 pagesPX1867legalmattersPas encore d'évaluation

- PX2150Document3 pagesPX2150legalmattersPas encore d'évaluation

- PX2156Document3 pagesPX2156legalmattersPas encore d'évaluation

- PX1868Document102 pagesPX1868legalmattersPas encore d'évaluation

- PX1319Document36 pagesPX1319legalmattersPas encore d'évaluation

- PX1308Document42 pagesPX1308legalmattersPas encore d'évaluation

- PX1565Document3 pagesPX1565legalmattersPas encore d'évaluation

- PX1763Document2 pagesPX1763legalmattersPas encore d'évaluation

- Gao DomaDocument18 pagesGao Domadigitalflavours09Pas encore d'évaluation

- PX1328Document20 pagesPX1328legalmattersPas encore d'évaluation

- P P E ? T I S - S M C ' B: Utting A Rice On Quality HE Mpact of AME EX Arriage On Alifornia S UdgetDocument37 pagesP P E ? T I S - S M C ' B: Utting A Rice On Quality HE Mpact of AME EX Arriage On Alifornia S UdgetlegalmattersPas encore d'évaluation

- (NT 002) GAMA, A. COSTA, R. (2021) - The Increasing Circulation of The Mumbuca Social Currency in Maricá, 2018-2020Document8 pages(NT 002) GAMA, A. COSTA, R. (2021) - The Increasing Circulation of The Mumbuca Social Currency in Maricá, 2018-2020carapalida01Pas encore d'évaluation

- GA Tax GuideDocument46 pagesGA Tax Guidedamilano1Pas encore d'évaluation

- Guna FibreDocument21 pagesGuna FibreAirlangga Prima Satria MaruapeyPas encore d'évaluation

- Government Securities Market in India - A PrimerDocument47 pagesGovernment Securities Market in India - A Primeruhyr ujdgbPas encore d'évaluation

- Colinares vs. CA With DigestDocument12 pagesColinares vs. CA With DigestRommel P. AbasPas encore d'évaluation

- Waterways Magazine Spring 2014Document84 pagesWaterways Magazine Spring 2014Waterways MagazinePas encore d'évaluation

- "New Customer Acquisition of IDBI Bank": A Project Report OnDocument55 pages"New Customer Acquisition of IDBI Bank": A Project Report OnGaganpreet SinghPas encore d'évaluation

- Electronic Payment Systems For E-Commerce (2002)Document360 pagesElectronic Payment Systems For E-Commerce (2002)Trà MộcPas encore d'évaluation

- Extra Vocabulary: Review Units 7 & 8Document1 pageExtra Vocabulary: Review Units 7 & 8Karen CamposPas encore d'évaluation

- 1566740571410uf5Ngn9Nm9H6neju PDFDocument2 pages1566740571410uf5Ngn9Nm9H6neju PDFChandu GoudPas encore d'évaluation

- RemDocument15 pagesRemMohammad Yusof MacalandapPas encore d'évaluation

- 26 As Latest Both Cob Sob On 240719 PDFDocument4 pages26 As Latest Both Cob Sob On 240719 PDFAnish SamantaPas encore d'évaluation

- Bangko Sentral NG PilipinasDocument59 pagesBangko Sentral NG PilipinasAnn balledosPas encore d'évaluation

- Demand LetterDocument2 pagesDemand Letter1bruceman100% (2)

- Bank QuestionsDocument2 pagesBank Questionsd_ochoa04Pas encore d'évaluation

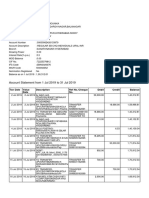

- Laporan Transaksi: No. Rekening Nama Produk Mata Uang Nomor CIFDocument2 pagesLaporan Transaksi: No. Rekening Nama Produk Mata Uang Nomor CIFEidPas encore d'évaluation

- DgamcDocument17 pagesDgamcSerpil AliPas encore d'évaluation

- A Manual On Non Banking Financial Institutions: 9. Anti Money Laundering StandardsDocument143 pagesA Manual On Non Banking Financial Institutions: 9. Anti Money Laundering StandardsRahul JagwaniPas encore d'évaluation

- Capitec Bank StatementDocument1 pageCapitec Bank Statementbc180204979 ALI FAROOQ100% (3)

- Fakhar Abbas Ansari: Sap Fi-Fm - Consultant Sap IdDocument5 pagesFakhar Abbas Ansari: Sap Fi-Fm - Consultant Sap IdFakhar Abbas AnsariPas encore d'évaluation

- Balance Sep 2019Document3 pagesBalance Sep 2019Kevis MartinezPas encore d'évaluation

- AFM AssignmentDocument3 pagesAFM AssignmentAin NsrPas encore d'évaluation

- Advanced Investment WorkDocument5 pagesAdvanced Investment WorkghislainchindoPas encore d'évaluation

- Pay Men Tech Response MessagesDocument16 pagesPay Men Tech Response MessagesMahesh Nakhate100% (1)

- Paigum ICP Invoice - ICP 237447Document1 pagePaigum ICP Invoice - ICP 237447sonalisabirPas encore d'évaluation

- Man With Two Shadows PLR3Document9 pagesMan With Two Shadows PLR3Lina JacovkisPas encore d'évaluation

- BC AssignmentDocument19 pagesBC AssignmentSrinath SaravananPas encore d'évaluation

- 02 Time Value of MoneyDocument50 pages02 Time Value of MoneyFauziah Husin HaizufPas encore d'évaluation

- Executive Summary: Mobile BankingDocument48 pagesExecutive Summary: Mobile Bankingzillurr_11Pas encore d'évaluation