Académique Documents

Professionnel Documents

Culture Documents

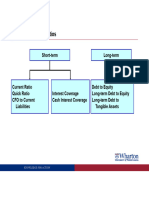

Common Liquidity Ratios: Short-Term Long-Term

Transféré par

osogboandrew_94805740 évaluation0% ont trouvé ce document utile (0 vote)

11 vues8 pagesdd

Titre original

_0951cac979f3932877fde22564672b99_Slides-4.4

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentdd

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

11 vues8 pagesCommon Liquidity Ratios: Short-Term Long-Term

Transféré par

osogboandrew_9480574dd

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 8

Common Liquidity Ratios

Short-term

Current Ratio

Quick Ratio

CFO to Current

Liabilities

KNOWLEDGE FOR ACTION

Interest Coverage

Cash Interest Coverage

Long-term

Debt to Equity

Long-term Debt to Equity

Long-term Debt to

Tangible Assets

Short-Term Liquidity Ratios

Does the company have enough cash coming in to cover obligations

to pay out cash?

Ideally, ratios would be over 1

Current Ratio = Current Assets / Current Liabilities

Quick Ratio = (Cash + Receivables) / Current Liabilities

CFO to Current Liabilities = Cash from Operations / Avg. Current

Liabilities

KNOWLEDGE FOR ACTION

Short-term Liquidity Ratios

Current Ratio

Quick Ratio

CFO-to-Current Liabilities

12/31/2009

2.39

0.94

0.79

12/31/2010

2.45

0.91

(0.58)

Current Ratio = Current Assets / Current Liabilities

Quick Ratio = (Cash + Accts Rec) / Current Liabilities

CFO-to-Current Liabilities = Cash from Operations / Avg. Current Liabilities

KNOWLEDGE FOR ACTION

12/31/2011

3.62

1.17

0.39

Interest Coverage Ratios

Does the company have enough cash coming in from operations to

cover interest obligations?

Ideally, ratios would be over 1

Interest Coverage = (Operating Income before Depreciation) / Interest

Expense

Cash Interest Coverage = (Cash from Operations + Cash Interest Paid

+ Cash Taxes) / Cash Interest Paid

KNOWLEDGE FOR ACTION

Interest Coverage Ratios

Interest Coverage

Cash Interest Coverage

12/31/2009

5.31

7.56

12/31/2010

5.95

(1.27)

12/31/2011

6.88

3.80

Interest Coverage = (Operating Income before Depreciation) / Interest Expense

Cash Interest Coverage = (Cash from Operations + Cash Interest +Cash Taxes) / Cash

Interest Paid

KNOWLEDGE FOR ACTION

Long Term Debt Ratios

How does the company finance its growth?

Also provide measure of bankruptcy risk

Debt to Equity = Total Liabilities / Shareholders Equity

Total Assets is sometimes used in the denominator

Long-Term-Debt to Equity = Total Long-Term Debt / Total

Stockholders Equity

Long-Term Debt to Tangible Assets = Total Long-Term Debt / (Total

Assets - Intangible Assets)

KNOWLEDGE FOR ACTION

Long-term Debt Ratios

Debt to Equity

Long-Term-Debt to Equity

Long-Term Debt to Tangible Assets

12/31/2009

0.67

0.41

0.25

12/31/2010

1.69

1.15

0.43

12/31/2011

1.05

0.76

0.37

Debt to Equity = Total Liabilities / Total Stockholders Equity

Long-Term-Debt to Equity = Total Long-Term Debt / Total Stockholders Equity

Long-Term Debt to Tangible Assets = Total Long-Term Debt / (Total Assets - Intangible

Assets)

KNOWLEDGE FOR ACTION

Liquidity Ratio Conclusions

Plainview is in a strong short-term cash position

Quick ratio over 1

High interest coverage ratios

Plainview has managed its leverage well through its expansion

Small increases in debt-to-equity and LTD-to-Tangible Assets ratios

Liquidity is not a major concern for Plainview

KNOWLEDGE FOR ACTION

Vous aimerez peut-être aussi

- Liqudity Ratios With Plainveiw CaseDocument8 pagesLiqudity Ratios With Plainveiw Casebsee21075Pas encore d'évaluation

- Ratio AnalysisDocument22 pagesRatio AnalysismAnisH MPas encore d'évaluation

- Financial Ratios: Presented To You By: SIM A. BELSONDRADocument23 pagesFinancial Ratios: Presented To You By: SIM A. BELSONDRASim BelsondraPas encore d'évaluation

- Appraisal - TCS - FinalDocument61 pagesAppraisal - TCS - FinalgetkhosaPas encore d'évaluation

- Cost and Financial Accounting Session 5 NotesDocument4 pagesCost and Financial Accounting Session 5 NotesDreadshadePas encore d'évaluation

- Ratio AnalysisDocument21 pagesRatio AnalysisRasha rubeenaPas encore d'évaluation

- 4 Financial Statement AnalysisDocument13 pages4 Financial Statement AnalysisAdnan RizviPas encore d'évaluation

- Summary - Ratios Lyst7357Document18 pagesSummary - Ratios Lyst7357Asma SaeedPas encore d'évaluation

- Discussion 4Document1 pageDiscussion 4Sadia AwanPas encore d'évaluation

- InsyncDocument6 pagesInsyncVivek AdatePas encore d'évaluation

- 11 Ratio Analysis PowerPointToPdfDocument11 pages11 Ratio Analysis PowerPointToPdfLexPas encore d'évaluation

- Debt Service Coverage Ratio (DSCR) : ValuationDocument17 pagesDebt Service Coverage Ratio (DSCR) : ValuationRh MePas encore d'évaluation

- Liquidity and SolvencyDocument2 pagesLiquidity and SolvencyGenelle SorianoPas encore d'évaluation

- RATIO AnalysisDocument36 pagesRATIO AnalysisRishika MadhukarPas encore d'évaluation

- Analysis of Financial StatementsDocument80 pagesAnalysis of Financial Statementsmano cherian mathew100% (1)

- Credit Analysis RatiosDocument24 pagesCredit Analysis RatiosParul Jain100% (1)

- Handout 4Document6 pagesHandout 4Xain AliPas encore d'évaluation

- Ratio AnalysisDocument7 pagesRatio Analysistanvi zodapePas encore d'évaluation

- FinalDocument4 pagesFinalSyeda Kinza HussainPas encore d'évaluation

- Corporate Finance & International Controlling (BPO) : Home Work 2 On The Balance Sheet and The Important RatiosDocument7 pagesCorporate Finance & International Controlling (BPO) : Home Work 2 On The Balance Sheet and The Important RatiosNitish RawatPas encore d'évaluation

- Ratio AnalysisDocument46 pagesRatio AnalysisPsyonaPas encore d'évaluation

- Financial Ratio Summary SheetDocument1 pageFinancial Ratio Summary SheetKeith Tomasson100% (1)

- Ratio AnalysisDocument104 pagesRatio AnalysisPrakashMhatrePas encore d'évaluation

- Financial Statement Analysis NotesDocument9 pagesFinancial Statement Analysis Notesshe lacks wordsPas encore d'évaluation

- Borisagarharsh 62Document24 pagesBorisagarharsh 62Borisagar HarshPas encore d'évaluation

- Formulas Accounting RatiosDocument12 pagesFormulas Accounting RatiosMAHI LADPas encore d'évaluation

- Quick RatioDocument15 pagesQuick RatioAin rosePas encore d'évaluation

- Financial Statement AnalysisDocument23 pagesFinancial Statement AnalysisEmmaryl PogadoPas encore d'évaluation

- Liquidity ManagementDocument54 pagesLiquidity Managementansary75Pas encore d'évaluation

- Ratio Analysis: Aditi Shanbhag 2010122 Kezia Fernandes 2010142 Nandini Chaudhury 2010149Document31 pagesRatio Analysis: Aditi Shanbhag 2010122 Kezia Fernandes 2010142 Nandini Chaudhury 2010149Rohit GuptaPas encore d'évaluation

- Financial RatiosDocument4 pagesFinancial RatiosRajdeep BanerjeePas encore d'évaluation

- RAT IOA NAL YsisDocument104 pagesRAT IOA NAL Ysisahsan habibPas encore d'évaluation

- Liquidity Ratios Calculation Formulas and Explanations: Acid Test RatioDocument14 pagesLiquidity Ratios Calculation Formulas and Explanations: Acid Test RatioPavithira MalligaPas encore d'évaluation

- RatioDocument27 pagesRatioHumair ShaheenPas encore d'évaluation

- Financial RatiosDocument3 pagesFinancial Ratiospv12356Pas encore d'évaluation

- Unit 5 Ratio AnalysisDocument43 pagesUnit 5 Ratio Analysisjatin4verma-2100% (1)

- Ratio Analysis: R K MohantyDocument30 pagesRatio Analysis: R K Mohantybgowda_erp1438Pas encore d'évaluation

- Income Statements:: Financial Statement AnalysisDocument11 pagesIncome Statements:: Financial Statement AnalysisSerge Olivier Atchu YudomPas encore d'évaluation

- 3 Finansiniai Spendimai Verslo AplinkaDocument26 pages3 Finansiniai Spendimai Verslo AplinkaOZZYMANPas encore d'évaluation

- Income Statements:: Financial Statement AnalysisDocument11 pagesIncome Statements:: Financial Statement AnalysisAsim MahatoPas encore d'évaluation

- Measuring Liquidity: Ratio AnalysisDocument33 pagesMeasuring Liquidity: Ratio AnalysispujaadiPas encore d'évaluation

- Ratio Analysis IIBFDocument30 pagesRatio Analysis IIBFRONANKI VIJAYA KUMARPas encore d'évaluation

- I) Short Term Solvency or Liquidity Ratios: Net IncomeDocument2 pagesI) Short Term Solvency or Liquidity Ratios: Net Incomedude devilPas encore d'évaluation

- C2 D1 Doc Tech 2Document2 pagesC2 D1 Doc Tech 2Alexey KirichokPas encore d'évaluation

- Financial Statement AnalysisDocument55 pagesFinancial Statement AnalysisPravin UntooPas encore d'évaluation

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisAli Gokhan Kocan100% (1)

- Solvancy and Liquidity RatioDocument45 pagesSolvancy and Liquidity RatioRitesh AnandPas encore d'évaluation

- Fin Stat AnalysisDocument23 pagesFin Stat AnalysisSadiabcdPas encore d'évaluation

- FPT Group's Seperate Financial of 2020 and Consolidated Financial Statements of 2020Document17 pagesFPT Group's Seperate Financial of 2020 and Consolidated Financial Statements of 2020Phạm Tuấn HùngPas encore d'évaluation

- B) Dividend Policy-SapremDocument3 pagesB) Dividend Policy-SapremSAURABH SINGHPas encore d'évaluation

- Financial Statements As A Management ToolDocument20 pagesFinancial Statements As A Management TooldavidimolaPas encore d'évaluation

- Business Metrics and Tools; Reference for Professionals and StudentsD'EverandBusiness Metrics and Tools; Reference for Professionals and StudentsPas encore d'évaluation

- Applied Corporate Finance. What is a Company worth?D'EverandApplied Corporate Finance. What is a Company worth?Évaluation : 3 sur 5 étoiles3/5 (2)

- High-Q Financial Basics. Skills & Knowlwdge for Today's manD'EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manPas encore d'évaluation

- Financial Accounting and Reporting Study Guide NotesD'EverandFinancial Accounting and Reporting Study Guide NotesÉvaluation : 1 sur 5 étoiles1/5 (1)

- Accounting and Finance Formulas: A Simple IntroductionD'EverandAccounting and Finance Formulas: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (8)

- Accounting Survival Guide: An Introduction to Accounting for BeginnersD'EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersPas encore d'évaluation

- Ritter-Us Ipo StatsDocument12 pagesRitter-Us Ipo Statsosogboandrew_9480574Pas encore d'évaluation

- 2020 Apprpriation Bill PDFDocument9 pages2020 Apprpriation Bill PDFosogboandrew_9480574Pas encore d'évaluation

- GHS Panel Survey Report Revised Jan31 2017Document170 pagesGHS Panel Survey Report Revised Jan31 2017osogboandrew_9480574Pas encore d'évaluation

- A Central Bankers Guide To Gold As A Reserve AssetDocument40 pagesA Central Bankers Guide To Gold As A Reserve Assetosogboandrew_9480574Pas encore d'évaluation

- Occurrence of BaritesDocument14 pagesOccurrence of Baritesosogboandrew_9480574Pas encore d'évaluation

- PPIAF Impact Stories PSP in Irrigation in EthiopiaDocument2 pagesPPIAF Impact Stories PSP in Irrigation in Ethiopiaosogboandrew_9480574Pas encore d'évaluation

- Relic Spotter SCF Solution 1Document13 pagesRelic Spotter SCF Solution 1osogboandrew_9480574Pas encore d'évaluation

- IShares MSCI Frontier 100 ETF FundDocument320 pagesIShares MSCI Frontier 100 ETF Fundosogboandrew_9480574Pas encore d'évaluation

- CIQ - Excel Cheat Sheet June 2012Document2 pagesCIQ - Excel Cheat Sheet June 2012Fernando SilvaPas encore d'évaluation

- GMAT MathDocument23 pagesGMAT Mathjitendra.paliya71% (7)

- IShares MSCI Frontier 100 ETF FundDocument320 pagesIShares MSCI Frontier 100 ETF Fundosogboandrew_9480574Pas encore d'évaluation

- Slides-2.2Document14 pagesSlides-2.2osogboandrew_9480574Pas encore d'évaluation

- Whos Who Global Supply Chain Finance - Final PDFDocument119 pagesWhos Who Global Supply Chain Finance - Final PDFosogboandrew_9480574Pas encore d'évaluation

- Lecture Slides Case-Relic Spotter-SolutionDocument6 pagesLecture Slides Case-Relic Spotter-Solutiontheodora21Pas encore d'évaluation

- The Accounting Cycle: Analyze Transactions Journalize and Post During PeriodDocument9 pagesThe Accounting Cycle: Analyze Transactions Journalize and Post During Periodosogboandrew_9480574Pas encore d'évaluation

- Balance Sheet EquationDocument5 pagesBalance Sheet EquationVijayPas encore d'évaluation

- Lecture Slides Case-Relic SpotterDocument10 pagesLecture Slides Case-Relic SpotterLoraine Julio JimenezPas encore d'évaluation

- Relic Spotter SCF Solution 1Document13 pagesRelic Spotter SCF Solution 1osogboandrew_9480574Pas encore d'évaluation

- T Accounts For Common Transactions. Into To AccountngDocument23 pagesT Accounts For Common Transactions. Into To AccountngyajkrPas encore d'évaluation

- Slides-1.3.2Document13 pagesSlides-1.3.2osogboandrew_9480574Pas encore d'évaluation

- Slides-2.3.2Document7 pagesSlides-2.3.2osogboandrew_9480574Pas encore d'évaluation

- The Accounting Cycle: Analyze Transactions Journalize and Post During PeriodDocument9 pagesThe Accounting Cycle: Analyze Transactions Journalize and Post During Periodosogboandrew_9480574Pas encore d'évaluation

- Lecture Slides Video02!01!1Document8 pagesLecture Slides Video02!01!1Cristina E. OroianPas encore d'évaluation

- Definition of Accounting: - Accounting Is A System For Recording Information About BusinessDocument5 pagesDefinition of Accounting: - Accounting Is A System For Recording Information About Businesstania7642Pas encore d'évaluation

- Relic Spotter Inc. Case: Transaction 25Document8 pagesRelic Spotter Inc. Case: Transaction 25osogboandrew_9480574Pas encore d'évaluation

- Relic Spotter Inc. CaseDocument9 pagesRelic Spotter Inc. CaseC DonisPas encore d'évaluation

- CMA IFRS Statements February09Document6 pagesCMA IFRS Statements February09osogboandrew_9480574Pas encore d'évaluation

- Slides-4.2Document14 pagesSlides-4.2osogboandrew_9480574Pas encore d'évaluation

- Slides-4.3Document11 pagesSlides-4.3osogboandrew_9480574Pas encore d'évaluation

- Entrepreneurial Marketing: After Completion of The Course, The Students Will Be Able ToDocument2 pagesEntrepreneurial Marketing: After Completion of The Course, The Students Will Be Able ToMurugan MPas encore d'évaluation

- IAS 16 PPE Lecture Slides (Updated)Document39 pagesIAS 16 PPE Lecture Slides (Updated)Ndila mangalisoPas encore d'évaluation

- Effective Use of SOC 1Document2 pagesEffective Use of SOC 1CL AhPas encore d'évaluation

- A Study On Asset Liability Management in Yes BankDocument29 pagesA Study On Asset Liability Management in Yes BankSurabhi Purwar0% (1)

- Activity Based Costing (ABC)Document8 pagesActivity Based Costing (ABC)Nah HamzaPas encore d'évaluation

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDocument51 pagesStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDomingo Mckinney100% (31)

- Accounting For Branches and Combined FSDocument112 pagesAccounting For Branches and Combined FSAbrish MelakuPas encore d'évaluation

- Case Study For BADocument14 pagesCase Study For BAHONGHANH DINHCHAUPas encore d'évaluation

- Chapter 2, Lesson 3demand ForecastingDocument15 pagesChapter 2, Lesson 3demand Forecastingfelize padllaPas encore d'évaluation

- Executive SummaryDocument2 pagesExecutive Summaryapi-258982553Pas encore d'évaluation

- Market SegmentationDocument10 pagesMarket SegmentationHardeep SinghPas encore d'évaluation

- Proposed Business Case Analysis 1Document19 pagesProposed Business Case Analysis 1Kathlene JaoPas encore d'évaluation

- Case Study On App: Didi TaxiDocument4 pagesCase Study On App: Didi TaxiUpmanyu KrishnaPas encore d'évaluation

- Contribution MarginDocument6 pagesContribution Marginajeng.saraswatiPas encore d'évaluation

- CH 4Document21 pagesCH 4Amir HussainPas encore d'évaluation

- Cyberdragon Cash Flow AnalysisDocument3 pagesCyberdragon Cash Flow AnalysisBablu EscobarPas encore d'évaluation

- The Study of Cash Flow Statement of Axis Bank For Period 2017-21Document11 pagesThe Study of Cash Flow Statement of Axis Bank For Period 2017-21Dnyandeep ManwarPas encore d'évaluation

- New Rekening Koran Online 493501004332535 2023-02-01 2023-02-28 00326282 PDFDocument2 pagesNew Rekening Koran Online 493501004332535 2023-02-01 2023-02-28 00326282 PDFSupebriasa AmdPas encore d'évaluation

- Introduction To Sales Management: by Prof. V KrishnamohanDocument20 pagesIntroduction To Sales Management: by Prof. V KrishnamohanKrishnamohan VaddadiPas encore d'évaluation

- Pareto OptimalityDocument5 pagesPareto OptimalityHuzaifaPas encore d'évaluation

- Proc No. 68-1997 Office of The Federal Auditor General EstaDocument7 pagesProc No. 68-1997 Office of The Federal Auditor General EstaFissiha WoldemichaelPas encore d'évaluation

- Sample Report 09MOF PDFDocument19 pagesSample Report 09MOF PDFRashadul hasan100% (1)

- Bookkeeping FinalDocument67 pagesBookkeeping FinalKatlene JoyPas encore d'évaluation

- MOS GameDocument13 pagesMOS GameNuhtimPas encore d'évaluation

- Notes On The Origin and Development of ReinsuranceDocument70 pagesNotes On The Origin and Development of Reinsuranceapi-261460293Pas encore d'évaluation

- Accounting Textbook Solutions - 22Document19 pagesAccounting Textbook Solutions - 22acc-expertPas encore d'évaluation

- Ind AS 115Document21 pagesInd AS 115Vrinda KPas encore d'évaluation

- ISB - PM - Week 2 - Required Assignment 2.4 - TemplateDocument3 pagesISB - PM - Week 2 - Required Assignment 2.4 - Templatesriram marinPas encore d'évaluation

- Morning Fresh (Saud Afzal)Document7 pagesMorning Fresh (Saud Afzal)Ismail LonePas encore d'évaluation

- Test Bank - Chapter 16Document25 pagesTest Bank - Chapter 16Jihad NakibPas encore d'évaluation