Académique Documents

Professionnel Documents

Culture Documents

Citigold SOC

Transféré par

nikCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Citigold SOC

Transféré par

nikDroits d'auteur :

Formats disponibles

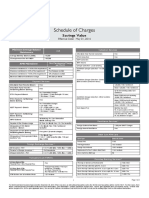

Citigold Account - Schedule of Charges

Monthly fee, if avg. net monthly relationship value falls below ` 1 lakh

[waived for corporate salary account customers]

Cheque bounce cases

-Cheque deposited

-Issued cheque, Foreign currency cheque return, ECS bounce**

Outward foreign currency TT

International usage of debit card (ATM/Shopping)

Debit card usage at petrol pump

Overdraft Interest (in case account goes into negative balance)

1% of shortfall^ or ` 600, whichever is lower

` 100

` 350

` 250

3.5% mark up

2.5% surcharge subject to a minimum of ` 10

(Waived on Citibank EDCs at IOC pumps)

24% p.a.

VER 9.0/SOC/CG-SA/WPC/07-15

All below mentioned benefits are now free of charge

ATM withdrawals and balance enquiry at any ATM in India*^

ATM withdrawal at any ATM worldwide@

NEFT/RTGS#

Demand drafts issuance andsd cancellation

Cheque book reorder

Duplicate statement

Stop payment

Cash Delivery (min ` 5,000 and max ` 5,00,000 per day)

Account Closure

Foreign currency draft issuance & cancellation

Foreign currency conversion charge for FCY sale/purchase##

Outstation and foreign currency^^ cheque collection

Signature verification

Account re-activation

Utility bill payment

Debit card for family members and Debit Card reissuance

Rail ticket booking/cancellation through IRCTC

^Example: If your actual average NRV for a month is ` 80,000 you will be charged 1% of ` 20,000 i.e. ` 200; However, if your NRV is ` 30,000, you will be charged ` 600 (max. charge limit).

Service tax as applicable would be levied on all charges mentioned.

Your savings account interest will be calculated on daily balances maintained in your account. The savings account interest will be paid at half yearly intervals on 30th September and 31st March each year.

Interest of 24% p.a. will be applicable if account moves in negative balance.

^*As per RBI communication, cash limit of ` 10,000 per withdrawal will be permitted at Non Citibank ATMs.

#

The minimum threshold value limit for RTGS transactions is ` 2 lakhs.

**This charge is levied only if the ECS transaction is not honored.

^^Other banks may charge FCY Cheque clearing fees, if applicable. These charges will need to be borne by the customer.

@

Other banks may charge fees for usage of their ATM for cash withdrawal overseas. These charges will need to be borne by the customer.

##

Service tax is applicable, in accordance with service tax provisions as per Government of India notifications dated March 31, 2011 on Foreign Currency Conversion for FCY/purchase.

For Citibanks charges on any other product/transaction, please refer to www.citibank.com/india or contact your Relationship Manager.

Net Relationship Value is across all accounts under a household and is calculated by aggregating average monthly balances across Savings Account, Current Account, Deposits, Mutual Funds, Loans against

Securities, Insurance Premium paid, outstanding Mortgage Loan and 25% of Demat holdings.

Working Example of Average Monthly Relationship Value.

Holdings

Description

a) Current/Savings Account

10,00,000

Average for the Month, calculated based on total of daily end of day balance/total number of days

b) Fixed Deposit

20,00,000

Daily end of day balances of principal amount/total number of days

c) Mutual Funds

15,00,000

Daily end of day balances/total number of days

25,000

Daily end of day balances/total number of days

d) Loans against securities

e) Demat Holdings

f) Insurance Premium

g) Mortgage/Home Loan

Average Monthly Relationship Value

1,00,000

10,000

5,00,000

51,35,000

Demat average balance=Sum (non pledged shares x Market rate); Only 25% of the balance will be considered

Sum of total premium paid@@

Outstanding principal amount

a+b+c+d+25%xe+f+g

@@

Towards active individual life insurance policies with the account holder as proposer.

The minimum average monthly relationship requirement or charges/fees may be revised by the bank, from time-to-time by giving prior notice to customer. The net relationship value (NRV) for

a month is computed on the penultimate working day of that month.

Vous aimerez peut-être aussi

- Terms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMDocument6 pagesTerms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMArnab Nandi100% (1)

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaD'EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaPas encore d'évaluation

- NW SIBDocument5 pagesNW SIBLoesh WaranPas encore d'évaluation

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountD'EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountÉvaluation : 2 sur 5 étoiles2/5 (1)

- SuperCard MITC PDFDocument47 pagesSuperCard MITC PDFPrudhvi RajPas encore d'évaluation

- Citi Rewards Card ChargesDocument7 pagesCiti Rewards Card ChargesLokesh SuranaPas encore d'évaluation

- Most Important Terms and Conditions - 2Document10 pagesMost Important Terms and Conditions - 2Mohit AroraPas encore d'évaluation

- SUPERCARD Most Important Terms and Conditions (MITC)Document14 pagesSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilPas encore d'évaluation

- MITC Paytm First Card 2019Document7 pagesMITC Paytm First Card 2019viwaPas encore d'évaluation

- Most Important Terms and ConditionsDocument7 pagesMost Important Terms and ConditionsSignupPas encore d'évaluation

- Citi Rewards Card ChargesDocument8 pagesCiti Rewards Card ChargesHem Pushp MittalPas encore d'évaluation

- Sosc Ver 210313Document3 pagesSosc Ver 210313Shashank AgarwalPas encore d'évaluation

- 1.1 FAQ On Tax Collection at Source (TCS) For Remittance and International Debit Card TransactionsDocument6 pages1.1 FAQ On Tax Collection at Source (TCS) For Remittance and International Debit Card Transactionsspyadav25298Pas encore d'évaluation

- Saadiq SOCDocument28 pagesSaadiq SOCAamir ShehzadPas encore d'évaluation

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuPas encore d'évaluation

- PremierMiles Terms and ConditionsDocument7 pagesPremierMiles Terms and ConditionsAnamika purohitPas encore d'évaluation

- Schedule of Charges: Savings ValueDocument2 pagesSchedule of Charges: Savings ValueNavjot SinghPas encore d'évaluation

- Most Important Terms and Conditions - Citi Rewards Credit CardDocument8 pagesMost Important Terms and Conditions - Citi Rewards Credit CardneverPas encore d'évaluation

- Citi Rewards Card ChargesDocument7 pagesCiti Rewards Card ChargesDivya NaikPas encore d'évaluation

- Most Important Terms and Conditions: As On The Date of Levy of The ChargeDocument7 pagesMost Important Terms and Conditions: As On The Date of Levy of The ChargeMohammed Tabrez ulla KhanPas encore d'évaluation

- HDFC - Saving AccountsDocument11 pagesHDFC - Saving Accountsপ্রিয়াঙ্কুর ধরPas encore d'évaluation

- Important Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDocument10 pagesImportant Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDeepak GuptaPas encore d'évaluation

- MidDocument1 pageMidSdspl DelhiPas encore d'évaluation

- Saadiq SOCDocument31 pagesSaadiq SOCjoshmalikPas encore d'évaluation

- Most Important Terms and ConditionsDocument5 pagesMost Important Terms and ConditionsaavisPas encore d'évaluation

- Citi Banks Credit NormsDocument6 pagesCiti Banks Credit NormsAshutosh TripathiPas encore d'évaluation

- Citibank Credit CardDocument6 pagesCitibank Credit CardgjvoraPas encore d'évaluation

- PDS Eng June2013Document2 pagesPDS Eng June2013NickHansenPas encore d'évaluation

- Landbank AccountsDocument17 pagesLandbank AccountscammiecazziePas encore d'évaluation

- Citi Rewards Domestic MITC FinalDocument8 pagesCiti Rewards Domestic MITC FinalGauravkPas encore d'évaluation

- IDBI Bank MITC ConditionsDocument14 pagesIDBI Bank MITC Conditionswestm4248Pas encore d'évaluation

- Product Disclosure Sheet: What Is This Product About?Document6 pagesProduct Disclosure Sheet: What Is This Product About?faisal_ahsan7919Pas encore d'évaluation

- Baroda Salary Classic AccountDocument3 pagesBaroda Salary Classic AccountSajid NavyPas encore d'évaluation

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaPas encore d'évaluation

- Cash Lite Pds enDocument7 pagesCash Lite Pds enSyarmimi LiyanaPas encore d'évaluation

- Saving AccountDocument29 pagesSaving AccountramshaPas encore d'évaluation

- Crown Salary Account 01042014Document2 pagesCrown Salary Account 01042014Vikram IsgodPas encore d'évaluation

- Terms and Conditions For SavingsDocument10 pagesTerms and Conditions For Savingsdevpal78Pas encore d'évaluation

- Platinum Aura Edge Govt Card MITC 4 10 2022Document12 pagesPlatinum Aura Edge Govt Card MITC 4 10 2022Aaryan S.Pas encore d'évaluation

- Heritage MITCDocument12 pagesHeritage MITCSankalp PatelPas encore d'évaluation

- Mitc RupifiDocument13 pagesMitc RupifiKARTHIKEYAN K.DPas encore d'évaluation

- Schedule of Charges: Smart Salary ExclusiveDocument2 pagesSchedule of Charges: Smart Salary ExclusivevedavakPas encore d'évaluation

- Most Important Terms & ConditionsDocument75 pagesMost Important Terms & Conditionsjamin2020Pas encore d'évaluation

- July 2013: Current, Call and Savings AccountsDocument1 pageJuly 2013: Current, Call and Savings AccountsBala MPas encore d'évaluation

- Key Facts StatementDocument4 pagesKey Facts StatementQuality SecretPas encore d'évaluation

- 2018 FRM CandidateGuideDocument14 pages2018 FRM CandidateGuideSagar SuriPas encore d'évaluation

- CC Mitc21122022Document28 pagesCC Mitc21122022jeetPas encore d'évaluation

- Deposit Schemes: Savings Plus AccountDocument17 pagesDeposit Schemes: Savings Plus AccountMAnmit SIngh DadraPas encore d'évaluation

- State Bank of IndiaDocument14 pagesState Bank of IndiaElora NandyPas encore d'évaluation

- Axis Bank Multi Currency Card - Exclusive Proposal For Students of Iim & XlrisDocument3 pagesAxis Bank Multi Currency Card - Exclusive Proposal For Students of Iim & XlrisHarsh DabasPas encore d'évaluation

- Basic Banking CRM-CBSDocument60 pagesBasic Banking CRM-CBSAkshayPas encore d'évaluation

- Mitc Gold RCPDocument6 pagesMitc Gold RCPu4rishiPas encore d'évaluation

- Bajaj Tiger CC MITC NewDocument12 pagesBajaj Tiger CC MITC NewMinatiPas encore d'évaluation

- SWATI SBI - OrganizedDocument5 pagesSWATI SBI - OrganizedVinod MPas encore d'évaluation

- Yes Bank - Schedule of Charges - Savings Select AccountDocument2 pagesYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMEPas encore d'évaluation

- Payment Gateway DetailsDocument9 pagesPayment Gateway DetailsArvind SrivastavaPas encore d'évaluation

- Schedule of Charges - Citi Rewards Credit Card: As On The Date of Levy of The ChargeDocument2 pagesSchedule of Charges - Citi Rewards Credit Card: As On The Date of Levy of The ChargemurugesaenPas encore d'évaluation

- Most Important Terms and ConditionsDocument8 pagesMost Important Terms and ConditionsTHIMMAPPA KODAVATIPas encore d'évaluation

- Savings AccountDocument27 pagesSavings AccountkjlgururajPas encore d'évaluation

- Oip73 20191001163115Document5 pagesOip73 20191001163115Nikhil RaviPas encore d'évaluation

- Sapphire 2019 VDocument3 pagesSapphire 2019 VNikhil RaviPas encore d'évaluation

- Examples Four VisualCV ResumeDocument2 pagesExamples Four VisualCV ResumeNikhil RaviPas encore d'évaluation

- Examples Four Visualcv ResumeDocument2 pagesExamples Four Visualcv ResumeFabiany Casas PulidoPas encore d'évaluation

- Innowera Control Panel Solution Highlights: Governance Within SAP Security: Global ActionsDocument4 pagesInnowera Control Panel Solution Highlights: Governance Within SAP Security: Global ActionsNikhil RaviPas encore d'évaluation

- 16 Fields in Pricing Procedure and Their Description - SAP IPC DeveloperDocument3 pages16 Fields in Pricing Procedure and Their Description - SAP IPC DeveloperNikhil RaviPas encore d'évaluation

- 108 Names of Goddess Durga, Shri Durga Ashtottara ShatanaamavaliDocument3 pages108 Names of Goddess Durga, Shri Durga Ashtottara ShatanaamavaliNikhil RaviPas encore d'évaluation

- Enterprise AppsDocument4 pagesEnterprise AppsNikhil RaviPas encore d'évaluation

- 16 Fields in Pricing Procedure and Their Description - ERP Operations - SCN WikiDocument3 pages16 Fields in Pricing Procedure and Their Description - ERP Operations - SCN WikiNikhil RaviPas encore d'évaluation

- 16 Fields in Pricing Procedure and Their Description - SAP IPC DeveloperDocument3 pages16 Fields in Pricing Procedure and Their Description - SAP IPC DeveloperNikhil RaviPas encore d'évaluation

- SAP SD Define Pricing ProcedureDocument5 pagesSAP SD Define Pricing ProcedureNikhil RaviPas encore d'évaluation

- Pricing Procedure in SD - ERP Operations - SCN WikiDocument2 pagesPricing Procedure in SD - ERP Operations - SCN WikiNikhil RaviPas encore d'évaluation

- Transportation Configuration and Process Flow - ERP Operations - SCN WikiDocument5 pagesTransportation Configuration and Process Flow - ERP Operations - SCN WikiNikhil RaviPas encore d'évaluation

- SAP - Sales and Distribution - Billing - Lesson 16 - SapTechProDocument30 pagesSAP - Sales and Distribution - Billing - Lesson 16 - SapTechProNikhil RaviPas encore d'évaluation

- Nikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationDocument3 pagesNikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationNikhil RaviPas encore d'évaluation

- Nikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationDocument3 pagesNikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationNikhil RaviPas encore d'évaluation

- Interview Questions For Sap SD PDFDocument50 pagesInterview Questions For Sap SD PDFRajan S PrasadPas encore d'évaluation

- LE-TRA - Config Guide For Shipment & Shipment Cost Document - Part III - SAP BlogsDocument18 pagesLE-TRA - Config Guide For Shipment & Shipment Cost Document - Part III - SAP BlogsNikhil RaviPas encore d'évaluation

- How To Create Sales Document Type in SAPDocument10 pagesHow To Create Sales Document Type in SAPNikhil RaviPas encore d'évaluation

- Nikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationDocument3 pagesNikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationNikhil RaviPas encore d'évaluation

- Nikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationDocument3 pagesNikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationNikhil RaviPas encore d'évaluation

- Nikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationDocument3 pagesNikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationNikhil RaviPas encore d'évaluation

- Nikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationDocument3 pagesNikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationNikhil RaviPas encore d'évaluation

- SAP SD Module ResumeDocument3 pagesSAP SD Module ResumeNikhil RaviPas encore d'évaluation

- SAP Handling Unit ManagementDocument61 pagesSAP Handling Unit ManagementSuvendu Bishoyi91% (23)

- Nikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationDocument3 pagesNikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationNikhil RaviPas encore d'évaluation

- Ritesh Prasad: Work Experience SAP CONSULTANT (Sales & Distribution)Document3 pagesRitesh Prasad: Work Experience SAP CONSULTANT (Sales & Distribution)Nikhil RaviPas encore d'évaluation

- Nikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationDocument3 pagesNikhil R: Seeking Middle Level Managerial Assignments in SAP SD Consultancy With A Growth Oriented OrganisationNikhil RaviPas encore d'évaluation

- Determination Rule in SD For Quick Reference - ERP Operations - SCN WikiDocument2 pagesDetermination Rule in SD For Quick Reference - ERP Operations - SCN WikiNikhil Ravi100% (1)

- Top 10 Must-Have SAP Fiori Apps For Sourcing and Procurement - SAP BlogsDocument7 pagesTop 10 Must-Have SAP Fiori Apps For Sourcing and Procurement - SAP BlogsNikhil RaviPas encore d'évaluation