Académique Documents

Professionnel Documents

Culture Documents

Копия Bank Model-Commerzbank

Transféré par

serpepeCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Копия Bank Model-Commerzbank

Transféré par

serpepeDroits d'auteur :

Formats disponibles

1.

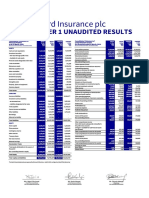

Commerzbank Balance Sheet (Euro million)

2002

2003

2004

2005

2006

2007

2008

8,466

54,343

148,514

(5,376)

3,131

117,192

84,558

1,040

111

2,505

5,995

1,655

422,134

7,429

51,657

138,438

(5,510)

2,552

87,628

87,842

690

112

2,063

6,038

2,646

381,585

7,652

53,723

144,668

(4,960)

2,667

87,628

87,842

580

112

2,063

6,038

857

388,869

7,881

55,872

151,901

(5,194)

2,800

87,628

87,842

470

112

2,063

6,038

1,392

398,805

8,118

58,107

159,496

(5,440)

2,940

87,628

87,842

360

112

2,063

6,038

1,820

409,085

8,361

60,431

167,471

(5,698)

3,087

87,628

87,842

250

112

2,063

6,038

2,133

419,719

8,612

62,849

175,845

(5,967)

3,242

87,628

87,842

140

112

2,063

6,038

2,320

430,722

114,984

95,700

92,732

5,696

83,238

3,528

3,664

3,285

9,237

1,262

413,326

1,378

6,131

3,268

(769)

(1,248)

(6)

54

0

8,808

422,134

95,249

100,000

83,992

5,932

67,017

3,307

4,495

2,911

8,381

1,213

372,497

1,545

4,475

3,286

1,240

(1,236)

(219)

0

0

9,091

381,588

98,106

103,000

87,352

6,199

67,017

3,307

4,495

2,911

8,381

1,300

382,069

1,545

4,475

3,286

1,240

(1,236)

(219)

568

(2,858)

6,801

388,869

101,050

106,090

90,846

6,509

67,017

3,307

4,495

2,911

8,381

1,437

392,042

1,545

4,475

3,456

1,240

(1,236)

(219)

576

(3,074)

6,763

398,805

104,081

109,273

94,480

6,834

67,017

3,307

4,495

2,911

8,381

1,603

402,382

1,545

4,475

3,629

1,240

(1,236)

(219)

616

(3,347)

6,703

409,085

107,204

112,551

98,259

7,176

67,017

3,307

4,495

2,911

8,381

1,810

413,110

1,545

4,475

3,814

1,240

(1,236)

(219)

658

(3,668)

6,609

419,719

110,420

115,927

102,189

7,535

67,017

3,307

4,495

2,911

8,381

2,073

424,255

1,545

4,475

4,011

1,240

(1,236)

(219)

698

(4,047)

6,467

430,722

5,376

2.65%

0.65%

5,376

1,084

(950)

5,510

2.90%

0.57%

5,510

1,131

(1,785)

4,856

2.50%

0.57%

4,960

1,185

(1,068)

5,077

2.50%

0.57%

5,194

1,241

(1,118)

5,317

2.50%

0.57%

5,440

1,300

(1,171)

5,569

2.50%

0.57%

5,698

1,361

(1,226)

5,832

2.50%

0.57%

Assets

Cash reserve

Claims on banks

Claims on customers

Provisions for loan losses

Positive fair values from derivative hedging instruments

Assets held for dealing purposes

Investments and securities portfolio

Goodwill

Other intangible assets

Fixed assets

Tax assets

Other assets

Total assets

Liabilities

Liabilities to banks

Liabilities to customers

Securitised liabilities

Negative fair values from derivative hedging instruments

Liabilities from dealing activities

Provisions

Tax liabilities

Other liabilities

Subordinated capital

Minority interests

Total liabilities

Subscribed capital

Capital reserve

Retained earnings

Revaluation reserve

Measurement of cash flow hedges

Reserve from currency translation

Consolidated profit/loss

Treasury stock

Shareholders funds

Total liabilities and shareholders funds

Bad debt provisions

Opening provision for loan losses

Provision for year

Amounts utilised and other changes

Closing provision for loan losses

Provisions/claims on banks and customers (%)

Annual provision/claims on banks and customers (%)

2. Commerzbank Profit and Loss Account (Euro million)

Interest received

Interest paid

Net interest income

Provisions for possible loan losses

Net interest income after provisioning

Commissions received

Commissions paid

Net commission income

Net result on hedge accounting

Trading profit

Net result on available for sale investments

Operating expenses

Other operating result

Operating profit

Amortization of goodwill

Profit before exceptional items

Exceptional items

Restructuring expenses

Profit before taxation

Taxation

Taxation rate (%)

Profit after taxation

Minority interest in profit

Profit attributable to ordinary shares

Transfer from capital reserve

Consolidated profit/loss

Ordinary dividends payable

Retained profit/loss

Payout ratio

Year end shares outstanding

Weighted average shares outstanding

Earnings per share

Dividends per share

2002

2003

2004

2005

2006

2007

2008

18,032

(14,899)

3,133

(1,321)

1,812

2,416

(296)

2,120

(56)

544

(11)

(5,155)

938

192

(108)

84

(247)

(209)

(372)

103

27.7%

(269)

(29)

(298)

352

54

0

54

0.0%

11,767

(8,991)

2,776

(1,084)

1,692

2,505

(369)

2,136

40

737

291

(4,511)

174

559

(110)

449

(2,325)

(104)

(1,980)

(249)

-12.6%

(2,229)

(91)

(2,320)

2,320

0

0

0

0.0%

11,672

(8,607)

3,065

(1,131)

1,933

2,580

(380)

2,200

0

737

297

(4,133)

167

1,200

(110)

1,090

0

0

1,090

(435)

39.9%

655

(87)

568

0

568

(398)

170

70.0%

12,339

(8,832)

3,507

(1,185)

2,322

2,658

(391)

2,266

0

737

297

(4,496)

171

1,296

(110)

1,186

0

0

1,186

(473)

39.9%

713

(136)

576

0

576

(403)

173

70.0%

13,049

(9,064)

3,985

(1,241)

2,744

2,737

(403)

2,334

0

737

297

(4,875)

175

1,412

(110)

1,302

0

0

1,302

(519)

39.9%

782

(166)

616

0

616

(431)

185

70.0%

13,795

(9,304)

4,491

(1,300)

3,191

2,819

(415)

2,404

0

737

297

(5,260)

179

1,549

(110)

1,439

0

0

1,439

(574)

39.9%

865

(207)

658

0

658

(461)

197

70.0%

14,578

(9,552)

5,027

(1,361)

3,665

2,904

(428)

2,476

0

737

297

(5,650)

184

1,709

(110)

1,599

0

0

1,599

(638)

39.9%

961

(263)

698

0

698

(489)

209

70.0%

529.9

533.6

-0.56

0.00

594.4

544.2

-4.26

0.00

407.8

501.1

1.13

0.97

393.7

400.8

1.44

1.02

375.9

384.8

1.60

1.15

355.0

365.4

1.80

1.30

330.2

342.6

2.04

1.48

3. Commerzbank Balance Sheet Drivers

2002

2003

2004

2005

2006

2007

2008

-12.2%

-4.9%

-6.8%

2.5%

-18.5%

-25.2%

3.9%

-33.7%

0.9%

-17.6%

0.7%

59.9%

-9.6%

3.0%

4.0%

4.5%

-10.0%

4.5%

0.0%

0.0%

-15.9%

0.0%

0.0%

0.0%

-67.6%

1.9%

3.0%

4.0%

5.0%

4.7%

5.0%

0.0%

0.0%

-19.0%

0.0%

0.0%

0.0%

62.5%

2.6%

3.0%

4.0%

5.0%

4.7%

5.0%

0.0%

0.0%

-23.4%

0.0%

0.0%

0.0%

30.8%

2.6%

3.0%

4.0%

5.0%

4.7%

5.0%

0.0%

0.0%

-30.6%

0.0%

0.0%

0.0%

17.2%

2.6%

3.0%

4.0%

5.0%

4.7%

5.0%

0.0%

0.0%

-44.0%

0.0%

0.0%

0.0%

8.7%

2.6%

-17.2%

4.5%

-9.4%

4.1%

-19.5%

-6.3%

22.7%

-11.4%

-9.3%

-3.9%

-9.9%

12.1%

-27.0%

0.6%

-261.2%

-1.0%

3550.0%

na

na

3.2%

-9.6%

3.00%

3.00%

4.00%

4.50%

0.0%

0.0%

0.0%

0.0%

0.0%

7.2%

2.6%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

na

na

-25.2%

1.9%

3.00%

3.00%

4.00%

5.00%

0.00%

0.00%

0.00%

0.00%

0.00%

10.5%

2.6%

0.0%

0.0%

5.2%

0.0%

0.0%

0.0%

1.5%

7.6%

-0.6%

2.6%

3.00%

3.00%

4.00%

5.00%

0.00%

0.00%

0.00%

0.00%

0.00%

11.6%

2.6%

0.0%

0.0%

5.0%

0.0%

0.0%

0.0%

6.9%

8.9%

-0.9%

2.6%

3.00%

3.00%

4.00%

5.00%

0.00%

0.00%

0.00%

0.00%

0.00%

12.9%

2.7%

0.0%

0.0%

5.1%

0.0%

0.0%

0.0%

6.8%

9.6%

-1.4%

2.6%

3.00%

3.00%

4.00%

5.00%

0.00%

0.00%

0.00%

0.00%

0.00%

14.5%

2.7%

0.0%

0.0%

5.2%

0.0%

0.0%

0.0%

6.1%

10.3%

-2.2%

2.6%

Assets

Cash reserve

Claims on banks

Claims on customers

Provisions for loan losses

Positive fair values from derivative hedging instruments

Assets held for dealing purposes

Investments and securities portfolio

Goodwill

Other intangible assets

Fixed assets

Tax assets

Other assets

Total assets

Liabilities

Liabilities to banks

Liabilities to customers

Securitised liabilities

Negative fair values from derivative hedging instruments

Liabilities from dealing activities

Provisions

Tax liabilities

Other liabilities

Subordinated capital

Minority interests

Total liabilities

Subscribed capital

Capital reserve

Retained earnings

Revaluation reserve

Measurement of cash flow hedges

Reserve from currency translation

Consolidated profit/loss

Treasury stock

Shareholders funds

Total liabilities and shareholders funds

4. Commerzbank Profit and Loss Drivers

Interest received/average earning assets

Interest paid/average interest-bearing liabilities

Growth in commissions received

Growth in commissions paid

Growth in trading profit

Profit on investments/investments

Operating expenses/interest and commission income

Other operating result/total assets

Minority interest in profit

2003

2004

2005

2006

2007

2008

2.99%

1.20%

3.68%

24.66%

35.48%

0.34%

117.84%

0.04%

4.08%

3.09%

1.20%

3.00%

3.00%

0.00%

0.34%

100.00%

0.04%

13.34%

3.19%

1.20%

3.00%

3.00%

0.00%

0.34%

98.00%

0.04%

19.12%

3.29%

1.20%

3.00%

3.00%

0.00%

0.34%

96.00%

0.04%

21.24%

3.39%

1.20%

3.00%

3.00%

0.00%

0.34%

94.00%

0.04%

23.91%

3.49%

1.20%

3.00%

3.00%

0.00%

0.34%

92.00%

0.04%

27.38%

5. Commerzbank end 2003 economic capital (Euro billion)

2003

RWA

Market risk (trading book)

Market risk (banking book)

Market risk (equity holdings)

Credit risk

Operational risk

Business risk

Total

Diversification effects

Economic capital after diversification effects

Tier I capital

Implied surplus

Economic capital/RWA (%)

140.8

0.8

0.7

2.9

4.3

0.9

0.5

10.1

-2.2

7.9

10.3

2.4

5.61%

6. Commerzbank Regulatory Risk Weighted Assets and Capital Ratios (Euro million)

Total book assets

Risk weighted assets (RWA)

Risk weighted assets/total assets

Minimum Tier 1 ratio (%)

Regulatory minimum total capital ratio (%)

Core capital

Equity capital in balance sheet

Minority interests

Goodwill

Adjustments

Tier I capital

Core capital ratio

Target capital ratio

Target capital

Surplus capital

Supplementary capital

Core capital

Subordinated capital

Adjustments

Tier II capital

Tier III capital

Total capital

Total capital ratio

2002

2003

2004

2005

2006

2007

2008

422,134

160,190

37.95%

381,585

140,829

36.91%

388,869

145,542

37.43%

398,805

149,261

37.43%

409,085

153,108

37.43%

419,719

157,088

37.43%

430,722

161,206

37.43%

4.00%

8.00%

4.00%

8.00%

4.00%

8.00%

4.00%

8.00%

4.00%

8.00%

4.00%

8.00%

4.00%

8.00%

8,808

1,262

(1,040)

2,661

11,691

7.30%

9,091

1,213

(690)

643

10,257

7.28%

5.61%

7,900

2,357

6,801

1,300

(580)

643

8,164

5.61%

5.61%

8,164

0

6,763

1,437

(470)

643

8,373

5.61%

5.61%

8,373

0

6,703

1,603

(360)

643

8,589

5.61%

5.61%

8,589

0

6,609

1,810

(250)

643

8,812

5.61%

5.61%

8,812

0

6,467

2,073

(140)

643

9,043

5.61%

5.61%

9,043

0

11,691

9,237

(1,475)

19,453

209

19,662

12.27%

10,257

8,381

(513)

18,125

125

18,250

12.96%

8,164

8,381

(513)

16,032

125

16,157

11.10%

8,373

8,381

(513)

16,241

125

16,366

10.96%

8,589

8,381

(513)

16,457

125

16,582

10.83%

8,812

8,381

(513)

16,680

125

16,805

10.70%

9,043

8,381

(513)

16,911

125

17,036

10.57%

7. Commerzbank Equity (Euro million)

2003

Share price (Euro)

Par value (Euro)

Equity issued

Equity bought back

Shares issued

Shares bought back

2004

2005

2006

2007

2008

0

(2,858)

0

(217)

0

(273)

0

(320)

0

(379)

0

(187)

0

(14)

0

(18)

0

(21)

0

(25)

15.32

2.60

8. Commerzbank Performance Ratios

2002

2003

2004

2005

2006

2007

2008

Income margin

Income/opening total assets

Return on opening total assets

Opening shareholders' funds/total assets

Return on equity

-5.67%

-47.23%

1.16%

-0.55%

2.09%

-26.34%

10.79%

1.38%

0.15%

2.38%

6.25%

9.98%

1.48%

0.15%

1.75%

8.48%

9.75%

1.58%

0.15%

1.70%

9.11%

9.54%

1.69%

0.16%

1.64%

9.82%

9.30%

1.79%

0.17%

1.57%

10.56%

Cost/income ratio

98.13%

91.84%

78.51%

77.89%

77.15%

76.28%

75.31%

9. Commerzbank cost of equity

Current cost of equity:

Risk free rate

Equity risk premium

Beta

Current cost of equity

4.02%

4.00%

1.17

8.70%

Market capitalisation

Surplus capital

Target capitalisation

9,106

(2,357)

6,749

Proforma Beta

Proforma cost of equity

1.58

10.33%

-25.88%

74.12%

10. Commerzbank Valuation (Euro million)

2004

2005

2006

2007

616

676

(60)

6,763

9.11%

10.33%

(83)

658

751

(93)

6,703

9.82%

10.33%

(35)

Terminus assumptions:

Assumed long term growth rate

Assumed long term ROE

2.00%

10.33%

Inputs from forecasts:

Profit after taxation

Cash flow to/(from) equity

Retained earnings

Opening shareholders' funds

Return on opening shareholders' funds

Cost of equity

Implied residual income

568

2,858

(2,290)

9,091

6.25%

10.33%

(372)

576

614

(38)

6,801

8.48%

10.33%

(126)

Discounted cash to equity value:

NPV five year free cash flow

NPV terminal value

Value of shareholders' funds

Shares issued (million)

Value per share (Eur)

Share price

Premium/(discount)

4,619

4,212

8,831

594

14.86

15.32

-3.01%

52.3%

47.7%

100.0%

Residual income valuation:

Opening shareholders' funds

PV five year residual income

PV terminal value (ex incremental investment)

PV terminal value (incremental investment)

Value of shareholders' funds

Shares issued (million)

Value per share (Eur)

Share price

Premium/(discount)

9,091

(517)

257

0

8,831

594

14.86

15.32

-3.01%

102.9%

-5.9%

2.9%

0.0%

100.0%

2008 Terminus

698

840

(142)

6,609

10.56%

10.33%

15

712

574

6,467

10.33%

10.33%

43

Vous aimerez peut-être aussi

- Bank ModelDocument12 pagesBank ModelDaviti LabadzePas encore d'évaluation

- 4019 XLS EngDocument4 pages4019 XLS EngAnonymous 1997Pas encore d'évaluation

- Financial Statements-Ceres Gardening CompanyDocument9 pagesFinancial Statements-Ceres Gardening CompanyHarshit MalviyaPas encore d'évaluation

- Love Verma Ceres Gardening SubmissionDocument8 pagesLove Verma Ceres Gardening Submissionlove vermaPas encore d'évaluation

- Financial+Statements Ceres+Gardening+CompanyDocument7 pagesFinancial+Statements Ceres+Gardening+CompanyBudhaditya basuPas encore d'évaluation

- Paramount Student SpreadsheetDocument12 pagesParamount Student Spreadsheetanshu sinhaPas encore d'évaluation

- Super Gloves 2Document6 pagesSuper Gloves 2anon_149445490Pas encore d'évaluation

- Ceres Gardening Company - Spreadsheet For StudentsDocument1 pageCeres Gardening Company - Spreadsheet For Studentsandres felipe restrepo arango0% (1)

- Caso Ceres en ClaseDocument4 pagesCaso Ceres en ClaseAdrian PeranPas encore d'évaluation

- BerauDocument2 pagesBerauluhutsituPas encore d'évaluation

- Ceres SpreadsheetDocument1 pageCeres SpreadsheetShannan RichardsPas encore d'évaluation

- Ceres Gardening CalculationsDocument9 pagesCeres Gardening CalculationsJuliana Marques0% (2)

- Financial ModelDocument38 pagesFinancial ModelufareezPas encore d'évaluation

- Exihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)Document22 pagesExihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)JuanPas encore d'évaluation

- Financial Statements-Ceres Gardening CompanyDocument7 pagesFinancial Statements-Ceres Gardening CompanyPrashant ChavanPas encore d'évaluation

- Maple Leaf Cement Factory Limited.Document17 pagesMaple Leaf Cement Factory Limited.MubasharPas encore d'évaluation

- Filinvest Land 2006-2010Document18 pagesFilinvest Land 2006-2010Christian VillarPas encore d'évaluation

- PROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetDocument17 pagesPROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetmissphPas encore d'évaluation

- 11 - Excelfiles - Student Text - Assignments - 2010Document6 pages11 - Excelfiles - Student Text - Assignments - 2010leuleuPas encore d'évaluation

- 11 Excelfiles Student Text Assignments 2010Document6 pages11 Excelfiles Student Text Assignments 2010leuleuPas encore d'évaluation

- Non Current Liabilities: Rupees in ThousandsDocument28 pagesNon Current Liabilities: Rupees in ThousandstanzeilPas encore d'évaluation

- Jiranna Financials 22Document20 pagesJiranna Financials 22Ellen MarkPas encore d'évaluation

- Financial MStatements Ceres MGardening MCompanyDocument11 pagesFinancial MStatements Ceres MGardening MCompanyRodnix MablungPas encore d'évaluation

- Financial+Statements Ceres+Gardening+CompanyDocument13 pagesFinancial+Statements Ceres+Gardening+Companysiri pallaviPas encore d'évaluation

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Complete Financial Model & Valuation of ARCCDocument46 pagesComplete Financial Model & Valuation of ARCCgr5yjjbmjsPas encore d'évaluation

- Financial+Statements Ceres+Gardening+CompanyDocument9 pagesFinancial+Statements Ceres+Gardening+CompanyVishalPas encore d'évaluation

- Financial Statements-Ceres Gardening CompanyDocument5 pagesFinancial Statements-Ceres Gardening CompanyVishesh0% (2)

- Atlas Honda: Analysis of Financial Statements Balance SheetDocument4 pagesAtlas Honda: Analysis of Financial Statements Balance Sheetrouf786Pas encore d'évaluation

- Sterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Document1 pageSterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Sterling Bank PLCPas encore d'évaluation

- Cargills (Ceylon) PLC: Provisional Financial StatementsDocument6 pagesCargills (Ceylon) PLC: Provisional Financial Statementskareem_nPas encore d'évaluation

- Balance Sheet of Maple Leaf: AssetsDocument12 pagesBalance Sheet of Maple Leaf: Assets01290101002675Pas encore d'évaluation

- Workshop For L2: Financial Statement Analysis: Ebit 1,230 1,607 1,858Document2 pagesWorkshop For L2: Financial Statement Analysis: Ebit 1,230 1,607 1,858Linh NguyễnPas encore d'évaluation

- Balance Sheet For 2009 & 2008: Assets 2009 (Nu.) 2008 (Nu.)Document3 pagesBalance Sheet For 2009 & 2008: Assets 2009 (Nu.) 2008 (Nu.)Singye SherubPas encore d'évaluation

- Aamir Ali Bba Viii ADocument9 pagesAamir Ali Bba Viii Aaamir aliPas encore d'évaluation

- Auditors Report: Financial Result 2005-2006Document11 pagesAuditors Report: Financial Result 2005-2006Hay JirenyaaPas encore d'évaluation

- Chapter 2Document32 pagesChapter 2AhmedPas encore d'évaluation

- Schwab Dec2022 SMART SupplementDocument1 pageSchwab Dec2022 SMART SupplementJames GarciaPas encore d'évaluation

- Financial Statements-Ceres Gardening CompanyDocument8 pagesFinancial Statements-Ceres Gardening Companypallavikotha84Pas encore d'évaluation

- Caso Ceres en ClaseDocument6 pagesCaso Ceres en ClaseYerly DescansePas encore d'évaluation

- Takaful Companies - Overall: ItemsDocument6 pagesTakaful Companies - Overall: ItemsZubair ArshadPas encore d'évaluation

- Newfield QuestionDocument8 pagesNewfield QuestionFaizan YousufPas encore d'évaluation

- Balance Sheet - Assets: Period EndingDocument3 pagesBalance Sheet - Assets: Period Endingvenu54Pas encore d'évaluation

- Case 2 - Q5 Group 5Document4 pagesCase 2 - Q5 Group 5Shaarang Begani0% (2)

- 3 Statement Financial Analysis TemplateDocument14 pages3 Statement Financial Analysis TemplateCười Vê LờPas encore d'évaluation

- Financial Statement of YAKULT Philippines CorpDocument5 pagesFinancial Statement of YAKULT Philippines CorpMonii OhPas encore d'évaluation

- Shipping Company Valuation-Case Study-141128Document17 pagesShipping Company Valuation-Case Study-141128nelvyPas encore d'évaluation

- Five Year Summary - Group: Balance SheetDocument1 pageFive Year Summary - Group: Balance SheetSab KeelsPas encore d'évaluation

- SCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022Document13 pagesSCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022kimPas encore d'évaluation

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14Pas encore d'évaluation

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhPas encore d'évaluation

- 2019 Quarter 1 FInancial StatementsDocument1 page2019 Quarter 1 FInancial StatementsKaystain Chris IhemePas encore d'évaluation

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaPas encore d'évaluation

- Spyder Student ExcelDocument21 pagesSpyder Student ExcelNatasha PerryPas encore d'évaluation

- IMT CeresDocument6 pagesIMT CeresDebasish PattanaikPas encore d'évaluation

- Datasets 523573 961112 Costco-DataDocument4 pagesDatasets 523573 961112 Costco-DataAnish DalmiaPas encore d'évaluation

- Balance SheetDocument2 pagesBalance SheetNishtha GuptaPas encore d'évaluation

- So Lieu Tai Chinh HAGL - Copy3.Document6 pagesSo Lieu Tai Chinh HAGL - Copy3.Dao HuynhPas encore d'évaluation

- CeresDocument9 pagesCeresDebangana BaruahPas encore d'évaluation

- Corporate Actions: A Guide to Securities Event ManagementD'EverandCorporate Actions: A Guide to Securities Event ManagementPas encore d'évaluation

- Terminal Value PDFDocument10 pagesTerminal Value PDFRoyLadiasanPas encore d'évaluation

- SEx 3Document33 pagesSEx 3Amir Madani100% (4)

- Exercise PTDTCK HVNHDocument10 pagesExercise PTDTCK HVNHBánh Bèo Kang100% (1)

- BFN3164 Assignment1 ReportDocument16 pagesBFN3164 Assignment1 ReportIBNAT AKILA IBNAT AKILAPas encore d'évaluation

- Tutorial 1 Bond ValuationDocument2 pagesTutorial 1 Bond Valuationtai kianhongPas encore d'évaluation

- Module 1 - Financial Statement Analysis - P2Document4 pagesModule 1 - Financial Statement Analysis - P2Jose Eduardo GumafelixPas encore d'évaluation

- Transferring Funds From Lenders To Borrowers: By: Myla Jenn L. ConstantinoDocument15 pagesTransferring Funds From Lenders To Borrowers: By: Myla Jenn L. ConstantinoIvy RosalesPas encore d'évaluation

- Final Exam Financial Management Antonius Cliff Setiawan 29119033Document20 pagesFinal Exam Financial Management Antonius Cliff Setiawan 29119033Antonius CliffSetiawan100% (4)

- Dividend Policy at FPLDocument24 pagesDividend Policy at FPLKinnari PandyaPas encore d'évaluation

- Mrs. Bectors - DRHP - Aug 2018Document493 pagesMrs. Bectors - DRHP - Aug 2018Vishal MPas encore d'évaluation

- Cyprus Regulations Financial Services Legal Framework Advanced Examination Ed1 V1.3Document270 pagesCyprus Regulations Financial Services Legal Framework Advanced Examination Ed1 V1.3jan rosenzweig100% (1)

- Trading SessionsDocument22 pagesTrading SessionsAdam SehramPas encore d'évaluation

- Pooled Funds 2019 EditionDocument97 pagesPooled Funds 2019 EditionPatrick CuraPas encore d'évaluation

- Sneha Black BookDocument53 pagesSneha Black BookAshwathi SumitraPas encore d'évaluation

- Flipkart See FinalDocument18 pagesFlipkart See FinalRavi ganganiPas encore d'évaluation

- NVCA Yearbook 2014Document127 pagesNVCA Yearbook 2014Jon RooneyPas encore d'évaluation

- Far670 - Q - Feb 2021Document5 pagesFar670 - Q - Feb 2021AMIRA BINTI AMRANPas encore d'évaluation

- Seergdsd 3 THRHRRTRDocument3 pagesSeergdsd 3 THRHRRTRrbp_1973Pas encore d'évaluation

- CBS Selection - GartnerDocument6 pagesCBS Selection - GartnerSIYONA CHAMOLAPas encore d'évaluation

- FPO-Follow On Public Offer: Consideration For An FPODocument8 pagesFPO-Follow On Public Offer: Consideration For An FPOpaliwal1987Pas encore d'évaluation

- SAPM Course OutlinelDocument7 pagesSAPM Course OutlinelNimish KumarPas encore d'évaluation

- DCF Excel FormatDocument5 pagesDCF Excel FormatRaja EssakyPas encore d'évaluation

- Section L Other Approaches To Value Measurement: Market Value Added Approach (MVA)Document7 pagesSection L Other Approaches To Value Measurement: Market Value Added Approach (MVA)SatyajeetPas encore d'évaluation

- Management Unit 1 PPT 2Document47 pagesManagement Unit 1 PPT 2satyam ranaPas encore d'évaluation

- Chain Roop Bhansali Scam (The CRB Scam)Document16 pagesChain Roop Bhansali Scam (The CRB Scam)taeyong leePas encore d'évaluation

- Coca Cola Vs PepsiDocument19 pagesCoca Cola Vs PepsiUsaid Khan100% (1)

- BD5 SM28Document2 pagesBD5 SM28ksgPas encore d'évaluation

- Eq Desember 2013Document241 pagesEq Desember 2013Herik AziziPas encore d'évaluation

- Infosys Limited - Letter of Offer PDFDocument70 pagesInfosys Limited - Letter of Offer PDFAvinash PatraPas encore d'évaluation

- Chapter 13 Financing The DealDocument27 pagesChapter 13 Financing The DealK60 Phạm Thị Phương AnhPas encore d'évaluation