Académique Documents

Professionnel Documents

Culture Documents

2 Cycle Monitor 15Q3 FINAL

Transféré par

mejiasidCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2 Cycle Monitor 15Q3 FINAL

Transféré par

mejiasidDroits d'auteur :

Formats disponibles

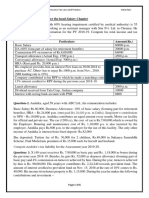

Cycle Monitor Real Estate Market

Cycles

Third Quarter 2015 Analysis

November 2015

Physical Market Cycle Analysis of All Five Major Property Types in More Than 50 MSAs.

International turmoil, slow European Union and Asian economic growth along with weak demand for oil have not harmed the moderate

growth in the U.S. economy as more jobs are being created. The consumer confidence index continues to improve and consumer demand

continues to grow. The result is that moderate demand growth has also continued in all property types. The strong dollar has slowed U.S.

exports and moderated manufacturing employment growth, but import growth is fueling demand for warehouse space along with higher

internet sales.

Office occupancies improved 0.2% in 3Q15, and rents grew 1.2% for the quarter and 4.3% annually.

Industrial occupancies improved 0.1% in 3Q15, but rents grew 1.2% for the quarter and 5.4% annually.

Apartment occupancies were flat in 3Q15, but rents grew 1.2% for the quarter and 4.2% annually.

Retail occupancy improved 0.1% in 3Q15, and rents grew 0.7% for the quarter and 2.7% annually.

Hotel occupancies improved 0.1% in 3Q15, and room rates declined 0.3% for the quarter and increased 2.1% annually.

National Property Type Cycle Locations

Phase 3 Hypersupply

Phase 2 Expansion

Retail 1st Tier Regional Mall

Hotel Full-Service

Hotel Ltd. Service

Industrial Warehouse

Apartment

Health Facility

Retail Power Center+1

10

11

9

8

Office Downtown+1

7

6

1

12

13

LT Average Occupancy

14

15

Industrial R&D Flex

Retail Factory Outlet+1

Retail Neighborhood/Community

16

Office Suburban

3rd Qtr 2015

Source: Mueller, 2015

Phase 1 Recovery

Phase 4 Recession

Glenn R. Mueller, Ph.D. 303.953.3872

gmueller@dividendcapital.com

th

th

Dividend Capital Research, 518 17 Street, 17 Floor, Denver, CO 80202

www.dividendcapital.com 866.324.7348

All relevant disclosures and certifications appear on page 9 of this report.

Real Estate Market Cycle Monitor

Third Quarter 2015 Analysis November 2015

-2-

Dividend Capital Research

The cycle monitor analyzes occupancy movements in five property types in more than 50 Metropolitan Statistical Areas (MSAs).

Market cycle analysis should enhance investment-decision capabilities for investors and operators. The five property type cycle charts

summarize almost 300 individual models that analyze occupancy levels and rental growth rates to provide the foundation for

long-term investment success. Real estate markets are cyclical due to the lagged relationship between demand and supply for physical

space. The long-term occupancy average is different for each market and each property type. Long-term occupancy average is a key

factor in determining rental growth rates a key factor that affects real estate returns.

Market Cycle Quadrants

Source: Mueller, Real Estate Finance, 1995.

Rental growth rates can be characterized in different parts of the market cycle, as shown below.

Source: Mueller, Real Estate Finance, 1995.

Real Estate Market Cycle Monitor

Third Quarter 2015 Analysis November 2015

-3-

Dividend Capital Research

OFFICE

The national office market occupancy level improved 0.2% in 3Q15, and was up 0.6% year-over-year to a seven-year high. Almost 30

million square feet were absorbed in 3Q15. San Jose, Atlanta, Chicago, Dallas and San Diego led with 2.1 million square feet of

absorption each. Completions were barely more than half demand growth at just more than 16 million square feet with New York,

Dallas, Houston and Seattle leading the pack. Average national rents were up 1.2% in 3Q15 and rents were up 4.3% year-over-year,

more than double the rate of inflation.

Office Market Cycle Analysis

3rd Quarter, 2015

Ft. Lauderdale

Hartford

Kansas City

Memphis

Richmond

St. Louis

Albuquerque

Chicago

East Bay

Long Island

Norfolk

N. New Jersey

Stamford

Wash DC

Wilmington

Atlanta

Columbus

Denver

Jacksonville

Minneapolis

Orlando

Palm Beach

Sacramento

Seattle

Austin+1

San Francisco

San Jose+1

Charlotte

10

9

6

3

Cincinnati

Cleveland

Houston

Los Angeles

Milwaukee

Orange County

San Antonio

5

Baltimore

Boston

Detroit

Indianapolis

Las Vegas+1

New Orleans

Oklahoma City

Philadelphia+1

Phoenix+1

San Diego

Tampa

NATION+1

12

8

7

11

Dallas FW

New York

Miami+1

Pittsburgh

Portland

Riverside

13

LT Average Occupancy

Honolulu

Nashville

Raleigh-Durham+1

Salt Lake

14

15

16

Source: Mueller, 2015

Note: The 11-largest office markets make up 50% of the total square footage of office space we monitor. Thus, the

11-largest office markets are in bold italic type to help distinguish how the weighted national average is affected.

Markets that have moved since the previous quarter are now shown with a + or - symbol next to the market name and the number of positions the market has moved is

also shown, i.e., +1, +2 or -1, -2. Markets do not always go through smooth forward-cycle movements and can regress, or move backward in their cycle position when

occupancy levels reverse their usual direction. This can happen when the marginal rate of change in demand increases (or declines) faster than originally estimated or if

supply growth is stronger (or weaker) than originally estimated.

Real Estate Market Cycle Monitor

Third Quarter 2015 Analysis November 2015

-4-

Dividend Capital Research

INDUSTRIAL

Industrial occupancies improved 0.1% in 3Q15, and were up 0.5% year-over-year. Absorption was approximately 50 million square

feet with the logistics warehouse sector capturing 38 million square feet of the total. Chicago led the pack in absorption while Los

Angeles was the highest occupancy market at approximately 99%. Completions were slightly higher than absorption, led by the Inland

Empire at more than 22 million square feet, but the national vacancy average still declined. Landlords continue to push rents making

industrial the best performing property type. The industrial national average rent index increased 1.2% in 3Q15 and was up 5.4%

year-over-year.

Industrial Market Cycle Analysis

3rd Quarter, 2015

Atlanta+2

Charlotte

Kansas City+1

Nashville

Pittsburgh

Portland

Raleigh-Durham+1

Seattle

Boston

Detroit+1

Ft. Lauderdale+1

New Orleans+2

New York

N. New Jersey

Orlando+1

San Antonio

St. Louis

Tampa

NATION

East Bay

Richmond+2

Sacramento

Wash DC

Austin

Chicago+1

Cincinnati

Columbus+1

Honolulu

Indianapolis

Las Vegas+1

Miami

Minneapolis

Palm Beach

Salt Lake

San Diego

San Jose

10

Denver

Houston+3

Los Angeles

Riverside+1

Dallas FW+1

San Francisco+1

11

12

8

7

Norfolk

Orange County

2

Stamford

6

4

5

Baltimore

Hartford

Long Island

Oklahoma City

Philadelphia

Phoenix

13

LT Average Occupancy

14

15

Cleveland

Jacksonville+1

Memphis+1

Milwaukee

16

Source: Mueller, 2015

Note: The 12-largest industrial markets make up 50% of the total square footage of industrial space we monitor. Thus, the 12-largest

industrial markets are in bold italic type to help distinguish how the weighted national average is affected.

Markets that have moved since the previous quarter are shown with a + or - symbol next to the market name and the number of positions the market has moved is also

shown, e.g., +1, +2 or -1, -2. Markets do not always go through smooth forward-cycle movements and can regress, or move backward in their cycle position when

occupancy levels reverse their usual direction. This can happen when the marginal rate of change in demand increases (or declines) faster than originally estimated or if

supply growth is stronger (or weaker) than originally estimated.

Real Estate Market Cycle Monitor

Third Quarter 2015 Analysis November 2015

-5-

Dividend Capital Research

APARTMENT

The national apartment occupancy average was flat in 3Q15, and improved only 0.1% year-over-year as most markets were at their

cyclical peak. We have been talking about overbuilding for more than a year, but the demand for apartments has been surprisingly

robust, due to the strong hiring of the Millennial generation, providing them with the ability to move to independent living quarters.

Downtowns have both the majority of demand and construction, but rental prices are high, pushing many Millennials out to less

expensive or smaller units. Many downtown markets are now seeing construction of sub-500 square foot apartments that can rent at

sub-$1,000 rents per month. San Francisco and San Jose markets have rents 40% above their 2007 market peaks, while Las Vegas is the

only market that has not yet returned to previous peak rents. Average national apartment rent growth slowed to 1.2% in 3Q15 and was

up 4.2% year-over-year.

Apartment Market Cycle Analysis

3rd Quarter, 2015

Austin-1

Baltimore

Chicago

Cleveland

Columbus

Dallas FW

Detroit+1

East Bay

Ft. Lauderdale

Honolulu

Indianapolis

Jacksonville

Kansas City

Las Vegas

Long Island

Los Angeles

Miami

Milwaukee

Minneapolis

10

9

New Orleans

N. New Jersey

Orange County

Orlando

Palm Beach-1

Philadelphia

Phoenix

Pittsburgh

Portland

Raleigh-Durham-1

Riverside

Sacramento

Salt Lake-1

San Antonio

San Francisco

San Jose

St. Louis

Wash DC-1

NATION

11

12

LT Average Occupancy

Stamford

Tampa

14

6

1

Atlanta

Boston

Charlotte

Cincinnati+1

Denver

Hartford

Houston

Source: Mueller, 2015

Norfolk

13

Memphis+1

Nashville-1

New York

Oklahoma City

Richmond

San Diego

Seattle+1

15

16

Note: The 10-largest apartment markets make up 50% of the total square footage of multifamily space we monitor. Thus, the 10-largest

apartment markets are in bold italic type to help distinguish how the weighted national average is affected.

Markets that have moved since the previous quarter are shown with a + or - symbol next to the market name and the number of positions the market has moved is also

shown, e.g., +1, +2 or -1, -2. Markets do not always go through smooth forward-cycle movements and can regress, or move backward in their cycle position when

occupancy levels reverse their usual direction. This can happen when the marginal rate of change in demand increases (or declines) faster than originally estimated or if

supply growth is stronger (or weaker) than originally estimated.

Real Estate Market Cycle Monitor

Third Quarter 2015 Analysis November 2015

-6-

Dividend Capital Research

RETAIL

Retail occupancies were up 0.1% in 3Q15, and were up 0.5% year-over-year. Retailers are taking a new tactic with Black Friday sales

promotions throughout the month of November to try to broaden their sales. The results of this new strategy are yet to be seen.

Occupancies improved enough in 19 markets to move them forward in their cycle position. Even though the national occupancy

increase was moderate, it was enough to move the national average forward to point #8 the cost feasible rent level point on the

cycle. Downtown retail has seen the strongest demand as retailers target the millennial generation growth. National average retail rents

increased 0.7% in 3Q15 and were up 2.7% year-over-year.

Retail Market Cycle Analysis

3rd Quarter, 2015

Charlotte+2

Dallas FW +1

Ft. Lauderdale+1

Hartford+1

Indianapolis

Nashville+1

N. New Jersey+1

New Orleans

San Antonio+1

Cleveland

Detroit

Jacksonville

Memphis

Milwaukee

Norfolk

Orange County

Philadelphia

Riverside

Denver+1

Los Angeles+1

Orlando+1

Portland+1

Seattle

Oklahoma City

St. Louis

Chicago

Columbus

Sacramento

Stamford

11

12

8

7

10

Boston

Honolulu

New York

Raleigh-Durham

San Francisco

6

3

Austin

Baltimore+2

East Bay+1

Houston+2

Miami

Minneapolis+1

Pittsburgh

Salt Lake

San Diego+1

San Jose

Wash DC

Atlanta+1

Cincinnati

Kansas City+2

Las Vegas+1

Phoenix+1

Richmond

13

LT Average Occupancy

Long Island

Palm Beach+1

Tampa

NATION+1

14

15

16

Source: Mueller, 2015

Note: The 15-largest retail markets make up 50% of the total square footage of retail space we monitor. Thus, the

15-largest retail markets are in bold italic type to help distinguish how the weighted national average is affected.

Markets that have moved since the previous quarter are shown with a + or - symbol next to the market name and the number of positions the market has moved is also

shown, e.g., +1, +2 or -1, -2. Markets do not always go through smooth forward-cycle movements and can regress, or move backward in their cycle position when

occupancy levels reverse their usual direction. This can happen when the marginal rate of change in demand increases (or declines) faster than originally estimated or if

supply growth is stronger (or weaker) than originally estimated.

Real Estate Market Cycle Monitor

Third Quarter 2015 Analysis November 2015

-7-

Dividend Capital Research

HOTEL

Hotel occupancies increased an average of 0.1% in 3Q15, and were up 1.5% year-over-year. Room demand growth moderated slightly

in the third quarter which many consider a seasonal and cyclical trend. The increased use of Airbnb.com is moderating occupancy

growth and putting pressure on hotels to keep room rates competitive. Many new hotels are also now online, creating additional new

and competitive supply. National average hotel room rates declined 0.3% in 3Q15, but were up 2.1% year-over-year.

Hotel Market Cycle Analysis

3rd Quarter, 2015

Charlotte

East Bay

Ft. Lauderdale

Las Vegas

Los Angeles

Orlando

Philadelphia

San Diego

San Francisco-1

Tampa

Atlanta

Wash DC

Baltimore+1

NATION

Jacksonville+2

New Orleans

N. New Jersey

Dallas FW+1

Detroit

Phoenix+2

San Antonio+2

Kansas City

Orange County

Richmond

Riverside+2

Sacramento+1

Cincinnati

Norfolk

6

2

Austin+1

Pittsburgh+1

12

13

Milwaukee+2

LT Average Occupancy

Columbus

Hartford

Stamford

11

8

7

10

Boston

Chicago+2

Denver+1

Honolulu

Houston

Long Island-1

Miami

Minneapolis+1

Nashville+1

New York

Palm Beach

Portland

San Jose+1

Seattle+1

14

15

Cleveland+1

Indianapolis

Memphis

Oklahoma City

Raleigh-Durham

Salt Lake

St. Louis

16

Source: Mueller, 2015

Note: The 14-largest hotel markets make up 50% of the total square footage of hotel space that we monitor. Thus, the

14-largest hotel markets are in boldface italics to help distinguish how the weighted national average is affected.

Markets that have moved since the previous quarter are shown with a + or - symbol next to the market name and the number of positions the market has moved is also

shown, e.g., +1, +2 or -1, -2. Markets do not always go through smooth forward-cycle movements and can regress, or move backward in their cycle position when

occupancy levels reverse their usual direction. This can happen when the marginal rate of change in demand increases (or declines) faster than originally estimated or if

supply growth is stronger (or weaker) than originally estimated.

Real Estate Market Cycle Monitor

Third Quarter 2015 Analysis November 2015

-8-

Dividend Capital Research

MARKET CYCLE ANALYSIS Explanation

Supply and demand interaction is important to understand. Starting in Recovery Phase I at the bottom of a cycle (see chart below), the

marketplace is in a state of oversupply from previous new construction or negative demand growth. At this bottom point, occupancy is at its trough.

Typically, the market bottom occurs when the excess construction from the previous cycle stops. As the cycle bottom is passed, demand growth begins

to slowly absorb the existing oversupply and supply growth is nonexistent or very low. As excess space is absorbed, vacancy rates fall allowing rental

rates in the market to stabilize and even begin to increase. As this recovery phase continues, positive expectations about the market allow landlords to

increase rents at a slow pace (typically at or below inflation). Eventually, each local market reaches its long-term occupancy average whereby rental

growth is equal to inflation.

In Expansion Phase II, demand growth continues at increasing levels, creating a need for additional space. As vacancy rates fall below the longterm occupancy average, signaling that supply is tightening in the marketplace, rents begin to rise rapidly until they reach a cost-feasible level that

allows new construction to commence. In this period of tight supply, rapid rental growth can be experienced, which some observers call rent spikes.

(Some developers may also begin speculative construction in anticipation of cost-feasible rents if they are able to obtain financing.) Once cost-feasible

rents are achieved in the marketplace, demand growth is still ahead of supply growth a lag in providing new space due to the time to construct. Long

expansionary periods are possible and many historical real estate cycles show that the overall up-cycle is a slow, long-term uphill climb. As long as

demand growth rates are higher than supply growth rates, vacancy rates will continue to fall. The cycle peak point is where demand and supply are

growing at the same rate or equilibrium. Before equilibrium, demand grows faster than supply; after equilibrium, supply grows faster than demand.

Hypersupply Phase III of the real estate cycle commences after the peak/equilibrium point #11 where demand growth equals supply growth.

Most real estate participants do not recognize this peak/equilibriums passing, as occupancy rates are at their highest and well above long-term averages,

a strong and tight market. During Phase III, supply growth is higher than demand growth (hypersupply), causing vacancy rates to rise back toward the

long-term occupancy average. While there is no painful oversupply during this period, new supply completions compete for tenants in the marketplace.

As more space is delivered to the market, rental growth slows. Eventually, market participants realize that the market has turned down and commitments

to new construction should slow or stop. If new supply grows faster than demand once the long-term occupancy average is passed, the market falls into

Phase IV.

Recession Phase IV begins as the market moves past the long-term occupancy average with high supply growth and low or negative demand

growth. The extent of the market down-cycle will be determined by the difference (excess) between the market supply growth and demand growth.

Massive oversupply, coupled with negative demand growth (that started when the market passed through long-term occupancy average in 1984), sent

most U.S. office markets into the largest down-cycle ever experienced. During Phase IV, landlords realize that they will quickly lose market share if

their rental rates are not competitive; they then lower rents to capture tenants, even if only to cover their buildings fixed expenses. Market liquidity is

also low or nonexistent in this phase, as the bidask spread in property prices is too wide. The cycle eventually reaches bottom as new construction and

completions cease, or as demand growth turns up and begins to grow at rates higher than that of new supply added to the marketplace.

Occupancy

Demand/Supply

Equilibrium

-Demand growth continues

-New construction begins

(Parallel Expectations)

-Space difficult

to find

-Rents rise rapidly

toward new

construction levels

-Supply growth higher

than demand growth

pushing vacancies up

Cost Feasible New Construction

LT Occupancy Average

- Low

-New demand

confirmed

Excess space absorbed

(Parallel Expectations)

-New demand not

confirmed in

marketplace

(Mixed Expectations)

Time

or negative

demand growth

-Construction

starts slow but

completions

push vacancies

higher

Physical

Market Cycle

Characteristics

Source: Mueller, Real Estate Finance, 1995

This research currently monitors five property types in more than 50 major markets. We gather data from numerous sources to evaluate and forecast

market movements. The market cycle model we developed looks at the interaction of supply and demand to estimate future vacancy and rental rates.

Our individual market models are combined to create a national average model for all U.S. markets. This model examines the current cycle locations

for each property type and can be used for asset allocation and acquisition decisions.

Real Estate Market Cycle Monitor

Third Quarter 2015 Analysis November 2015

-9-

Dividend Capital Research

Important Disclosures and Certifications

I, Glenn R. Mueller, Ph.D. certify that the opinions and forecasts expressed in this research report accurately reflect my

personal views about the subjects discussed herein; and I, Glenn R. Mueller, certify that no part of my compensation from

any source was, is, or will be directly or indirectly related to the content of this research report.

The information contained in this report: (i) has been prepared or received from sources believed to be reliable but is not guaranteed;

(ii) is not a complete summary or statement of all available data; (iii) is not an offer or recommendation to buy or sell any particular

securities; and (iv) is not an offer to buy or sell any securities in the markets or sectors discussed in the report.

The opinions and forecasts expressed in this report are subject to change without notice and do not take into account the particular

investment objectives, financial situation or needs of individual investors. Any opinions or forecasts in this report are not guarantees

of how markets, sectors or individual securities or issuers will perform in the future, and the actual future performance of such

markets, sectors or individual securities or issuers may differ. Further, any forecasts in this report have not been based on information

received directly from issuers of securities in the sectors or markets discussed in the report.

Dr. Mueller serves as a Real Estate Investment Strategist with Dividend Capital Group. In this role, he provides investment advice

to Dividend Capital Group and its affiliates regarding the real estate market and the various sectors within that market. Mr. Muellers

compensation from Dividend Capital Group and its affiliates is not based on the performance of any investment advisory client of

Dividend Capital Group or its affiliates.

Dividend Capital Group is a real estate investment management company that focuses on creating institutional-quality real estate

financial products for individual and institutional investors. Dividend Capital Group and its affiliates also provide investment

management services and advice to various investment companies, real estate investment trusts, and other advisory clients about the

real estate markets and sectors, including specific securities within these markets and sectors.

Investment advisory clients of Dividend Capital Group or its affiliates may from time to time invest a significant portion of their

assets in the securities of companies primarily engaged in the real estate industry, such as real estate investment trusts, or in real

estate itself, and may have investment strategies that focus on specific real estate markets, sectors and regions. Real estate investments

purchased or sold based on the information in this research report could indirectly benefit these clients by increasing the value of

their portfolio holdings, which in turn would increase the amount of advisory fees that these clients pay to Dividend Capital Group

or its affiliates.

Dividend Capital Group and its affiliates (including their respective officers, directors and employees) may at times: (i) release

written or oral commentary, technical analysis or trading strategies that differ from or contradict the opinions and forecasts expressed

in this report; (ii) invest for their own accounts in a manner contrary to or different from the opinions and forecasts expressed in this

report; and (iii) have long or short positions in securities or in options or other derivative instruments based thereon. Furthermore,

Dividend Capital Group and its affiliates may make recommendations to, or effect transactions on behalf of, their advisory clients in

a manner contrary to or different from the opinions and forecasts in this report. Real estate investments purchased or sold based on

the information in this report could indirectly benefit Dividend Capital Group, its affiliates, or their respective officers, employees

and directors by increasing the value of their proprietary or personal portfolio holdings.

Dr. Mueller may from time to time have personal investments in real estate, in securities of issuers in the markets or sectors discussed

in this report, or in investment companies or other investment vehicles that invest in real estate and the real estate securities markets

(including investment companies and other investment vehicles for which Dividend Capital Group or an affiliate serves as investment

adviser). Real estate investments purchased or sold based on the information in this report could directly benefit Dr. Mueller by

increasing the value of his personal investments.

2015 Dividend Capital Research, 518 17th Street, Denver, CO 80202

NOT A DEPOSIT | NOT FDIC INSURED | NOT GUARANTEED BY THE BANK | MAY LOSE VALUE |

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Summary Candle PatternsDocument6 pagesSummary Candle PatternsmejiasidPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Spe 175111 MS PDFDocument21 pagesSpe 175111 MS PDFmejiasidPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Explanations Examples: How Form Infinitives and GerundsDocument2 pagesExplanations Examples: How Form Infinitives and GerundsmejiasidPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Essay Main PointsDocument11 pagesEssay Main PointsmejiasidPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Reversal Patterns GuideDocument6 pagesReversal Patterns GuidemejiasidPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- ConnectorsDocument2 pagesConnectorsmejiasidPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Essay Main PointsDocument11 pagesEssay Main PointsmejiasidPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Spe 174968 MS PDFDocument11 pagesSpe 174968 MS PDFmejiasidPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Spe 173213 MSDocument31 pagesSpe 173213 MSmejiasidPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Spe 1317581Document1 pageSpe 1317581kounhetsovPas encore d'évaluation

- Spe 170690Document35 pagesSpe 170690ilkerkozturkPas encore d'évaluation

- Spe4832 CompletefinalDocument16 pagesSpe4832 CompletefinalTfay89Pas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Paper Conventional and NonConventional WellsDocument40 pagesPaper Conventional and NonConventional WellsmejiasidPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Spe164545 PDFDocument14 pagesSpe164545 PDFmejiasidPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- OTC 20879 MS (Perdido)Document10 pagesOTC 20879 MS (Perdido)mejiasidPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- IPTC 10994-MS-P Mercury Capillary PressureDocument12 pagesIPTC 10994-MS-P Mercury Capillary PressuremejiasidPas encore d'évaluation

- 00018873Document6 pages00018873mejiasidPas encore d'évaluation

- Spe 151442 MS PDocument11 pagesSpe 151442 MS PmejiasidPas encore d'évaluation

- SPE 72598 Carbonate Reservoir CharacterizationDocument10 pagesSPE 72598 Carbonate Reservoir CharacterizationmejiasidPas encore d'évaluation

- B P - Petrophysical Reservoir EvaluationDocument42 pagesB P - Petrophysical Reservoir Evaluationmejiasid100% (5)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Chapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document21 pagesChapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Arrangement of Funds LPSDocument57 pagesArrangement of Funds LPSRohan SinglaPas encore d'évaluation

- Practical Accounting Problems SolvedDocument11 pagesPractical Accounting Problems SolvedStela Marie CarandangPas encore d'évaluation

- 12-Leverage and Capital StructureDocument34 pages12-Leverage and Capital StructureJean Jane EstradaPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Ind As - 33Document13 pagesInd As - 33RaghavanPas encore d'évaluation

- Financial Litigation Dividend and Stock Split CalculatorDocument5 pagesFinancial Litigation Dividend and Stock Split CalculatorAjeet YadavPas encore d'évaluation

- 2019legislation - RA-11232-REVISED-CORPORATION-CODE-2019 With NotesDocument73 pages2019legislation - RA-11232-REVISED-CORPORATION-CODE-2019 With NotesSha NapolesPas encore d'évaluation

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Question BankDocument6 pagesQuestion BankmaabachaPas encore d'évaluation

- Nature of treasury sharesDocument4 pagesNature of treasury sharesMae SampangPas encore d'évaluation

- Exercise Problem 3 - Shareholder's EquityDocument5 pagesExercise Problem 3 - Shareholder's EquityLLYOD FRANCIS LAYLAYPas encore d'évaluation

- Kddi Ar2019 eDocument134 pagesKddi Ar2019 eCam CruzPas encore d'évaluation

- Nirc PDFDocument160 pagesNirc PDFCharlie Magne G. Santiaguel100% (3)

- Financial RatiosDocument9 pagesFinancial RatiosDavid Isaias Jaimes ReyesPas encore d'évaluation

- Vijaya Bank Loans and Advances PerformanceDocument80 pagesVijaya Bank Loans and Advances Performanceram801100% (1)

- Rio Tinto Annual Report 2018Document306 pagesRio Tinto Annual Report 2018Mikhael Yudha Damara PurbaPas encore d'évaluation

- Hotel and Restaurant at Blue Nile FallsDocument26 pagesHotel and Restaurant at Blue Nile Fallsbig johnPas encore d'évaluation

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbPas encore d'évaluation

- MCQ On Buy Back of Shares - Multiple Choice Questions and AnswerDocument2 pagesMCQ On Buy Back of Shares - Multiple Choice Questions and AnswerDhawal RajPas encore d'évaluation

- Generic Ic Disc PresentationDocument55 pagesGeneric Ic Disc PresentationInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 14 Financial Statement AnalysisDocument56 pages14 Financial Statement Analysissonuabbasali100% (1)

- By Graham HoltDocument5 pagesBy Graham Holtwhosnext886Pas encore d'évaluation

- Analisa SahamDocument10 pagesAnalisa SahamGede AriantaPas encore d'évaluation

- p2 With AnswersDocument26 pagesp2 With AnswersDeepak ParidaPas encore d'évaluation

- Chapter 2 Advanced AccountingDocument9 pagesChapter 2 Advanced AccountingMohamad Adel Al AyoubiPas encore d'évaluation

- Group Financial Results & Update for FY2017Document40 pagesGroup Financial Results & Update for FY2017vignespoonganPas encore d'évaluation

- Bank WooRi Saudara 2013Document412 pagesBank WooRi Saudara 2013Ramadhan FauziPas encore d'évaluation

- Valuation of Bonds and DebenturesDocument10 pagesValuation of Bonds and DebenturescnagadeepaPas encore d'évaluation

- Apino Jan Dave T. BSA 4-1 QuizDocument14 pagesApino Jan Dave T. BSA 4-1 QuizRosemarie RamosPas encore d'évaluation

- Accounting Theory PDFDocument14 pagesAccounting Theory PDFConnor McCarraPas encore d'évaluation

- $100M Leads: How to Get Strangers to Want to Buy Your StuffD'Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffÉvaluation : 5 sur 5 étoiles5/5 (12)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoD'Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoÉvaluation : 5 sur 5 étoiles5/5 (21)

- Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) (The Surrounded by Idiots Series) by Thomas Erikson: Key Takeaways, Summary & AnalysisD'EverandSurrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) (The Surrounded by Idiots Series) by Thomas Erikson: Key Takeaways, Summary & AnalysisÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)