Académique Documents

Professionnel Documents

Culture Documents

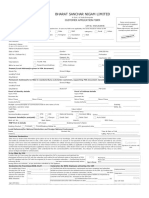

UBL Form

Transféré par

Sikandar GujjarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

UBL Form

Transféré par

Sikandar GujjarDroits d'auteur :

Formats disponibles

Date 18-Feb-2016

Reset

Application / Remittance Form

Branch

Remittance Details

Remittance to be processed against

Cash

Transfer

Account Holder

Non Account Holder

Currency of Transaction

EURO

PKR

GBP

USD

Cheque No #

(Debit Authority) if transfer,Please Specify

Branch Code

(Please ensure correct mode of transaction is selected)

AED

Debit Account:

SAR

Other

Online Transfer

(For UBL to UBL Transfer only)

Cashier's Cheque

FDD

SWIFT

Inter Bank Fund Transfer-IBFT

Foreign Transfer

Corporate Banker's Cheque-CBC

Others e.g. Telegraphic Transfer etc.

SDR

Amount in Figures

Amount in words

Beneficiary Details

Favoring/Name of the Beneficiary

Bank Account No/IBAN

Swift / FDD

Drawn On

Address of the Bank

Country

City

CNIC/SNIC

Identification (Select Any one)

NICOP

(Overseas Pakistani)

Pakistan Origin Card

Passport No.

Expiry date

ARC

POR

DD-MMM-YYYY

Address

Contact No. (Mobile/Landline)

N.T.N No:

Remitter's/Applicant's Details

Name

Father/Husband Name

CNIC/SNIC

Identification (Select Any one)

NICOP

Pakistan Origin Card

Passport No.

(Overseas Pakistani)

(Copy to be retained from walkin customer)

Expiry date

ARC

DD-MMM-YYYY

Address

Contact No. (Mobile/Landline)

Nationality

N.T.N No:

Beneficial owner of the Funds

Relationship with

the Beneficiary

(if different from Applicant)

Source of Funds

Salary

Business

Remittance

Others (Please Specify)

Rental

Sales of Moveable & Immoveable Property

(For Non Account Holders & Cash Remittances

above Rs. 0.5 M & For FCY above US$ 5,000 or equivalent)

Line of Business/ Occupation

Remittance by Individual

Date of Birth

Place of Birth

Date of Registration

Registration No.

Remittance by Business entity

Purpose of

Remittance

DD-MMM-YYYY

DD-MMM-YYYY

Place of Incorporation of Business

Personal

Education (Admission/Term fee)

Vehicle

Business

Commercial Remittance

Medical Treatment

Property

Agent Commission

Remittance as per Form M

Other

Import

Other

(Attach Performa Invoice)

Family Purpose / Home Remittance

Declaration

It is understood and agreed that this transfer is to be made entirely at my/our risk without responsibility

on the part of United Bank Limited or its correspondent(s), for any loss occasioned by errors ordelays in

transmission nor for the correspondent(s) or agencies necessarily employed by United Bank Limited in

the transfer of the money. I/We confirm that the information provided by me on

this form is true and correct. The Bank reserves the right to ask for any transaction related documents

from the applicant whenever required. I/We authorise the Bank to disclose any information

statedabove, should it be required by the Bank's Branches / correspondents for effecting Payment. I/We

have also read, understood and accept the terms and conditions printed overleaf.

Applicants Signature

Applicants Acknowledgement

(I confirm having received the instrument)

For Bank User Only

Amount

Rupee

Principal Amount

PS.

Instrument No:

Fax Charges

Commission

F.E.D

Withholding Tax

Total Deduction

Cashier

Officer 1

Officer 2

POR

TERMS AND CONDITIONS OF REMITTANCE

In consideration of Bank's acceptance of the Customer/Account Holder/Applicant(Customer) funds transfer instructions or for

purchasing the Cashier's Cheque or Foreign Demand Drafts or Security Deposit Receipt (SDR) on the standard form of the

Bank or on Customer's written request, the Customer hereby agrees that the following terms and conditions shall apply.

The customer shall comply with all relevant exchange control regulations. The Bank shall not be indemnified by the customer in respect of, any loss or damage

caused by any act or omission which with contravenes any of the provisions of the Foreign Exchange Regulation Act, 1947 or of any rule, direction or order

made thereunder.

Under these terms and conditions of transfers hereof, the transfer of funds deposited with the Bank in the customer's account, or on account of the cash

customer in either local or foreign currency as stated in the funds transfer instructions, shall be subject to all laws, regulations, decrees, administrative rules,

and orders of Government of Pakistan or State Bank of Pakistan now or thereafter affecting the same. It is understood that the customer shall be indemnified

and hold the Bank harmless from any loss that the Bank may suffer or incur in respect of the funds transfer instructions under these terms and conditions of

transfer hereof by reason of any such laws, decrees, administrative rules and orders, or for losses resulting from fraudulent, duplicate, or erroneous manually

initiated funds transfer instructions originated or purporting to have been originated by the customer which shall include the instructions that are initiated via

phone, fax, messenger, paper mail, voice mail, electronic mail, file transfer or other similar manual originating means.

Encasement of Cashier's Cheque/SDR or payment of transferred fund is subject to any rules and regulations of the country where the Cashier's Cheque /SDR is

to be en cashed or payment is to be made. The liability of the Bank with respect to the encasement of the Cashier's Cheque/SDR or payment of the transferred

fund shall not exceed in any case the extent to which payment may be allowed in the currency in which the Cashiers's Cheque/SDR is drawn or transferred

funds are to be paid. Neither the Bank, nor the head office, nor other branches of the Bank, nor its correspondents or agents shall be liable for any delay or loss

caused by any act or order of any Government or Government Agency or as a result or consequences of any other cause whatsoever.

Should refund or repurchase by the Bank of the amount of the Cashier's Cheque/SDR or of the transferred funds be desired, refund or repurchase shall be made

at the bank's option only to or from customer and or in case Cashier's Cheque/SDR upon receipt by the Bank of the Cashier's Cheque/SDR duly endorsed by the

customer at the current demand buying for the currency in question, less cost, charges, expenses and interest (in case of Foreign Currency transaction)

provided the bank is in possession of the funds, for which the payment instructions were issued, free from any exchange or other restrictions.

Unless it is otherwise expressly and specifically agreed in writing, the Bank may at its discretion, convert into foreign value the funds, received from the

customer at the Bank's selling rate on the day such funds are received. The Bank's statement in writing that it has effected such conversion shall be conclusive.

Currency other than that of country to which the remittance is made shall be payable to the payee in the currency of the said country at the Bank's selling rates

on the day such funds are received. The Bank's statement in writing that it has effected such conversion shall be conclusive.

The Bank may take its customary steps for issuance of Cashier's Cheque /SDR or for remittance. The Bank shall be free on behalf of the customer to make use of

any correspondent , sub-agent or other agency but in no case will the Bank or the Head Office or other branches of the Bank or any of its correspondents or

agents be liable for mutilations, interruptions, omissions, errors or delay due to any cause. The Bank may sent any message in explicit language, code or cipher.

It is understood that if any instrument (i.e including, for instance, a Cashier's Cheque, SDR, FDD, Mail Transfer, e.t.c.) is lost, stolen or destroyed, the Bank will be

provided with a bond or indemnity duly acceptable to the Bank protecting the Bank against liability with respect to the lost, stolen or destroyed instrument

and for the issuance of replacement Cashier's Cheque/SDR /FDD /Mail Transfer or refund of the amount of the instrument.

The Bank may also accept standing instructions from the customer for transfer of the funds to any account of the designated beneficiary at periodic intervals

from the customer's account(s) maintained with the bank ( the "Standing Instructions") , which shall subject to the condition that neither losses, damages,

direct or consequential, arising out of any failure to comply or delay in complying with any Standard Instructions, except for the willful default or negligence on

the part of Bank.

The Bank shall have the right but not an obligation, to confirm the content's of the customer's manually initiated funds transfer instructions by a confirmatory

telephone call. The customer hereby also agrees and authorizes the Bank to record the conversation of such confirmatory telephone calls as is deemed

appropriate by the Bank, solely for the purposes of manually initiated funds transfer instructions if there is a failure or denial on the pat of the customer to

confirm its manually initiated funds transfer instructions in the aforesaid manner. The Bank may also refuse to transfer funds if the confirming person is not an

authorized signatory of the customer's account maintained with the Bank.

The Bank shall not be liable for any errors, neglects or default, except for it's own employees' gross negligence or willful default, acting in the course of their

employment.

Currency other than that of the country to which the remittance is made shall be payable to the payee in the currency of the said country at the buying rate of

the Bank's correspondent or agent unless the payee by arrangement with the paying correspondent or agent obtains the payment in some other currency

upon paying all charges of the Bank's correspondent or agent in connection therewith.

The Cashier's Cheque is valid for six months from the date of issuance, after which revalidation is required from the issuing branch of the Bank.

The Security Deposit Receipt (SDR) is valid for one year from the date of issuance, after which revalidation is required from the issuance branch of the Bank.

The bank will not be required to examine the genuineness of the beneficiary or otherwise of the beneficiary's discharge on SDR and Cashier's Cheque (both)

If a remittance/instrument remains outstanding for a period of ten years then it will become unclaimed deposit and will surrendered to SBP as per the

provisions of Banking Companies Ordinance, 1962

United Bank Limited

111-825-888

www.ubldirect.com

Vous aimerez peut-être aussi

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaD'EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaPas encore d'évaluation

- Rtgs Neft FormDocument2 pagesRtgs Neft Formanaga1982Pas encore d'évaluation

- Evaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersD'EverandEvaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersPas encore d'évaluation

- Bank GuaranteeDocument1 pageBank GuaranteeMuralikrishna SingamaneniPas encore d'évaluation

- 1390388459576-Own Request Transfer FormatDocument3 pages1390388459576-Own Request Transfer FormatAkhilesh BhuraPas encore d'évaluation

- APPLICATIONDocument8 pagesAPPLICATIONLovely ReddyPas encore d'évaluation

- Ddo HandbookDocument312 pagesDdo HandbookShayan AhmadPas encore d'évaluation

- Personal Business Loan Agreement PDFDocument16 pagesPersonal Business Loan Agreement PDFVijay V RaoPas encore d'évaluation

- Simple Bank AgreementDocument30 pagesSimple Bank AgreementNora RadovanPas encore d'évaluation

- International Remittances: Business Process Outsourcing Consulting System Integration Universal Banking SolutionDocument11 pagesInternational Remittances: Business Process Outsourcing Consulting System Integration Universal Banking Solutionakther_aisPas encore d'évaluation

- Acr For Officers in Bps 17Document14 pagesAcr For Officers in Bps 17Sikandar Khaleel78% (9)

- Agreement Format - 13032013 Sdarepo AgentsDocument17 pagesAgreement Format - 13032013 Sdarepo AgentsIsmail MswPas encore d'évaluation

- BSNL CafDocument3 pagesBSNL CafAnoop K JayanPas encore d'évaluation

- HSBC Rtgs Form - 241109Document2 pagesHSBC Rtgs Form - 241109Kevin HillPas encore d'évaluation

- Application Form. City Bank PDFDocument5 pagesApplication Form. City Bank PDFRumah Titian Ashraful Rohaniah100% (1)

- SCB - Personal Loan Terms and ConditionsDocument13 pagesSCB - Personal Loan Terms and Conditionsmytake100Pas encore d'évaluation

- Migration FormDocument2 pagesMigration Formsaurabh2k1Pas encore d'évaluation

- Vehicle Sales Agreement TemplateDocument4 pagesVehicle Sales Agreement TemplateTutorialsSapabapPas encore d'évaluation

- Public Service Commission, West Bengal: Advertisement No. 7 /2011Document8 pagesPublic Service Commission, West Bengal: Advertisement No. 7 /2011AlexaRodPas encore d'évaluation

- PUNJAB TA Rules (U)Document76 pagesPUNJAB TA Rules (U)Humayoun Ahmad FarooqiPas encore d'évaluation

- Fund TransferDocument2 pagesFund TransferQaiser KhalilPas encore d'évaluation

- Advance Tnc77Document16 pagesAdvance Tnc77Sayed MohamedPas encore d'évaluation

- Telegaphic Transferfom HSBCDocument2 pagesTelegaphic Transferfom HSBCTin Valdez MendozaPas encore d'évaluation

- Page From SR 5 Infra Disclosure DocumentDocument1 pagePage From SR 5 Infra Disclosure DocumentkartiksharmainspirePas encore d'évaluation

- Ott AppformDocument2 pagesOtt Appformsujay13780Pas encore d'évaluation

- Doa TradeDocument17 pagesDoa TradeEduardo WitonoPas encore d'évaluation

- General Terms and Conditions 2022Document7 pagesGeneral Terms and Conditions 2022seetamePas encore d'évaluation

- HKB FORM Remittance ApplicationDocument2 pagesHKB FORM Remittance ApplicationangkalabawPas encore d'évaluation

- Wire TransfersDocument4 pagesWire TransfersWilliam Donaldson100% (1)

- Go4itCreditCardTermsConditions PDFDocument29 pagesGo4itCreditCardTermsConditions PDFJismin JosephPas encore d'évaluation

- Remittance Application Form MAR2022 E - Form PDFDocument2 pagesRemittance Application Form MAR2022 E - Form PDFAlldyPas encore d'évaluation

- Remittance Application FormDocument2 pagesRemittance Application Formnxbtest007Pas encore d'évaluation

- MCB Credit Card Terms & Conditions: DefinitionsDocument15 pagesMCB Credit Card Terms & Conditions: DefinitionsMuhammad AsifPas encore d'évaluation

- GTC New Format - UpdatedDocument8 pagesGTC New Format - Updatedd surviPas encore d'évaluation

- Standard Charted - SaadiqDocument16 pagesStandard Charted - SaadiqkirshanlalPas encore d'évaluation

- Guidance For Outward International Swift Payment Off201117nwiDocument4 pagesGuidance For Outward International Swift Payment Off201117nwijamalazoz05Pas encore d'évaluation

- P P Terms ConditionsDocument16 pagesP P Terms Conditionsfahadnadeeem47Pas encore d'évaluation

- General Terms & Conditions: Applicable To All AccountsDocument7 pagesGeneral Terms & Conditions: Applicable To All AccountsKhalid Saif JanPas encore d'évaluation

- Forms en 6 Payment Systems Directive enDocument22 pagesForms en 6 Payment Systems Directive enJoaquinPas encore d'évaluation

- Terms and ConditionsDocument7 pagesTerms and ConditionsUrs AteequePas encore d'évaluation

- Shahid HussainDocument16 pagesShahid HussainShahzaib Hussain100% (1)

- PNB CCDocument13 pagesPNB CCArim TorrPas encore d'évaluation

- TC Conventional Assan Digital AccountDocument8 pagesTC Conventional Assan Digital Accountvicky khanPas encore d'évaluation

- Terms and Conditions For Bank AL Habib ATM Debit CardDocument7 pagesTerms and Conditions For Bank AL Habib ATM Debit CardTanveer AhmedPas encore d'évaluation

- UBLWiz Application FormDocument2 pagesUBLWiz Application Formsaif_khan1155Pas encore d'évaluation

- Sample Employee Handbook - National Council of Nonprofits OrganizationDocument13 pagesSample Employee Handbook - National Council of Nonprofits OrganizationKenneth GarciaPas encore d'évaluation

- HDFC PL AgreementDocument16 pagesHDFC PL AgreementAnilkumar chavanPas encore d'évaluation

- General Terms and ConditionsDocument47 pagesGeneral Terms and ConditionsCharmaine CorpuzPas encore d'évaluation

- Application FormDocument8 pagesApplication FormAustine ObasuyiPas encore d'évaluation

- Payment Application Form: Applicant'S ParticularsDocument2 pagesPayment Application Form: Applicant'S ParticularsVijay PuramPas encore d'évaluation

- RB Chapter 2A-Current Account-MITCDocument9 pagesRB Chapter 2A-Current Account-MITCRohit KumarPas encore d'évaluation

- DBTCDocument42 pagesDBTCMUHAMMAD SHERAZPas encore d'évaluation

- DCB RTGSDocument2 pagesDCB RTGSBharat VardhanPas encore d'évaluation

- En Terms and Conditions PDFDocument7 pagesEn Terms and Conditions PDFRanjit SawantPas encore d'évaluation

- TCs TBC Epaycard Jan 2022Document10 pagesTCs TBC Epaycard Jan 2022Aileen SalazarPas encore d'évaluation

- Terms ConditionDocument3 pagesTerms ConditionctgmainulPas encore d'évaluation

- Electronic Funds Transfer Application: WWW - Rakbank.aeDocument2 pagesElectronic Funds Transfer Application: WWW - Rakbank.aeMehran KhanPas encore d'évaluation

- Steward Bank Individual Loan Application Form - (Customer Section)Document3 pagesSteward Bank Individual Loan Application Form - (Customer Section)Wilsfun100% (2)

- CR TermsDocument14 pagesCR Termsmaruf.potterPas encore d'évaluation

- EFT Credit Application Form For Customer Initiated Entry (CIE)Document2 pagesEFT Credit Application Form For Customer Initiated Entry (CIE)Nirob Hasan VoorPas encore d'évaluation

- Google Map Adp 2016-171Document5 pagesGoogle Map Adp 2016-171Sikandar GujjarPas encore d'évaluation

- Pia RportDocument35 pagesPia RportSikandar GujjarPas encore d'évaluation

- AslamDocument19 pagesAslamSikandar GujjarPas encore d'évaluation

- Layyah Superior Science Academy Layyah: ObjectiveDocument2 pagesLayyah Superior Science Academy Layyah: ObjectiveSikandar GujjarPas encore d'évaluation

- Chak 425 QtyDocument7 pagesChak 425 QtySikandar GujjarPas encore d'évaluation

- Chak 425 QtyDocument7 pagesChak 425 QtySikandar GujjarPas encore d'évaluation

- Capital and Risk Management Report 31 December 2011Document68 pagesCapital and Risk Management Report 31 December 2011Sikandar GujjarPas encore d'évaluation

- Bond MGMT StrategyDocument28 pagesBond MGMT Strategyswati_rathourPas encore d'évaluation

- Internship Report of Bank Alfalah: Submitted ToDocument25 pagesInternship Report of Bank Alfalah: Submitted ToSikandar GujjarPas encore d'évaluation

- Bioinf DDDocument9 pagesBioinf DDSikandar GujjarPas encore d'évaluation

- Supervisor: Engr Muhammad Usman HaidarDocument1 pageSupervisor: Engr Muhammad Usman HaidarSikandar GujjarPas encore d'évaluation

- University of Sargodha: Application Form (Bs - 17 & Above)Document3 pagesUniversity of Sargodha: Application Form (Bs - 17 & Above)Sikandar GujjarPas encore d'évaluation

- Bioinf DDDocument9 pagesBioinf DDSikandar GujjarPas encore d'évaluation

- Hanouts 401Document448 pagesHanouts 401Sikandar Gujjar100% (1)

- Business Plan GuideDocument32 pagesBusiness Plan GuideJunkJloPas encore d'évaluation

- Internship Report of Bank Alfalah: Submitted ToDocument25 pagesInternship Report of Bank Alfalah: Submitted ToSikandar GujjarPas encore d'évaluation

- 09 External DebtDocument14 pages09 External DebtAmanullah Bashir GilalPas encore d'évaluation

- UBL Bank JKDocument5 pagesUBL Bank JKSikandar GujjarPas encore d'évaluation

- RJAPS21 - Nonperforming Loans in The Banking Sector of BangladeshDocument21 pagesRJAPS21 - Nonperforming Loans in The Banking Sector of Bangladeshshovon mukitPas encore d'évaluation

- Internship Report of Bank Alfalah: Submitted ToDocument25 pagesInternship Report of Bank Alfalah: Submitted ToSikandar GujjarPas encore d'évaluation

- AccountingDocument80 pagesAccountingSikandar GujjarPas encore d'évaluation

- FGHDocument2 pagesFGHSikandar GujjarPas encore d'évaluation

- Business Plan GuideDocument32 pagesBusiness Plan GuideJunkJloPas encore d'évaluation

- 1 This First Bank: Sample Account Statement and BalancingDocument2 pages1 This First Bank: Sample Account Statement and BalancingQuenie De la CruzPas encore d'évaluation

- The Anatomy of A Transaction 020311Document1 pageThe Anatomy of A Transaction 020311ealpeshpatelPas encore d'évaluation

- ST TH: Ordinance No. 28, Series of 2017Document20 pagesST TH: Ordinance No. 28, Series of 2017Marites TaniegraPas encore d'évaluation

- Md. Shafiqullah Khan Vs Md. Samiullah Khan On 19 July, 1929: AssignmentDocument8 pagesMd. Shafiqullah Khan Vs Md. Samiullah Khan On 19 July, 1929: AssignmentPratham Garg0% (1)

- BUS 5111 - Financial Management - Written Assignment Unit 7Document4 pagesBUS 5111 - Financial Management - Written Assignment Unit 7LaVida Loca100% (1)

- Quiz Conceptual Framework WITH ANSWERSDocument25 pagesQuiz Conceptual Framework WITH ANSWERSasachdeva17100% (1)

- Great Ministry FinanceDocument5 pagesGreat Ministry FinanceERAnkitMalviPas encore d'évaluation

- Are Taxes EvilDocument5 pagesAre Taxes Evilpokeball0010% (1)

- Combinatorial Mathematics Business Mathematics Special Theory of Relativity-I Computational Mathematics Lab-IDocument13 pagesCombinatorial Mathematics Business Mathematics Special Theory of Relativity-I Computational Mathematics Lab-IBurnwal RPas encore d'évaluation

- Invoice Pemasangan Panel Kayu Logo AnamiDocument4 pagesInvoice Pemasangan Panel Kayu Logo Anamiarulmaung25Pas encore d'évaluation

- UntitledDocument84 pagesUntitledMary Jenel Nodalo ColotPas encore d'évaluation

- CH 5 Problem Session Exercise - StudentDocument5 pagesCH 5 Problem Session Exercise - StudenthannahPas encore d'évaluation

- Hong Kong Housing Authority: For Chinese Medicine ClinicDocument14 pagesHong Kong Housing Authority: For Chinese Medicine Clinicapi-22629871Pas encore d'évaluation

- Time Table Internal Audit SMK3 PT Ubs (2022)Document1 pageTime Table Internal Audit SMK3 PT Ubs (2022)Javiero Isroj WilnadiPas encore d'évaluation

- Birla Sun Life - Garima - Group 3Document30 pagesBirla Sun Life - Garima - Group 3mukesh chhotalaPas encore d'évaluation

- Interest and Depreciation QuestionsDocument5 pagesInterest and Depreciation QuestionsP100% (1)

- CalenderDocument2 pagesCalenderirmaPas encore d'évaluation

- Depreciation, Impairments, and DepletionDocument83 pagesDepreciation, Impairments, and DepletionfebrythiodorPas encore d'évaluation

- Auditing and Assurance Services 15th Edition Arens Solutions ManualDocument23 pagesAuditing and Assurance Services 15th Edition Arens Solutions Manualfidelmaalexandranbj100% (34)

- Week5 Debt MKT 1: You Have CompletedDocument8 pagesWeek5 Debt MKT 1: You Have CompletedDerek LowPas encore d'évaluation

- Form CSRF Subscriber Registration FormDocument7 pagesForm CSRF Subscriber Registration FormPranab Kumar DasPas encore d'évaluation

- Legal RiskDocument7 pagesLegal RiskOmprakash MaheshwariPas encore d'évaluation

- Introduction To Cost AccountingDocument2 pagesIntroduction To Cost AccountingHunson AbadeerPas encore d'évaluation

- Tax BillDocument1 pageTax BillBrenda SorensonPas encore d'évaluation

- Display PDFDocument22 pagesDisplay PDFMurugan AnathanPas encore d'évaluation

- A History of BankingDocument3 pagesA History of BankinglengocthangPas encore d'évaluation

- 14 Central Bank vs. CA, 106 SCRA 143 PDFDocument2 pages14 Central Bank vs. CA, 106 SCRA 143 PDFSilver Anthony Juarez Patoc100% (1)

- Duplichecker Plagiarism ReportDocument2 pagesDuplichecker Plagiarism ReportErika DeboraPas encore d'évaluation

- Bayou Steel Bankruptcy FilingDocument19 pagesBayou Steel Bankruptcy FilingWWLTVWebteamPas encore d'évaluation

- Assignment For Fundamentals of Land AdministrationDocument12 pagesAssignment For Fundamentals of Land Administrationgebremikeal ambayePas encore d'évaluation