Académique Documents

Professionnel Documents

Culture Documents

Keppel - Media-Analyst Briefingd

Transféré par

Jing Yi'nCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Keppel - Media-Analyst Briefingd

Transféré par

Jing Yi'nDroits d'auteur :

Formats disponibles

Proposed Consolidation of Keppels

Interests in Asset Management Businesses

Briefing to media and analysts

25 January, 2016

Asset management is a key part of Keppels business

model of capturing value across the value chain

Keppel Group

Business Model:

DESIGN

&

BUILD

Offshore & Marine

Property

Infrastructure

Investments

Earning Stream:

Development profit

Project-Based

SALE

&

SERVICE

Newbuilds, repair &

upgrading projects

Residential projects

WTE technology packages

Operation

Revaluation

& Divestment

Fee-based

OWN

&

OPERATE

STABILISE

&

MONETISE

TRUSTS

&

FUNDS

Midstream assets

Commercial properties

Plants & data centres

Unlocking value

Recycling &

reinvesting capital for

higher returns

Operations fee

Property mgt fee

Facility mgt fee

Repair/service fee

Capital gains

Fund management

Operating & maintenance

services

Facilities & property

management

Asset mgt fee

Operations fee

Property mgt fee

Facility mgt fee

Asset management businesses are a significant

contributor to the Keppel Group

$26B total assets under

management

30% p.a.

Capital recycling opportunities

for operating units

Asset monetisation with ability

to continue to manage assets

Provides stable, recurring fee

income

Steady dividend income stream

Today, the trust and fund management businesses are

dispersed across the Group

Keppel Corporation

Keppel

Infrastructure

Fund Management

Keppel DC REIT

Management

Keppel

Infrastructure

Trust

Keppel REIT

Management

Keppel

DC REIT

Alpha

Investment

Partners

Keppel

REIT

Keppel intends to consolidate its interests in all asset

management companies under Keppel Capital

Keppel Corporation

Keppel Capital

Keppel DC REIT

Management

Alpha

Investment

Partners

Keppel REIT

Management

Keppel

Infrastructure

Trust

Keppel

DC REIT

Keppel

REIT

Keppel

Infrastructure

Fund Mgmt

Consolidation benefits Keppel Group

Strengthens Groups

capital recycling

platform to unlock value

Increases velocity

of new vehicle launches

across asset classes

Enhances investment

returns from improved

vehicle performance

Expands capital

platform for

co-investing

Generates higher

recurring income from

management fees

Consolidation also benefits REITs/business trust/

funds unitholders and investors

Greater operational efficiency and

effectiveness with expanded scale

Strengthens capabilities

via sharing of best practices

Expanded platform strengthens

recruitment and retention of top talent

Shared services allow greater

management focus on core business

Improved unitholder and investor returns

Keppel aims to enhance its asset management

business by consolidating interests under one unit

Vision to be a best-in-class asset management platform,

serving as trusted partners for our investors

Scale

People

Excellence

Velocity

Total Keppel units

AUM of >$26B

High-performance

culture with 200+ top

talent

Funds of choice for

retail & institutional

investors

Repeatable model for

launching new vehicles

End

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 5Document29 pages5Tshewang DemaPas encore d'évaluation

- All Solutions are with the Prophet's Progeny: Why Following Ahlul Bayt is Necessary for Correct Islamic GuidanceDocument164 pagesAll Solutions are with the Prophet's Progeny: Why Following Ahlul Bayt is Necessary for Correct Islamic GuidanceShahid.Khan1982Pas encore d'évaluation

- KBP Radio Code 1999Document37 pagesKBP Radio Code 1999Emerson C. BenozaPas encore d'évaluation

- Engineering College ListDocument6 pagesEngineering College ListGagana. MPas encore d'évaluation

- The CrossDocument7 pagesThe CrossTeresita KingPas encore d'évaluation

- P0751 Shift Solenoid ADocument5 pagesP0751 Shift Solenoid Aeduardo201186Pas encore d'évaluation

- Attacks On Vedic CultureDocument123 pagesAttacks On Vedic CultureHinduism100% (1)

- MIni Rules Quick Card PDFDocument2 pagesMIni Rules Quick Card PDFhectorPas encore d'évaluation

- Multiple Choice: Choose The Letter of The Correct Answer. Write The Letter of Your Answer On The Box ProvidedDocument3 pagesMultiple Choice: Choose The Letter of The Correct Answer. Write The Letter of Your Answer On The Box ProvidedDiana Monterde100% (1)

- Winols Tutorial - Howto by TiguanDocument17 pagesWinols Tutorial - Howto by Tiguanmasinac91Pas encore d'évaluation

- IBMDocument3 pagesIBMSanket JainPas encore d'évaluation

- Gts 250Document217 pagesGts 250Eduardo M. R. SousaPas encore d'évaluation

- The Secret Language of RelationshipsDocument840 pagesThe Secret Language of RelationshipsJPas encore d'évaluation

- Use of English 1. Choose The Most Appropriate Word To Complete The Following Sentences. Dear KateDocument1 pageUse of English 1. Choose The Most Appropriate Word To Complete The Following Sentences. Dear Katefrepova100% (1)

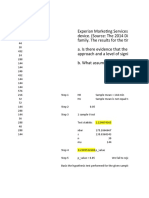

- Hypothesis test for promotion bias between merged companiesDocument12 pagesHypothesis test for promotion bias between merged companiesanniePas encore d'évaluation

- New Frog FAQsDocument5 pagesNew Frog FAQsThames Discovery Programme100% (3)

- The Canterbury TalesDocument4 pagesThe Canterbury TalesAnonymous cHvjDH0OPas encore d'évaluation

- Installing Oracle Application Server 11g R1 On CentOSDocument13 pagesInstalling Oracle Application Server 11g R1 On CentOSNguyen Quoc Huy100% (3)

- Astm F1498Document13 pagesAstm F1498Hernando Andrés Ramírez GilPas encore d'évaluation

- Raei 07 16Document9 pagesRaei 07 16A Google UserPas encore d'évaluation

- Important Urdu MCQs For NTS Test PreparationDocument6 pagesImportant Urdu MCQs For NTS Test PreparationMasoom Farishtah100% (4)

- QC Test For CapsulesDocument4 pagesQC Test For CapsulesMuhammad Masoom Akhtar100% (1)

- Workplace Environment and Ergonomics PDFDocument31 pagesWorkplace Environment and Ergonomics PDFwsuzanaPas encore d'évaluation

- 2CSG299893R4052 m2m Modbus Network AnalyserDocument3 pages2CSG299893R4052 m2m Modbus Network AnalyserjuandeloPas encore d'évaluation

- Effects of Activator and High Pull Headgear Combination Therapy PDFDocument9 pagesEffects of Activator and High Pull Headgear Combination Therapy PDFDilesh PradhanPas encore d'évaluation

- The Feminist Postmodern Ontology: The Case of Marianne Wiggins' John DollarDocument8 pagesThe Feminist Postmodern Ontology: The Case of Marianne Wiggins' John DollarIJELS Research JournalPas encore d'évaluation

- Solving Problems Through Search and PlanningDocument12 pagesSolving Problems Through Search and PlanningjmtruciosPas encore d'évaluation

- Econ1194: Prices and Markets Semester C, 2020 Assignment Cover PageDocument14 pagesEcon1194: Prices and Markets Semester C, 2020 Assignment Cover PageZoey LePas encore d'évaluation

- CT Dose Profiler - Users Manual - English-6.2A PDFDocument62 pagesCT Dose Profiler - Users Manual - English-6.2A PDFSveto SlPas encore d'évaluation

- 8th Grade Personal Consumer Health Study GuideDocument2 pages8th Grade Personal Consumer Health Study Guideapi-263456844Pas encore d'évaluation