Académique Documents

Professionnel Documents

Culture Documents

Drawback Declaration

Transféré par

Himanshu KushwahaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Drawback Declaration

Transféré par

Himanshu KushwahaDroits d'auteur :

Formats disponibles

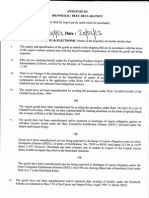

APPENDIX III

(DRAWBACK DECLARATION)

(To be filled for export of goods under Claim for Drawback)

SHIPPING BILL NO. :

I/We M/s.

DATE : 29.05.2014

Company Name do hereby further declare as follows:

1.

That the quality and specification of the goods as stated in this Shipping Bill are in accordance with the terms of

the export contracts entered into with the Buyer/Consignee in pursuance of the goods which are being exported.

2.

That we are not claiming benefit under Engineering products export (Replenishment of Iron and Steel

Intermediates) Scheme notified vide Ministry of Commerce Notification No. 539 RE/92-97 dt. 01.03.95.

3.

That there is no change in the manufacturing formula and in the quantum per unit of the imported material or

components utilized in the manufacture of the export of goods and that the materials are components which have been

stated in the application under Rule 6 or Rule 7 of the DBK Rules, 1995 to have been imported, continue to be so

imported and are not been obtained from indigenous source.

4.* (A) That the export goods have not been manufactured by availing the procedure under Rule 12(1)(b)/13(1)(b) of the

Central Excise Rules, 1944.

OR

*(B)That the export goods have been manufactured by availing the procedure under Rule 12(1)(b)/13(1)(b) of the

Central Excise Rules, 1944, but we are/ shall be claiming DBK on the basis of special brand rate in terms of Rule 6 of the

DBK Rules, 1995

5*(A) That the goods are not manufactured and/or exported in discharge of

export obligation against an Advance License issued under the Duty Exemption Scheme (DEEC) vide relevant import &

export policy in force.

OR

*(B)

That the goods are manufactured and are being exported in discharge of

export obligation under the Duty

Exemption Scheme (DEEC), in terms of Notification No. 79/95-CUS or 80/95-CUS both dated 31.03.1995 or 31/97 dt.

01.04.1997 but I/We are claiming Drawback only the Central Excise portion of the duties on inputs specified in the

Drawback Schedule.

*(C )

That the goods are manufactured and are being export in discharge of export obligation under the Duty

Exemption Scheme (DEEC), but I/We are claiming brand rate of Drawback fixed under Rule 6 or 7 of DBK Rules, 1995

6.

That the goods are not manufactured and/or exported after availing of the facility under the Passbook scheme as

contained in Para 7.25 of the Export and Import Policy (April,1997-31st March,2002)

7.

That the goods are not manufactured and/or exported by a unit licensed as 100% export oriented unit in terms

of Import and Export Policy in force.

8.

That the goods are not manufactured and/or exported by a unit situated in any free trade zone/export

processing zone or any other such zones.

9.

That the goods are not manufactured partly or wholly in bond under Section 65 of the Customs Act, 1962.

10.

That the present market value of the goods is as follows:

11.

That the export value of the exports covered by this Shipping Bill is not less than the total value of all imported

materials used in manufacture of such goods

That the market price of the goods being exported is not less than the drawback being claimed.

12.

13.

That the drawback amount claimed is more than 1% of the FOB value of the export product, or the drawback

amount claimed in less than 1% of the FOB value but more than Rs.500.00 against the Shipping Bill.

14.

I/WE undertake to repatriate export proceeds within six months from the date of exports and submit B.R.C. to Asst.

Commissioner (Drawback). In case, the export proceeds are not realised within 6 months from the date of export, I/We will either

furnish extension of time from R.B.I. and suibmit B.R.C. within such extended period or will pay back the drawback received against

this shipping bill.

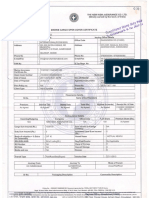

Drawack scheme code : 4823000099 B

3926909912 A

For,

.

AUTHORISED SIGNATORY

Place :

Date :

Vous aimerez peut-être aussi

- Procurement Process & PolicyDocument52 pagesProcurement Process & PolicyHimanshu Kushwaha100% (1)

- 1040 Exam Prep Module X: Small Business Income and ExpensesD'Everand1040 Exam Prep Module X: Small Business Income and ExpensesPas encore d'évaluation

- FAR-FC 2021: Federal Aviation Regulations for Flight CrewD'EverandFAR-FC 2021: Federal Aviation Regulations for Flight CrewPas encore d'évaluation

- Bar Review Companion: Taxation: Anvil Law Books Series, #4D'EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Pas encore d'évaluation

- Proforma Invoice - FilledDocument1 pageProforma Invoice - FilledHimanshu KushwahaPas encore d'évaluation

- Atlantean Dolphins PDFDocument40 pagesAtlantean Dolphins PDFBethany DayPas encore d'évaluation

- 61 Point MeditationDocument16 pages61 Point MeditationVarshaSutrave100% (1)

- God Made Your BodyDocument8 pagesGod Made Your BodyBethany House Publishers56% (9)

- Duty DrawbackDocument9 pagesDuty DrawbackshubhamPas encore d'évaluation

- DBK AnxDocument2 pagesDBK AnxrsmajodPas encore d'évaluation

- DBK and DeecDocument3 pagesDBK and DeecManik RajPas encore d'évaluation

- Draw BackDocument1 pageDraw BackrohishaakPas encore d'évaluation

- Various Schemes Like EOUDocument14 pagesVarious Schemes Like EOUranger_passionPas encore d'évaluation

- FieoDocument31 pagesFieoparidhi9Pas encore d'évaluation

- A. B. C. D. E.: Drawback Rules: - Definition and ObjectivesDocument7 pagesA. B. C. D. E.: Drawback Rules: - Definition and ObjectivesganeshPas encore d'évaluation

- Circular No. 11 /2009-CusDocument6 pagesCircular No. 11 /2009-CusrpadmakrishnanPas encore d'évaluation

- Exim PolicyDocument5 pagesExim PolicyRavi_Kumar_Gup_7391Pas encore d'évaluation

- Sro 565-2006Document44 pagesSro 565-2006Abdullah Jathol100% (1)

- Duty Drawback India Presentation 2003Document10 pagesDuty Drawback India Presentation 2003dinkar13375Pas encore d'évaluation

- Excise Duty-1Document11 pagesExcise Duty-1AftabKhanPas encore d'évaluation

- Documents Availing For Export IncentivesDocument13 pagesDocuments Availing For Export IncentivesArun MannaPas encore d'évaluation

- Duty Drawback On Re-Export of Duty Paid Imported GoodsDocument9 pagesDuty Drawback On Re-Export of Duty Paid Imported GoodssahasidPas encore d'évaluation

- Capital Goods As NotifiedDocument74 pagesCapital Goods As NotifiedRamesh RamPas encore d'évaluation

- Notification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The CentralDocument5 pagesNotification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The Centralpatelpratik1972Pas encore d'évaluation

- Office of The Commissioner of Custom (Export)Document9 pagesOffice of The Commissioner of Custom (Export)bharadvaj_jsplPas encore d'évaluation

- Advance LicenceDocument42 pagesAdvance LicenceAnoop NautiyalPas encore d'évaluation

- cs22 2013Document7 pagescs22 2013stephin k jPas encore d'évaluation

- Customs Circular NoDocument1 pageCustoms Circular Nochinmay-jhawar-7651Pas encore d'évaluation

- Warehouse FaqDocument6 pagesWarehouse FaqsrinivasPas encore d'évaluation

- Cmta As Per SyllabusDocument33 pagesCmta As Per SyllabusDowie M. MatienzoPas encore d'évaluation

- Duty DrawbackDocument35 pagesDuty DrawbackTuhin SaxenaPas encore d'évaluation

- Short Title, Extent and Commencement.Document13 pagesShort Title, Extent and Commencement.SagarPas encore d'évaluation

- A Brief Note On Export Promotion Capital Goods Scheme (EPCG Scheme) - Taxguru - inDocument6 pagesA Brief Note On Export Promotion Capital Goods Scheme (EPCG Scheme) - Taxguru - inshailendraPas encore d'évaluation

- FMS, FPS, MLFPS Schemes & Documents Reqd.Document7 pagesFMS, FPS, MLFPS Schemes & Documents Reqd.bibhas1Pas encore d'évaluation

- Duty DrawbackDocument4 pagesDuty DrawbackShaji KuttyPas encore d'évaluation

- Central Excise: Meenal P WagleDocument15 pagesCentral Excise: Meenal P WagleMeenal Prasad WaglePas encore d'évaluation

- Epcg Scheme: (Export Promotion Capital Goods (EPCG) )Document18 pagesEpcg Scheme: (Export Promotion Capital Goods (EPCG) )Milna JosephPas encore d'évaluation

- FTP 2Document13 pagesFTP 2Sachi Bani PerharPas encore d'évaluation

- Import Tax ExemptionDocument103 pagesImport Tax ExemptionAranya KhuranaPas encore d'évaluation

- Notification No. 145 89 C.EDocument11 pagesNotification No. 145 89 C.Epatelpratik1972Pas encore d'évaluation

- Cenvat Credit Rules, 2017Document9 pagesCenvat Credit Rules, 2017Latest Laws TeamPas encore d'évaluation

- Exemption To Specified Goods Imported For Production of Goods For Export or For Use in 100% Export-Oriented UndertakingsDocument6 pagesExemption To Specified Goods Imported For Production of Goods For Export or For Use in 100% Export-Oriented UndertakingsAbhishek SoniPas encore d'évaluation

- 2013811082624459UpdatedSRO655 (I) 2006june2013Document5 pages2013811082624459UpdatedSRO655 (I) 2006june2013asma_20786Pas encore d'évaluation

- Central VATDocument13 pagesCentral VATBharat ChoudharyPas encore d'évaluation

- Cao No. 7-2002Document6 pagesCao No. 7-2002Sam RafzPas encore d'évaluation

- Duty Drawback Scheme: Hemen Ruparel 1Document11 pagesDuty Drawback Scheme: Hemen Ruparel 1Ritu JainPas encore d'évaluation

- Reporting Sec. 900-913Document17 pagesReporting Sec. 900-913CLARK LOUISE PALOMARESPas encore d'évaluation

- Inward Processing Rebate RegulationsDocument7 pagesInward Processing Rebate RegulationsBewovicPas encore d'évaluation

- Imposition of Supplementary DutyDocument7 pagesImposition of Supplementary DutyHarippa23Pas encore d'évaluation

- Circular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedDocument10 pagesCircular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedNitesh RawatPas encore d'évaluation

- India New Foreign Trade Policy 2015Document15 pagesIndia New Foreign Trade Policy 2015Hameem KhanPas encore d'évaluation

- Notification No. 32/97-Cus., Dated 1-4-1997 Jobbing-Export Order Goods Imported For Execution ofDocument2 pagesNotification No. 32/97-Cus., Dated 1-4-1997 Jobbing-Export Order Goods Imported For Execution ofRavi ViswanadhaPas encore d'évaluation

- CM5 MidDocument3 pagesCM5 MidAilea Kathleen BagtasPas encore d'évaluation

- Sro 327 PDFDocument20 pagesSro 327 PDFOmer ToqirPas encore d'évaluation

- Authorisation Is Issued To Allow Duty Free Import of InputsDocument8 pagesAuthorisation Is Issued To Allow Duty Free Import of InputsHirdayesh VermaPas encore d'évaluation

- Export ProcedureDocument33 pagesExport ProcedureNand SinghPas encore d'évaluation

- Export Promotion SchemesDocument45 pagesExport Promotion Schemesasifanis100% (1)

- DTREDocument10 pagesDTRESeeraj KhanPas encore d'évaluation

- Circular No. 36 /2020-CustomsDocument16 pagesCircular No. 36 /2020-CustomsAshok KumarPas encore d'évaluation

- VALUE ADDED TAX Part 02Document19 pagesVALUE ADDED TAX Part 02wellawalalasithPas encore d'évaluation

- Anf 5A Application Form For Epcg Authorisation IssueDocument6 pagesAnf 5A Application Form For Epcg Authorisation IssueBaljeet SinghPas encore d'évaluation

- PN No 78Document7 pagesPN No 78saurabhPas encore d'évaluation

- FTP 2015-20Document30 pagesFTP 2015-20chandrajeet yadavPas encore d'évaluation

- Highlight 09Document5 pagesHighlight 09nadeem549Pas encore d'évaluation

- Shippingline DoccDocument3 pagesShippingline DoccHimanshu KushwahaPas encore d'évaluation

- Shipment AdviseDocument1 pageShipment AdviseHimanshu KushwahaPas encore d'évaluation

- Sample InvoiceDocument4 pagesSample InvoiceHimanshu KushwahaPas encore d'évaluation

- Shipment Advice FilledDocument1 pageShipment Advice FilledHimanshu KushwahaPas encore d'évaluation

- Quotation FilledDocument1 pageQuotation FilledHimanshu KushwahaPas encore d'évaluation

- SAPTA CertificateDocument2 pagesSAPTA CertificateHimanshu KushwahaPas encore d'évaluation

- Pre Shipment InvoiceDocument4 pagesPre Shipment InvoiceHimanshu KushwahaPas encore d'évaluation

- Pre Shipment Packing ListDocument4 pagesPre Shipment Packing ListHimanshu KushwahaPas encore d'évaluation

- Sample Invoice - FilledDocument1 pageSample Invoice - FilledHimanshu KushwahaPas encore d'évaluation

- Proforma InvoiceDocument4 pagesProforma InvoiceHimanshu KushwahaPas encore d'évaluation

- Certificate of Origin (CII)Document1 pageCertificate of Origin (CII)Himanshu KushwahaPas encore d'évaluation

- Form Ct-1: Certificate For Procurement of Excisable Goods For Export Without Payment of DutyDocument1 pageForm Ct-1: Certificate For Procurement of Excisable Goods For Export Without Payment of DutyHimanshu KushwahaPas encore d'évaluation

- Post Ship. - Packing List FilledDocument1 pagePost Ship. - Packing List FilledHimanshu KushwahaPas encore d'évaluation

- Pre Ship Packing List - FilledDocument1 pagePre Ship Packing List - FilledHimanshu KushwahaPas encore d'évaluation

- LC DraftDocument2 pagesLC DraftHimanshu Kushwaha0% (1)

- EVD - Export Value Dec.Document1 pageEVD - Export Value Dec.Himanshu Kushwaha0% (1)

- Insurance PolicyDocument2 pagesInsurance PolicyHimanshu KushwahaPas encore d'évaluation

- And Place of Bank)Document1 pageAnd Place of Bank)Himanshu KushwahaPas encore d'évaluation

- Commercial Packing ListDocument4 pagesCommercial Packing ListHimanshu KushwahaPas encore d'évaluation

- Commercial InvoiceDocument4 pagesCommercial InvoiceHimanshu KushwahaPas encore d'évaluation

- Format of B/L - B/L Draft: Place of Receipt by Pre-CarriageDocument4 pagesFormat of B/L - B/L Draft: Place of Receipt by Pre-CarriageHimanshu KushwahaPas encore d'évaluation

- Form A.R.E. 1: .. Application For Removal of Excisable Goods For Export by (Air/Sea/Post/Land)Document9 pagesForm A.R.E. 1: .. Application For Removal of Excisable Goods For Export by (Air/Sea/Post/Land)Himanshu KushwahaPas encore d'évaluation

- Bill of Exchange (Sole) Drawn Under LC No .. Dated . Issued by (Name and Place of Bank)Document3 pagesBill of Exchange (Sole) Drawn Under LC No .. Dated . Issued by (Name and Place of Bank)Himanshu Kushwaha100% (1)

- Bill of Exchange Filled - CollectionDocument1 pageBill of Exchange Filled - CollectionHimanshu KushwahaPas encore d'évaluation

- Peptic UlcerDocument48 pagesPeptic Ulcerscribd225Pas encore d'évaluation

- Vocabulary Words - 20.11Document2 pagesVocabulary Words - 20.11ravindra kumar AhirwarPas encore d'évaluation

- List of Notified Bodies Under Directive - 93-42 EEC Medical DevicesDocument332 pagesList of Notified Bodies Under Directive - 93-42 EEC Medical DevicesJamal MohamedPas encore d'évaluation

- Surat Textile MillsDocument3 pagesSurat Textile MillsShyam J VyasPas encore d'évaluation

- Internship Report On A Study of The Masterbranding of Dove: Urmee Rahman SilveeDocument45 pagesInternship Report On A Study of The Masterbranding of Dove: Urmee Rahman SilveeVIRAL DOSHIPas encore d'évaluation

- Statement 876xxxx299 19052022 113832Document2 pagesStatement 876xxxx299 19052022 113832vndurgararao angatiPas encore d'évaluation

- Komatsu Hydraulic Excavator Pc290lc 290nlc 6k Shop ManualDocument20 pagesKomatsu Hydraulic Excavator Pc290lc 290nlc 6k Shop Manualmallory100% (47)

- Peacekeepers: First Term ExamDocument2 pagesPeacekeepers: First Term ExamNoOry foOT DZ & iNT100% (1)

- Governance Whitepaper 3Document29 pagesGovernance Whitepaper 3Geraldo Geraldo Jr.Pas encore d'évaluation

- Problem Based LearningDocument23 pagesProblem Based Learningapi-645777752Pas encore d'évaluation

- ANTH 222 Syllabus 2012Document6 pagesANTH 222 Syllabus 2012Maythe S. HanPas encore d'évaluation

- E F Eng l1 l2 Si 011Document2 pagesE F Eng l1 l2 Si 011Simona ButePas encore d'évaluation

- Soul Winners' SecretsDocument98 pagesSoul Winners' Secretsmichael olajidePas encore d'évaluation

- For Printing Week 5 PerdevDocument8 pagesFor Printing Week 5 PerdevmariPas encore d'évaluation

- Adrenal Cortical TumorsDocument8 pagesAdrenal Cortical TumorsSabrina whtPas encore d'évaluation

- Apush Leq Rubric (Long Essay Question) Contextualization (1 Point)Document1 pageApush Leq Rubric (Long Essay Question) Contextualization (1 Point)Priscilla RayonPas encore d'évaluation

- Narrative of John 4:7-30 (MSG) : "Would You Give Me A Drink of Water?"Document1 pageNarrative of John 4:7-30 (MSG) : "Would You Give Me A Drink of Water?"AdrianPas encore d'évaluation

- Neolms Week 1-2,2Document21 pagesNeolms Week 1-2,2Kimberly Quin CanasPas encore d'évaluation

- Pengaruh Abu Batu Sebagai Subtitusi Agregat Halus DanDocument10 pagesPengaruh Abu Batu Sebagai Subtitusi Agregat Halus Danangela merici rianawatiPas encore d'évaluation

- Event Planning Sample Cover Letter and ItineraryDocument6 pagesEvent Planning Sample Cover Letter and ItineraryWhitney Mae HaddardPas encore d'évaluation

- Accountancy Service Requirements of Micro, Small, and Medium Enterprises in The PhilippinesDocument10 pagesAccountancy Service Requirements of Micro, Small, and Medium Enterprises in The PhilippinesJEROME ORILLOSAPas encore d'évaluation

- Bike Chasis DesignDocument7 pagesBike Chasis Designparth sarthyPas encore d'évaluation

- Not Just Another Winter Festival: Rabbi Reuven BrandDocument4 pagesNot Just Another Winter Festival: Rabbi Reuven Brandoutdash2Pas encore d'évaluation

- 1 3 Quest-Answer 2014Document8 pages1 3 Quest-Answer 2014api-246595728Pas encore d'évaluation

- Odisha Block Summary - NUAGAONDocument8 pagesOdisha Block Summary - NUAGAONRohith B.NPas encore d'évaluation

- United States Court of Appeals, Third CircuitDocument8 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsPas encore d'évaluation