Académique Documents

Professionnel Documents

Culture Documents

Angel Fund Chart

Transféré par

Rob PortCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Angel Fund Chart

Transféré par

Rob PortDroits d'auteur :

Formats disponibles

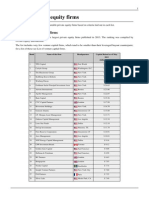

APPENDIX K

Updated as of December 22, 2015

North Dakota Office of State Tax Commissioner

Angel Fund Investment Tax Credit Program

Summary of Investment and Credit Activity by Certified Angel Funds

For Investments Made During The Period January 1, 2011, through December 22, 2015

Number of Investors 1

Amount Invested

Tax Credits Earned

Tax Credits Transferred To

Another Taxpayer 4

(Only applied to the 2011-12 tax years)

Name of Angel Fund

In-State Out-of-State

Investors

Investors

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

Out-of-State

Investors

In-State

Investors

Total

In-State

Investors

Total

Out-of-State

Investors

Out-of-State

Investors

In-State

Investors

Total

Location and Number of

Enterprises In Which Angel Fund

Has Invested Its Funds

Total

In North

Dakota

Outside

North

Dakota

Total

7

Arthur Ventures Growth Fund LLC

10

Arthur Ventures LLC

Arthur Ventures Growth Fund II LP

Aurora Angel Fund LLC

240,000

240,000

108,000

108,000

10

10

Edgewood Angel Fund LLC

1,395,000

1,395,000

627,750

Flickertail Capital Ventures LLC

85

90

8,795,170

700,000

9,495,170

3,753,077

FM Angel Investment Fund LLC

22

25

435,000

60,000

495,000

175,500

2,273,856

2,028,141

4,301 ,997

321,405

238,773

560,178

627,750

270,000

4,023,077

130,000

45,000

175,000

27,000

202,500

11

11

12

14

Grow Dakota Angel Fund LLC

315,000

315,000

141,750

141,750

11,764

11,764

10

10

Harvest Fund I LLLP

23

32

340,000

180,000

520,000

153,000

81,000

234,000

Leading Edge Angel Fund LLC

27

27

3,575,000

3,575,000

1,563,750

1,563,750

42,000

42,000

Legendary Investments LLC

87

89

4,665,488

107,000

4,772,488

2,097,895

48,150

2,146,045

Linn Grove Angel Fund LP

33

35

2,155,000

100,000

2,255,000

947,250

45,000

992,250

67,500

67,500

ND Capital Ventures LLC

41

43

4,040,350

400,000

4,440,350

1,818,158

180,000

1,998,158

Northern Plains Investments LLC

Rain Venture 1 LLC

14

15

660,000

10,000

670,000

297,000

4,500

301,500

10

Rain Venture 2 LLC

43

44

1,824,000

10,000

1,834,000

820,800

4,500

825,300

15

21

Rain Venture 3 LLC

36

36

1,611,000

1,611,000

724,950

724,950

11

Rain Venture 4 LLC

44

45

1,699,500

10,000

1,709,500

764,775

4,500

769,275

Southern Valley Angel Fund LLC

15

18

305,000

70,000

375,000

130,500

31,500

162,000

10

12

Springfield Group Angel Fund LLC

25

25

2,360,000

2,360,000

1,030,500

1,030,500

Vall ey Angel Investment Fund LLC

Wilbar Holdings LLC

0

5

0

1

0

6

0

800,000

0

200,000

0

1,000,000

0

225,000

0

45,000

0

270,000

0

0

0

0

0

0

2

2

10

2

12

4

81

75

156

TotalsIn-State Investors

Out-of-State Investors

All investors

519

$15,701,059

$37,489,364

34

$

553

3,875,141

$

$

$41 ,364,505

979,923

172,000

$

$16,680,982

124,264

$

296,264

Notes

1

The total number of investors will reflect an investor more than once if that investor made an investment in more than one fund.

Investment amounts shown reflect the total amount invested. They do not reflect the fo llowing statutory limitations: (1) Annual limit-Only the first $100,000 invested in a tax year by a taxpayer is eligibl e for the credit. (2) Lifetime

limit-For tax years 2011 and 2012, a taxpayer was allowed no more than $150,000 in total credits (equivalent to $333,333 of eligible investments). For ta x years 2013 and after, a taxpayer is allowed no more than $500,000 in total

credits (equivalent to $1,111,111 of eligible investme nts). (3) Lifetime limit per angel fund -For investments made on or after January 1, 2009, no more than $5,000,000 in tota l credits is allowed for total investments made in each

angel fund, wh ich is equivalent to $11,111,111 of eligible investments.

3

Tax credit amounts shown take into account the statutory limitations on the credit, which are set out in Note 2 above.

For credits based on investm ents made in the 20 11 and 2012 tax years only, cred its could be transferred or sold to another taxpayer under certain conditions. The transfer feature expired at end of 2012 tax year.

Vous aimerez peut-être aussi

- List of Private Equity FirmsDocument10 pagesList of Private Equity FirmsJimmy Carlos Riojas MarquezPas encore d'évaluation

- US Angel InvestorsDocument46 pagesUS Angel InvestorsShaik InayathPas encore d'évaluation

- Investors Email List SampleDocument6 pagesInvestors Email List SampleAsheesh prajapatiPas encore d'évaluation

- PE/VC Firms With Women, Minority FoundersDocument14 pagesPE/VC Firms With Women, Minority FoundersdavidtollPas encore d'évaluation

- Murrey Trading Strategy Lines and Price Action - Trading Strategy GuidesDocument9 pagesMurrey Trading Strategy Lines and Price Action - Trading Strategy Guideshansley cook100% (2)

- List of Angel Investors AssociationDocument14 pagesList of Angel Investors AssociationdroldiesPas encore d'évaluation

- Angel Investor DirectoryDocument15 pagesAngel Investor DirectoryOsaz Aiho33% (3)

- VC'sDocument42 pagesVC'sElchai GranotPas encore d'évaluation

- Microsoft Word - AngelInvestorListDocument6 pagesMicrosoft Word - AngelInvestorListJesse Barrett-Mills0% (1)

- VC ListDocument455 pagesVC ListK12 edzPas encore d'évaluation

- Investors For StartupsDocument36 pagesInvestors For StartupsSumit SavaraPas encore d'évaluation

- Preqin Investor List - 270Document60 pagesPreqin Investor List - 270ilias ahmedPas encore d'évaluation

- UND Reporton Conflict InvestigationDocument34 pagesUND Reporton Conflict InvestigationRob PortPas encore d'évaluation

- Hedge Fund Email ListDocument56 pagesHedge Fund Email ListShareMind100% (1)

- Fintech InvestorsDocument52 pagesFintech InvestorsIngmar Janssen0% (1)

- VC ListDocument16 pagesVC ListDavid SavagePas encore d'évaluation

- 2010 ACA Summit Registration - Angel Capital Association - Angel InvestorsDocument8 pages2010 ACA Summit Registration - Angel Capital Association - Angel InvestorsLindsey SantosPas encore d'évaluation

- Sbi MF Common Equity Form Arn EuinDocument2 pagesSbi MF Common Equity Form Arn EuinARVINDPas encore d'évaluation

- Venture Capital FirmsDocument36 pagesVenture Capital FirmsGopalakrishna100% (1)

- List of All Incubators Seed FundsDocument3 pagesList of All Incubators Seed FundsaznboyxPas encore d'évaluation

- Uk Angel InvestorsDocument38 pagesUk Angel InvestorsShaik Inayath0% (1)

- Company List - Venture Capital DirectoryDocument210 pagesCompany List - Venture Capital Directoryleonnox0% (1)

- Europe Hedge FundsDocument126 pagesEurope Hedge Fundsheedi0Pas encore d'évaluation

- List of Investors - Short TermDocument12 pagesList of Investors - Short Termrshah11508Pas encore d'évaluation

- Family Office Database V15 SampleDocument1 pageFamily Office Database V15 SampleIZ SaintedPas encore d'évaluation

- EU InvestorsDocument201 pagesEU InvestorsVineet Vinod25% (8)

- India Investors List 2020 PDFDocument157 pagesIndia Investors List 2020 PDFshashank katariya33% (3)

- Angel Investor ListDocument10 pagesAngel Investor Listluvisfact7616Pas encore d'évaluation

- Fortune 1000 Company ListDocument10 pagesFortune 1000 Company ListGayathri RupinPas encore d'évaluation

- List of Institutional Investors (Compiled)Document15 pagesList of Institutional Investors (Compiled)Ritik kattePas encore d'évaluation

- Crowd-Sourced List of European InvestorsDocument67 pagesCrowd-Sourced List of European InvestorsEnrike Nur100% (1)

- Venture Capital Directory of Silicon Valley Venture Capital FirmsDocument10 pagesVenture Capital Directory of Silicon Valley Venture Capital FirmsSnr Owusu Achiaw KwasiPas encore d'évaluation

- 2Q 15 Vcsurvey PDFDocument11 pages2Q 15 Vcsurvey PDFBayAreaNewsGroupPas encore d'évaluation

- Investment and VC Funds Acting in SEE RegionDocument72 pagesInvestment and VC Funds Acting in SEE Regionpaul_costasPas encore d'évaluation

- List of Registered Venture Capital FundsDocument11 pagesList of Registered Venture Capital FundsMushtakh Ahmed MussuPas encore d'évaluation

- 2008 Global Private Equity & Venture Capital Contact DirectoryDocument3 pages2008 Global Private Equity & Venture Capital Contact Directorywww.gazhoo.com100% (5)

- Zimbabwe Angel Investors - AngelListDocument15 pagesZimbabwe Angel Investors - AngelListjrmutengeraPas encore d'évaluation

- Indian Seed and Angel Investor ListDocument2 pagesIndian Seed and Angel Investor ListDarpan Ashokrao Salunkhe100% (1)

- Crunchbase InvestorsDocument436 pagesCrunchbase InvestorsDoc SaabPas encore d'évaluation

- Updated List VC PE Angel Seed Fund List (2) ,,,,,,,,,,,updatedDocument57 pagesUpdated List VC PE Angel Seed Fund List (2) ,,,,,,,,,,,updatedRASHMIPas encore d'évaluation

- 47 Most Active Venture Capital Firms in India For StartupsDocument21 pages47 Most Active Venture Capital Firms in India For StartupsfinvistaPas encore d'évaluation

- VC-Seed Funding CompaniesDocument15 pagesVC-Seed Funding CompaniesqwertyPas encore d'évaluation

- Venture Capital Directory - Wavc - DirectoryDocument48 pagesVenture Capital Directory - Wavc - DirectoryAlan Tikwart100% (2)

- Alvaro CV CBS Resume FormatDocument1 pageAlvaro CV CBS Resume FormatAlvaroDeCampsPas encore d'évaluation

- Proper Filing of New Saln Baseline Declaration FormDocument41 pagesProper Filing of New Saln Baseline Declaration FormRubyrose TagumPas encore d'évaluation

- 140+ Active Angel Investor & Seed Fund Profiles in IndiaDocument110 pages140+ Active Angel Investor & Seed Fund Profiles in IndiaShrutesh Sharma67% (3)

- VC ListDocument42 pagesVC ListAbhijit ChokshiPas encore d'évaluation

- High Frequency Trading - Shawn DurraniDocument49 pagesHigh Frequency Trading - Shawn DurraniShawnDurraniPas encore d'évaluation

- BSPI Media Release 2-2-2023Document1 pageBSPI Media Release 2-2-2023Rob PortPas encore d'évaluation

- Active Investor List by Trace CohenDocument53 pagesActive Investor List by Trace Cohens4shivPas encore d'évaluation

- Angel Investors India PDFDocument5 pagesAngel Investors India PDFSourav KumarPas encore d'évaluation

- InvestorsDocument26 pagesInvestorssmute20100% (2)

- TxtartDocument384 pagesTxtartapi-27370939100% (1)

- Investment Managers ListDocument4 pagesInvestment Managers ListKnightspagePas encore d'évaluation

- Investor Contacts VC'sDocument1 pageInvestor Contacts VC'sWeAreKopi100% (3)

- Family Office 2010 Europe NamesDocument11 pagesFamily Office 2010 Europe Namescraig2786100% (1)

- Investments Test 2 Study GuideDocument30 pagesInvestments Test 2 Study GuideLaurenPas encore d'évaluation

- Investors ContactDocument9 pagesInvestors Contactsavaliyaparesh1Pas encore d'évaluation

- Venture CapitalDocument62 pagesVenture CapitalNikhil Thakur0% (1)

- Scientific Forex PDFDocument34 pagesScientific Forex PDFAlain Castillo0% (1)

- Andrew Keene - Trading With The Ichimoku CloudDocument28 pagesAndrew Keene - Trading With The Ichimoku CloudJms JmsPas encore d'évaluation

- Strategic Profit ModelDocument4 pagesStrategic Profit ModelLavanya WinsletPas encore d'évaluation

- Venture Capital Funding, Fourth Quarter 2015Document10 pagesVenture Capital Funding, Fourth Quarter 2015BayAreaNewsGroupPas encore d'évaluation

- MGT827Document2 pagesMGT827Yen GPas encore d'évaluation

- 7 Emails For Potential InvestorsDocument24 pages7 Emails For Potential InvestorsVenugopal T RPas encore d'évaluation

- Accelerators: List of Start-Up Incubators and AcceleratorsDocument2 pagesAccelerators: List of Start-Up Incubators and AcceleratorsnamanPas encore d'évaluation

- Handbook & Directory On Venture Capital in India - Venture IntelligenceDocument81 pagesHandbook & Directory On Venture Capital in India - Venture IntelligencePri BPas encore d'évaluation

- General Angel FundDocument8 pagesGeneral Angel FundinforumdocsPas encore d'évaluation

- 2012 02 01 PRGovDevBank01a FIN PDFDocument304 pages2012 02 01 PRGovDevBank01a FIN PDFMetro Puerto RicoPas encore d'évaluation

- Imf Fy 2012Document39 pagesImf Fy 2012nikitas666Pas encore d'évaluation

- WK 3 Textbook AssignmentDocument4 pagesWK 3 Textbook AssignmentTressa audellPas encore d'évaluation

- Form 11-K: United States Securities and Exchange CommissionDocument15 pagesForm 11-K: United States Securities and Exchange CommissionSurya PermanaPas encore d'évaluation

- 17 ACE Ltd. 2012 Annual Report (Form 10-K) at F-20Document1 page17 ACE Ltd. 2012 Annual Report (Form 10-K) at F-20urrwpPas encore d'évaluation

- Simons Pre-Trial BriefDocument5 pagesSimons Pre-Trial BriefRob PortPas encore d'évaluation

- Borneman EmailDocument2 pagesBorneman EmailRob PortPas encore d'évaluation

- Legalize Cannabis PetitionDocument25 pagesLegalize Cannabis PetitionRob PortPas encore d'évaluation

- Horace Property Property Tax StatementDocument2 pagesHorace Property Property Tax StatementRob PortPas encore d'évaluation

- Katrina ChristiansenDocument566 pagesKatrina ChristiansenRob PortPas encore d'évaluation

- LIFT Success ExampleDocument2 pagesLIFT Success ExampleRob PortPas encore d'évaluation

- Becker Property Tax Fundraising PitchDocument5 pagesBecker Property Tax Fundraising PitchRob PortPas encore d'évaluation

- 7 - Resolution On CO2 Private Property and Eminent DomainDocument1 page7 - Resolution On CO2 Private Property and Eminent DomainRob PortPas encore d'évaluation

- Mohr Candidate FilingDocument32 pagesMohr Candidate FilingRob PortPas encore d'évaluation

- Protect District 37s Rights LetterDocument1 pageProtect District 37s Rights LetterRob PortPas encore d'évaluation

- PD Ir2314849Document6 pagesPD Ir2314849Rob PortPas encore d'évaluation

- Vote No On 7 - Full Page - CompleteDocument2 pagesVote No On 7 - Full Page - CompleteRob PortPas encore d'évaluation

- Becker Property Tax Fundraising PitchDocument5 pagesBecker Property Tax Fundraising PitchRob PortPas encore d'évaluation

- Cramer For SenateDocument1 359 pagesCramer For SenateRob PortPas encore d'évaluation

- 2011 o 12Document3 pages2011 o 12Rob PortPas encore d'évaluation

- Retire CongressDocument1 pageRetire CongressRob PortPas encore d'évaluation

- Miller AnnouncementDocument1 pageMiller AnnouncementRob PortPas encore d'évaluation

- Legendary PacDocument1 pageLegendary PacRob PortPas encore d'évaluation

- Presidential Caucuses Media Advisory 29feb24Document1 pagePresidential Caucuses Media Advisory 29feb24Rob PortPas encore d'évaluation

- Cramer For SenateDocument1 359 pagesCramer For SenateRob PortPas encore d'évaluation

- Approved Property Tax Petition 29june23Document8 pagesApproved Property Tax Petition 29june23Rob PortPas encore d'évaluation

- Matt Entz Contract AmendmentsDocument4 pagesMatt Entz Contract AmendmentsMike McFeelyPas encore d'évaluation

- Burleigh County Conflict Case Stenehjem Email No Prosecution LetterDocument28 pagesBurleigh County Conflict Case Stenehjem Email No Prosecution LetterRob PortPas encore d'évaluation

- 25 5061 02000 Meeting AgendaDocument3 pages25 5061 02000 Meeting AgendaRob PortPas encore d'évaluation

- Brocker EmailDocument1 pageBrocker EmailJeremy TurleyPas encore d'évaluation

- Election Integrity Ballot MeasureDocument13 pagesElection Integrity Ballot MeasureRob PortPas encore d'évaluation

- Combined ReportsDocument131 pagesCombined ReportsRob PortPas encore d'évaluation

- Combined ReportsDocument131 pagesCombined ReportsRob PortPas encore d'évaluation

- Chapter 17Document21 pagesChapter 17pvaibhyPas encore d'évaluation

- (##-See Rebate) : 1st Year 2nd Year 3rd Year 4th Year 5th Year 6th YearDocument1 page(##-See Rebate) : 1st Year 2nd Year 3rd Year 4th Year 5th Year 6th YearMita SethiPas encore d'évaluation

- Financial Risk Management: Prof. Ian GiddyDocument43 pagesFinancial Risk Management: Prof. Ian GiddyShahrez KhanPas encore d'évaluation

- 5wayspostbtfd2018 LPDocument17 pages5wayspostbtfd2018 LPpenumudi233Pas encore d'évaluation

- Project Report On Bajaj CapitalDocument61 pagesProject Report On Bajaj Capitalharman singhPas encore d'évaluation

- Profitability: TTM Vs 5 Year Average MarginsDocument3 pagesProfitability: TTM Vs 5 Year Average MarginsSariephine Grace ArasPas encore d'évaluation

- App DDocument16 pagesApp DJulious CaalimPas encore d'évaluation

- Aero Agro Chemical Industries LTDDocument15 pagesAero Agro Chemical Industries LTDBhavin SagarPas encore d'évaluation

- Analysis of Financial Statement Bank Alfalah ReportDocument14 pagesAnalysis of Financial Statement Bank Alfalah ReportIjaz Hussain BajwaPas encore d'évaluation

- 05 Iipm Nota EntrepreneurshipDocument127 pages05 Iipm Nota EntrepreneurshipAMIR HARITH HILMI BIN MOHAMAD HIZAM -Pas encore d'évaluation

- CFAP 2 CLS Summer 2017 PDFDocument4 pagesCFAP 2 CLS Summer 2017 PDFJawad TariqPas encore d'évaluation

- EDHEC 2015 SyllabusmDocument7 pagesEDHEC 2015 SyllabusmVivek HaldarPas encore d'évaluation

- CCME Top Pick of 2011 Northland SecuritiesDocument8 pagesCCME Top Pick of 2011 Northland SecuritieswctbillsPas encore d'évaluation

- Financial Management at Bajaj AutoDocument11 pagesFinancial Management at Bajaj AutoShikha AgarwalPas encore d'évaluation

- Jacque Capitulo 15 LTCM 307953Document29 pagesJacque Capitulo 15 LTCM 307953Sebastian DuranPas encore d'évaluation

- Shangrila 2010Document107 pagesShangrila 2010Nana ShahPas encore d'évaluation

- Synopsis ON Customer Satisfaction Towards HDFC Bank: Introduction of The TopicDocument3 pagesSynopsis ON Customer Satisfaction Towards HDFC Bank: Introduction of The TopicRakesh JangidPas encore d'évaluation

- Tsogo Sun Gaming LTD - Annual-ResultsDocument40 pagesTsogo Sun Gaming LTD - Annual-ResultskoosPas encore d'évaluation

- Finance OverviewDocument19 pagesFinance OverviewyomoPas encore d'évaluation