Académique Documents

Professionnel Documents

Culture Documents

Canada's Top 50 Research Colleges List 2015 Analysis

Transféré par

Maisha AronnoTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Canada's Top 50 Research Colleges List 2015 Analysis

Transféré par

Maisha AronnoDroits d'auteur :

Formats disponibles

Canadas Top 50 Research Colleges List 2015

Analysis

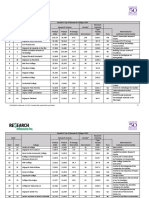

Research Trajectory Slowing

Growth in research activity at Canadas Top 50 Research Colleges cooled substantially in Fiscal

2014, posting a 4.7% increase compared with a 38.8% expansion in Fiscal 2013. Combined

research income reached $158.0 million, compared with $150.8 million the previous year. In total

31 colleges reported gains in research income while 19 colleges reported declines. Because the

number of college faculty engaged in research increased by 14.3%, year-on-year research intensity

(income per faculty) declined by -8.3%, to $75,054 from $81,883.

George Brown College headed the Top 50 list, attracting $14.2 million of research income last year,

with year-on-year growth reaching 53.5%. Cgep de Saint-Hyacinthe recorded about $9.4 million

of income, followed by SAIT Polytechnic at $7.2 million. Rounding out the top 10 were Cgep de

la Gaspsie et des les ($7.1 million), British Columbia Institute of Technology ($7.0 million),

Cgep douard-Montpetit ($6.2 million), Cgep de La Pocatire ($5.6 million), Red River College

($5.6 million), Sheridan College ($5.5 million), and Niagara College ($5.3 million).

Provincial Performance

Provincially, Qubecs 17 colleges accounted for a total of $57.3 million of research income and

36.3% of total Top 50 activity. With 16 colleges, Ontario posted income of $54.3 million and

accounted for 34.4% of national activity. Colleges in all other provinces/territories combined

accounted for 29.2% of national income.

Among the 4 leading provinces with more than 1 college reporting, average per-college income was

highest in Ontario ($3.40 million), Qubec ($3.37 million), British Columbia ($2.78 million) and

Alberta ($2.59 million). (Note that Albertas results were affected because NAIT and Bow Valley

College did not participate in this years survey.)

Top 50 Leading Provinces

Average $

Province

(millions)

% of Total

Qubec (17)

$3.37

36.3

Ontario (16)

$3.40

34.4

Alberta (6)

$2.59

9.9

British Columbia (4)

$2.78

7.0

RE$EARCH Infosource Inc. 2015

Unauthorized reproduction prohibited

Income Growth Leaders

In spite of the modest national result (4.7% increase) many colleges exhibited very strong rates of

growth in income last year. Income grew by 271.6% at Cgep de La Pocatire, 89.7% at College of

New Caledonia, 70.8% at Nova Scotia Community College, 70.3% at Lambton College and 67.8%

at Collge communautaire du Nouveau-Brunswick.

Top 10 Research Colleges by Growth

2014 Rank

Income

Growth

Overall

Research College

7

Cgep de La Pocatire

1

48

College of New Caledonia

2

19

Nova Scotia Community College

3

11

Lambton College

4

20

Collge communautaire du

5

Nouveau-Brunswick

1

George Brown College

6

50

Cgep rgional de Lanaudire

7

17

Mohawk College

8

21

Olds College

9

12

Centennial College

10

% Change

2013-2014

271.6

89.7

70.8

70.3

67.8

53.5

44.8

43.5

39.3

32.8

Research Intensity

Average Top 50 research intensity research income per faculty declined by -8.3% last year, to

$75,054. Research intensity was highest at Yukon College ($418,400 per faculty), followed by

Cgep Andr-Laurendeau ($305,800 per faculty) and Collge de Maisonneuve ($196,400 per

faculty). Overall, 25 of the 50 research colleges posted research intensities higher than the national

average.

Top 10 Research Intensive Colleges

2014 Rank

Research Intensity

Research

($ per Faculty)

Intensity Overall

Research College

$000

14

Yukon College

$418.4

1

15

Cgep Andr-Laurendeau

$305.8

2

26

Collge de Maisonneuve

$196.4

3

11

Lambton College

$182.5

4

7

Cgep de La Pocatire

$160.6

5

25

Collge Shawinigan

$155.8

6

4

Cgep de la Gaspsie et des les

$150.9

7

38

Lakeland College

$147.3

8

6

Cgep douard-Montpetit

$144.3

9

17

Mohawk College

$139.7

10

RE$EARCH Infosource Inc. 2015

Unauthorized reproduction prohibited

Research Partnerships and Projects

A key metric for college research is the number of active and completed formal research

partnerships and projects that colleges have with external organizations. This year the Top 50

Research Colleges reported a total of 2,093 active research partnerships, compared with 1,810 in

Fiscal 2013. Similarly, they tallied 2,021 completed projects compared with 1,782 the year before.

This Year and Next

This is the third year in which Research Infosource has reported on college research activity. We

thank all the participating colleges for their cooperation in providing the data that help us to track

national trends. As previously indicated, total Fiscal 2014 research income expanded by 4.7%,

which was well below the 38.8% growth seen in Fiscal 2013 and the 35.4% growth in Fiscal 2012.

On the positive side, the number of college faculty engaged in research expanded by 14.3%. Active

research partnerships grew by 15.6% and completed projects expanded by 13.4%.

Why the reduced rate of income growth, which admittedly is only one measure of research activity?

It is possible (though not likely) that external funders primarily governments and the private sector

reduced the amounts of money available for college research. Or perhaps the college research

model has harvested the low hanging fruit and may need to evolve in the future in order to sustain

prior levels of growth. Unlike their university counterparts, college faculty generally do not have a

research mandate; they are hired primarily to teach. Colleges are thus required to hire additional

teaching personnel to fill in for college staff who secure research funds, a situation that creates

program delivery inefficiencies. Another barrier is that colleges do not have a cadre of graduate

students to do the research legwork in a sustained way. College students do an admirable job, but

their time is limited compared with that of a university graduate student. Another factor might be

the relative absence of infrastructure to support additional research. Other considerations may also

be at play. This years Top 50 Research Colleges results should encourage colleges and funders to

consider future prospects and examine barriers and opportunities to growing college research.

There is no doubt that college research typically applied in nature fills an important space in

Canadas national research agenda. Colleges and funders are both eager to expand their role. There

is a willing group of companies, government departments, community groups and others interested

in working with colleges. The coming year is a good time to establish a new action plan to move

the sector forward.

-30-

RE$EARCH Infosource Inc. 2015

Unauthorized reproduction prohibited

Vous aimerez peut-être aussi

- Understanding College and University EndowmentsDocument16 pagesUnderstanding College and University EndowmentsAbu 3abdPas encore d'évaluation

- The Fruits of Opportunism: Noncompliance and the Evolution of China's Supplemental Education IndustryD'EverandThe Fruits of Opportunism: Noncompliance and the Evolution of China's Supplemental Education IndustryPas encore d'évaluation

- Features (11) - 4/13Document1 pageFeatures (11) - 4/13lindsey_arynPas encore d'évaluation

- Presentation To The Austin CACDocument30 pagesPresentation To The Austin CACValerie F. LeonardPas encore d'évaluation

- Global Impact STEM AcademiesDocument2 pagesGlobal Impact STEM AcademiesGISAOHIOPas encore d'évaluation

- Forecasting Mainstream School Funding: School Financial Success Guides, #5D'EverandForecasting Mainstream School Funding: School Financial Success Guides, #5Pas encore d'évaluation

- From The Dean: A Growth SpurtDocument1 pageFrom The Dean: A Growth SpurtSalsa_Picante_BabyPas encore d'évaluation

- David Naylor, President of The University of Toronto: Final Exam: The Urgent Need For A Bold Discussion About Canada's UniversitiesDocument18 pagesDavid Naylor, President of The University of Toronto: Final Exam: The Urgent Need For A Bold Discussion About Canada's UniversitiesCanada 2020 - Canada's Progressive CentrePas encore d'évaluation

- Act ADocument3 pagesAct ASteve CouncilPas encore d'évaluation

- Total Quality Management in Higher Education: Symbolism or Substance? a Close Look at the Nigerian University SystemD'EverandTotal Quality Management in Higher Education: Symbolism or Substance? a Close Look at the Nigerian University SystemPas encore d'évaluation

- Turning Around America's Failing Schools:: Bold Opportunities For Education FundersDocument42 pagesTurning Around America's Failing Schools:: Bold Opportunities For Education FundersMatt SlyPas encore d'évaluation

- Canadian Federation of Students-Ontario 2009-2010 Campaigns GuideDocument18 pagesCanadian Federation of Students-Ontario 2009-2010 Campaigns GuideclimbrandonPas encore d'évaluation

- Higher Education Review - Executive Summary Recommendations and FindingsDocument19 pagesHigher Education Review - Executive Summary Recommendations and FindingsjvaneedenPas encore d'évaluation

- The Iron Warrior: Volume 26, Issue 4Document16 pagesThe Iron Warrior: Volume 26, Issue 4The Iron WarriorPas encore d'évaluation

- Institute of Fiscal Studies: Pupil Premium - Assessing The Options 2010Document97 pagesInstitute of Fiscal Studies: Pupil Premium - Assessing The Options 2010Matt GrantPas encore d'évaluation

- 2013 University Convocation Transcript - 0Document10 pages2013 University Convocation Transcript - 0Anonymous BPl9TYiZPas encore d'évaluation

- CFS (2009, August) Submission To The 2009 Pre-Budget ConsultationsDocument10 pagesCFS (2009, August) Submission To The 2009 Pre-Budget ConsultationsMelonie A. FullickPas encore d'évaluation

- Market Research Within The Australian Fitness IndustryDocument5 pagesMarket Research Within The Australian Fitness IndustryfitnessresearchtodayPas encore d'évaluation

- I3 Proposal: Validating ELT As A Turnaround Strategy For Persistently Low-Performing Middle SchoolsDocument35 pagesI3 Proposal: Validating ELT As A Turnaround Strategy For Persistently Low-Performing Middle SchoolscitizenschoolsPas encore d'évaluation

- Four Years CollegeDocument60 pagesFour Years CollegeLisaPas encore d'évaluation

- RSA Education Between The Cracks ReportDocument74 pagesRSA Education Between The Cracks ReportThe RSAPas encore d'évaluation

- FCSS-FESC 2024 Ontario Pre-Budget Consultations SubmissionDocument6 pagesFCSS-FESC 2024 Ontario Pre-Budget Consultations Submissionvictor.vasilevPas encore d'évaluation

- iNACOL Fast Facts About Online LearningDocument4 pagesiNACOL Fast Facts About Online LearningiNACOL100% (1)

- Spring 2012 in Brief: To Graduation and Beyond: College & Career Readiness in Duval CountyDocument12 pagesSpring 2012 in Brief: To Graduation and Beyond: College & Career Readiness in Duval CountyJacksonville Public Education FundPas encore d'évaluation

- Education Issues Brief 2010-2011Document30 pagesEducation Issues Brief 2010-2011Valori OliverPas encore d'évaluation

- Essay On EducationDocument4 pagesEssay On EducationbusonPas encore d'évaluation

- Challenges and Issues in Philippine Higher Education Report No 2Document26 pagesChallenges and Issues in Philippine Higher Education Report No 2HUI SONG100% (2)

- Uni EndowmentsDocument2 pagesUni Endowmentselina 14Pas encore d'évaluation

- Matching University Graduates Competences With emDocument12 pagesMatching University Graduates Competences With emlumutanpatrickjohnPas encore d'évaluation

- Ontario - Institutional Vision, Proposed Mandate Statement and Priority Objectives - Conestoga College Institute of Technology and Advanced LearningDocument9 pagesOntario - Institutional Vision, Proposed Mandate Statement and Priority Objectives - Conestoga College Institute of Technology and Advanced LearningclimbrandonPas encore d'évaluation

- Running Head: Analysis and Comparison of Approaches To E-Learning 1Document9 pagesRunning Head: Analysis and Comparison of Approaches To E-Learning 1Elizabeth KimPas encore d'évaluation

- Public No More: A New Path to Excellence for America’s Public UniversitiesD'EverandPublic No More: A New Path to Excellence for America’s Public UniversitiesPas encore d'évaluation

- A Roadmap For Nigerian EducationDocument7 pagesA Roadmap For Nigerian EducationSeye KuyinuPas encore d'évaluation

- Higher EducationDocument37 pagesHigher EducationAs RmPas encore d'évaluation

- North Rocks Poaching College: Independent Review of Science and Mathematics TeachingD'EverandNorth Rocks Poaching College: Independent Review of Science and Mathematics TeachingPas encore d'évaluation

- New York Report Highlights School ReformsDocument20 pagesNew York Report Highlights School ReformsShuang SongPas encore d'évaluation

- Civic Committee Reform ReportDocument20 pagesCivic Committee Reform ReportValerie F. LeonardPas encore d'évaluation

- Commentary: Carrots & SticksDocument28 pagesCommentary: Carrots & SticksbvenkatachalamPas encore d'évaluation

- New Strategies To Fund and Support Career Pathway ProgramsDocument31 pagesNew Strategies To Fund and Support Career Pathway Programs3CSNPas encore d'évaluation

- LSEDigest2006 07Document100 pagesLSEDigest2006 07Anurag Singal0% (1)

- Paying the Price: College Costs, Financial Aid, and the Betrayal of the American DreamD'EverandPaying the Price: College Costs, Financial Aid, and the Betrayal of the American DreamÉvaluation : 3.5 sur 5 étoiles3.5/5 (7)

- U21 Ranking of National Higher Education Systems 2015Document36 pagesU21 Ranking of National Higher Education Systems 2015vhaufniensisPas encore d'évaluation

- Engines of Innovation: The Entrepreneurial University in the Twenty-First CenturyD'EverandEngines of Innovation: The Entrepreneurial University in the Twenty-First CenturyÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- 2013 Yankee Institute Friedman Day PresentationDocument37 pages2013 Yankee Institute Friedman Day PresentationHeath W. FahlePas encore d'évaluation

- Drop OutDocument4 pagesDrop OutMikee Mandi Rufila ViovicentePas encore d'évaluation

- 2015 LCTCS Annual ReportDocument20 pages2015 LCTCS Annual ReportKristen DufauchardPas encore d'évaluation

- EDLD 5398 Weeks 1 - 2 - Part 1 - School Improvement Action Research Report Kimberly McKayDocument10 pagesEDLD 5398 Weeks 1 - 2 - Part 1 - School Improvement Action Research Report Kimberly McKaykjmckay915Pas encore d'évaluation

- Romero Et Al AER 2020Document37 pagesRomero Et Al AER 2020Justin SandefurPas encore d'évaluation

- Ontario - Institutional Vision, Proposed Mandate Statement and Priority Objectives - University of OttawaDocument9 pagesOntario - Institutional Vision, Proposed Mandate Statement and Priority Objectives - University of OttawaclimbrandonPas encore d'évaluation

- Charting The Course Final PDFDocument28 pagesCharting The Course Final PDFJohn Burton Advocates for YouthPas encore d'évaluation

- Ontario - Institutional Vision, Proposed Mandate Statement and Priority Objectives - University of TorontoDocument9 pagesOntario - Institutional Vision, Proposed Mandate Statement and Priority Objectives - University of TorontoclimbrandonPas encore d'évaluation

- AUDITING ACADEMIC INSTITUTIONSDocument12 pagesAUDITING ACADEMIC INSTITUTIONSMa. Katrina BusaPas encore d'évaluation

- British Schools Opportunity in Southeast AsiaDocument16 pagesBritish Schools Opportunity in Southeast AsiaAlana RushPas encore d'évaluation

- Trends in Elearning: Tracking The Impact of Elearning at Community CollegesDocument20 pagesTrends in Elearning: Tracking The Impact of Elearning at Community CollegesJohn Melendez100% (1)

- Degrees of UncertaintyDocument42 pagesDegrees of UncertaintyelshofPas encore d'évaluation

- Isko U Chapter IIDocument5 pagesIsko U Chapter IIJohn Benedict D. FranciscoPas encore d'évaluation

- Breaking Point Funding Survey ReportDocument13 pagesBreaking Point Funding Survey ReportMathew PanickerPas encore d'évaluation

- Scholars Circle (Final)Document19 pagesScholars Circle (Final)gabriel morleyPas encore d'évaluation

- The Economic Benefits of International Education To The United States For The 2009-2010 Academic Year: A Statistical AnalysisDocument5 pagesThe Economic Benefits of International Education To The United States For The 2009-2010 Academic Year: A Statistical AnalysisMuhammad MotaweaPas encore d'évaluation

- Original StatementDocument7 pagesOriginal Statementapi-263365115Pas encore d'évaluation

- Halo: Combat Evolved Is A 2001: Halo Is Set in The Twenty-Sixth Century, With The Player Assuming The Role of TheDocument1 pageHalo: Combat Evolved Is A 2001: Halo Is Set in The Twenty-Sixth Century, With The Player Assuming The Role of TheMaisha AronnoPas encore d'évaluation

- Bioshock Is A: System ShockDocument1 pageBioshock Is A: System ShockFong CaiPas encore d'évaluation

- Tomb Raider, Styled As Lara Croft: Tomb Raider Between 2001 and 2007, Is ADocument1 pageTomb Raider, Styled As Lara Croft: Tomb Raider Between 2001 and 2007, Is AMaisha AronnoPas encore d'évaluation

- Hill7e Basic Ch03Document20 pagesHill7e Basic Ch03Syed TajbirPas encore d'évaluation

- Watch Dogs: Watch Dogs 2 (Stylized As WATCH - DOGS2) Is An UpcomingDocument1 pageWatch Dogs: Watch Dogs 2 (Stylized As WATCH - DOGS2) Is An UpcomingMaisha AronnoPas encore d'évaluation

- Edexcel GCE Chemistry Unit-4 June 2014 Question Paper (R)Document24 pagesEdexcel GCE Chemistry Unit-4 June 2014 Question Paper (R)AvrinoxPas encore d'évaluation

- Watch Dogs (Stylized As WATCH - DOGS) Is AnDocument1 pageWatch Dogs (Stylized As WATCH - DOGS) Is AnMaisha AronnoPas encore d'évaluation

- Nelson Chapter 1Document18 pagesNelson Chapter 1Maisha AronnoPas encore d'évaluation

- Nelson Chapter 11Document18 pagesNelson Chapter 11Maisha AronnoPas encore d'évaluation

- June 2009 MS - Unit 2 Edexcel PhysicsDocument10 pagesJune 2009 MS - Unit 2 Edexcel PhysicsMaisha AronnoPas encore d'évaluation

- Top 50 Research Colleges List 2015Document4 pagesTop 50 Research Colleges List 2015Maisha AronnoPas encore d'évaluation

- B411 - International Business Management MTCU Code - 70202 Program Learning OutcomesDocument9 pagesB411 - International Business Management MTCU Code - 70202 Program Learning OutcomesMaisha AronnoPas encore d'évaluation

- CIL Top 50 Research Colleges 2015Document1 pageCIL Top 50 Research Colleges 2015Maisha AronnoPas encore d'évaluation

- January 2007 Full Mark SchemesDocument78 pagesJanuary 2007 Full Mark SchemesSam GibsonPas encore d'évaluation

- PHY3Document3 pagesPHY3jeewantha1996Pas encore d'évaluation

- What Is A Political SubjectDocument7 pagesWhat Is A Political SubjectlukaPas encore d'évaluation

- (Genus - Gender in Modern Culture 12.) Segal, Naomi - Anzieu, Didier - Consensuality - Didier Anzieu, Gender and The Sense of Touch-Rodopi (2009)Document301 pages(Genus - Gender in Modern Culture 12.) Segal, Naomi - Anzieu, Didier - Consensuality - Didier Anzieu, Gender and The Sense of Touch-Rodopi (2009)Anonymous r3ZlrnnHcPas encore d'évaluation

- Thermodynamics - Lectures b4 MidsemDocument545 pagesThermodynamics - Lectures b4 MidsemVismit Parihar100% (1)

- List of indexed conferences from Sumatera UniversityDocument7 pagesList of indexed conferences from Sumatera UniversityRizky FernandaPas encore d'évaluation

- Probability Problems With A Standard Deck of 52 CardsByLeonardoDVillamilDocument5 pagesProbability Problems With A Standard Deck of 52 CardsByLeonardoDVillamilthermopolis3012Pas encore d'évaluation

- Assessment of Knowledge, Attitude Andpractice Toward Sexually Transmitteddiseases in Boditi High School StudentsDocument56 pagesAssessment of Knowledge, Attitude Andpractice Toward Sexually Transmitteddiseases in Boditi High School StudentsMinlik-alew Dejenie88% (8)

- Qdoc - Tips Select Readings 2nd Pre IntermediateDocument178 pagesQdoc - Tips Select Readings 2nd Pre IntermediateFarzana BatoolPas encore d'évaluation

- Cloud Computing Vs Traditional ITDocument20 pagesCloud Computing Vs Traditional ITgarata_java100% (1)

- SplunkCloud-6 6 3-SearchTutorial PDFDocument103 pagesSplunkCloud-6 6 3-SearchTutorial PDFanonymous_9888Pas encore d'évaluation

- Reflexiones Sobre La Ciencia de La Administración PúblicaDocument19 pagesReflexiones Sobre La Ciencia de La Administración PúblicaPedro Olvera MartínezPas encore d'évaluation

- EssayDocument2 pagesEssaySantoshKumarPatraPas encore d'évaluation

- Manage Faisalabad WasteDocument2 pagesManage Faisalabad WasteUsama SanaullahPas encore d'évaluation

- Cost-effective laboratory thermostats from -25 to 100°CDocument6 pagesCost-effective laboratory thermostats from -25 to 100°CCynthia MahlPas encore d'évaluation

- Fractions, Decimals and Percent Conversion GuideDocument84 pagesFractions, Decimals and Percent Conversion GuideSassie LadyPas encore d'évaluation

- Impact of K-Pop Music On The Academic PDocument29 pagesImpact of K-Pop Music On The Academic Pdave tayron paggao100% (1)

- E F Schumacher - Small Is BeautifulDocument552 pagesE F Schumacher - Small Is BeautifulUlrichmargaritaPas encore d'évaluation

- HA200Document4 pagesHA200Adam OngPas encore d'évaluation

- JCL RefresherDocument50 pagesJCL RefresherCosta48100% (1)

- ANSI B4.1-1967 Preferred Limits and Fits For Cylindrical PartsDocument25 pagesANSI B4.1-1967 Preferred Limits and Fits For Cylindrical Partsgiaphongn100% (5)

- Friction Stir Welding: Principle of OperationDocument12 pagesFriction Stir Welding: Principle of OperationvarmaprasadPas encore d'évaluation

- Propagating Trees and Fruit Trees: Sonny V. Matias TLE - EA - TeacherDocument20 pagesPropagating Trees and Fruit Trees: Sonny V. Matias TLE - EA - TeacherSonny MatiasPas encore d'évaluation

- Write Hello in The PDFDocument95 pagesWrite Hello in The PDFraghupulishettiPas encore d'évaluation

- Training Program On: Personality Development Program and Workplace SkillsDocument3 pagesTraining Program On: Personality Development Program and Workplace SkillsVikram SinghPas encore d'évaluation

- Shriya Arora: Educational QualificationsDocument2 pagesShriya Arora: Educational QualificationsInderpreet singhPas encore d'évaluation

- Affine CipherDocument3 pagesAffine CipheramitpandaPas encore d'évaluation

- Newsletter April.Document4 pagesNewsletter April.J_Hevicon4246Pas encore d'évaluation

- Chapter 1&2 Exercise Ce StatisticDocument19 pagesChapter 1&2 Exercise Ce StatisticSky FirePas encore d'évaluation

- Standard:: SS2H1 The Student Will Read About and Describe The Lives of Historical Figures in Georgia HistoryDocument4 pagesStandard:: SS2H1 The Student Will Read About and Describe The Lives of Historical Figures in Georgia Historyjeffmiller1977Pas encore d'évaluation

- The Benefits of Radio Broadcasting As Perceived by The People in Rural AreasDocument10 pagesThe Benefits of Radio Broadcasting As Perceived by The People in Rural AreasMaePas encore d'évaluation

- SWR SRB Product SheetDocument2 pagesSWR SRB Product SheetCarlo AguiluzPas encore d'évaluation