Académique Documents

Professionnel Documents

Culture Documents

Requirements For Application of New and Renewal of Business

Transféré par

ElsieRaquiño0 évaluation0% ont trouvé ce document utile (0 vote)

31 vues1 pageLocational / Zoning Clearance Prior to Business Permit. (If different from the previous business address) 2. Lease Contract between the Lessee and the Lessor. If leased, attach Mayor's Permit registration of the building owner / landlord as a real estate Lessor and the latest official receipt of payment. 3. Business Name Registration with the Department of Trade and Industry for sole proprietorship and partnership. 4. Article of Incorporations Partnership approved by S.E.C. For corporation.

Description originale:

Titre original

Requirements for Application of New and Renewal of Business (1)

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentLocational / Zoning Clearance Prior to Business Permit. (If different from the previous business address) 2. Lease Contract between the Lessee and the Lessor. If leased, attach Mayor's Permit registration of the building owner / landlord as a real estate Lessor and the latest official receipt of payment. 3. Business Name Registration with the Department of Trade and Industry for sole proprietorship and partnership. 4. Article of Incorporations Partnership approved by S.E.C. For corporation.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

31 vues1 pageRequirements For Application of New and Renewal of Business

Transféré par

ElsieRaquiñoLocational / Zoning Clearance Prior to Business Permit. (If different from the previous business address) 2. Lease Contract between the Lessee and the Lessor. If leased, attach Mayor's Permit registration of the building owner / landlord as a real estate Lessor and the latest official receipt of payment. 3. Business Name Registration with the Department of Trade and Industry for sole proprietorship and partnership. 4. Article of Incorporations Partnership approved by S.E.C. For corporation.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

REQUIREMENTS FOR APPLICATION OF

NEW BUSINESS

REQUIREMENTS FOR APPLICATION OF

RENEWAL OF BUSINESS

1. Locational / Zoning Clearance Prior to Business

Permit.

1. Locational Clearance Prior to Business Permit. (If

different from the previous business address)

2. Lease Contract between the Lessor and the

Lessee.

2. If different business address from the previous

Business Permit.

a. Lease Contract between the Lessor and

the Lessee if leased; attach Mayor's Permit

registration of the building owner/landlord as

a Real Estate Lessor.

i)

If leased, attach Mayor's Permit

registration of the building owner/landlord

as a Real Estate Lessor and the latest

official receipt of payment.

ii) If not, Lease Contract between the Lessee

and the Sub-Lessee with conformity of the

Owner of the Building Administration.

iii) If owned, transfer Certificate of Title (TCT)

or Tax Declaration (photocopy) together

with the latest receipt of payment of real

property tax (RPT) and Real Estate Lessor

Occupancy Permit and Ownership

3. Business Name Registration with the

Department of Trade and Industry for sole

proprietorship and partnership.

4. Article of Incorporations Partnership approved

by S.E.C. for corporation

5. Barangay Clearance

6. Residence Certificate A and B for single

proprietorship, C and C1 in case of corporation

or partnership for the current year

b. photocopy of the latest official receipt of

payment of the Real estate Lessor.

i. If not, Lease Contract between the

Lessee and the Sub-Lessee with

conformity of the Owner of the Building

Administration.

ii. If owned, transfer Certificate of Title

(TCT) or Tax Declaration

(photocopy copy).

iii. Latest Real Property Tax (RPT) receipt

of the Land and Building where the

business is located (whether owned or

leased).

3. Barangay Clearance

4. Previous Mayor's Permit/License issued

5. Official Receipt of payments - 1st to 4th quarters of

the previous year

6. Declaration of Gross Sales/Receipts for the

preceding year and floor area (in sq. meters) of the

office/factory or premises/compound occupied.

i. Income Tax Returns and Financial

Statements (FS) for the preceding

calendar year which were filed with

the BIR on the current year

(Example: Income Tax Returns and FS for the

taxable year 2014, which were filed and paid with the

BIR on or before April 15, 2015)

ii. For consolidated FS, attached

breakdown of gross sales/receipts

from other City/Municipality.

iii. For Fiscal year FS, attached breakdown of

gross sales/receipts from January to

December.

7. Residence Certificate A and B for single

proprietorship, C and C1 in case of corporation or

partnership for the current year.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Simple and Compound InterestDocument26 pagesSimple and Compound InterestCarlos Cary Colon100% (7)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- CCH Test BankDocument41 pagesCCH Test Bankdoug1190% (8)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Question 1Document11 pagesQuestion 1Jason StevetimmyPas encore d'évaluation

- Final Exam Sample QuestionsDocument13 pagesFinal Exam Sample QuestionsYashrajsing LuckkanaPas encore d'évaluation

- Bank of Kigali Investor Presentation Q1 & 3M 2012Document43 pagesBank of Kigali Investor Presentation Q1 & 3M 2012Bank of Kigali100% (1)

- Innovation at Progressive: Pay As You Go InsuranceDocument3 pagesInnovation at Progressive: Pay As You Go InsurancePatricia De La MotaPas encore d'évaluation

- Quiz 2 Problem - SolutionDocument9 pagesQuiz 2 Problem - SolutionCharice Anne VillamarinPas encore d'évaluation

- Joint Venture Accounts: 1. MeaningDocument22 pagesJoint Venture Accounts: 1. Meaningkuldeep_chand10Pas encore d'évaluation

- Near The End of 2013 The Management of Dimsdale SportsDocument2 pagesNear The End of 2013 The Management of Dimsdale SportsAmit PandeyPas encore d'évaluation

- Eicher MotorsDocument16 pagesEicher MotorsjehanbhadhaPas encore d'évaluation

- Transfer PricingDocument19 pagesTransfer PricingamanPas encore d'évaluation

- AFM AssignmentDocument3 pagesAFM AssignmentAin NsrPas encore d'évaluation

- 2015 Saln FormDocument3 pages2015 Saln FormLance Aldrin AdionPas encore d'évaluation

- The Lagrangian Method in EconomicsDocument4 pagesThe Lagrangian Method in EconomicsasfawmPas encore d'évaluation

- CIR V TMX SalesDocument12 pagesCIR V TMX SalesJolo RomanPas encore d'évaluation

- Financial Analysis of Hul and GodrejDocument53 pagesFinancial Analysis of Hul and GodrejJiwan Jot SinghPas encore d'évaluation

- Shell Pakistan Limited Financial Statements For The Year Ended December 31, 2010Document60 pagesShell Pakistan Limited Financial Statements For The Year Ended December 31, 2010popatiaPas encore d'évaluation

- M&M 2006-2007Document160 pagesM&M 2006-2007Ramajit BhartiPas encore d'évaluation

- Project Template Comparing Tootsie Roll & HersheyDocument37 pagesProject Template Comparing Tootsie Roll & HersheyMichael WilsonPas encore d'évaluation

- Pre-Feasibility Study: Tea CompanyDocument20 pagesPre-Feasibility Study: Tea CompanyIPro PkPas encore d'évaluation

- IAS 17 LeaseDocument7 pagesIAS 17 LeaseMaqsoodPas encore d'évaluation

- Act 624 Finance No.2 Act 2002Document23 pagesAct 624 Finance No.2 Act 2002Adam Haida & CoPas encore d'évaluation

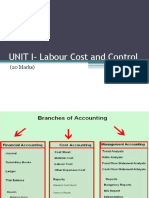

- Labour Cost and ControlDocument65 pagesLabour Cost and Controlaishwarya raikarPas encore d'évaluation

- Punjab Relief of Indebtedness Act, 1934 PDFDocument23 pagesPunjab Relief of Indebtedness Act, 1934 PDFLatest Laws Team0% (1)

- Lecture 08 - Relative Valuation - Using Market ComparablesDocument76 pagesLecture 08 - Relative Valuation - Using Market ComparablesDanila GallaratoPas encore d'évaluation

- Assignment #1 Tri Pack Film Limited: Analysis of Solvency RatiosDocument4 pagesAssignment #1 Tri Pack Film Limited: Analysis of Solvency RatiossooperusmanPas encore d'évaluation

- Basic Banking Tools and VocabularyDocument1 pageBasic Banking Tools and Vocabularyperrine11Pas encore d'évaluation

- J Wick Productions V SINGERDocument63 pagesJ Wick Productions V SINGERTHROnlinePas encore d'évaluation

- Phiamphu TrustDocument12 pagesPhiamphu TrustHau PhiamphuPas encore d'évaluation

- Principles of Accounting Lecture 4Document5 pagesPrinciples of Accounting Lecture 4Masum HossainPas encore d'évaluation