Académique Documents

Professionnel Documents

Culture Documents

IAS 19 - Employee Benefits

Transféré par

Clarize R. MabiogCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

IAS 19 - Employee Benefits

Transféré par

Clarize R. MabiogDroits d'auteur :

Formats disponibles

IAS

19 EMPLOYEE BENEFITS (REVISED-2011)

TERMS

Employee Benefits

All forms of consideration given by an entity in exchange for

services rendered or for the termination of employment.

SHORT-TERM EMPLOYEE BENEFITS

Those expected to be settled wholly within the 12 months after

the reporting period end, in which the employee has rendered

the related services.

No need to reclassify if timing of settlement changes.

Compensated absences (e.g. sick leave)

Accumulating expense when service that increases

entitlement is rendered. e.g. leave pay

Non-accumulating expense when absence occurs.

All short term benefits

Recognise undiscounted amount as an expense/liability

(e.g. wages, salaries, bonuses, etc. )

BONUS/PROFIT-SHARING SCHEMES

Recognise the expense when entity has a present legal or

constructive obligation to make payments; and a reliable

estimate of the obligation can be made.

POST-EMPLOYMENT

BENEFITS

Employee benefits payable after the completion of

employment (excluding termination and short term benefits),

such as:

Retirement benefits (e.g. pensions, lump sum payments)

Other post-employment benefits (e.g. post employment

life insurance, medical care).

Defined Contribution Plan (DCP)

The entity pays fixed contributions into a fund and does not

have an obligation to pay further contributions if the fund does

not hold sufficient assets

Recognise the contribution expense /liability when the

employee has rendered the service.

Defined Benefit Plan (DBP)

Post employment plans other than defined contribution plans.

Statement of financial position

Recognise the net defined benefit liability/(asset) in the

statement of financial position (being equal to the deficit

(surplus) in the defined benefit plan and the possible effect of

the asset ceiling).

When an entity has a surplus in a DBP, measure the net

defined benefit asset at the lower of:

The surplus in the defined benefit plan

TERMINATION BENEFITS

The asset ceiling (i.e. PV of any economic benefits

Employee benefits provided in exchange for the termination of

available in the form of refunds from the plan or reductions

an employees employment, as a result of either:

in future contributions to the plan), determined using

a) An entitys decision to terminate an employees employment

appropriate discount rate.

before the normal retirement date

b)An employees decision to accept an offer of benefits in

Statement of comprehensive income

exchange for the termination of employment.

Recognise actuarial gains/losses in OCI in the period in

Recognise liability and expense at the earlier of:

which they occur.

The date the entity can no longer withdraw the benefit or

Past-service-costs are recognised in P&L in the period

offer

incurred.

The date the entity recognises restructuring costs under

Net interest on defined benefit liability/(asset) is

IAS 37.

recognised in P&L.

If termination benefits settled wholly before 12 months

o Represents unwinding of discount on DBP

from reporting date apply requirements for short-term

liability/(asset) from passage of time.

employee benefits

o Multiply DBP liability/(asset) by discount rate;

If termination benefits are not settled wholly before 12

adjust for actual contributions and benefits paid

months from reporting date apply requirements for other

in period

long term employee benefits.

Defined Benefit Cost (3 components)

OTHER LONG-TERM EMPLOYEE BENEFITS

Service cost (current, past, curtailment loss/(gain), and

Employee benefits other than short-term employee benefits,

settlement loss/(gain) in P&L

post-employment benefits, and termination benefits.

Net Interest (see above) in P&L

Remeasurements (actuarial gains, the return on plan

Statement of financial position

assets (excl. net interest), change in the effect of the asset

Carrying amount of liability = PV of obligation minus the

ceiling) in OCI

fair value of any plan assets

Actuarial gains and losses (OCI) and past service costs

Multi-employer Plans

(P&L are recognised immediately and in full in the SOCI.

These are post-employment plans other than state plans

that pool the assets of various entities that are not under

Statement of comprehensive income

common control and use those assets to provide benefits

Recognise the net total of: Current service cost + Net interest

to employees of more than one entity

on net defined benefit liability/(asset) + remeasurement of the

May be a DCP or DBP

net defined benefit liability/(asset).

If the plan is a DBP, an entity may apply defined

contribution accounting when sufficient information is not

available to apply the accounting requirements for DBPs.

EFFECTIVE DATE

Accounting periods beginning on or after 1 Jan 2013

2015 C hartered Education All rights reserved

IFRS Summary

www.CharteredEducation.com

Vous aimerez peut-être aussi

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideD'EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuidePas encore d'évaluation

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionD'EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionPas encore d'évaluation

- IAS 19 Employee BenefitsDocument5 pagesIAS 19 Employee Benefitshae1234Pas encore d'évaluation

- IAS 19 Employee BenefitsDocument22 pagesIAS 19 Employee Benefitsanon_419651076Pas encore d'évaluation

- Ias 19 Employee BenefitsDocument43 pagesIas 19 Employee BenefitsHasan Ali BokhariPas encore d'évaluation

- LKAS 19 2021 UploadDocument31 pagesLKAS 19 2021 Uploadpriyantha dasanayake100% (1)

- Revised PAS 19Document2 pagesRevised PAS 19jjmcjjmc12345Pas encore d'évaluation

- FR17 - Employee Benefits (Stud) .Document45 pagesFR17 - Employee Benefits (Stud) .duong duongPas encore d'évaluation

- IAS 19 Employee Benefits (2021)Document6 pagesIAS 19 Employee Benefits (2021)Tawanda Tatenda Herbert100% (1)

- Ias 19Document5 pagesIas 19Tope JohnPas encore d'évaluation

- Ias 19-Employee BenefitsDocument3 pagesIas 19-Employee Benefitsbeth alviolaPas encore d'évaluation

- Handout 3.0 ACC 226 Sample Problems Employee BenefitsDocument12 pagesHandout 3.0 ACC 226 Sample Problems Employee BenefitsLyncee BallescasPas encore d'évaluation

- PAS 19 Employee Benefits: Short-Term Employee Benefits Are Employee Benefits (Other Than Termination BenDocument5 pagesPAS 19 Employee Benefits: Short-Term Employee Benefits Are Employee Benefits (Other Than Termination BenKaila Clarisse CortezPas encore d'évaluation

- Employee Benefits IAS 19Document17 pagesEmployee Benefits IAS 19Sbonga Gift Blessedbeyondmeasure MbathaPas encore d'évaluation

- Ias 19 - Employee BenefitsDocument6 pagesIas 19 - Employee BenefitsIfyPas encore d'évaluation

- PAS 19 Employee BenefitsDocument62 pagesPAS 19 Employee BenefitsBenj FloresPas encore d'évaluation

- Lesson Six: Accounting For Employee BenefitsDocument27 pagesLesson Six: Accounting For Employee BenefitssamclerryPas encore d'évaluation

- Revised PAS 19 (PAS 19R) Employee Benefits Technical SummaryDocument4 pagesRevised PAS 19 (PAS 19R) Employee Benefits Technical SummaryJBPas encore d'évaluation

- IAS 19 Employee Benefits StudentDocument40 pagesIAS 19 Employee Benefits StudentYI WEI CHANGPas encore d'évaluation

- IAS 19 Employee BenefitsDocument32 pagesIAS 19 Employee BenefitsTamirat Eshetu WoldePas encore d'évaluation

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- Employee BenefitDocument32 pagesEmployee BenefitnatiPas encore d'évaluation

- Module 18 - Employee Benefits - With AnswersDocument6 pagesModule 18 - Employee Benefits - With AnswersLui100% (1)

- Lesson Employee BenefitDocument18 pagesLesson Employee BenefitDesiree GalletoPas encore d'évaluation

- Employee Benefit PlanDocument8 pagesEmployee Benefit PlantinydmpPas encore d'évaluation

- Ias 19Document25 pagesIas 19Claire RamosPas encore d'évaluation

- PAT P13 Notes - Ias 19, 10, Ifrs 11 & Ifrs 12Document14 pagesPAT P13 Notes - Ias 19, 10, Ifrs 11 & Ifrs 12HSFXHFHXPas encore d'évaluation

- Overview of IAS 19Document9 pagesOverview of IAS 19amitsinghslidesharePas encore d'évaluation

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpPas encore d'évaluation

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpPas encore d'évaluation

- IAS 19 Employee Benefits: Technical SummaryDocument3 pagesIAS 19 Employee Benefits: Technical SummaryHassan Iqbal PenkarPas encore d'évaluation

- Chapter 5 Employee Benefit Part 1Document9 pagesChapter 5 Employee Benefit Part 1maria isabellaPas encore d'évaluation

- Employee BenefitsDocument83 pagesEmployee BenefitsArlene Rose GonzaloPas encore d'évaluation

- Lecture Notes - IAS 19Document14 pagesLecture Notes - IAS 19Muhammed NaqiPas encore d'évaluation

- I. Concept Notes IAS19: Employee BenefitsDocument5 pagesI. Concept Notes IAS19: Employee Benefitsem cortezPas encore d'évaluation

- 5.12.3 Employee BenefitsDocument5 pages5.12.3 Employee BenefitsBaher MohamedPas encore d'évaluation

- Employees Benifits Cfas Group 3Document10 pagesEmployees Benifits Cfas Group 3Theresa CruzPas encore d'évaluation

- FAR - Post-Employement Employee BenefitsDocument5 pagesFAR - Post-Employement Employee BenefitsJohn Mahatma Agripa100% (1)

- Unit 7 E-Tutor PresentationDocument18 pagesUnit 7 E-Tutor PresentationKatrina EustacePas encore d'évaluation

- Csfas Pas19Document30 pagesCsfas Pas19Jack GriffoPas encore d'évaluation

- FARAP-4413 (Post-Employment Benefits)Document5 pagesFARAP-4413 (Post-Employment Benefits)Dizon Ropalito P.Pas encore d'évaluation

- PCOA Module 4 - For LMSDocument5 pagesPCOA Module 4 - For LMSJan JanPas encore d'évaluation

- Module 12 - PAS 19 Employee BenefitsDocument6 pagesModule 12 - PAS 19 Employee BenefitsAKIO HIROKIPas encore d'évaluation

- MFRS 119 Employee BenefitsDocument38 pagesMFRS 119 Employee BenefitsAin YaniePas encore d'évaluation

- Employee Benefit (Ias 19) FinalDocument36 pagesEmployee Benefit (Ias 19) FinalKanbiro OrkaidoPas encore d'évaluation

- Ias 19 Employee BeneftDocument24 pagesIas 19 Employee Beneftesulawyer2001Pas encore d'évaluation

- Chapter 6 Employee Benefits (Part 2)Document21 pagesChapter 6 Employee Benefits (Part 2)not funny didn't laughPas encore d'évaluation

- PSAK 24-Imbalan KerjaDocument57 pagesPSAK 24-Imbalan KerjaMutiara RamadhantiPas encore d'évaluation

- IAS19 (Employee Benefits) SummaryDocument5 pagesIAS19 (Employee Benefits) Summaryfebzz88Pas encore d'évaluation

- Ias 19 Employee BenefitsDocument5 pagesIas 19 Employee BenefitsCA Rekha Ashok PillaiPas encore d'évaluation

- Employee Benefits: Cruz, Jerica May A. CBET-01-501EDocument21 pagesEmployee Benefits: Cruz, Jerica May A. CBET-01-501Eclara san miguelPas encore d'évaluation

- Employee Benefits Part 1 PDFDocument21 pagesEmployee Benefits Part 1 PDFHerald JoshuaPas encore d'évaluation

- Post Employment BenefitsDocument31 pagesPost Employment BenefitsSky SoronoiPas encore d'évaluation

- 1FU491 Employee BenefitsDocument14 pages1FU491 Employee BenefitsEmil DavtyanPas encore d'évaluation

- Chapter 4 - Accounting For Other Liabilities: A. Post Employment BenefitsDocument50 pagesChapter 4 - Accounting For Other Liabilities: A. Post Employment BenefitsLovely AbadianoPas encore d'évaluation

- For Session DTD 5th Sep by CA Alok Garg PDFDocument46 pagesFor Session DTD 5th Sep by CA Alok Garg PDFLakshmi Narayana Murthy KapavarapuPas encore d'évaluation

- Ias 19Document43 pagesIas 19Reever RiverPas encore d'évaluation

- IAS 19 Employee BenefitsDocument110 pagesIAS 19 Employee BenefitsFritz MainarPas encore d'évaluation

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryD'EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryPas encore d'évaluation

- 2009 F-9 Class NotesDocument4 pages2009 F-9 Class NotesClarize R. MabiogPas encore d'évaluation

- Kintsugi: Mindmap OutlineDocument1 pageKintsugi: Mindmap OutlineClarize R. MabiogPas encore d'évaluation

- Guide To Business CombinationsDocument6 pagesGuide To Business CombinationsClarize R. MabiogPas encore d'évaluation

- Guide To Consolidation Journal EntriesDocument9 pagesGuide To Consolidation Journal EntriesClarize R. MabiogPas encore d'évaluation

- Strategic Planning Goal Setting 2Document8 pagesStrategic Planning Goal Setting 2Clarize R. MabiogPas encore d'évaluation

- IAS 2 - InventoriesDocument1 pageIAS 2 - InventoriesClarize R. MabiogPas encore d'évaluation

- Highway MaterialsDocument4 pagesHighway MaterialsClarize R. MabiogPas encore d'évaluation

- A 6. C 2. B 7. C 3. D 8. A 4. A 9. A 5. A 10. C: Answers To Multiple Choice - TheoreticalDocument6 pagesA 6. C 2. B 7. C 3. D 8. A 4. A 9. A 5. A 10. C: Answers To Multiple Choice - Theoreticalsweetwinkle09Pas encore d'évaluation

- Labor Management RelationDocument29 pagesLabor Management RelationClarize R. MabiogPas encore d'évaluation

- Chapter16 - AnswerDocument5 pagesChapter16 - AnswerxxxxxxxxxPas encore d'évaluation

- Answers To Multiple Choice - Theoretical: Charged To Specific JobDocument11 pagesAnswers To Multiple Choice - Theoretical: Charged To Specific JobJennifer Marie AlmuetePas encore d'évaluation

- Guide To Consolidation Journal EntriesDocument9 pagesGuide To Consolidation Journal EntriesClarize R. MabiogPas encore d'évaluation

- Chapter13 - AnswerDocument5 pagesChapter13 - AnswerxxxxxxxxxPas encore d'évaluation

- Chapter10 - AnswerDocument21 pagesChapter10 - Answershanerikim100% (1)

- Chapter13 - AnswerDocument5 pagesChapter13 - AnswerxxxxxxxxxPas encore d'évaluation

- Chapter 13Document25 pagesChapter 13Clarize R. Mabiog50% (2)

- Personality DevelopmentDocument24 pagesPersonality DevelopmentMarilou Jumalon MontefalconPas encore d'évaluation

- BI FORM ECC Application FormDocument1 pageBI FORM ECC Application FormRuel Dc100% (1)

- Chapter 16Document18 pagesChapter 16Clarize R. Mabiog100% (1)

- Chapter15 - Answer PDFDocument14 pagesChapter15 - Answer PDFAvon Jade RamosPas encore d'évaluation

- Chapter 14Document25 pagesChapter 14Clarize R. Mabiog100% (1)

- Strategic Management Full NotesDocument135 pagesStrategic Management Full NotesClarize R. MabiogPas encore d'évaluation

- Chapter 19Document5 pagesChapter 19Clarize R. MabiogPas encore d'évaluation

- Chapter 21 2014 Answer PDFDocument6 pagesChapter 21 2014 Answer PDFClarize R. MabiogPas encore d'évaluation

- Chapter 22 2014 App AudDocument25 pagesChapter 22 2014 App AudClarize R. MabiogPas encore d'évaluation

- Access Controls and Backup ControlsDocument2 pagesAccess Controls and Backup ControlsClarize R. MabiogPas encore d'évaluation

- Applied Auditing by CabreraDocument25 pagesApplied Auditing by CabreraClarize R. Mabiog67% (9)

- 13 Methods To Increase Your Conditioning - Strength by SkylerDocument5 pages13 Methods To Increase Your Conditioning - Strength by SkylerMarko Štambuk100% (1)

- Kmart PDFDocument105 pagesKmart PDFkaranbhayaPas encore d'évaluation

- Msds Aluminium SulfatDocument5 pagesMsds Aluminium SulfatduckshaPas encore d'évaluation

- Sialoree BotoxDocument5 pagesSialoree BotoxJocul DivinPas encore d'évaluation

- Maternal and Child Health Nursing 7 BulletsDocument4 pagesMaternal and Child Health Nursing 7 BulletsHoneylie PatricioPas encore d'évaluation

- DocumentDocument6 pagesDocumentGlennford Loreto SuyatPas encore d'évaluation

- Contact Point ContoursDocument69 pagesContact Point ContourstarekrabiPas encore d'évaluation

- Culturally Safe Classroom Context PDFDocument2 pagesCulturally Safe Classroom Context PDFdcleveland1706Pas encore d'évaluation

- Diagnostic Evaluation and Management of The Solitary Pulmonary NoduleDocument21 pagesDiagnostic Evaluation and Management of The Solitary Pulmonary NoduleGonzalo Leal100% (1)

- NHT Series High-Throughput Diffusion PumpsDocument12 pagesNHT Series High-Throughput Diffusion PumpsJosé Mauricio Bonilla TobónPas encore d'évaluation

- Ryder Quotation 2012.7.25Document21 pagesRyder Quotation 2012.7.25DarrenPas encore d'évaluation

- Learnership AgreementDocument10 pagesLearnership Agreementkarl0% (1)

- Subhead-5 Pump Motors & Related WorksDocument24 pagesSubhead-5 Pump Motors & Related Worksriyad mahmudPas encore d'évaluation

- Strict and Absolute LiabilityDocument29 pagesStrict and Absolute LiabilityShejal SharmaPas encore d'évaluation

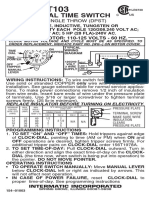

- T103 InstructionsDocument1 pageT103 Instructionsjtcool74Pas encore d'évaluation

- Circulatory SystemDocument51 pagesCirculatory SystemTina TalmadgePas encore d'évaluation

- Allison Burke Adime 4Document8 pagesAllison Burke Adime 4api-317577095Pas encore d'évaluation

- Physical Activity and Weight ControlDocument6 pagesPhysical Activity and Weight Controlapi-288926491Pas encore d'évaluation

- Maxs AdultDocument1 pageMaxs Adultclark lopezPas encore d'évaluation

- Microporous WikiDocument2 pagesMicroporous WikiIris BalcarcePas encore d'évaluation

- Gambaran Professional Quality of Life Proqol GuruDocument7 pagesGambaran Professional Quality of Life Proqol Gurufebrian rahmatPas encore d'évaluation

- MN - 2019 01 29Document28 pagesMN - 2019 01 29mooraboolPas encore d'évaluation

- SOP of Conveyor ReplacementDocument11 pagesSOP of Conveyor ReplacementDwitikrushna Rout100% (1)

- A-V300!1!6-L-GP General Purpose Potable Water Commercial Industrial Hi-Flo Series JuDocument2 pagesA-V300!1!6-L-GP General Purpose Potable Water Commercial Industrial Hi-Flo Series JuwillgendemannPas encore d'évaluation

- Data SheetDocument2 pagesData SheetsswahyudiPas encore d'évaluation

- MLT IMLT Content Guideline 6-14Document4 pagesMLT IMLT Content Guideline 6-14Arif ShaikhPas encore d'évaluation

- Inside The Earth NotesDocument2 pagesInside The Earth NotesrickaturnerPas encore d'évaluation

- JAR Part 66 Examination Mod 03Document126 pagesJAR Part 66 Examination Mod 03Shreyas PingePas encore d'évaluation

- Week 4 (Theories)Document15 pagesWeek 4 (Theories)Erica Velasco100% (1)

- Material Specification: Mechanical Property RequirementsDocument2 pagesMaterial Specification: Mechanical Property RequirementsNguyễn Tấn HảiPas encore d'évaluation