Académique Documents

Professionnel Documents

Culture Documents

Final 50 Points On Ub

Transféré par

VikashKumar0 évaluation0% ont trouvé ce document utile (0 vote)

38 vues2 pagesThe total expenditure in the General Budget for 2016-17 has been projected at Rs.19. Lakh crore, consisting of Rs.5. Lakh crore under Plan and Rs.14. Lakh crore under non-plan. Fiscal deficit in RE 2015-16 and be 2016-17 have been retained at 3.9% and 3.5% of GDP respectively. 100 crore each allocated for celebrating Birth Centenary of Pt Deen Dayal Upadhyay and 350th Birth Anniversary of Guru Gobind Singh.

Description originale:

Titre original

Final 50 Points on Ub

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe total expenditure in the General Budget for 2016-17 has been projected at Rs.19. Lakh crore, consisting of Rs.5. Lakh crore under Plan and Rs.14. Lakh crore under non-plan. Fiscal deficit in RE 2015-16 and be 2016-17 have been retained at 3.9% and 3.5% of GDP respectively. 100 crore each allocated for celebrating Birth Centenary of Pt Deen Dayal Upadhyay and 350th Birth Anniversary of Guru Gobind Singh.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

38 vues2 pagesFinal 50 Points On Ub

Transféré par

VikashKumarThe total expenditure in the General Budget for 2016-17 has been projected at Rs.19. Lakh crore, consisting of Rs.5. Lakh crore under Plan and Rs.14. Lakh crore under non-plan. Fiscal deficit in RE 2015-16 and be 2016-17 have been retained at 3.9% and 3.5% of GDP respectively. 100 crore each allocated for celebrating Birth Centenary of Pt Deen Dayal Upadhyay and 350th Birth Anniversary of Guru Gobind Singh.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

THE MOST IMPORTANT 50 POINTS ON THE UNION BUDGET 2016-17

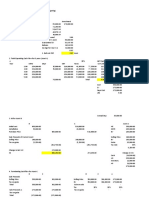

1. The total expenditure in the General Budget for

2016-17 has been projected at Rs.19.78 lakh crore,

consisting of Rs.5.50 lakh crore under Plan and

Rs.14.28 lakh crore under Non-Plan.

2. 100 Crore each allocated for celebrating Birth

Centenary of Pt Deen Dayal Upadhyay and 350th

Birth Anniversary of Guru Gobind Singh

3. The fiscal deficit in RE 2015-16 and BE 2016-17

have been retained at 3.9% and 3.5% of GDP

respectively.

4. Revenue Deficit target has been improved upon

from 2.8% to 2.5% of GDP in RE 2015-16.

5. The Government will double the income of the

farmers by 2022.

6. Total allocation for Agriculture and farmers

Welfare is Rs. 35,984 crore.

7. Allocation under Pradhan Mantri Gram Sadak

Yojana has been increased to Rs. 19,000 crore

and it will connect remaining 65,000 eligible

habitations by 2019.

8. The target for agricultural credit in 2016-17 will

be an all-time high of Rs. 9 lakh crore. To reduce

the burden of loan repayment on farmers, a

provision of Rs. 15,000 crore has been made in

the BE 2016-17 towards interest subvention.

9. The Finance Minister informed that for effective

implementation of Prime Minister Fasal Bima

Yojana, Rs. 5,500 crore have been provided in

the Budget 2016-17.

10. Set the target for Soil Health Card Scheme coverage

to 14 crore farm holdings by March, 2017. This will

help farmers to make judicious use of fertilizer.

11. Parmparagat Krishi Vikas Yojana for bringing 5

lakh acres of rain fed areas under organic farming.

12. Price Stabilisation Fund has been provided with a

corpus of Rs.900 crore to support market

interventions.

13. 28.5 lakh hectares will be brought under

Pradhan Mantri Krishi Sinchai Yojana.

14. The Finance Minister announced creation of a

dedicated Long Term Irrigation Fund in NABARD

with an initial corpus of about Rs. 20,000 crore.

15. 62 new Navodaya Vidyalayas will be opened in the

remaining uncovered districts over the next two

years.

16. To set up a Higher Education Financing Agency

(HEFA) with initial capital base of Rs. 1,000 crore.

www.bankersadda.com

17. To incentivize creation of new jobs in the formal

sector, GOI will pay the Employee Pension Scheme

contribution of 8.33% for all new employees

enrolling in EPFO for the first three years of their

employment. The Scheme will be applicable to

those with salary up to Rs.15,000 per month and a

budget provision of Rs.1000 crore has been made

for this.

18. The surcharge increased from 12% to 15% on

persons having income above Rs. 1 crore.

19. Proposed to collect tax at source at the rate of

1% on purchase of luxury cars exceeding value of

Rs. 10 lakh and purchase of goods and services in

cash exceeding Rs. 2 lakh.

20. Proposed Krishi Kalyan Cess @ 0.5% on all

taxable services. It will come into effect from 1st

June, 2016.

21. Proposed infrastructure cess of 1% on small

petrol, LPG, CNG cars, 2.5% on diesel cars of

certain capacity and 4% on other higher engine

capacity vehicles and SUVs.

22. Clean Energy Cess levied on coal, lignite and peat

was proposed to be renamed as Clean Environment

Cess. Its rate was increased from Rs. 200 per tonne

to Rs. 400 per tonne.

23. Increase the excise duties on various tobacco

products other than beedi by about 10 to 15%.

24. Scheme to declare undisclosed income by paying

45% tax in a given compliance window. This will

include paying tax at 30% and surcharge at 7.5%

and penalty at 7.5%, which is a total of 45% of the

undisclosed income. The surcharge levied at 7.5%

of undisclosed income will be called Krishi

Kalyan surcharge which will be used for

agriculture and rural economy. Government of

India plan to open the window under this Income

Disclosure Scheme from 1st June to 30th

September, 2016.

25. Dispute Resolution Scheme

A taxpayer who has an appeal pending as of

today before the Commissioner (Appeals) can

settle his case by paying the disputed tax and

interest up to the date of assessment.

No penalty in respect of Income-tax cases with

disputed tax up to Rs. 10 lakh will be levied.

www.careerpower.in

www.sscadda.com

Page 1

Cases with disputed tax exceeding Rs. 10 lakhs

will be subjected to only 25% of the minimum

of the imposable penalty for both direct and

indirect taxes.

Any pending appeal against a penalty order can

also be settled by paying 25% of the minimum

of the imposable penalty.

26. Proposed to increase the limit of deduction of rent

paid U/s.80 GG from Rs.24,000 per annum to

Rs.60,000 to provide relief to those who live in

rented houses.

27. Raise the ceiling of tax rebate U/s. 87A from

Rs.2000 to Rs.5000.

28. Corporate Tax on the new manufacturing

companies incorporated on or after 1st March 2016

will be given an option to be taxed at 25% +

Surcharge and Cess.

29. To lower the Corporate Tax rate for the next

financial year for companies with turnover not

exceeding Rs.5 crore (in the financial year ending

March 15), to 29% +Surcharge and Cess.

30. Create closer engagement b/w states and districts

through Ek Bharat, Shresth Bharat.

31. New health protection scheme to provide health

cover up to Rs. One lakh per family for

economically weak families. For senior citizens of

age 60 & above, an additional top-up package up

to Rs. 30,000 will be provided.

32. National Dialysis Services Programme will be

started to provide dialysis services in all district

hospitals.

33. Stand

Up

India

Scheme

to

promote

entrepreneurship among SC/ST and women. Rs.500

Crore has been provided for this purpose.

34. Rs. 2.87 lakh crore will be given as Grant in Aid

to Gram Panchayats and Municipalities. It will

translate to an average assistance of over Rs. 80

lakh per Gram Panchayat and over Rs. 21 crore

per Urban Local Body.

35. Allocation of Rs. 38,500 crore for MGNREGS.

36. 100% village electrification by 1st May, 2018.

37. Under the Swachh Bharat Mission, Rs. 9,000 crore

has been provided.

38. To develop governance capabilities of Panchayati

Raj Institutions on the Sustainable Development

Goals, a new scheme namely Rashtriya Gram

Swaraj Abhiyan, for which Rs. 655 crore is being

set apart.

39. For rural development as a whole, Rs. 87,765

crore have been allocated.

40. A massive mission to provide LPG connection in

the name of women members of poor

households for which Rs. 2000 crore have been

earmarked. This will benefit about 1 crore 50

www.bankersadda.com

lakh households below the poverty line in 201617.

41. To spread digital literacy in Rural India, 2 new

Schemes approved viz. National Digital Literacy

Mission and Digital Saksharta Abhiyan

(DISHA).

42. Together with the capital expenditure of the

Railways, the total outlay on roads and railways will

be Rs. 2,18,000 crore. He said 10,000 kms. of

National Highways are expected to be approved in

2016-17.

43. Deduction for additional interests of Rs.50,000 per

annum for loans up to Rs.35 lakh sanctioned in

2016-17 for first time home buyers, where house

costs does not exceed Rs.50 lakh.

44. SARFAESI Act is to be amended to strengthen Asset

Reconstruction Companies. This will help in

dealing with stressed assets of Banks.

45. Target of amount sanctioned under Pradhan

Mantri Mudra Yojana is proposed to increase to

Rs 1,80,000 crore.

46. General Insurance Companies will be listed in

stock exchanges.

47. RBI Act 1934 is being amended to provide statutory

basis for a Monetary Policy Framework and a

Monetary Policy Committee through the Finance

Bill 2016.

48. Allocation of Rs. 25,000 crore towards

recapitalisation of PSBs

49. Considering reduction of Government equity in IDBI

Bank to 49% of below

50. He said 100% FDI will be allowed through FIPB

route in marketing of food products produced

and manufactured in India.

www.careerpower.in

www.sscadda.com

Page 2

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- 7.5 20 2017 2018 Anbc 1 - : WWW - Careerpower.inDocument1 page7.5 20 2017 2018 Anbc 1 - : WWW - Careerpower.inVikashKumarPas encore d'évaluation

- Syllabus JEDocument2 pagesSyllabus JEChelsea MitchellPas encore d'évaluation

- Notice For The Candidates of NTPC (Graduate) Exam. Against CEN No. 03/2015Document1 pageNotice For The Candidates of NTPC (Graduate) Exam. Against CEN No. 03/2015VikashKumarPas encore d'évaluation

- Insurance industry in India key facts and figuresDocument1 pageInsurance industry in India key facts and figuresVikashKumarPas encore d'évaluation

- Digital Signature TechDocument2 pagesDigital Signature TechVikashKumarPas encore d'évaluation

- Syllabus JEDocument2 pagesSyllabus JEChelsea MitchellPas encore d'évaluation

- ,, Indirect Tax: WWW - Careerpower.inDocument1 page,, Indirect Tax: WWW - Careerpower.inVikashKumarPas encore d'évaluation

- (Iv) Anbc 7.5 ,: WWW - Careerpower.inDocument1 page(Iv) Anbc 7.5 ,: WWW - Careerpower.inVikashKumarPas encore d'évaluation

- (Basis Point) : WWW - Careerpower.inDocument1 page(Basis Point) : WWW - Careerpower.inVikashKumarPas encore d'évaluation

- Nitp FormDocument3 pagesNitp FormVikashKumarPas encore d'évaluation

- GKDocument24 pagesGKVikashKumarPas encore d'évaluation

- Pune OrdnanceDocument2 pagesPune OrdnanceVikashKumarPas encore d'évaluation

- (Basis Point) : WWW - Careerpower.inDocument1 page(Basis Point) : WWW - Careerpower.inVikashKumarPas encore d'évaluation

- Microsoft Word - Fitter QuestionDocument6 pagesMicrosoft Word - Fitter QuestionVikashKumarPas encore d'évaluation

- Common Layout Tools - SmithyDocument1 pageCommon Layout Tools - SmithyVikashKumarPas encore d'évaluation

- RFC 3561Document38 pagesRFC 3561Ndaru SetyawanPas encore d'évaluation

- Hary SSCDocument7 pagesHary SSCJeshiPas encore d'évaluation

- Pune OrdnanceDocument2 pagesPune OrdnanceVikashKumarPas encore d'évaluation

- HSSCDocument9 pagesHSSCVikashKumarPas encore d'évaluation

- PolicyDocument16 pagesPolicyVikashKumarPas encore d'évaluation

- Notification SSC Junior Notification-SSC-Junior-Engineer-Posts - Pdfengineer PostsDocument36 pagesNotification SSC Junior Notification-SSC-Junior-Engineer-Posts - Pdfengineer PostsVikas GoyalPas encore d'évaluation

- Certified Trainee SearchITIDocument1 pageCertified Trainee SearchITIVikashKumarPas encore d'évaluation

- PolicyDocument16 pagesPolicyVikashKumarPas encore d'évaluation

- Get Top IIT JEE Physics Study MaterialDocument1 pageGet Top IIT JEE Physics Study MaterialVikashKumar0% (2)

- Video Links: Trigonometric Functions: Definitions Trigonometric Functions: Rules of CalculationDocument6 pagesVideo Links: Trigonometric Functions: Definitions Trigonometric Functions: Rules of CalculationVikashKumarPas encore d'évaluation

- What Is A Function? How To Describe A Function Domain and RangeDocument5 pagesWhat Is A Function? How To Describe A Function Domain and RangeVikashKumarPas encore d'évaluation

- Equations Week3Document4 pagesEquations Week3VikashKumarPas encore d'évaluation

- RailDocument7 pagesRailJeshiPas encore d'évaluation

- Mathematical ModellingDocument12 pagesMathematical ModellingAnirvan ShuklaPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 7221-7225 Beverly BLVDDocument10 pages7221-7225 Beverly BLVDJu PoPas encore d'évaluation

- Notes Labor RevDocument4 pagesNotes Labor RevCharmagnePas encore d'évaluation

- People VS Hon. Bienvenido TanDocument3 pagesPeople VS Hon. Bienvenido Tanjoy dayagPas encore d'évaluation

- Ethics of UtilitarianismDocument26 pagesEthics of UtilitarianismAngelene MangubatPas encore d'évaluation

- Rape Conviction Upheld Despite Victim's Inconsistent TestimonyDocument5 pagesRape Conviction Upheld Despite Victim's Inconsistent TestimonyAlvin NiñoPas encore d'évaluation

- Full Download Understanding Human Sexuality 13th Edition Hyde Test BankDocument13 pagesFull Download Understanding Human Sexuality 13th Edition Hyde Test Bankjosiah78vcra100% (29)

- AE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBDocument7 pagesAE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBArly Kurt TorresPas encore d'évaluation

- Accounting For Merchandising Operations Chapter 6 Test Questions PDFDocument31 pagesAccounting For Merchandising Operations Chapter 6 Test Questions PDFDe Torres JobelPas encore d'évaluation

- Simple Stress & StrainDocument34 pagesSimple Stress & StrainfaisalasgharPas encore d'évaluation

- Digest 25. Serrano de Agbayani vs. PNB, 38 SCRA 429Document1 pageDigest 25. Serrano de Agbayani vs. PNB, 38 SCRA 429Inez Monika Carreon PadaoPas encore d'évaluation

- Oracle Applications EBS - Accounting EntriesDocument43 pagesOracle Applications EBS - Accounting EntriesUdayraj SinghPas encore d'évaluation

- Vol 4Document96 pagesVol 4rc2587Pas encore d'évaluation

- PNB V CADocument7 pagesPNB V CAAriana Cristelle L. PagdangananPas encore d'évaluation

- Citizenship-Immigration Status 2016Document1 pageCitizenship-Immigration Status 2016rendaoPas encore d'évaluation

- FNDWRRDocument2 pagesFNDWRRCameron WrightPas encore d'évaluation

- Meaning PerquisiteDocument2 pagesMeaning PerquisiteModassir Husain KhanPas encore d'évaluation

- Standard Joist Load TablesDocument122 pagesStandard Joist Load TablesNicolas Fuentes Von KieslingPas encore d'évaluation

- Unit 8 Money ManagementDocument6 pagesUnit 8 Money ManagementJasmine Mae BalageoPas encore d'évaluation

- V2150 Mexico CAB MU920 MU610Document2 pagesV2150 Mexico CAB MU920 MU610RubenL MartinezPas encore d'évaluation

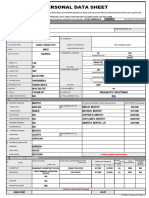

- Abner PDSDocument7 pagesAbner PDSKEICHIE QUIMCOPas encore d'évaluation

- Industrial Security ConceptDocument85 pagesIndustrial Security ConceptJonathanKelly Bitonga BargasoPas encore d'évaluation

- PT Indomobil Sukses Internasional TBK.: Annual ReportDocument397 pagesPT Indomobil Sukses Internasional TBK.: Annual ReportSUSANPas encore d'évaluation

- Companies View SampleDocument4 pagesCompanies View Samplesuresh6265Pas encore d'évaluation

- 15562711-ad97-4f6d-9325-e852a0c8add9Document7 pages15562711-ad97-4f6d-9325-e852a0c8add9Julia FairPas encore d'évaluation

- Arizona Reception For Dan CrenshawDocument2 pagesArizona Reception For Dan CrenshawBarbara EspinosaPas encore d'évaluation

- Dyslexia and The BrainDocument5 pagesDyslexia and The BrainDebbie KlippPas encore d'évaluation

- Academic Test 147-2Document12 pagesAcademic Test 147-2Muhammad Usman HaiderPas encore d'évaluation

- Marc II Marketing, Inc. vs. Joson, G.R. No. 171993, 12 December 2011Document25 pagesMarc II Marketing, Inc. vs. Joson, G.R. No. 171993, 12 December 2011Regienald BryantPas encore d'évaluation

- Mark Minervini - Master Trader Program 2022 Volume 1-241-281Document41 pagesMark Minervini - Master Trader Program 2022 Volume 1-241-281thuong vuPas encore d'évaluation

- Bicol Medical Center vs. BotorDocument4 pagesBicol Medical Center vs. BotorKharrel GracePas encore d'évaluation