Académique Documents

Professionnel Documents

Culture Documents

CREDIT APPRAISAL PROCESS

Transféré par

Smitha K BDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CREDIT APPRAISAL PROCESS

Transféré par

Smitha K BDroits d'auteur :

Formats disponibles

CREDIT APPRAISAL PROCESS

RESEARCH METHODOLOGY:

Research is a common parlance which refers to search for knowledge. It is a procedure of logical

and systematic application of the fundamentals of science to the general and overall questions of a study

and scientific technique, which provide precise tools, specific procedures, and technical rather

philosophical meaning for getting and ordering the data prior to their logical analysis and manipulating

different type of research designs is available depending upon the nature of research project, availability of

manpower and circumstances.

Research methodology is a way to systematically solve research problem in it.We study the various

steps that are generally adopted by researcher in studying his research problem along with the logic behind

them. It is necessary for a researcher to know not only the research methods/techniques but also the

methodology. It may be noted, in the context of planning & development, that the significance of research

lies in its quality and not in quantity. Researchers should know how to apply particular research techniques,

but they also need to know which of these methods or techniques, are relevant and which are not, and what

would they mean and indicate and why.

This topic, CREDIT APPRAISAL PROCESS OF MAHINDRA FINANCE demanded an

elaborate study of the presently followed credit appraisal process of Mahindra Finance, make suggestions

regarding betterment of the whole system if any, and finally base all the above on solid research work.

4.1. STATEMENT OF THE PROBLEM:

Credit Appraisal Process

During my research at Mahindra finance, I noticed that Mahindra finance always follows a specific

procedure for approving loans, irrespective of their variant. I also observed the whole procedure very

carefully and realized that it could be decomposed into 8 basic steps. They are:1) Interest shown by potential customers

2) Briefing by Mahindra Finance

3) Filling up of form

4) Submission of documents required

5) Verification of documents

6) Recording deviations

7) Deviation Approval

8) Loan Approval

Bapuji Academy Of Management And Research, Davangere

Page 17

CREDIT APPRAISAL PROCESS

Now, I am going to briefly describe each of the above 8 steps involved in the Credit Appraisal

Process of Mahindra Finance.

1) Interest Shown by Potential Customers

Whenever a person desires to buy a vehicle he/she approaches a dealer. After selecting the Vehicle,

the on road price is being evaluated. If the person opts for financial assistance and Mahindra finance in

particular, he/she becomes a potential customer to Mahindra finance .The dealer makes arrangements for a

meet of between the customers and Mahindra Finance.

2) Briefing by Mahindra Finance

When the customer agrees to take loan from Mahindra Finance, the MMFSL agent briefly talks

about the terms & conditions of Mahindra Finance for availing the loan.

3) Filling up of form

After all the discussions have been completed and the person has agreed to take loan from

Mahindra Finance, he is given a loan application form to fill up.

4) Submission of documents required

For submission of the form, what are the documents required, the agent tells to the person, applying

for the loan. There are 5 types of documents required to submit the form for loan:

Co-hirer documents: Identity Proof, Residence Proof, Photo with Front attested, Income Proof,

Bank Statement Mention Last 6 Months, PDC- Post Dated Cheques, Signature Verification and

CIBIL Score and LTV (Loan to Value).

CIBIL (Credit Information Bureau of India Limited): CIBIL is Indias first Credit Information

Company (CIC) founded in August 2000. CIBIL collects and maintains records of an individual s

payments pertaining to loans and credit cards. These records are submitted to CIBIL by banks and

credit institutions, on a monthly basis.

CIBIL Score: The CIBIL Score is a 3 digit numeric summary of ones credit history which indicates

the financial & credit health. The Score is derived from credit history as detailed in the Credit

Information Report [CIR] and ranges from 300 to 900 points. Credit score tells the lender how

likely you are to pay back loan or credit card dues based on past repayment behavior.

Guarantor Document

Co-hirer Document

Office Documents: Agreement Duly Sign, Offer Letter, IRR Sheet (Internal rate of return sheet),

MLS (Multiple Listing Services) Form, Vehicle Scheme, Field Investigation Report, Route Map,

Proposal Form, Sanction Letter, Post Tele-verification.

Bapuji Academy Of Management And Research, Davangere

Page 18

CREDIT APPRAISAL PROCESS

Dealer Documents: Invoice, Sales Certificate, Delivery Challan, Chassis Print, Duplicate Key,

Dealer Recommendation sheet, Balance Of Payment Case, IHM Receipt(Both dealer & Mahindra

Finance), Insurance Policy, Welcome Letter, Tax Challan, RC Copy and Certificate.

5) Verification of documents

After submission of all the documents, the agent verifies all the documents for address, Identity

proof, electricity bills, annual income etc.

6) Recording deviations

If the applicant fails to fulfill any of the requirements, it is recorded as deviation from the usual

requirement. All such deviations are recorded duly, without any fail.

7) Deviation approval

If MMFSL believes that one or some of the deviations are acceptable under the circumstances and a

deviation approval letter is being given by the Mahindra Finance.

8) Loan Approval

After all the process has been completed and MMFSL finds that the person applying for the Loan is

actually eligible for it, the Loan is sanctioned.

Applications for Loan & their processing

Customers, who have evinced interest in availing the loan from MMFSL should fill up the loan

application form, complete in all aspects and should submit the same to the Companys nearest branch.

The application so received will be acknowledged by the Company immediately on submission and

will be processed for sanction of the loan. The Company will consider all the documents submitted and the

information provided, verify the creditworthiness of the customer and evaluate the proposal at its sole

discretion and will grant loan by issuing a sanction letter within 10 days from the date of receipt of the loan

application and if no communication is received by the customer, the loan application is deemed to have

been rejected and the Company will not send any communication for rejected cases. Sanction letter in the

vernacular language is to be issued to all borrowers whose loan have been sanctioned after due diligence.

4.2. NEED FOR THE STUDY:

An important need of credit appraisal is obtaining an understanding of the anticipated expenditure

and benefits of a project, usually expressed in terms of its inputs (costs) and outputs (results).

The expected timing of this must also be made clear.

Whilst detailed appraisal is generally necessary before decisions can be taken and offers made.

Bapuji Academy Of Management And Research, Davangere

Page 19

CREDIT APPRAISAL PROCESS

It will enable any obviously poor or ineligible ones to be eliminated, avoid duplication and give an

early overall view of the success of the measure.

4.3. LITERATURE REVIEW:

Mritunjay Kumar Pandey conducted a study on Financial Performance Appraisal of TISCO, the

paper of which was published in Accounting World, September 2008, The ICFAI University Press.

The Objectives of the study was to check the profitability and efficiency of the firm in the near

future, to give brief summery about the ratios which affect the organizations financial structure and

to point out the relationship between ratios and reasons behind it.

Machiko Nissanke, Ernest Aryeetey in their book: Financial Integration and Development

explained about the loan administration and risk reduction by formal lenders (i.e. banks), Credit

Analysis Standards, Increase Project equity requirements, Loan screening of banks and assessing

creditworthiness during screening. Banks consider return on project as an important indicator for

appraising the projects.

Credit Appraisal, Risk Analysis and Decision Making by D.D.Mukherjee.

Banking Strategy, Credit Appraisal and Lending Strategies by Author(s) : Hrishikesh

Bhattacharya

Analyses lending strategies, credit appraisal, risk analysis and lending decisions keeping in

mind the broad framework of corporate banking strategy, and helps us understand better the vast

and significant changes in the financial market. Numerous examples from the world of business

have been provided to facilitate better understanding.

A research was conducted by Mr. V.M.V.Subba Rao, B.Com. , FCA, DISA (ICA), MICA on

Monitoring of Advances -- A New Look. The researcher gave two views on the commencement

of monitoring process-(i)Narrow view- the monitoring starts only after the advance is disbursed,

(ii)Broad view- at the time of conducting credit investigation of the borrower and continue in all

other stages of credit cycle.

Eleanor Charles in his paper, Appraising the Role of the Appraiser Published: September 3, 1995,

talked about the centralized function of the appraiser to grant the loan and virtually every loan

applicant will have to rely on an appraisal to set a value on the property against which the loan is to

be made.

RBI reports (2011-13) had maintained that though the Indian banks remained well capitalized,

concerns about the growing non-performing assets loomed large, particularly on the public sector

banks (RBI, 2013). RBI further observed that economic slow-down is not the sole reason for

deteriorating asset quality but also the inadequate appraisal and monitoring of credit proposals by

Bapuji Academy Of Management And Research, Davangere

Page 20

CREDIT APPRAISAL PROCESS

banks.

Arnoud and Anjan (2007)17 study appear as the lead chapter in a readings book on corporate

finance, financial intermediation and market micro structure. The unifying theme in the book is

optimal design, and various chapters deal with the design of contracts, securities, institutions,

market mechanisms, and regulation from an information-theoretic perspective.

Christian (2006)15 focused on the changing intensity of three policies that are commonly associated

with financial repression, namely interest rate controls, statutory pre-emption and directed credit as

well as the effects these policies had. The main findings are that the degree of financial repression

has steadily increased between 1960 and 1980, and then declined somewhat before rising to a new

peak at the end of the 1980s.

4.4. OBJECTIVES:

To know the loans and advances are issued based on the requirements of the customers.

2. To ensure that the Level of risk is Acceptable and mitigated.

3. To know the level of NPA in MMFSL.

4.5. HYPOTHESIS:

H0: Loans and advances are not issued based on the requirements of the customers.

H1: Loans and advances are issued based on the requirements of the customers.

H0: Level of risk is not acceptable and not mitigated.

H1: Level of risk is acceptable and mitigated.

H0: Level of NPA is not decreased in Mahindra Finance.

H1: Level of NPA is decreased in Mahindra Finance.

4.6. RESEARCH METHODOLOGY:

I have chosen Descriptive Research for this project. The data also consists of secondary data in the

form of articles, journals, and data from websites of the company. 5 years data of Mahindra finance. By

this, I am going to analyse and interpret the results.

4.6.1. Collection of Data

Bapuji Academy Of Management And Research, Davangere

Page 21

CREDIT APPRAISAL PROCESS

I decided to go for collecting Secondary Data in my project work.

Secondary data is previously collected 5 years Annual Reports of MMFSL from 2010 to 2015,

Balance Sheet, Profit and Loss account.

4.6.2. Tools used:

Microsoft Excel

4.7. SCOPE OF THE STUDY:

The topic selected is, The credit appraisal system with respect to Mahindra Finance.

This means, how the employees in Mahindra Finance appraise individuals and the corporate firms

lending process and how the whole process is carried forward like an integrated system, keeping certain

aspects like risk, legality into concern.

The scope lays in Mahindra Finance, its potential borrowers, which is tailor made at times to meet

the client need and help with all the services the Mahindra Finance can deliver in order to meet its goals

and objectives.

4.8. LIMITATIONS OF THE STUDY:

During the course of my project, everything did not go the way I planned and expected, for I faced

certain obstacles. Some of these obstacles are stated below,

Interaction with the employees is very limited because of the work schedule.

Regarding the data provided by the company is mostly secondary, i.e. it may have been audited by

the organization so it may not be 100% correct.

The accuracy of analysis depends on the data collected from the financial statements.

Finding and analysis of the report is prepared from the information available in the annual report

and book of account.

Bapuji Academy Of Management And Research, Davangere

Page 22

Vous aimerez peut-être aussi

- Project ReportDocument77 pagesProject ReportPiyush MaheshwariPas encore d'évaluation

- XX Credit Appraisal Project FinalDocument40 pagesXX Credit Appraisal Project FinalDhaval ShahPas encore d'évaluation

- Credit Risk Management On HDFC BankDocument17 pagesCredit Risk Management On HDFC BankAhemad 12Pas encore d'évaluation

- My Project of Vijaya BankDocument103 pagesMy Project of Vijaya Banktamizharasid100% (1)

- Bank of India SWOT AnalysisDocument13 pagesBank of India SWOT AnalysisPoornima K KPas encore d'évaluation

- 166-2020 Roi PDFDocument47 pages166-2020 Roi PDFANJAN SINGH 3APas encore d'évaluation

- Analysis of Credit Management of JanataDocument47 pagesAnalysis of Credit Management of Janataprokash halderPas encore d'évaluation

- Project Report Union BankDocument201 pagesProject Report Union BankVikas SinghPas encore d'évaluation

- AN ANALYTICAL STUDY OF CREDIT APPRAISAL SYSTEM AT BANK OF INDIADocument142 pagesAN ANALYTICAL STUDY OF CREDIT APPRAISAL SYSTEM AT BANK OF INDIAVismay GharatPas encore d'évaluation

- A Project Report On: Customer Preference & Attributes Towards Saving-AccountDocument68 pagesA Project Report On: Customer Preference & Attributes Towards Saving-AccountchinunanaPas encore d'évaluation

- Sanjay Srinivaas, Sadasiv and KishoreDocument43 pagesSanjay Srinivaas, Sadasiv and KishoreSanjay SrinivaasPas encore d'évaluation

- Decision-making processes in Polish cement industry inventory managementDocument14 pagesDecision-making processes in Polish cement industry inventory managementmalay paulPas encore d'évaluation

- Name: Arpita SengarDocument69 pagesName: Arpita Sengartripti48Pas encore d'évaluation

- UCG7p2g3rF SBICAPsDocument31 pagesUCG7p2g3rF SBICAPsHarapriyaPandaPas encore d'évaluation

- Meaning of Cash Reserve Ratio and Statutory Liquidity....Document7 pagesMeaning of Cash Reserve Ratio and Statutory Liquidity....Radhey JangidPas encore d'évaluation

- Loans &advances (Mantu) - Project - 1-2Document48 pagesLoans &advances (Mantu) - Project - 1-2Shivu BaligeriPas encore d'évaluation

- Credit Appraisal For Term Loan And: Working Capital FinancingDocument93 pagesCredit Appraisal For Term Loan And: Working Capital FinancingRohit AggarwalPas encore d'évaluation

- Yes BankDocument24 pagesYes Banktrisanka banikPas encore d'évaluation

- DocumentationDocument36 pagesDocumentationRamesh BethaPas encore d'évaluation

- Management of Non-Performing Assets in Public Sector Banks: Evidence From IndiaDocument11 pagesManagement of Non-Performing Assets in Public Sector Banks: Evidence From IndiaNavneet GurjurPas encore d'évaluation

- Home Loan - A Comparitive Study at BOIDocument86 pagesHome Loan - A Comparitive Study at BOIRuchi Prabhu100% (2)

- Sanju 1 ReportDocument85 pagesSanju 1 ReportSanjay SanjuPas encore d'évaluation

- Bandhan Case Study: Prepared By: Bakshi Satpreet Singh (10MBI1005)Document17 pagesBandhan Case Study: Prepared By: Bakshi Satpreet Singh (10MBI1005)Sachit MalikPas encore d'évaluation

- SBI Service ReportDocument39 pagesSBI Service ReportVatsal GadhiaPas encore d'évaluation

- Questions: Company BackgroundDocument5 pagesQuestions: Company BackgroundVia Samantha de AustriaPas encore d'évaluation

- Icici Home LoansDocument43 pagesIcici Home Loanskashyappawan007Pas encore d'évaluation

- A Study On Credit Appraisal System On SME of Union Bank of IndiaDocument56 pagesA Study On Credit Appraisal System On SME of Union Bank of IndiaSarva ShivaPas encore d'évaluation

- Non - Performing Assests (Npa'S)Document12 pagesNon - Performing Assests (Npa'S)Suhit SarodePas encore d'évaluation

- Comparative Analysis Report On Npa of Pubic & Private Sector BankDocument10 pagesComparative Analysis Report On Npa of Pubic & Private Sector BankMBA SEM 3 2019Pas encore d'évaluation

- HDFC Bank CAMELS AnalysisDocument15 pagesHDFC Bank CAMELS Analysisprasanthgeni22Pas encore d'évaluation

- Comparative Study of Home Loans of PNB and Sbi Bank Final ProjectDocument11 pagesComparative Study of Home Loans of PNB and Sbi Bank Final ProjectManish KumarPas encore d'évaluation

- NPA AnalysisDocument61 pagesNPA AnalysisSabyasachi PandaPas encore d'évaluation

- Main ProjectDocument23 pagesMain ProjectEkta chodankarPas encore d'évaluation

- Credit AppraisalDocument12 pagesCredit AppraisalAishwarya KrishnanPas encore d'évaluation

- Chapter-1: N.R.K&K.S.R Gupta Degree College, TenaliDocument58 pagesChapter-1: N.R.K&K.S.R Gupta Degree College, TenaligupthaPas encore d'évaluation

- NPA Final ReportDocument60 pagesNPA Final ReportVish Amit KandaPas encore d'évaluation

- Universal Banking in IndiaDocument60 pagesUniversal Banking in IndiaPratik GosaviPas encore d'évaluation

- Bajaj Finserv Consumer Loan StudyDocument48 pagesBajaj Finserv Consumer Loan StudyDashing HemantPas encore d'évaluation

- Sonata Finance PVTDocument23 pagesSonata Finance PVTArunima Naithani100% (2)

- Home Loans in Banking Sector ReportDocument17 pagesHome Loans in Banking Sector ReportMohmmedKhayyumPas encore d'évaluation

- Customer Satisfaction Towards Lic Housing FinancDocument69 pagesCustomer Satisfaction Towards Lic Housing Financboss_144569224100% (1)

- Agricultural LoanDocument62 pagesAgricultural Loanprasad pawlePas encore d'évaluation

- Ashika DCCDocument64 pagesAshika DCCUDayPas encore d'évaluation

- An Overview of Credit Appresal Process With Special Reference To Differnent Loans Offer by Indian BankDocument86 pagesAn Overview of Credit Appresal Process With Special Reference To Differnent Loans Offer by Indian BankAbhinandan SahooPas encore d'évaluation

- A Study On Bank of Maharashtra: Commercial Banking SystemDocument13 pagesA Study On Bank of Maharashtra: Commercial Banking SystemGovind N VPas encore d'évaluation

- Credit Risk Management in Karnataka State Credit Risk Management in Karnataka StateDocument98 pagesCredit Risk Management in Karnataka State Credit Risk Management in Karnataka StatePrashanth PBPas encore d'évaluation

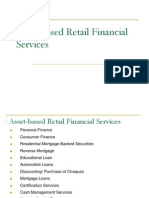

- Asset Retail Financial ServicesDocument37 pagesAsset Retail Financial Servicesjimi02100% (1)

- A Major Project ON: "Comparison of Home Loan Scheme of Different Banks"Document81 pagesA Major Project ON: "Comparison of Home Loan Scheme of Different Banks"ganesh joshiPas encore d'évaluation

- BlackbookDocument56 pagesBlackbookrashmishaikh68Pas encore d'évaluation

- MSME Government SupportDocument36 pagesMSME Government SupportBhaskaran BalamuraliPas encore d'évaluation

- Complete Analysis of Bandhan BankDocument18 pagesComplete Analysis of Bandhan BankAkashPas encore d'évaluation

- Economics For Finance Nitin GuruDocument74 pagesEconomics For Finance Nitin GuruJai GuptaPas encore d'évaluation

- Credit Policy Version 1.2Document157 pagesCredit Policy Version 1.2Amit SinghPas encore d'évaluation

- Canara Bank Home LoanDocument4 pagesCanara Bank Home LoanShekarPas encore d'évaluation

- Project Study On Credit Risk ManagementDocument73 pagesProject Study On Credit Risk ManagementYesmilliPas encore d'évaluation

- Prof.. Anju Dusseja: Name Roll - NoDocument18 pagesProf.. Anju Dusseja: Name Roll - NoOmkar PandeyPas encore d'évaluation

- AdvancesprocessmDocument98 pagesAdvancesprocessmAmol DahiphalePas encore d'évaluation

- Home Loan - Hdfc&Icici BankDocument65 pagesHome Loan - Hdfc&Icici BankSahil SethiPas encore d'évaluation

- ThakraDocument1 pageThakraSmitha K BPas encore d'évaluation

- Optimal Working Capital ManagementDocument26 pagesOptimal Working Capital ManagementSmitha K BPas encore d'évaluation

- GY 34 Home Advice For Patients Who Are Due To Undergo A Hysterosalpingogram v1Document2 pagesGY 34 Home Advice For Patients Who Are Due To Undergo A Hysterosalpingogram v1Smitha K BPas encore d'évaluation

- Chapter Generation and Screening of Project IdeasDocument33 pagesChapter Generation and Screening of Project IdeasSmitha K BPas encore d'évaluation

- Saving and Capital Formation: The Engine of Economic GrowthDocument16 pagesSaving and Capital Formation: The Engine of Economic GrowthSmitha K BPas encore d'évaluation

- Chapter 3 Generation and Screening of Project IdeasDocument20 pagesChapter 3 Generation and Screening of Project IdeasRaunak Mainkar100% (6)

- Merchant Banking: What Is It and What Do They DoDocument38 pagesMerchant Banking: What Is It and What Do They DoSmitha K BPas encore d'évaluation

- Parle Must Get The Marketing Mix Right For Rol-a-Cola 2.0 - BlocDocument4 pagesParle Must Get The Marketing Mix Right For Rol-a-Cola 2.0 - BlocSmitha K BPas encore d'évaluation

- CH 020 STG Acute Watery DiarrheaDocument9 pagesCH 020 STG Acute Watery DiarrheaSmitha K BPas encore d'évaluation

- Overview of Project ManagementDocument36 pagesOverview of Project ManagementSmitha K BPas encore d'évaluation

- 24.social Netwoking Service For Families With Diabilities - 1Document3 pages24.social Netwoking Service For Families With Diabilities - 1Smitha K BPas encore d'évaluation

- Deep learning detects Android malware with 96.76% accuracyDocument10 pagesDeep learning detects Android malware with 96.76% accuracySmitha K BPas encore d'évaluation

- Project ManagementDocument87 pagesProject ManagementSmitha K BPas encore d'évaluation

- Project Management: Michel Tollenaere (INPG)Document56 pagesProject Management: Michel Tollenaere (INPG)Smitha K BPas encore d'évaluation

- Accounting For Managers: Dr.R.Vasanthagopal University of KeralaDocument22 pagesAccounting For Managers: Dr.R.Vasanthagopal University of KeralaSmitha K BPas encore d'évaluation

- Recent DvlptsDocument3 pagesRecent DvlptsSmitha K BPas encore d'évaluation

- 5.chapter3 Company ProfileDocument12 pages5.chapter3 Company ProfileSmitha K BPas encore d'évaluation

- HISTORICAL DEVELOPMENT OF DERIVATIVES MARKETSDocument6 pagesHISTORICAL DEVELOPMENT OF DERIVATIVES MARKETSSmitha K BPas encore d'évaluation

- Organisation Climate (Compatibility Mode) (Repaired)Document41 pagesOrganisation Climate (Compatibility Mode) (Repaired)Smitha K BPas encore d'évaluation

- 3 Chapter1introductionDocument2 pages3 Chapter1introductionSmitha K BPas encore d'évaluation

- 2.declration and Content SheetDocument6 pages2.declration and Content SheetSmitha K BPas encore d'évaluation

- 2.1 Banking Industry: Credit Appraisal ProcessDocument4 pages2.1 Banking Industry: Credit Appraisal ProcessSmitha K BPas encore d'évaluation

- Constitution of India-Complete Full TextDocument471 pagesConstitution of India-Complete Full TextDaras Bir Singh67% (6)

- 2015 Scheme (Model Question Paper)Document3 pages2015 Scheme (Model Question Paper)Aswathy M NPas encore d'évaluation

- FSDocument4 pagesFSSmitha K BPas encore d'évaluation

- Corporate Governance and Securities Exchange Board of IndiaDocument11 pagesCorporate Governance and Securities Exchange Board of IndiaSmitha K BPas encore d'évaluation

- In-Plant GuidelinesDocument15 pagesIn-Plant GuidelineshariharaPas encore d'évaluation

- Paper Presentation On Role of Oecd and Sebi in Corporate GovernanceDocument10 pagesPaper Presentation On Role of Oecd and Sebi in Corporate GovernanceSmitha K BPas encore d'évaluation

- Depositories ActDocument36 pagesDepositories Actsushant247Pas encore d'évaluation

- Managing Credit RisksDocument18 pagesManaging Credit RisksJAY SHUKLAPas encore d'évaluation

- Spouses Salonga Vs Spouses ConcepcionDocument2 pagesSpouses Salonga Vs Spouses ConcepcionelmersgluethebombPas encore d'évaluation

- Case Title: BPI Savings Bank, Icnc Vs Sps. Yujuico Ponente: Bersamin DoctrineDocument2 pagesCase Title: BPI Savings Bank, Icnc Vs Sps. Yujuico Ponente: Bersamin DoctrineNasrifah LangcoPas encore d'évaluation

- Dela Cruz Vs Dela Cruz 130 Phil 324Document2 pagesDela Cruz Vs Dela Cruz 130 Phil 324preiquencyPas encore d'évaluation

- Bar Examination Questions in Mercantile Law (2006-2018)Document132 pagesBar Examination Questions in Mercantile Law (2006-2018)hazelpugongPas encore d'évaluation

- Danfurn Restructuring OptionsDocument50 pagesDanfurn Restructuring OptionsAlia80% (5)

- Operating Costs in Hotel IndustryDocument38 pagesOperating Costs in Hotel IndustryRajVishwakarmaPas encore d'évaluation

- Case DigestDocument6 pagesCase DigestCyrra Balignasay100% (1)

- Ratio Analysis of BGPPLDocument53 pagesRatio Analysis of BGPPLmayurPas encore d'évaluation

- Specific Performance Unaffected by WaiverDocument5 pagesSpecific Performance Unaffected by WaiverZaza Maisara50% (2)

- Tenancy AgreementDocument3 pagesTenancy AgreementCA Vaibhav Maheshwari50% (2)

- First Metro Investment vs. Estate of Del SolDocument3 pagesFirst Metro Investment vs. Estate of Del SolEmir MendozaPas encore d'évaluation

- Shadda KaporDocument25 pagesShadda KaporAyushi MehtaPas encore d'évaluation

- Commercial Law (Atty. M. Gapuz) PDFDocument8 pagesCommercial Law (Atty. M. Gapuz) PDFRhald KhoPas encore d'évaluation

- DS Plan With Exhibits and OrderDocument492 pagesDS Plan With Exhibits and Orderhitokiri8Pas encore d'évaluation

- RCBC V CADocument6 pagesRCBC V CAAra Lorrea MarquezPas encore d'évaluation

- Sales Case DigestDocument25 pagesSales Case DigestmarcPas encore d'évaluation

- Fundamentals of Property OwnershipDocument4 pagesFundamentals of Property OwnershipMichelleOgatis83% (6)

- Risk ManagementDocument14 pagesRisk ManagementMichelle TPas encore d'évaluation

- CHEE KOK CHOON V SERN KUANG ENGDocument32 pagesCHEE KOK CHOON V SERN KUANG ENGsierraPas encore d'évaluation

- DBP v. Arcilla Jr. Ruling on Housing Loan ComplianceDocument6 pagesDBP v. Arcilla Jr. Ruling on Housing Loan ComplianceJImlan Sahipa IsmaelPas encore d'évaluation

- SecuritizationDocument28 pagesSecuritizationMohit MakhijaPas encore d'évaluation

- Tan vs. Valdehueza Facts: Jardenil vs. Solas - Art. 1956 - CalinisanDocument8 pagesTan vs. Valdehueza Facts: Jardenil vs. Solas - Art. 1956 - CalinisannikkimaxinevaldezPas encore d'évaluation

- Sean P. Callan, EsqDocument32 pagesSean P. Callan, EsqImran ShaPas encore d'évaluation

- Chapter 05Document50 pagesChapter 05Putri IndrianaPas encore d'évaluation

- Deed of AssignmentDocument3 pagesDeed of AssignmentJessiePatronPas encore d'évaluation

- Property law quiz answersDocument8 pagesProperty law quiz answersIzzat FeisalPas encore d'évaluation

- Types of Mortgages in India DefinedDocument6 pagesTypes of Mortgages in India Definedravi1214Pas encore d'évaluation

- GR 158262 Spouses Violago Vs BA FinanceDocument2 pagesGR 158262 Spouses Violago Vs BA FinanceMylene Gana Maguen Manogan100% (2)

- Co Operative BanksDocument13 pagesCo Operative Banksamyncharaniya100% (4)