Académique Documents

Professionnel Documents

Culture Documents

Management Discussion & Analysis Report

Transféré par

mostafaragab1983Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Management Discussion & Analysis Report

Transféré par

mostafaragab1983Droits d'auteur :

Formats disponibles

Aksh Optifibre Limited

MANAGEMENT DISCUSSION AND ANALYSIS OF THE FINANCIAL

STATEMENTS AND OPERATIONAL RESULTS

This report may contain certain statements that the Company believes are, or may be considered to be forward-looking statements

that describe our objectives, plans or goals. All these forward-looking statements are subject to certain risks and uncertainties, including,

but not limited to, Government action, local political or economic development, technological risks, risks inherent in the Companys

growth strategy, dependence on certain customers, dependence on availability of technical personnel and other factors that could

cause our actual results to differ materially from those contemplated by the relevant forward-looking statements.

The forward-looking statements included in this report are made only as of the date of this report and we undertake no obligation

to publicly update these forward-looking statements to reflect subsequent events or circumstances.

Overview

Aksh Optifibre Limited commenced operations in 1986 to manufacture and export PVC and PE insulated Speciality Cables. In the

year 1994, the Company diversified into Optical Fibre Cables (OFC). The first Plant was set up in Bhiwadi, Rajasthan, with an

installed capacity of 6500 Cable Kilo Meters (ckm) p.a. at a total capital outlay of Rs.910 Lacs.

As a first step towards backward integration, in 1994, we set up a 150,000 Fibre Kilometre (fkm) facility to manufacture Optical

Fibre from Quartz Preforms, thus becoming one of the first Indian Companies to set up its own fibre manufacturing unit. This

step proved very opportune and insulated the Company against raw material shortages and price fluctuations in the global market.

The year also saw a significant cable capacity increase to 13,708 ckm which was further raised to a whopping 33,222 ckm in

1998-99.

1998-99 the Company further realigned its focus and hived off its PVC division, thus concentrating exclusively on the manufacture

of Fibre Optics. In continuance of its realigned focus, Aksh also acquired the OFC Plant of CMI, enhancing the cable capacity

to 50,358 ckm.

The Company also succeeded in benchmarking quality and innovation standards with achieving the highly coveted certification by

the Underwriter Laboratories of the US (UL Certification).

Taking another leapfrog step towards backward integration last year, Telecords (India) Pvt. Ltd. (TIPL) merged with Aksh for the

manufacture of FRP Rods with an installed capacity of 100,000 km per annum.

The backward integration strategy has not only helped AKSH become a highly competitive and a significant industry player but

has also made it the only integrated Cable, Fibre and FRP Producer worldwide. Add to this, a number of strategic partnerships,

value addition through a highly skilled team, and you have a Company that has the capability to deliver its promise of sustained

growth with stability, a very critical factor in todays environment.

The current status and growth of AKSH becomes clearer if seen in the light of the industry and the operating environment.

The ongoing reforms in the Telecom Sector coupled with a dynamic and friendly regulatory environment has brought the Optical

Fibre Industry at the threshold of a new revolution.

With the huge potential for high bandwidth, low cost rate of information, low mass and the ability to provide a truly integrated

convergence scenario, Optical Fibre networks are interlinked with the future of any economy and its people.

Keeping the above in mind, AKSH, a Company committed to benchmarking Indias future, is poised towards dynamic growth on

its way to becoming a leading global player.

INDUSTRY STRUCTURE AND DEVELOPMENTS:

DEMAND SUPPLY

During the year under review, the Global Optical Fibre (OF) industry, has witnessed a large demand-supply gap, sometimes

at 35% of demand. The growth in demand is a direct function of:

Data traffic having exceeded voice traffic.

Increased demand for higher data rate fibres.

Increase in route-km and fibre count.

Expansion of Optical Fibre closer to the subscriber Fibre Reaching Homes.

Optical Fibre segment is witnessing a higher growth rate of 92%. The same is expected to rise at an even higher rate in

the times to come. While Global demand is likely to grow at a Compounded Annual Growth Rate (CAGR ) of over 30%,

Indian demand is expected to grow by 42% CAGR in the next 5 years. Reasons for higher domestic demand are:

Aksh Optifibre Limited

Growth in domestic long-distance (DLD) network of BSNL and private telecom service operators. (The DLD segment was

opened to private participation in 2000-2001).

Expected increase of OFC penetration in intra-city networks of BSNL and MTNL, as well as increased installation by providers

of broadband access networks, such as ISPs and large cable TV Companies.

Estimated increase in average fibre count from 17 in 2000-2001 to 31 by 2004-2005.

The Government has announced the policy to end the monopoly of VSNL in International voice communication services

by March 2002.

In 2000-2001, total orders of Optical Fibre Cables, placed by BSNL were lower at 5,40,000 fkm against 8,82,000 fkm

in 1999-2000. This was mainly because of the inability of OFC producers to supply the cable due to shortage of optical

fibre during the year. In 2000-2001, off-take of OFC by private operators (such as Reliance, PowerGrid, Railways, Bharti,

GAIL, etc.) is estimated at 5,04,720 fkm (as compared to 1,96,560 fkm in 1999-2000)

This worldwide increase in demand resulted in a steep rise in OF prices, from approx. US$ 35-40 per fkm in April 2000

to US$ 90-100 in March 2001. This has prompted all the major players to firm up large investment plans. Many cable

producers in India have also decided to integrate backwards into the manufacture of Optical Fibre.

With strong demand growth expected in Fibre Optics, there is a major requirement for an expansion in the raw materials

for fibre manufacturing. Major players in the free market supply of Preforms, like Shin-Etsu, Japan, and Heraeus of Germany,

are expanding their capacities to meet the growing demand. Shin-Etsu is doubling its Preform capacity from 12 mn fkm to

24 mn fkm.

KMI Fibre Optics Marketing Intelligence News, a world leder in Fibre Optics Research, estimates that India will become the

fifth-largest consumer of OF by 2003 after US, China, Japan and Brazil.

STRUCTURAL CHANGES IN THE INDUSTRY

The following changes would impact the dynamics of the market in the coming years:

Corporatisation of BSNL

Increasing private participation

Consolidation of ownership among cable companies

SWOT ANALYSIS OF AKSH:

Strengths

Largest Capacity to manufacture Optical Fibre Cable in India

Procurement of contracts for Preforms, Nylon-12, Aramid yarn

Ability to draw Fibre

Proposed backward integration into Preforms

Backward integration to manufacture FRP Rods

Worlds largest FRP Rod capacity by year 2002

Lowest cabling cost in India

Strong relations with the raw material suppliers

Record of innovations and quality benchmarks

Ability to attract and retain best talent in the industry

Sole player in India focusing only on Optical Fibre

People driven organisation with highly innovative HR practices

Weaknesses

Absence of capability to manufacture Preforms presently

Opportunities

Increasing bandwidth demand

Increasing numbers of fibre per cable due to networks reaching closer to the consumer

Entry barriers imposed by supply side constraints in Preforms

Threats

Supply side constraints

Shortage of trained manpower in the industry

Numerous Fibre producers with idle drawing capacity

Aksh Optifibre Limited

SEGMENT-WISE OR PRODUCT-WISE PERFORMANCE

PRICE REALISATIONS:

The price realisations on BSNLs OFC tender applicable to supplies in the last quarter of 2000-01, increased significantly to

Rs.8,422 per fkm of cable, as compared to Rs.3,475 per fkm in 1999-2000. For Aksh, price realisation for OFC has increased

from Rs.37,742 per ckm, to Rs.51,252 per ckm in the year 2000-01.

For the industry, average prices of Optical Fibre increased significantly from Rs.1,500 per fkm to Rs.4,000 per fkm in

2000-01. For Aksh, price realisation has increased from Rs.2,300 per fkm last year to Rs.3,560 per FKM in the year

2000-01, keeping with the international trends. The prices in the cash market are expected to remain higher than those for

contractual purchases.

Aksh Responds to Changing Environment :

Aksh proposes to meet the environmental demands in the following manner :

1.

Rapidly scaling up the production capacity for Optical Fibre. A new project for manufacturing 4 million fkm of Optical

Fibre as well as 5,00,000 kms of FRP Rods is being put up at Ringus. This represents the largest capacity of FRP rods

manufactured worldwide.

2.

Long-term Preform contracts have been signed with Shin-Etsu Chemicals Corporation Ltd., Japan, arguably the largest

and the best quality manufacturer of Preforms worldwide.

3.

Pilot plant for manufacturing Preforms from core-rods has been ordered. Two out of three machines have been received

and are operational. The idea is to simultaneously assimilate Preform manufacturing technology.

4.

Attempt at opening up Fibre-To-The-Home (FTTH) market is being done so that future demand is driven by this new segment,

where Aksh has unique strengths of possessing technology for reducing costs of FTTH phenomenally.

Disclosure Practices :

Aksh has become the first Company in India to present a Monthly Update, drived from Audited financial results of its operations.

RISKS & CONCERNS

Supply may catch up with Demand:

Global players are increasing their OF Capacities. However, we expect the demand to outplace supply as opticalisation

is shifting from a backbone network to Last-mile and other Networks, which would sustain high-demand growth.

Price hikes may not sustain:

Surge in OF Prices may not grow in future. However, the current demand-supply gap suggests further increases, though

in moderate measures. Also, even if prices stabilise at the current levels, it will be beneficial.

Project Delays

Any delays in the projects would hamper growth prospects. However, at the worst, it can result only in delay in earning

growth. Nevertheless, Current Progress suggests that we would be able to stick to the targeted schedule.

OF may become a commodity:

As technology is changing at a brisk rate, if Technological compatibility is not adhered to, the OF may become like

a Product and will suppress the Growth of the Company. However, the Company with its Research & Development and

various Innovative measures, will always be inclined towards higher technological products.

We believe that the growth prospects outweigh the risks and the concerns.

INTERNAL CONTROL SYSTEMS AND THEIR ADEQUACY

Aksh has a proper and adequate system of internal controls to ensure that all assets are safeguarded and protected against loss

from unauthorised use or disposition, and that transactions are authorised, recorded and reported correctly.

The internal control system is supplemented by an exhaustive programme of internal audits, review by management, and documented

policies, guidelines and procedures. The internal control system is designed to ensure that the financial and other records are reliable,

for preparing financial statements and other data, and for maintaining accountability of assets.

The Companys business ethics policy is an integral part of the internal control system. The policy sets forth the managements

commitment to conduct business with the highest ethical standards and in conformity with applicable laws. The business ethics policy

also requires that the documents supporting all transactions clearly describe their true nature and that all transactions be properly

reported and classified in the financial records.

Aksh Optifibre Limited

DEVELOPMENTS IN HR

During the year, 115 member joined the Aksh family. There was continuous focus on organisational development and various training

programmes. Visionary exercises were conducted to ensure that all employees were involved in achieving future goals. Your Companys

efforts in the last two years in the area of Human Resource developments, has made Aksh a Preferred Employer, attracting more

and more talented professionals. The Companys HR practices are in line with the fast-changing world of todays work environment.

FINANCIAL PERFORMANCE COUPLED WITH OPERATIONAL PERFORMANCE

The Financial Statements have been prepared in compliance with the requirements of the Companies Act, 1956. The Company

also had its financial results recast in accordance with U.S.-GAAP, for the years from 1997-98 to 2000-2001, the copy of which

can be provided on request, received from any member in writing. The management of Aksh accepts responsibility for the integrity

and objectivity of these financial statements, as well as for various estimates and judgements used therein. In addition to the historical

information contained herein, the following discussion includes forward-looking statements which involve risks and uncertainties,

including but not limited to, risks inherent in the Companys growth strategy, dependence on certain clients, dependence on availability

of qualified technical consultants, and other factors discussed in this report.

A. FINANCIAL CONDITION

1 . Share Capital

The Company has, at present, only one class of shares. During the year 91,400 Redeemable preference shares were

converted into 18,28,000 Equity Shares of Rs.5/- each. In addition, 3,65,000 Equity Shares of Rs.5/- each were allotted

to Aksh Employees Welfare Trust. Further, the Company also came out with the IPO and allotted 59,68,950 Equity

Shares of Rs.5/- each. The Shares of the Company are listed on Jaipur Stock Exchange Ltd, the Stock Exchange, Mumbai

and National Stock Exchange of India Ltd. The Company has also issued 16,60,942 Equity Shares of Company to the

Members of Telecords (India) Pvt. Ltd. consequent to Merger.

2 . Reserves and Surplus

The reason for net change in the share premium account of Rs.37,28,60,201 during the year is as per the details given

below :

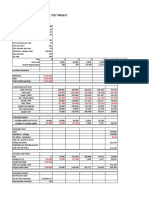

Particulars

No. of Shares

Premium

per share

Public Issue

59,68,950

55

RPS (Balance conversion premium at

IPO price) ** (Rs.20/- per share received

in the last year).

18,28,000

35 **

Aksh Employees Welfare Trust

Transferred from Telecords (India) Pvt. Ltd.

on account of Merger

Sub Total

Less : Public Issue expenses written off

Total

Amount

32,82,92,250

6,39,80,000

3,65,000

7.50

27,37,500

39,68,000

39,89,77,750

2,61,17,549

37,28,60,201

** As per the terms of the issue of RPS, additional premium has been received from RPS holders being differential of

conversion price and IPO price.

During the year, the Company transferred the Profit of Rs.1,92,00,000 to the General Reserve, after providing for dividend

payment of Rs.5,50,91,352 (Rs.33053460 (Interim) + Rs.22037892 (Proposed Final) and dividend tax of Rs.96,18,628.

In addition, Rs.21,33,491 has been transferred from Telecords (India) Pvt. Ltd on account of Merger.

3.

Fixed Assets

During the year, the Company capitalised Fixed Assets worth Rs.11,17,73,352 including assets acquired on merger of

Telecords (India) Pvt. Ltd. with the Company. At the year end the Gross Block was Rs.10,81,72,096 net of old office

Equipment, Plant & Machinery and Vehicles worth Rs.36,01,256.

The capital work-in-progress as on year ended 31st March, 2001 and 2000, represents advances paid towards acquisitions

of fixed assets and the cost of assets not put to use.

Aksh Optifibre Limited

4 . Investments

During the year, company has invested an amount of Rs.9045 towards National Saving Certificate (Transferred on account

of Merger) and the same stood Rs.3000 during the previous year (transferred on account of acquisition of CMI Ltd,

OFC division). The Company has also made a provision of Rs.11,30,129 for diminution in value of quoted investments.

5 . Sundry Debtors

Sundry Debtors amounts to Rs.29,88,80,589 as at March 31, 2001, as compared with Rs. 14,20,65,877 as at March

31, 2000. These debtors are considered good and realizable. The debtors as a percentage of total turnover is 20.96%

for the year ended 31st March, 2001 as compared with 14.18% for the previous year. The increase in the debtors is

on account of more sales made in the month of March, 2001.

The classification of debtors is as under.

Current Year

(Rs. in Lacs)

Previous Year

153.45

4.55

76.50

8.45

1898.56

925.29

932.24

410.42

Debts outstanding for a

Period exceeding six months

Govt.

Non Govt.

Others

Govt.

Non Govt.

6 . Loans and Advances

Advances recoverable in cash or kind or for value to be received, are primarily towards amounts paid in advance for

value and services to be received in future. Loans represent loans to Aksh Employee Welfare Trust amounting to Rs.97,98,539

due to ESPS launched by the Company. Prepaid Taxes amounting to Rs.1,67,72,350 represents advance income tax and

TDS.

7 . Current Liabilities

Sundry Creditors represents the amount payable to vendors for the supply of goods. Creditors for expenses represents

the amounts accrued for various other operational expenses. Advances received from customers denotes monies received

for the delivery of future services.

8 . Provisions

Provisions for taxation represents estimated income tax liabilities. The provisions and the advance tax payments would

be set off upon assessment. The proposed dividend and provision for tax on dividend represent the final dividend

recommended to the shareholders by the Board and would be paid after the Annual general Meeting, upon approval

by the shareholders.

B.

RESULTS FOR OPERATIONS

1. Turnover

During the current fiscal , the Turnover has increased from 100.17 Crores to Rs. 142.55 Crores, registering a rise of

42.30% per cent. The main drivers for this increase in Turnover are increased price of Optical Fibre Cable, higher demand

for Optical Fibre, exports sales and optimum utilisation of in-house fibre.

Miscellaneous Income

During the year, the Company has earned interest on inter corporate and fixed deposits amounting to Rs.1,70,04,178

and duty drawback of Rs.61,51,180 on account of Exports. The miscellaneous income has increased by 18.69% compared

to previous year.

2 . Expenditure

2.1 Manufacturing Expenses

The Manufacturing expenses have decreased as a percentage of sales due to the following:

Low cost of self-made Fibre.

Steep rise in prices of optical Fibre Cableparticularly in the fourth quarter.

In-house production of FRP rods, due to the merger

Aksh Optifibre Limited

2.2 Administrative, Selling and Other Expenses

Administrative expenses accounts for 8.8% and 4.71% of total turnover for the year ended 31st March, 2001, and

2000. The expenses have gone up as a % of turnover due to higher expenses being incurred on account of professional

charges being paid for creating MIS and Budgetary Control System, creating long term relationship with the suppliers

and vendors, building up domestic and export market and new recruitments taking place due to expansion activities.

2.3 Human Resource Cost

The Human Resource Cost (inclusive of Manufacturing and Administrative) represents 3.16 % and 2.51% of total

Turnover for the year ended 31st March, 2001 and 2000 respectively.

3.

Depreciation

The Company provided a sum of Rs. 2,32,15,475 towards depreciation for the year ended March 31, 2001 as against

Rs. 1,48,22,132 in the previous year. This increase is due to the additional plant & machinery brought during the year

on account of expansion project.

4.

Provision for Tax

The Company has provided for its tax liability. The present Indian Corporate tax rate is 35% plus surcharge of 13%.

The Company is entitled for Income Tax benefits under Section 80 IB of the Income Tax Act, 1961, for Plant I & III

and under Section 80 HHC of the said Act for export sales.

The Company has provided a sum of Rs.1,80,00,000 and Rs.55,00,000 during the years ended March 31, 2001 and

2000, for the tax liability of earlier years, consequent to the finalization of the tax assessment.

5.

Net Profit

The net profit after tax of the Company amounted to Rs. 19,11,50,148 which represents a Net Profit ratio of 13.40

% as against 5.83 % last year. This indicates increase in operating margins and the same can be attributed to the reasons

as already specified above.

Vous aimerez peut-être aussi

- Indian Cable IndustryDocument30 pagesIndian Cable Industrykushal812Pas encore d'évaluation

- Finolex Cables LTD.: Company CapsuleDocument15 pagesFinolex Cables LTD.: Company CapsuleHeena KhetarpalPas encore d'évaluation

- HBL Power - Summary For Ar Fy 21-22Document6 pagesHBL Power - Summary For Ar Fy 21-22abhishekbasumallick0% (1)

- Business Process & Strategy For Fibre Optics NigeriaDocument25 pagesBusiness Process & Strategy For Fibre Optics Nigeriaomoyegun100% (1)

- Fiber Optic Cable Production-823233 PDFDocument67 pagesFiber Optic Cable Production-823233 PDFravikkotaPas encore d'évaluation

- Aksh Optifibre LimitedDocument10 pagesAksh Optifibre LimitedpushpkantsharmaPas encore d'évaluation

- Cable and Wiring Industry PakistanDocument4 pagesCable and Wiring Industry PakistanSauban JeelaniPas encore d'évaluation

- Top Cable Companies in India 2022 - Wire & Cable IndiaDocument59 pagesTop Cable Companies in India 2022 - Wire & Cable Indiaganesh kondikire100% (1)

- FinolexDocument16 pagesFinolexNeha Thakur100% (1)

- Market Feasibility Report-OfCDocument11 pagesMarket Feasibility Report-OfCShashank SaxenaPas encore d'évaluation

- Value Research Stock Advisor - Finolex Cables PDFDocument39 pagesValue Research Stock Advisor - Finolex Cables PDFksreddy956Pas encore d'évaluation

- McKinsey Telecoms. RECALL No. 12, 2010 - The Fiber FutureDocument63 pagesMcKinsey Telecoms. RECALL No. 12, 2010 - The Fiber FuturekentselvePas encore d'évaluation

- Fiber Development Index 2021 - OmdiaDocument48 pagesFiber Development Index 2021 - Omdiaashinlee123Pas encore d'évaluation

- Market: Third BUSINES Superbrands-2010-Final 6/1/11 12:38 PM Page 74Document2 pagesMarket: Third BUSINES Superbrands-2010-Final 6/1/11 12:38 PM Page 74Aman GargPas encore d'évaluation

- RR KabelDocument2 pagesRR Kabeldua.punitPas encore d'évaluation

- Power TodayDocument12 pagesPower Todaydiptenb4Pas encore d'évaluation

- Wimax: India Broadband & Wimax Market AnalysisDocument7 pagesWimax: India Broadband & Wimax Market AnalysisMaansi BhasinPas encore d'évaluation

- Mega Project Profiles PVC Manufacturing KSIDC IPDocument6 pagesMega Project Profiles PVC Manufacturing KSIDC IPAgasthya BPas encore d'évaluation

- Fiber Development Index 2022 - OmdiaDocument43 pagesFiber Development Index 2022 - Omdiaashinlee123Pas encore d'évaluation

- Trends in Bandwidth MarketDocument11 pagesTrends in Bandwidth MarketŚáńtőśh MőkáśhíPas encore d'évaluation

- West Coast Optilinks-Company ProfileDocument9 pagesWest Coast Optilinks-Company ProfileAncient IntellectPas encore d'évaluation

- HFCL Annual Report 2016 17Document204 pagesHFCL Annual Report 2016 17abchbvPas encore d'évaluation

- Prysmian Group Financials: Pankaj BaidDocument37 pagesPrysmian Group Financials: Pankaj BaidPankaj Kumar BaidPas encore d'évaluation

- Teracom Mehta Bhavesh 2013151Document3 pagesTeracom Mehta Bhavesh 2013151Mehtabhavesh19Pas encore d'évaluation

- JFCDocument9 pagesJFCVipul PariharPas encore d'évaluation

- STL - Presentation Oct 13, 2014.V1Document29 pagesSTL - Presentation Oct 13, 2014.V1SUKHSAGAR1969Pas encore d'évaluation

- Optical Fibre CableDocument21 pagesOptical Fibre Cableanon_982742681Pas encore d'évaluation

- International CaseDocument26 pagesInternational CaseAnshu AhujaPas encore d'évaluation

- Industrial Visit ReportDocument6 pagesIndustrial Visit ReportgaureshraoPas encore d'évaluation

- Optical Components and Their Role in Optical NetworksDocument4 pagesOptical Components and Their Role in Optical NetworksManveen KaurPas encore d'évaluation

- Value Research Stock Advisor - Sterlite TechnologiesDocument32 pagesValue Research Stock Advisor - Sterlite TechnologiesjesprilePas encore d'évaluation

- PTCL Audit ReportDocument17 pagesPTCL Audit ReportSana PervezPas encore d'évaluation

- Australian Japan CableDocument33 pagesAustralian Japan CableSourabh Dhawan100% (2)

- FINAL PROJECT OF BP ON PTCL For PrintingDocument27 pagesFINAL PROJECT OF BP ON PTCL For PrintingSaad AzharPas encore d'évaluation

- Earnings Presentation Q3 FY23 VFDocument32 pagesEarnings Presentation Q3 FY23 VFMohit MotwaniPas encore d'évaluation

- Polysilicon in Solar EnergyDocument23 pagesPolysilicon in Solar EnergyKishore KrishnaPas encore d'évaluation

- SMMDocument11 pagesSMMAnonymous Nr6XSvkqjPas encore d'évaluation

- Pakistan Telecommunication Authority: Headquarters, F - 5/1 IslamabadDocument24 pagesPakistan Telecommunication Authority: Headquarters, F - 5/1 IslamabadThe RevealerPas encore d'évaluation

- Power Cables: Electrical Power and Industrial Cable, Electrical Wire, PVC Wire and CablesDocument65 pagesPower Cables: Electrical Power and Industrial Cable, Electrical Wire, PVC Wire and CablesYonatanPas encore d'évaluation

- Steel - February 2017 IREPDocument54 pagesSteel - February 2017 IREPChinmayiPas encore d'évaluation

- PCI SDN BHD (Case Study)Document7 pagesPCI SDN BHD (Case Study)angelPas encore d'évaluation

- NWEG5111 EaDocument5 pagesNWEG5111 Eanzfpbte564Pas encore d'évaluation

- Strategic Change and Flexibility Case of Moser Baer: Submitted By: Padam Tewani Pravir Saxena Sumit Tyagi BhavikaDocument19 pagesStrategic Change and Flexibility Case of Moser Baer: Submitted By: Padam Tewani Pravir Saxena Sumit Tyagi Bhavikapadamtewani71Pas encore d'évaluation

- Bel Project & Training ReportDocument91 pagesBel Project & Training Reportvitrone2267% (3)

- BPS Industry AirblueDocument13 pagesBPS Industry AirblueHamza Bin TahirPas encore d'évaluation

- Finolex Industries LTD: ContentDocument43 pagesFinolex Industries LTD: Contentlakkannad0% (1)

- KEI Traning and DevelopmentDocument80 pagesKEI Traning and DevelopmentgoswamiphotostatPas encore d'évaluation

- FinolexDocument56 pagesFinolexRadhey JangidPas encore d'évaluation

- 5G Is Here, But Where 'S The Fibre?Document6 pages5G Is Here, But Where 'S The Fibre?Mohammed Aaquib MubeenPas encore d'évaluation

- Analysis of Vodafone Essar IndiaDocument34 pagesAnalysis of Vodafone Essar Indiachapal07Pas encore d'évaluation

- Airtel Acquiring Tulip TelecomDocument10 pagesAirtel Acquiring Tulip TelecomSankalp ChughPas encore d'évaluation

- Finecab Information DocumentDocument37 pagesFinecab Information DocumentAnirudhPas encore d'évaluation

- Global Optical Fibre Cleaver Industry Report 2015Document6 pagesGlobal Optical Fibre Cleaver Industry Report 2015api-282708578Pas encore d'évaluation

- Ericsson Tough Cable CatalogueDocument77 pagesEricsson Tough Cable CatalogueAbdul HameedPas encore d'évaluation

- Investor-Presentation 17.02.2020Document34 pagesInvestor-Presentation 17.02.2020sub_zer01Pas encore d'évaluation

- Project Report Final1.1Document74 pagesProject Report Final1.1adsfdgfhgjhkPas encore d'évaluation

- Final Report 09-11Document43 pagesFinal Report 09-11Raghavendra Singh SinghPas encore d'évaluation

- DOCSIS Evolution and How 3.1 Will Change EverythingD'EverandDOCSIS Evolution and How 3.1 Will Change EverythingÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- TELECOM ORGANIZATIONS ADAPT IN A POST-COVID-19 REALITYD'EverandTELECOM ORGANIZATIONS ADAPT IN A POST-COVID-19 REALITYPas encore d'évaluation

- Investment Analysis and Portfolio ManagementDocument7 pagesInvestment Analysis and Portfolio Managementqari saibPas encore d'évaluation

- HPAIR Harvard 2015 HandbookDocument86 pagesHPAIR Harvard 2015 HandbookSiddhant PardeshiPas encore d'évaluation

- Chapter 16: Hybrid and Derivative SecuritiesDocument70 pagesChapter 16: Hybrid and Derivative SecuritiesJoresePas encore d'évaluation

- Corporate PersonalityDocument7 pagesCorporate PersonalityPrashant MeenaPas encore d'évaluation

- Dividend Policy Literature ReviewDocument11 pagesDividend Policy Literature ReviewAli100% (1)

- E-Mechanic Business PlanDocument40 pagesE-Mechanic Business PlanSana Jameel100% (1)

- Capital Budgeting Example ExcelDocument1 pageCapital Budgeting Example ExcelNgoc Hong DuongPas encore d'évaluation

- Runescape Insider To MillionsDocument51 pagesRunescape Insider To MillionsPaul CotePas encore d'évaluation

- AccontancyDocument144 pagesAccontancyNikhilPas encore d'évaluation

- Cross Border Transactions HandbookDocument232 pagesCross Border Transactions Handbookralphhvillanueva100% (2)

- Draft Deed of Trust Question 1b Equity CAT 1Document5 pagesDraft Deed of Trust Question 1b Equity CAT 1ANDIAPas encore d'évaluation

- Case 2 McDonalds RussiaDocument37 pagesCase 2 McDonalds Russiaashmit100% (1)

- Pgdba - Fin - Sem III - Capital MarketsDocument27 pagesPgdba - Fin - Sem III - Capital Marketsapi-3762419100% (1)

- KU MBA Syllabus 2013Document4 pagesKU MBA Syllabus 2013Vinod JoshiPas encore d'évaluation

- Content For Bridge CourseDocument19 pagesContent For Bridge CourseharipriyaPas encore d'évaluation

- Insolvency To Innovation: The Five-Year RecordDocument16 pagesInsolvency To Innovation: The Five-Year RecordGeorge RegneryPas encore d'évaluation

- Fair Trade Report South Africa FinalDocument41 pagesFair Trade Report South Africa FinalIvan FarárikPas encore d'évaluation

- Evaluation of Oil & Gas AssetsDocument14 pagesEvaluation of Oil & Gas AssetsRajat Kapoor100% (1)

- Getting Ready For Initial Margin (IM) Regulatory RequirementsDocument4 pagesGetting Ready For Initial Margin (IM) Regulatory RequirementsKathir KPas encore d'évaluation

- Handbookoflondon 00 PricuoftDocument490 pagesHandbookoflondon 00 Pricuoftchickenlickenhennypenny0% (1)

- Chapter - 5: Risk and Return: Portfolio Theory and Assets Pricing ModelsDocument23 pagesChapter - 5: Risk and Return: Portfolio Theory and Assets Pricing Modelswindsor260Pas encore d'évaluation

- Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for internship reportDocument2 pagesProposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for internship reportsourav4730100% (1)

- Understanding The Bad Bank - McKinsey QuarterlyDocument11 pagesUnderstanding The Bad Bank - McKinsey QuarterlyitsalmaitiPas encore d'évaluation

- Analysis of Life Insurance SectorLife Insurance CorporationDocument38 pagesAnalysis of Life Insurance SectorLife Insurance Corporationmayur9664501232Pas encore d'évaluation

- SII PIF Rating AgenciesDocument31 pagesSII PIF Rating AgenciesCP Mario Pérez LópezPas encore d'évaluation

- Money WiseDocument62 pagesMoney Wisejei liPas encore d'évaluation

- Chapter 4 Organization and Functioning of Securities MarketsDocument71 pagesChapter 4 Organization and Functioning of Securities Marketsditayohana100% (1)

- MA Case Question 11-72Document2 pagesMA Case Question 11-72guptarahul1992Pas encore d'évaluation

- Final Exam in Taxation AccountingDocument5 pagesFinal Exam in Taxation AccountingMarvin CeledioPas encore d'évaluation

- Comparative Analysia of MF Reported by ARCHANA.KDocument78 pagesComparative Analysia of MF Reported by ARCHANA.KMartha PraveenPas encore d'évaluation