Académique Documents

Professionnel Documents

Culture Documents

Amibroker Trend Lines

Transféré par

nmjahangir6469Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Amibroker Trend Lines

Transféré par

nmjahangir6469Droits d'auteur :

Formats disponibles

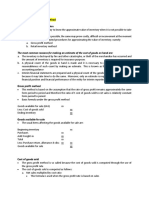

Amibroker Trend lines

Technical analysis is built on the assumption that prices trend. Trendlines are an important tool in

technical analysis for both trend identification and confirmation. A trendline is a straight line that connects

two or more price points and then extends into the future to act as a line of support or resistance. Many of

the principles applicable to support and resistance levels can be applied to trendlines as well.

Up Trendline

An up trendline has a positive slope and is formed by connecting two of more low points. The second low

must be higher than the first for the line to have a positive slope. Up trendlines act as support and indicate

that net-demand (demand less supply) is increasing even as the price rises. A rising price combined with

increasing demand is very bullish and shows a strong determination on the part of the buyers. As long as

prices remain above the trendline, the uptrend is considered solid and intact. A break below the up

trendline indicates that net-demand has weakened and a change in trend could be imminent.

Down Trendline

A down trendline has a negative slope and is formed by connecting two or more high points. The second

high must be lower than the first for the line to have a negative slope. Down trendlines act as resistance

and indicate that net-supply (supply less demand) is increasing even as the price declines. A declining

price combined with increasing supply is very bearish and shows the strong resolve of the sellers. As long

as prices remain below the down trendline, the downtrend is considered solid and intact. A break above

the down trendline indicates that net-supply is decreasing and a change of trend could be imminent.

Scale Settings

High points and low points appear to line up better for trendlines when prices are displayed using a semilog scale. This is especially true when long-term trendlines are being drawn or there has been a large

change in price. AmiBroker allows to set the scale as arithmetic or logarithmic (semi-log). An arithmetic

scale displays incremental values (5,10,15,20,25,30) evenly as they move up the y-axis. A $10 movement

in price will look the same from $10 to $20 or from $100 to $110. A semi-log scale displays incremental

values in percentage terms as they move up the y-axis. A move from $10 to $20 is a 100% gain and

would appear to be a much larger than a move from $100 to $110, which is only a 10% gain. Please

remember however that straight line in the log chart is no longer straight in the linear scale, so trend lines

drawn in one scale may look strange in the other scale.

Validation

It takes two or more points to draw a trendline. The more points used to draw the trendline, the more

validity attached to the support or resistance level represented by the trendline. It can sometimes be

difficult to find more than 2 points from which to construct a trendline. Even though trendlines are an

important aspect of technical analysis, it is not always possible to draw trendlines on every price chart.

Sometimes the lows or highs just dont match up and it is best not to force the issue. The general rule in

technical analysis is that it takes two points to draw a trendline and the third point confirms the validity.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Case ALDIDocument2 pagesCase ALDIerp_sitepuPas encore d'évaluation

- Phelps Lecture2006Document26 pagesPhelps Lecture2006Tuan HoangPas encore d'évaluation

- Buzila DDocument5 pagesBuzila DDragoi CosminPas encore d'évaluation

- Handout 1 - Warranty ProblemsDocument6 pagesHandout 1 - Warranty ProblemsAnonymousScribPas encore d'évaluation

- 2267 SampleDocument94 pages2267 SampleChetna Shetty Dikkar67% (3)

- Management of Business TextbookDocument83 pagesManagement of Business TextbookSammy Wizz100% (1)

- Group8 - SectionA - Ninjacart Marketing PlanDocument8 pagesGroup8 - SectionA - Ninjacart Marketing PlanRitu Mendiratta100% (1)

- Additional Work For Skylight Glazing (Rate Analysis)Document5 pagesAdditional Work For Skylight Glazing (Rate Analysis)civilsmvdime1965Pas encore d'évaluation

- Ocean Carriers Capesize Ship Project AnalysisDocument10 pagesOcean Carriers Capesize Ship Project AnalysisScottMeltonPas encore d'évaluation

- Assignment II: Maple Case Study: Strategic ChoicesDocument4 pagesAssignment II: Maple Case Study: Strategic ChoicesSudan KhadgiPas encore d'évaluation

- Survey QuestionnaireDocument2 pagesSurvey QuestionnaireCarla Pabuaya100% (2)

- Amibroker Price Charts: Line Chart Traditional Bar ChartDocument1 pageAmibroker Price Charts: Line Chart Traditional Bar Chartnmjahangir6469Pas encore d'évaluation

- Amibroker Major Candlestick Chart FormationsDocument1 pageAmibroker Major Candlestick Chart Formationsnmjahangir6469Pas encore d'évaluation

- Women Entrepreneurs Issues and Challenges of Credit Access - Support Services Bangladesh Scenario 4Document1 pageWomen Entrepreneurs Issues and Challenges of Credit Access - Support Services Bangladesh Scenario 4nmjahangir6469Pas encore d'évaluation

- Women Entrepreneurs Issues and Challenges of Credit Access - Support Services Bangladesh Scenario 5Document1 pageWomen Entrepreneurs Issues and Challenges of Credit Access - Support Services Bangladesh Scenario 5nmjahangir6469Pas encore d'évaluation

- Women Entrepreneurs Issues and Challenges of Credit Access-Support Services Bangladesh Scenario 2Document2 pagesWomen Entrepreneurs Issues and Challenges of Credit Access-Support Services Bangladesh Scenario 2nmjahangir6469Pas encore d'évaluation

- Women Entrepreneurs-Bangladesh ScenarioDocument1 pageWomen Entrepreneurs-Bangladesh Scenarionmjahangir6469Pas encore d'évaluation

- Women Entrepreneurs Issues and Challenges of Credit Access - Support Services Bangladesh Scenario 3Document1 pageWomen Entrepreneurs Issues and Challenges of Credit Access - Support Services Bangladesh Scenario 3nmjahangir6469Pas encore d'évaluation

- Women Entrepreneurs: Issues and Challenges of Credit Access-IntroductionDocument2 pagesWomen Entrepreneurs: Issues and Challenges of Credit Access-Introductionnmjahangir6469Pas encore d'évaluation

- Volume Price or Spread Analysis Part 7Document2 pagesVolume Price or Spread Analysis Part 7nmjahangir6469Pas encore d'évaluation

- Women Entrepreneurs Support Services-Bangladesh ScenarioDocument1 pageWomen Entrepreneurs Support Services-Bangladesh Scenarionmjahangir6469Pas encore d'évaluation

- Volume Price or Spread Analysis Part 5Document1 pageVolume Price or Spread Analysis Part 5nmjahangir6469Pas encore d'évaluation

- Volume Price or Spread Analysis Part 6Document3 pagesVolume Price or Spread Analysis Part 6nmjahangir6469100% (1)

- Study of Chart PatternsDocument7 pagesStudy of Chart Patternsnmjahangir6469Pas encore d'évaluation

- Centrifugal Pumps: Installation and Use Performance RangeDocument10 pagesCentrifugal Pumps: Installation and Use Performance Rangenmjahangir6469Pas encore d'évaluation

- Vital Star - 8322985 - General Cargo: Ship InfoDocument1 pageVital Star - 8322985 - General Cargo: Ship Infonmjahangir6469Pas encore d'évaluation

- Report On Demolition SalesDocument8 pagesReport On Demolition Salesnmjahangir6469Pas encore d'évaluation

- KPL Swing - Breakout Trading SystemDocument2 pagesKPL Swing - Breakout Trading Systemnmjahangir64690% (2)

- National Income Imp QDocument4 pagesNational Income Imp QamulyavatsPas encore d'évaluation

- On Accounting Flows and Systematic RiskDocument10 pagesOn Accounting Flows and Systematic RiskKinshuk AcharyaPas encore d'évaluation

- Job Order Costing MethodsDocument31 pagesJob Order Costing MethodszamanPas encore d'évaluation

- Daily Edible Oil Analysis Dt.22112019Document7 pagesDaily Edible Oil Analysis Dt.22112019Riksan RiksanPas encore d'évaluation

- Graeber Summary Chapter 11Document5 pagesGraeber Summary Chapter 11api-291732914Pas encore d'évaluation

- PRICING EXERCISES FOR B2B (5 Probs)Document4 pagesPRICING EXERCISES FOR B2B (5 Probs)Pravish KharePas encore d'évaluation

- Nil Hill Corporation Has Been Using Its Present Facilities atDocument2 pagesNil Hill Corporation Has Been Using Its Present Facilities atAmit PandeyPas encore d'évaluation

- BombardierDocument22 pagesBombardierDr. Sadaf khanPas encore d'évaluation

- Life Cycle Banknotes - en PDFDocument15 pagesLife Cycle Banknotes - en PDFFranciscoCordovaPas encore d'évaluation

- Reliance Infrastructure 091113 01Document4 pagesReliance Infrastructure 091113 01Vishakha KhannaPas encore d'évaluation

- Ic 34Document37 pagesIc 34PankajaPas encore d'évaluation

- MTF of Wheat - 5Document18 pagesMTF of Wheat - 5chengadPas encore d'évaluation

- Research Report CowenDocument14 pagesResearch Report CowenzevioPas encore d'évaluation

- Linear Equation Dinesh KumarDocument20 pagesLinear Equation Dinesh KumarVibhu GoelPas encore d'évaluation

- INDIAN COAL SECTOR OVERVIEWDocument154 pagesINDIAN COAL SECTOR OVERVIEWSiju Alex CherianPas encore d'évaluation

- Dissertation: Analysis, Impact and The Future of CryptocurrenciesDocument41 pagesDissertation: Analysis, Impact and The Future of Cryptocurrenciesjoseph mainaPas encore d'évaluation

- Topic 3-1Document20 pagesTopic 3-1Qasim AkramPas encore d'évaluation

- Separation of Ownership and ControlDocument4 pagesSeparation of Ownership and ControldishaPas encore d'évaluation

- Estimate Inventory Value Using Gross Profit MethodDocument2 pagesEstimate Inventory Value Using Gross Profit MethodJoanne Rheena BooPas encore d'évaluation