Académique Documents

Professionnel Documents

Culture Documents

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Transféré par

Shyam SunderDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

Date : 27.05.

2016

The Manager

The Manager

Corporate Relationship Department

Listing Department

BSE Limited

National Stock Exchange of lndia Limited

Floor 25, Phiroze Jeejeebhoy Towers

Exchange Plaza, Bandra Kurla Complex

DalalStreet

Bandra (East)

Mumbai

Mumbai - 400 051

400 001

BSE Scrip Code- 533267

NSE Scrip Symbol: CANTABTL and

Series: EQ

Fax No.: 022-2272 3121 I 127

8t

SS7

tZgS4

Fax No. : 022-26598237 138

Sub: outcome of the Board Meetinq herd on 2sth Dav of Mav 2016

oursuant to Reoulation 30 of the SEBI Listinq Requtations

Dear Sir,

Pursuant to Regulation 33 of the Listing Regulations, please find attached herewith Audited Financial Results

for

the quarter ended 31"t March 2016 and Audited Financial Results for the year ended 31"1 March 2016. The said

results were reviewed by the Audit Committee and approved by the Board of Directors at their Two Hundred

Eightieth meeting hetd on Friday, the 27th Day of May 2016.

Thanking you,

Yours faithfully,

ntabi! Retaillndia

.;\

d\

\;

Encl.:

1.

Au-dit Report of statutory auditors on the Audited Financial Results of the Company for the year ended

31't March 2016.

2.

Form A pursuant to Regulation 33 under sEBl (LODR), Regulations, 2015.

CANTABIL RETAIL IN DIA LTD.

B-.l6, Lowrence Rood lnd. Areo, New Delhi - I l0 035. Tel : 9l -11-27156381 /82 Telefox: 9l-l I -27156383

e-moil info@contobilinternotiono l.com Website : www.contobili nlernotionol.com

CIN No. L7 4899Dt1989P1C034995

:

CANTABIL RETAIL INDIA LIMITED

CIN : L74899DL1989PLC034995 web-site : www.cantabilinternational.com

Regd. Office: B-16,Lawrence Road lndustrial Area, Delhi - 110035. 'lel :91-11:27156381/82 Telefax : 91-11-27156383

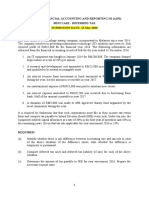

STATEMENT OF STANDALONE AUDITED FINANCIAL RESULTS FOR THE QUARTER/YEAR ENDED 31ST MARCH. 2016

(Rs. ln Lacs)

Preceeding 3

Months ended

31.12.2015

Corresponding 3

ended

31 .03.2016

(Audited)

(Unaudited)

(Audited)

3 Months

Particulars

S. No.

(b)

Net Sales/lncome from Operations(Net of Excise Duty)

4,071.29

4,563.13

3,799.25

(5.23)

15,487.92

',3,829.17

25.89

4,589.02

3,794.03

38.59

15.526.52

38.60

13.867.77

(a)

Cost of Materials consumed

1,009.01

1,023.49

818.93

4,253.30

3,813.64

(b)

Purchase of stock-in-trade

308.98

1,041.93

588.20

1,936.19

2,076.80

Change

in inventories of finished goods, work

in

(165.32)

(87.44l,

(47.48)

(1,069.09)

progress and stock-in-trade

{d) Employee benefits expense

352.27

657.29

547.22

478.23

2,206.05

(e)

Depreciation and amortisation expense

192.34

151.75

172.38

611.75

636.47

(f)

Job Work Charges

403.02

566.58

414.49

1,746.18

1,895.87

(g)

(h)

Rent

394.99

381.99

335.22

1,461.37

1,305.17

Discounts

123.06

61.26

395.20

390.51

931.94

(i)

Other Expenses

493.40

557.73

482.02

3,934.37

4,166.64

3,597.24

1,959.09

14,516.95

1,737.23

13,072.18

422.39

196.7S

Total Expenses

Profit ,rom Operations before Other lncome, finance cosl

Cther lncome

Profit from ordinary activites before finance cost

138.83

Finance Cost

Profit from ordinary activites after finance cost but before

exceptional ltems(5-6)

Exceptional items

)rofit / (Loss) from ordinary activities before Tax (7+8)

10

[ax Expenses

139.84

422.39

129.88

128.24

9.9

b) Deferred Tax (Assets)/Liability

11

tlet ProfiU (Loss) from ordinary activities after Tax (9-10)

12

ixtraordinary ltems (net of tax)

13

tlet ProfiU (Loss) for the period (11+12)

raid-up equity share capital (Face Value of Rs. 10/-)

Reserves excluding Revaluation Reserves as per balancr

sheet of previous accounting year

(i) Earnings Per Share (EPS)(before extraordinar)

items)(Face value of Rs.10/- each) (not annualised) :

Earnings

294.15

0.88

10.84

a) Current Tax (MAT)

(ii)

4.20

1.00

anc

exceptional ltems (3+4)

16

(Audited)

1.91

15

(Audited)

4,073.20

Other Operating lncome

and exceptional ltems (1-2)

14

Previous Year

ended

31.03.2015

Total lncome from Operations (net)

Expenses

(c)

Year ended

31.03.2016

lncome from Operations

(a)

Months endod

31.03.2015

294.15

200.99

1

1,009.57

'1,744.17

795.59

'1,79

16.92

1,011.3

812.50

18.90

497.35

494.94

82.09

514.00

317.56

(0.80)

3.55

(60.23

81.28

517.56

257.34

37.92

2,88

35.0

(42.59)

16.3!

(8.751

(27.35)

(31.77

50.55

242.71

90.0:

506.98

289.11

50.55

242.71

90.03

s06.98

289.11

1,632.76

1.632.7e

1,632.76

1,632.76

1.632.7e

6,115.8t

5,608.8(

'

(a) Basic

0.31

1.49

0.55

3.11

1.77

(b) Diluted

0.31

1.49

0.55

3.11

1.77

(a) Basic

0.31

1.49

0.55

3.11

't.77

(b) Diluted

0.3't

1.49

0.55

3.11

1.77

Per Share (EPSXafter

extraordinary

itemsxFace value of Rs.10/. each) (not annualised) :

tu$,#

"-"'#*q

CANTABIL RETAIL INDIA LIMITED

CIN : L74899DL1989PLC034995 web-site : www.cantabilinternational.com

Regd. Office: B-16, Lawrence Road lndustrial Area, Delhi - 110035. fel:91-11-27155381/82 Telefax : 91-11-27156383

Statement of Assets and Liabilities as on 31st March, 2016

(Rs. ln Lacs)

Sr. No.

PARTICULARS

As at 31.03.2016

As at 31.03.2015

AUDITED

AUDITED

EQUIry AND LIABILITIES

A

1

Shareholders Funds

(a) Share Capital

(b) Reserve & Surplus

Sub-total - Shareholders' Funds

2

7.748.64

7.241.65

438.33

40.19

549.30

576.32

'197.5'.1

157.90

1,185.14

774.4'.1

(a) Short-term borrowings

(b) Trade payables

2,902.08

3,449.87

1,653.85

(c) Other current liabilities

360.57

119.76

270.06

4,780.97

5,421.67

13,714.75

13.437.73

5,444.78

4,336.92

25.82

19.69

Sub-total - Non-current liabilities

Current Liabilities

1,398.57

(d) Short{erm provisions

Sub-total - Current liabilities

TOTAL-EQUITY AND LIABILITIES

B

1,632.76

5,608.89

Non-Current Liabilities

(a) Long term Borrowings

(b) Other long-term liabilities

(c) Longterm provisions

1,632.76

6,1 15.88

47.89

ASSE TS

1

Non-Current Assets

(a) Fixed assets

(i) Tangible assets

(ii) lntangible assets

(iii) Capital work-in-progress

30.68

6.16

(b) Deferred tax assets (net)

(c) Long-term loans and advances

283.05

255.70

487.23

835.12

(d) Other non-current assets

372.16

620.46

6.643.71

6,074.06

Sub-total - Non-current assets

2

Current Assets

(a) Current lnvestments

(b) Inventories

(c) Trade Receivables

(d) Cash And Cash Equivalents

(e) Short-Term Loans And Advances

Sub-total - Current assets

TOTAL. ASSETS

21.64

1.64

5,825.76

5,898.50

950.43

1,022.84

't04.73

168.48

255.45

7,071.03

7,363.67

13.714.75

13,437.73

185.24

Notes:

1

The above financial results have been reviewed by the Auditors, recommened by the Audit Committee, approved and taken on record

by the Board of Directors at their respective meeting held on 27th May 2016

Company's revenue from Real Estate segment is less than minimum level required to be reported , therefore segment results are not

given as per Accounting Standard (AS) 17 "Segment Reporting" prescribed by Companies (Accounting Standard) Amendment Rules

.

2.

2011.

ihe

figures of the Previous periods (quarter /year) have been regrouped/rearranged/reclassified wherever considered necessary.

For Cantabil Retail lndia Limited

PlSce: Delhi

Date: May 27,2016

(Vijay Bansal)

Chairman & Managing Director

DtN 01110877

The aforesaio Results have been filed with the Stock Exchanges under Regulation 33 of SEBI (Listing and Other Disclosures

Requirements) Regulations, 2015 and are also available on the Stock Exchange websites (www.bseindia.com & www.nseindia.com) and

on the Company's website www.cantabilinternational.com

SURESH & ASSOCIATES

CHARTERED ACCOUNTANTS

34, Bigjo's Tower, Netaji Subhash Place

Pitam Pura, Delhi-110034

Ph: 273569

6,

27

356917, 45058028

ax 273569 1 8

Email suresh_associates@redifimail.com, suresh_assocrates2002@yahoo com

SURESH K, GUPTA

SUNIL AGARWAL

B Com . FC.A

B Sc FCA

NARENDRAARORA

ASHATANEJA

AMIT KUMAR

B Sc., F.C.A

B Com., FC A.

BCom.ACA.

To Board of Directors of

M/s Cantabil Retail India Limited

we have audited the quarterly

financial results of cantabil

Retair India Limited for the

quarter ended 3lst March'

2016 and,the year to date

resurts for the period rrtAprir,

31't March, 2016 attached

2015 to

herewith,

suumittei--b, ,n. company pursuant

requirement of Regulation

_o_.llg

to the

33 of the sEet

fl-Lting obrigations and Discrosu." Requirements)

Regulations' 2015' These quarterly

financial results as weil as

the year todate financiar

results have been prepared

on the basis of the interim

financiar

statements, which are the

responsibility of the company's

management. ourresponsibirity

is to express an opinion on

these financial results based

on or. uio,, of such int".im

nnuncial statements, which

been prepared in accordance

have

with the recognition and measurement

principles laid down in

Accounting Standard for Interim

Financiar Reporting (Aa

;;;, prescribed, under.section r33

t'uu,.t'u t eI i s sued

r"

fi :Tr,.",:::ffi

ffl#i

;:1ffi ' "

;;.;"#;

"il.;"",""

untin g

we

conducted our audit in accordance

with the auditing standards generaly

India' Those standards require

accepted in

that we plan and p..ro.i,

the audit to obtain reasonabre

assurance about whether

the financial results are free

of materiar misstatement(s). An

includes examining' on a test

audit

basis, evidence supporting

the

amounts

discrosed

results' An audit also includes

as financiar

assessing the accornri"ng principres

used

and significant

made by management' we

believe that our audit

[rovides a reasonabre basis for our

:;t'ff::t

In our opinion and to the best

of our informatfon and according

to the explanations given to

us these quarterly financial

results as well as the year

to date results:

(D

are presented in accordance

with the requirements of Regulation

33

li*T,*bligations

and Disclosure Requir",n.r,r;

Regularions

of

the SEBI

20ts in this

(ii)

For

give a true and fair view of the net profit and other financial

information for the

quarter ended 31't March,2016 as well as the year

to date results for the period

from I't April, 2015 to 31't March, 2016

Suresh

& Associates

Chartered

Firm'

tants

No.003316N

(CASuresh

Partner

(Membership Number,: 080050)

Place : Delhi

Date:2if_1Ayl0l$

Vous aimerez peut-être aussi

- ACCA F3 Quiz QuestionDocument5 pagesACCA F3 Quiz QuestionA Muneeb Q100% (1)

- Final Project Training Program: Subject:: Master's Degree in Digital Marketing & E-CommerceDocument11 pagesFinal Project Training Program: Subject:: Master's Degree in Digital Marketing & E-Commercegadde viegas90% (10)

- Fixed Assets PolicyDocument19 pagesFixed Assets PolicypummysharmaPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionPas encore d'évaluation

- Smart Industry Readiness IndexDocument52 pagesSmart Industry Readiness IndexLouis VuPas encore d'évaluation

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- Snaxville Business PlanDocument15 pagesSnaxville Business PlanJulius Ceasar AranasPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document6 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document22 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document8 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Auditors Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- TTR RRL: LimitedDocument5 pagesTTR RRL: LimitedShyam SunderPas encore d'évaluation

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Document7 pagesAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document15 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Form A For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Maynard Solutions Ch04Document17 pagesMaynard Solutions Ch04Anton VitaliPas encore d'évaluation

- Pepsi vs. CokeDocument2 pagesPepsi vs. Cokekfcsh5cbrcPas encore d'évaluation

- CA23 Financial Reporting and AnalysisDocument5 pagesCA23 Financial Reporting and AnalysisjoanPas encore d'évaluation

- Statement of Financial PositionDocument36 pagesStatement of Financial PositionAbdulmajed Unda MimbantasPas encore d'évaluation

- Report Arutmin Indonesia September 2011Document56 pagesReport Arutmin Indonesia September 2011Fredy Milson SimbolonPas encore d'évaluation

- Analysis of Financial Statements: DATE: January 05, 2021 Presented By: Mr. Florante P. de Leon, Mba, CB, CTTDocument59 pagesAnalysis of Financial Statements: DATE: January 05, 2021 Presented By: Mr. Florante P. de Leon, Mba, CB, CTTFlorante De LeonPas encore d'évaluation

- Branch Home PuzzleDocument12 pagesBranch Home PuzzleDainika ShettyPas encore d'évaluation

- Illustrative-Financial-Statements - IGAAP PDFDocument65 pagesIllustrative-Financial-Statements - IGAAP PDFSubhash BhatPas encore d'évaluation

- PAS16 mcq1Document11 pagesPAS16 mcq1Margaux CornetaPas encore d'évaluation

- IFRS Separate Fincancial Statements Up DateDocument264 pagesIFRS Separate Fincancial Statements Up DatestiljanPas encore d'évaluation

- AccountancyDocument183 pagesAccountancyAnita YadavPas encore d'évaluation

- TOA ASSET Midterm QuizDocument10 pagesTOA ASSET Midterm QuizEzra Mae SangcoPas encore d'évaluation

- Solution NIngDocument3 pagesSolution NIngfahim tusarPas encore d'évaluation

- Annex A1 - Detailed Statement of Financial PositionDocument26 pagesAnnex A1 - Detailed Statement of Financial PositionwichupinunoPas encore d'évaluation

- Horngren Ima16 stppt16Document66 pagesHorngren Ima16 stppt16SumitasPas encore d'évaluation

- Daimler Ir Annual Financialstatements Entity 2017 PDFDocument55 pagesDaimler Ir Annual Financialstatements Entity 2017 PDFGate Bennet4Pas encore d'évaluation

- DepreciationDocument14 pagesDepreciationKris Hazel RentonPas encore d'évaluation

- Reading 22 Slides - Understanding Balance SheetsDocument41 pagesReading 22 Slides - Understanding Balance SheetstamannaakterPas encore d'évaluation

- Investment Center Problems ROI CalculationsDocument4 pagesInvestment Center Problems ROI CalculationsEigha apriliaPas encore d'évaluation

- Corporate Reporting Professional 1 Exam NotesDocument22 pagesCorporate Reporting Professional 1 Exam NotesJasonSpringPas encore d'évaluation

- Trắc nghiệm Kế toán tài chính 1Document19 pagesTrắc nghiệm Kế toán tài chính 1THINH HIEN NGOCPas encore d'évaluation

- Bkar3033 Financial Accounting and Reporting Iii (A192) Mini Case - Deferred Tax Submission Date: 13 May 2020Document4 pagesBkar3033 Financial Accounting and Reporting Iii (A192) Mini Case - Deferred Tax Submission Date: 13 May 2020Rubiatul Adawiyah33% (3)

- Dire Dawa University business plan for computer training centerDocument9 pagesDire Dawa University business plan for computer training centerAhmed HonestPas encore d'évaluation

- Amchem Products Private LimitedDocument19 pagesAmchem Products Private LimitedAtika malikPas encore d'évaluation

- Chapter 3 CLCDocument24 pagesChapter 3 CLCVăn ThànhPas encore d'évaluation