Académique Documents

Professionnel Documents

Culture Documents

Sales Tax Form

Transféré par

zilchhourCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sales Tax Form

Transféré par

zilchhourDroits d'auteur :

Formats disponibles

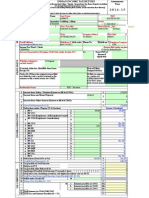

QuarterlyST-100

Department of Taxation and Finance

New York State and Local

Quarterly Sales and Use Tax Return

Tax period: 1st Quarter

March 1, 2016 May 31, 2016

Due: Monday, June 20, 2016

Sales tax identification number

Mandate to use Sales Tax Web File

Most filers fall under this requirement; see

Form ST-100-I (instructions).

Legal name (Print ID number and legal name as it appears on the Certificate of Authority)

DBA (doing business as) name

Has your address or business

information changed?

Number and street

117

Mark an X in the box if the address

listed is new or has changed (see

in instr.).

City, state, ZIP code

No tax due? If you have no taxable sales,

taxable purchases, or credits to report for this

Income reporting information

period, complete Step 1 below; enter none in

If a different entity files the corporation tax, partnership, or personal income tax return to report

boxes 12, 13, and 14, and complete Step 9.

income from this business, enter that entitys federal employer identification number (EIN) or

social security number (SSN). Leave this field blank if the same entity files this sales tax return

ID number

and reports the income from the business or if you arent required to file income tax returns (for

example, NYS governmental entities). .............................................................................................

Is this your final return? If you sell or discontinue your business, or change the form of your business, you are required to file a final

return with the applicable information completed in Step 2 below. You must file your final return within 20 days of the last day of business

or change in status. The return should include the tax due from business operations to the last day of business, as well as any tax

collected on assets that you sell. Mark an X in the box if this is your final return. ..........................................................................................

Are you claiming any credits in Step 3 on this return or any schedules? (Mark an X in the box.) ..................................................................

If Yes, enter the total amounts of credits claimed and complete Form ST-100-ATT (see

Step 1 of 9 Return summary

.00

in instructions) ...........

1

.00

1 Gross sales and services................................................................

1a

1a Nontaxable sales ...........................................................................

1b Gross credit card and debit card deposits (optional;

see

in instructions) ....................................................................

.00

1b

.00

Step 2 of 9 Final return information

A

Business sold or discontinued

Mark an X in the appropriate box if your business has been sold or discontinued.

Sold

Insolvent

Owner deceased

Dissolved

Other

Note: If you intend to sell your business or any of your business assets, including tangible, intangible, or real property, other than

in the ordinary course of business, you must give each prospective purchaser a copy of Form TP-153, Notice to Prospective

Purchasers of a Business or Business Assets. You must also provide us with the following information:

Last day of business

Date of sale

/

/

Name and address of purchaser

Sale price

In whole In part

Name and address of business

Location of property

Was sales tax collected on any taxable items (furniture, fixtures, etc.) included in the sale?..................................... Yes

B

No

Business form changed (sole proprietor to partnership, partnership to corporation, etc.)

In addition to filing a final return, you must also apply for a new Certificate of Authority

for the new entity. See

in instructions for more information.

For office use only

50000105160094

Proceed to Step 3, page 2

ST-100 (3/16) Page 1 of 4

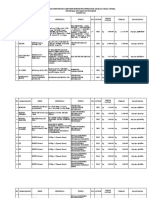

Page 2 of 4ST-100 (3/16)

Sales tax identification number

117

Column C

Column D Column E

of 9 Calculate sales and use taxes

Taxable sales

Purchases subject

Tax rate

and

services

to tax

See Form ST-100-I, ST-100 Quarterly Instructions, for more information.

(see

in instructions)

Step 3

Enter total from Form ST-100.10, page 4, step 6, box 18 in box 2 (if any)

3

4

Enter the sum of any totals from Schedules A, B, H, N, T and W (if any) .00

.00

Column A

Taxing jurisdiction

New York State only

Albany County

Allegany County

Broome County

Cattaraugus County (outside the following)

Olean (city)

Salamanca (city)

Cayuga County (outside the following)

Auburn (city)

Chautauqua County

Chemung County

Chenango County (outside the following)

Norwich (city)

Clinton County

Columbia County

Cortland County

Delaware County

Dutchess County

Erie County

Essex County

Franklin County

Fulton County (outside the following)

Gloversville (city)

Johnstown (city)

Genesee County

Greene County

Hamilton County

Herkimer County

Jefferson County

Lewis County

Livingston County

Madison County (outside the following)

Oneida (city)

Monroe County

Montgomery County

Nassau County

Niagara County

Oneida County (outside the following)

Rome (city)

Utica (city)

Onondaga County

Ontario County

Orange County

Orleans County

Oswego County (outside the following)

Oswego (city)

Otsego County

2

5

Column B

Jurisdiction code

NE

AL

AL

BR

CA

OL

SA

CA

AU

CH

CH

CH

NO

CL

CO

CO

DE

DU

ER

ES

FR

FU

GL

JO

GE

GR

HA

HE

JE

LE

LI

MA

ON

MO

MO

NA

NI

ON

RO

UT

ON

ON

OR

OR

OS

OS

OT

0021

0181

0221

0321

0481

0441

0431

0511

0561

0651

0711

0861

0831

0921

1021

1131

1221

1311

1451

1521

1621

1791

1741

1751

1811

1911

2011

2121

2221

2321

2411

2511

2541

2611

2781

2811

2911

3010

3015

3018

3121

3211

3321

3481

3501

3561

3621

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

6

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

7

Column subtotals; also enter on page 3, boxes 9, 10, and 11: .00 .00

50000205160094

4%

8%

81/2%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

81/8%*

83/4%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

8%

85/8%*

8%

83/4%

83/4%

83/4%

8%

7%

81/8%*

8%

8%

8%

8%

8

Quarterly

Column F

Sales and

use tax

(C + D) E

Quarterly 117

Sales tax identification number

ST-100 (3/16) Page 3 of 4

Column A

Taxing jurisdiction

Column B

Column C

Column D Column E

Jurisdiction

Taxable sales

Purchases subject

Tax rate

code

and services

to tax

(see

in instructions)

Putnam County

Rensselaer County

Rockland County

St. Lawrence County

Saratoga County (outside the following)

Saratoga Springs (city)

Schenectady County

Schoharie County

Schuyler County

Seneca County

Steuben County

Suffolk County

Sullivan County

Tioga County

Tompkins County (outside the following)

Ithaca (city)

Ulster County

Warren County (outside the following)

Glens Falls (city)

Washington County

Wayne County

Westchester County (outside the following)

Mount Vernon (city)

New Rochelle (city)

White Plains (city)

Yonkers (city)

Wyoming County

Yates County

New York City/State combined tax

PU 3731

RE 3881

RO 3921

ST 4091

SA 4111

SA 4131

SC 4241

SC 4321

SC 4411

SE 4511

ST 4691

SU 4711

SU 4821

TI 4921

TO 5081

IT 5021

UL 5111

WA 5281

GL 5211

WA 5311

WA 5421

WE 5581

MO 5521

NE 6861

WH 6513

YO 6511

WY 5621

YA 5721

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Column F

Sales and use tax

(C + D) E

83/8%*

8%

83/8%*

8%

7%

7%

8%

8%

8%

8%

8%

85/8%*

8%

8%

8%

8%

8%

7%

7%

7%

8%

73/8%*

83/8%*

83/8%*

83/8%*

87/8%*

8%

8%

[New York City includes counties of Bronx, Kings (Brooklyn),

New York (Manhattan), Queens, and Richmond (Staten Island)]

NE 8081

.00

.00 87/8%*

New York State/MCTD NE 8061

.00

.00 43/8%*

New York City - local tax only

NE 8091

.00

.00 4%

.00

.00

.00

.00

Column subtotals from page 2, boxes 6, 7, and 8: .00 .00

9

10

11

12

13

14

If the total of box 12 + box 13 = $300,000 or more,

see page 1 of instructions.

Column totals:

.00 .00

Internal code

Column G Column H

Column J

Tax rate = Special taxes due

Taxable receipts

Step 4 of 9 Calculate special taxes

(G H)

Passenger car rentals (outside the MCTD)

Passenger car rentals (within the MCTD)

Information & entertainment services furnished via telephony and telegraphy

PA 0012

PA 0030

IN 7009

6%

11%

5%

Total special taxes:

15

Internal code

Step 5 of 9 Other tax credits and advance payments

.00

.00

.00

Column K

Credit amount

Credit for prepaid sales tax on cigarettes

CR C8888

Overpayment being carried forward from a prior period (see in instructions) C

Advance payments (made with Form ST-330)

A

Total tax credits, advance payments, and overpayments:

*43/8% = 0.04375;

73/8% = 0.07375;

81/8% = 0.08125;

50000305160094

83/8% = 0.08375;

85/8% = 0.08625;

87/8% = 0.08875

16

Proceed to Step 6,

page 4

Sales tax identification number

117

Page 4 of 4ST-100 (3/16)

Quarterly

Add Sales and use tax column total (box 14) to Total special

taxes (box 15) and subtract Total tax credits, advance

payments, and overpayments (box 16). Enter result in box 17.

Step 6 of 9 Calculate taxes due

Box 14

Box 15

Box 16

amount

amount

amount

or pay penalty and interest

7A Vendor collection credit

Box 14 amount $

+ $

=

Enter the amount from Schedule FR as instructed on the schedule (if any).

Be sure to enter this amount as a positive number. +

=

5% (.05) (credit rate)

**

= $

Box 15 amount

OR

7B

17

If you are filing this return after the due date and/or not paying the

full amount of tax due, STOP! You are not eligible for the vendor

collection credit. If you are not eligible, enter 0 in box 18 and go to 7B.

Step 7 of 9 Calculate vendor collection credit

Taxes due

** In box 18, enter the amount calculated up to $200.

Vendor collection credit

VE 7706

18

Penalty and interest

Pay penalty and interest if you are filing late

Penalty and interest are calculated on the amount in box 17, Taxes due. See

Step 8 of 9 Calculate total amount due

in the instructions.

19

Make check or money order payable to New York State Sales Tax.

Write on your check your sales tax ID#, ST-100, and 5/31/16.

Total amount due

8A

Amount due:

Taking vendor collection credit? Subtract box 18 from box 17.

Paying penalty and interest? Add box 19 to box 17.

20

8B

Amount paid:

Enter your payment amount. This amount should match your

amount due in box 20. See

in the instructions.

21

Step 9 of 9 Sign and mail this return

Must be postmarked by Monday, June 20, 2016, to be considered filed on time.

Please be sure to keep a completed copy for your records. See below for complete mailing information.

Third

party

designee

Do you want to allow another person to discuss this return with the Tax Dept? (see instructions)

Designees name

Designees e-mail address

Designees phone number

( )

Printed name of taxpayer

Taxpayers e-mail address

Signature of taxpayer

Date

Printed name of preparers firm (or yours if self-employed)

Preparers address

Preparers e-mail address

Signature of preparer, if other than taxpayer

*See

Yes

(complete the following) No

Personal identification

number (PIN)

Title

Daytime

telephone ( )

Firms employer

identification number*

Preparers

PTIN*

Preparers

NYTPRIN

NYTPRIN*

excl. code

Daytime

telephone ( )

in instructions

Where to file your return and attachments

Web File your return at www.tax.ny.gov (see Highlights in instructions).

(If you are not required to Web File, mail your return and attachments to:

NYS Sales Tax Processing, PO Box 15168, Albany NY 12212-5168)

If using a private delivery service rather than the U.S. Postal

Service, see Publication 55, Designated Private Delivery Services.

50000405160094

June 10, 2016

New York State Sales Tax

(your payment amount)

00-0000000

ST-100

5/31/16

Dont forget to write your sales tax

ID#, ST-100, and 5/31/16.

Need help?

X,XXX.XX

Dont forget to

sign your check

See Form ST-100-I, ST-100 Quarterly Instructions, page 4.

Vous aimerez peut-être aussi

- Zuckerman2015 Tax ReturnDocument3 pagesZuckerman2015 Tax ReturnAnonymous 2zbzrvPas encore d'évaluation

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerPas encore d'évaluation

- Submitting Your U.S. Tax Documents: Print, Sign, MailDocument5 pagesSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- TAX Return ProjectDocument17 pagesTAX Return Projectqlcjung09Pas encore d'évaluation

- Introduction To AmplifierDocument8 pagesIntroduction To AmplifierElaine BicolPas encore d'évaluation

- Bloomberg 2012Document316 pagesBloomberg 2012josephlordPas encore d'évaluation

- Scan 0001Document11 pagesScan 0001Kimmie3050% (2)

- Process Industry Practices Insulation: PIP INEG2000 Guidelines For Use of Insulation PracticesDocument15 pagesProcess Industry Practices Insulation: PIP INEG2000 Guidelines For Use of Insulation PracticesZubair RaoofPas encore d'évaluation

- Tax Return ScribdDocument5 pagesTax Return ScribdYvonne TanPas encore d'évaluation

- Astm D 1196 PDFDocument3 pagesAstm D 1196 PDFSetyawan Chill Gates0% (1)

- As-Built Commercial BLDG.1Document11 pagesAs-Built Commercial BLDG.1John Rom CabadonggaPas encore d'évaluation

- Marylynn Huggins - Clifden Ut State Tax Return 2013Document4 pagesMarylynn Huggins - Clifden Ut State Tax Return 2013api-2573405260% (1)

- PDF DownloadDocument3 pagesPDF DownloadPedro ChapaPas encore d'évaluation

- 1701 Bir FormDocument12 pages1701 Bir Formbertlaxina0% (1)

- 16 Personalities ResultsDocument9 pages16 Personalities Resultsapi-605848036Pas encore d'évaluation

- India Biotech Handbook 2023Document52 pagesIndia Biotech Handbook 2023yaduraj TambePas encore d'évaluation

- TAC42055 - HO01 Edition I2.0: Section 1 Module 1 Page 1Document69 pagesTAC42055 - HO01 Edition I2.0: Section 1 Module 1 Page 1matheus santosPas encore d'évaluation

- BasDocument2 pagesBasJill GeorgePas encore d'évaluation

- New York Corporation Tax ReturnDocument4 pagesNew York Corporation Tax Returnbshahn1189Pas encore d'évaluation

- MAIN IDEAS IN CHAPTER 1, TOPIC 1, © Kermit Keeling: Solution - PAGE 1Document25 pagesMAIN IDEAS IN CHAPTER 1, TOPIC 1, © Kermit Keeling: Solution - PAGE 1юрий локтионовPas encore d'évaluation

- State Sales and Use Tax ReturnDocument2 pagesState Sales and Use Tax ReturnRick JordanPas encore d'évaluation

- ITR Form 1Document7 pagesITR Form 1gj29herePas encore d'évaluation

- Indian Income Tax Return Assessment Year SahajDocument7 pagesIndian Income Tax Return Assessment Year SahajSubrata BiswasPas encore d'évaluation

- Goods and Services Tax (GST) : Complete Option 1 OR 2 OR 3 (Indicate One Choice With An X)Document2 pagesGoods and Services Tax (GST) : Complete Option 1 OR 2 OR 3 (Indicate One Choice With An X)rajkrishna03Pas encore d'évaluation

- NYS - 45 Fill inDocument2 pagesNYS - 45 Fill inSalameh LauriePas encore d'évaluation

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocument11 pagesITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranPas encore d'évaluation

- 2013 Financial StatementsDocument31 pages2013 Financial Statementsapi-307029847100% (1)

- ERPFI TaxwithCashDiscount 180515 1553 1800Document5 pagesERPFI TaxwithCashDiscount 180515 1553 1800Janardhan KumarPas encore d'évaluation

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranPas encore d'évaluation

- Filing Instructions: Please Follow These Instructions CarefullyDocument4 pagesFiling Instructions: Please Follow These Instructions CarefullyMafer ChavezPas encore d'évaluation

- Sahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialDocument10 pagesSahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialAjit KumarPas encore d'évaluation

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvPas encore d'évaluation

- Sales Purchase InvoiceDocument8 pagesSales Purchase InvoicefalleppaPas encore d'évaluation

- 2011 1 Stat ReportDocument9 pages2011 1 Stat ReportRob PortPas encore d'évaluation

- Tally ShortcutkeysDocument8 pagesTally ShortcutkeysAlok Kumar SinghPas encore d'évaluation

- F 1040 NRDocument5 pagesF 1040 NRsrao_919525Pas encore d'évaluation

- Donativo de Alfredo Escudero Nuevo Director de AEE A Pedro Pierluisi Por $500 Ver Pag.46Document214 pagesDonativo de Alfredo Escudero Nuevo Director de AEE A Pedro Pierluisi Por $500 Ver Pag.46Todo Puerto Rico contra el abuso de la AEEPas encore d'évaluation

- Assessment Year Sahaj Indian Income Tax ReturnDocument7 pagesAssessment Year Sahaj Indian Income Tax Returnrajshri58Pas encore d'évaluation

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailPas encore d'évaluation

- 2011 ITR1 r4Document9 pages2011 ITR1 r4Prashant HosamaniPas encore d'évaluation

- Form R-1 - VA Department of Taxation Business Registration ApplicationDocument4 pagesForm R-1 - VA Department of Taxation Business Registration ApplicationRichie DonaldsonPas encore d'évaluation

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamPas encore d'évaluation

- Utah Form TC-20 Tax Return and InstructionsDocument26 pagesUtah Form TC-20 Tax Return and InstructionsBrandonPas encore d'évaluation

- Schedule A (Form 940) For 2012:: Multi-State Employer and Credit Reduction InformationDocument2 pagesSchedule A (Form 940) For 2012:: Multi-State Employer and Credit Reduction InformationpdizypdizyPas encore d'évaluation

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986Pas encore d'évaluation

- 433-A (OIC) : Collection Information Statement For Wage Earners and Self-Employed IndividualsDocument8 pages433-A (OIC) : Collection Information Statement For Wage Earners and Self-Employed IndividualspdizypdizyPas encore d'évaluation

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraPas encore d'évaluation

- Document 16 PDFDocument5 pagesDocument 16 PDFZennie AbrahamPas encore d'évaluation

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinPas encore d'évaluation

- IT-2 2011 With Formula and Surcharge and Annex DDocument15 pagesIT-2 2011 With Formula and Surcharge and Annex DPatti DaudPas encore d'évaluation

- 2013 Itr1 PR11Document9 pages2013 Itr1 PR11Akshay Kumar SahooPas encore d'évaluation

- 403 HW Week 6Document19 pages403 HW Week 6nleonard29Pas encore d'évaluation

- 2012 2 Stat ReportDocument9 pages2012 2 Stat ReportRob PortPas encore d'évaluation

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocument2 pages1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsRajesh Kumar ReddyPas encore d'évaluation

- Resolve Incomplete/Mismatch in Information - GSTR-3BDocument14 pagesResolve Incomplete/Mismatch in Information - GSTR-3BVidyadhara HegdePas encore d'évaluation

- CIN TAXINJ ConfigurationDocument43 pagesCIN TAXINJ ConfigurationThomas Lehr0% (1)

- Sap Fico Configuration-CinDocument25 pagesSap Fico Configuration-Cinpiyush3600Pas encore d'évaluation

- Tally 7.2 ShortcutsDocument6 pagesTally 7.2 ShortcutsVikash Surana60% (10)

- ITX 200.01.E - Estimates - IndividualDocument6 pagesITX 200.01.E - Estimates - IndividualUrusi TeklaPas encore d'évaluation

- Week 2 Notes From AssignmentsDocument11 pagesWeek 2 Notes From AssignmentsTamMaxPas encore d'évaluation

- MO-1040A Fillable Calculating - 2015 PDFDocument3 pagesMO-1040A Fillable Calculating - 2015 PDFAnonymous 3RVba19mPas encore d'évaluation

- F 1040 SaDocument2 pagesF 1040 Saljens09Pas encore d'évaluation

- Sap-Fi/Co - 2 Cont : Sales TaxDocument30 pagesSap-Fi/Co - 2 Cont : Sales Taxkrishna_1238Pas encore d'évaluation

- Vat3 FormDocument2 pagesVat3 FormMacharia MainaPas encore d'évaluation

- Instruments, Indicating Devices & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryD'EverandInstruments, Indicating Devices & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Instruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryD'EverandInstruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Shock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryD'EverandShock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Black-Owned Businesses Will See Extended 'Challenge' Even After Pandemic EndsDocument1 pageBlack-Owned Businesses Will See Extended 'Challenge' Even After Pandemic EndszilchhourPas encore d'évaluation

- How This Man Made $2.8 Million Trading Stocks Part-Time From HomeDocument1 pageHow This Man Made $2.8 Million Trading Stocks Part-Time From HomezilchhourPas encore d'évaluation

- Cisco Earnings: What To Know in Markets WednesdayDocument1 pageCisco Earnings: What To Know in Markets WednesdayzilchhourPas encore d'évaluation

- Paper 3 PDFDocument1 pagePaper 3 PDFzilchhourPas encore d'évaluation

- Pajama Sales Spike 143%, Pant Sales Drop 13% As Coronavirus Crisis Drags OnDocument1 pagePajama Sales Spike 143%, Pant Sales Drop 13% As Coronavirus Crisis Drags OnzilchhourPas encore d'évaluation

- Stock Market News Live Updates: Stock Futures Extend Declines As Pandemic Concerns ContinueDocument1 pageStock Market News Live Updates: Stock Futures Extend Declines As Pandemic Concerns ContinuezilchhourPas encore d'évaluation

- Board of Directors Bankers: Corporate InformationDocument22 pagesBoard of Directors Bankers: Corporate InformationzilchhourPas encore d'évaluation

- Financial Reporting 2008Document6 pagesFinancial Reporting 2008zilchhourPas encore d'évaluation

- Board of Directors Bankers: Corporate InformationDocument22 pagesBoard of Directors Bankers: Corporate InformationzilchhourPas encore d'évaluation

- Board of Directors Bankers: Corporate InformationDocument22 pagesBoard of Directors Bankers: Corporate InformationzilchhourPas encore d'évaluation

- Technical ReleaseDocument35 pagesTechnical ReleasezilchhourPas encore d'évaluation

- 14th February 2010 PIPFA SyllabusDocument1 page14th February 2010 PIPFA SyllabuszilchhourPas encore d'évaluation

- SAP HR - Legacy System Migration Workbench (LSMW)Document5 pagesSAP HR - Legacy System Migration Workbench (LSMW)Bharathk KldPas encore d'évaluation

- D. Das and S. Doniach - Existence of A Bose Metal at T 0Document15 pagesD. Das and S. Doniach - Existence of A Bose Metal at T 0ImaxSWPas encore d'évaluation

- Shaker ScreenDocument2 pagesShaker ScreenRiaz EbrahimPas encore d'évaluation

- PronounsDocument6 pagesPronounsHải Dương LêPas encore d'évaluation

- Report-Smaw Group 12,13,14Document115 pagesReport-Smaw Group 12,13,14Yingying MimayPas encore d'évaluation

- AppcDocument71 pagesAppcTomy lee youngPas encore d'évaluation

- Needle BasicsDocument31 pagesNeedle BasicsARYAN RATHOREPas encore d'évaluation

- Jurnal Vol. IV No.1 JANUARI 2013 - SupanjiDocument11 pagesJurnal Vol. IV No.1 JANUARI 2013 - SupanjiIchsan SetiadiPas encore d'évaluation

- CL200 PLCDocument158 pagesCL200 PLCJavierRuizThorrensPas encore d'évaluation

- Nse 2Document5 pagesNse 2dhaval gohelPas encore d'évaluation

- Coco Mavdi Esl5Document6 pagesCoco Mavdi Esl5gaurav222980Pas encore d'évaluation

- Bathinda - Wikipedia, The Free EncyclopediaDocument4 pagesBathinda - Wikipedia, The Free EncyclopediaBhuwan GargPas encore d'évaluation

- Flowrox Valve Solutions Catalogue E-VersionDocument16 pagesFlowrox Valve Solutions Catalogue E-Versionjavier alvarezPas encore d'évaluation

- RESEARCH 10 Module 1 Lesson 1 (WEEK 1-2)Document5 pagesRESEARCH 10 Module 1 Lesson 1 (WEEK 1-2)DennisPas encore d'évaluation

- Dash 3000/4000 Patient Monitor: Service ManualDocument292 pagesDash 3000/4000 Patient Monitor: Service ManualYair CarreraPas encore d'évaluation

- BA 4722 Marketing Strategy SyllabusDocument6 pagesBA 4722 Marketing Strategy SyllabusSri GunawanPas encore d'évaluation

- Principles To Action (Short)Document6 pagesPrinciples To Action (Short)nsadie34276Pas encore d'évaluation

- Jurnal 1 Ieevee LPF PDFDocument4 pagesJurnal 1 Ieevee LPF PDFNanda SalsabilaPas encore d'évaluation

- Thermodynamic c106Document120 pagesThermodynamic c106Драгослав БјелицаPas encore d'évaluation

- Epistemology and OntologyDocument6 pagesEpistemology and OntologyPriyankaPas encore d'évaluation

- Tourbier Renewal NoticeDocument5 pagesTourbier Renewal NoticeCristina Marie DongalloPas encore d'évaluation

- English 2nd Quarter Week 7 Connotation DenotationDocument28 pagesEnglish 2nd Quarter Week 7 Connotation DenotationEdward Estrella GucePas encore d'évaluation

- Rab Sikda Optima 2016Document20 pagesRab Sikda Optima 2016Julius Chatry UniwalyPas encore d'évaluation