Académique Documents

Professionnel Documents

Culture Documents

Retio Analysis Profitability Ratios: Gross Margin

Transféré par

Amjath JamalDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Retio Analysis Profitability Ratios: Gross Margin

Transféré par

Amjath JamalDroits d'auteur :

Formats disponibles

RETIO ANALYSIS

SOURCE: http://en.wikipedia.org/wiki/Financial_ratio

Profitability ratios

Profitability ratios measure the company's use of its assets and control of its expenses

to generate an acceptable rate of return

Gross margin, Gross profit margin or Gross Profit Rate[7][8]

:::OR :::

Operating margin, Operating Income Margin, Operating profit

margin or Return on sales (ROS)[8][9]

Note: Operating income is the difference between operating revenues and operating

expenses, but it is also sometimes used as a synonym for EBIT and operating profit.

[10]

This is true if the firm has no non-operating income. (Earnings before interest and

taxes / Sales[11][12])

Profit margin, net margin or net profit margin[13]

Return on equity (ROE)[13]

Return on assets (ROA ratio or Du Pont Ratio)[6]

Return on assets (ROA)[14]

Return on assets Du Pont (ROA Du Pont)[15]

Return on Equity Du Pont (ROE Du Pont)

Return on net assets (RONA)

Return on capital (ROC)

Risk adjusted return on capital (RAROC)

:::OR :::

Return on capital employed (ROCE)

Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's

Equity

Cash flow return on investment (CFROI)

Efficiency ratio

Net gearing

Basic Earnings Power Ratio[16]

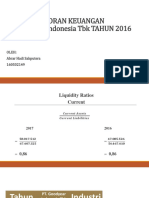

Liquidity ratios[edit]

Liquidity ratios measure the availability of cash to pay debt.

Current ratio (Working Capital Ratio)[17]

Acid-test ratio (Quick ratio)[17]

Cash ratio[17]

Operating cash flow ratio

Activity ratios (Efficiency Ratios)[edit]

Activity ratios measure the effectiveness of the firm's use of resources.

Average collection period[3]

Degree of Operating Leverage (DOL)

DSO Ratio.[18]

Average payment period[3]

Asset turnover[19]

Stock turnover ratio[20][21]

Receivables Turnover Ratio[22]

Inventory conversion ratio[4]

Inventory conversion period (essentially same thing as above)

Receivables conversion period

Payables conversion period

Cash Conversion Cycle

Debt ratios (leveraging ratios)[edit]

Debt ratios quantify the firm's ability to repay long-term debt. Debt ratios

measure financial leverage.

4

Debt ratio[23]

Debt to equity ratio[24]

Long-term Debt to equity (LT Debt to Equity)[24]

Times interest earned ratio (Interest Coverage Ratio)[24]

OR

Debt service coverage ratio

Market ratios[edit]

Market ratios measure investor response to owning a company's stock and also the

cost of issuing stock. These are concerned with the return on investment for

shareholders, and with the relationship between return and the value of an investment

in companys shares.

Earnings per share (EPS)[25]

Payout ratio[25][26]

OR

Dividend cover (the inverse of Payout Ratio)

P/E ratio

Dividend yield

Cash flow ratio or Price/cash flow ratio[27]

Price to book value ratio (P/B or PBV)[27]

Price/sales ratio

PEG ratio

Other Market Ratios

EV/EBITDA

EV/Sales

Cost/Income ratio

Sector-specific ratios

EV/capacity

EV/output

REFERENCES:

1.

Groppelli, Angelico A.; Ehsan Nikbakht (2000). Finance, 4th ed. Barron's Educational Series, Inc. p. 433. ISBN 0-

2.

Jump up^ Groppelli, p. 434.

3.

^ Jump up to:a b c Groppelli, p. 436.

4.

^ Jump up to:a b Groppelli, p. 439.

5.

Jump up^ Groppelli, p. 442.

6.

^ Jump up to:a b Groppelli, p. 445.

7.

Jump up^ Williams, P. 265.

8.

^ Jump up to:a b Williams, p. 1094.

9.

Jump up^ Williams, Jan R.; Susan F. Haka; Mark S. Bettner; Joseph V. Carcello (2008).Financial & Managerial

7641-1275-9.

Accounting. McGraw-Hill Irwin. p. 266. ISBN 978-0-07-299650-0.

10. Jump up^ Operating income definition

11. Jump up^ Groppelli, p. 443.

12. Jump up^ Bodie, Zane; Alex Kane and Alan J. Marcus (2004). Essentials of Investments, 5th ed. McGraw-Hill

Irwin. p. 459. ISBN 0-07-251077-3.

13. ^ Jump up to:a b Groppelli, p. 444.

14. Jump up^ Professor Cram. "Ratios of Profitability: Return on Assets" College-Cram.com. 14 May 2008

15. Jump up^ Professor Cram. "Ratios of Profitability: Return on Assets Du Pont", College-Cram.com. 14 May 2008

16.

Weston, J. (1990). Essentials of Managerial Finance. Hinsdale: Dryden Press. p. 295. ISBN 0-03-030733-3.

17.

^ Jump up to:a b c Groppelli, p. 435.

18.

Jump up^ Houston, Joel F.; Brigham, Eugene F. (2009). Fundamentals of Financial Management. [Cincinnati,

Ohio]: South-Western College Pub. p. 90. ISBN 0-324-59771-1.

19.

Jump up^ Bodie, p. 459.

20.

Jump up^ Groppelli, p. 438.

21.

Jump up^ Weygandt, J. J., Kieso, D. E., & Kell, W. G. (1996). Accounting Principles (4th ed.). New York,

Chichester, Brisbane, Toronto, Singapore: John Wiley & Sons, Inc. p. 801-802.

22.

Jump up^ Weygandt, J. J., Kieso, D. E., & Kell, W. G. (1996). Accounting Principles (4th ed.). New York,

Chichester, Brisbane, Toronto, Singapore: John Wiley & Sons, Inc. p. 800.

23.

Jump up^ Groppelli, p. 440; Williams, p. 640.

24.

^ Jump up to:a b c Groppelli, p. 441.

25.

^ Jump up to:a b Groppelli, p. 446.

26.

Jump up^ Groppelli, p. 449.

27.

^ Jump up to:a b Groppelli, p. 447

Vous aimerez peut-être aussi

- Applied Corporate Finance. What is a Company worth?D'EverandApplied Corporate Finance. What is a Company worth?Évaluation : 3 sur 5 étoiles3/5 (2)

- Gross Profit Margin or Gross Profit Rate: Profitability RatiosDocument8 pagesGross Profit Margin or Gross Profit Rate: Profitability Ratiossrik1011Pas encore d'évaluation

- RatiosDocument26 pagesRatiosJoshin ShajicPas encore d'évaluation

- RatiosDocument19 pagesRatiosUdayam Kumar SinghPas encore d'évaluation

- Profitability Ratios: Gross MarginDocument6 pagesProfitability Ratios: Gross MarginKiran Kumar TarlanaPas encore d'évaluation

- Financial RatioDocument6 pagesFinancial RatioankittalkiesPas encore d'évaluation

- Profitability Ratios: Gross MarginDocument6 pagesProfitability Ratios: Gross MarginSaishree ShirsekarPas encore d'évaluation

- Profitability Ratios: Gross MarginDocument6 pagesProfitability Ratios: Gross Marginvis_madPas encore d'évaluation

- Financial RatiosDocument7 pagesFinancial RatiosSuraj GuptaPas encore d'évaluation

- Rumus Rasio KeuanganDocument13 pagesRumus Rasio KeuanganedwonvanhoutenPas encore d'évaluation

- Financial RatioDocument7 pagesFinancial Ratiotimothy454Pas encore d'évaluation

- Sources of Data For Financial RatiosDocument5 pagesSources of Data For Financial Ratiosjatinmakwana90Pas encore d'évaluation

- Financial Ratio - Wikipedia, The Free EncyclopediaDocument7 pagesFinancial Ratio - Wikipedia, The Free EncyclopediaZahidur RahmanPas encore d'évaluation

- BA Financial RatiosDocument54 pagesBA Financial RatiosVolker MeyerPas encore d'évaluation

- DuPont Analysis - Wikipedia, The Free EncyclopediaDocument3 pagesDuPont Analysis - Wikipedia, The Free EncyclopediaidradjatPas encore d'évaluation

- Profitability Ratios: Gross MarginDocument9 pagesProfitability Ratios: Gross MarginAlfonce NziokaPas encore d'évaluation

- Profitability Ratios: Gross MarginDocument3 pagesProfitability Ratios: Gross MarginBriand DaydayPas encore d'évaluation

- DuPont AnalysisDocument3 pagesDuPont AnalysisDinesh KotadiyaPas encore d'évaluation

- Financial Statement Analysis of Dell Technologies: Haris Saqib QaziDocument16 pagesFinancial Statement Analysis of Dell Technologies: Haris Saqib QaziFarzana AbdullahPas encore d'évaluation

- Finance Material 3Document6 pagesFinance Material 3Akshay UdayPas encore d'évaluation

- Jamil Ahmed Assistant ProfessorDocument29 pagesJamil Ahmed Assistant ProfessorParizad456Pas encore d'évaluation

- Chapter - 4: Analysis and Interpretation OF DataDocument62 pagesChapter - 4: Analysis and Interpretation OF Dataprashanraj123Pas encore d'évaluation

- Return On EquityDocument2 pagesReturn On EquityBOBBY212Pas encore d'évaluation

- Effects of Working Capital Management On The Profitability of Thai Listed FirmsDocument6 pagesEffects of Working Capital Management On The Profitability of Thai Listed FirmsDicky SupriantoPas encore d'évaluation

- Analysis of Financial Statements 1-10-19Document28 pagesAnalysis of Financial Statements 1-10-19Shehzad QureshiPas encore d'évaluation

- Evaluating A Firms Financial Performance3767Document17 pagesEvaluating A Firms Financial Performance3767Yasser MaamounPas encore d'évaluation

- Shareholder - Value - Creation Final VBM Intro and Indicators Final BestDocument93 pagesShareholder - Value - Creation Final VBM Intro and Indicators Final Bestsuparshva99iimPas encore d'évaluation

- LeverageDocument13 pagesLeverageMANSI JOSHIPas encore d'évaluation

- RATIOSDocument16 pagesRATIOSantra10tiwariPas encore d'évaluation

- Financial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDocument30 pagesFinancial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDammika MadusankaPas encore d'évaluation

- BA 141 RatiosDocument14 pagesBA 141 RatiosNigelT.LeePas encore d'évaluation

- Debt Service Coverage Ratio (DSCR) : ValuationDocument17 pagesDebt Service Coverage Ratio (DSCR) : ValuationRh MePas encore d'évaluation

- 1 - Unit III Full Unit NotesDocument54 pages1 - Unit III Full Unit NotesPrasanna VenkatesanPas encore d'évaluation

- Analysis of Financial Statements We Will See How Financial Statements Can Be Analyzed by The Firm's Management As Well As OutsidersDocument28 pagesAnalysis of Financial Statements We Will See How Financial Statements Can Be Analyzed by The Firm's Management As Well As OutsidersCorolla GrandePas encore d'évaluation

- Evaluation of The Capital Structure of Nigerian Bottling CompanyDocument8 pagesEvaluation of The Capital Structure of Nigerian Bottling CompanyOlisameduaPas encore d'évaluation

- Ratio AnalysisDocument8 pagesRatio AnalysisKitty N FamPas encore d'évaluation

- 2007 01Document16 pages2007 01GeetanjaliRVijayaPas encore d'évaluation

- 5AKMC - Financial Ratio AnalysisDocument24 pages5AKMC - Financial Ratio AnalysisWindy anastasyaPas encore d'évaluation

- DuPont AnalysisDocument4 pagesDuPont AnalysisRaman SutharPas encore d'évaluation

- Financial RatiosDocument3 pagesFinancial Ratiospv12356Pas encore d'évaluation

- Return On EquityDocument6 pagesReturn On EquitySharathPas encore d'évaluation

- Understanding of Financial Statements: What Is An Accounting?Document53 pagesUnderstanding of Financial Statements: What Is An Accounting?Rashmi KhatriPas encore d'évaluation

- Financial Management Economics For Finance 1679035282Document135 pagesFinancial Management Economics For Finance 1679035282Alaka BelkudePas encore d'évaluation

- Accounting Ratio Is A Relative Magnitude of Two Selected Numerical Values Taken From AnDocument4 pagesAccounting Ratio Is A Relative Magnitude of Two Selected Numerical Values Taken From AnEllaine Pearl AlmillaPas encore d'évaluation

- PDFen 2Document15 pagesPDFen 2shah.rushabh311Pas encore d'évaluation

- Analysis TheoryDocument8 pagesAnalysis TheoryShorov ChowduryPas encore d'évaluation

- FinQuiz - Smart Summary - Study Session 8 - Reading 28Document3 pagesFinQuiz - Smart Summary - Study Session 8 - Reading 28RafaelPas encore d'évaluation

- Unit 2 RatioDocument51 pagesUnit 2 Ratiov9510491Pas encore d'évaluation

- HBS Toolkit License AgreementDocument6 pagesHBS Toolkit License Agreementcool_gayathiriPas encore d'évaluation

- Module 8 (FINP7)Document4 pagesModule 8 (FINP7)David VillaPas encore d'évaluation

- Dupont Analysis: From Wikipedia, The Free EncyclopediaDocument3 pagesDupont Analysis: From Wikipedia, The Free Encyclopediacorporateboy36596Pas encore d'évaluation

- Ratio AnalysisDocument5 pagesRatio AnalysisganeshPas encore d'évaluation

- InterpretationonFinancialStatementsByMr V AnojanDocument30 pagesInterpretationonFinancialStatementsByMr V AnojankhinthetzunPas encore d'évaluation

- Accounting RatiosDocument4 pagesAccounting RatiosRakesh KumarPas encore d'évaluation

- Introduction To Corporate Finance: Fourth EditionDocument48 pagesIntroduction To Corporate Finance: Fourth EditionTyler NielsenPas encore d'évaluation

- 2financial Statement AnalysisDocument24 pages2financial Statement AnalysisSachin YadavPas encore d'évaluation

- 3 Statement & DCF ModelDocument17 pages3 Statement & DCF ModelArjun KhoslaPas encore d'évaluation

- Course Code: COM-405 Course Title: Credit Hours: 3 (3-0) : Introduction To Business FinanceDocument21 pagesCourse Code: COM-405 Course Title: Credit Hours: 3 (3-0) : Introduction To Business FinanceSajjad AhmadPas encore d'évaluation

- Corporate Value Creation: An Operations Framework for Nonfinancial ManagersD'EverandCorporate Value Creation: An Operations Framework for Nonfinancial ManagersÉvaluation : 4 sur 5 étoiles4/5 (4)

- Islamic Modes of Financing W9W10Document28 pagesIslamic Modes of Financing W9W10Amjath JamalPas encore d'évaluation

- Malay SocietyDocument81 pagesMalay SocietyAmjath JamalPas encore d'évaluation

- Lecture 2 Business Ethics, Corporate Governance & CSRDocument24 pagesLecture 2 Business Ethics, Corporate Governance & CSRAmjath JamalPas encore d'évaluation

- Myanmar Good GovernanceDocument29 pagesMyanmar Good GovernanceAmjath JamalPas encore d'évaluation

- Buddhist Ethics: by Mohsen Omar and Sara EmamiDocument13 pagesBuddhist Ethics: by Mohsen Omar and Sara EmamiAmjath JamalPas encore d'évaluation

- Contrac T Law: Your Begins HereDocument54 pagesContrac T Law: Your Begins HereAmjath JamalPas encore d'évaluation

- Tax Bik QaDocument2 pagesTax Bik QaAmjath JamalPas encore d'évaluation

- Audit1 QADocument8 pagesAudit1 QAAmjath JamalPas encore d'évaluation

- Quali Research Ass 16 May 15Document2 pagesQuali Research Ass 16 May 15Amjath JamalPas encore d'évaluation

- OCBC - Case Study On CGDocument10 pagesOCBC - Case Study On CGAmjath Jamal0% (1)

- Back Flush CostingDocument7 pagesBack Flush CostingAmjath JamalPas encore d'évaluation

- Internal Audit Department Hotel Audit ProgramDocument17 pagesInternal Audit Department Hotel Audit ProgramIdo DodyPas encore d'évaluation

- Gurney - Audit QuerriesDocument1 pageGurney - Audit QuerriesAmjath JamalPas encore d'évaluation

- Jurnal Ananda Indra, Rustam Hidayat DLLDocument10 pagesJurnal Ananda Indra, Rustam Hidayat DLLIlham Rajid RPas encore d'évaluation

- 288-Article Text-925-1-10-20191206 PDFDocument17 pages288-Article Text-925-1-10-20191206 PDFsaridPas encore d'évaluation

- Essay M12 Riset AkuntansiiiDocument11 pagesEssay M12 Riset AkuntansiiiBoni Bonifacius SinagaPas encore d'évaluation

- Scheme Name Plan Category NameDocument8 pagesScheme Name Plan Category NamePriyamGhoshPas encore d'évaluation

- Analisis Rasio Keuangan - PT Blue BirdDocument8 pagesAnalisis Rasio Keuangan - PT Blue BirdAzis HailyPas encore d'évaluation

- Jurnal Reyneke Thalia Putri Hasan-1Document8 pagesJurnal Reyneke Thalia Putri Hasan-1ReynekePas encore d'évaluation

- Jurnal Roe BerpengaruhDocument10 pagesJurnal Roe BerpengaruhZora NayakaPas encore d'évaluation

- Adiwibowo 021122264Document36 pagesAdiwibowo 021122264wadi7188Pas encore d'évaluation

- Avenue Supermart Dupont AnalysisDocument3 pagesAvenue Supermart Dupont AnalysisShubhamShekharSinhaPas encore d'évaluation

- DuPont AnalysisDocument3 pagesDuPont AnalysisSunit AroraPas encore d'évaluation

- Sales Dashboard in Excel With Power QueryDocument90 pagesSales Dashboard in Excel With Power Querymargono0% (1)

- 20170519021234part 1 ProjectDocument12 pages20170519021234part 1 ProjectEkkala NarutteyPas encore d'évaluation

- Return On Sales (ROS)Document3 pagesReturn On Sales (ROS)Justine CruzPas encore d'évaluation

- Date Open High Low Close Return Adj Close : PT Charoen Pokphand Indonesia TBK (CPIN - JK)Document10 pagesDate Open High Low Close Return Adj Close : PT Charoen Pokphand Indonesia TBK (CPIN - JK)ainopePas encore d'évaluation

- Analisis Penetapan Harga Jual Sarung Dengan Metode Gross Margin Pricing Pada Kelompok Usaha Bersama Aneka Cahaya Aqila Di Samarinda SeberangDocument32 pagesAnalisis Penetapan Harga Jual Sarung Dengan Metode Gross Margin Pricing Pada Kelompok Usaha Bersama Aneka Cahaya Aqila Di Samarinda SeberangAnisa armadianaPas encore d'évaluation

- FinancialAnalysis - EQUIPOS DEL NORTEDocument6 pagesFinancialAnalysis - EQUIPOS DEL NORTEOscar TrujilloPas encore d'évaluation

- 403Document12 pages403al hikmahPas encore d'évaluation

- Templete Laporan Keuangan UMKMDocument110 pagesTemplete Laporan Keuangan UMKMabuhaifaPas encore d'évaluation

- Uts Manajemen KeuanganDocument8 pagesUts Manajemen KeuangantntAgstPas encore d'évaluation

- Pengurusan Kewangan (Kumpulan 6)Document42 pagesPengurusan Kewangan (Kumpulan 6)Wai ChongPas encore d'évaluation

- Reminder Pak Diki 250923Document10 pagesReminder Pak Diki 250923Yellowly DiPas encore d'évaluation

- Pembahasan Analisis Rasio Keuangan Nilai Waktu UangDocument22 pagesPembahasan Analisis Rasio Keuangan Nilai Waktu UangMichael OktavianusPas encore d'évaluation

- Pengaruh Internasionalisasi, Afiliasi Bisnis, Dan Research & Development Terhadap Kinerja Perusahaan Manufaktur Di IndonesiaDocument14 pagesPengaruh Internasionalisasi, Afiliasi Bisnis, Dan Research & Development Terhadap Kinerja Perusahaan Manufaktur Di IndonesiaRicky AuliaPas encore d'évaluation

- Analisis Efisiensi Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Jakarta Sebelum Dan SesudahDocument14 pagesAnalisis Efisiensi Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Jakarta Sebelum Dan Sesudahpriandhita asmoroPas encore d'évaluation

- Analisis Laporan Keuangan PT. Goodyear Indonesia TBK TAHUN 2016 DAN 2017Document34 pagesAnalisis Laporan Keuangan PT. Goodyear Indonesia TBK TAHUN 2016 DAN 2017Tri AmbarPas encore d'évaluation

- Bajaj Auto Pvt. Ltd. Market Returns and Stock PriceDocument4 pagesBajaj Auto Pvt. Ltd. Market Returns and Stock PriceArron CarterPas encore d'évaluation

- Ice-Magic-Week 02 U1q1643295492Document38 pagesIce-Magic-Week 02 U1q1643295492Kamlesh SuthariyaPas encore d'évaluation

- Pengaruh Merger Dan Akuisisi Terhadap Kinerja Keuangan PerusahaanDocument27 pagesPengaruh Merger Dan Akuisisi Terhadap Kinerja Keuangan PerusahaanApa 512Pas encore d'évaluation

- IhsanDocument63 pagesIhsanShiffa Indrianti DewiPas encore d'évaluation

- Kinerja Keuangan Dan Ukuran PerusahaanDocument14 pagesKinerja Keuangan Dan Ukuran Perusahaanmelly nkmlsrPas encore d'évaluation